merchant funding

Merchant Lending: The Evolution (Feedback)

March 13, 2013 The Inefficient Merchant Lending Market Theory got a lot of responses across social media sites and e-mail and I believe that some of them out to be echoed here for all to see. Feedback and debates are good because it allows everyone to know how the industry is actually thinking. Here are some snippets of what was said:

The Inefficient Merchant Lending Market Theory got a lot of responses across social media sites and e-mail and I believe that some of them out to be echoed here for all to see. Feedback and debates are good because it allows everyone to know how the industry is actually thinking. Here are some snippets of what was said:

Frank C: I think that the pragmatism of healthy business practices sometimes collide with the emotion of the sales process and when that happens the industry suffers. This is an emotionally charged–sales driven– industry and when companies are willing to “fund all deals” something will go wrong. The history of this industry is well documented by the failure of the “bring me all deals” model.

Robert S: After almost 40 years years of commercial finance, including as a factor, I’ve seen the same thing and highly recommend a strong Chinese wall between sales and credit.

Matt F: The conventional wisdom of the industry has been to keep the deals as short as possible to minimize the risk of default. This ignores the impact to the merchant over the long term… By making the terms longer, there is a lower risk of hurting the business therefore making the default rate lower.

Rodney B: After 6 months or less the client has gone thru all the funds and no access to additional funds and too far away from paying 50-80% of the MCA off, so they do the unthinkable.

A few soundbites I came across also seem to suggest that it may be time to drop the MCA name, especially since there are now funders offering products that are strikingly similar to a bank Line of Credit. I’m kind of thinking this may be the way things will turn out and I’ve said so in The MCA Industry is More Fractured. The name hasn’t been the same since February 2009 anyway, at least that’s what Google tells us based on search volume:

There are some that believe that the industry has stuck to short term deals for so long because the margins and annual return on them are just so darn good. Booking incredible yields with low defaults probably makes it easier to attract VCs, hedge funds, and other investors, so why screw it all up?

Lots to think about!

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Funding for Startups – An Ongoing Struggle

March 6, 2013Startup. Some people like the term and some people hate it. It doesn’t even mean the same thing to everyone. To some, the mega giant Groupon is a startup and they’ve been in business for almost 4 years and earned $638 million in revenue last quarter. To others, a startup is simply an idea for a business that hasn’t gotten off the ground yet. And to the Merchant Cash Advance industry, startups are people who don’t qualify for funding but manage to come storming through the front gates demanding loans while waving around business plans. There’s a real dilemma in this country. Millions of people aspire to go into business for themselves and very few have any idea what to do. I get exhausted just thinking about this because for many years, I’ve been trying to tackle what you’d think would be a simpler problem, funding people that ALREADY have a business.

It’s finally gotten much easier for existing businesses to obtain capital, so much so that I started to warn the lenders in a recent article about getting too aggressive with their programs. But all that aside, these lenders have been plagued with an ongoing problem for years, a problem that has caused marketing costs to skyrocket, and have made loans for everyone more expensive. That problem is startups. It’s not that startups aren’t appreciated, it’s just that imagine opening a hair salon and seeing there’s a line of a thousand people waiting outside the door to get in. At first, you’d probably think “wow! we’re going to need to hire 50 more stylists to satisfy all this demand,” but then you find out that 900 of the people waiting were men that were completely bald. It’s awesome that they were interested to come out and get a perm, but without hair, there’s nothing for the stylists to do. The business ends up spending a lot of time and money telling folks with no hair that a mohawk will not be possible, causing the price of haircuts to go up for everyone else.

It’s finally gotten much easier for existing businesses to obtain capital, so much so that I started to warn the lenders in a recent article about getting too aggressive with their programs. But all that aside, these lenders have been plagued with an ongoing problem for years, a problem that has caused marketing costs to skyrocket, and have made loans for everyone more expensive. That problem is startups. It’s not that startups aren’t appreciated, it’s just that imagine opening a hair salon and seeing there’s a line of a thousand people waiting outside the door to get in. At first, you’d probably think “wow! we’re going to need to hire 50 more stylists to satisfy all this demand,” but then you find out that 900 of the people waiting were men that were completely bald. It’s awesome that they were interested to come out and get a perm, but without hair, there’s nothing for the stylists to do. The business ends up spending a lot of time and money telling folks with no hair that a mohawk will not be possible, causing the price of haircuts to go up for everyone else.

Some lenders are so inundated with startups that they stop marketing altogether. Others try to board up their pay-per-click ads with specific instructions for startups to STAY AWAY. It doesn’t reflect very well on the brand to do this, but if bald guys were overrunning a hair salon, the poor stylists would have to do something so they weren’t driven out of business. I’m not making fun of startups per se, I’ve been a part of 3 startups, including my own. I’ve been in the position where I was unsure of what to do first, especially since I never knew anyone that funded people whose businesses weren’t already up and running. Yes, I was the guy who knew tons about business lending and I had no idea how to raise capital for a business that hadn’t yet started.

Some lenders are so inundated with startups that they stop marketing altogether. Others try to board up their pay-per-click ads with specific instructions for startups to STAY AWAY. It doesn’t reflect very well on the brand to do this, but if bald guys were overrunning a hair salon, the poor stylists would have to do something so they weren’t driven out of business. I’m not making fun of startups per se, I’ve been a part of 3 startups, including my own. I’ve been in the position where I was unsure of what to do first, especially since I never knew anyone that funded people whose businesses weren’t already up and running. Yes, I was the guy who knew tons about business lending and I had no idea how to raise capital for a business that hadn’t yet started.

Oh I knew how to set the gears in motion: perform market research, talk to potential customers about what they want, draw up a plan, incorporate, get the necessary permits, draw up an operating agreement, pay for legal advice, and set aside a large enough cash cushion to pay for at least 3 months expenses in case nothing went as planned. I had enough experience to know what I needed to be ready, but I guess I was still shocked the day I went to a bank to finally open a business account. With my account, the bank granted me a substantial unsecured line of credit. I’m fortunate to have an excellent credit score and that definitely played a role, but try to understand that I walked into the bank with no job and no income. I told them I was starting a business, wanted to open a bank account, and had all my business document ducks in a row and within 2 minutes I was approved for a line. This is after I’ve been hearing for years that no banks were lending, businesses with excellent credit couldn’t get money, and startups had no place to go.

Keep in mind though that I didn’t just walk into the bank and tell them all my good ideas and sum it up by asking for money. Heck, I didn’t even ask for money at all, though it was really nice to have it. I went in showing I meant business and walked out with something that everyone said is impossible to get in this country. I’ll admit there’s a few caveats. I live in New York City, have a decent net worth, have great credit, and have a background in business financing. So I’m not going to pretend that what worked for me is what’s going to work for everyone else.

I’ve always wanted to help the people I couldn’t. So I’ve been wracking my brain for some time as to what to do if a hair salon had 900 bald customers waiting on line. Do you help them regrow their hair first?

I totally believe in the old fashioned way of raising money, which means making sure you have enough of your own money saved up and taking every measure possible to be ready to launch before looking elsewhere for help. I realized though that many people don’t have the capital to get them as far as opening day, some don’t have strong enough credit to be confident that a bank line would ever be possible, and others just have a dream of something they want to do but have no money to even put their idea to the test. I’d say they were out of luck, but new friends of mine were telling me that’s not exactly right.

I totally believe in the old fashioned way of raising money, which means making sure you have enough of your own money saved up and taking every measure possible to be ready to launch before looking elsewhere for help. I realized though that many people don’t have the capital to get them as far as opening day, some don’t have strong enough credit to be confident that a bank line would ever be possible, and others just have a dream of something they want to do but have no money to even put their idea to the test. I’d say they were out of luck, but new friends of mine were telling me that’s not exactly right.

Crowdfunding – Get familiar

I recently spoke with Rachael Alford, a crowdfunding consultant who told me that you didn’t need to approach startup capital the old fashioned way. A bank? What’s that? The exact conversation between us is available online and I learned that folks with a serious idea can actually raise money just on the IDEA alone. Crowdfunding means raising money from other people so a lot of effort is required to make it work for you. When you go to a bank, the bank is forced to acknowledge that you applied and then decide to either approve or reject your application. With crowdfunding, your campaign to raise money can be outright ignored. It’s not a “hi, please approve me, bye” experience. Rachael said, “the problem is, people think it is as easy as making a page (on Kickstarter, GoFundMe etc.) and then they can just tweet or share the funding request and that is it.”

Driving interest to your crowdfunding campaign to raise money is kind of like a test to sell your product on opening day. If you can’t get anyone interested in your campaign, how in the heck are you going to get them interested to buy your product once it’s done? It should be mentioned that crowdfunding doesn’t necessarily require you pay back the money raised with interest like a loan. Some campaigns can be donation based. Others can be in return for a prototype of the product. Rachael shared this example with me to better explain: “Say Joe has an idea that may or may not cure XYZ disease but he needs to buy a super xyz widget before he can prove his hypothesis. No one will loan him the $10,000 he needs to see if it can work. With crowdfunding, he can’t offer (as a reward) to cure backers who pledge $1,000 or more. He should offer what he has: limited edition t-shirts that read: I’m a hero, I helped Joe Smith try to cure XYZ. Get the point? If it’s a food start up don’t offer to cater a wedding, offer to name a brick, booth etc.”

So having the idea is a starting point but you have to sell that dream HARD to get people to invest in it. Fortunately, it’s easier than making appointments with scary Silicon Valley venture capitalists and having to sweat out a presentation and then being told at the end that your idea is terrible.

So having the idea is a starting point but you have to sell that dream HARD to get people to invest in it. Fortunately, it’s easier than making appointments with scary Silicon Valley venture capitalists and having to sweat out a presentation and then being told at the end that your idea is terrible.

Rachael teaches classes specifically to help people approach crowdfunding in the most efficient manner. If you’d like to know more about crowdfunding, I highly suggest you connect with her.

P2P Lending – Have you really not tried this yet?

On the flip side of raising capital is peer to peer lending. This type of financing has been around for quite some time. Websites like Prosper.com allow people to post loan requests so that individuals can collectively contribute to the amount wanted. Unlike crowdfunding, peer to peer lending is… lending. You can’t offer to name bricks after your peers instead of paying them back. In the case of Prosper.com, they act as the loan servicer but they also determine based on your credit rating the interest rate that your peers will have to charge. Prosper.com works for personal loans and for startup loans, but the key again here is that you can’t post a request and walk away. Instead you to have to rally people to your cause. Prosper.com sums it up with this tip on their website: “Asking your friends and family to invest in your listing and give you a recommendation will increase your chances of having your listing fully funded.”

Selling on Ebay or Amazon makes you official already

A third option for startups is Kabbage. Though they are technically a Merchant Cash Advance financing provider for established businesses, they specifically fund people with ebay and Amazon stores. I find that many people that want a shot at starting their own retail business have already tested out their skills on ebay or Amazon. What they may not know is that Kabbage sees these sellers as businesses already and that they need not feel like a startup at all!

There is no sleep-while-you-get-funded method of raising capital

Alas, raising money for a startup means work. Whether that work means being ready to cut the tape at the grand opening before applying for a loan or furiously banging the social media drum to mobilize people to your cause to invest. To the entrepreneurs that read this, I hope you’re a little bit more informed about where to start. To the lenders, the good news is that startup financing does exist, we just need to guide these people to the right places.

Perhaps there is an opportunity for lenders to set up peer to peer lending or crowdfunding campaigns on behalf of all the serious startups that call in. They could top it off by contributing the first 10% of capital needed to help them generate buzz to raise the rest. Let the market decide if the business plans are viable. If successful, then you can consult them through their grand opening and up through the point that they become eligible for a merchant loan. I would think a fee for this service would be reasonable. Everybody wins.

We need not struggle!

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

The Inefficient Merchant Lending Market Theory

March 5, 2013There are 4 major factors used to determine approvals in the merchant lending market:

• FICO Score / Credit Report history of owners

• Monthly Gross Revenue

• Time in Business

• Average Daily Bank Balance

Only 1 of these factors considers the applicant’s reputation, and that’s credit reports. Credit reports reveal past payment history with other creditors. They show lawsuits, unpaid taxes, and bankruptcies. Knowing whether an applicant pays on time or not is valuable to lenders but it fails to reveal an even more important metric, the business’s ability to generate future profits. If you’re shaking your head and saying “credit reports aren’t for that purpose,” I would respond by asking which of the 4 factors then is?

The amount of money deposited in someone’s bank account in the past reveals how much they took in, but it doesn’t indicate what will happen in the future. Similarly, a substantial daily ending bank balance may show responsibility to maintain a cash cushion, but it says nothing about how likely customers are to buy from that business in the future.

Could time in business then tell us? Is it safe to assume that a business that has been operational for a year, two years, or five years will be there for many more years to come? The local auto mechanic that’s been around for 5 years may only have lasted because no one else has gotten around to opening up a rival auto shop. Would it be safe to give the most hated mechanic in town a three year loan when their success is simply the result of being the only auto mechanic in the community? There may be somewhat of a correlation between time in business and customer satisfaction but it is by no means strong enough to predict future success.

In effect, the major metrics used to judge small businesses for financing today take no consideration of the number one thing that matters to a business for survival, customers. Without customers, the amount deposited historically means nothing. Without customers, a 700 FICO score cannot produce sales, profits, or money to repay a loan. Without customers, a 50 year old restaurant can’t continue to stay open just because it’s been there for 50 years. And without customers you better hope that $1 million in sales last year made you really rich, since without customers, you’re going to need to start a new business… preferably one WITH customers.

This doesn’t mean that these 4 factors are irrelevant, they’re not. But I believe these factors combined are but a tiny sliver of data to predict how well a business will do in the future and at the same time repay a loan. Relying on weak indicators forces lenders to charge higher rates since they must compensate for the risk of unknowns. It also decreases the length of time that lenders can trust their borrowers to hold their money for.

It is no surprise then that loan terms in the merchant lending industry only range from 3 to 12 months. None of the lenders are able to predict how their borrowers are going to do far into the future, so they bank on the odds that sales and deposits in the next few months will mimic sales and deposits in the last few months. That’s also the reason why there are a lot of test/starter/trial funding rounds that are short to witness how a merchant “does” before funding additional capital on a longer term. Underwriters are flying blind. They have to see how you do because they have no data to suggest what will happen.

The big firms do have SOME data by now, but they’re broad statistics that say a certain industry in a certain region is likely to perform X with a Y margin of error. Or FICO scores below 600 are likely to have a Z rate of default. Yet this data also ignores a business’s reputation and relationship with its customers. It applies a blanket assumption of performance over the period of 3 to 12 months. These statistics are highly important to a lender because they can use them to predict defaults and delinquencies as a whole and enable them to set rates that will cover all of it and then some.

The big firms do have SOME data by now, but they’re broad statistics that say a certain industry in a certain region is likely to perform X with a Y margin of error. Or FICO scores below 600 are likely to have a Z rate of default. Yet this data also ignores a business’s reputation and relationship with its customers. It applies a blanket assumption of performance over the period of 3 to 12 months. These statistics are highly important to a lender because they can use them to predict defaults and delinquencies as a whole and enable them to set rates that will cover all of it and then some.

The owner of an ISO once asked me, “Wouldn’t it be great if we got to the point where we were funding every business in America?” My answer was “No.” If 10, 20, or 30% of those businesses failed to repay or eventually went out of business (and they would if you funded everyone) and the lender STILL made money, then the ones in good standing had to of gotten charged way too much. It would also mean that there had to be a portion of performing loans that were actually distressing the borrower, causing the capital they obtained to work against them, rather than for them. The goal shouldn’t be to fund EVERYONE, but rather to fund the few that could truly benefit.

A great example of doing it wrong is Wonga, a UK based lender that accepted a 41% rate of bad debt in 2011 while still managing to reap £62.4 million in profit. If Wonga had a few hundred bucks, a few thousand bucks, or heck only a million, they’d probably be very careful about who they approved and why they approved them. But venture capital changes the game and not always in a positive way. Putting a few hundred million dollars in the hands of Wonga has caused them to become incredibly inefficient.

Why should they only fund 5,000 people through a highly comprehensive underwriting process when they can fund 30,000 people with a one-size fits all rate, ask no questions, and accept that they will burn a lot of their customers along the way? This is the question they must have asked themselves years ago. (You can read the founder’s interview HERE)

At some point when they were developing their business model they had to admit that they really didn’t care what the outcome would be for their borrowers, so long as the business made money. And so they created an algorithm that would statistically predict the rate of default based on weak indicators like demographics, how they answered a few questions, and credit score and the resulting delinquencies were just necessary casualties to make the system work. In essence, Wonga knows they will devastate a portion of their customers and accepts this. They’re like a restaurant that only sells sugar frosted donut cheese ice cream to obese people and accepts that 41% of their revenues will be lost due to their customers dying. Can a lender truly be helping a community or economy where it intentionally hurts a percentage of borrowers because it’s still profitable at the end of the day? Do their contests, soccer sponsorships, and positive messaging on social media make up for their disruption to the economy?

Wonga’s mission is to grab market share, a strategy to make holy their blanket performance statistics and the rate that has to be charged to make money. Every single individual in the country becomes a candidate for their loans even though the lender will never know anything about the individual borrowers, their long term prospects, or what they can afford. The math says it doesn’t matter because an acceptable amount of the loans will perform and applicants can either accept the high rate or get nothing.

How I portray Wonga is not what I think of the merchant lending market in the US but rather I believe they’re a good example of the trap that merchant lenders COULD fall into if they come into too much money. When I first began to hear lenders fresh off a capital raise saying they wanted to fund the sh*t out of small business and would do anything in their power to fund as many deals as possible, I fear they could end up disrupting communities more than they could help them.

You know that thing called the Internet?

You know that thing called the Internet?

So I’ve talked a lot about what lenders don’t know but nothing about what they can learn. There is an unbelievable amount of free data available on the web that can collectively be used as a strong indicator of future business performance. You know those all important customers I spoke about earlier? The ones that make a business a business? Well lucky for us, they seem to go online and offer feedback about their experiences. Yelp, Zagat, and Facebook come to mind.

How is a business REALLY doing? Reviews will tell you a lot so long as there are enough of them, and not just the star meter, but the actual written reviews. I assure you that it will help a lender if they see that the last 10 reviews say that the owner is a no good lying crook that stopped paying his employees and punched a customer just the other night. A business’s whole reputation can’t be assessed from paperwork and credit scores, but it can be by hearing from people in the local community. That community is online.

That brings me to another point here. If a small business isn’t online, then no faith should be put in that small business in 2013. I don’t know why there are still so many small businesses out there that don’t use e-mail, don’t have a website, and don’t participate on social networks. Unless their shtick is that they are an Amish style operation striving for authenticity, then not being online should be an indicator that they do not care much about their long-term success. I would go so far as to say that any business that does not have at least a website, business fan page on Facebook, twitter account, or a reasonable substitute should be automatically declined for financing. Yeah, I said it!

In 2013, ignoring the Internet is like opening a store with no sign, boarding up the windows, and surrounding the front door with barbed wire. Sure, the locals might know you’re there and be smart enough to come in the back door, and maybe they’re enough to keep your business stable but no one else will find you and the ones that do, will see that you have no interest in being something more. You don’t have to be on every social network but if you’re not on any, you’re doing something wrong. Ideally, you should be somewhat active with your customers online too. This doesn’t mean sending each person that dined at a restaurant a Thank-You e-mail, but it does mean addressing complaints if there are any, posting announcements so customers can see them, and taking steps to improve your reputation.

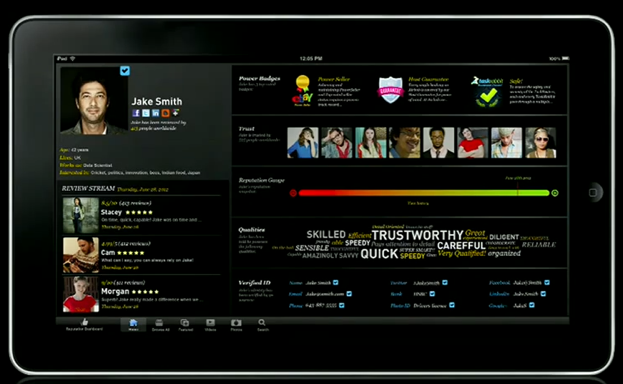

There are many, many trust and reputation signals online. At the most recent TED Conference, Rachel Botsman talked about collaborative consumption, trust, and reputation. She believes that trust is the most vital currency in our economy, not the money in your bank account, but trust. I highly recommend you watch it below. You should definitely take notice of what may eventually become a reality, an individual’s reputation scorecard, a report that aggregates reviews from everyone you’ve ever had an exchange with, and one that has the ability to evaluate the transactions which have the most meaning. My stellar e-bay seller record going back to 1999 might be on there (72 rave reviews baby!) but they won’t be as important if you’re looking to determine how credible I am as a business lending analyst. Still, in the grand scheme of reputation, they could have their place if someone wanted to gauge how trustworthy I am to deliver on something I agreed to.

Release the darn data

You want to know who is holding out on making the merchant lending industry and American economy a better place? The North American Merchant Advance Association (NAMAA) is. NAMAA possesses a database of every merchant that has defaulted or gone delinquent with a funding member in the last 4 years. There’s thousands of names in it. Not a member of NAMAA? You won’t get to know if a merchant has tried some funny stuff with another funder or gone out of business while having an advance.

But you want to know who this private bank of data hurts most? It hurts every business and wholesaler these merchants work with in the future. A month after a retail store fraudulently skips out on a $100,000 advance, that same retailer could apply for 60 day terms with a supplier and sign a 5 year lease for a new business location. Don’t that supplier and landlord deserve to know that their “awesome” new client has a reputation for committing theft and fraud as recent as 30 days ago? I think it’s our duty to let them know. NAMAA is withholding information that could prevent a lot of unreputable people from doing further harm in local economies. Make this data public and we’ll allow suppliers, landlords, and other lenders to make more informed decisions.

But you want to know who this private bank of data hurts most? It hurts every business and wholesaler these merchants work with in the future. A month after a retail store fraudulently skips out on a $100,000 advance, that same retailer could apply for 60 day terms with a supplier and sign a 5 year lease for a new business location. Don’t that supplier and landlord deserve to know that their “awesome” new client has a reputation for committing theft and fraud as recent as 30 days ago? I think it’s our duty to let them know. NAMAA is withholding information that could prevent a lot of unreputable people from doing further harm in local economies. Make this data public and we’ll allow suppliers, landlords, and other lenders to make more informed decisions.

I’ve heard the argument that privacy can be a big selling point to borrowers. They don’t necessarily want outsiders to know that they borrowed money or to suffer the shame if they don’t pay it back. I can understand the benefits of privacy from a competitive standpoint for a borrower but it defies all logic and reason for a lender to keep a default under tight wraps. Public record of a default discourages borrowers from defaulting in the first place and is helpful to everyone that may interact with that borrower in some way in the future. How many merchants would reconsider signing on the dotted line for $50,000 if they knew a default meant the lender would personally message all of their fans on Facebook to tell them about it? Is this wrong? Is this any of the customers business? What if their customers were paying for services 12 weeks in advance? Would their customers have the same confidence that their service would be rendered knowing this new information? It is likely that some customers would view a default as a sign that the business cannot deliver on their promises and reconsider using them. By not letting them know, you are putting them all at risk of paying for services they might not get.

Even though everyone hates me, I project 300% growth!

Show an underwriter a chart of sales projections for the next two years and they’ll have no idea if it’s just wishful thinking. All the demographic research in the world won’t convince the bank that people will trust your product. Show an underwriter that 50, 100, or a thousand people are saying positive things about their experience with you online, and they might believe you’re on to something. Time in business, cash flow, profitability, and positive credit history show what someone did and what they have, but reputation and trust reveal what someone’s success in the future will be like.

It’s not just what they say about you

Your reputation goes beyond just what people are saying about you. At some point, you’ll talk back and what you say can clue lenders into who you are and what you are doing. I’ve caught a few business announcements on Facebook that went something like “To our loyal customers, we are making a last ditch effort to get a merchant cash advance to pay off our landlord by Friday and keep the business open. If it does not happen, then we want to thank you all for your support over the years as we will close for good.” Yeah, it’s interesting to see things like this after you just had a 15 minute conversation with that same person that claimed the funds would be used for a marketing campaign.

With hundreds of millions of dollars burning a hole in their pocket, a lender may be tempted to take the Wonga approach. I guarantee Wonga would say I wasted my time by examining a business owner’s social interactions. They’d say there were statistics and data that show they should fund that business anyway because the FICO score and sales volume are within their parameters, that defaults were acceptable and built into the numbers, and that funding as many businesses as fast as you can above a certain interest rate, is better than funding fewer businesses with more appropriate terms.

This is the premise of my inefficient merchant lending hypothesis for lenders that get real sloppy when they have too much money. Would you rather be a lender that charges more, funds more, and knows less about your borrowers or would you rather charge less, fund more intelligently, and know more about who you’re funding? The first road accepts that you will outright devastate a percentage of your customers, disrupt local economies, and leave a bad taste in the mouth of a handful of people. It might be profitable, but could you really claim to be a helper of small business?

When you fund EVERYONE, businesses with bad reputations can knock out competitors with good reputations, the cost of debt can harm more than it helps, or lenders can get skinned alive by defaults they never saw coming. We need to be aware that there are consequences to backing a business with a bad reputation because it can allow them to squeeze out the guys that would’ve actually had the most positive impact on a community. The counter argument may be the theory by the philosopher Adam Smith, a gentleman famous for promoting economic principles such that the pursuit of self-interest promotes the good of society. By this standard, if it’s good for the lender, then ultimately it must be good for the economy. However, allowing yourself to devastate a percentage of your customers isn’t good for the lender’s reputation even if it’s profitable. In a sense, pursuing immediate profit doesn’t mean pursuing ones self-interest. It may be months or years before enough unsatisfied borrowers begin to affect your reputation as a whole. Eventually, public opinion will sway. It’s happening to Wonga right now. If a lender’s business practices today could force them out of business in 5 years, then they are not pursuing their self-interest.

When you fund EVERYONE, businesses with bad reputations can knock out competitors with good reputations, the cost of debt can harm more than it helps, or lenders can get skinned alive by defaults they never saw coming. We need to be aware that there are consequences to backing a business with a bad reputation because it can allow them to squeeze out the guys that would’ve actually had the most positive impact on a community. The counter argument may be the theory by the philosopher Adam Smith, a gentleman famous for promoting economic principles such that the pursuit of self-interest promotes the good of society. By this standard, if it’s good for the lender, then ultimately it must be good for the economy. However, allowing yourself to devastate a percentage of your customers isn’t good for the lender’s reputation even if it’s profitable. In a sense, pursuing immediate profit doesn’t mean pursuing ones self-interest. It may be months or years before enough unsatisfied borrowers begin to affect your reputation as a whole. Eventually, public opinion will sway. It’s happening to Wonga right now. If a lender’s business practices today could force them out of business in 5 years, then they are not pursuing their self-interest.

Real predictions, not just hoping tomorrow’s financial standing will be the same as it was yesterday

I look forward to the day when a merchant lender announces a 3, 5, or 7 year program. Their underwriting analysis would have to be incredibly well thought out, but that’s not a bad thing. Borrowers shouldn’t be forced to choose between an 8 month loan and a 9 month loan because so few lenders are willing to make real long-term projections. A business might make good use of short term financing to pay for an aggressive marketing campaign, but the likelihood that they could “open a 2nd store” and pay back all of the money with interest in 4 months isn’t very good.

My advice to the merchant lenders that are flexing their hundred million dollar muscles right now? Don’t carpet bomb the entire country with loans and hope that a one-size fits all rate and term will have a positive impact on the economy. It won’t. Writing off a portion of your customers today as collateral damage will hurt your reputation in the long run. Some businesses shouldn’t be getting funded even if they have money in the bank and a history of revenue. Others can’t sustain such short term repayments. These things should matter not just in the context of how much it will impact profits, but how much it will impact communities.

Incorporating factors like trust and reputation don’t have to slow the application process down. There are technologies to help aggregate, sort, and make sense of these signals online. Automation and speed are good but the day that lenders stop caring about who they’re funding and why they’re funding them is the day that lending becomes inefficient. When it becomes purely a numbers game, we’ll be in bubble territory. Can you think of any other industries where lenders stopped considering whether or not the loans were good for their borrowers and played the numbers? I’m sure you can 😉

Incorporating factors like trust and reputation don’t have to slow the application process down. There are technologies to help aggregate, sort, and make sense of these signals online. Automation and speed are good but the day that lenders stop caring about who they’re funding and why they’re funding them is the day that lending becomes inefficient. When it becomes purely a numbers game, we’ll be in bubble territory. Can you think of any other industries where lenders stopped considering whether or not the loans were good for their borrowers and played the numbers? I’m sure you can 😉

Lend efficiently, be a good citizen, and don’t be afraid to place a value on what customers are saying about your applicants.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Largest Merchant Cash Advance in History Ends in Default

September 27, 2011 Six months ago, news headlines publicized just how far the Merchant Cash Advance (MCA) product had reached. Once the ‘Plan B’ option for retail businesses in need of capital, the sale of future card payments was utilized to finance a project at a Las Vegas casino. And it was no small figure. New York based Strategic Funding Source (SFS) in collaboration with Vion, shelled out $3.147 Million in return for $4.092 Million of the Las Vegas Mob exhibits’s future sales. That’s a cost factor of 1.30, a price that typifies the average MCA deal.

Six months ago, news headlines publicized just how far the Merchant Cash Advance (MCA) product had reached. Once the ‘Plan B’ option for retail businesses in need of capital, the sale of future card payments was utilized to finance a project at a Las Vegas casino. And it was no small figure. New York based Strategic Funding Source (SFS) in collaboration with Vion, shelled out $3.147 Million in return for $4.092 Million of the Las Vegas Mob exhibits’s future sales. That’s a cost factor of 1.30, a price that typifies the average MCA deal.

While SFS was given high praise from their peers, some began to speculate if transactions that large were practical. After all, the costly financing of a MCA is priced in accordance with the risk of default, not in accordance with big profits for the financier. When your portfolio is in great shape, it can be easy to forget what the pitfalls are. And since the MCA industry paraded the Las Vegas Mob exhibit as the $4 Million deal that changed everything, we’re eerily reminded of the words by Jeff Mitelman, the CEO of AdvanceIt who was quoted two years ago as asking: “How prepared are you to lose $4 million dollars?”

We won’t pretend to know what led to the downfall of the Las Vegas Mob exhibit or why it went south so quickly. SFS could potentially lose 98% of their investment, a hit that will surely change their outlook on doing large deals in the future. The VegasInc article alleges gross mismanagement and fraud, factors that are difficult to foresee in the course of underwriting.

Industry message boards have been abuzz with comments on the default, with some competitors of SFS being accused of kicking a man while he’s down. “you ought to do smart funding, not just showing off your Balls,” one broker fired off at them. SFS has a stellar reputation and is one of the most knowledgeable firms in the MCA space. We have no doubt they inspected the merits of the deal backwards, forwards, and upside down. But nothing is perfect.

The default is expected to attract attention of the news media, leaving many to wonder how this transaction will be interpreted under the public eye. We assert that it will put to rest any criticism the MCA product has ever received about high costs.

Risk vs. Reward

Back in March when the deal was written, an outsider could claim that SFS just had an easy million handed to them. This view clashes with the Risk vs. Reward philosophy that MCA providers hold dear. To the MCA providers, the question was never “how can I make an easy million?” but rather, “how prepared am I to lose $4 Million?”

Any business that can’t get a bank loan, can’t get one for a reason. There’s a measurable value of risk that’s not worth taking. MCA providers fill the gap but compensate to offset defaults. There’s a term for something like this. It’s called a Happy Medium.

Merchant Cash Advance is the happy medium financing option for small businesses. And for the immediate future it is likely to stay within the small business niche. We all know now what can happen when the concept is applied to a multi-million dollar project. The outcome was not so happy and the loss not so medium.

But it will all even out in the end…

– Merchant Processing Resource

Merchant Cash Advance Industry is Waiting for its Big Moment

August 25, 2011Originally Posted 7/28/2011

According to an article in ISO&AGENT Magazine, the Merchant Cash Advance (MCA) industry has had significant success but “the companies that fund them acknowledge the cash-advance market is still waiting for its big moment.” This echoes our earlier opinion that a lack of collective marketing is keeping this financial tool from reaching its true potential.

How is it that in an ultra tight credit market that small businesses have not heard of MCA? With lax credit score standards, fast turnaround, minimal documentation, and a flexible method of repayment, it’s absurd that the industry has not reached so many that are looking to borrow. ISO & AGENT points to a negative image crisis and fingers the costs involved as a possible culprit.

The costs are a non-crisis. MCAs would be less expensive if they required collateral, perfect credit scores, fixed terms, ten years in business, and a 3 month underwriting process. If a small business meets those requirements and does not have a time sensitive opportunity they are looking to capitalize on, they should be going to their local bank. But most small business owners either do not meet that criteria or need the funds for a project they have going on today. Hence the product has to be more expensive for it to make sense for the firms providing the funds.

ISO&AGENT claims the industry has been compared to payday loans, an untrue characterization. In fact, that comparison has so rarely been made, that we can pinpoint the exact place they got that from. Inc.com published a very unflattering article on April 1, 2008 titled ‘Thanks, But No Thanks‘, in which they explain MCAs as “the business equivalent of a payday loan.” That was three and half a years ago! The article was not only biased and unfair, but was also written at a time when everything related to Wall Street, banks, or lending was being demonized as the nation sat on the verge of the Great Recession and economic collapse.

Still one can’t help but notice that buried deep within their criticism, is the answer to why MCAs are a tad bit more expensive:

The fact that collateral isn’t necessary is another important part of the MCA providers’ pitch. Entrepreneurs sometimes risk losing their homes if they can’t repay a bank loan, but they have no legal obligation to repay merchant cash advances if their companies fail, as long as they strictly follow the terms of the contract. They can’t encourage customers to pay in cash, for example, and they cannot switch credit card processors (typically, the MCA provider gets paid directly by the processor, rather than by the merchant). “If Diane’s Bistro goes out of business because Lauren’s Bar & Grill opens up across the street, we have absolutely no recourse to Diane, none whatsoever — as long as she follows the clearly defined covenants in our contracts,” says Glenn Goldman, AdvanceMe’s CEO.

And if you had any more reason to suspect MCAs are not as bad they tried to make it out to be, Inc.com published that article on April Fools Day. Case closed.

But there is indeed an image crisis and it’s that many businesses haven’t been exposed to the concept of MCA and thus cannot consider the pros and cons at all.

For instance: Most people can make the case for or against consumer payday loans. They’ve already got loads of information from the media, newspapers, banks, and lawmakers on which to base their argument. It’s become a well known household accepted form of financing. Whether or not payday loans can help the consumer is a separate debate.

That’s the difference. MCA is rarely spoken about by newspapers, banks, or lawmakers. Its presence in the media is limited and as a result we’re referring to stories published over three years ago. We have many friends employed as small business loan officers across the country and the only reason they’re aware of how MCAs work is because we told them. It’s embarrassing. And for an industry that funded over $500 Million last year alone, it really makes no sense.  We blamed antiquated marketing techniques: cold calling, junk mail, useless internet marketing, and spamming. The industry has gotten lazy and has a propensity to market their financing to small businesses that have already secured a MCA. This comes with bold promises of lower rates and other gimmicks. This inner competitiveness leads to both smaller margins and lower conversion rates. It does nothing to grow the industry as a whole.

We blamed antiquated marketing techniques: cold calling, junk mail, useless internet marketing, and spamming. The industry has gotten lazy and has a propensity to market their financing to small businesses that have already secured a MCA. This comes with bold promises of lower rates and other gimmicks. This inner competitiveness leads to both smaller margins and lower conversion rates. It does nothing to grow the industry as a whole.

That’s complemented by carpet bombing the public with an approach their customers learned to ignore a long time ago. Cold calls and junk mail. Really? Yes, really. There will always be a sliver of effectiveness from these methods and the firms that employ them will defend their success to the death. These methods may score some deals and perhaps even work well enough to grow a MCA firm, but it will not lead to the industry’s ‘big moment.’ Same goes for internet spam, poorly constructed articles that serve no purpose other than to boost some company’s SEO, and useless blogs kept by both respectable firms and no-name websites set up to harvest leads. Sure that’s the way of things on the internet these days but there isn’t anything beyond that. There are no mainstream media articles about MCA, forums for business owners where it is actively discussed, nor any public endorsements by anyone of high political or business stature.

Sounds like we have an image crisis on our hands. The Merchant Cash Advance Resource (the site you’re on right now) has been in existence for 1 year. In that time, we’ve made significant additions to the information that can be accessed here. We constantly receive emails from business owners and MCA brokers alike with the hope that we can provide them with an unbiased answer. And guess what? We do just that. By having no commercial affiliation, we give the best advice we can. The e-mail volume has gotten so heavy that our volunteer editors have trouble answering them all. But we try anyway.

And along the way we’ve managed to get some formal offers to convert this resource into a commercial site to generate sales leads. A six figure buyout offer here and there coupled with some lengthy, legalese filled non-disclosure agreements. We say ‘no’ every time. The Merchant Cash Advance Resource is designed to provide information, opinions, critiques, data, guides, and an independent ‘thumbs up’ to an industry that’s destined to do great things for small business.

Why do we spend the time, money, and effort to provide this service? We’re looking at the big picture of MCA. Big picture… Big moment…

And we’re on our way.

deBanked

https://debanked.com

The Fork in the Merchant Cash Advance Road

August 23, 2011Originally Posted on April 25, 2011 at 10:48 PM

The Merchant Cash Advance (MCA) industry is growing, albeit slower than some may have you believe. But it’s moving in two opposing directions, a condition that’s making it tougher to describe the financial product itself in general terms. MCAs are becoming more expensive and a lot cheaper at the same time. HUH? You read that right.

Originally aimed at business owners with poor credit, the risk of default or delinquency was overcome by withholding a percentage of sales revenue directly. As the credit crisis and Great Recession took hold, it attracted businesses of all credit backgrounds and today it’s widely accepted as a lending alternative, rather than a solution to poor credit.

As MCAs pushed forward to compete for customers normally accustomed to bank credit lines, the cost was stiffly resisted. These businesses had a tough time envisioning their financing terms to be anything outside of some percentage over the Prime Rate. Since a MCA is supposed to be structured as a sale, there is no APR equivalent, no timeframe, no amortization, nor any real familiarities of a loan. As the past couple years have passed, the product is more publicly understood, but for it to actually catch on, the costs had to come down. Many funding providers now refer to such high credit, low cost accounts as premium, platinum, preferred, gold, etc.

While the margins earned on high credit accounts shrank, funding providers were dealing with another challenge simultaneously, defaults. Whether the business owner intentionally interfered with their credit card processing or the store went out of business altogether, bad debt in the MCA world was mounting…FAST!

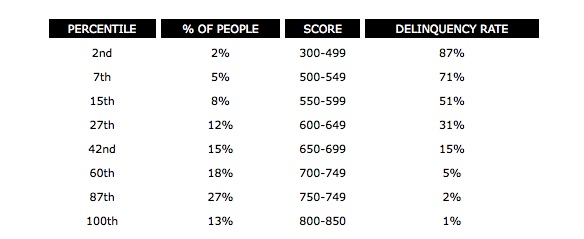

No matter which company ran the figures or how secret these portfolio statistics were, every funding provider came to the same realization. The lower the credit score of the business owner, the greater the chance of a problem. Why this came as any surprise, is a surprise in that of itself. The Fair Isaac Corporation (FICO) will have you know that any individual with a score below 499 has an 87 percent chance of being delinquent on a credit payment within the next 2 years. Delinquent, is defined as a payment of 90 days or more past due.

But wait… if a MCA is not a loan, nor does it depend on the business owner to make payments, then how can there be a risk of delinquency? Intentional manipulation of the revenue flow back to the funding provider can be relatively easy to do. A business owner could use spare POS equipment to accept card payments for which the funding provider is not aware of and therefore prevent the collection of funds. That’s a method known as splitting, and serious consequences can result when discovered. (Read more on what happens in the case of default or deliquency on a MCA in a previous article)

But outside the scope of malice, there’s the traditional reason, the inability to make payments. If the suppliers and wholesales aren’t being paid, then the business isn’t going to have inventory on hand to sell. If the rent isn’t being paid, then there’s not going to be any location to generate these sales. Essentially, the funding provider has a mutual interest in the business being able to satisfy ALL of their obligations, not just the MCA itself.

If there is an 87% chance that suppliers, landlords, or other essential creditors will not be paid on time in the next 2 years, then there’s an excellent probability that the business will be unable to operate at the same level. With no collateral as protection, the MCA industry has adapted to the challenge by raising the cost. Business owners with poor credit can expect funds to be expensive and the terms to be more restrictive. Lower funding amounts, higher withholding percentages, and the sacrifice of any negotiation is the price the MCA industry has set to make funding to the maximum risk group possible. These programs, which are now often referred to as starter advances, don’t work for everyone so the pros and cons should be weighed prior to executing a contract.

Both the premium advances and starter advances have experienced extraordinary growth to the point where they have become niches of their own. There are now starter advance companies and premium advance companies. Funding providers like Strategic Funding Source have taken the product a step further and reportedly did a MCA for an exhibit at the Tropicana Hotel in Las Vegas for $4 Million. Contrast that with deals that are struck for as little as $750. And we can’t fail to mention that some have taken it back to the basics, a loan. ForwardLine in Woodland Hills, CA lends money to businesses which are then repaid in accordance with a predetermined, fixed pace through the card sales. They have reintroduced concepts like APR back to the finance world.

If we continue at the current pace, MCAs will become less expensive, more costly, a lot bigger, and markedly smaller. We’ve come to the fork in the road for what the Merchant Cash Advance industry seeks to brand itself as. Loan alternative? First choice? Backup plan? Is it for smaller businesses or larger ones? Should it go the way of lending or continue to remain a structured purchase of future card sales? Is industry cohesion really necessary or will increased decentralization lead to greater acceptance of this financial product a whole? Will there come a time when America’s big banks swallow the industry up, buy out the existing portfolios, and add this product to their financing arsenals?

These are tough questions. Merchant Cash Advance is evolving, growing, and no longer moving in one direction. While we contemplate our next step, one thing is for certain, there’s no turning back.

– deBanked

www.merchantprocessingresource.com

Deja vu? Merchant Cash Advance in Wall Street Journal

August 10, 2011 Have you ever had a deja vu moment where you feel like something has happened already even though it hasn’t? And then all of the sudden it happens? Yeah, we just got a little of that. Or maybe we’re just psychic.

Have you ever had a deja vu moment where you feel like something has happened already even though it hasn’t? And then all of the sudden it happens? Yeah, we just got a little of that. Or maybe we’re just psychic.

It was just a couple months ago that we published a scathing editorial on the failure of the Merchant Cash Advance (MCA) industry to reach mainstream acceptance. (See: The Colossal Marketing Failure of the Merchant Cash Advance Product – June 28th, 2011). Most of our readers acknowledged the shortcomings but were at a loss for suggestions to overcome them. ISO&Agent Magazine quickly added their two cents by claiming that MCA was waiting for its big moment (See: Cash Advances: Negotiating a Maturing Market – July 26th, 2011) but completely missed the mark when they identified cost as the obstacle holding it back. It’s not cost, it’s communication.

How often is MCA cited in mainstream news publications? Wall Street Journal? New York Times?

-direct quote from our piece on June 28th

Today we can say that Merchant Cash Advance got its mention in the Wall Street Journal. :::Applause::: Though it’s only in their blog section, most people today get their news online anyway. The article features AdvanceMe, the largest and oldest player of the bunch. So how does the glorification of one company carry over to the industry as a whole? There were a bunch of good messages in there that describe the product itself: The article title implies it’s becoming more popular: “Cash-Advance Demand Rising” A description of how it works: “Merchant cash advances, which first appeared about a decade ago, provide capital in exchange for a share of future debit or credit-card sales. As such, they tend to be used by retailers, restaurants and other small businesses where a large number of customers pay with cards.”The common uses for it: “Business owners use the cash to buy new equipment, restock inventory or pay off debt” Yes, Yes, and Yes. Good for AdvanceMe and good for the MCA industry but this is only the beginning.

Every business owner should be aware of MCA, not just the ones that read the Journal today. It is Un-American (Yeah, that’s right) to withhold information from business owners that may enable them to capitalize on opportunities. With no bank loans available, most projects in this country are on hold. It’s simply not fair. We badly want to take the credit for today’s Journal mention, especially since we delivered our two previous articles on this topic to their editors in July. But the real hero here is AdvanceMe. Their press release the day before clearly caught the attention of the mainstream media. Great job guys. And we’d be remiss if we didn’t point out they forecasted an increase in funding by $1 billion in the next 2 years. That’s about equal to the industry’s entire volume combined. Is Merchant Cash Advance about to hit its growth spurt? AdvanceMe seems to think so. If they’re about to have their ‘moment‘, they’ll likely pull everyone else along with them.

– deBanked

https://debanked.com

Merchant Cash Advance Forums Goes Quiet

March 31, 2011 The Merchant Cash Advance Forums is an old discussion board for those working within or looking into the Merchant Cash Advance industry. On March 25th, 2011 the Forums implemented stricter account policies that now require members to submit detailed information about who they are and who they represent. This includes:

The Merchant Cash Advance Forums is an old discussion board for those working within or looking into the Merchant Cash Advance industry. On March 25th, 2011 the Forums implemented stricter account policies that now require members to submit detailed information about who they are and who they represent. This includes:

- Real name

- Company you work for

- Company’s address

- Your phone number

A public notice on the forums states “For the sake of adding value and integrity to the MCA Forums, an additional layer of moderation as well as basic data collection have been implemented. Members MUST now complete their private profile with their basic contact information. This required information is confidential, and other members will NOT be able to view it. Data collected is NEVER sold to third parties remains strictly confidential.”

And since this went into effect, the bustling discussion board has been for the most part a ghost town. While a few active participants proudly make their company affiliations known, most users hide behind a nickname for privacy. This certainly makes sense from a personal standpoint (the internet is dangerous!), but it also helps protect employers from liability should one of their employees openly discuss their opinions.

For example: John Doe states his affiliation with ABC Funding Co. upon registering with the site and posts “tHe iNdUsTrY iS dOoMeD!” Many of the other forum members may interpret that to mean ABC Funding Co. is in serious trouble or because of the way John Doe posts, that ABC Funding Co. does not employ very intelligent people.

Though there is an explicit promise of confidentiality, this industry has bred many stone cold skeptics over the years. If Facebook can get someone in trouble, anything can.

Of course, we may be wrong completely and the dull conversation could be a result of more time spent working, there being little to talk about, or an unwillingness to talk as the news of what is happening in California spreads.

This is by no means an attack on the MCA Forums. We used to check in on it pretty often. We recommend anyone in the MCA, payments, or banking industry to sign up to for DailyFunder.com now as of 2013. Just be careful. Anything you post on the internet can be linked back to you by someone, somehow.