Lead Management Fundamentals: How to purchase qualified leads

September 16, 2015 “I’ll never buy another lead again,” says a disgruntled sales person after failing to close quickly leads. Being in the lead business, I hear this all the time. Rarely do you hear, “I’ll never advertise again.” Yet, in many cases 99% of the people who see your ad won’t buy your product or your service. (Advertising serves other purposes like branding, but for most small businesses, advertising is to produce sales.)

“I’ll never buy another lead again,” says a disgruntled sales person after failing to close quickly leads. Being in the lead business, I hear this all the time. Rarely do you hear, “I’ll never advertise again.” Yet, in many cases 99% of the people who see your ad won’t buy your product or your service. (Advertising serves other purposes like branding, but for most small businesses, advertising is to produce sales.)

I once did a consulting job for a company that sold uniforms to Fire and Police depts. Their shtick was to send out catalogs every quarter and hope that 0.25% of those receiving the catalogs bought. Compare that to the Victoria’s Secret catalog that gets 11% of its catalog receivers to purchase. Uniforms are not as sexy as lingerie. But there is a huge gap between 11% and .25%. Even with such a small return on its catalog, this company was profitable.

In the lead business, the standard is raised even higher. A 0.25% response rate on leads does not work because you will typically pay a higher cost for a lead campaign than an advertising campaign. Besides, lead campaigns are a more targeted approach rather than the rapid fire shot gunning of advertising.

A good lead campaign should be bringing the buyer and seller together. A good lead campaign may only close 5% to 25% of the leads purchased. The percentages vary according to the industry. By comparison, on average only 2% to 3% of the clicks in a Google Merchant Cash Advance PPC campaign convert to sales. A reputable lead generation company can provide better averages than Google and in the MCA industry, it can deliver leads at a lower cost. There is real value in purchasing qualified leads.

Where I see most companies make a mistake in purchasing leads is that they focus on price rather than qualitative aspects of the leads. One of the most basic questions to ask is how the lead generation company defines a lead. (Data brokers like to say they are selling leads. Instead they are selling you contacts. Contacts are not leads. Contacts are information.)

A lead is a merchant who is in the market to buy a product or a service and is somewhere along the buying cycle and is willing to discuss purchasing the product or service with vendor(s). The real key phrase is “somewhere along the buying cycle and is willing to discuss with vendor(s).” This implies intent on the part of the merchant. Without intent to purchase, the merchant is simply window shopping.

The second area to focus on when purchasing fresh leads is to find out how the leads are qualified and optimized. Many lead generation companies rely on data scoring to qualify their leads. They simply scrub the leads against a database and those leads that meet a certain score are considered qualified. There is no attempt made to discover the intent of the merchant.

Lead generation is a people to people business. Phone qualification is the best qualifying approach. Phone qualified leads are some of the best optimized leads on the market because a good lead company will make sure that the merchants meet the minimum standards, that they have demonstrated intent to purchase, and that the expectations have been set on what is to happen next. (As can be expected, phone qualified leads offer some of the highest contact ratios as well.)

If you want to close more leads, make sure that the leads you are buying meet the criteria above. If you do, you will see your sales soar.

Who’s On Your Fantasy Funding Team?

September 14, 2015 A few years ago, a friend of mine was dropped by the funding brokerage he worked for and put on the waiver wire. He was promptly picked up by a competitor and today ranks among one of the top closers in the industry. It was one of the strangest moves of the season because his numbers had been really good month after month. It turned out that he was turned loose for earning too much money, something the firm wasn’t content with.

A few years ago, a friend of mine was dropped by the funding brokerage he worked for and put on the waiver wire. He was promptly picked up by a competitor and today ranks among one of the top closers in the industry. It was one of the strangest moves of the season because his numbers had been really good month after month. It turned out that he was turned loose for earning too much money, something the firm wasn’t content with.

Even though he was compensated on a commission-only basis, he was apparently putting the company over their salary cap. That of course begged the question, why was there a compensation cap for a top performer, somebody who was directly leading to the firm’s growth? For what it’s worth, he was entitled to approximately 20% of the company’s gross commission revenue. So on every deal funded the company took home the other 80% of the commission. This worked for both parties until the closer started earning well into the six figures, at which point they told him he wasn’t allowed to earn more than a certain amount.

Although discouraged by the sudden limitation, he continued to work hard to prove why the cap should be removed. It wasn’t. Soon afterward he found himself on the waiver wire.

He was replaced by two rookies fresh out of college who were willing to do the same job for a lot less, but neither had any experience in the field.

As someone who has been active in this industry for nearly a decade, I’ve watched this scenario play out dozens of times.

- Firm needs top talent to grow

- Firm hires Talent

- Talent produces

- Firm grows

- Firm doesn’t like that Talent is making so much

- Firm fires Talent or Talent quits

As the firms gallop off to the next scouting combine to find somebody younger and more malleable, the pool of experienced talent is dispersed across a sea of competitors. A consequence of this is that each of those companies become more evenly matched and it becomes increasingly difficult to stand apart from the crowd.

At trade shows and happy hours, it’s not uncommon for top players to openly question what would happen if they all joined forces to create a funding dream team of sorts. And while such cohesion rarely actually happens, I can’t help but imagine if given the opportunity to build the best team to win, who I would pick.

Top talent is expensive. I know this because I recently spent 89% of my budget in a fantasy football auction draft to acquire just three players. And last year I spent a similar percentage on only four players and won the entire league. My thought process was to build a team that was centered around the best of the best. Previous years of conservative play led to mediocre results and I wanted to change that.

Today, there are hundreds of alternative business financing companies and thousands that can be considered brokers. There’s a lot of decent teams out there but few that are built around a group of all stars. And oddly, some companies seem to be dumping their best and brightest on purpose, just like I described previously. That might lead to improved margins for the firm, but probably won’t help them win in the long run.

Here’s something to think about while you’re watching Monday Night Football. If you had to build your company around a core group of talented people, who would you pick? Don’t worry about whether or not they’re available or if they fit into your budget. Those are obstacles that can be overcome.

Here’s a list of positions to help you imagine your fantasy funder:

- 1 Senior Manager

- 2 Underwriters

- 2 Closers

- 1 Flex Spot

- 1 Admin

- 1 Collector

- 1 Tech Person

Good luck!

Yellowstone Capital to Drive Job Growth in New Jersey

September 11, 2015 According to Business Facilities Magazine (BF), NYC-based Yellowstone Capital is considering a move to Jersey City and was approved for up to $3.3 million in Grow NJ tax credits over 10 years.

According to Business Facilities Magazine (BF), NYC-based Yellowstone Capital is considering a move to Jersey City and was approved for up to $3.3 million in Grow NJ tax credits over 10 years.

Grow NJ is a New Jersey job creation program that is designed to give the state a competitive economic edge against surrounding states.

BF says that Yellowstone Capital would create 45 jobs.

The move would loosen the grip that Manhattan’s financial district has on the fast growing alternative business financing industry. Currently located at 160 Pearl Street, just steps away from Wall Street, Yellowstone surprised many industry insiders several months ago when their lifetime funding figures of $1.1 billion were published on the industry’s leaderboard.

A move to the Garden State would not be surprising in the midst of all the infrastructural improvements the company has made in 2015.

Competing Factions Hurt Alternative Lending’s Message

September 10, 2015 It’s over. Legislators and regulators in Washington DC know alternative lenders exist, and there’s no going back. There will be regulations that impact the industry in some way. That seems to be a definite at this point. What aspects will be regulated and to what extent however is yet to be determined.

It’s over. Legislators and regulators in Washington DC know alternative lenders exist, and there’s no going back. There will be regulations that impact the industry in some way. That seems to be a definite at this point. What aspects will be regulated and to what extent however is yet to be determined.

And here’s the important thing you need to know about that impending conversation with folks in DC; They’re not up to speed on many of the issues being debated between industry insiders, and honestly probably won’t be for a long time, if ever.

They’re literally on square one. So if you were secretly hoping that regulators were on the verge of outlawing stacking, excessive broker fees, or high interest rates, you’re going to be very disappointed. I would argue that more than likely they’d have no idea what you were talking about if you broached these issues with them and it would come across like this:

And that’s because they’re trying to fully understand more basic things such as, why would a small business borrow money online as opposed to a bank? And what does marketplace lending really mean and how does it work?

Folks in DC are genuinely curious about the basics. They want to understand because they don’t want to be caught not understanding and ignorantly lead the nation into another financial crisis. That’s why the Treasury recently issued a Request For Information. You should notice how there’s nothing about stacking in it, but rather more fundamental issues like whether or not marketplace lending is helping borrowers that were historically underserved.

You have to applaud the Treasury’s approach because informed regulations, if that’s what this all leads to, would be much better than uninformed regulations.

The process could easily be jeopardized however if everyone’s so caught up in choosing teams, sides, and points of view that they believe are the “right” ones with the hope of scoring nothing other than perceived political points.

If this is what folks in DC see while they are in the information gathering stage, well then it’s probably not going to be a good outcome for anyone:

Companies that buy future receivables with daily payments and lenders originating 3-year loans with monthly payments actually have a lot in common on the fundamental level. They’re both bank alternatives. And for a number of reasons, small businesses are choosing them over more traditional sources. That’s where the conversation needs to begin.

The opportunity to communicate with rule-makers shouldn’t be squandered on complaints about what other people are doing, but rather on the what, why, and how for small business.

The worst thing that could happen is that divisive language within the industry leads to a regulatory result that negatively impacts all the parties involved, including the small businesses that benefit from this improved system of accessing capital.

Surely there is a way forward for everyone…

Revenue Advance Searches Up, Small Business Loan Searches Down

September 8, 2015Back in early 2013, I explored the popularity of Google search phrases related to the industry. At the time, keyword phrases such as merchant cash advance were on a downswing after reaching their peak back in September 2008. Oddly, the keyword hasn’t been able to match the popularity it had seven years ago, but it is on the way back up.

Other keywords are just about dead, but perhaps most interesting of all is that small business loans has been declining consistently for about ten years straight, though it appears to have tapered off a bit.

Take a look:

three additional terms: merchant loans, ach loan, merchant financing

Hanna Kassis of Oarex Capital Markets noticed that the term Revenue Advance is at an all-time high. You can read his thoughts about that here:

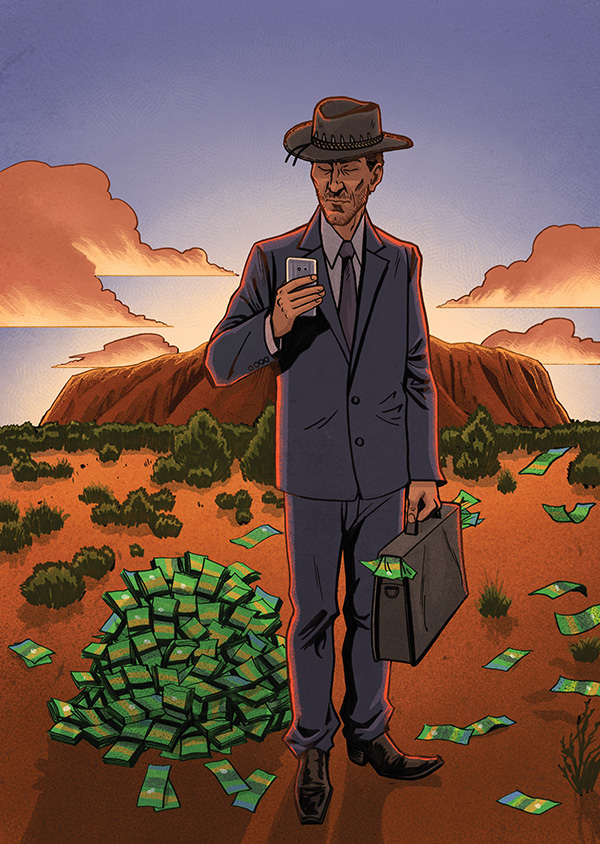

Alternative Funding: Over The Top Down Under

September 2, 2015 San Francisco had its gold rush, Oklahoma had its land rush and now Australia is experiencing a rush of alternative funding. After a slow start a few years ago, foreign and domestic companies have been flocking to the market down under in the last 18 months.

San Francisco had its gold rush, Oklahoma had its land rush and now Australia is experiencing a rush of alternative funding. After a slow start a few years ago, foreign and domestic companies have been flocking to the market down under in the last 18 months.

As many as 20 new alt-funders are doing business in Australia, but that number could swell to a hundred, said Beau Bertoli, joint CEO of Prospa, a Sydney-based alternative funder. “The market in Australia has been very ripe for alternative finance,” Bertoli, said. “We see an opportunity for the alternative finance segment to be more dominant in Australia than it is in America.”

Recent entrants to the embryotic Australian market include Spotcap, a Berlin-based company partly funded by Germany’s Rocket Internet; Australia’s Kikka Capital, which gets tech backing from U.S.-based Kabbage; America’s Ondeck, which is working with MYOB, a software company; Moula, which began offering funding this year but considers itself ahead of the curve because it formed two years ago; and PayPal, the giant American payments company.

The new entrants are joining ‘pioneers’ that have been around a few years, like Prospa, which has been working for three years with New York-based Strategic Funding Source, and Capify (formerly AUSvance until it was consolidated into the international brand Capify), which came to market in 2008 with merchant cash advances and started offering small-business loans in 2012.

Some don’t take the newcomers that seriously. “There are small players I’ve never heard of,” said John de Bree, managing director of Capify’s Sydney-based office, in a reference to local Australian funders. “The big ones like OnDeck and Kabbage don’t have the local experience.”

But many players view the influx as a good sign. “I think it’s an endorsement of the market,” Bertoli said. “There’s more publicity and more credibility for what we’re doing here in terms of alternative finance.” It’s like the merchant who gets more business when a competing store opens across the street.

Besides, the market remains far from crowded. “I’m not concerned about the arrival of OnDeck and Kabbage because it really does validate our model,” maintained Aris Allegos, who serves as Moula CEO and cofounded the company with Andrew Watt.

The market’s relatively small size – at least compared to the U.S. – doesn’t seem to bother players accustomed to the heavily populated U.S., a development some observers didn’t expect. “I’m very surprised,” de Bree said of the American interest in Australia. “The American market’s 15 times the size of ours.”

Others see nothing but potential in Australia. “This is a market that will evolve over time, and we think the opportunity is enormous,” said Lachlan Heussler, managing director of Spotcap Australia.

Some view the Australian rush to alternative finance not so much as a solitary phenomenon but instead as part of a worldwide explosion of interest in the segment, driven by banks’ reluctance to provide loans since the financial crisis, de Bree said.

Viewed independently or in a larger context, the flurry of activity in Australia is new. “The boom is probably only getting started,” Bertoli maintained in a reference to the Australian market. “Right now, it’s about getting the foundation of the market established.”

To get the business underway in Australia, alternative funders are alerting small-business owners and the media to the fact that alternative funding is becoming available and teaching them how it works, de Bree said. “Half of our job is educating the market,” noted Heussler.

New players are building the track record they need to bring down the cost of funds, according to Allegos. “Our base rate is 2 percent or 3 percent higher than yours,” he said, adding that the cost of funds is more challenging than gearing up the tech side of the business.

Although the alternative-lending business started later in Australia than in the United States and lags behind America in in exposure, it’s maturing rapidly, said de Bree. Aussie funders are benefitting from the lessons their counterparts have learned in the U.S., he said.

But the exchange of information flows both ways. Kabbage, for example, chose to enter the Australian market with a local partner, Kikka. Kabbage learned from its earlier foray into the United Kingdom that it makes sense to work with colleagues who understand the local regulatory system and culture, said Pete Steger, head of business development for Atlanta-based Kabbage.

But the exchange of information flows both ways. Kabbage, for example, chose to enter the Australian market with a local partner, Kikka. Kabbage learned from its earlier foray into the United Kingdom that it makes sense to work with colleagues who understand the local regulatory system and culture, said Pete Steger, head of business development for Atlanta-based Kabbage.

Such differences mean that risk-assessment platforms that work in the United States or Europe require localization before they can perform effectively in Australia, sources said.

Sydney-based Prospa, for example, got its start three years ago and has been working ever since with New York-based Strategic Funding Source to localize the SFS American risk-assessment platform for Australia, said Bertoli, who shares the company CEO title with Greg Moshal.

Moula, which has headquarters in Melbourne, sees so many differences among markets that it decided to build its own local platform from scratch, according to Allegos.

One key difference between the two markets is that Australia does not have positive credit reporting. “We have nothing that even comes close to a FICO score,” said Allegos. The only credit reporting centers on negative events, he said.

Without credit scores from credit bureaus, funders base their assessments of credit worthiness largely on transaction history. “It’s cash-flow analytics,” said Allegos. “It’s no different from the analysis you’re doing in your part of the world, but it becomes more significant” in the absence of positive credit reporting, he said.

Australia lacks credit scores at least partly because the country’s four main banks control most of the financial sector and choose not to release credit information, sources said. The banks have warded off attacks from all over the world because the regulatory environment supports them and because their management understands how to communicate with and sell to Australian customers, sources said.

The big banks – Commonwealth Bank, Westpac, Australia and New Zealand Banking Group, and National Australia Bank – set their own rules and have kept money tight by requiring secured loans and long waiting periods, Bertoli said. It’s difficult for merchants who don’t fit into a “particular box” to procure funding, he maintained. “It’s almost like an oligarchy,” Allegos said of the banks’ grip on the financial system.

Eventually, the banks may form partnerships with alternative lenders, but that day won’t come soon, in Allegos’ estimation. It could be 12 months or more away, he said.

Even as the financial system evolves, deep-seated differences will remain between Australia and the U.S. Most Americans and Australians speak English and share many views and values, but the cultures of the two countries differ greatly in ways that affect marketing, Bertoli said. “In your face” advertising that can work well with “loud, confident” Americans can offend the more “laid-back” Australian consumers and business owners, he said.

Australians have become tech-savvy and comfortable with online banking, but they guard their privacy and often hesitate to reveal their banking information to a funding company, Allegos said. The entrance of OnDeck and Kabbage should help familiarize potential customers with the practice of sharing data, he predicted.

Cost structures for businesses differ in Australia from the U.S., Bertoli noted. Australian companies pay higher rent and have to pay minimum wages set much higher than in the United States, he said. Published reports set the Australian minimum wage at $13.66 U.S. dollars. The higher costs down under can take a toll on cash flow. “Take an American scorecard and apply it to Australia?” Bertoli asked rhetorically. “You just can’t.”

Distribution’s not the same for commercial enterprises in the two countries, Bertoli maintained. Despite having about the same geographic area as America’s 48 contiguous states, Australia has a population of 23 million, compared with America’s 322 million.

Distribution’s not the same for commercial enterprises in the two countries, Bertoli maintained. Despite having about the same geographic area as America’s 48 contiguous states, Australia has a population of 23 million, compared with America’s 322 million.

No matter how many people are involved, changing their habits takes time. Australian merchants prefer fixed-term loans or lines of credits instead of merchant cash advances, Bertoli said. In many cases Australian merchants simply aren’t as familiar as Americans are with advances, Allegos said.

Besides, the four big banks in Australia tend to solicit merchants for credit and debit card transactions without the help of the independent sales organizations and sales agents. In the U.S., ISOs and agents play an important role in explaining and promoting advances to merchants, Bertoli said. Advances make sense for merchants because advances adjust to cash flow, and they help funders control risk, but just haven’t caught on in Australia, Bertoli said. Australians resist advances if too many fees are attached, said Allegos.

Pledging a portion of daily card receipts might seem too frequent, too, he said. Besides, advances are limited to merchants who accept debit and credit cards, while any business could conceivably choose to take out a loan, said de Bree.

Advances have to compete with inventory factoring, which has become a massive business in Australia, according to Heussler. The business can become intrusive because funders may have to examine balance sheets and talk to customers, he said.

Australia’s reluctance to turn to advances, leaves most alternative funders promoting loans and lines of credit. Prospa, for example, uses some brokers to that end but also relies on online connections, direct contact with customers, and referrals from companies that buy and sell with small and medium-sized businesses.

“Anyone that touches a small business is a potential partner,” said Heussler, including finance brokers, accountants, lawyers and even credit unions, which have the distribution but not the product.

Moula finds that most of its business comes from well-established companies and that loans average just over $27,000 in U.S. currency and they offer loans of up to more than $77,000 U.S. The company offers straight-line, six- to 12-month amortizing loans.

Using a model that differs from what’s common in the U.S., Moula charges 1 percent every two weeks, collects payments every two weeks and charges no additional fees, Allegos said. A $10,000 (Australian) loan for six months would accrue $714 (Australian) in interest, he noted.

Spotcap Australia offers a three-month unsecured line of credit and doesn’t charge customers for setting it up, Heussler said. If the business owner decided to draw down, it turns into a six-month amortizing business loan for up to $100,000 Australian. Rates vary according to risk, starting at half a percent per month but averaging 1.5% per month.

Spotcap Australia offers a three-month unsecured line of credit and doesn’t charge customers for setting it up, Heussler said. If the business owner decided to draw down, it turns into a six-month amortizing business loan for up to $100,000 Australian. Rates vary according to risk, starting at half a percent per month but averaging 1.5% per month.

If companies have all of the necessary information at hand, they can complete an application in 10 minutes, Allegos said. Moula has to research some applications offline if the company’s structure deviates too greatly from the usual examples – much the same as in the U.S., he maintained. The latter requires strong customer-service departments, he said.

Kikka uses a platform based on the Kabbage model, which gives 95 percent of customers a 100-percent automated experience, Steger said. “It goes to show the power of our automation, our algorithms and our platform,” he maintained.

Spotcap prefers to deal with businesses that have been operating for at least six months, Heusler said. The funder examines records for Australia’s value-added tax and other financials, and it likes to connect with the merchant’s bank account. Spotcap can usually gain access to the account information through cloud-based accounting systems and thus doesn’t require most companies to download a lot of financial documents, he noted.

Despite the differences between the two countries, banking regulations bear similarities in Australia and the United States, sources said. In both nations the government tries harder to protect consumers than businesses because they assume business owners are more financially savvy. For consumers, regulators scrutinize length of term and pricing, sources said, and on the commercial side the government is concerned about money laundering and privacy.

Regulation of commercial funding will probably intensify, however, to ward off predatory lending, Bertoli said. Government will consult with businesses before imposing rules, he said. A couple of alternative business funders aren’t transparent with their pricing and they charge several fees – that sort of behavior will encourage regulation, Allegos said.

“I know they’re watching us – and watching us very closely,” he added.

In general, however, the Australian government supports alternative finance, Bertoli said, because they want there to be options other than the four big banks and wants small business to have access to capital. Small businesses account for 46 percent of economic activity in Australia and employ 70 percent of the workforce, he noted, saying that “if small businesses are doing badly, the economy is doing badly.”

Hence the need, many in the industry would say, for more alternative funding options in Australia.

Qwave Capital Steps Up Pressure to Acquire IOU Financial

September 2, 2015 The nuclear scientists in venture capital clothing have laid out their case to IOU Financial’s shareholders that they would be better served if they were running things. In a letter distributed on Monday by Qwave Capital, the firm trying to acquire IOU, they criticized the lender’s state of affairs.

The nuclear scientists in venture capital clothing have laid out their case to IOU Financial’s shareholders that they would be better served if they were running things. In a letter distributed on Monday by Qwave Capital, the firm trying to acquire IOU, they criticized the lender’s state of affairs.

In all, IOU continues to demonstrate that it cannot grow profitably and compete effectively within its current model. This is made worse by the fact that, because IOU does not have sufficient capital, conservative lenders are reluctant to provide IOU access to capital at competitive rates. In comparison, OnDeck, IOU’s major online lending competitor, had raised far more capital when at the same stage of development that IOU is at today. OnDeck can now attract the lower interest funds it requires to lend out to customers and support its profitable growth in the U.S. and Canada.

Qwave chastised IOU’s board members for decisions it didn’t feel aligned with the best interests of the company.

“IOU transactions have allowed Board members and insiders to maintain their dominant interest in IOU and purchase shares for below-market value,” they wrote.

And continued:

“For instance, IOU recently completed a private placement financing at $0.40 per share, a 20% discount to Qwave’s Offer and the private placement’s original $0.50 per share price. IOU completed the $0.40 per share offering even though Qwave’s offer was on the table and IOU had confirmed offers at $0.50 per share on its books. Parties related to IOU management subscribed to approximately 17% of the offering at the discounted offer price.”

Judging by the rest of the letter, IOU shareholders will certainly have a lot to consider. You can read a full copy of it here.

What Does the Federal Reserve Think About When It Thinks About Alternative Small Business Financing?

August 27, 2015 The Federal Reserve Bank of Cleveland recently published results of a focus group it conducted on alternative small business financing. As part of the paper, the Fed included a brief discussion of some of the questions raised by the study. The considerations discussed offered an interesting glimpse of some the legal issues the Fed is thinking about in relation to alternative small business finance.

The Federal Reserve Bank of Cleveland recently published results of a focus group it conducted on alternative small business financing. As part of the paper, the Fed included a brief discussion of some of the questions raised by the study. The considerations discussed offered an interesting glimpse of some the legal issues the Fed is thinking about in relation to alternative small business finance.

First, the Fed considered the increasing trend of bank referral partnerships and wondered if such referral arrangements raise disparate impact concerns under the Equal Credit Opportunity Act. It asked:

Do issues of disparate treatment arise if banks refer certain customers to their alternative lending partners, but offer traditional loan products to others?

The Fed’s question seems to suggest that a bank’s referral of some customers to alternative lenders over others could potentially be used against the bank in a disparate impact claim. The Fed’s comment is especially noteworthy given the recent Supreme Court decision in Texas Department of Housing and Community Affairs v. The Inclusive Communities Project, Inc. That decision approved the use of the disparate impact theory under the Fair Housing Act. Many observers had hoped the Court would find that such claims could not be brought under the FHA and thereby limit their use under other federal statutes, such as ECOA.

The Fed was also interested in the effect the use of automated underwriting systems is having on small business lending. It asked:

Does the use of automated underwriting raise or address fair lending concerns?

Unfortunately, the Fed did not specify in what ways it believes fair lending laws may be implicated by the use of automated systems. These concerns could include larger societal issues, such as the effect automated systems are having on credit availability. Or they may involve practical considerations, such as how lenders are meeting their disclosure requirements under ECOA given the increasing number of applications reviewed by automated processes.

While these questions are quite preliminary, they offer interesting insight about how regulators are thinking about the industry and the issues they’re focusing on.