Capify Secures Massive Credit Facility from Goldman Sachs

January 16, 2019 Capify, which serves the UK and Australia markets, announced this morning that it has secured a £75 million (roughly $95 million) credit facility from Goldman Sachs.

Capify, which serves the UK and Australia markets, announced this morning that it has secured a £75 million (roughly $95 million) credit facility from Goldman Sachs.

“This credit facility validates our company as a leader in the marketplace and underlines the strength of our business model to provide simple, affordable and smart financial options to UK and Australian small businesses,” Capify founder and CEO David Goldin said.

The achievement is notable for a company that is not venture capital or private equity based.

“Capify is one of the leading small business providers in the UK and Australia,” said Pankaj Soni, Executive Director at Goldman Sachs Private Capital. “We have been impressed with the management team, business model and innovative finance solutions for small businesses [and] we look forward to supporting their growth in the years ahead.”

Capify provides MCA deals and business loans to small business merchants. Goldin told deBanked that MCA deals make up about 75% of Capify’s business in the UK, with about 25% in business loans. The ratio in Australia is the inverse, he said.

Goldin entered the UK and Australian markets in 2008 and said that they have become hyper competitive over the last three to four years. He acknowledged that both markets are still far smaller than the U.S. though.

“You don’t see these big crazy origination volumes [that you do in the U.S.]…[for us,] it’s about building a profitable, growing company.”

According to Goldin, another difference between the U.S. market and the UK and Australian markets is that the latter has embraced self-regulation much faster than the U.S. For instance, in Australia, there have been recommendations from semi-governmental organizations on how funders should perform, including the publishing of APR in contracts for business loans.

“These markets have moved quicker for self-regulation in the last two or three years than the U.S. market has moved in 10 years.”

This may be a matter of other countries learning from the experiences of the U.S., he said.

Goldin said that in addition to scaling Capify, the money from the facility will also be used to launch partner/broker programs in the UK and Australia. So far, the majority of Capify’s leads come from internal direct marketing efforts.

Capify employs more than 120 people divided between two offices, one in Manchester, England and the other in Sydney, Australia.

Goldin integrated the U.S. operations of Capify to Strategic Funding (now Kapitus) in 2017.

Coming Soon: The End of Confession of Judgments (COJs) in New York State

January 16, 2019 New York State plans to outlaw the use of Confession of Judgments (COJs) in small business loan contracts this year, according to details revealed in Governor Andrew Cuomo’s newly published Justice Agenda.

New York State plans to outlaw the use of Confession of Judgments (COJs) in small business loan contracts this year, according to details revealed in Governor Andrew Cuomo’s newly published Justice Agenda.

The proposal, dubbed “Stopping Predatory Merchant Cash-Advance Loans,” is a 3-part plan to:

- Codify an FTC rule that prohibits COJs in consumer loans

- Prohibit the use of COJs in small business loans under $250,000

- Stop lenders from exploiting New York courts for nationwide collections by requiring that any permissible confession of judgment enforced in New York courts have a nexus to business activity in New York

Cuomo’s proposal echoes calls from the State legislature in response to a series published in Bloomberg Businessweek late last year that speculated COJs were vulnerable to abuse.

Both the Assembly and Senate maintain a Democrat majority, the same party as Cuomo, increasing the likelihood that such a bill could become law.

The proposal is separate from a bill that was recently introduced at the federal level. The Small Business Lending Fairness Act, a bipartisan bill co-sponsored by Senators Marco Rubio and Sherrod Brown, call for a nationwide ban on COJs. That bill has not progressed, perhaps due in part to the government shutdown. Like New York, that initiative was a response to the series published in Bloomberg.

The proposal is separate from a bill that was recently introduced at the federal level. The Small Business Lending Fairness Act, a bipartisan bill co-sponsored by Senators Marco Rubio and Sherrod Brown, call for a nationwide ban on COJs. That bill has not progressed, perhaps due in part to the government shutdown. Like New York, that initiative was a response to the series published in Bloomberg.

A review of Bloomberg’s facts by deBanked revealed highly questionable reporting. In one example, it’s claimed that a business owner had been so victimized by predatory lending that he’d been forced to sell his furniture just to feed himself. deBanked later determined that the “victim” was actually a multimillionaire TV station owner whose account of any such engagement with merchant cash advance companies was incredibly unlikely. The reporters have not responded to deBanked’s findings.

Zeke Faux, who co-authored the series with Zachary Mider, deleted his entire tweet history around the same time that deBanked uncovered strange ties between his editor and the New York Attorney General’s office. The AG is reported to have sent subpoenas to several companies in response to the stories.

On Monday, Faux and Mider reported that clerks in three New York counties, whose job, among other roles, is to enter legally compliant COJs into the public record, were revolting by refusing to process COJs submitted by merchant cash advance companies. Though a clerk’s duties is largely an administrative one, two that spoke on the record with Bloomberg were former state legislators. Erie County Clerk Michael Kearns, for example, who told Bloomberg News that he felt that the use of COJs was criminal, had actually drafted a bill in 2017 when he was an assemblyman that sought to regulate cash advances of a different sort in the litigation financing industry. Although Kearns is a Democrat, he has historically enjoyed support from the Republican Party.

Orange County Clerk Annie Rabbitt and Richmond County Clerk Stephen Fiala, who are rebelling along with Kearns by refusing to enter COJs, are registered as Republicans, demonstrating that the movement is crossing party lines.

According to deBanked, less than half of 1% of all MCA transactions have resulted in the filing of a COJ, despite Bloomberg’s insinuation that the outcome is common or typical.

Among the most prolific filers of merchant cash advance COJs, deBanked found, is Itria Ventures, LLC, a company affiliated with Biz2Credit. Itria filed more than 50 in the last two months. Biz2Credit’s CEO, Rohit Arora, is a writer for both CNBC and Forbes.

Why Strategic Funding Rebranded as Kapitus

January 15, 2019 Today, Strategic Funding announced the launch of a new brand identity, including a name change. Strategic Funding will now be called Kapitus.

Today, Strategic Funding announced the launch of a new brand identity, including a name change. Strategic Funding will now be called Kapitus.

“We had a name that was very well respected,” said Kapitus founder and CEO Andy Reiser. “Everybody loved our name, quite frankly. They loved it so much, they all copied it. You can’t trademark ‘Strategic Funding.’ It’s too generic.”

Kapitus, spelled this way, is not a word in any language, which makes it easier to trademark.

“We wanted to separate ourselves in a way that is clearly identifiable,” Reiser said. “It’s an easy one-word name [that] symbolizes stability and strength. It’s ‘capital from us,’ if you want to break it down.”

Reiser said that the company has been relatively quiet over the last three years, but they have been advancing all along, and they are particularly proud of their brand new ISO portal. According to Reiser, the new portal helps ISOs better understand their book at Kapitus and allows brokers to generate a contract quickly without having to call them. The company has an in-house marketing team, but well over 50% of its business comes from the ISO channel.

Kapitus provides a variety of financial products, including equipment financing (they have an in house equipment leasing division) and factoring (they have a small internal factoring group). They also offer business loans, lines of credit and MCA deals. But the company’s largest portion of its business – more than 15% – comes from its Helix Healthcare Financing product, which finances healthcare practitioners like doctors, dentists and veterinarians.

Unlike other funders of healthcare practitioners that may offer financing terms up to 18 months, Kapitus offers terms of up to 10 years as long as the merchant satisfies its requirements. The company also funds a considerable number of healthcare-related businesses, like medical equipment providers. Otherwise, Reiser said that Kapitus has a diversified mix of merchants, from restaurants to manufacturers.

Reiser said that about 15% of Kapitus’s business consists of deals above $150,000 for which they have a seperate team. They do deals as high as $750,000.

When operating under the Strategic Funding name, there was a payment servicing division of the company, called Colonial Servicing. That entity will remain, but will be woven into the new Kapitus name.

Founded in 2006, Kapitus employs 240 people divided among three offices. The headquarters is in New York and there is an office with about 30 people in Arlington, VA, and a Dallas-area office with about 35 people working in collections and customer service.

How One Broker Moved from One-Man Home Office to 23 Person Shop

January 7, 2019Zach Ramirez started the brokerage company ZR Consulting from his home in Orange County, CA in June 2018. He was generating leads and making phone calls, often in a hushed voice because he was also looking after his six month old daughter.

“That was difficult, having a baby and with my life savings in the business,” Ramirez said.

But he had three brokers working remotely for him and things were working pretty smoothly. That number was growing by the time deBanked profiled him in August.

His fledgling business was manageable until he got to six brokers. At this point, the 29 year-old Ramirez said his home office was starting to feel like a call center.

“All day, I was answering calls to help them,” Ramirez said. “‘Zach, I have a question about this merchant, Zach, can you help me close this deal?’ It gave me a ton of anxiety.”

Ramirez realized that it would be much easier to manage employees from a brick and mortar space. So he found the company an office.

“Technically, we could have stayed at home,” Ramirez said.

“Technically, we could have stayed at home,” Ramirez said.

And he acknowledges that some brokers can make a nice living working from home.

“But I want to have the biggest ISO,” Ramirez said.

With this as his goal, he said it makes the most sense to have everyone under one roof. If he’s having a large meeting, he wants to know that everyone is paying attention and not driving or playing a video game as they could on a conference call.

“It was difficult to manage salespeople and to track everything, like how many leads we generated in one day? How many leads does it take for me to fund one deal? How much money does the average deal bring me?”

Having his brokers work remotely made keeping track of these numbers even harder. Ramirez still has a couple of people who work for him remotely, but he said that 95% of his employees, or 23 people, now work at their office in Anaheim, CA. Ramirez said that the office was much too big for them with just six people at the beginning.

“We could hear echoes bouncing off the walls,” he recalled.

But now with 23 people, mostly brokers and some support staff, Ramirez is actually planning to expand into an office next door.

“[As we grew in the office,] we just re-invested every penny we earned back into the company,” Ramirez said. “We upgraded our computers and furniture and we put people on W-2s. We gave our employees a 401k right away. I think it’s important to really treat your people right.”

Ramirez acknowledged that he can’t make changes to the business as quickly as he used to. With more than 20 people, he said that costs go up dramatically and therefore decisions have to be much more calculated.

“It takes time to move the ship,” Ramirez said, “and if you’re not careful, everyday can be consumed by the small stuff.”

That’s why he stresses the importance of delegating roles to others.

“It’s the only way to free up your time so you can focus on the bigger picture,” he said.

Now, he said that he very rarely speaks to funders anymore. He has two processors on staff whose job is to organize the paperwork from the brokers and send it to the funders. They organize the company pipeline, he said.

Ramirez said that it can be quite difficult to find the right mix of funders.

“Some funders who you think will be great turn out not to be and other funders who you’ve never heard of turn out to be real diamonds in the rough,” Ramirez said.

And like many brokers feel, Ramirez agrees that when it comes to funders, less is more.

“Having a very precise and small list of funders is incredibly important…because it simplifies your process [and] having a simple process is one of the keys to scaling your business,” Ramirez said.

Ramirez said that a common mistake brokers make is to test out a bunch of brokers all at once. He said that brokers need to try working with new funders intelligently, which means one at a time.

“When you bring on a new lender, you carefully watch every submission to them,” Ramirez said. “You want to make sure they’re not backdooring you. So usually you want to put your phone number and your email address in the contact info so you can catch them if they’re trying to be sneaky. [If they are,] they’ll call asking for the client and you know you only sent that deal to one lender.”

He’ll sometimes then pretend he’s interested and record the call. On about three occasions, he said that he has sent recordings like this to the backdooring lender and he’ll write “this is why I don’t send deals to you.”

Ramirez’s small group of trusted funders are OnDeck, National Funding, BFS, and Orange Advance.

As Ramirez expands, he says he only hires brokers by referral. He said that 90% of his business is short term business loans and MCAs, and 10% is SBA loans and real estate transactions.

Ramirez said that so far, ZR Consulting has originated $15 million in deals since inception and has earned $1.5 million in revenue.

For Some Brokers, Funding Never Sleeps

January 4, 2019 While holidays, including New Year’s Eve, are usually slow days for funding, for some brokers this year, New Year’s Eve was a strong day.

While holidays, including New Year’s Eve, are usually slow days for funding, for some brokers this year, New Year’s Eve was a strong day.

“New Year’s Eve was not a slow day here,” said Elana Kemp, a broker at Fundomate, in Los Angeles, who was in the office that day. “It was amusing to see so many people looking for money on the last day of the year. I’m also a procrastinator, so I can relate,” she said.

Zach Ramirez, Founder and Managing Director of ZR Consulting, LLC in Orange County, CA, said that New Year’s Eve was the second biggest funding day for his company in December, despite the fact he told his brokers that it was an optional work day, he said.

At the same time, for many other brokers, business was on the slow side, as expected. John Celifarco of Horizon Financial Group in Brooklyn, said it was a good day to organize and prepare for the new year. Meanwhile, Joe Cohen, of Business Finance Advance in Brooklyn, said he generally doesn’t go to work on major holidays.

“The holidays are to enjoy, regenerate and spend time with the family,” Cohen said. “That’s why you’re working anyway.”

What We Learned About RapidAdvance From RapidAdvance’s Planned Securitization

January 1, 2019

RapidAdvance is raising money through their first-ever securitization. This is what we’ve learned about the company as a result so far, thanks to the bond ratings process:

2017 origination volume: $260 million | See how this ranks against their peers

Lifetime funding volume: > $1.5 billion

Total shareholder equity: $54 million

Majority owned by: Rockbridge Growth Equity LLC

# of employees: 168

Notable strategic partnerships: Office Depot and Worldpay

Provides: Mainly Business loans (≈80%) but also merchant cash advances (≈20%)

Founded: 2009

Generates deals via: 62% ISO & Funding Partner Channel / 38% Direct

Other funders that recently did their first securitizations include Credibly and Strategic Funding Source.

deBanked’s Most Popular Stories of 2018

December 22, 2018

Five of the top 10 most read stories of 2018 were related to the saga of 1st Global Capital; The bankruptcy, SEC charges, the revelation that they had made a $40 million merchant cash advance, and finally the devastating news of that deal falling apart. We decided to lump all of them together in our #1 slot, but first, the following story was the most independently read of 2018:

The Saga of 1st Global Capital

1. Largest MCA Deal in History Suffers Multiple Closures was picked up by ABC News in California, placing deBanked’s website on TV for the first time.

These were the other most read stories related to 1st Global Capital

- 1 Global Capital Files Chapter 11

- Syndication at Heart of SEC and Criminal Investigation into 1st Global Capital

- 1st Global Capital Charged With Fraud by SEC

- The Largest Merchant Cash Advance in History

Bloomberg Businessweek began publishing a series in November about the allegedly scandalous merchant cash advance industry. An initial review by deBanked uncovered questionable holes in their reporting, but when the series’ senior editor thanked a state senator for proposing legislation in response, suspicious ties were uncovered, followed by one Bloomberg reporter wiping his twitter account clean. Bloomberg’s exaggerated series dubbed #signhereloseeverything has spawned a highly popular counterseries that has challenged Bloomberg’s reporting. We call it #tweetherewipeeverything. The following stories were all in the year’s top 12 most read, but we’ve lumped them together here at #2.

The Bloomberg Blitz

2. Multimillionaire CEO Claims Predatory Lenders are Causing Him to Sell His Furniture for Food

The other two were:

Arrested for Data Theft

3. CAUGHT: Backdoored Deals Leads to Handcuffs was the year’s third most read story.

MCAs are Not Usurious

4. It’s Settled: Merchant Cash Advances Not Usurious came in at #4 this year, ending the debate that has persisted in hundreds of cases at the trial court level in New York State.

In October 2016, the plaintiffs sued defendant Pearl in the New York Supreme Court alleging that the Confession of Judgment filed against them should be vacated because the underlying agreement was criminally usurious. As support, plaintiffs argued that the interest rate of the transaction was 43%, far above New York State’s legal limit of 25%. The defendant denied it and moved to dismiss, wherein the judge concurred that the documentary evidence utterly refuted plaintiffs’ allegations. Plaintiffs appealed and lost, wherein The Appellate Division of The First Department published their unanimous decision that the underlying Purchase And Sale of Future Receivables agreement between the parties was not usurious.

Debt Settlement Company Sued

5. ISOs Alleged to Be Partners in Debt Settlement “Scam” in Explosive Lawsuit was #5 in 2018. The lawsuit ultimately settled and resulted in a big payout to the MCA companies.

A Broker’s Bio

6. The Broker: How Zach Ramirez Makes Deals Happen was #6. deBanked interviewed Zachary Ramirez to find out what makes a successful broker like him tick, how he does it, and what kinds of things he’s encountered along the way.

Ban COJs?

7. Senate Bill Introduced to Ban Confession of Judgments Nationwide was #7. Although this is related to the Bloomberg Blitz, the introduction of this bill fits more neatly into a category of its own.

Who’s Funding How Much?

8. A Preliminary Small Business Financing Leaderboard was #8. Despite this being published early in the year and offering detailed origination volumes for several companies all in one place, it wasn’t as well-read as all the drama that unfolded later in the year. Unsurprisingly, a chart of The Top 2018 Small Business Funders by Revenue ranked right behind this one, but we’ve lumped it in with #8 since it’s related.

Thoughts by Ron

9. Ron Suber: ‘This Industry Will Look Very Different One Year From Now’ was #9. Known as the Magic Johnson of fintech, the 1-year prediction by former Prosper Marketplace president Ron Suber, originally captured in the LendAcademy Podcast, resonated all throughout the fintech world. Will he be proven correct?

A Rags to Riches Tale

10. How A New Hampshire Teen Launched A Lending Company And Climbed Into The Inc. 500 was #10.

Josh Feinberg was not a complete newbie when he started in the lending business in 2009, but he also had a long way to go to find success. His dad had been in the business for 15 years and shortly after graduating high school, Josh started to work in equipment financing and leasing at Direct Capital in New Hampshire, his home state. He then had a brief stint working remotely for Balboa Capital, but he wasn’t sure that finance was for him.

He was 19, with a three year old daughter, and he took a low paying job working at a New Hampshire pawn shop owned by his brother and a guy named Will Murphy.

“I was making $267 a week at the pawn shop and I was having to ask friends to help me pay my rent for a room,” Feinberg said. “So at that point, I realized that something needed to change.”

Less Than Perfect — New State Regulations

December 21, 2018

You could call California’s new disclosure law the “Son-in-Law Act.” It’s not what you’d hoped for—but it’ll have to do.

That’s pretty much the reaction of many in the alternative lending community to the recently enacted legislation, known as SB-1235, which Governor Jerry Brown signed into law in October. Aimed squarely at nonbank, commercial-finance companies, the law—which passed the California Legislature, 28-6 in the Senate and 72-3 in the Assembly, with bipartisan support—made the Golden State the first in the nation to adopt a consumer style, truth-in-lending act for commercial loans.

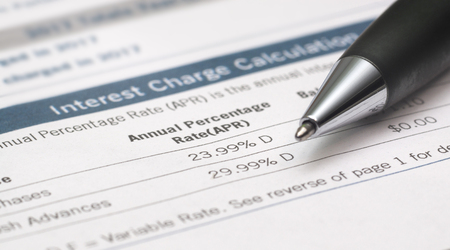

The law, which takes effect on Jan. 1, 2019, requires the providers of financial products to disclose fully the terms of small-business loans as well as other types of funding products, including equipment leasing, factoring, and merchant cash advances, or MCAs.

The financial disclosure law exempts depository institutions—such as banks and credit unions—as well as loans above $500,000. It also names the Department of Business Oversight (DBO) as the rulemaking and enforcement authority. Before a commercial financing can be concluded, the new law requires the following disclosures:

The financial disclosure law exempts depository institutions—such as banks and credit unions—as well as loans above $500,000. It also names the Department of Business Oversight (DBO) as the rulemaking and enforcement authority. Before a commercial financing can be concluded, the new law requires the following disclosures:

(1) An amount financed.

(2) The total dollar cost.

(3) The term or estimated term.

(4) The method, frequency, and amount of payments.

(5) A description of prepayment policies.

(6) The total cost of the financing expressed as an annualized rate.

The law is being hailed as a breakthrough by a broad range of interested parties in California—including nonprofits, consumer groups, and small-business organizations such as the National Federation of Independent Business. “SB-1235 takes our membership in the direction towards fairness, transparency, and predictability when making financial decisions,” says John Kabateck, state director for NFIB, which represents some 20,000 privately held California businesses.

“What our members want,” Kabateck adds, “is to create jobs, support their communities, and pursue entrepreneurial dreams without getting mired in a loan or financial structure they know nothing about.”

Backers of the law, reports Bloomberg Law, also included such financial technology companies as consumer lenders Funding Circle, LendingClub, Prosper, and SoFi.

But a significant segment of the nonbank commercial lending community has reservations about the California law, particularly the requirement that financings be expressed by an annualized interest rate (which is different from an annual percentage rate, or APR). “Taking consumer disclosure and annualized metrics and plopping them on top of commercial lending products is bad public policy,” argues P.J. Hoffman, director of regulatory affairs at the Electronic Transactions Association.

The ETA is a Washington, D.C.-based trade group representing nearly 500 payments technology companies worldwide, including such recognizable names as American Express, Visa and MasterCard, PayPal and Capital One. “If you took out the annualized rate,” says ETA’s Hoffman, “we think the bill could have been a real victory for transparency.”

The ETA is a Washington, D.C.-based trade group representing nearly 500 payments technology companies worldwide, including such recognizable names as American Express, Visa and MasterCard, PayPal and Capital One. “If you took out the annualized rate,” says ETA’s Hoffman, “we think the bill could have been a real victory for transparency.”

California’s legislation is taking place against a backdrop of a balkanized and fragmented regulatory system governing alternative commercial lenders and the fintech industry. This was recognized recently by the U.S. Treasury Department in a recently issued report entitled, “A Financial System That Creates Economic Opportunities: Nonbank Financials, Fintech, and Innovation.” In a key recommendation, the Treasury report called on the states to harmonize their regulatory systems.

As laudable as California’s effort to ensure greater transparency in commercial lending might be, it’s adding to the patchwork quilt of regulation at the state level, says Cornelius Hurley, a Boston University law professor and executive director of the Online Lending Policy Institute. “Now it’s every regulator for himself or herself,” he says.

Hurley is collaborating with Jason Oxman, executive director of ETA, Oklahoma University law professor Christopher Odinet, and others from the online-lending industry, the legal profession, and academia to form a task force to monitor the progress of regulatory harmonization.

For now, though, all eyes are on California to see what finally emerges as that state’s new disclosure law undergoes a rulemaking process at the DBO. Hoffman and others from industry contend that short-term, commercial financings are a completely different animal from consumer loans and are hoping the DBO won’t squeeze both into the same box.

Steve Denis, executive director of the Small Business Finance Association, which represents such alternative financial firms as Rapid Advance, Strategic Funding and Fora Financial, is not a big fan of SB-1235 but gives kudos to California solons—especially state Sen. Steve Glazer, a Democrat representing the Bay Area who sponsored the disclosure bill—for listening to all sides in the controversy. “Now, the DBO will have a comment period and our industry will be able to weigh in,” he notes.

While an annualized rate is a good measuring tool for longer-term, fixed-rate borrowings such as mortgages, credit cards and auto loans, many in the small-business financing community say, it’s not a great fit for commercial products. Rather than being used for purchasing consumer goods, travel and entertainment, the major function of business loans are to generate revenue.

A September, 2017, study of 750 small-business owners by Edelman Intelligence, which was commissioned by several trade groups including ETA and SBFA, found that the top three reasons businesses sought out loans were “location expansion” (50%), “managing cash flow” (45%) and “equipment purchases” (43%).

The proper metric to be employed for such expenditures, Hoffman says, should be the “total cost of capital.” In a broadsheet, Hoffman’s trade group makes this comparison between the total cost of capital of two loans, both for $10,000.

Loan A for $10,000 is modeled on a typical consumer borrowing. It’s a five-year note carrying an annual percentage rate of 19%—about the same interest rate as many credit cards—with a fixed monthly payment of $259.41. At the end of five years, the debtor will have repaid the $10,000 loan plus $5,564 in borrowing costs. The latter figure is the total cost of capital.

Compare that with Loan B. Also for $10,000, it’s a six month loan paid down in monthly payments of $1,915.67. The APR is 59%, slightly more than three times the APR of Loan A. Yet the total cost of capital is $1,500, a total cost of capital which is $4,064.33 less than that of Loan A.

Meanwhile, Hoffman notes, the business opting for Loan B is putting the money to work. He proposes the example of an Irish pub in San Francisco where the owner is expecting outsized demand over the upcoming St. Patrick’s Day. In the run-up to the bibulous, March 17 holiday, the pub’s owner contracts for a $10,000 merchant cash advance, agreeing to a $1,000 fee.

Once secured, the money is spent stocking up on Guinness, Harp and Jameson’s Irish whiskey, among other potent potables. To handle the anticipated crush, the proprietor might also hire temporary bartenders.

When St. Patrick’s Day finally rolls around—thanks to the bulked-up inventory and extra help—the barkeep rakes in $100,000 and, soon afterwards, forwards the funding provider a grand total of $11,000 in receivables. The example of the pub-owner’s ability to parlay a short-term financing into a big payday illustrates that “commercial products—where the borrower is looking for a return on investment—are significantly different from consumer loans,” Hoffman says.

SBFA’s Denis observes that financial products like merchant cash advances are structured so that the provider of capital receives a percentage of the business’s daily or weekly receivables. Not only does that not lend itself easily to an annualized rate but, if the food truck, beautician, or apothecary has a bad day at the office, so does the funding provider. “It’s almost like the funding provider is taking a ride” with the customer, says Denis.

SBFA’s Denis observes that financial products like merchant cash advances are structured so that the provider of capital receives a percentage of the business’s daily or weekly receivables. Not only does that not lend itself easily to an annualized rate but, if the food truck, beautician, or apothecary has a bad day at the office, so does the funding provider. “It’s almost like the funding provider is taking a ride” with the customer, says Denis.

Consider a cash advance made to a restaurant, for instance, that needs to remodel in order to retain customers. “An MCA is the purchase of future receivables,” Denis remarks, “and if the restaurant goes out of business— and there are no receivables—you’re out of luck.”

Still, the alternative commercial-lending industry is not speaking with one voice. The Innovative Lending Platform Association—which counts commercial lenders OnDeck, Kabbage and Lendio, among other leading fintech lenders, as members—initially opposed the bill, but then turned “neutral,” reports Scott Stewart, chief executive of ILPA. “We felt there were some problems with the language but are in favor of disclosure,” Stewart says.

The organization would like to see DBO’s final rules resemble the company’s model disclosure initiative, a “capital comparison tool” known as “SMART Box.” SMART is an acronym for Straightforward Metrics Around Rate and Total Cost—which is explained in detail on the organization’s website, onlinelending.org.

But Kabbage, a member of ILPA, appears to have gone its own way. Sam Taussig, head of global policy at Atlanta-based financial technology company Kabbage told deBanked that the company “is happy with the result (of the California law) and is working with DBO on defining the specific terms.”

Others like National Funding, a San Diego-based alternative lender and the sixth-largest alternative-funding provider to small businesses in the U.S., sat out the legislative battle in Sacramento. David Gilbert, founder and president of the company, which boasted $94.5 million in revenues in 2017, says he had no real objection to the legislation. Like everyone else, he is waiting to see what DBO’s rules look like.

“It’s always good to give more rather than less information,” he told deBanked in a telephone interview. “We still don’t know all the details or the format that (DBO officials) want. All we can do is wait. But it doesn’t change this business. After the car business was required to disclose the full cost of motor vehicles,” Gilbert adds, “people still bought cars. There’s nothing here that will hinder us.”

With its panoply of disclosure requirements on business lenders and other providers of financial services, California has broken new legal ground, notes Odinet, the OU law professor, who’s an expert on alternative lending and financial technology. “Not many states or the federal government have gotten involved in the area of small business credit,” he says. “In the past, truth-in-lending laws addressing predatory activities were aimed primarily at consumers.”

The financial-disclosure legislation grew out of a confluence of events: Allegations in the press and from consumer activists of predatory lending, increasing contraction both in the ranks of independent and community banks as well as their growing reluctance to make small-business loans of less than $250,000, and the rise of alternative lenders doing business on the Internet.

In addition, there emerged a consensus that many small businesses have more in common with consumers than with Corporate America. Rather than being managed by savvy and sophisticated entrepreneurs in Silicon Valley with a Stanford pedigree, many small businesses consist of “a man or a woman working out of their van, at a Starbucks, or behind a little desk in their kitchen,” law professor Odinet says. “They may know their business really well, but they’re not really in a position to understand complicated financial terms.”

The average small-business owner belonging to NFIB in California, reports Kabateck, has $350,000 in annual sales and manages from five to nine employees. For this cohort—many of whom are subject to myriad marketing efforts by Internet-based lenders offering products with wildly different terms—the added transparency should prove beneficial. “Unlike big businesses, many of them don’t have the resources to fully understand their financial standing,” Kabateck says. “The last thing they want is to get steeped in more red ink or—even worse—have the wool pulled over their eyes.”

California’s disclosure law is also shaping up as a harbinger—and perhaps even a template—for more states to adopt truth-in-lending laws for small-business borrowers. “California is the 800-lb. gorilla and it could be a model for the rest of the country,” says law professor Hurley. “Just as it has taken the lead on the control of auto emissions and combating climate change, California is taking the lead for the better on financial regulation. Other states may or may not follow.”

California’s disclosure law is also shaping up as a harbinger—and perhaps even a template—for more states to adopt truth-in-lending laws for small-business borrowers. “California is the 800-lb. gorilla and it could be a model for the rest of the country,” says law professor Hurley. “Just as it has taken the lead on the control of auto emissions and combating climate change, California is taking the lead for the better on financial regulation. Other states may or may not follow.”

Reflecting the Golden State’s influence, a truth-in-lending bill with similarities to California’s, known as SB-2262, recently cleared the state senate in the New Jersey Legislature and is on its way to the lower chamber. SBFA’s Denis says that the states of New York and Illinois are also considering versions of a commercial truth-in-lending act.

But the fact that these disclosure laws are emanating out of Democratic states like California, New Jersey, Illinois and New York has more to do with their size and the structure of the states’ Legislatures than whether they are politically liberal or conservative. “The bigger states have fulltime legislators,” Denis notes, “and they also have bigger staffs. That’s what makes them the breeding ground for these things.”

Buried in Appendix B of Treasury’s report on nonbank financials, fintechs and innovation is the recommendation that, to build a 21st century economy, the 50 states should harmonize and modernize their regulatory systems within three years. If the states fail to act, Treasury’s report calls on Congress to take action.

The triumvirate of Hurley, Oxman and Odinet report, meanwhile, that they are forming a task force and, with the tentative blessing of Treasury officials, are volunteering to monitor the states’ progress. “I think we have an opportunity as independent representatives to help state regulators and legislators understand what they can do to promote innovation in financial services,” ETA’s Oxman asserts.

The ETA is a lobbying organization, Oxman acknowledges, but he sees his role—and the task force’s role—as one of reporting and education. He expects to be meeting soon with representatives of the Conference of State Bank Supervisors (CSBS), the Washington, D.C.-based organization representing regulators of state chartered banks. It is also the No. 1 regulator of nonbanks and fintechs. “They are the voice of state financial regulators,” Oxman says, “and they would be an important partner in anything we do.”

The ETA is a lobbying organization, Oxman acknowledges, but he sees his role—and the task force’s role—as one of reporting and education. He expects to be meeting soon with representatives of the Conference of State Bank Supervisors (CSBS), the Washington, D.C.-based organization representing regulators of state chartered banks. It is also the No. 1 regulator of nonbanks and fintechs. “They are the voice of state financial regulators,” Oxman says, “and they would be an important partner in anything we do.”

Margaret Liu, general counsel at CSBS, had high praise for Treasury’s hard work and seriousness of purpose in compiling its 200-plus page report and lauded the quality of its research and analysis. But Liu noted that the conference was already deeply engaged in a program of its own, which predates Treasury’s report.

Known as “Vision 2020,” the program’s goals, as articulated by Texas Banking Commissioner Charles Cooper, are for state banking regulators to “transform the licensing process, harmonize supervision, engage fintech companies, assist state banking departments, make it easier for banks to provide services to non-banks, and make supervision more efficient for third parties.”

While CSBS has signaled its willingness to cooperate with Treasury, the conference nonetheless remains hostile to the agency’s recommendation, also found in the fintech report, that the Office of the Comptroller of the Currency issue a “special purpose national bank charter” for fintechs. So vehemently opposed are state bank regulators to the idea that in late October the conference joined the New York State Banking Department in re-filing a suit in federal court to enjoin the OCC, which is a division of Treasury, from issuing such a charter.

Among other things, CSBS’s lawsuit charges that “Congress has not granted the OCC authority to award bank charters to nonbanks.”

Previously, a similar lawsuit was tossed out of court because, a judge ruled, the case was not yet “ripe.” Since no special purpose charters had actually been issued, the judge ruled, the legal action was deemed premature. That the conference would again file suit when no fintech has yet applied for a special purpose national bank charter— much less had one approved—is baffling to many in the legal community.

“I suspect the lawsuit won’t go anywhere” because ripeness remains a sticking point, reckons law professor Odinet. “And there’s no charter pending,” he adds, in large part because of the lawsuit. “A lot of people are signing up to go second,” he adds, “but nobody wants to go first.”

Treasury’s recommendation that states harmonize their regulatory systems overseeing fintechs in three years or face Congressional action also seems less than jolting, says Ross K. Baker, a distinguished professor of political science at Rutgers University and an expert on Congress. He told deBanked that the language in Treasury’s document sounded aspirational but lacked any real force.

“Usually,” he says, such as a statement “would be accompanied by incentives to do something. This is a kind of a hopeful urging. But I don’t see any club behind the back,” he went on. “It seems to be a gentle nudging, which of course they (the states) are perfectly able to ignore. It’s desirable and probably good public policy that states should have a nationwide system, but it doesn’t say Congress should provide funds for states to harmonize their laws.

“When the Feds issue a mandate to the states,” Baker added, “they usually accompany it with some kind of sweetener or sanction. For example, in the first energy crisis back in 1973, Congress tied highway funds to the requirement (for states) to lower the speed limit to 55 miles per hour. But in this case, they don’t do either.”