That’s All Folks! COJ Ban in New York May Pass on Wednesday

June 17, 2019 The New York legislature has until Wednesday night to pass two bills that would prohibit the use of COJs, one on out-of-state debtors entirely and the other from being used as a condition in a financial contract. Either or both would effectively outlaw their use in the small business finance industry in New York State. If they do not pass a Floor vote by Wednesday night, the clock on the debate would reset until 2020 and the bills would have to be reintroduced in January.

The New York legislature has until Wednesday night to pass two bills that would prohibit the use of COJs, one on out-of-state debtors entirely and the other from being used as a condition in a financial contract. Either or both would effectively outlaw their use in the small business finance industry in New York State. If they do not pass a Floor vote by Wednesday night, the clock on the debate would reset until 2020 and the bills would have to be reintroduced in January.

Both bills have momentum. Both bills have a Democrat sponsor. The Democrats control the Assembly, the Senate, and the Office of the Governor. The bills have at least some support from Republicans. By all counts, at least one of these bills should pass this week.

Bill A07500 would prevent COJs being filed against Non-New York parties by requiring that they only be permissibly filed in a county in which the debtor party “resides.” This bill has already sailed through three committees, the most recent of which had unanimous bipartisan support. Its counterpart in the Senate is S06395.

A03636 is targeted specifically at small business lenders and merchant cash advance companies. “This bill will protect small businesses from predatory lenders that often offer loans and cash advances on the pre-condition that they sign a confession of judgment,” it says.

It’s possible the bills could also be reworded at the last minute.

There is no doubt where the impetus for these bills stems from. A07500’s official memo, for example, cites the controversial Bloomberg story series authored by Zeke Faux and Zachary Mider in its footnotes.

If either or both bills pass by Wednesday night, they would still require the signature of the governor. That step, a technicality, would probably provide clarity on the official date of which the amended law would go into effect.

Long Island Business Loan Brokers Arrested in Bust

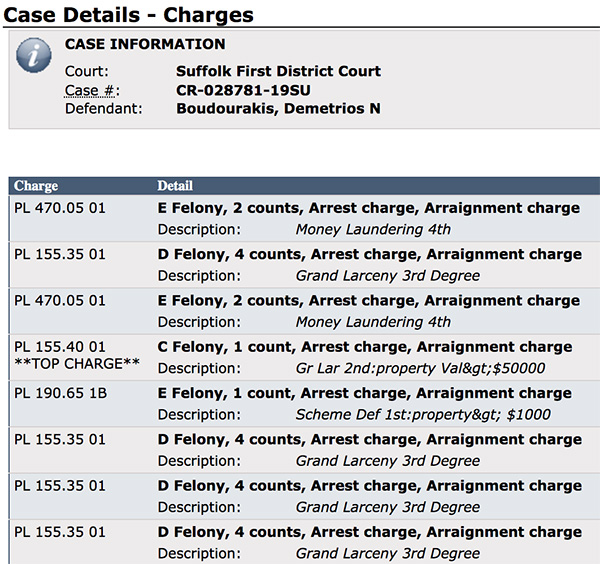

June 13, 2019 The owner of a Long Island based ISO/loan brokerage and several employees have been arrested, Newsday reports. Demetrios Boudourakis, whom deBanked has previously reported on, is charged with grand larceny, money laundering and other crimes for his role in an advance fee loan scheme. Boudourakis allegedly led a fraud ring that stole more than $2 million from small business owners nationwide. Six other defendants have also been charged with related crimes. They include Nadim Afzali of Hicksville, Tanya Balbi of Farmingdale, Christopher Looney of Bethpage, Joseph Johnson of Brentwood, Jude Brun of Elmont, and Michelle Soccodato of Hicksville.

The owner of a Long Island based ISO/loan brokerage and several employees have been arrested, Newsday reports. Demetrios Boudourakis, whom deBanked has previously reported on, is charged with grand larceny, money laundering and other crimes for his role in an advance fee loan scheme. Boudourakis allegedly led a fraud ring that stole more than $2 million from small business owners nationwide. Six other defendants have also been charged with related crimes. They include Nadim Afzali of Hicksville, Tanya Balbi of Farmingdale, Christopher Looney of Bethpage, Joseph Johnson of Brentwood, Jude Brun of Elmont, and Michelle Soccodato of Hicksville.

The investigation began last year and involved numerous agencies, including the Suffolk and Nassau police and sheriff’s departments, New York State Police, the FBI and the Drug Enforcement Administration.

The investigation began last year and involved numerous agencies, including the Suffolk and Nassau police and sheriff’s departments, New York State Police, the FBI and the Drug Enforcement Administration.

According to Newsday, “Boudourakis and his associates, through the dark web, obtained the names of people who had been denied loans. They would then call those people to tell them they had qualified for loans but would have to pay interest and fees upfront.”

According to Long Island Business News, law enforcement agents who executed search warrants at several locations recovered electronic equipment, three handguns, a sawed-off shotgun and a pill press. The investigation leading up to the bust included court-authorized eavesdropping and audits of financial records and physical and electronic surveillance.

Previously, deBanked reported that JTT Funding, Boudourakis’ company, had been accused of forging a Confession of Judgment and impersonating rival companies. Those were civil cases, not criminal cases. Court records show that those cases remain ongoing.

Among the company names the ring used in the alleged scheme were Federal Business Lenders, Federal Business Funding, JTT Funding, JTT Global Holdings, Inc. Blackrock Funders, Inc. and Blackrock, Inc. It is possible that some of those names closely resemble names of competitors and the actual companies have not been accused of any wrongdoing.

Boudourakis is a retired MMA fighter. His nickname in the ring was “The Tyrant.”

Bitty Advance Opens Office in NYC

June 6, 2019

Bitty Advance has expanded to midtown Manhattan. The company’s first location, in Fort Lauderdale, FL, will remain intact as the corporate office.

“We wanted to have a New York presence to hire sales talent, underwriters and, of course, raise more capital because obviously this is the mecca for finance,” said CEO of Bitty Advance Edward Siegel.

Siegel said he is currently hiring salespeople and experienced underwriters for the New York office. There were about 10 well-dressed salespeople at the spacious Bitty Advance office in New York this morning, and Siegel said he plans to grow the office to about 20. He said there are 30 employees in Florida, none of whom moved to the New York office. The New York office does sales and underwriting, while the corporate office in Florida also handles sales and underwriting and houses the customer service and executive teams.

“We also wanted to have a presence in New York for our partners,” Siegel said.

Siegel’s partners include ISOs and other funders that don’t fund the smaller deals that Bitty Advance specializes in. Bitty Advance provides “micro advances” (from $2,000 to $10,000) to merchants doing less than $100,000 in revenue.

Siegel has another Florida-based funding company called Fundzio, and Bitty Advance launched in 2017 when Siegel recognized that almost 50% of online applications to Fundzio were coming from merchants doing less than $100,000 in revenue.

“I realized that the only proper way to do this was to create another company, carve out a niche, and build a team that was just focused on micro advances,” Siegel said.

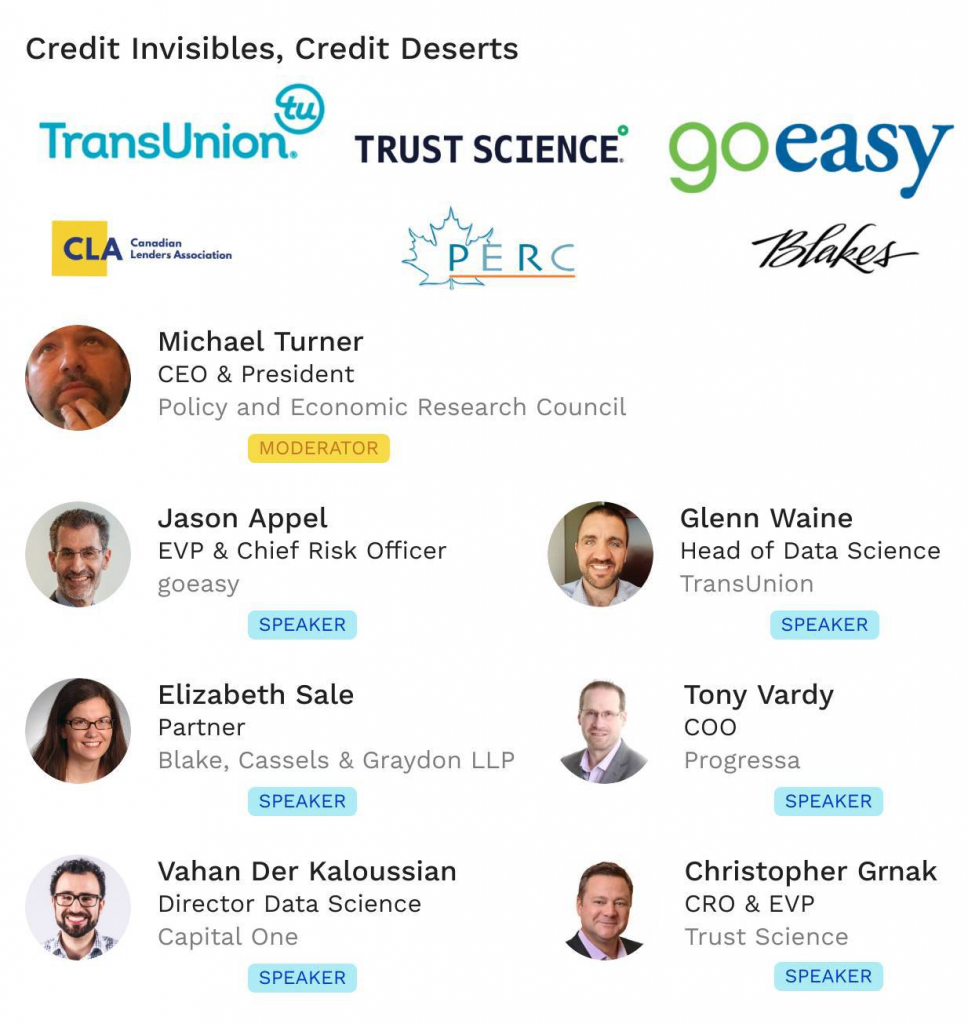

Canadian Alternative Finance Event Calendar

May 28, 2019Here’s what’s on the agenda this Summer for the Canadian alternative finance industry:

June 5th

Credit Invisibles Summit – Presented by the Canadian Lenders Association

July 25th

deBanked CONNECT Toronto – Presented by deBanked

Jonathan Braun Sentenced to 10 Years

May 28, 2019

Jonathan Braun, who Bloomberg Businessweek profiled in a merchant cash advance story series, was sentenced to 10 years for drug related offenses this morning at the federal courthouse in Brooklyn. He will get credit for 17 months previously served in 2010 – 2011. He is scheduled to surrender on August 25th.

Prior to the judge’s order, Braun was given an opportunity to speak and proclaimed himself a changed man. The judge took many things into consideration including letters supporting Braun’s transformation as well as some new lawsuits and allegations that cast him in a negative light. Nevertheless, the judge explained that no new charges had been brought against Braun since he pleaded guilty 8 years ago. The 10-year sentence was the mandatory minimum.

Does The Borrower Even Exist? Image Algorithms, Site Inspectors Spot The Fakers

May 24, 2019 Their product research lab was the real deal. That’s what a business seeking capital hoped to convince a lender of when they snapped a photo of a $450,000 microscope and sent it over to underwriting along with two dozen other photos of their warehouse.

Their product research lab was the real deal. That’s what a business seeking capital hoped to convince a lender of when they snapped a photo of a $450,000 microscope and sent it over to underwriting along with two dozen other photos of their warehouse.

Most of the pictures were genuine, but the microscope was not. Truepic, a virtual site inspection and photo verification company that the lender had relied on, algorithmically determined that the microscope was actually a photo of a photo, one that had been grabbed off the web.

If they had just emailed these photos directly to the lender, the loan would’ve been issued, but this image analyzing technology changed everything.

Truepic founder and COO Craig Stack said that they were able to identify the false ones because of software they have that can detect when a photo is being taken of a two-dimensional image. Truepic didn’t just obtain the photos, they were taken in real time using their mobile photo-taking app. In addition to detecting only two dimensions, Truepic also found the real photos online through a reverse-image search to show where the photos came from.

Photo verification isn’t brand new. Nationwide Management Services has been providing these very same services to their customers since 2015, according to its CEO John Marsh. Marsh started his company in 2005 and originally provided traditional on-site inspections with certified field agents taking pictures.

“You can’t tell the difference,” Marsh said of photos taken by a field agent, compared to those taken virtually by the owner of the store or office. In the virtual one, the merchant receives a text and clicks on a link that essentially turns the merchant’s phone into a live video feed for the lender.

Commonly, the lender wants to see, among other things, the company’s signage, credit card machine and merchant’s driver’s license. Using GPS technology, Nationwide Management Services can tell exactly where the merchant is, so they can’t be taking photos – in real time – of a different store.

Marsh still offers on-site inspection for clients, but mostly as discreet, unannounced visits to check up on a merchant that is having a hard time making payments. Sometimes a field agent will find that a direct competitor moved in across the street or the neighborhood is declining and there are a number of vacant stores, Marsh said.

Marsh still offers on-site inspection for clients, but mostly as discreet, unannounced visits to check up on a merchant that is having a hard time making payments. Sometimes a field agent will find that a direct competitor moved in across the street or the neighborhood is declining and there are a number of vacant stores, Marsh said.

Marsh’s virtual video verification product is instantaneous, allowing the lender to see the merchant’s space – and face – in real time, virtually eliminating misrepresentation of the merchant’s store. Stack said that Truepic also has a video verification product that they will be releasing in less than three weeks.

Marsh said that would-be merchant fraudsters get scared as soon as they hear about a real time virtual inspection.

“When we reach out to them for the virtual inspection, they go dark,” Marsh said.

Most of the deception Marsh has encountered is of merchants giving a P.O. Box address as the address of their “physical store.”

Gayle Juhl, President and CEO of Metro Inspections, said that one of her field agents found a merchant with a far more unusual distortion of its company address. The field agent went to the address of the merchant only to find a 1970s bright blue Volvo station wagon with a sign on it, parked in front of the address listed, which belonged to a completely different store.

The man seeking funding, who came out of the car-turned-store, was apparently confrontational, according to the field agent’s report.

Juhl said that she will coordinate a virtual inspection upon request, but that her company primarily does onsite inspections.

“You can’t replace a handshake and an eye-to-eye to see what’s really going on,” Juhl said.

This may be true, but Marsh said that it can take 24 to 48 hours to collect photos for his onsite inspections whereas it can take as little as four minutes with his virtual video or virtual photo services. (This depends on how many images the lender is looking to capture.) Granted, Juhl said that Metro Inspections’ on-site inspections can be collected and delivered on the same day it was requested, given that the request comes early enough in the day.

Stack, who has only been servicing the online lending industry for about five months, says that he has gotten financial services clients who are very excited about the speed of virtual inspections and the fact that they are far less invasive for the merchant. Rather than have a stranger come in to take pictures – raising questions among employees and customers – the business owner can discreetly photograph their space at their convenience. Stack’s company has never offered onsite inspections and says he never will.

“Our camera doesn’t lie,” he said.

Lawyers: Earn CLE Credits While Learning About Alternative Finance

May 23, 2019| June 13 Sessions | June 14 Sessions |

| Case Law Updates | Regulatory Download: The Complete Picture |

| TCPA: Defining ATDS, Exploring the TCPA and How Emails are Covered | Legislation, Business and Lobbying: How does it work and Does it work at all? |

| Bankruptcy Updates | Future Invoice Factoring and Traditional Factoring: Can’t We All Just Get Along? |

| Securities: A Lesson from Bitcoin and Recent Industry Case Law | Clean Contracts: Merchant Agreements, Inter-Creditor Agreements and ISO Agreements: What you MUST know to keep up with the times |

| Inside the UCC with Bob Zadek | |

| Collections in a Post Bloomberg World | |

| Ethics: Conflicts of Interest | |

| *Evening Social event at Lucky Strike in Manhattan Food, drinks and bowling! 7:00pm – 9:00pm* | *Rooftop Cocktail Reception, Castell Rooftop Lounge 3:00pm – 5:00pm* |

Admission Price List:

Admission for Members: $75

2-Day Ticket Includes:

- Day One: breakfast and lunch during the full day of panels. Evening at Lucky Strike with food and drinks.

- Day Two : Three panel discussions, lunch and cocktail hour immediately to follow.

Non-Member Attorneys $250.00 for the 2 day ticket

Non-Member Attorneys $150.00 for a 1 day ticket

(may only attend one of the two days.)

Corporate Guests (Day Two only) $150.00

Featuring the Following Speakers:

- Christopher Murray, Esq.

- Patrick Siegfried, Esq.

- William Molinski, Esq.

- Natalie Nahabet, Esq.

- David Fuad, Esq.

- Kate Fisher, Esq.

- Jamie Polon, Esq.

- Thomas Telesca, Esq.

- Richard J. Zack, Esq.

- Robert Zadek, Esq.

- Richard Simon, Esq.

- Anthony Giuliano, Esq.

- Mark Dabertin, Esq.

- Gregory Nowak, Esq.

Email Lindsey Rohan: lindsey@lrohanlaw.com

BFS Capital Joins ILPA

May 23, 2019

The Innovation Lending Platform Association (ILPA), a group of online small business financing and service companies, announced today the addition of BFS Capital. ILPA is known for creating the Straightforward Metrics Around Rate and Total Cost (SMART) Box.

“We believe that transparency matters,” Ruddock told deBanked.

“BFS Capital is committed to being both a responsible and an innovative lender,” Ruddock said. “Our membership in the ILPA allows us to work with industry leaders who are dedicated to advancing standards and best practices in the critical small business lending marketplace… [and] we believe that clarity and transparency is critical in helping [small businesses] make educated and informed financial decisions.”

As a new member of ILPA, BFS will join current members including OnDeck, Kabbage, BlueVine and 6th Avenue Capital.

“We applaud Mulligan Funding and BFS Capital for committing to adopt fair and transparent disclosure best practices to ensure small businesses are well informed when seeking funding,” said ILPA CEO Scott Stewart. (ILPA announced that Mulligan Funding has joined the association as well).

BFS is also a member of the Small Business Finance Association (SBFA) and Ruddock told deBanked that BFS will remain a member of that trade association as well.

Separately, BFS announced today that it has named Fred Kauber as the company’s new Chief Technology Officer and Chief Product Officer. Kauber was previously with fintech marketplace platform CAIS Group and he served in senior roles at First Data, Dun & Bradstreet and IBM.

“I’m confident that Fred is the right person to advance both our vision and our capabilities [at BFS,]” Ruddock said.