Large Fintech Companies Helping to Normalize Revenue Based Financing

May 6, 2022 With business increasing for wide-reaching financial technology companies like Square, Paypal, and Shopify, this has brought more attention to revenue-based financing products like the ones they offer. Henry Abenaim, Founder and CEO of Fundingo, said that it brings more businesses to the table.

With business increasing for wide-reaching financial technology companies like Square, Paypal, and Shopify, this has brought more attention to revenue-based financing products like the ones they offer. Henry Abenaim, Founder and CEO of Fundingo, said that it brings more businesses to the table.

“…you sometimes think it’s a small world or small group of merchants, and you really come to realize that it’s huge,” he told deBanked. “And the more they’re serviced, the more they need, the more they grow. So it just feels like there’s just more awareness of the product, and then more merchants that are going to come in demand and ask for it, as well as these bigger players are always going to service only a subset of the businesses.”

At the same time, a greater public awareness of options could tighten margins for certain funding providers. “I think it’s going to make the merchants that are way more bankable… get lower price deals, so it’s going to hurt the margins, it’s going to hurt the profits,” Abenaim commented.

John Bulnes, Vice President of Business Development at Fenix Capital Funding, expressed how it is not yet determined what kind of effect the larger mainstream companies will have on the industry. “I do think it’s something that the larger first position MCA companies may feel the effects of first, because they’re going to be competing more or so with taking away clients from those companies first, as opposed to the companies that are smaller that are doing shorter term deals.”

As these big companies operate with larger capital bases, it may indeed become more difficult for smaller companies to compete.

“… it’s going to be something that’s going to constantly adapt and fluctuate as time goes, but I do see it as an expanding industry… it’s kind of a sign that when you see more commercials and we see these bigger companies jumping into the space, that it is something that’s going to continue to grow,” said Bulnes.

And commercials and ads are definitely increasing. One of the largest online small business lenders in the country was asked about their TV and radio campaigns during their recent quarterly earnings call.

“We’ve definitely been ramping [commercials up] hopefully with a little bit more diligence than OnDeck was running ads three or four years ago,” said David Fisher, CEO of Enova. “But we’ve definitely jump back into kind of broader base advertising in that business and it’s been working really well.”

New Domain Name Gold Rush Sets Up Possible Battle for Future of SMB Finance

April 25, 2022 If you could have businessloan.com or businessloans.com as your website, would you jump on the opportunity to get it?

If you could have businessloan.com or businessloans.com as your website, would you jump on the opportunity to get it?

It’s evident that the market for keyword-based domains has evolved over time. Couldn’t get the .com? You could’ve tried to get the less coveted .net or .org. Don’t like those? Today, you can get the .business, .deals, .financial, .loan, .loans, or hundreds of other customized tlds. With so many to choose from, most experts in the field would advise that if you don’t own the .com version, to not even bother getting cute with customizations for your brand or keyword because customers will just get confused.

But recently, another domain name market has quietly been gaining steam. It’s for something called a .eth, an Ethereum blockchain-based crypto address shortener by the Ethereum Name Service. It’s not necessarily something one could use to build a website with, at least not yet. Originally envisioned as a way to condense long impossible-to-remember crypto wallet addresses into memorable words, users have started to buy up a bunch of keywords that may be familiar to deBanked readers. Just to name a few:

- businessloan.eth

- businessloans.eth

- smbloans.eth

- merchantcashadvance.eth

- ach.eth

- syndication.eth

- lending.eth

- ppploan.eth

- underwriting.eth

- brokers.eth

- loanbroker.eth

- mca.eth

- factoring.eth

- funding.eth

- backdoored.eth

At face-value, this might appear to be a vanity crypto play, one in which one could send crypto to your-name-here.eth instead of trying to type out a long address like: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829. But an ENS domain name holds much more potential than just that. It’s moving towards becoming the backbone of one’s identity in the upcoming era of the web called web 3.0 (web3 for short). Instead of having to remember passwords for hundreds of websites, identity can be validated through one’s digital wallet. Such a concept is not theoretical. It’s already being used.

Take seanmurray.eth for example. You could send eth, bitcoin, litecoin, or dogecoin to it, but at the same time it’s connected to an email address and a url (this one). Plus it’s linked to an NFT avatar (broker #7 from The Broker NFT collection) which is in that wallet. I can use it to do an e-commerce online checkout in 5 seconds without ever needing to enter any payment information even if I’ve never visited the site before. It’s faster than PayPal and with less steps involved. I can connect it to my twitter account, OpenSea, or use it to vote in an official poll without ever having to create an account on something. The wallet is the identity verification. The .eth name, therefore, has the potential to become the defining baseline of who or what one is on the internet. Not theoretically. It’s already happening.

Take seanmurray.eth for example. You could send eth, bitcoin, litecoin, or dogecoin to it, but at the same time it’s connected to an email address and a url (this one). Plus it’s linked to an NFT avatar (broker #7 from The Broker NFT collection) which is in that wallet. I can use it to do an e-commerce online checkout in 5 seconds without ever needing to enter any payment information even if I’ve never visited the site before. It’s faster than PayPal and with less steps involved. I can connect it to my twitter account, OpenSea, or use it to vote in an official poll without ever having to create an account on something. The wallet is the identity verification. The .eth name, therefore, has the potential to become the defining baseline of who or what one is on the internet. Not theoretically. It’s already happening.

Crypto is already starting to creep into the small business finance industry. In August, a funding company announced that it would begin offering commissions and fundings in crypto because of the speed potential. Far from being a gimmick, brokers started to choose crypto payments over ACH or a wire because of how fast it would be. There’s also no chargeback risk with crypto.

Currently, the owner of mca.eth has listed the domain for sale on OpenSea at a price of 20 eth (approximately $60,000). That’s less than what MerchantCashInAdvance.com sold for in 2011. Perhaps the value of an Ethereum Name Service domain holds less promise than a website that ranked well on Google in 2011. But then again, being well ranked on Google is not as important as it used to be. It’s impossible to say what, if any impact web3 will have on the small business finance industry long term, but for now there are those out there quietly buying up names like ach and funding and syndication on the chance that they will become something.

Man Who Defrauded MCA Companies Indicted

April 19, 2022 An alleged fraud executed five years ago against merchant cash advance companies did not go unnoticed. A grand jury indicted an El Dorado Hills resident named Suneet Singal on April 7th under seal. The Department of Justice announced it yesterday morning.

An alleged fraud executed five years ago against merchant cash advance companies did not go unnoticed. A grand jury indicted an El Dorado Hills resident named Suneet Singal on April 7th under seal. The Department of Justice announced it yesterday morning.

According to the Grand Jury, Singal engaged in a scheme to fraudulently induce financing companies to provide merchant cash advances to a company he had previously sold and no longer owned. In doing so, Singal allegedly received six wires from four financing companies between April 12 and May 22, 2017 in the amounts of $197,370, $112,308, $48,500, $294,946, $96,970, and $43,975. The indictment did not cite any of the companies by name. Allegedly, Singal used those funds for various expenses, and the company he did not own was forced to file for bankruptcy. Singal was indicted on 10 counts.

The DOJ did not publish the full indictment but it can viewed in its entirety here. Despite the “sealed” stamp at the top, the court ordered it be unsealed upon Singal’s arrest and is public record.

Ten Percent of Small Businesses That Sought Financing in 2021 Sought a Merchant Cash Advance

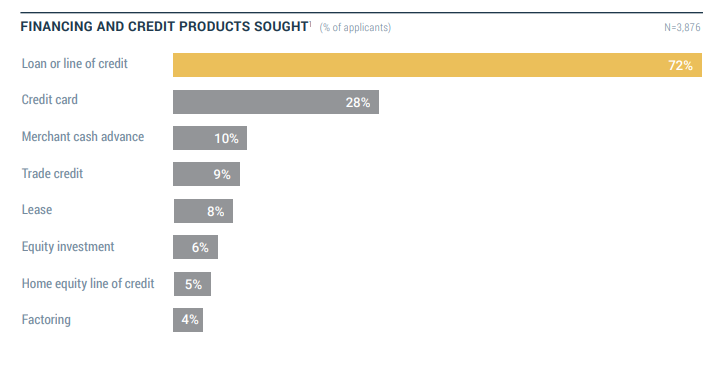

April 18, 2022A whopping 10% of small businesses that sought financing last year sought out a merchant cash advance, according to the latest study published by the Federal Reserve. That figure was up from 8% in 2020 and 9% in 2019. For the the preceding years, that figure had held fairly consistent at 7%. [See 2015, See 2017]. Market penetration, therefore, has arguably increased by about 40% since 2015.

Meanwhile, the percentage of applicants that sought out leasing has gone down over the last seven years: from 11% in 2015 to 8% in 2021. Factoring has hovered around 3-4% consistently.

The pursuit of of loans and lines of credit decreased dramatically from 89% in 2020 to 72% in 2021. And approvals have gone down across the board. Approvals on business loans, lines of credits, and MCAs hit a peak of 83% in 2019 and plunged to 76% in 2020, the first year of Covid. The figure fell even further in 2021, down to 68%. Online lenders and large banks had the lowest approval rates overall, at 51% and 48% respectively.

Small Business Finance Industry Mulls What’s in The Rearview, Is Optimistic For Rest of 2022

April 14, 2022 The small business finance industry is looking ahead to anticipated growth for the remainder of the year, despite new challenges ahead. With massive government aid fading in the rearview, some industry players now have had the time to consider what the impact of it was as they move onward into the future.

The small business finance industry is looking ahead to anticipated growth for the remainder of the year, despite new challenges ahead. With massive government aid fading in the rearview, some industry players now have had the time to consider what the impact of it was as they move onward into the future.

Bob Squiers of Meridian Leads expressed his view on the topic, “a lot of our customers, mostly the ISO shops, many of them converted and started selling and pitching the government programs. So in that sense it kind of helped keep those guys afloat, helped keep our business going. A lot of what we do in the marketing side, translated for those government programs. But then it did also squash the demand for the cash advance.”

In some cases, government funding has helped merchants pay off pre-existing obligations in a timely manner. Matthew Washington, founder and CEO of Moneywell GRP, noted, “An educated business owner is using the financing options available as they see fit for the timing. Someone that is waiting to get an SBA or an EIDL is more susceptible to take a bridge product to get them through that time gap,” he said. “As long as you’re working with the merchant and pushing out good products and you know what is on the rise, I think it has done nothing but help in some cases.”

Trucking became one of the number one fields that made up a large percentage of submissions during the pandemic, industry insiders say. However, with gas prices increasing, business with trucking could go down. Other businesses such as restaurants, where only a third received funding last year from the government, are desperate for funding.

“There’s tons of restaurants left that haven’t yet received their funding. So we could be seeing a lot of exposure in that industry,” stated Michael Yunatan of Specialty Capital. “But overall, I definitely do feel that we’ll be seeing an uptrend in our numbers across the board.”

“We definitely do think the industry is growing as a whole,” said Yunatan. “Even though we are a new player in the space we have been growing.”

Chad Otar, founder and CEO of Lending Valley, said, “We need to keep monitoring the interest rates that are coming up from the Federal Reserve, we need to make sure we’re not heading towards a recession, we need to make sure that we’re able to fully have the capital ready, in order to be able to deploy at a reasonable rate.”

Otar acclaimed the indirect benefit of large tech companies operating in the space with a competing product, arguing that the presence of PayPal and Amazon are helping to bring exposure to the industry overall.

“And now that Kabbage is back as well, since they partnered up with American Express, it’s gonna help us out to be able to push the product more into the mainstream,” said Otar. “So I believe there will be a growth in the industry.”

Brokers, Funders Find Their Footing and It’s Back to Business

April 12, 2022 For Mike Brooks, CEO of Best Connect Capital, the deal making never stops. A former boxing trainer turned funder said that there are no days off. “I’m always funding, I am always, always funding,” he said.

For Mike Brooks, CEO of Best Connect Capital, the deal making never stops. A former boxing trainer turned funder said that there are no days off. “I’m always funding, I am always, always funding,” he said.

Recently, Brooks has taken an interest in text message marketing. “I’ve had trouble finding somebody in text marketing,” he said. I was going on the internet and using word of mouth, and I wasn’t really able to connect with anybody. I hooked up with this company [in Miami], and it worked out really well. I already funded a couple of deals.”

Around the industry, brokers and funders have found their footing after Covid. A recent mass gathering in Miami definitely helped push things along. “The second I got off the plane in Miami this year, I saw an old friend, a business associate,” said Brooks. “That was a great connect right there.”

Nicholas Saccone, Senior Funding Advisor at Proto Financial had a similar experience. “Having the opportunity to meet up with some of our partners face-to-face [is] a really cool experience,” said Saccone. “Sometimes it is hard to find time to build relationships with all of our schedules. [Through networking] I’m able to get different perspectives on where the industry is headed and where we are now.”

“Small business lending is on the up and up,” said Frankie DiAntonio, CEO of Lexington Capital, who also ventured down to Miami with his team from Long Island. “With inflation going up, we’re finding that small businesses are outsourcing their need of funding outside the government, and there are companies like us that can come in and take care of them.”

DiAntonio spoke about how important it is to sell legitimacy to both his lenders and staff. “We’re the new kids on the block, we’re a newer company,” he said. Despite the head start his competitors may have, DiAntonio said that old school sales mentalities combined with modern marketing strategies have recently helped his company consistently fund deals and build a book of business.

“We bring in a lot of Google click ads which brings us a lot of leads, but obviously our guys just make phone calls throughout the day, as much as humanly possible,” DiAntonio said. “My guys know what they’re doing, they know the industry, they’re really good on the phones, and they know how to take care of customers.”

Tomorrow’s Broker/Funder Relationship, According to Funders

February 23, 2022 “In the end, we all press zero to talk to someone.”

“In the end, we all press zero to talk to someone.”

The conversation about what characteristics will make up tomorrow’s loan brokers is surrounded with ideas latched in fintech, social media, and more. Brokers from around North America have been showcasing these new strategies on social media or in chats with deBanked, which sparked the question — what do the funders think of all of this?

Efraim Kandinov, CEO of FundFi Merchant Funding, has a lot of ideas about how brokers should function in a constantly changing financial landscape. According to him, it’s not the style of funding or modernization of business logistics that will make tomorrow’s broker, but it’s leveraging ethics with both merchants and funders to preserve future business down the line.

“I believe more and more merchants look for the digital aspect and remove the broker because of the dishonesty that we usually uncover and want something clean without interpretation. Many issues with merchants in my opinion [stem] from being misled by the broker, promising something after to just take this deal or promising to get payments lowered and take an overleveraged position.”

Other funders think much differently, identifying a sense of community being brought about by tech, having a ‘we’re in this together’ type of mantra to hold the legacy industry up.

“There’s a sense of familiarity when dealing with my brokers,” said Amanda Schuster, CEO and President of Fundhouse LLC. “We’re your friends, we get you, we get your business.”

Schuster believes that relationships between funders, brokers and merchants alike will help them weather the storm of tech’s emergence into their industry.” We are your business and it’s just as important to us that you succeed,” she said. “I have business owners that I still speak to this day, that I funded over five years ago.”

Schuster dismissed companies like PayPal, Square, and Shopify’s takeover of small business lending, circling back to the interpersonal value that a broker provides as a face to a financial product.

“At the end of the day, business is always about the people,” she said. It’s about creating a need and filling it. You can’t do that on a website.”

When asked about the value of this happy-go-lucky community of brokers, funders and merchants, Kandinov brought up how some brokers have found ways around the ‘repeat business’ model of funding deals, thus making relationships between brokers and merchants pointless.

“I think brokers are less caring of repeat business because they have discovered a short term model of stack, stack, stack, and then put in a reverse. This front loads commission. I believe a broker has a huge advantage in creating the relationship. [This] unfortunately is starting to take a back seat to a new way to score big commissions.”

Kandinov spoke about brokers who will say anything to make a sale carelessly shooting themselves in the foot when it comes to forming a book of business. By saying whatever they need to get paid now, merchants are either going straight to the funders to big tech for their next source of funding.

“Jaded merchants then look to only speak to the funding house in the future and stay or just prefer the direct to consumer model of fintech,” said Kandinov.

Despite these feelings, Kandinov does believe that there’s a bright outlook on the future of the broker/funder relationship if some change occurs.

“[Brokers] deserve their high commissions as they do a lot of work. I think funding houses have much less overhead with the broker model, but lately with the broker behavior it is almost pushing themselves out if it continues. I do not believe fintech alone is advantageous, just in speed and clarity. It’s a byproduct of poor behavior.”

Bitty Advance’s New Suite

February 22, 2022 Bitty Advance hopes that an enticing in-person environment will bring people back to the office. As part of that, the company recently moved into a new space.

Bitty Advance hopes that an enticing in-person environment will bring people back to the office. As part of that, the company recently moved into a new space.

“We want to give our team both the flexibility of working from home and having a premier office space for collaboration,” Bitty Principal and CEO Craig Hecker told deBanked. “…making our space open and dynamic, with comfortable couches, TVs, and relaxed meeting areas was important, we are also incorporating fun things like resting areas and table tennis to promote wellness and engagement.”

The new office is immediately adjacent to Dania Pointe, a 102-acre premier mixed-use development with almost one million square feet of retail and restaurants, luxury offices, hotels, luxury apartments, and public event space.

Bitty is seeking to acquire tech talent in many areas as they expand platform offerings for their white-label application intake process, affiliate online checkout referral page, payment processing & management interface, and self-service customer portal.

“Bitty is a tech company first. All of our focus is on utilizing technology to revolutionize the MCA space,” said Hecker.