Industry News

Ascentium Capital Reports $2.5 Billion in Managed Assets

July 23, 2020Ascentium Capital announced it has reached $2.5 billion in managed assets, a new record for the Kingswood, Texas-based alternative funder. The news comes after the firm finished Q2 of 2020 with a funding volume of $225 million. Being a subsidy of Regions Bank, Ascentium has been funding businesses since 2011.

“Ascentium’s executive team has successfully weathered several periods of economic uncertainty and we are leveraging this to respond to the current situation as the US faces unexpected uncertainty for an unexpected duration,” Executive Vice President Tom Depping noted in a statement. “Our specialized finance platform incorporates process flexibility which enables us to adjust quickly. We have a strong team in place that is dedicated to meet market demands while managing risk.”

Kabbage Launches Checking Accounts for SMBs

July 22, 2020 Today Kabbage announced the launch of its latest service, business checking accounts. Targeting small-sized businesses and offering no monthly fees, 1.10% APY, and a Kabbage debit card; Kabbage Checking is available now and is part of an effort by Kabbage to transition from being a pure SMB-funding company into a cash-flow management company.

Today Kabbage announced the launch of its latest service, business checking accounts. Targeting small-sized businesses and offering no monthly fees, 1.10% APY, and a Kabbage debit card; Kabbage Checking is available now and is part of an effort by Kabbage to transition from being a pure SMB-funding company into a cash-flow management company.

“Kabbage is a full financial services platform that’s focused on solving on cash-flow management for small businesses.” President Kathryn Petralia explained in an email. “A business checking account is a core function of how they manage their money, and we saw an opportunity to build them a solution specifically designed for them – while simultaneously reducing their costs and increasing their yield.”

Launched in the wake of a study which reports that over 40% of small businesses are looking to change their bank following struggles with their Paycheck Protection Program applications, Kabbage is optimistic that fintechs an online lenders will benefit from a wave of interest following the failures of financial institutions in the face of the coronavirus.

“Amidst one of the largest financial crises in history, we helped over 225,000 small businesses access services many of their long-time bank partners would only provide to their largest customers,” the President said in a statement. “We believe in the businesses too often left out, overlooked, and underestimated. Kabbage Checking is a new banking service built to give those small businesses an upper hand to earn more, save more, and grow their business faster without sacrificing anything they expect from a bank.”

New York State Legislators Resume Push of Commercial Finance Disclosure Bill

July 17, 2020 A bill (A10118A / S5470B) intended to create uniform disclosures for comparison purposes while also placing control of the commercial finance industry under the purview of the superintendent of the New York Department of Financial Services, is moving forward.

A bill (A10118A / S5470B) intended to create uniform disclosures for comparison purposes while also placing control of the commercial finance industry under the purview of the superintendent of the New York Department of Financial Services, is moving forward.

The March 2020 initiative was picked back up this week by members of the Assembly where it passed the banking committee and codes committee on a unanimous and bipartisan basis.

“When enacted, this bill will become the strongest commercial lending disclosure law in the country that covers all commercial financing products,” wrote Ryan Metcalf, Head of US Regulatory Affairs and Social Impact at Funding Circle, on LinkedIn. “It includes strong provisions that ensures enforcement and eliminates loopholes that will prevent gaming & abuse, & requires APR to be disclosed for all products.”

Metcalf further wrote that they and the Responsible Business Lending Coalition (RBLC) have been working diligently with NY state legislators for the last year or so to craft this bill. Among RBLC’s membership is Fundera, Nav, Lendistry, LendingClub and about 4 dozen other companies.

7/17 Update: OnDeck Still Negotiating Workouts With Creditors

July 17, 2020This morning, OnDeck disclosed that it was still actively engaged in securing workout arrangements with its creditors.

For its corporate debt facility, OnDeck’s lenders consented to an additional two week extension on the increased monthly principal repayments that OnDeck is required to pay as a result of the company’s covid-impacted portfolio triggering a rapid payout event. The circumstances mean that OnDeck has to make millions of dollars in loan payments but temporary workouts like these are enabling the company to slow them down.

OnDeck’s asset-backed revolving debt facility, meanwhile, has been spared the consequences of a borrowing base deficiency under a renewed agreement to suspend any designation of such to at least through August 18th.

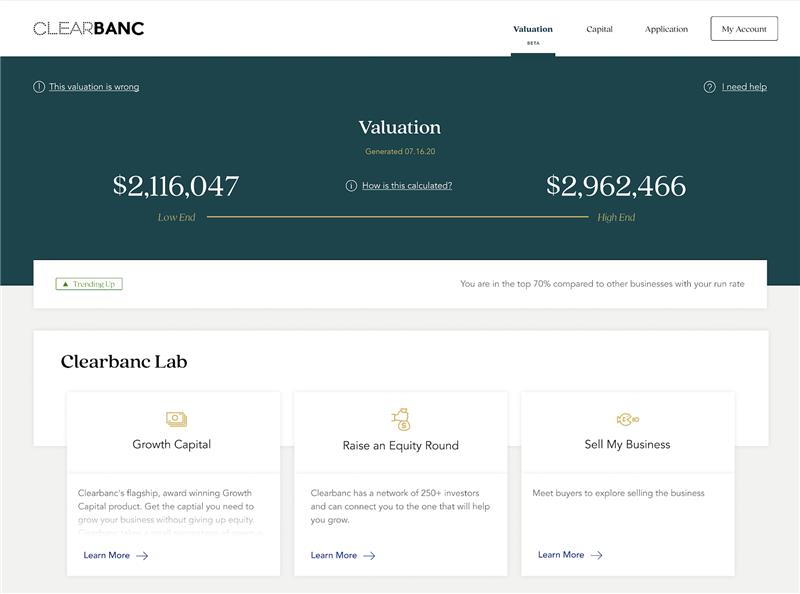

Clearbanc Launches Valuation Service for Founders

July 16, 2020

Today Clearbanc, the Toronto-based alternative finance company, has launched its latest service, Valuation, allowing founders to gauge their company’s value. Being an extension to Clearbanc’s platform, the service will be free to everyone and promises an estimation within 24 hours that can be checked weekly.

Valuation also offers three options to founders upon receiving their company’s value: the chance to access capital via Clearbanc’s funding channels, connect with investors in order to raise an equity round, and investigate possible acquisition opportunities. For the last two of these options, Clearbanc makes introductions to a selection of venture capital investors that have connected with the program.

As per the requirements, founders will have to connect a selection of private data points. Their business accounts, payment processor, accounting platform, and their admin account will all be required. As well as this, public data is also used to arrive at a valuation, basing the estimations on information specific to the company as well as the industry it is in.

“We think this could be as revolutionary as what Credit Karma did when they launched free credit scores for everyone and gave consumers access to their own information,” explained Clearbanc CEO Michele Romanow. “We’re really excited about this as it represents our first non-capital launch, and we think that it’s part of a much bigger vision of how we help founders win in this environment.”

Maxim Commercial Capital Funds Deals in 30 States During 2Q 2020

July 16, 2020Maxim Commercial Capital is pleased to report it funded hard asset-secured financings for small and mid-sized businesses (SMBs) in 30 states across the United States during the second quarter of 2020. After pivoting quickly in March to safer-at-home working conditions for its 30+ team members, Maxim experienced a steady increase in applications from equipment brokers and vendors for their borrowers with challenged credit. Maxim lends $10,000 to $3,000,000 to SMBs nationwide secured by heavy equipment and real estate to facilitate asset purchases, working capital and to refinance expensive short term debt.

“Maxim was founded during the Great Recession of 2008,” noted Behzad Kianmahd, Chairman and CEO. “We are applying our experiences gained during that time to overcome today’s extraordinary economic challenges and long term uncertainty caused by the COVID-19 pandemic. We have reaffirmed our commitment to finance SMBs, which are the backbone of our economy, refreshed our underwriting standards, and are continually improving our infrastructure by investing in technology and communication tools for the benefit of our customers, vendors, brokers and team members.”

During the second quarter, Maxim received numerous applications from business owners with strong credit but negative cash flow due to the economic downturn. Funded transactions for such borrowers included $95,000 secured by a 2019 Mack GR64F Tri-Axle Dump Truck for a growing landscaping company in New Jersey; $42,500 for a seasoned contractor’s purchase of a 2014 Caterpillar 312E Hydraulic Excavator; and, $29,000 to enable a business started up by seasoned contractors to purchase a 2020 Reinert ZR Concrete Pump.

Buyers of used class 8 trucks faced numerous challenges during the second quarter, ranging from lenders shutting down without warning to closed DMVs. Maxim successfully funded deals across the country, including $26,500 for a California-based long-haul truck owner-operator to purchase a 2017 Volvo 780; $20,800 for an Ohio-based transportation company to purchase a 2017 Freightliner Cascadia; and, $23,000 for a Texas-based owner-operator to purchase a 2016 Freightliner Cascadia to replace a truck with mechanical issues.

“We are humbled and encouraged by our team’s commitment to positively impact our customers’ future success, and by our customers’ continuous effort to make tough but rational decisions to stay in business during these difficult times,” commented Michael Kianmahd, Executive Vice President. “Based on our experience over the past few months, we are confident that SMBs across the nation will contribute substantially to the nation’s recovery from the biggest economic shock since The Great Depression.”

About Maxim Commercial Capital

Maxim Commercial Capital helps small and mid-sized business owners seize opportunity by providing financing in amounts up to $3,000,000 secured by heavy equipment and real estate. Maxim facilitates equipment purchases, provides working capital and refinances debt for companies across all industries located nationwide. Through Maxim’s tailored financing programs, businesses unlock capital tied up in underleveraged assets, often replacing expensive short-term debt and daily repayment working capital loans with longer term capital. As a leading provider of transportation equipment finance, Maxim funds up to 75% of the acquisition cost of class 8 and class 6 trucks, trailers and reefers for owner-operators and small businesses. Learn more at www.maximcc.com or by calling 877.776.2946.

Layoffs At Ondeck

July 10, 2020 OnDeck issued a round of layoffs this week, new former employees report.

OnDeck issued a round of layoffs this week, new former employees report.

One said that the company had “made changes needed to navigate these unprecedented times.” The layoffs were announced on Wednesday and appear to span both the company’s New York and Denver offices.

Ironically, when deBanked sent an email to OnDeck’s head of corporate communications to obtain a comment on the news, the message was returned with an auto response that said that he too was no longer with the company.

Breakout Capital Weathered The Storm And Came Out With Expanded Access to Credit

July 8, 2020 Breakout Capital never stopped funding. That’s what CEO & President McLean Wilson recently shared with deBanked. The company not only weathered the storm but has come out with expanded access to credit totalling $20MM with Medalist Partners, one a current term loan facility and the other a new term loan facility with “attractive” forward flow features.

Breakout Capital never stopped funding. That’s what CEO & President McLean Wilson recently shared with deBanked. The company not only weathered the storm but has come out with expanded access to credit totalling $20MM with Medalist Partners, one a current term loan facility and the other a new term loan facility with “attractive” forward flow features.

The company said in its announcement that these facilities will allow Breakout to increase loan originations across all of its product offerings, including its term-loan product, FactorAdvantage®, and its newest factor product, FactorBridge.

“Small businesses are at the core of our economy and they were, as we were, largely blindsided by recent economic interruptions,” Wilson told deBanked. “We adapted quickly and rolled with the punches and never stopped funding. It is a testament to the resiliency, loyalty and borrower first mentality that Breakout Capital has not only weathered the storm, but has strengthened our company throughout the past few months. We quickly adapted to a new way of thinking, which helped us serve our clients in real time and forge ever closer relationships with our factor partners, lenders, online marketplaces, ISOs and borrowers.”

John Slonieski, Director of Private Credit for Medalist Partners, said in the announcement that “We are pleased to enhance our relationship with Breakout Capital in our asset-based lending strategy. Their high-quality underwriting and SMB-friendly lending solutions, coupled with their talented credit and management team, provide us confidence as we continue working closely with them to successfully scale their lending program.”