Business Lending

How Kaaj is Accelerating Small Business Lending

October 8, 2025Utsav Shah first met Kristen Castell at deBanked CONNECT MIAMI this past February. At the time, Shah and his partner Shivi Sharma were freshly promoting a new AI technology to simplify small business lending. It’s called Kaaj, described as a core intelligence layer that bolts into a lender or broker’s CRM and handles all of the early-stage application intake and underwriting work. Shah had been familiar with the fintech accelerator Castell directs, the Center for Advancing Financial Equity (CAFE), which she was speaking about at the conference, but he had never actually met her in person until then.

“That’s really when we learned deeply about what CAFE’s mission is and how it works with a lot of startups, a very unique mission and very unique approach to work with startups and bring the ecosystem together,” said Sharma. “So we loved it and decided to apply this Fall.”

They applied into the exclusive accelerator program and were one of six companies to be selected, an honor considering hundreds of companies apply for entry on a bi-annual basis. As previously noted on deBanked, it’s an eight-week program, some of which takes place on location at the Fintech Innovation Hub on the University of Delaware campus. The rest is virtual but there are in-person field trips like a recent one to Washington DC, for example. deBanked has sponsored the last three accelerator cohorts which in the most recent cohort includes headline names like JPMorgan, PNC, Discover, Barclays, Capital One, M&T Bank, WSFS BANK, BNY Mellon, Prudential, Fulton Bank, County Bank, Best Egg, United Way, NeighborGood Partners, and the Delaware Bankers Association.

Kaaj, based in San Francisco, was already getting noticed beforehand. The company won the Fintech Meetup Startup Pitch Competition in March and secured a $50,000 prize, for example. Their technology is especially suited for equipment financing companies, MCA providers, small business lenders, SBA lenders, factors, and more.

Kaaj, based in San Francisco, was already getting noticed beforehand. The company won the Fintech Meetup Startup Pitch Competition in March and secured a $50,000 prize, for example. Their technology is especially suited for equipment financing companies, MCA providers, small business lenders, SBA lenders, factors, and more.

“So imagine that you’re a lender, and you get hundreds of applications in a day, and you don’t really know where you want to focus your time on,” Shah said to deBanked. “‘What do these 100 deals mean for me, for my business? Are they even qualifying against my criteria, etc.’ So what Kaaj does, it provides very quick intelligence, within the first three minutes.”

Shah explained that as soon as someone submits a package with documents, they get analyzed from top to bottom, like KYC/KYB, the bank statements, and more. This helps lenders (and brokers) decide how to prioritize their time. Utsav’s background in technology has played a major role in building this out as he comes with a decade of AI experience and was building autonomous cars before building Kaaj.

“Time wins deals or time kills deals,” said Shah. “Either way that you want to look at it, if we can give that time back to them, if we can reduce that turnaround time on each individual deal and focus on those higher profitability deals for these companies or these lenders, then they can start really feeding the top line and the bottom line, because they’re not having to hire a bunch of folks.”

Sharma said that equipment finance is slightly more complex than MCA, for example, but that as a $1.4 trillion industry, it’s a market that’s ripe for innovation. Sharma used to work in commercial lending herself and has seen firsthand how manual processes and outdated technology slow things down and hurt not only the lenders but the borrowers in the process.

“I have worked on small business lending, commercial lending, payments fraud, onboarding fraud, a lot of that,” Sharma said. “I spotted a lot of challenges in that space and a clear lack of good technological solutions that really help these lenders scale efficiently.”

Shah, meanwhile, said that ultimately it’s about helping the end-user, the business borrower.

“We are very focused on solving for small businesses, because the final mission of the company is to get better access to capital for small businesses,” he said.

BHG Financial Had a Strong Second Quarter

August 22, 2025 BHG Financial had loan originations of $1.5B in the 2nd quarter of 2025, up from 1.2B YoY. The company is 49% owned by Pinnacle Bank.

BHG Financial had loan originations of $1.5B in the 2nd quarter of 2025, up from 1.2B YoY. The company is 49% owned by Pinnacle Bank.

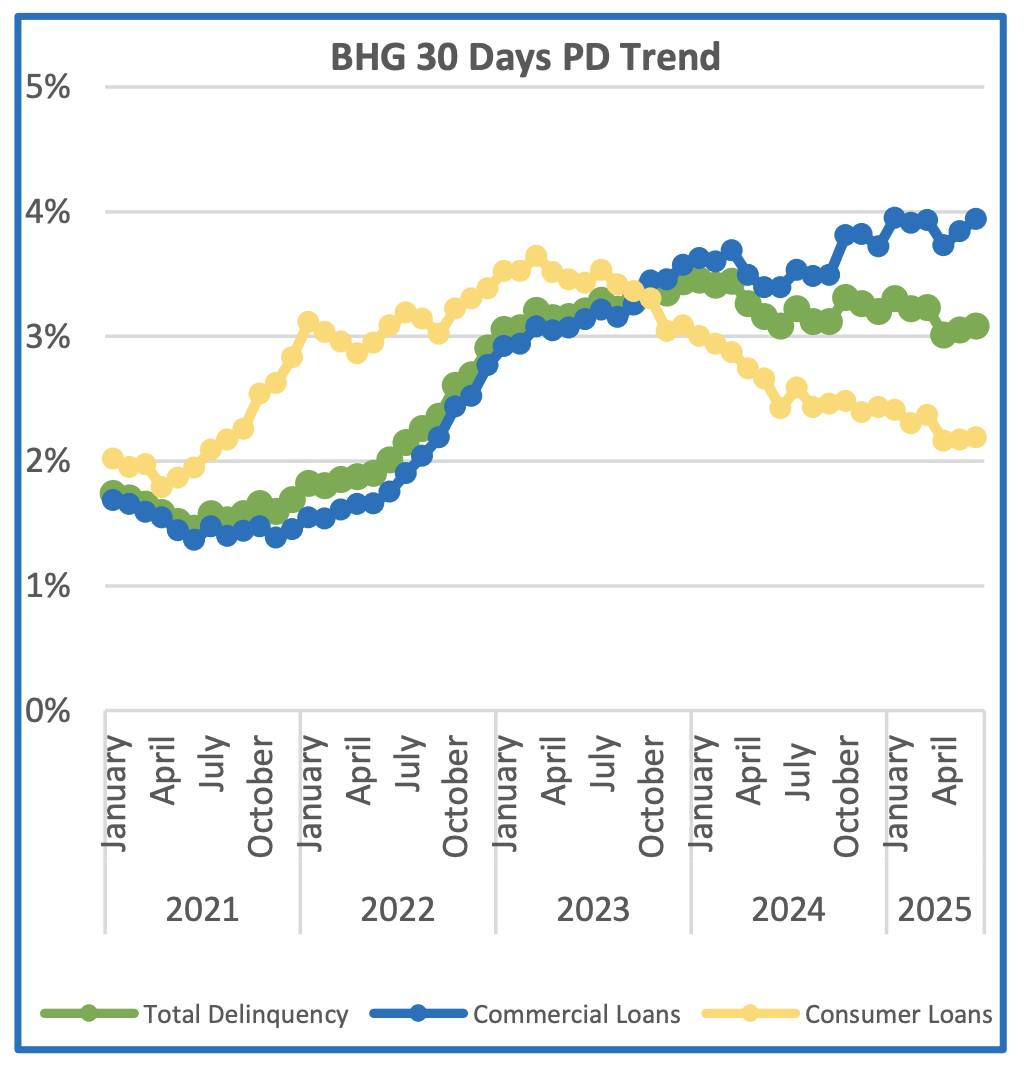

The company’s trending 30-day commercial past-due rate has been hovering at around 4% since the same time last year while past-due rates on their consumer loans have been in a consistent decline since Summer 2023.

During the Q2 earnings call, Pinnacle CFO Harold Carpenter, said that both production and credit growth have been good this year.

“I think credit has really been the bigger surprise for the year,” said Carpenter, “and we feel like that it looks like it’s pivoted and hopefully, it will continue to pivot.”

BHG primarily serves as a full-service commercial loan provider to healthcare providers and other skilled professionals for business purposes but also makes consumer loans for various purposes.

Business Finance Brokers in 2025

August 15, 2025

We’re now ten years out from the original “Year of the Broker” article in deBanked Magazine. Brokers are still here, the business has just changed slightly. Here’s some of the top line differences vs. 2015:

Cold Calling: 12% of merchants say they started their search for business funding options from a cold call.

Google Search: Organic search rankings beginning to diminish in favor of AI Q&As.

Training: AI can now listen to every call and grade you on every component of it.

CRMs: Pen and paper are over. Every touch on a deal should be traced and automated and deal tracking organized in a system.

Competition: Every POS solution and merchant fintech software now has a funding button embedded into it.

Commissions: Still high.

Funding Options: Lines of credit, term loans, MCAs, SBA, equipment financing, real estate lending, and more.

Regulations: There are now numerous state registration and disclosure requirements. (See the map here).

Leads: Referral networks are now more valuable than ever. Referrals from CPAs, lawyers, trade associations, chambers of commerce, and more.

Gates: You may have to go through a super broker to get access to a top tier funder.

Startup Costs: The registration requirements in several states has significantly increased the cost of starting a new broker shop today.

Business Finance Companies on Inc 5000 List in 2025

August 12, 2025Here’s where small business finance companies rank on the Inc 5000 list for 2025 (and if we’ve missed you, email info@debanked.com):

| Ranking | Company | 3-Year % Growth |

| 15 | Parafin | 9594 |

| 206 | businessloans.com | 1862 |

| 669 | Pinnacle Funding | 626 |

| 831 | SBG Funding | 508 |

| 1215 | Essential Funding Group | 359 |

| 1240 | Clara Capital | 352 |

| 1417 | Backd | 306 |

| 1705 | Kapitus | 256 |

| 1719 | Channel | 255 |

| 1756 | Fundible | 248 |

| 2027 | 4 Pillar Funding | 214 |

| 2117 | Biz2Credit | 203 |

| 2293 | Byzfunder | 187 |

| 2671 | Critical Financing | 156 |

| 3081 | Lendzi | 131 |

| 3226 | eCapital | 124 |

| 3508 | ApplePie Capital | 111 |

| 3545 | SellersFi | 109 |

| 3901 | Splash Advance | 95 |

| 3973 | Fora Financial | 92 |

| 3993 | Capital Infusion | 91 |

| 4076 | Expansion Capital Group | 88 |

| 4162 | Shore Funding Solutions | 85 |

| 4206 | Direct Funding Now | 83 |

| 4712 | ROK Financial | 63 |

Square Loans Originates $1.64B in Small Business Loans in Q2

August 8, 2025Block’s merchant financing division, Square Loans, continues to lead the competition. The company originated $1.64B in small business loans in Q2, up slightly from $1.59B in Q1. That puts them on pace for $6.5B for the year and allow them to maintain their top position among small business finance companies that deBanked tracks. Square Loans’ advantage is that its customers repay their loans automatically through their daily Square POS transactions.

Overall, Block CEO Jack Dorsey announced that the entire company is “Back on offense.”

“We had a strong second quarter,” wrote Dorsey in his shareholder letter. “Square GPV grew 10% year over year and Cash App gross profit grew 16% year over year, accelerating as we exited Q2.”

LendingTree: ‘Small Business Loan Originations Up 40% On Our Platform’

August 1, 2025LendingTree’s small business loan origination volume is up 40% YoY, according to the company’s latest quarterly earnings report.

“In small business, we made a strategic investment to grow our sales force and it has paid off in more business and more efficiency,” said LendingTree CEO Doug Lebda. “I think that small business can be a real growth driver for us.”

Lebda added that profitability had been consistently growing each quarter and that the company was “on a roll.” And part of that is being attributed to staying on top of AI.

“Eighteen months ago, I told our board and our company that we’re going to be an AI first company,” Lebda said. “And today, effectively, all of our employees are using AI in their day jobs, including having enterprise GPT for everyone.”

Enova on Business Loan Originations Growth: ‘Like Running Downhill’

July 28, 2025Enova originated $1.2B in small business loans in Q2 2025, marking the fourth time they’ve exceeded $1B. When asked how that segment of their business has continued to perform so consistently, Enova CEO David Fisher said that small businesses had a couple of rock solid quarters in a row.

“It’s almost like running downhill,” Fisher said. “It’s not like you’re trying that hard. It just kind of happens. Credit has been incredibly stable…and when you have rock solid credit and you’re in a very strong competitive position, yes, generating origination growth is like I said, kind of like running downhill. It’s not like we’re trying super hard to do it. We just let the business perform the way it was performing.”

Later on Fisher added that “the competitive dynamics on the small business side are more stable. There’s fewer players. We know who they are. Brand matters more. And so that super strong position we have in SMB, I think helps with the stability a bit.”

In regards to how they’ve evolved their approach to TV advertising, Fisher said:

“So ten years ago, we were running a lot of national TV. Now it’s almost all digital TV, where you can almost target city by city and certainly state by state and even different types of groups within those markets. So that all plays into what we do super well because we develop models ‘that the more data focused that we’re looking at, the easier it is for us.’ So TV was never our favorite thing, but if we can target specific states, specific groups, specific times of days, figuring out which types of programming work the best, that’s really amazing for us to be able to plug that all into our algorithms and become more and more efficient with marketing.”

Lastly, Fisher is retiring as CEO to become Executive Chairman effective January 1, 2026. During the call Fisher said that with the business on super stable footing, that it was simply the right time. CFO Steve Cunningham will take over the CEO position.

Heron Makes Big Splash in Small Business Finance Industry

July 15, 2025 Heron, a startup using AI to automate workflows, just raised a $16M Series A round. Already a well-known brand in the small business finance industry, the funds will be used to grow their presence, expand into adjacent verticals, and grow their go-to market & and engineering teams.

Heron, a startup using AI to automate workflows, just raised a $16M Series A round. Already a well-known brand in the small business finance industry, the funds will be used to grow their presence, expand into adjacent verticals, and grow their go-to market & and engineering teams.

While Heron serves top tier clientele like insurance carriers and FDIC-insured banks, its technology can be utilized at almost any level.

“Our technology is built to serve funders of all sizes from industry leaders like Bitty, Forward, Vox, and CFG to sub-five person shops originating hundreds of thousands of dollars a month,” the company told deBanked. “If a team is receiving 25 or more submission documents per day, Heron can deliver immediate value by automating their document intake and reducing manual review time. Our platform scales to meet volume, and we often see smaller, fast-moving teams who want to scale submissions and originations without scaling headcount benefit the most from Heron.”

Heron noticed that small business lenders were employing teams of underwriting analysts that spend hours on repetitive intake work and created a process to streamline it within seconds. Consequently, they’ve seen that improving efficiencies in this market has had a positive impact on the economy overall.

“At Heron, we believe that SMB lending is the backbone of the American economy — it powers everything from local restaurants to trucking fleets,” the company said. “But outdated, document-heavy processes slow things down. Heron helps lenders move faster and smarter, so they can get capital to the businesses that need it most.”