Equipment Leasing

What’s Your Equipment Worth? They’ll Tell You

April 14, 2023 Sandhills Global, a publishing and technology conglomerate, has served as a central marketplace for selling heavy equipment since 1978. Often considered the auto trader of the industry, it primarily focuses on the sale of used machinery in the transportation, construction, and agriculture sectors.

Sandhills Global, a publishing and technology conglomerate, has served as a central marketplace for selling heavy equipment since 1978. Often considered the auto trader of the industry, it primarily focuses on the sale of used machinery in the transportation, construction, and agriculture sectors.

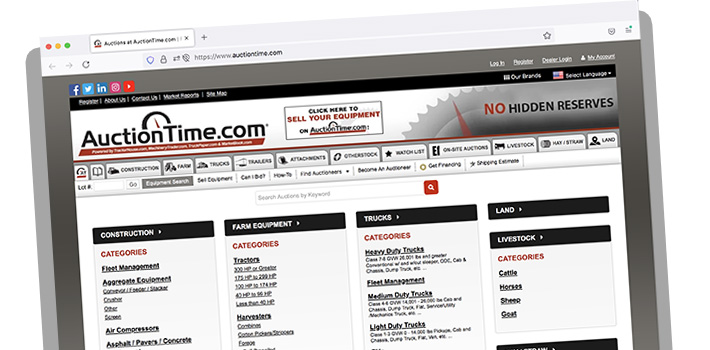

“Nearly every dealer in the country, be it a Caterpillar, Volvo, Peterbilt, or John Deere dealer, works with us because we’re the hub where they go to move their US machinery,” said Mitch Helman, Sales Manager at AuctionTime.

AuctionTime is one of many used-equipment marketplaces owned by Sandhills Global. Other popular Sandhills brands like AuctionTime include Machinery Trader, Tractor House, and Truck Paper.

“Virtually every wholesale buyer and dealer is our customer, allowing us to showcase their equipment to a wide range of potential buyers, including the average Joe or end user, who are typically found on Machinery Trader and Truck Paper. These buyers are the ones we want to reach, as they’ll often pay the most for the equipment,” explained Helman.

Sandhills strives to educate sellers on setting realistic prices for their equipment, helping them understand the retail value versus the auction value. Their value insight portal tool provides information on the specifics of the equipment, depending on its features and location, as location can greatly influence its worth.

“First and foremost, customers come to us to determine the market value and worth of their equipment. If they have a returned asset, we’re then able to connect them with different buyer bases, depending on the asset, to help them get the most money back in their pocket,” said Helman.

And those customers, it turns out, very often are drawn from Sandhills’ print publications.

“…It’s interesting because you hear print media is dead, there’s no need for print, all these newspapers are going away, but in our industry print has turned into like a physical search engine and it ultimately drives more traffic to the internet for people to look at more pictures, videos, specs and stuff like that,” said Helman. “And so, it’s still very relevant and vibrant in our spaces as of today.”

These publications can often be found at truck stops, tractor houses, and local convenience stores. Once a reader goes to a site like AuctionTime, the craigslist-style homepage (a tab says a new look is coming soon) will guide users to various live auctions or fixed-priced listings with photographs. A 2013 Hamm 3307 smooth drum roller located in Olney, Illinois, for example, is currently up for sale for $56,900. The listing has it all, including an integration to get shipping quotes and a button to apply for financing.

Ultimately, Helman explained that in a way the market depends on them to compile all this information to establish which way the market is going and what’s happening. “They love it,” he said. “Absolutely love it.”

Shaping Industry Experts With the CLFP

April 10, 2023 The CLFP (Certified Lease & Finance Professional) is a certification program for professionals in the equipment finance and leasing industry. The end-to-end course covers sales and marketing, credit, documentation, funding, and various accounting intricacies specific to the leasing and finance arena.

The CLFP (Certified Lease & Finance Professional) is a certification program for professionals in the equipment finance and leasing industry. The end-to-end course covers sales and marketing, credit, documentation, funding, and various accounting intricacies specific to the leasing and finance arena.

“It is a designation now that a lot of employers look fondly upon when they are trying to hire for positions because it indicates that the person who has the designation has basically gone through a very extensive process to learn everything about the industry as a whole…,” said Lia Wax, President of CLFP.

Within the last few years, COVID forced the academy to go virtual but has recently gone back to offering in-person classes in regions that span from the west coast to Philadelphia to Chicago and more. They have also launched an online self-paced option where a candidate can choose to do it at their leisure through a prerecorded self-paced product.

“Usually, the academies are hosted by somebody within the industry and then the company that’s hosting the ALFP (Academy for Lease & Finance Professionals) can decide whether or not they want it to be a private one for just their own employees or if they’re going to host the public one.”

The academy offers two options; a two-day option, which is two full eight-hour days of instruction and then we have a three-day option, which is four to four-and-a-half hours a day for three days. Between them both, they already have 12 courses scheduled up to June.

Once the course is completed, the academy maintains ongoing contact with students throughout the year, including an annual CLFP day.

People can also get together in various regions to network at different conferences. For example, the third day on NEFA’s agenda was closed by a CLFP toast to give those individuals the opportunity to discuss their journey in the industry with other members.

“I think the driving force here is to make sure that people in our industry are as educated and as informed as they possibly can be about the industry that we’re working in,” said Wax. “It’s great for somebody in sales or credit or accounting to know their facet of what they do, but I think the value-add for the foundation is we are able to provide education to applicants about all the different pieces that go into making up the industry and how it functions. And it helps us see the bigger picture.”

Women Eye Opportunities in the Equipment Finance Industry

March 13, 2023 Coming into equipment finance around 2003, Reid Raykovich found that there were very few women in the field. Attending her first Captive and Vendor Finance conference through ELFA with 300 people, she realized she was only one of three women in the room. Fast forward to current day, Raykovich has seen a great influx of women come into the industry and she herself is now the CEO of the Certified Lease & Finance Professional (CLFP) Foundation, the organization that helps individuals in the industry achieve exceptional standards of professional conduct and technical expertise. She first attained that position in 2012 when she was only 34 years old. From there she has watched change come firsthand. Associations like NEFA, AACFB, and ELFA have also made efforts for women to be more involved and have a seat in leadership positions, according to Raykovich.

Coming into equipment finance around 2003, Reid Raykovich found that there were very few women in the field. Attending her first Captive and Vendor Finance conference through ELFA with 300 people, she realized she was only one of three women in the room. Fast forward to current day, Raykovich has seen a great influx of women come into the industry and she herself is now the CEO of the Certified Lease & Finance Professional (CLFP) Foundation, the organization that helps individuals in the industry achieve exceptional standards of professional conduct and technical expertise. She first attained that position in 2012 when she was only 34 years old. From there she has watched change come firsthand. Associations like NEFA, AACFB, and ELFA have also made efforts for women to be more involved and have a seat in leadership positions, according to Raykovich.

“I think that people are now aware that it’s not just having them work at a company, it’s giving them opportunities to go out, so the conference composition is no longer – to give the phrase ‘stale, male, and pale,’” Raykovich said. “It is changing and there’s certainly a lot more women…”

“Women just offer a unique value to the industry,” said Jena Morgan, COO at 360 Equipment Finance. When Morgan was first employed at a working capital provider, only 10% of employees were women. These days she’s a C-level exec for a well-known equipment finance company. Although she has gradually noticed more women being embedded into the industry, she still finds situations where she is the only woman at the executive table.

“A lot of times, I’ve seen women just spin off and start their own business, because they’re not able to move up how they want to,” said Morgan. “And so, I think sometimes that’s part of it, part of why you’re seeing more women in equipment finance is because they’ve spun off and just started their own business; and then they hire women.”

Like Morgan, Raykovich of the CLFP Foundation echoed the possibility of making a change if a ceiling has been reached.

“I think the best advice is if you’re at a company that’s not acknowledging your role as maybe a mother or a woman, move on to another company,” said Raykovich. “The amount of opportunities in this industry is just limitless. You can do any position, anything you want to do and you can find that in this industry if you do it well, you will never leave because you will have a name and people will want to hire you.”

Reality TV Loan Broker Shares What Happened After the Show

March 17, 2022 Juan Carlos Marcano’s experience on Equipping the Dream has given his loan brokering career a major jumpstart.

Juan Carlos Marcano’s experience on Equipping the Dream has given his loan brokering career a major jumpstart.In a chat with Juan Carlos Marcano this week, the Equipping The Dream broker who became a fan favorite for his personality and demeanor, it was learned that he’s been up to some interesting stuff since he appeared in deBanked’s first reality show. While operating JFK Business Financing in Dallas, Texas, Marcano shared that he is still in cahoots with some of the other participants in the show.

“I closed five deals last week,” said Marcano, when asked about what happened after he left the training office of Everlasting Capital. “After filming the show, I started with Will and Josh,” he said in reference to the two partners of Everlasting Capital. “They sent me leads, and I started closing.”

When asked what the Spanish speaking merchant needs most out of the small business financing industry, and more so Spanish speaking brokers like him, Marcano spoke about how these merchants just need service above all else. He spoke about how because of the language barrier, many of these merchants don’t have access to the same type of capital as an english-speaking business because there are not many people out there to go ask for it in their language.

Marcano awaited the final results of the one-week training competition at Everlasting Capital while wearing the flag of Venezuela as a cape, his native country.

Marcano awaited the final results of the one-week training competition at Everlasting Capital while wearing the flag of Venezuela as a cape, his native country.When asked if he is working exclusively with the brokerage from the show or if has future plans to expand his business, Juan spoke like a true broker. “I’m open to hearing from other funders and brokers about doing more deals,” he said.

“I will use the leads I get from [Everlasting] to help build my business in that industry,” said Marcano. “I’m starting to get better and better. When I get my cash flow going on and up, I’m setting a plan with a strategy to build my own details. I just need to get better with my website, social media, everything here is marketing.”

He said one major advantage of being a small shop is the potential he has as a broker in where he can live and do business. Currently a Dallas resident, Marcano sees a future in multiple cities. “I want to open up businesses in Miami,” he said, “but as I think about it, I’d like to open up a business in New York too.”

When asked about how he will compete with big tech’s emergence into small business lending, Marcano highlighted customer service and personality are the key to success for companies like his.

“For me, it’s all about providing great service. It’s all about five star service.”

You can meet Marcano at deBanked Connect Miami on March 24, where he alongside the cast of Equipping the Dream will be in attendance.

Broker Show Ends in a Cold Call Showdown For The Ages

March 3, 2022

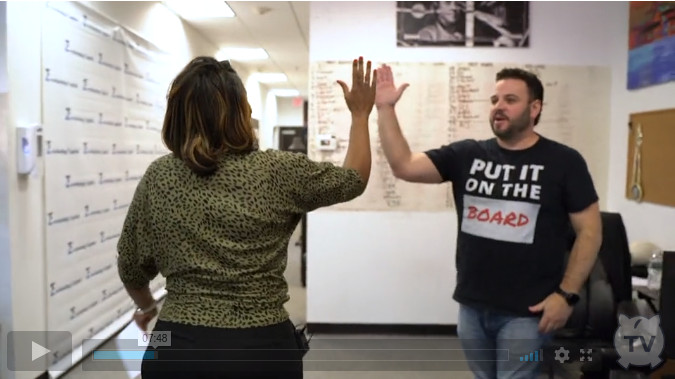

The nearly 1-hour long season finale of Equipping The Dream aired on Thursday, concluding the first reality show to ever capture the business finance industry. The six-episode series which followed four aspiring equipment finance brokers, proved, if nothing else, that cold calling and phone sales are not dead.

The show’s contestants capped off their week of sales training with a calling competition that came down to the wire and an outcome that left viewers shocked. Josh Feinberg, one of the sales trainers in Equipping The Dream, explained it best. “It almost seemed like it was scripted, but it couldn’t have been more real.”

Two episodes were released each week starting on February 15th. The March 3rd airing of the finale means that eager viewers can now binge the entire show on deBanked TV without having to wait for future episodes. (Start With Episode 1 here)

The show captured a real life broker training at the office of Everlasting Capital in Rochester, New Hampshire. deBanked’s Sean Murray served as Executive Producer.

“I really had no idea what we were going to capture by having our camera crew there all week,” Murray said. “But what we got is something everyone doing sales in the industry should watch at least once. It came out that good.”

Reality Show About SMB Finance Sales Rockets to The Top Spot

February 20, 2022 Four aspiring equipment finance brokers traveled to Rochester, New Hampshire last November to get a hands-on sales training from the management team at Everlasting Capital. With a variety of backgrounds and dreams of turning commercial finance sales into a lucrative career, each trainee wasn’t sure what they were in for when a team of mentors and a film crew awaited them inside.

Four aspiring equipment finance brokers traveled to Rochester, New Hampshire last November to get a hands-on sales training from the management team at Everlasting Capital. With a variety of backgrounds and dreams of turning commercial finance sales into a lucrative career, each trainee wasn’t sure what they were in for when a team of mentors and a film crew awaited them inside.

That’s the basis for Equipping The Dream, a deBanked TV produced web-based reality show that debuted on February 15th. The six-episode show is dropping twice a week until the finale scheduled for March 3rd.

Over the weekend, Episode 1 of the show became the most visited page on deBanked in 2022 so far.

“There’s never been anything like this about the industry,” said Executive Producer Sean Murray. “We did a screening of it for some people who had nothing to do with sales or finance and they were captivated by it.”

Partners Josh Feinberg and Will Murphy were already well-known throughout the industry. The two were featured in a 2018 deBanked story that explains how their journey began years earlier in a pawnshop basement. Since then, the pair now also run Equipment Broker School, a training course for aspiring brokers.

Partners Josh Feinberg and Will Murphy were already well-known throughout the industry. The two were featured in a 2018 deBanked story that explains how their journey began years earlier in a pawnshop basement. Since then, the pair now also run Equipment Broker School, a training course for aspiring brokers.

The sales tips and experience in the show, therefore, are as real as it gets. Viewers have shared what they thought of the first two episodes out so far:

“It was inspiring to see other people doing what I’m doing.”

“Awesome production!”

“This is getting good! COLD CALLERS watch this!!!!”

“This did not disappoint.”

“Your camera quality is better than most shows on Netflix.”

“I’m rooting for these brokers to succeed.”

“Now that’s reality!”

Episode 3 will be released on Tuesday, February 22nd. The four trainees range in ages 35-50. The show is exclusively on deBanked TV.

CFPB Initially Proposed to Exclude MCAs, Factoring, and Equipment Leasing From Section 1071

December 17, 2020 After ten years of debate over when and how to roll out the CFPB’s mandate to collect data from small business lenders, the Bureau has initially proposed to exclude merchant cash advance providers, factors, and equipment leasing companies from the requirement, according to a recently published report.

After ten years of debate over when and how to roll out the CFPB’s mandate to collect data from small business lenders, the Bureau has initially proposed to exclude merchant cash advance providers, factors, and equipment leasing companies from the requirement, according to a recently published report.

The decision is not final. A panel of Small Entity Representatives (SERS) that consulted with the CFPB on the proposed rollout recommended that the “Bureau continue to explore the extent to which covering MCAs or other products, such as factoring, would further the statutory purposes of Section 1071, along with the benefits and costs of covering such products.”

The SERS included individuals from:

- AP Equipment Financing

- Artisans’ Bank

- Bippus State Bank

- CDC Small Business Finance

- City First Bank

- Floorplan Xpress LLC

- Fundation Group LLC

- Funding Circle

- Greenbox Capital

- Hope Credit Union

- InRoads Credit Union

- Kore Capital Corporation

- Lakota Funds

- MariSol Federal Credit Union

- Opportunity Fund

- Reading Co-Operative bank

- River City Federal Credit Union

- Security First Bank of North Dakota

- UT Federal Credit Union

- Virginia Community Capital

The panel discussed many issues including how elements of Section 1071 could inadvertently embarrass or deter borrowers from applying for business loans. That would run counter to the spirit of the law which aims to measure if there are disparities in the small business loan market for both women-owned and minority-owned businesses.

One potential snag that could complicate this endeavor is that the concept of gender has evolved since Dodd-Frank was passed in 2010. “One SER stated that the Bureau should consider revisiting the use of male and female as categories for sex because gender is not binary,” the CFPB report says.

But in any case, there was broad support for the applicants to self-report their own sex, race, and ethnicity, rather than to force loan underwriters to try and make those determinations on their own. The ironic twist, however, according to one SER, is that when applicants are asked to self-report this information on a business loan application, a high percentage refuse to answer the questions at all.

The CFPB will eventually roll the law out in some final fashion regardless. The full report can be viewed here.

Oakmont Capital Services Follows Top Talent to Minnesota

July 26, 2018

Yesterday, Oakmont Capital Services announced that it had hired 11 equipment finance veterans to staff its new office in Albany, Minnesota.

All of the new hires were previously working in the Equipment Finance division of Stearns Bank, a regional bank headquartered in Minnesota with retail bank locations throughout the state and in Arizona and Florida. Among banks with $2 to $10 billion in assets, Stearns Bank was named the top performing bank by American Banker for 2017 and 2018. The American Banker noted last year the bank’s expertise in equipment financing. Stearns Bank also received the number one ranking for top-performing community bank in the country from ICBA Independent Banker magazine in its May 2017 edition.

“I’m most excited about the depth of the knowledge base of the people we brought on,” said Founder of Oakmont, Joe Leonard, in reference to the new hires.

Leonard told deBanked that Oakmont was looking to expand all along, but the decision to locate its new office in Minnesota was largely based on the group of talent that became available from Stearns Bank. Leonard said there was management change at Stearns Bank, but that the bank still has a robust equipment finance team.

Oakland does equipment finance for the transportation, construction and medical industries, among others. It also provides working capital loans for business acquisitions, commercial real estate, debt consolidation, bridge Loans and export financing. Oakmont can make working capital loans from $300,000 to $20 million.

Leonard said that the bulk of Oakmont’s business is commercial equipment financing and SBA loans. And business is derived almost exclusively from referrals from equipment dealers and manufacturers.

The new hires include Daryn Lecy, who will serve as Vice President of Operations. He has experience helping to grow a portfolio from $140 million to $1.2 billion. He also has experience co-managing over 150 equipment finance employees. Lecy will be responsible for managing Oakmont’s new Minnesota office.

Jim Peach will be Vice President of Sales, Kayla Perling, Syndication Manager, Mikki Henkelman, Credit Manager, Tracey Elfering, Business Development Coordinator, and Jena Dirkes, Channel Development Officer. Chad Primus, Elise Linn, Jayme Gerads, Molly Sand and Michael McElroy will all serve as business development officers.

Founded in 1998, Oakland has its headquarters in West Chester, Pennsylvania. With the Minnesota office, it now employs roughly 40 people.