Thinking Capital Acquired by Canadian Finance Firm Purpose Financial

March 12, 2018

Thinking Capital, a leader in the fintech lending industry in Canada, was acquired last week by Canadian finance company, Purpose Financial, based in Toronto.

“Under the Purpose Financial umbrella, our time to market on product innovation and funding capacity will be greatly amplified,” said Jeff Mitelman, CEO and co-founder of Thinking Capital.

Mitelman, who co-founded Thinking Capital in 2006, has long been an advocate for improving the way small business credit is evaluated and communicated in Canada.

“The challenge in Canada is that our lending institutions historically either don’t lend to small business or don’t lend to enough of our small businesses,” Mitelman told deBanked. “And that’s driven by the fact that so many of the measures of small business credit worthiness simply don’t exist. Our credit bureaus don’t report on it, there aren’t metrics or scores unique to small business, and most significantly, small business credit has never been attached to retail or institutional conduits for funding.”

This is where Purpose Financial comes in. Mitelman believes that Purpose Financial’s investment arm and its relationship with Omers, a large Canadian pension fund, will provide small businesses with “access to conduits that historically small businesses have never been able to access.”

This is where Purpose Financial comes in. Mitelman believes that Purpose Financial’s investment arm and its relationship with Omers, a large Canadian pension fund, will provide small businesses with “access to conduits that historically small businesses have never been able to access.”

Thinking Capital provides an MCA product, which it calls Flexible, as well as a term product, which it calls Fixed. It also helps power loans provided by large companies like Staples.

Purpose Financial has three verticals: Investment Management (retail and institutional), Digital Technology, and Capital / Funding.

“Thinking Capital is a clear leader in the small to medium-sized business lending space…” said Som Seif, CEO of Purpose Financial. “[And] this acquisition brings together leading origination, asset management, and technology platforms as a unified entity, and enables us to bolster our product capabilities and optimize the technology, distribution, and funding model of our combined business.”

Enova’s TBB Did $15M in Merchant Cash Advance Revenue in 2017

March 12, 2018International online lending conglomerate, Enova, generated $843.7 million in revenue last year, according to their recent annual report. More than $15 million came from merchant cash advances (MCAs) made through The Business Backer (TBB), a small business financing company they acquired in 2015. That’s down from $18.6 million in MCA revenue generated in 2016.

Though MCA revenue may be down, TBB began offering an installment small business loan product in 2017. They’re available in 10 states, according to the company.

Enova refers to MCAs as RPAs in their reports, short for Receivable Purchase Agreements. “Small businesses receive funds in exchange for a portion of the business’s future receivables at an agreed upon discount,” they state.”A small business customer who enters into a RPA commits to delivering a percentage of its receivables through ACH or wire debits or by splitting credit card receipts until all purchased receivables are delivered.” That is a textbook explanation of MCAs.

Their average “RPA” customer averages $1.5 million in annual sales and has 10 years of operating history.

How One Company is Helping MCA Brokers and Clients Through Credit Repair

March 5, 2018

Venture Credit Solutions, a New Jersey-based credit repair business, was created in 2016 by founder and CEO Joe Clapman. Because of extensive licensing and other legal conditions required to run a credit repair shop, the company didn’t start operating until the beginning of this year, with a soft launch at deBanked’s Miami event in January.

Formerly an MCA broker, Clapman saw firsthand that really bad personal credit could hinder one’s ability to get cash advances for their businesses, along with home mortgages and even jobs. So he started a consumer credit repair business. He is very clear about what he can and cannot do.

“We get erroneous items that do not belong on your credit report, off,” he said.

He cannot recoup people’s money or eliminate credit card debt. He does not guarantee that he will improve your credit score, but he maintains that when negative erroneous data is removed, generally FICO scores go up and people become eligible for more credit or better credit.

This can benefit MCA brokers by allowing them to take unfundable or less fundable MCA clients and turn them into additional clients for credit repair. Clapman said that brokers for credit repair can get a commission similar to a $15,000 to $20,000 MCA deal.

“We don’t have some secret handshake with Equifax and Experian,” Clapman said. “We can’t do anything you can’t do on your own.”

Instead, Clapman told deBanked that Venture Credit Solutions is a service-based company of researchers, who he calls “information givers,” that are trained in determining the accuracy of data on personal credit reports.

“Any data on your credit report has to be accurate to the letter,” he said.

Clapman and his team make money only when they are able to successfully prove inaccurate data and remove it from a customer’s credit report. Every line of a customer’s report is itemized and the customer is told beforehand how much they will pay Venture Credit Solutions if the company is able to prove that the data is inaccurate.

And data is either accurate or it isn’t.

“If someone tells me that something is accurately described on their credit report, it’s actually illegal for me to try and get it removed,” Clapman said.

While Venture Credit Solutions provides services to individual consumers, they do not advertise to the general public. Instead, they get business from brokers, who Clapman calls “referral agents.” These are MCA and real estate brokers, among others, who are trying to improve their client’s credit – if it has been inaccurately reported.

Clapman gave the example of an MCA merchant who signed a document allowing his broker to submit an application to only one funder. But the broker sent the application out to like 93 funders, severely damaging his credit because of all the credit inquiries.

“We can help him to get all these inquiries off,” Clapman said.

One of the core mantras at Venture Credit Solutions is “The client is your client.” This is important to Clapman because he wants to communicate to his referral agents that the company is not trying to steal their clients – by, for instance, finding the client a lower mortgage. Doing something like this would adversely affect the customer’s credit, which is exactly what Venture Credit Solutions is trying to improve.

“We’re trying to create a win-win process,” Clapman said. “The broker is winning because he’s not losing a client, he’s helping a client [and getting a commision.] And the client is winning because his credit is getting better.”

Clapman said that he is in talks with the New York and New Jersey police and fire departments to potentially help their members who might have erroneous data on their credit reports.

Venture Credit Solutions also has a program for startup companies, designed to improve and build the credit of entrepreneurs. The company now has 15 people working at its office in New Jersey and it plans to be onboarding at least an additional 30 within the next two weeks. Some will work remotely, but all will be in the US, Clapman said.

Nest Planner: The Story Of A Startup MCA Broker

March 4, 2018deBanked interviewed Anthony Frisone, the founder of Nest Planner, a young ISO on Long Island, on how he got his start.

What were you doing before becoming an MCA broker?

I was doing real estate and then I got sick. I was having a hard time walking. And you can’t sell real estate when you can’t walk. I was bedridden for a long time [before I got better.] I was in a bad place, mentally and physically, and a friend of mine just said to me “you should try this out.” I knew nothing about it. So I went to his office and I actually grabbed a deBanked magazine off of one of the desks in his office.

What’s the greatest challenge of being an MCA broker?

Being sick was easier than starting out in this business. It was rough. The first three or four months was an uphill battle. It was brutal. We did zero. No business at all. But I didn’t give up. We just kept dialing the phone. I couldn’t even get funders to send deals to. I was calling quite a few of them. And they were like “Who are you sending deals to now?” And I said, “No one. I’m brand new in the business.” And they were basically like “Come back to me when you have something under your belt.”

I had a whole list of people I was calling and I called up a place called Cardinal Equity, which came from the deBanked website or magazine. The owner answered the phone and we were just talking, for a half hour, maybe an hour. I remember it was late at night and right before Thanksgiving, and he said “Call me next week and I’ll send you the application.” I was like “Oh wow, thanks.” [..] Finally he sent it to me and I sent it back to him. And he let me send him deals.

What about getting deals made?

Getting deals was a whole different story because I didn’t have anyone to tell me “Don’t take $5,000 a month accounts.” We were surrounded by no one that knew the business. So it made it even harder by not knowing what I was doing. But I had no choice. So I just came in everyday and worked. And something, little by little, started panning out.

After Cardinal Equity, I didn’t get another funder until after I took the deBanked “Merchant Cash Advance Basics” [online course] in January 2017. It was eye opening for me. Everything started making sense. I was able to have a conversation with funders and actually understand them. I started sending over my MCA Basics Certificate of Completion to every funder I could think of, and within a month’s time, I had over 30 different funders waiting for me to send them deals. However, [at the time] I had no merchants to send them.

After Cardinal Equity, I didn’t get another funder until after I took the deBanked “Merchant Cash Advance Basics” [online course] in January 2017. It was eye opening for me. Everything started making sense. I was able to have a conversation with funders and actually understand them. I started sending over my MCA Basics Certificate of Completion to every funder I could think of, and within a month’s time, I had over 30 different funders waiting for me to send them deals. However, [at the time] I had no merchants to send them.

So where have you found your best leads?

We tried out so many different places and spent so much money. But we had no one to guide us in the right direction. So we would look online and probably at deBanked also. We called up a bunch of different places. None of them were fantastic, but none of them were terrible. So we knew it was a numbers game and we had to stay on the phone. So there was no set place. I bought a little bit from everywhere and a little bit worked from everywhere.

When did you start making money?

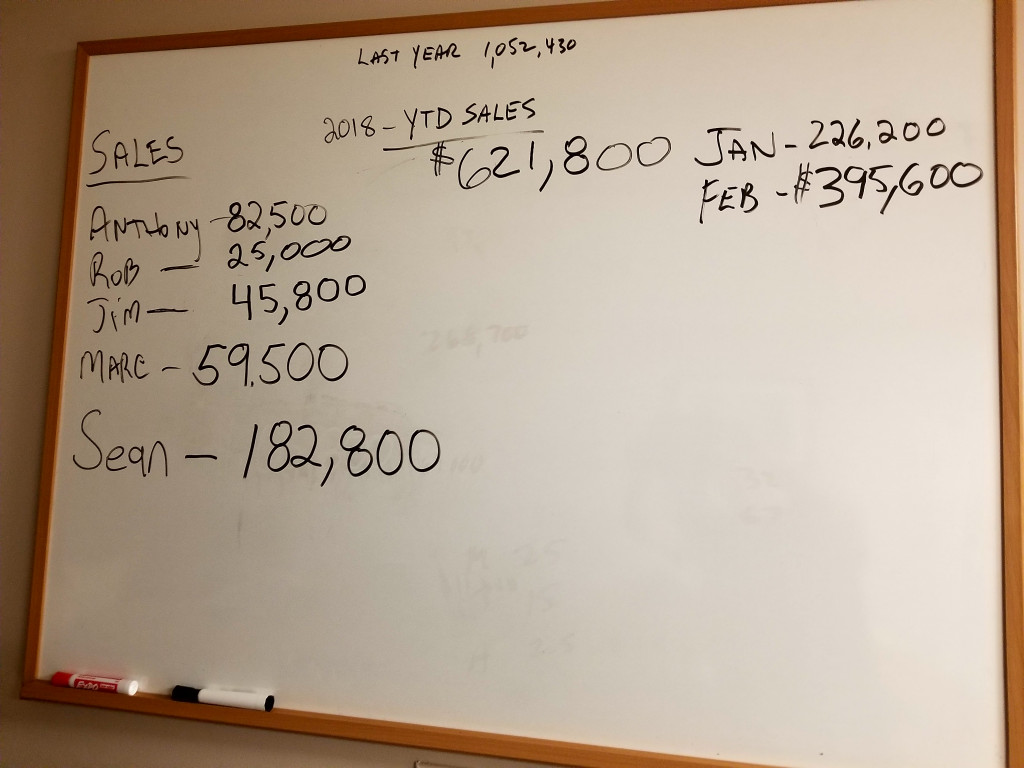

I started the business, called Nest Planner, in October 2016 all by myself. Just me and a desk and a laptop. And I didn’t start making money until March 2017. From October to March was a long 5 months. And in March I made close to $10,000 in advances. But by the end of last year, we hit the $1 million mark in advances. It’s not a lot, but it’s something that showed that we’re doing something right. And this year, it’s just February, and we have over $600,000 in [advances]. That’s huge for us and it’s just from us not giving up and pounding the phones.

How many people work for you?

Six.

How do you personally define success as a broker?

I guess the obvious part is the funds. If you make sales or close deals, it does feel good to make money. I have a wife and two kids and not taking home a paycheck is brutal. But what’s nice, also, is to see the people we hire make money. It’s nice to see them go home with a check.

How many applications do you typically send out?

So far, for January and February of this year, five of us sent in just under a 100 applications. And we funded 20 of them so far.

What resources do you wish you had that could have helped you made more deals in the beginning?

A CRM. I just had paper leads everywhere. We would just write it up on a piece of paper. No CRM and it’s rough. But it costs money. So we weren’t able to do it.

Apart from approving your applications, what do you look for in a funder?

Someone I could trust. Someone that returns calls. At the very beginning, it was hard. couldn’t get the time of day [from funders]. No one would call me back, except for Cardinal Equity. Now they’re actually calling me.

Want to become a better closer in this industry? Join your peers for training and networking at Broker Fair on May 14 in Brooklyn, NY! You can register here.

Banks, Alt Funders Continue to Compete for Small Business

February 13, 2018

The alternative small-business finance industry owes its very existence to banks’ reluctance to lend money to mom-and-pop shopkeepers, tradespeople and restauranteurs, but bankers’ tight fists may be loosening. Small-business owners are reporting better results when they apply for bank loans.

In fact, small entrepreneurs succeeded in landing bank loans 37 percent of the time in the fourth quarter of 2017, up from 29 percent a year earlier, according to the 1,341 merchants surveyed for the most recent quarterly Private Capital Access Index report provided by Dun & Bradstreet and Pepperdine University’s Graziadio School of Business and Management.

“That’s a big change. It’s outside the margin of error and outside normal statistical variation,” Craig R. Everett, assistant professor of finance at Pepperdine and director of the Graziadio and Dun & Bradstreet Private Capital Markets Project, tells deBanked. He’s comparing the shift to patterns established in the nearly six years the quarterly index has pegged small-business trends.

But the effects of bankers’ increased willingness to lend to small businesses may prove a bit muted in the alternative funding industry. That’s partly because Pepperdine and Dun & Bradstreet define small businesses as having up to $5 million in annual revenue. Alt funders often deal with much smaller enterprises that could still fail to capture the attention of bank loan officers, says Noah Grayson, managing director of South End Capital in Encino, Calif. “If you’re making $5 million in gross revenue, that’s a pretty robust business,” he says of his clients.

But the effects of bankers’ increased willingness to lend to small businesses may prove a bit muted in the alternative funding industry. That’s partly because Pepperdine and Dun & Bradstreet define small businesses as having up to $5 million in annual revenue. Alt funders often deal with much smaller enterprises that could still fail to capture the attention of bank loan officers, says Noah Grayson, managing director of South End Capital in Encino, Calif. “If you’re making $5 million in gross revenue, that’s a pretty robust business,” he says of his clients.

Then there are the borrowers whose companies seem small in that they employ just a few people but might rake in $5 million on a single contract – like contractors who specialize in heavy construction equipment or have a presence in the aviation business – but aren’t profitable enough to qualify for bank loans, says Gene Ayzenberg, CEO of PledgeCap, a company with offices on Long Island and in Manhattan that specializes in business and personal loans secured by collateral.

Besides, lots of alternative lenders don’t regard gross revenue as the measure of a business. “I would look at what kind of resources and infrastructure the business has to define what is small and medium-sized,” says David Obstfeld, CEO of New York-based SOS Capital. Many alt lenders cite the importance of net over gross.

The size of prospective borrowers aside, banks are probably lending to small merchants more often these days because small businesses are becoming more profitable in today’s relatively healthy business climate and thus stand a better chance of qualifying for credit, Everett says. The recent reduction in corporate taxes will also improve profits and make small businesses more credit-worthy, he says.

The change in bank lending volume seems tied to those financial gains and doesn’t appear to be linked to any shift in policy among bankers, Everett notes. But new policies at the Small Business Administration could prompt the banking community to view small-business loans more favorably, according to Grayson. The SBA is increasing the percentage it guarantees for some loans and reducing the amount required for a down payment on some loans, he notes. That could make life more difficult for some alternative lenders because most of the small-business loans made by major banks, like Wells Fargo and Chase, are SBA loans, he says. The SBA did not provide details regarding the changes by press time.

Regardless of what’s making banks loosen their grip on the purse strings, merchants are feeling more optimistic – or at least less gloomy – about obtaining bank loans in the near term, the study by Pepperdine and Dunn & Bradstreet indicates. In the fourth quarter of last year, 55 percent of small-business owners predicted difficulty in raising financing in the next six months, down from 61 percent a year earlier, the survey shows.

Regardless of what’s making banks loosen their grip on the purse strings, merchants are feeling more optimistic – or at least less gloomy – about obtaining bank loans in the near term, the study by Pepperdine and Dunn & Bradstreet indicates. In the fourth quarter of last year, 55 percent of small-business owners predicted difficulty in raising financing in the next six months, down from 61 percent a year earlier, the survey shows.

“That’s an improvement, but I still think it’s an alarmingly high number,” Ayzenberg says of those findings. “Before they even start worrying about how their operations are going and how good their product is, one in two businesses is already worrying that their bank is not going to be able to fulfill their needs. They shouldn’t have to have those fears.”

So, banks are becoming a bit more likely to loan to small businesses but still aren’t throwing open the flood gates to create a flood of funding. That’s true of banks that qualify as large and those classified as small.

American banks tend to be either small community institutions or huge national concerns that are swallowing up the remaining mid-sized regional banks, observers agree. Between 80 and 90 banks control assets of $10 billion or more and thus qualify as large, while thousands of small banks have more limited resources, says David O’Connell, an Aite Group senior analyst.

Large and small banks exhibit about the same degree of ambivalence toward small-business loans. Banks can mitigate the downside of the loans because they have funds to hire staffs and buy technology to analyze risk, O’Connell says. Executives at small banks can avoid potential problems with small-business loans because they’re often dealing with prospective borrowers who were their high school or college classmates, he notes.

Whether banks are large or small, they have their reasons to deny loans to small businesses. Perhaps foremost among the rationales for denying loans to small businesses is the cost of underwriting, says O’Connell. Banks simply can’t make enough money on the loans to pay the cost of processing them, he says, adding that, “It’s a long-standing problem.” For example, a bank can make a profit by loaning $2 million at prime plus 2 percent, but can’t cover the underwriting costs of an $80,000 loan that also earns prime plus 2 percent. The underwriting costs would be the same in both cases, he notes.

Banks became even more ambivalent about loaning to small businesses after the Great Recession struck in 2008, O-Connell continues. They didn’t want to repeat the mistakes of the freewheeling period that preceded the economic catastrophe. About the same time, private equity and hedge funds began madding more capital available to alternative lenders, he says. Meanwhile, technology and alternative data sets helped the alternative industry understand risk and reduce underwriting costs, he maintains.

Banks also find it more expensive to loan to small businesses these days because the Dodd-Frank Act has increased compliance costs, Everett points out. “Red tape and reserve requirements for the banks have all increased under Dodd-Frank, so making loans to small businesses is less cost-effective than it was before.” Banks now need upwards of $1 billion in assets under management to remain viable, and they feel compelled to expand their staffs to follow all the new rules for lending, he says.

What’s more, bankers still exercise extreme caution when it comes to extending credit to small businesses because stores or restaurants often fail and then the business or the owner defaults on the loan, Everett says. That’s why banks often require business-loan applicants to demonstrate two years of profitability to qualify for credit, he notes. Higher interest that can mitigate that risk, but state usury laws often capping rates at 36 percent or less, Everett notes. New York, for example, limits banks to 16 percent, he says.

State usury laws don’t apply to factoring or merchant cash advances, and that enables alternative funders to charge more for the use of funds, Everett says. “If it’s not called a loan and what the customer is paying is not called interest, then it’s not subject to state usury laws,” he says.

Obstfeld puts it this way: “In would be great to be in a business where nobody defaults. The rates we charge at SOS Capital are necessary to cover our losses and be profitable at the same time.”

The high cost of obtaining funds in the alternative market could eventually prompt the federal government to intervene with regulation but that probably won’t happen anytime soon, Everett predicts. O’Connell agrees, noting that in the current political climate the government has little appetite for new restrictions on a major source of capital for thousands of small businesses.

Because alternative funders have greater flexibility than banks in how much they can charge for access to credit, banks have sometimes formed referral relationships with alt funders to hand off small-business borrowers. “That looks good on paper and makes great headlines, but it’s harder to do in real life,” O’Connell maintains, because the bank loses control of the customer experience. If the alt funder doesn’t manage customers’ expectations effectively, the bank might have to take the blame – at least in some consumers’ minds, he contends. He’s surveyed bankers and found them feeling “really mixed” about such partnerships.

The impact of such partnerships hasn’t been as great as some anticipated. “We were quite nervous when we heard that JPMorgan would be using OnDeck’s platform,” recalls Obstfeld. “However, it’s been quite some time that they’ve been doing that and it hasn’t seemed to make a dent – at all – in alternative lending.”

The impact of such partnerships hasn’t been as great as some anticipated. “We were quite nervous when we heard that JPMorgan would be using OnDeck’s platform,” recalls Obstfeld. “However, it’s been quite some time that they’ve been doing that and it hasn’t seemed to make a dent – at all – in alternative lending.”

But alternative funders can provide borrowers with advantages that banks can’t match. Some alternative lenders can approve a client’s application in a few hours and wire funds to the recipient the same day, Grayson says. Steve Hauptman, chief operating officer at SOS Capital, notes that banks can require weeks or even months to respond to an application.

That’s why SOS Capital customers sometimes obtains funding from the company as a bridge to keep operating while they’re waiting for an SBA bank loan or to take advantage of an opportunity that requires a quick response, Obstfeld says.

That’s why SOS Capital customers sometimes obtains funding from the company as a bridge to keep operating while they’re waiting for an SBA bank loan or to take advantage of an opportunity that requires a quick response, Obstfeld says.

The advantages of the alternative funding industry don’t end there. SBA bank loans require more paperwork than is needed for a merchant cash advance, which can slow the process even further as the client assembles the documentation, Obstfeld notes.

In addition, banks can simply seem slow to respond to the needs of the market. “Banks are banks – they’re never going to be able to do the things we can do,” says Obstfeld. “If one product becomes an issue, we can pivot and create new product tomorrow. It takes banks years to get approval for something new.”

Then there are cards. Besides an increase in banks’ willingness to lend to small businesses, merchants are finding it easier to obtain business credit cards, the index provided by Pepperdine and Dun & Bradstreet finds. In the fourth quarter of last year, 65 percent of survey respondents applied successfully for cards, compared with 51 percent in the corresponding period a year earlier.

Easier access to credit cards might not make merchants less likely to apply for loans, Everett says. “Usually, credit cards are a backup plan,” he notes. “They’re the poor man’s line of credit. It’s a very high interest rate.” Most businesses would prefer to open a line of credit from a bank with a lower interest rate. Many cardholders use cards only for travel expenses or to ease short-term cash-flow issues, he says.

Easier access to credit cards might not make merchants less likely to apply for loans, Everett says. “Usually, credit cards are a backup plan,” he notes. “They’re the poor man’s line of credit. It’s a very high interest rate.” Most businesses would prefer to open a line of credit from a bank with a lower interest rate. Many cardholders use cards only for travel expenses or to ease short-term cash-flow issues, he says.

Finding the right credit card poses a challenge, even for those who are adept at online searches, says Grayson of South End Capital. In addition, many business credit cards carry a low spending limit. A business might qualify for a $5,000 credit limit on the card but could receive a $50,000 loan, he adds. “A card generally doesn’t fill their needs,” he declares.

Others have a slightly different view of business cards. “Once you get approved, it’s easy money,” Obstfeld says of business credit cards. However, cards can’t finance some of the actions that cash from merchant cash advances can cover, such as buying out a partner or opening a second location, he notes.

Moreover, the fact that competitors exist – whether they’re banks, card issuers or other alternative lenders – doesn’t necessarily threaten existing alt funders, according to Hauptman. Remember that banks and alternative lenders aren’t offering the same products, he says. Those products, such as bank loans, factoring and merchant cash advances, each have advantages and disadvantages, which prompt merchants to pursue the vehicles that are right for them, he says.

Having banks and nonbanks in the mix can even prove complementary, too. Pumping more funds into the small-business economy from any source can result in a healthier environment that offers more opportunities for all, Ayzenberg says.

The real danger resides not so much from direct competition but rather from failing to keep pace with the alternative lending industry’s introduction of new products, falling behind in the quest to speed up the decision-making process granting funding or neglecting to obtain technology that eases the application process, Grayson says.

In one recent development, some alternative lenders aren’t reviewing credit histories, he notes. Instead they look just at deposits and can extend credit based just on that, Grayson notes. That’s somewhat like a merchant cash advance, but it’s offered at single-digit rates and on favorable terms, he says. “A lot of lenders are making it very simple for borrowers to get money now,” he continues, concluding that alt funding firms that can’t afford to make such improvements probably can’t remain in business.

Though some players will inevitably disappear, the alternative small-business funding industry in general seems likely to survive so long as banks remain reticent about lending to small businesses – the situation that gave rise to the alternative industry in the first place.

Yalber Obtains $20 Million Credit Facility

February 13, 2018

Small business financing company Yalber has announced the closing of a $20 million credit facility from an institutional credit fund focused on specialty finance and related investments.

Yalber CEO Amir Landsman told deBanked that the money was raised primarily in response to increased demand for capital. The company will use the new credit facility to satisfy customer demand for funding and to continue building out its technology platform.

“This is part of the bigger picture of really looking ahead to the future – to advance technology, marketing and customer service,” Landsman said. “For us, this is just the beginning.”

Yalber was founded in 2007, and until now, it has been self-funded.

The New York-based company derives 90 percent of its leads internally with an in-house sales and marketing team.

“We still work with some ISOs,” Landsman said. “We consider the ISO channel as an important one, but we are quite picky.”

Yalber offers small businesses up to $500,000 and so far it has provided more than 5,000 businesses with over $300 million in working capital.

From its original office in New Jersey, which since moved to New York, Yarber now has offices in Dallas, Los Angeles, San Francisco and London. Most of the company’s 30 employees are based in New York.

With an emphasis on making the application process simpler and faster, and all online, what is the value in having multiple offices?

Landsman told deBanked that by better understanding local business environments, they can make better credit decisions. And having a local office also gives merchants more comfort, knowing that they can speak to someone familiar with their area.

In the decade since Yalber started in the MCA business, CTO Nir Goshen noted how much the industry has grown.

“When I started with Google AdWords [in 2007], when I searched ‘Merchant Cash Advance,’ Google said ‘too little traffic.’ Today, it’s one of the most expensive ad words. The only one I can think of that’s more expensive is ‘insurance.’”

Yalber’s $20 million financing was raised by Brean Capital.

deBanked Connect – Miami (Recap)

January 30, 2018Thank you to everyone who attended our cocktail networking event in South Beach last week. It was a great opportunity for funders, lenders, brokers and others in the industry to connect with each other (many for the first time ever). Thank you again to Everest Business Funding, National Funding, Knight Capital Funding, NISO, Grand Capital Funding, and Venture Credit Solutions for sponsoring.

Below is a sample of our photos from the evening. If you attach any of your own on social media, please use #debankedconnect so that we can find them.

READY FOR AN EVEN BIGGER & MORE COMPREHENSIVE DEBANKED INDUSTRY EVENT?

BROKER FAIR IS COMING MAY 14, 2018

TO BROOKLYN, NY

JOIN FUNDERS, LENDERS AND BROKERS FOR THE INAUGURAL CONFERENCE

LEARN MORE HERE

CHECK OUT THE BIG NAMES SPONSORING BROKER FAIR 2018

BFS Capital’s Marrache on Canadian Small Business Landscape

January 28, 2018

It’s been about five months since Michael Marrache took the reins as CEO of BFS Capital. He spoke with us then about the company’s algorithmic solutions, ISO relationships and product pipeline. He recently took some time to talk with deBanked about the key themes in the Canadian market in 2018 – from minimum wage, to the impact of US tax reform on the Canadian economy, to ISO opportunities — and BFS Capital’s role there.

deBanked: When did BFS Capital begin operating in Canada?

Marrache: BFS Capital funded its first loan in Canada in 2012. Traditionally, we have approached Canada’s market via our partner channel, both US and Canada based. We plan on increasing that effort in 2018.

deBanked: Is Canada a market that BFS Capital recognizes as growing?

Marrache: Canada is a growing market for BFS Capital, though our non-US markets, including Canada and the UK, currently represent less than 20% of our global $300 million in financings. We see significant upside in both Canada and the UK in the next 12 months.

deBanked: What are the themes as you see them for Canadian small businesses and BFS Capital in 2018?

Marrache: There might be more insecurity among Canadian small businesses this year. The 2018 minimum wage increase to $14 an hour in Ontario, expected to rise again in 2019, for example, might cause some small businesses to have to cut hours or reduce staff to make up for the expense. They may have to raise their prices, which could impact demand.

Additionally, recent policy and legislative changes in the US could also impact Canada. For example, tax reform in the US, specifically a reduction in the US corporate rate, will put the US on par with Canada in terms of tax rates and similar burdens. At the same time, US regulations are being reduced while Canada’s appear to be increasing. All of this is part of the current US government’s initiative to drive domestic business growth and we are not sure how it will affect Canada’s economy, business confidence and consumer spending.

The Canadian dollar is also forecast to remain weak and might continue to fall for a while longer. With US tax reform potentially boosting the economy here, the US Fed is likely to raise interest rates, which might reduce demand for the Canadian dollar. The CAN$ could further slide if Bank of Canada cuts rates again. [Scotiabank]

At the core, however, Canada has 1.1 million small businesses. Not a small number. There were more than 350,000 small businesses created in Canada in 2016 and 42% of job creation in the country in the past decade stemmed from firms with fewer than 100 employees (CIBC Capital Markets). These businesses need working capital for a variety of needs related to their everyday business and, importantly for where we fit in, it has traditionally been difficult for small businesses to obtain financing from banks.

BFS Capital financing has come into the mainstream because it’s more accessible than a bank loan, less expensive than equity, and less risky than bootstrapping. Our financing solutions also require less commitment than taking on a partner or getting venture capital. Moreover, the few big banks in the market have tended to shy away from small businesses, so we have seen an opportunity with our ISO partner-base and directly, for our lending solutions.

Today small businesses in Canada can get the money in their account in just a day or two and there are a variety of products with different rates and payment options. As the market in Canada gets more competitive the rates will continue to go down.

deBanked: The last time I spoke with you, you talked about automated solutions, transparency tied to ISOs and company culture. Are these at the forefront of the Canadian business as well? Explain.

Marrache: Yes. These initiatives are embedded in the company strategy at the top. We believe speed is required but not sufficient; the company must lead with a culture of service and transparency. We are also investing in data science to improve risk profiling and process efficiencies for every partnership and every financing, including in Canada. These initiatives have been instrumental to our strengthened partnerships in the US and we expect these to benefit our Canadian partners as well.

deBanked: Can you provide any illustration of the number of Canadian merchants on the BFS Capital platform or the amount in loans or MCAs you’ve deployed in the country?

Marrache: Although at a more modest volume than our business in the US, since entering the Canadian market in 2012, BFS Capital has achieved originations growth of approximately 100 percent on a compounded annual growth basis.