Marketplace Lending

Real Estate Crowdfunder Patch of Land Returns $25 mn to Investors

March 24, 2016Patch of Land has returned $25 million to investors this year, a quarter of its originations at $100 million.

The LA-based online lender for real estate loans also expanded its business to Hawaii, marking its presence in 36 states. The company uses a data-driven underwriting model and promises investors a risk adjusted return with extensive available data to support the underlying credit decision on each loan.

Earlier this month, Patch of Land started selling mid-term loan option for 2-5 years starting at 6 percent, extending its typical short-term loans starting at 10 percent for up to two years. It sells ‘bridge loans’ ranging from $100,000 to $5 million to cover the borrower until they can secure permanent capital or those who may not immediately qualify for long-term financing on properties that they rehabilitate and then hold as rentals. As far as demands for these loans go, the company’s CEO Jason Fritton said bridge loans generated $40 million in loan interest in less than two weeks since.

The three year old startup signed a $250 million agreement with an east coast based credit fund to purchase its loans in a forward flow arrangement. Last year, it raised a million in seed funding and $125,000 in debt in 2014, followed by $23 million in Series A funding last year when it funded more than 200 projects, with an average blended rate of return to investors of 12 percent.

CEO of RealtyShares, a real estate crowdfunding platform Nav Atwal in a Forbes post said enlisted reasons why commercial real estate is investor friendly — 12 percent annual returns, tax benefits, hedge against stock market and inflation being some of them. But for larger context, the commercial real estate environment is of caution among lenders towards big projects. Real estate firm CBRE said that it “conservatively” estimates that 18 percent of loans this year and 29 percent of loans next year to have refinancing problems as investors move away from commercial real estate bonds. CBRE estimates $43 billion to be in “troubled loans” over the next two years.

Why Marketplace Lenders Want to Share Borrowers

March 22, 2016 In a not-so-strange coming together, loandepot and Avant launched a borrower referral program.

In a not-so-strange coming together, loandepot and Avant launched a borrower referral program.

Loandepot and Avant are both marketplace lending platforms. Loandepot identifies itself as the ‘nonbank consumer lender’ and sells home equity loans, refinances mortgages and credit card loans and added personal loans in May 2015. Avant mostly sells personal loans and as of very recently, consumer auto loans.

Under the mutual borrower program, the two companies will have access to each other’s customer base to “expand credit options to responsible borrowers.”

California-based Loandepot has to date funded $60 billion in loans since 2010, $400 million of which was in personal loans. Chicago-based Avant has funded $3 billion in personal loans since 2012.

Industry analyst Michael Tarkan at Compass Point Research called the partnership a turndown program from Loandepot to Avant. “Referrals are an easy channel to facilitate loan volume,” he said.

There have been other partnerships in the industry with either banks or other lenders. JPMorgan and OnDeck, OnDeck and Prosper being noteworthy ones.

Tarkan expected more such collaborations before the industry consolidates itself. Marketplaces look for new borrowers to reach in different ways. “Goal for the platforms is to build a brand and a relationship with the customer so there is a repeat loan purchase,” Tarkan said. “There will be some degree of consolidation simply because there are many platforms out there searching for the similar borrower and industry won’t be able to support so many platforms.”

Avant Will Refinance Auto Loans

March 21, 2016 Online lending platform Avant said it will refinance consumer auto loans.

Online lending platform Avant said it will refinance consumer auto loans.

The Chicago-based marketplace platform, Avant added auto-secured loans earlier. This refinancing option is available to borrowers in California with Illinois and Georgia to follow in the coming months.

According to the company website, Avant’s auto refinance loans range between $4,000 and $35,000 with APRs between 10.11 percent and 25 percent ranging over 2-5 years.

“Today’s middle-income consumers have to often settle for auto loans with high interest rates and poor lending experiences,” said Al Goldstein, CEO of Avant. “We want to be the one stop shop for the borrowing needs of consumers across the credit spectrum,” he said in a statement.

Earlier this month, the company crossed $3 billion in personal loans. Avant uses big data and machine learning to underwrite loans.

This move however comes at a time when subprime auto delinquencies are higher now than they were during the height of the most recent recession. The 60-day-plus delinquency rate of the subprime loan group reached 5.16% last month, compared to 5.09 percent in January, 2009. Credit ratings agency Fitch attributes this surge to increased competition among lenders resulting in weaker underwriting standards and more originations.

Lending Club Performance Data Has Obvious Errors, Investors Say

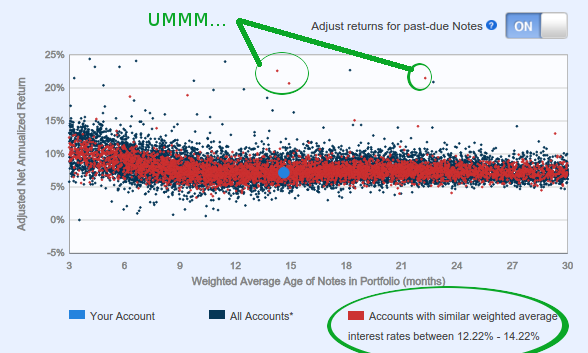

March 20, 2016There’s something wrong with the returns Lending Club is dangling in front of investors, some diligent note buyers say. And the numbers are so far off, that it’s being chalked up as a bug, instead of something nefarious.

On the “Understanding Your Returns” page, investors can view how their portfolio stacks up against all others on the platform with the same weighted average interest rate. Most investors will end up somewhere in the middle, but a few are outperforming the rest with seemingly impossible results.

The flawed chart, which I could duplicate myself, shows investors supposedly making over 20% annual returns on seasoned portfolios where the weighted average interest rate of notes is between 12.22% and 14.22%. But how can an overall return be so much greater than the interest rates that make up the portfolio? They can’t be. But Lending Club’s chart tells a different tale.

With projected defaults, the adjusted returns should be lower than the weighted average interest rate, certainly not much higher and definitely not double.

On the Lend Academy forum where this was noticed, at least one investor said they emailed Lending Club on March 18th to alert them to the impossible performance data.

For now, the page that is meant to help investors understand their returns, is doing anything but.

Update 3/22: Lending Club has reportedly told an investor asking about this discrepancy that it is indeed a bug and will be fixed.

Update 3/24: This has mostly been fixed

Funding Circle To Expand Bay Area Staff

March 17, 2016 P2P Lender Funding Circle will expand its Bay Area staff by ten percent.

P2P Lender Funding Circle will expand its Bay Area staff by ten percent.

The company plans to hire 20 people in risk and compliance, product engineering and sales teams. Funding Circle’s marketplace connects borrowers, mostly small business merchants and investors. The company makes money in origination and servicing fees.

The San Francisco-based company was founded in 2010 in the United Kingdom and was launched in the US in 2013. It employs 550 people globally and has so far funded $2 billion to 15,000 businesses.

Earlier this month, Funding Circle announced that it hired former Executive Board Member of the European Central Bank (ECB), Jörg Asmussen, to join its board. This aligns with the company’s streak of boosting manpower. Last year, it hired top executives from Barclays and American Express to head its global risk and analytics team.

Retail Investors Can Invest In Business Loans – Thanks To StreetShares Regulatory Approval

March 16, 2016 If not being an accredited investor has kept you on the sidelines of marketplace lending, you’ll soon be able to invest in business loans on the StreetShares platform, thanks to a special regulatory approval by the SEC. While you’re not going to the earn the yields you’d get with merchant cash advance (MCA) syndication, StreetShares makes loans for as short as three months. The available products are 3, 6, 12, 18, 24 & 36 month term loans, according to their website, which are desirable lengths for investors used to MCA. The Funding Circle platform by contrast, requires investors be accredited and loan terms range from 1 to 5 years. If you aren’t eligible to invest through Funding Circle, well that is what will make StreetShares different.

If not being an accredited investor has kept you on the sidelines of marketplace lending, you’ll soon be able to invest in business loans on the StreetShares platform, thanks to a special regulatory approval by the SEC. While you’re not going to the earn the yields you’d get with merchant cash advance (MCA) syndication, StreetShares makes loans for as short as three months. The available products are 3, 6, 12, 18, 24 & 36 month term loans, according to their website, which are desirable lengths for investors used to MCA. The Funding Circle platform by contrast, requires investors be accredited and loan terms range from 1 to 5 years. If you aren’t eligible to invest through Funding Circle, well that is what will make StreetShares different.

Unlike the laborious process that Lending Club and Prosper took with the SEC to sell loan performance-dependent notes to unaccredited investors, StreetShares got a special approval under the JOBS Act’s Regulation A+. That only allows them to raise up to $50 million over a 12-month period so investing availability may be limited.

In a press release, the company specified that “repayment to investors is not tied to the performance of a particular underlying loan.” The LendAcademy blog is reporting that “StreetShares will provide a vehicle for investors to become diversified through some kind of fund” and that details should be revealed around the time of the LendIt Conference.

Though company CEO Mark Rockefeller of StreetShares might not remember this, we spoke during a lunch break at LendIt 2014 when his company was a brand new startup. At that time, he told me about his “veterans funding veterans” lending marketplace model where the costs would be much lower than what can be experienced in the merchant cash advance industry. Since then his company has won the 2015 #1 global Best Investment Award from Harvard Business School and is now the first small business lender to get approval under Regulation A+.

One other person that is trying to bring small business lending investing to the unaccredited investor community is hedge fund manager Brendan Ross. Ross’s Direct Lending Income Fund filed an N-2 with the SEC at the conclusion of last year to become a “40 Act fund,” a special investment company permitted under The Investment Company Act of 1940 that can accept investments from retail investors. In January, Ross explained to CNBC during an interview that the fund’s structure would be converted so that investors become shareholders in what would essentially be a lending business.

StreetShares plans to officially debut their new program at LendIt next month.

Why this Real Estate Lender is Going Long

March 15, 2016 Patch of Land, an online lender for real estate loans added a mid-term loan option for 2-5 years starting at 6 percent.

Patch of Land, an online lender for real estate loans added a mid-term loan option for 2-5 years starting at 6 percent.

The LA-based lender issued loans starting at 10 percent for up to two years. The company uses a data-driven underwriting model and promises investors a risk adjusted return with extensive available data to support the underlying credit decision on each loan.

Patch of Land provides loans ranging from $100,000 to $5 million and prides itself on providing quick loans. These short term loans are called ‘bridge loans’ and as the name suggests are a bridge until the borrower secures permanent capital. The company on its website noted, “Although this type of financing has relatively high interest rates, it allows the user to meet current obligations because it provides immediate cash flow.”

Should this be considered in the larger context of the commercial real estate environment, it aligns with the general attitude of caution among lenders towards big projects. CNBC quoted real estate firm CBRE and said that it “conservatively” estimates that 18 percent of loans this year and 29 percent of loans next year to have refinancing problems as investors move away from commercial real estate bonds. CBRE estimates $43 billion to be in “troubled loans” over the next two years.

Should other lenders pay attention?

Why did HomeAdvisor Choose Prosper over Lending Club?

March 14, 2016 Home services marketplace HomeAdvisor partnered with Prosper Loans exclusively to provide home improvement loans to its users under a multi-year contract.

Home services marketplace HomeAdvisor partnered with Prosper Loans exclusively to provide home improvement loans to its users under a multi-year contract.

Formerly known as ServiceMagic, HomeAdvisor lists service professionals, resources and tools for home improvement and maintenance and claimed to have connected 35 million home owners to service professionals and so branching out to offer loans on the platform was a logical business move. But, Prosper was not its first ally. Last year in March the Golden, Colorado-based company announced Lending Club as its exclusive lending partner, again under a multi-year agreement.

Did the deal go sour? Maybe. Is Prosper a better partner?

Home improvement loans have been a big cash cow for Prosper. As of 2014, approximately 8 percent of their borrowers said their loan was for home improvement. Orchard, in its analysis states that these loans may in part be a substitute for traditional home equity lines of credit, which used to be easier to obtain prior to the housing crash.

HomeAdvisor struck similar deals with both the lenders. Lending Club offers interest rates for fixed monthly payments starting at 3.99 percent (4.99 percent APR) and Prosper personal loans are priced between 5.99 percent to 36 percent.

“We stopped working with Lending Club solely because we started working with Prosper. We chose to work with Prosper because they’re a better fit for our business at this time,” said a Prosper spokesperson, commenting on the deal.

Are there more dots to be connected?