internet marketing

Is Google Getting Greedy?

October 21, 2012By now, you’ve probably heard of Google’s earnings release blunder when their financial printer published an unfinished report. That version went viral and was clearly not ready for print since it included a placeholder note that said “Pending Larry Quote,” a space that was reserved for a quotable by CEO Larry Page.

Ad revenue was up 16% for the quarter, a 33% surge over last year’s numbers. But is Google getting greedy? We like to search for MCA industry news and in the last couple weeks, we noticed an interesting “glitch” that started to happen. Approximately 1 out of every 15 times (we didn’t run a statistical analysis), zero results show on the page. It doesn’t actually say “no results found,” but rather looks as if the results failed to load. That is of course except for the ads. The ads conveniently become the only clickable options.

This happens often enough that it has become annoying. We’ve experienced it with multiple browsers and three computers. Has anyone else fallen victim to this glitch?

Perhaps it’s psychological, but it seems like this occurs most frequently on business lending related searches, when the revenue-per-click Google earns just happens to be at its highest. Is Google getting greedy?

Merchant Cash Advance Community Teams up for Charity

September 27, 2012You may have seen the news story somewhere already: Twelve Members of the Alternative Small Business Lending Community Join Forces for Charity, but you haven’t heard the background of all the companies involved. We’d like to shed some light on the competitors that are battling it out in an epic competition of fantasy football:

Merchant Cash Group

Based in Gainesville, FL, they are a charity league co-founder and direct provider of capital. They recently launched their Fast Funding Equity Program, a unique financial solution to merchants that may not be able to get approved anywhere else.

Competing for: Kiva

Kiva is a non-profit organization with a mission to connect people through lending to alleviate poverty.

Rapid Capital Funding

Based in Miami, FL, they are a direct financing source. They are one of the industry’s fastest growing companies and recently acquired a major credit facility from Veritas Financial Partners.

Competing for: Epilepsy Foundation

Financial Advantage Group

Based in Land O’Lakes, FL, they have been a financial provider since 2004. They have helped fund some big name franchises including individual locations for Sonic, Dunkin’ Donuts, and Quiznos.

Competing for: Society of St. Vincent De Paul

The Society of St. Vincent de Paul offers tangible assistance to those in need on a person-to-person basis.

RapidAdvance

Based in Bethesda, MD, RapidAdvance is one of the oldest and largest MCA firms in the country. They are often called upon to offer expert insight on the industry.

Competing for: Cystic Fibrosis Foundation

This foundation is the world’s leader in the search for a cure for cystic fibrosis.

Sure Payment Solutions

Based in New York City, they made a name for themselves by offering low credit card processing rates to merchants nationwide and expanded on that success by providing businesses with financing. They are well known for their industry blog, Sure Resources.

Competing for: ALS Association

The ALS Association is the only national non-profit organization fighting Lou Gehrig’s Disease on every front.

Meridian Leads

Meridian provides direct marketing programs for financial services companies. They are one of the most used and acclaimed marketing firms in the MCA space.

Competing for: 100 Urban Entrepreneurs

100 Urban Entrepreneurs is dedicated to helping provide a meaningful, long-term economic boost to urban communities throughout the United States by supporting minority entrepreneurship at its earliest stages.

Merchant Cash and Capital

Headquartered in New York City, they have funded over half a billion dollars to small businesses since 2005. They’re heavily involved in the financing of retail and food service franchises. Check out their new website.

Competing for: Gift of Life Bone Marrow Foundation – on behalf of The Silver Project

Gift of Life is a world leader facilitating transplants for children and adults suffering from many life-threatening diseases, among them leukemia and lymphoma.

NVMS, Inc.

A Manassas, VA firm, NVMS offers a full range of inspection services for the Mortgage, Banking, Commercial and Residential Property, Construction and Insurance industries. They’ve established a stellar reputation and are the inspection company of choice for many MCA providers.

Competing for: The Missionaries of our Lady of Divine Mercy

They provide humanitarian assistance to those suffering from poverty

United Capital Source

Based in Long Island, NY, United Capital Source has garnered much attention from their recent spate of seven figure financing deals. They are constantly adding new staff to satisfy the incredible demand for funding from mid-sized businesses.

Competing for: Smile Train

Smile Train partners with local surgeons in developing countries to provide free cleft care for poor children and follow-up services 24/7, 365 days a year.

Swift Capital

From the wonderful city of Wilmington, DE, Swift Capital has made a major splash in the alternative business loan space with low cost working capital. They have helped over 10,000 small businesses nationwide.

Competing for: American Heart Association

This association helps to build healthier lives, free of cardiovascular diseases and stroke.

TakeCharge Capital

TakeCharge Capital has offices in Connecticut, Mississippi, and Florida. They built their reputation on spectacular payment processing services and grew into becoming a national financing provider.

Competing for: Distressed Children & Infants International

DCI’s primary objective is to provide children in rural areas the opportunity to receive an education instead of entering into child labor.

Raharney Capital, LLC

Raharney Capital is a Merchant Cash Advance industry consulting firm based in New York City. They are a charity league co-founder and the operators of this very website, Merchant Processing Resource.

Competing for: Network for Teaching Entrepreneurship

This organization’s mission is to provide programs that inspire young people from low-income communities to stay in school, to recognize business opportunities and to plan for successful futures.

The above companies are participants in the Merchant Cash Advance/ Microloan fantasy football league. Other firms within the same industry are constantly making charitable efforts as well, such as Yellowstone Capital. They recently raised money to help Hatzalah Volunteer Ambulance Corp acquire two ambulances. Noticeable company donors included Strategic Funding Source and Benchmark Merchant Solutions.

All of the mentioned firms are strongly recommending others to donate to the charities they are representing. In addition, any company or person that would like to contribute to the competition’s prize donation can do so by contacting sean@raharneycapital.com or heather@merchantcashgroup.com. We are not accepting contributions to individual charities, only to the prize donation that will be given to the winner’s charity. $5,850 has already been pledged to the prize as of the publication of this story.

– Merchant Processing Resource

https://debanked.com

New and improved New York City office location coming soon!

1375 Broadway, 6th Floor, New York, NY 10018

Donate to one of the represented charities today!

8 Advances Are Better Than 1

September 11, 2012Things just got interesting. Your merchant processing $20,000 a month got approved for $26,000 and it was hard fought. Bad credit and some other issues would normally have forced this deal to go the starter route, but not this time. This time you can reflect back on the past few weeks of sweet talking the underwriter and know that it’s starting to pay off. Maybe it was the fact that you obnoxiously concluded every e-mail to him or her with a <3 or 🙂 just to make them feel extra special even if it was in response to a deal of yours they moronically declined.

I understand why you had to decline my client with 720 credit. We’ll get the next one! <3 :-)

And now this time you’re chalking up a tally on the closer board for a deal that shouldn’t have gotten done…that is until your client claims to have received a contract for $50,000 from another source. “There’s no way that can be true,” you tell them while rolling your eyes in frustration. This always happens at the finish line. Someone comes in and shouts out wild figures just to steal their attention away for a minute. But what if there really was a company offering 250% of processing volume to merchants who teeter on the subprime/starter threshold?

Sure there are ACH funders out there who will step in and say “based on their gross sales we might be able to give this merchant 500% of their processing volume!” and the like, but very few people are doing this from a split processing perspective.

We’ve been speaking with Heather Francis at Merchant Cash Group (MCG) and they plan to formally announce the details of their Fast Funding Equity program in the next couple of weeks. Without going into all qualifying parameters merchants must meet to be eligible, we’ve learned that these advances will be disbursed in 8 fixed monthly installments rather than the entire lump sum upfront. And that’s the catch. Under this program the merchant might be contracted for $50,000 but only receive a deposit for $6,000 today. However, there would be no future “renewal agreements” to negotiate or sign. Additional funds would be sprinkled into the merchant’s bank account on a near constant basis of every 6 weeks.

MCG might not win the deal every time with this program but they’re going to give a lot of account reps a run for their money. We all know the pitch of verbally promising additional funds in 3-6 months from the date of the initial advance, which is based mainly on hope that the account will perform and that the funder won’t play games. Put that up against 7 renewals in writing and it’s fair to say we’ve got a good match on our hands. There are some other special incentives for MCG account reps on the Fast Funding Equity program that are being leaked on the DailyFunder Forum.

———————————

G-Day

Today was G-Day in the Merchant Cash Advance arena. GoDaddy.com’s servers were taken down singlehandedly by a jerk (let’s be real here) in the hacker group known as Anonymous. But this time we couldn’t all point and laugh like when it happened to Sony, Yahoo, or LinkedIn. No, this time thousands of MCA agents, underwriters, and staffers wondered why they stopped receiving e-mails after 2pm EST. This time Internet leads stopped coming in, internal databases stopped responding, and websites stopped loading. This time we learned that almost everyone uses GoDaddy for something no matter how much they brag about their systems and technology.

Today was G-Day in the Merchant Cash Advance arena. GoDaddy.com’s servers were taken down singlehandedly by a jerk (let’s be real here) in the hacker group known as Anonymous. But this time we couldn’t all point and laugh like when it happened to Sony, Yahoo, or LinkedIn. No, this time thousands of MCA agents, underwriters, and staffers wondered why they stopped receiving e-mails after 2pm EST. This time Internet leads stopped coming in, internal databases stopped responding, and websites stopped loading. This time we learned that almost everyone uses GoDaddy for something no matter how much they brag about their systems and technology.

We didn’t take a poll of which companies were affected (we couldn’t because our e-mail was down!), but we did participate in the mass hysteria with several other people that were affected. As this very website went down around 2pm today, we lost contact with our database and e-mail servers. One ISO reported that their website, e-mail, and even their VOIP phones were down (You can have GoDaddy phones?). Another reported that their system was so connected to their GoDaddy servers that they couldn’t even print, scan, or fax! If you’re not a fan of Mondays, today was certainly a good day to make up an excuse to leave early. With systems crashing nationwide, chances are your stapler may not have been stapling right and your boss would have had no choice but to send you home.

Strangely, we have run into the hacker group Anonymous before. Back when they hacked Sony in 2011, they sent a 5 page blistering explanation of why they did it to the U.S. Federal Government. They included a link to our site on page 4 to an area that is now deprecated. That area outlined the basics of PCI compliance. For a week, our analytics showed that most of our web traffic originated from the Department of Homeland Security, Department of Justice, and the FBI. Boy, that was fun. Read that report and see our citation below:

———————————

Who To Beat in 2012

“How’s your month going?” we asked. “Pretty slow, but that’s because it’s August,” said a lot of companies we spoke to. August is typically a slow month in the world of MCA. Account reps go on vacation, small business owners hit the beach, and America subconsciously puts everything on the back burner until after Labor Day. That was quite the opposite for 2 New York based MCA firms, United Capital Source and YellowStone Capital, both of whom reportedly broke single month funding records.

According to YellowStone Capital’s posts on LinkedIn, they funded $11,125,000 in August alone. With that, they gave a special thanks to RapidAdvance, GBR Funding, The Business Backer, Max Advance, On Deck Capital, Promac and Snap Advances.

———————————

Add This To Your Data Points!

Companies that actively work to gain Facebook fans and Twitter followers are 20% less likely to be delinquent on their Merchant Cash Advance. Seriously. Kabbage, a company we mention in blurbs every so often operates independently from the rest of the industry by targeting e-bay sellers, independent Amazon stores, and social media retailers. Some people feel that they are not a serious challenger to the status quo and that their tactics, methods, and headlines are merely shock value fodder for the rest of us to laugh at while we all rant and rave about ACH deals being the hottest thing since Square. The founder of twitter (Jack Dorsey) started Square and it has completely disrupted the payments market that quite frankly was used to disruptions until Dorsey turned everything upside down. We believe Kabbage is a company everyone should keep an eye on.

On another note, our favorite part of Kabbage’s recent press release is actually the level of interest banks are expressing in their business model.

While the firm said it is open to establishing alliances with credit unions, banks have expressed more interest in seeing how they can leverage the technology platform to serve its customers.

-Kabbage

Fresh off our rant about John Tozzi’s recent article in BusinessWeek that concluded Wells Fargo was essentially evil for being involved with MCA companies, we’ve become suddenly self-conscious of what journalists might think. Little do they know that America’s big banks have been joined at the hip with the MCA industry for a while now. Banks are still lending to small businesses, we’re just all doing it on their behalves. TRUTH!

– Merchant Processing Resource

https://debanked.com

The Funders of Summer

August 2, 2012What’s new? Who funded? What happened? Merchant Processing Resource will try to give you a glimpse into the Merchant Cash Advance (MCA) universe:

We all know salespeople love to fund, but underwriters?!! This banner hangs on the wall of the underwriting department at mid-sized MCA firm, Rapid Capital Funding:

Holy Moses Batman! $10 Million in a month?! Yellowstone Capital is reporting a new personal monthly funding record of $10,245,000.

There has been an influx of really creative instructional/promotional videos about MCA lately. Cartoons are really “in” right now:

PayPal white labeled a Merchant Cash Advance program in the U.K.

Will the mega banks be next?

It feels like 2006 all over again says First Annapolis Consulting in a recent article:

This seems to be the same bullish sentiment that surrounded the industry in 2006, when there was a constant influx of new MCA providers into the industry and what appeared to be unlimited financial sources. What might be different now is the experience accumulated in the industry during the recession. In the last few years, and as a result of the mounting losses that the industry suffered during the economic crisis, MCA players have implemented more conservative risk management practices and procedures.

Underwriters industrywide are also reporting that stacking, splitting, double funding, and fake statements are on the rise. It certainly brings back some nostalgia for veterans and not the good kind. A screenshot of a current ad on craigslist that is directed at bad apple merchants:

A new chapter opened for Merchant Cash Advance (This is soooo last month but a great read if you missed it).

http://greensheet.com/emagazine.php?issue_number=120602&story_id=3088

Is the loan shortage a banking problem or a merchant problem? Ami Kassar makes the case in his New York Times column.

“Where are the leads? I need the leads. Can you tell me where the leads are?” We literally get asked daily where to get leads from. We recommend:

http://SmallBusinessLoanRates.com

http://meridianleads.com

By the way… for every company that says cold calling doesn’t work, there’s a company getting rich doing just that. Same goes for SEO, mailers, e-mail blasts, PPC, and so. Marketing is an art form. Just because it doesn’t work for you, doesn’t mean it doesn’t work period. Keep doing what you’re doing. Too many ISOs/agents/marketing directors abandon campaigns after 30-60 days. Practice makes perfect!

Have you abandoned social media? We ask this question: What looks worse to a prospect?

Not having a business twitter account or having one but failing to tweet at all in the last 8 months?

Not having a business blog or having one but failing to add any new blog posts in over a year?

We didn’t spend much time researching hard data but we would surmise that freshness is a psychological component to a prospect’s shopping experience. If a business blogged regularly on their site up until May, 2011 and then stopped, might a merchant think the entire business itself is abandoned or gone? Is a facebook fan page with 1 post from 8 months ago a positive or negative selling point? WE SAY: If you build it, maintain it. Nothing brings down your presence on the Internet like abandonment. We understand that smaller companies might not have the manpower, time, or creative energy to write informative articles or engage people through social networking, especially when it’s hard to measure the results and value it creates. Consider the value you might actually be losing by projecting to the world that you have given up. It’s like operating a store with a sign out front that says “THIS BUILDING HAS BEEN CONDEMNED” even though you are actually open for business. If WE stopped posting articles for a year, would you still come back several times a month?

Here are two examples of MCA firms that keep it FRESH!:

http://unitedcapitalsource.com/blog/

http://takechargecapital.com/category/blog/

Don’t you just love MCA? We do! Visit our site again soon.

– Merchant Processing Resource

https://debanked.com

The Other 93%

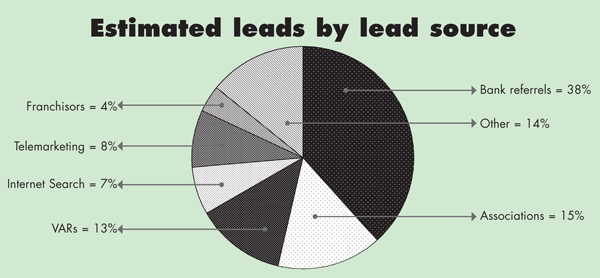

July 13, 2012The SEO war rages on for Merchant Cash Advance providers, ISOs, micro lenders, and other financing firms, but just how much real estate is everyone really fighting over? According to data recently provided in The Green Sheet by First Annapolis Consulting, only 7% of all merchant account leads are generated via the Internet. So if your business plan’s success hinges on getting to page 1 of Google search, you might be shutting yourself out from nearly the entire marketplace. Don’t get us wrong, there’s a lot of money to be made and business to be acquired via the Internet, but even the big firms get roughed up from time to time by competition, new algorithms, and SEO companies that promise the world but deliver few results.

So if not the Internet, then what else is there besides cold calling? That’s a question that tons of small ISOs ask themselves when they realize that competing online isn’t easy. It just so happens that the “what else” comprises of 85% of all generated leads in the payments industry. More than 50% are derived from bank referrals and associations alone.

Has anyone ever wondered why companies like AdvanceMe (Capital Access Network) are still number one in the Merchant Cash Advance arena? They’ve managed to defy Darwin’s theory of evolution. In every industry, there is a pioneer that leads the way, gets too comfortable, stops innovating, and is systematically made irrelevant by fresh thinking competition. There was MySpace until there was Facebook. There was Yahoo until there was Google. There was AOL until…there was just everything else.

So one would expect that in 2012, the mere mention of AdvanceMe would be part of a requiem for the founding fathers of the Merchant Cash Advance industry. That isn’t the case and is quite the opposite considering they are on pace to fund at least $700 million this year. So they must be #1 on Google, right? Nope. For all of the main keywords that people are fighting over, they rarely if ever, even show up on the first page of the results.

Chances are a lot of their clients never even bothered to search online for financing, or if they did, it was just to get a second opinion. Once they saw that full page advertisement in the merchant account statement their processor mails them every month, they probably just called the phone number listed on there, went through the steps, and got funded. AdvanceMe and other players have some pretty badass referral connections.

Chances are a lot of their clients never even bothered to search online for financing, or if they did, it was just to get a second opinion. Once they saw that full page advertisement in the merchant account statement their processor mails them every month, they probably just called the phone number listed on there, went through the steps, and got funded. AdvanceMe and other players have some pretty badass referral connections.

All the sales pitches in the world about lower rates and free POS systems aren’t going to compete with a merchant who has just been given a referral by a company they already have a relationship with. Hell, even you have probably enlisted an insurance company, wedding vendor, or mortgage broker because someone you trusted said they were great.

This isn’t another lecture about how referrals are crazy good and that cold calling is wicked bad, especially since we don’t even necessarily feel that way. The point is really to highlight just how much more potential there is out there for small funders and ISOs. You can actually be successful with a sucky website and no SEO if you can just solidify some key relationships.

If you want to be around 14 years later, you can’t ignore the other 93% of the market. The volume of Internet leads will probably increase in the future as more computer savvy people become small business owners. But it’s way too easy to set up a website, hire an SEO guy, and throw money at Pay-Per-Click. Anyone can do it and everyone is doing it. That means most companies are losing the battle and tons of you are saying “what else is there?” Fortunately, the lead generation pie chart offers unlimited hope. You just need to think bigger and try harder.

If the other categories seem too ambitious, well then you’ll never make it in this biz kid…

The American Obsession With Startups

June 20, 2012Hi, I was just driving down 3rd Street and I saw an old building that had a For Sale sign on it. So I was just thinking it would be a great place to open a restaurant. It would have a really big outdoor eating area and I’ve always dreamed of owning my own restaurant. Lord knows I love food. I can’t talk long but I Googled loans on the Internet and you guys came up so I wanted to know if I could get a $4 million loan or line of credit to buy the building, fix it up, and make it into a Mexican restaurant, or maybe even Italian! Is that something you could do? I would need the money by friday…

This is the real transcript of a call to a Merchant Cash Advance brokerage. Don’t let anyone tell you that the U.S. is not a capitalistic society. Opportunity and entrepreneurship is so ingrained into the very fabric of our being that even self-proclaimed communists and socialists cast away their utopian worker ideals for the chance and self-satisfaction of turning something small into something big. We’re also an impulsive society, a trait partially due to our obsession with immediate self-gratification, but more to do with the fact that opportunities come and go in the blink of an eye. It is for these reasons that an individual who was taught to do market research, create a business plan, and mull things over is instead flying down the road with one hand on the wheel while the other hand is furiously applying for a $4 million loan to finance an opportunity he thought up 7 seconds ago.

How many other people driving down this road thought the same thing? How many of them have access to that kind of capital? Some might and so for the ones that don’t, the fear that someone is going to beat them to it turns them into unrealistic cash demanding lunatics. It’s true. The full service Merchant Cash Advance shops should probably offer John (the name we’re going to assign to the guy driving down the road) a proposal to help him create a business plan, form an LLC, and obtain the necessary licenses. These services would come with a price, a price that many people like John misinterpret as obstacles to be handled once he’s received the $4 Million. As John continues driving down the road, the dream of starting a restaurant is repeatedly crushed as he makes phone call after phone call to business lenders he found on the Internet. “There’s just no help for startups,” he concludes, and decides to hold off until the economy gets better before giving it another shot.

For 37 minutes that day, John was one of the many millions of startup businesses searching for capital. For the Merchant Cash Advance brokerage, he may have been one of the few hundred phone calls an account rep was bogged down with, while trying to help businesses that have been open for at least 1 year. The account reps have probably heard it all. “I want to start a home-based gas station“, “I need twenty million dollars for a good idea that I can’t tell you what it is because I don’t want anyone to steal the idea“, “I just got an LLC and I need $100,000 to come up with some business ideas“, “I’m gonna start an online shoe store and I need money to buy my first computer so I can get on the Internet.” We’re not poking fun at entrepreneurs since there are plenty of those who are really serious. But for the millions that call first and think second, they’re creating a disease unique to the U.S. It’s called startup fatigue. Business lenders are losing so much money by just talking to non-business owners, that they’ve taken to putting up big signs to ward them off.

The Internet is a great example because the cost of one click to the lender’s website can reach as high as $20. So how then does one tactfully express that their financing programs are for existing businesses only? It’s an art form that many have difficulty mastering. Advertisements, which are usually created to rope people in are instead being crafted to keep people out. “Hey Startups, GET OUT AND STAY OUT!” is the marketing campaign some lenders might be considering rolling out next quarter.

We expect that at this point in our post, startup specialists have already stopped reading and have instead taken to writing us long e-mails explaining how ignorant we are.

“DEAR MPR,

You are dumb. There are tons of startup lenders out there just begging for business.”

We’ll welcome any e-mails like this. Maybe these companies will stop hiding in the shadows and we can finally start helping people.

Raharney Capital, the organization that owns Merchant Processing Resource has a division that connects existing small businesses with financing companies. Coincidentally, they encounter a lot of pre-operational startups and continuously face the dilemma of how to service them.

Their first attempt to refer them out was with Go Big Network, a gargantuan networking service specifically for startups to obtain capital. Their homepage touts:

We help entrepreneurs find funding.

Over 300,000 Startups Have Used Go BIG to Connection with Millions of Dollars in Funding. Join today to connect with our network of over 20,000 investors.

They’ve been around for years and their advertisements can be seen all over the web. Inquiries about referring startups to them for a fee went nowhere as Go Big Network made abundantly clear that they did not want affiliates. Further attempts to refer them the business (even free of charge) went unanswered. It seems that even the startup masters don’t want to deal with more startups.

So we took to LinkedIn discussion groups and replied to the many individuals claiming to be angel investors or startup lenders. All of them backtracked on their original statements, with most eventually revealing that they were really looking for businesses that have been operating two years with positive cash flow. Are they liars? Not really. A young business is technically still a startup. What we did find though is that some Merchant Cash Advance providers are funding businesses that have been open for as little as three months. Not bad! (Check out: Capital Stack, Yellowstone Capital, United Capital Source, and Merchant Cash and Capital)

We thought we struck gold when we joined Startup Specialists, expecting to find lenders swarming the discussions with startup lending spam. Instead, we found no mention of financing at all. Interestingly though, this group was abuzz with activity. Thought you were cool because your post got 1 thumbs up? Thought that nothing was happening on LinkedIn? Some posts in this group are receiving hundreds or THOUSANDS of engaging, thoughtful responses! Sadly, no one seems to know where the money is, but that doesn’t seem to matter to them.

While writing this, our own inbox has grown considerably bigger and our voicemail box more full. Many are reaching out to us with questions about startup financing. The fatigue is slowly starting to set in.

One is a voicemail from Google, asking us to reactivate our Adwords campaign, something this site experimented with in the past with $100 in free ad credits. In their message, the account rep mentions that they have reviewed our site and can help startup lenders like ourselves create successful ads(what gave them this impression?). In startup-obsessed America, a stable, sustainable, and somewhat aged business is a mythical beast. Even Google has somehow mistaken our small business information site to be startup information. Too many people assume that small business means the act of trying to start a business. “Do You Have An Existing Business?” a bank advertisement might ask. Tons of people who don’t will still answer ‘yes‘ simply because the idea exists in their mind. It’s a beautiful thing in America to think that way, but getting off the ground and generating revenue shouldn’t be like winning the lottery, a game that you’ll never win but is fun to dream about.

We have interviewed writers for our site, some for volunteer positions, others to be paid. While instructing them to use small business as the subject matter, almost all of them revert to writing about starting a business. Marketing companies have also made the same mistake by pitching us their proposal to make cool videos for the site and then go on to create a demo video that talks about starting a business. One company actually asked us to provide a script and still they CHANGED IT to talk about how Merchant Processing Resource is a premier helper of startups. WHAT?!!!

By now, we’re running a high fever and the doctors suspect we have startup fatigue. Eleven more people have left voicemails, to request $300, $10,000, or $100,000,000 because they have this really sweet idea to make a restaurant named Chesster’s, (Chester’s with a double ‘s’) because each dining table will have a chessboard on it with chess pieces. Boo ya!! They haven’t worked out all the details yet but they thought the name was brilliant and oh yea… they need the money by tomorrow.

We’ll refer them to SCORE, a nonprofit association dedicated to helping small businesses get off the ground, grow and achieve their goals through education and mentorship. They may not get financing, but they will get HELP. And that’s really what Americans need. There isn’t a lending problem, there’s a helping problem.

Entrepreneurs like Mark Zuckerberg made it tougher for all of us. His progression went from random idea to scooping up cash from a classmate, to billionaire CEO of a publicly traded empire. He didn’t sit down with a SCORE mentor, do market research, and consult with a lawyer about how best to structure an organization. These are things he would have considered as obstacles to achieving his dream before someone else beat him to it. “I need the money by friday because this is going to be big,” Zuckerberg might have told a Merchant Cash Advance account rep who had heard the same story 97 times that morning alone.

Zuckerberg’s whirlwind success story portrays him as a role model genius, a boy who acted and capitalized on the split second window of opportunity while all the pieces fell into place after the fact. The rest of America so badly wants to replicate that. Too many people envision themselves in an interview with a New York Times reporter two years from now to talk about how they were driving down 3rd Street and the idea of starting a home-based gas station just popped into their heads, prompting them to Google business loans, and the rest of their billion dollar story is history. Similarly, when that doesn’t happen, just as many people chalk up their failure to a bad economy, Obama’s unwillingness to help, or the big bad banks indifference to the little guy.

It’s okay to go slow and get your ducks in a row. Hell, doing it this way is probably more honorable than what Zuckerberg did. You don’t need the funds by tomorrow, friday, or even next week. What you need is proof that you can provide a product or service for a profit and then to carefully plan and structure an organization that will last. Raising money should be a contingency for expanding sales, not for registering your LLC or to solidify an idea.

There’s a reason that the topic of small business is inundated with information on how to start one. So many fail to get off the ground. There are conflicting and sensational statistics that claim that 9 out of every 10 startups fail. In startup-obsessed America, it’s probably more than that. We would argue that John’s wild foray into entrepreneurship started when he spotted available space for a restaurant and failed when his first instinct was to search for lenders. In the meantime, a few financial firms got caught in the cross fire and spent money to answer his phone calls. Both sides were left frustrated since neither got what they wanted.

In today’s world there is a growing anti-startup movement. Americans want jobs to feed their families and lenders prefer to invest only in existing businesses. The problem is that without startups, fewer businesses will become established (bad for lenders) and fewer jobs will be created (bad for Americans). Our only hope then to turn the tide is to embrace the startups, not shun them. The message shouldn’t be: Get lost you potential job creating jerks! Every lender (and Merchant Cash Advance provider) should have a model to assist startups in some way. It’s okay to charge for this service and profit from it by the way. Any potential business owner who enters the startup arena expecting not to pay anything out of pocket is dreaming.

If America associates small business with starting a business, can a lender really parade themselves as a small business champion if their public message is to send startups packing? We don’t think they can. Similarly, individuals need to do their part and calm their impulses. Drawing up a plan, forming an LLC, and obtaining the necessary licenses aren’t annoying obstacles to take care of after the fact. You can’t really expect to raise capital on a wild whim while you’re flying down the street talking about a random building you saw on the side of the road. Imagine how crazy that sounds to a lender?

Patience and hard work, we say. That goes for the entrepreneurs and lenders alike. Let’s help each other, not hate each other. It won’t be easy, but then again success isn’t supposed to be like winning the lottery, a game that you’ll never win but is fun to dream about.

Why LinkedIn is King

June 9, 2012This may be risky…but we’re doubling down on LinkedIn. The Los Angeles Times will disagree with us, since they recently embraced the radical view that LinkedIn is a big joke. Sure, LinkedIn recently got hacked and that’s a major security issue they’ll need to deal with, but for the haters that brag they haven’t logged into their accounts in years, they probably missed the point of this social media site. LinkedIn isn’t Facebook. They aren’t even competitors. If you want to share your funny photos and write witty updates about how you hate work, please by all means spare the rest of the business world from it. We’ve got some tips for those haters:

- If you view your job as a 9-5 that’s a burden to living your life, LinkedIn is not for you.

- If you’re employed in an entry level position and don’t care about climbing the corporate ladder, LinkedIn is not for you.

- If your goal is to make sure that you never get any kind of individual recognition in your field, LinkedIn is not for you.

- If you want to avoid talking about your line of work with other like-minded people in a way that can help you grow, LinkedIn is not for you.

- If you’re a business owner that has no desire to speak to other business owners, LinkedIn is not for you.

- If you LOL at the thought of networking, in person or online, LinkedIn is not for you.

- If you want to spam the Internet and submit updates that no one will ever read, go sign up for Google Plus.

LinkedIn isn’t a resumé site or a social network. It’s a cooperative movement to make the private sector vastly more efficient. We’ve heard grumblings from Merchant Cash Advance industry insiders that some of the most popular vBulletin-style forums are pretty much losing their value. The discussion is sporadic, many people hide behind a screen name, and there isn’t any way to validate the information being shared. At best, it’s an anonymous way to spread propaganda. Traditional web forums rely on users to visit the site and once there, go on a scavenger hunt to find new posts and discussions. If there are no new posts, then the time spent going to the forum is nothing more than a waste.

LinkedIn has groups, which are monitored and policed by the group owner much like a forum would be. The stakes are upped because everyone participating can view each other’s business credentials through their profiles. In a traditional web forum, you get situations like this all the time:

The individual offering to sell leads looks highly suspect. If only there were a way to find out who they really were, where they were located, how long they’ve been in the lead business for, what company they work for, who else they know in the industry, who has publicly recommended them, etc. Even if they had included a real company e-mail address and website in their post, there would still be much more information left to be desired. We believe it’s a lot harder to accomplish anything with anyone you don’t know via the inherent anonymity of traditional web forums. Sure, anyone can fake their credentials on LinkedIn but if you see they’re connected with a former colleague of yours, you can call that old colleague right up and get the scoop. The transparency leads to transactions that get closed faster and both parties can feel more confident in their decisions to do business with a stranger.

Is LinkedIn perfect? No, it’s not. But the results are incredible if you know how to use the site correctly. We’ll put it this way, in the month of May, LinkedIn brought 21% more visitors to our site than what came organically from the Bing search engine. If you LOL at that because Bing is notoriously smaller than Google, just think about how much money you or other people you know are spending on SEO experts to get traffic from search engines. So LOL it up because LinkedIn is free.

Those statistics also don’t count the relationships we’ve built purely through the site itself. You see, it’s not always about making a sale and the numbers of connections you have isn’t what we mean by relationships. You’re a lot better off reading the updates of a C-level executive on the ins and outs of Crowd Funding in a LinkedIn group than you would be from reading a sensationalist, empty opinion about it by the LA Times. Comment intelligently to that exec’s posts and you could find them wanting to connect with you to discuss further and possibly do some kind of business together.

Here are some of the industry groups we recommend you check out:

We cordially invite the haters described in the bullet point list above NOT to join. Not that we should really worry they will. If you actually visit the twitter accounts that the LA Times cites as proof of LinkedIn’s unpopularity, you’ll find that these people spend their time online talking about Kim Kardashian, Lindsay Lohan, and other useless crap. They read like play-by-play diaries of a junior high school girl. Hate away losers, they made twitter just for people like you.

Job Losses Possible Threat to MCA Industry / Google Penguin Kills Survivors / No Debit Card Savings

May 6, 2012How sure is this recovery?

A few months ago, all signs pointed to a roaring recovery. As the data comes in each month, it’s looking less and less like a definitive thing. Sure the unemployment rate is going down, but mainly because hundreds of thousands of people are giving up on searching for jobs. The Wall Street Journal recently analyzed a less popular statistic, the civilian labor participation rate. At present, the percentage of Americans working is at its lowest point since 1981.

At the same time, the nation’s largest banks are cutting back on loans to businesses yet again. It makes one wonder if the explosive growth being experienced in the Merchant Cash Advance industry will start to fizzle out in the 2nd half of this year.

Google Penguin wipes out the survivors

If you used blog networks like BuildMyRank to game Google into ranking your site higher, you probably noticed your website got whacked in late March. After years of spending precious money on marketing, 2012 brought upon the realization that leads generated from organic searches are not only possible, but free. This is of course before you factor in the thousands and tens of thousands that MCA funders and ISOs are spending a month on SEO. But since many SEO tactics are doomed to fail and because Google’s algorithm can change at any time, investing in organic rankings is incredibly risky.

If you used blog networks like BuildMyRank to game Google into ranking your site higher, you probably noticed your website got whacked in late March. After years of spending precious money on marketing, 2012 brought upon the realization that leads generated from organic searches are not only possible, but free. This is of course before you factor in the thousands and tens of thousands that MCA funders and ISOs are spending a month on SEO. But since many SEO tactics are doomed to fail and because Google’s algorithm can change at any time, investing in organic rankings is incredibly risky.

For example, one mid-sized MCA provider secretly shared that they had spent two years and nearly a hundred thousand dollars to get the rankings for the keywords they wanted on Google. Leads were just finally starting to come in on a daily basis when out of nowhere, they got thrown back to page 25. Blog networks were a big part of their strategy and when Google cracked down on them, the MCA provider’s presence on the Internet went down with the ship.

Some MCA companies survived the blog network armageddon only to become extinct on April 24th when Google made a key algorithm change to help defeat web spam. This major update has become notoriously known as Penguin. If you were a victim, you may need an SEO crisis management plan.

In any case, the changes at Google immediately affected unemployment in India, the country that most U.S. companies turn to for SEO services. As their clients sites disappeared from search results, so too did their contracts. At least that is the gag story surrounding a photoshopped image that has been going viral around the Internet.

Read our previous coverage on Merchant Cash Advance and SEO:

The SEO War for Merchant Cash Advance

The SEO War Continues

Debit card savings not being passed along

Remember when all those small business owners got their swipe rates reduced? Oh wait, that didn’t happen. The Durbin Amendment limited the interchange rates, which are the fees that acquiring banks pay to card issuing banks. The rates and fees charged to the small business are still left to the discretion of Merchant Service providers. Sure they can lower the cost if they so choose, but there’s no law that dictates they have to. It seems the Durbin Amendment victory was all one big misunderstanding for America’s retailers. We’ve been following this law since December, 2010. ISO&Agent Magazine just published an article titled, Unintended Results Plague Durbin Amendment. Are they seriously just figuring this out now?

Published by: Merchant Processing Resource

https://debanked.com