MPR Authored

Interchange Regulation and Reduction: Proof it will fail

August 23, 2011Originally Published on April 16, 2011.

As proponents and opponents debate debit card fee reform, few seem to be aware that interchange regulation has been

implemented before and the results were disastrous. In 2000, The Reserve Bank of Australia (RBA) published a 90 page report (A STUDY OF INTERCHANGE FEES AND ACCESS) that outlined their assessment on card payment interchange rates and the impact. It’s central thesis was this: “The study is concerned with the economic efficiency of these [payment] networks. Most importantly, are they delivering the best possible service at the lowest cost to end-users?”

Eerily similar to the U.S. Federal Reserve’s 2010 analysis, the RBA reached the following conclusion: “While a pricing system based on interchange fees still seems to be the most practical arrangement for the credit card network, the levels of interchange fees are high relative to costs and fees of this magnitude are not essential to the continued viability of this network.”

Bolstered by the findings, consumer activitsts groups pushed for regulation and by 2002, the RBA announced that 4 party payment networks such as those operated by Visa and MasterCard would need to make serious changes. Lobbyists groups fought to rally against regulation but came up short. In 2004, strict measures to limit costs became law and with that a series of unintended consequences.

The U.S. should examine the outcome in Australia, a country whose values and economic system is much like our own. 3 years before the Durbin Amendment came to pass, MasterCard did just that. In early 2007, it researched the impact and side effects of regulation in a report titled “Interchange Regulation: Lessons From the RBA Intervention in Australia.” We reviewed the rules that most closely resemble those of the Federal Reserve and have republished MasterCard’s findings below:

Regulatory Measure #1: Reduction of Interchange Costs

Intended Consequence #1: Merchant fees would be reduced, which would then be passed onto consumers, resulting in lower prices for all.

Actual Outcome: 70% of merchants did not realize that any changes had been implemented and thus did not make an effort to pass on savings to consumers. Annual reports actually showed that retailers pocketed the difference instead. This issue has been largely debated in the U.S., with many retailers openly stating that they would not pass on any savings. Proposed New Debit Card Rules May Not Help Consumers Much

Intended Consequence #2: Debit card usage expands while credit usage declines.

Actual Outcome: Debit card usage declined instead. This appears to be the same path the U.S. is on already as implementation of the law approaches. JP Morgan Chase, Bank of America and Citigroup Might Limit Debit Card Purchases

Regulatory Measure #2: Elimination of The “No Surcharge” Rule

Intended Consequence: Merchants would judiciously surcharge for accepting credit cards; and in so doing, make credit usage less attractive than debit usage; which would in turn encourage higher debit card usage.

Actual Outcome: Where surcharging actually occurred, it appeared to be mainly by brand, applied in a way that is not disclosed to consumers, and done mainly outside of retail markets. As of July 2010, the U.S. implemented a similar law under the Durbin Amendment that is already in effect. See an article we wrote on the subject back in December titled “Take Your Rewards Card and Get Out My Store!.”

The outcomes seem to answer questions that we in the U.S. are spending too much time debating. Regulation in Australia was a failure. “Contrary to the RBA’s intention of making the payments system more efficient and increasing competitive intensity, the exact opposite has happened in Australia. In addition, the payments system has actually become more expensive for the average cardholder. While there is no evidence of retail price reduction by the merchants (so confidently predicted by the RBA), there is widespread acknowlegement that issuers have actually increased fees to cardholders to compensate for lower interchange fees since the RBA regulation.”

Consumer rewards programs are already disappearing as reported by CBS News. “Banks to strip debit card rewards; What next?” This is the exact sequence of events that happened abroad. MasterCard addressed this in their report, but did not offer any hard statistics. “For the most issuers, the rewards programs have been downsized, and in some instances very substantially.”

Many believe the shortsighted push for reform has less to do with savings for retailers and consumers and more with to do with a desire for Americans to punish the banks for their role in the financial crisis. The banking industry employees millions of people so the harm intended for rich CEOs is more likely to affect the jobs of the middle class.

There is still hope. A few Senators have proposed the Debit Interchange Fee Study Act of 2011, which seeks to delay regulation for two years. This will allow the Federal Reserve to properly assess the goals they hope to achieve, come up with a better plan of action, and study the likely consequences.

While two years seems fair, we can’t help but point out the chain of events in Australia should be all the evidence we need. Ignorant disdain for the electronic payments industry is a major distraction from the real issues facing our country today. The unemployment rate, the national deficit, and the educational system all lose our full attention every time we quip about debit card fees.

Customers spend more when they pay with plastic. Consumers don’t need to carry bundles of cash in their pocket. Banks employ millions of workers. Everybody already wins. deBanked’s advice? Let’s move on to fix a different system that’s actually broken. We’ll all be better off.

– deBanked

Debit Card Fee Reform is Gaining Steam in Canada

August 23, 2011Originally published on April 18, 2011.

Emboldended by the looming implementation of debit card fee regulation in the U.S., Canadians seem to have entered the ring. According to TheSpec, “Canadian retailers are calling on Ottawa to regulate the credit and debit card industry, saying voluntary measures have failed to reduce their costs.”

Previous attempts to lower fees, such as the Voluntary Code of Conduct introduced by the Federal Finance Minister Jim Flaherty have failed to produce any changes. What they hoped to gain from a voluntary code, one can only wonder. However, it does provide the basic framework on which retailers will build their case. Read the below from the Financial Consumer Agency of Canada:

Code of Conduct for the Credit and Debit Card Industry in Canada

Purpose

The purpose of the Code is to demonstrate the industry’s commitment to:

- Ensuring that merchants are fully aware of the costs associated with accepting credit and debit card payments thereby allowing merchants to reasonably forecast their monthly costs related to accepting such payments.

- Providing merchants with increased pricing flexibility to encourage consumers to choose the lowest-cost payment option.

- Allowing merchants to freely choose which payment options they will accept.

Scope

The Code applies to credit and debit card networks, (referred to herein as payment card networks), and their participants (e.g. card issuers and acquirers1).

The payment card networks that choose to adopt the Code will abide by the policies outlined below and ensure compliance by their participants. The Code of Conduct will be incorporated, in its entirety, into the payment card networks’ contracts, governing rules and regulations.

The Code will apply within 90 days of being adopted by the card networks and their participants. Networks and acquirers will have up to nine months to implement Element 1. Issuers will have up to one year to re-issue cards already in circulation that contravene Element 6 or 7.

Requirements for Payment Card Networks

By adopting the Code, payment card networks agree to provide any requested information regarding actions taken by themselves or participants to the Financial Consumer Agency of Canada, for the purpose of monitoring compliance with the Code. In addition, payment card networks agree to pay for the fees associated with monitoring compliance with the Code, as determined by the Financial Consumer Agency of Canada.

Policy Elements

1. Increased Transparency and Disclosure by Payment Card Networks and Acquirers to Merchants

The payment card networks and their participants will work with merchants, either directly or through merchant associations, to ensure that merchant – acquirer agreements and monthly statements include a sufficient level of detail and are easy to understand. Payment card networks will make all applicable interchange rates easily available on their websites. In addition, payment card networks will post any upcoming changes to these fees once they have been provided to acquirers.

Payment card network rules will ensure that merchant statements include the following information:

- Effective merchant discount rate2 for each type of payment card from a payment card network;

- Interchange rates and, if applicable, all other rates charged to the merchants by the acquirer;

- The number and volume of transactions for each type of payment transaction;

- The total amount of fees applicable to each rate; and,

- Details of each fee and to which payment card network they relate.

This information must be presented in a manner that is clear, simple and not misleading.

2. Payment card network rules will ensure that merchants will receive a minimum of 90 days notice of any fee increases or the introduction of a new fee related to any credit or debit card transactions. Payment card networks will provide at least 90 days notice to acquirers for rate and / or fee changes and at least 180 days notice for structural changes3.

Notification is not required for fee changes made in accordance with pre-determined fee schedules, such as those based on merchant sales volume, provided that the schedules are included in the merchant’s contract.

3. Payment card network rules will ensure that following notification of a fee increase or the introduction of a new fee, merchants will be allowed to cancel their contracts without penalty.

By signing a contract with an acquirer, a merchant will have the right to cost certainty over the course of their contract. As a result, in the event of a fee increase or the introduction of a new fee, merchants will be allowed to opt out of their contracts, without facing any form of penalty, within 90 days of receiving notice of the fee increase or the introduction of a new fee.

Merchants may not cancel their contracts in relation to fee increases made in accordance with pre-determined fee schedules, such as those based on merchant sales volume, provided that the schedules are included in the merchant’s contract.

4. Payment card network rules will ensure that merchants who accept credit card payments from a particular network will not be obligated to accept debit card payments from that same payment card network, and vice versa.

Payment card networks will not require merchants to accept both credit and debit payments from their payment card network. A merchant can choose to accept only credit or debit payments from a network without having to accept both.

5. Payment card network rules will ensure that merchants will be allowed to provide discounts for different methods of payment (e.g. cash, debit card, credit card). Merchants will also be allowed to provide differential discounts among different payment card networks.

Discounts will be allowed for any payment method. As well, differential discounting will be permitted between payment card networks.

Any discounts must be clearly marked at the point-of-sale.

6. Competing domestic applications from different networks shall not be offered on the same debit card. However, non-competing complementary domestic applications from different networks may exist on the same debit card.

A debit card may contain multiple applications, such as PIN-based and contactless. A card may not have applications from more than one network to process each type of domestic transaction, such as point-of-sale, Internet, telephone, etc. This limitation does not apply to ABM or international transactions.

7. Payment card networks will ensure that co-badged debit cards are equally branded.

Payment card network rules shall ensure that the payment networks available on payment cards will be clearly indicated. Payment card networks will not include rules that require that issuers give preferential branding to their brand over others. To ensure equal branding, brand logos must be the same size, located on the same side of the card and both brand logos must be either in colour or black and white.

8. Payment card network rules will ensure that debit and credit card functions shall not co-reside on the same payment card.

Debit and credit cards have very distinct characteristics, such as providing access to a deposit account or a credit card account. These accounts have specific provisions and fees attached to them. Given the specific features associated with debit and credit cards, and their corresponding accounts, such cards shall be issued as separate payment cards. Consumer confusion would be minimized by not allowing debit and credit card functions to co-reside on the same payment card.

9. Payment card network rules will require that premium credit and debit cards may only be given to consumers who apply for or consent to such cards. In addition, premium payment cards shall only be given to a well-defined class of cardholders based on individual spending and/or income thresholds and not on the average of an issuer’s portfolio.

Premium payment cards have a higher than average interchange rate. They must be targeted at individuals who meet specific spending and/or income levels.

10. Payment card network rules will ensure that negative option acceptance is not allowed.

===================

If payment card networks introduce new products or services, merchants shall not be obligated to accept those new products or services. Merchants must provide their express consent to accept the new products or services.

1 “Acquirers” are entities that enable merchants to accept payments by credit or debit card, by providing merchants with access to a payment card network for the transmission or processing of payments.

2 The effective merchant discount rate is calculated as the total fees paid by the merchant to an acquirer, related to the processing of a specific type of payment card from a payment card network, divided by the total sales volume for that type of payment card.

3 Structural changes are significant changes to the fee structure for a payment card network. This includes the introduction of new types of interchange or other fees, a change to the interchange rate structure or the introduction of a new type of credit or debit card.

===================

There are many similarities with this and reports published in two other countries:

Australia: A Study of Interchange Fees and Access, Year 2000

United States: Debit Card Interchange Fees and Routing, Year 2010

As Canada copies their neighbor to the south to regulate electronic payments, we can’t help but shake our heads. This scenario played out in Australia back in 2004 and the outcome was very different than intended. Debit card costs rose as a result and savings were not passed along to consumers. There is proof that Interchange Regulation and Reduction Will Fail, as outlined in a recent article.

Americans and Canadians enjoy poking fun at eachother’s missteps. This time however, the jokes on both of us. Debit card fee reform will fail and we’ll all be worse off. What did we learn from Australia? Nothing mate.

– deBanked

Your Credit Card Processor is on the Hook for illegal Sales

August 23, 2011

A long, long time ago when I first got into the electronic payments business, I encountered a tricky situation. One of my clients owned a small retail store in a mall selling African art, sculptures, posters, and merchandise. Looking over the previous few statements, it was obvious their customers paid face to face, their transactions ranged from as low as $2 to as high as $150, and that they conducted about $10,000 in sales per month. I was happy to have saved them a few bucks and made my way on to the next client.

Three weeks later I was called into the boss’s office. He stared at me intently and asked in a very serious tone “What do you know about this art store?” I replied with what I knew but was confused as to what the fuss was about. That very same art store had run three transactions for $7,000 in one day, all with foreign credit cards that were hand-keyed into the machine. Red flags went off and the processing account was frozen. The sales were far in excess of $150, he processed double what he would normally do in a month all in one day, the transactions were not conducted face to face, and the cardholders were not in the U.S. It didn’t look good.

I, with my boss, called the art store to determine what had happened. The owner explained that his brother owned an adventure touring business in Kenya. Since he didn’t have the ability to accept credit cards, he would occassionally take the card information from customers, call his brother in the U.S. and have him run the transactions for him at the art store. Once the deposit cleared, the proceeds would be wired back to his brother in Kenya and the customers would be told that their adventure tour was approved.

That’s not exactly art, sculptures, posters or merchandise now is it? We didn’t catch it because they hadn’t done this in any of the previous three months statements they supplied to approve the account. To our surprise, the banks reached the card holders who confirmed the transactions were legitimate and they had actually intended to pay $7,000 each for tours in Kenya. The only problem was that this retail store merchant account wasn’t approved for such use, nor could sales be processed by one business on behalf of another.

The result was termination of the account and a crash course for me in the school of electronic payment schemes.

All that was nothing compared to the shocking message online poker players received when trying to access fulltiltpoker.com and others on April 15th. A screenshot is below:

Online gambling is illegal and U.S. based banks are not allowed to process payments for gambling. So how did online poker sites accept card payments for over a billion dollars? They lied to the credit card processors about what they did or induced them to commit fraud in order to reap big profits.

As reported by Forbes, the scheme was very complex. the poker companies created multiple fake online shopping sites that supposedly sold flowers, pet supplies, and other items. So when a gambler used their Visa card to load their poker account with $100, the poker company would create a false invoice that showed $100 worth of flowers had been sold and shipped to the customer. The scheme was so efficient that it remained undetected for years.

As stated on Forbes “Federal prosecutors claim that the men behind PokerStars, Full Tilt and Absolute Poker, relied on highly compensated payment processors who lied to U.S. banks about the nature of financial transactions they were processing.” Shame on them.

I bet my old boss is shaking his head right now after hearing this on the news. No doubt all the new sales representatives are in his office, being stared at intently and spoken to in a serious tone. “What do you know about these poker sites you’re hearing about?” Confused by all the fuss, I’m sure they’re learning just like I did, that payment processing is a very, very serious business. Keep it clean and play by the rules.

– deBanked

Not an Expert in Payment Processing? Then Don’t Fund Merchant Cash Advances

August 23, 2011

If you have no experience in underwriting payment processing accounts, don’t bother becoming a Merchant Cash Advance (MCA) provider.

After a quick underwriting process, a MCA provider  purchases Business ABC’s future card sales. Business ABC receives a lump sum of capital and a percentage of each card sale is now directed back to the MCA provider. Two weeks later, Business ABC loses a $2,000 payment dispute with a customer and suffers a chargeback. Unwilling to bear any additional risk, the payment processor terminates Business ABC’s account. Business ABC can no longer accept card payments. What does the MCA provider do?

purchases Business ABC’s future card sales. Business ABC receives a lump sum of capital and a percentage of each card sale is now directed back to the MCA provider. Two weeks later, Business ABC loses a $2,000 payment dispute with a customer and suffers a chargeback. Unwilling to bear any additional risk, the payment processor terminates Business ABC’s account. Business ABC can no longer accept card payments. What does the MCA provider do?

Why did we hypothesize this scenario? Because this situation happens. The underwriting of a MCA doesn’t start with a credit score and end with a cash flow examination. The focus should be on the merchant’s future card payments. If the merchant’s ability to accept payments is at risk, then all the other factors aren’t worth diddly. You can have a client with 800 credit, processing consistent volume, have $50,000 in the bank at all times, and it just won’t matter. So what can go wrong? Your client’s funds can be frozen or their account closed in any of the following situations:

- The merchant processes a sale that is outside their approved parameters. For example: A restaurant has a $50 average ticket with a maximum allowable sale of $300. During the holidays they book a catering gig and attempt to swipe a $3,500 sale. BAD NEWS.

- The merchant is set up to swipe 95% of all card transactions but lately has been key-entering the card numbers nearly 70% of the time. BAD NEWS.

- The merchant you funded owns a retail store. His brother has a landscaping business. Occassionally the landscaping business will swipe cards through the retail store’s credit card machine and the brother will pay him the proceeds. If a business accepts payments on behalf of another business…. then BAD NEWS.

- The merchant has too many customers disputing charges. BAD NEWS.

- The merchant has insufficient funds in the bank account to cover the month end fees to the payment processor. BAD NEWS.

- The merchant processes payment far in advance of the services being rendered. BAD NEWS.

- The merchant’s average sale size is in excess of $1,000. BAD NEWS.

- The merchant swipes their own credit card through the terminal, effectively giving themselves a cash advance. This is illegal. BAD NEWS.

- The merchant has no refund policy. BAD NEWS.

- The merchant is processing with non-pci compliant equipment. BAD NEWS.

- The merchant changes their business ownership structure or legal entity type. BAD NEWS.

- The merchant takes payment for a prohibited item or service. BAD NEWS.

- The merchant has a security breach. BAD NEWS.

- The merchant violates any policy of their payment processor or payment network. BAD NEWS.

These are just a few situations that MCA providers need to be prepared for. One day everything is perfect and the next day their client’s ability to accept card payments is suspended or terminated. Historical statements can provide clues but anything can happen. A merchant with no chargeback history can have their account jeopardized with just one chargeback.

Alternative methods of collection such as direct debit and lockbox will be futile since they still depend on proceeds of payment processing. Simply speaking, if there are no more card sales, then you cannot recoup what you have purchased. And that’s the end of it.

It’s a risky business. MCA providers place an unbelievable amount of faith in their clients’ continuing ability to accept card payments. Rookies often comment that MCA providers are in a much better position to collect funds than a bank is on outstanding loans. This is outright false. A bank is entitled to payment no matter what happens to the business. Failure to pay a loan results in the reposession of collateral.

We have witnessed hundreds of MCA deals go south due to unforeseen payment processing issues. Being a funding provider may look attractive on paper, but if you think looking at the average sales volume, credit score, and cash flow history will get the job done, you’ll get smoked in this business. There’s a reason our site has two sections, Merchant Processing and Merchant Cash Advance. They go together. Don’t learn the hard way.

– The Merchant Cash Advance Resource

Banks Still Not Lending But Don’t Take Our Word For it

August 23, 2011Originally published 4/21/11

We’ve preached that banks aren’t lending and we feel confident in that assessment. This was today’s news headline:

According to Fortune, the four largest banks have reduced their loan balances by $210 Billion over the past year. Now about three years out from the height of the financial crisis, capital is becoming harder to access, not easier. “That’s partly because banks must put the worst mistakes of the bubble era in the rearview mirror, by taking losses on bad loans and letting other low-quality portfolios run off. Both those moves lead to lower loans outstanding.” With no tolerance for anything but the highest quality borrowers, business owners have few places to turn.

Now just might be the time to look into a Merchant Cash Advance...

– The Merchant Cash Advance Resource

Get a True Merchant Statement Analysis

August 23, 2011Get a True Merchant Statement Analysis for Free!

Posted on April 23, 2011 at 2:24 PM

News update 4/23/11

deBanked is now offering a free merchant statement analysis for business owners. Confused by what you’re paying? Looking to negotiate your current costs down? Want a second opinion? We’ll do it for you!

* No pressure to change your merchant service provider (We don’t even provide merchant accounts)

* No need to share your contact information with us (We won’t share your information)

The Fork in the Merchant Cash Advance Road

August 23, 2011Originally Posted on April 25, 2011 at 10:48 PM

The Merchant Cash Advance (MCA) industry is growing, albeit slower than some may have you believe. But it’s moving in two opposing directions, a condition that’s making it tougher to describe the financial product itself in general terms. MCAs are becoming more expensive and a lot cheaper at the same time. HUH? You read that right.

Originally aimed at business owners with poor credit, the risk of default or delinquency was overcome by withholding a percentage of sales revenue directly. As the credit crisis and Great Recession took hold, it attracted businesses of all credit backgrounds and today it’s widely accepted as a lending alternative, rather than a solution to poor credit.

As MCAs pushed forward to compete for customers normally accustomed to bank credit lines, the cost was stiffly resisted. These businesses had a tough time envisioning their financing terms to be anything outside of some percentage over the Prime Rate. Since a MCA is supposed to be structured as a sale, there is no APR equivalent, no timeframe, no amortization, nor any real familiarities of a loan. As the past couple years have passed, the product is more publicly understood, but for it to actually catch on, the costs had to come down. Many funding providers now refer to such high credit, low cost accounts as premium, platinum, preferred, gold, etc.

While the margins earned on high credit accounts shrank, funding providers were dealing with another challenge simultaneously, defaults. Whether the business owner intentionally interfered with their credit card processing or the store went out of business altogether, bad debt in the MCA world was mounting…FAST!

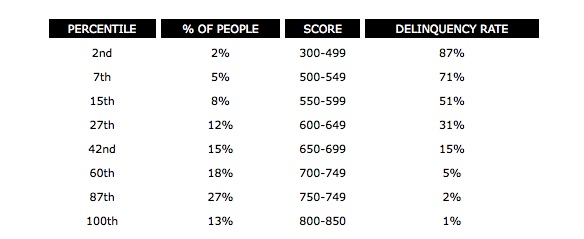

No matter which company ran the figures or how secret these portfolio statistics were, every funding provider came to the same realization. The lower the credit score of the business owner, the greater the chance of a problem. Why this came as any surprise, is a surprise in that of itself. The Fair Isaac Corporation (FICO) will have you know that any individual with a score below 499 has an 87 percent chance of being delinquent on a credit payment within the next 2 years. Delinquent, is defined as a payment of 90 days or more past due.

But wait… if a MCA is not a loan, nor does it depend on the business owner to make payments, then how can there be a risk of delinquency? Intentional manipulation of the revenue flow back to the funding provider can be relatively easy to do. A business owner could use spare POS equipment to accept card payments for which the funding provider is not aware of and therefore prevent the collection of funds. That’s a method known as splitting, and serious consequences can result when discovered. (Read more on what happens in the case of default or deliquency on a MCA in a previous article)

But outside the scope of malice, there’s the traditional reason, the inability to make payments. If the suppliers and wholesales aren’t being paid, then the business isn’t going to have inventory on hand to sell. If the rent isn’t being paid, then there’s not going to be any location to generate these sales. Essentially, the funding provider has a mutual interest in the business being able to satisfy ALL of their obligations, not just the MCA itself.

If there is an 87% chance that suppliers, landlords, or other essential creditors will not be paid on time in the next 2 years, then there’s an excellent probability that the business will be unable to operate at the same level. With no collateral as protection, the MCA industry has adapted to the challenge by raising the cost. Business owners with poor credit can expect funds to be expensive and the terms to be more restrictive. Lower funding amounts, higher withholding percentages, and the sacrifice of any negotiation is the price the MCA industry has set to make funding to the maximum risk group possible. These programs, which are now often referred to as starter advances, don’t work for everyone so the pros and cons should be weighed prior to executing a contract.

Both the premium advances and starter advances have experienced extraordinary growth to the point where they have become niches of their own. There are now starter advance companies and premium advance companies. Funding providers like Strategic Funding Source have taken the product a step further and reportedly did a MCA for an exhibit at the Tropicana Hotel in Las Vegas for $4 Million. Contrast that with deals that are struck for as little as $750. And we can’t fail to mention that some have taken it back to the basics, a loan. ForwardLine in Woodland Hills, CA lends money to businesses which are then repaid in accordance with a predetermined, fixed pace through the card sales. They have reintroduced concepts like APR back to the finance world.

If we continue at the current pace, MCAs will become less expensive, more costly, a lot bigger, and markedly smaller. We’ve come to the fork in the road for what the Merchant Cash Advance industry seeks to brand itself as. Loan alternative? First choice? Backup plan? Is it for smaller businesses or larger ones? Should it go the way of lending or continue to remain a structured purchase of future card sales? Is industry cohesion really necessary or will increased decentralization lead to greater acceptance of this financial product a whole? Will there come a time when America’s big banks swallow the industry up, buy out the existing portfolios, and add this product to their financing arsenals?

These are tough questions. Merchant Cash Advance is evolving, growing, and no longer moving in one direction. While we contemplate our next step, one thing is for certain, there’s no turning back.

– deBanked

www.merchantprocessingresource.com

The Interchange Debate: A Political Mess and a Waste of Time

August 23, 2011

The Huffington Post published a lengthy article today, titled “Swiped: Banks, Merchants And Why Washington Doesn’t Work For You.” While it reiterated the talking points for both sides of the Durbin Amendment debate, it made the case for neither. Rather it highlighted the dirty business of Washington politics. Millions of dollars are being spent on an unrelenting battle, which frankly will result in no winner.

Debit interchange reform was enacted in Australia in 2004 after an exhausting four year debate. The outcome? No savings were passed on to consumers and debit card use declined nationally. We broke down the findings in a previous article: Interchange Regulation and Reduction, Proof it Will Fail.

We will not make our case here again, but instead would like to point out the refreshing perspective by the Huffington Post:

“As swipe fees dominate the Congressional agenda, a handful of other intra-corporate contests consume most of what remains on the Congressional calendar: a squabble over a jet engine, industry tussling over health-care spoils and the never-ending fight over the corporate tax code.

The endless meetings and evenings devoted to arbitrating duels between big businesses destroy time and energy that could otherwise be spent on higher priorities. In America today, over 13 million people are out of work and millions more are underemployed. One out of every seven is living on food stamps. One out of every five American children lives in poverty. Yet the most consuming issue in Washington — according to members of Congress, Hill staffers, lobbyists and Treasury officials — is determining how to slice up the $16 billion debit-card swipe fee pie for corporations.”

We don’t remember debit card fees causing the Great Recession. We do remember the corrupt mortgage brokers, the exotic derivative securities, the overly leveraged investment banks, and the deficit spending at all levels of government. Repeal the Durbin Amendment or support the Debit Interchange Fee Study Act so we can undo the damage already caused and move on to more important matters.

– deBanked