Business Lending

SoFi Says it is Working With SMB Finance Companies

May 10, 2022 SoFi may not exactly be in the small business lending market per se, but a digital payments company it acquired in April 2020, Galileo, has been put to good use.

SoFi may not exactly be in the small business lending market per se, but a digital payments company it acquired in April 2020, Galileo, has been put to good use.

“Galileo continues to expand its client base to include B2B and enterprise clients as adoption of modern cloud-based digital payments and banking has opened up new verticals and client types, use cases and opportunities,” said SoFi CEO Anthony Noto during the company’s Q1 earnings call. “For example, we launched two new clients in the first quarter that offer innovative working capital models for B2B and small- to medium-sized businesses.”

Noto said that they were not naming specific names at this time. “We will announce those [names] in conjunction with our partners as opposed to during our earnings call, but that’s increasingly a big channel for us, and we have a product pipeline to better serve the enterprise and SMB space holistically based on the demand we are seeing.”

SoFi reported a Q1 net loss of $110M, which it said was an improvement over the $177.6M net loss it recorded during the same period last year.

Shopify Capital Originated $346.7M in Business Funding in Q1

May 8, 2022 Shopify Capital originated $346.7M in MCAs and business loans in Q1, the company announced. That included merchants in the US, UK, and Canada. Though it was a 12% increase over the same period last year, the figure puts them virtually on par with originations in 2021 if the following three quarters hold steady.

Shopify Capital originated $346.7M in MCAs and business loans in Q1, the company announced. That included merchants in the US, UK, and Canada. Though it was a 12% increase over the same period last year, the figure puts them virtually on par with originations in 2021 if the following three quarters hold steady.

Shopify was one of the only online lenders whose origination volume substantially increased during covid. Most experienced significant drops but have since dramatically recovered.

“The hundreds of thousands of businesses that shifted their business to Shopify during the pandemic and stayed with us since can now take advantage of our powerful retail point-of-sale offering for a unified view of their sales online and offline,” said Shopify CEO Harley Finkelstein during the Q1 earnings call. “Shopify has been developing the world’s best point-of-sale retail software for years, and it’s now at the point where all merchants who came to Shopify during the pandemic can leverage it.”

Large Fintech Companies Helping to Normalize Revenue Based Financing

May 6, 2022 With business increasing for wide-reaching financial technology companies like Square, Paypal, and Shopify, this has brought more attention to revenue-based financing products like the ones they offer. Henry Abenaim, Founder and CEO of Fundingo, said that it brings more businesses to the table.

With business increasing for wide-reaching financial technology companies like Square, Paypal, and Shopify, this has brought more attention to revenue-based financing products like the ones they offer. Henry Abenaim, Founder and CEO of Fundingo, said that it brings more businesses to the table.

“…you sometimes think it’s a small world or small group of merchants, and you really come to realize that it’s huge,” he told deBanked. “And the more they’re serviced, the more they need, the more they grow. So it just feels like there’s just more awareness of the product, and then more merchants that are going to come in demand and ask for it, as well as these bigger players are always going to service only a subset of the businesses.”

At the same time, a greater public awareness of options could tighten margins for certain funding providers. “I think it’s going to make the merchants that are way more bankable… get lower price deals, so it’s going to hurt the margins, it’s going to hurt the profits,” Abenaim commented.

John Bulnes, Vice President of Business Development at Fenix Capital Funding, expressed how it is not yet determined what kind of effect the larger mainstream companies will have on the industry. “I do think it’s something that the larger first position MCA companies may feel the effects of first, because they’re going to be competing more or so with taking away clients from those companies first, as opposed to the companies that are smaller that are doing shorter term deals.”

As these big companies operate with larger capital bases, it may indeed become more difficult for smaller companies to compete.

“… it’s going to be something that’s going to constantly adapt and fluctuate as time goes, but I do see it as an expanding industry… it’s kind of a sign that when you see more commercials and we see these bigger companies jumping into the space, that it is something that’s going to continue to grow,” said Bulnes.

And commercials and ads are definitely increasing. One of the largest online small business lenders in the country was asked about their TV and radio campaigns during their recent quarterly earnings call.

“We’ve definitely been ramping [commercials up] hopefully with a little bit more diligence than OnDeck was running ads three or four years ago,” said David Fisher, CEO of Enova. “But we’ve definitely jump back into kind of broader base advertising in that business and it’s been working really well.”

Square Loans Originated $756M in Q1

May 5, 2022 Square Loans, the small business lending division of Block, is off to a roaring start. The company originated 90,000 loans for a total of $756M in Q1, according to the company’s latest quarterly earnings. One cause of that was a foray into the Canadian market as part of the company’s strategy to offer all its products in every market it operates in.

Square Loans, the small business lending division of Block, is off to a roaring start. The company originated 90,000 loans for a total of $756M in Q1, according to the company’s latest quarterly earnings. One cause of that was a foray into the Canadian market as part of the company’s strategy to offer all its products in every market it operates in.

“I would say that we have always felt that fast access to funds, whether it’s a customer’s own funds or access to credit has been a key part of our platform and a key part of what our customers need in good times and in uncertain times,” said Block CFO Amrita Ahuja. “And we’ve built a lot of data, a lot of heuristics machine learning around the ability to enable customers for access to those funds in a responsible way. Obviously, we do that today on the Square platform with our Loans — Square Loans product, which we were able to very quickly pause during the early days of the pandemic, pivot to PPP, and then relaunch. And now with originations there back to pre-pandemic levels with continued strong results, encouraging results we’ve seen with respect to loss rates and repayment rates.”

Square Loans’ first quarter originations more than doubled YoY. The increase is consistent with results experienced by competitor Enova/OnDeck.

Enova Doubles Small Business Loan Originations YOY

May 4, 2022 Enova’s small business lending arm, powered mostly by OnDeck, originated $659M in Q1 of 2022. That was more than double the volume over the same period in 2021 and up 14% sequentially from Q4 2021. Overall, Enova reported a Q1 net income of $52M.

Enova’s small business lending arm, powered mostly by OnDeck, originated $659M in Q1 of 2022. That was more than double the volume over the same period in 2021 and up 14% sequentially from Q4 2021. Overall, Enova reported a Q1 net income of $52M.

“The first quarter net charge-off ratio for small business receivables was 1.9%, up from 80 basis points last quarter, but below the prior year ratio of 2.6% and below pre-pandemic periods as we continue to see strong payment performance across all of our small business products,” said Enova CFO Steven Cunningham during the quarterly earnings call.

Company CEO David Fisher said that Enova felt really good about its market position in the small business lending space and considered itself the largest player in the non-prime sector of it overall. “We are not feeling APR pressure in our small business products,” Fisher said when asked if competitive forces might drive the company’s loan prices down. He attributed the company’s rapid originations growth to both an increase in marketing spend and an increase in customer awareness that they can access capital quickly online.

“…small businesses have a pretty strong appetite for growth, but also for kind of more traditional non-bank small business lenders,” Fisher said. “I think kind of the online approach with kind of the speed and the ease and the transparency is really appealing to businesses.”

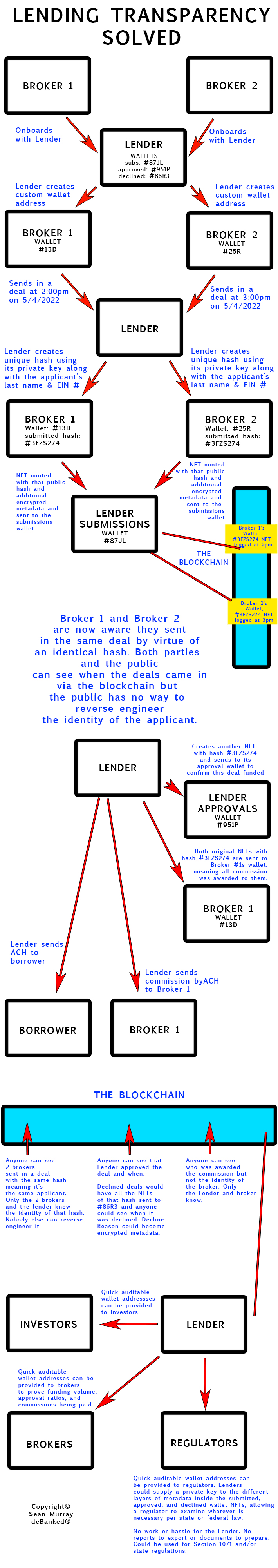

Lender / Broker Ecosystem Transparency Solved

May 4, 2022What happens when a broker sends in a deal and is told it’s declined, only to find out that it was approved and funded for another broker? Usually, a very angry post on social media. The problem is that everyone wants maximum transparency, but how to get it? Who can trust who? What can be done? When will someone do it?

Well, call me insane, but I’ve taken a crack at solving it. And don’t get mad at me because I use the word blockchain because I promise this is not about crypto. Everything would still be ACH-based and recorded just as you already do it, but this little piece of tech would sit underneath it without any manual effort. All automated. No work. Also, it’s possible I’m just totally wrong or have missed some possibilities. You be the judge. Realistic or dream world?

1. Brokers and Merchants don’t need to use the blockchain or know how to use it.

2. A dev at a lender justs need to understand digital wallet addresses and a little feature about them called Non-Fungible Tokens to build or implement a third-party add-on of this. (These “NFTs” have nothing to do with art, they are just uniquely identifiable text files logged into the blockchain with metadata inside them.)

First, here’s my diagram:

Here’s what it’s doing:

1. When brokers sign up with a lender, the lender assigns a uniquely identifiable blockchain wallet address to them on an automated basis.

2. When a broker sends in a deal, the lender creates a unique encrypted hash of the applicant’s bare minimum identifiable data (like last name and EIN #). This hash is placed into a text file in plain english along with the applicant’s application data encrypted. (also automated).

3. The lender creates a Non-Fungible Token from the broker’s wallet address and sends it to the lenders’s official submission wallet. (automated). This wallet will show the NFTs for every deal ever submitted to this lender. Nobody will be able to reverse engineer info about the deals and only the broker who submitted the deal will be aware of what the hash of the deal is. This gives them a chance to view exactly when their deal was logged and if there’s any duplicate hashes in the wallet that would signal that same deal had already been submitted by someone else and when it was submitted.

4. If the deal is approved by the lender, the lender pays the broker and funds the merchant via ACH like normal. Then the lender creates an NFT with the same public hash and sends that one to its approval wallet. The original NFT sent to its submissions wallet is now sent to the broker’s wallet, signaling that they have been awarded the commission on this deal. (automated).

5. If the deal is declined, the lender creates an NFT with the same public hash and all the NFTs for this deal are sent to the decline wallet, signaling that the deal was killed and nobody was awarded the commission on it. (automated).

Every deal’s NFT has to eventually be moved to approved or declined. They can’t sit in submissions in perpetuity.

End result: brokers that submit deals can see if their deal has been submitted before and when it was submitted. Brokers can verify if the deal was funded, when, and if commissions were paid to someone. No actual money is changing hands via crypto (though there might be transactions fees to move NFTs around.) Investors and regulators can also examine the flow and if necessary, be given access to a private key so that they can unlock and view the metadata in the submissions, approvals, and declines themselves.

Naturally, everyone’s first question is: what happens if the lender tries to bypass this?

1. A broker who submits a deal that does not see an NFT created for it in the lender’s submissions wallet, already knows that the lender is trying to operate outside the system. Time to move on!

2. A lender that shows a deal was declined and commissions paid to nobody could be easily discovered if the borrower shows a statement with proof that they received a deposit. No need to speculate what happened. Time to move on!

3. A broker that submitted a deal first can show that its deal was logged first in the submissions wallet. Anyone on social media or the public square could also confirm that and the lender could not manipulate the data to play favorites.

4. Lenders that operate outside of it would show little-to-no submissions or approval volume, signaling to a broker that for some reason they do not want the anonymized data auditable.

5. Lenders that are not real that go around pretending to be a lender just to scoop up deals would be hard-pressed to provide the three verifiable wallet addresses showing the volume of submissions, approvals, declines, and the respective ratios for the latter two. If they can’t show that they’ve ever done any deals or paid commissions, even if you can’t see what the individual details are, they’re not real.

6. After a lender moves the deal’s NFT to a broker’s wallet to signal they’re being awarded the commission, it’s possible the lender does NOT actually ACH the broker the commission. In that case, the broker would have a nice verifiable public display that shows it was supposed to be paid the commission for all to see. Public pressure ensues.

7. If the lender secretly pays a broker the commission but then publicly marks the deal as declined so that another broker who sent in the same deal doesn’t suspect what happened, well then the broker who got paid is going to be suspicious that the lender could do the same thing to them. There’s an incentive to be honest.

8. Merchants need not know about any of this. It doesn’t concern them.

9. The broker does not interact with the blockchain in any way except in the case it just wanted to view the data.

10. The lender does not have to manually interact with the blockchain at all. The system would just be bolted on to an existing CRM. It would do all the above by itself.

LendingClub Expects Modest Growth of its Commercial Lending Business

May 1, 2022 Fintech bank LendingClub expects its commercial loan business to grow modestly, according to Sameer Gokhale, Head of Investor Relations. Gokhale made the comment briefly during the company’s Q1 earnings call. “These commercial loans are largely secured by collateral or cash flow and should continue to be a good source of revenue and credit quality diversification,” he added.

Fintech bank LendingClub expects its commercial loan business to grow modestly, according to Sameer Gokhale, Head of Investor Relations. Gokhale made the comment briefly during the company’s Q1 earnings call. “These commercial loans are largely secured by collateral or cash flow and should continue to be a good source of revenue and credit quality diversification,” he added.

LendingClub had $615M worth of commercial loans and equipment leases on its balance sheet as of March 31st. That excluded the $185M worth of PPP loans it still held.

The company’s overall lending business is still consumer-focused. Auto lending is expected to increase, but not to such an extent that it catches up to Lending Club’s personal loan business.

Overall, the company reported a net income of $40.8M on $289.5M in revenue for the quarter.

CUNA to Congress: No More Direct Lending From the SBA, Please

April 28, 2022 On Tuesday the Credit Union National Association wrote letters to the House and Senate Small Business Committees stating that it is in the best interest for small business entrepreneurs to partner with a financial service provider, rather than the Small Business Administration directly. CUNA addressed their role in supporting emerging businesses and argued for policies that would block the SBA from serving as a direct lender. The letters will be brought forward at an oversight hearing to examine the SBA on Wednesday.

On Tuesday the Credit Union National Association wrote letters to the House and Senate Small Business Committees stating that it is in the best interest for small business entrepreneurs to partner with a financial service provider, rather than the Small Business Administration directly. CUNA addressed their role in supporting emerging businesses and argued for policies that would block the SBA from serving as a direct lender. The letters will be brought forward at an oversight hearing to examine the SBA on Wednesday.

CUNA stated, “… we strongly support legislation – such as S. 3382 and H.R. 6037 – that would prohibit the SBA from directly making loans under the 7(a) Loan Program and oppose any efforts in the FY 2023 Budget to fund a direct lending program.”

As the SBA became a direct lender during the COVID-19 pandemic, relationships between small businesses and financial service providers have not been able to form.

“… when working with local lenders, small businesses are likely to benefit from guidance and experience from a lender with a stake in helping the borrowing business succeed. By becoming a direct lender to small businesses, the SBA is likely to harm local financial institutions’ relationships with businesses and possibly hamper these businesses from establishing important banking relationships that can only help their business survive and flourish.”

At the small business committee hearing, Congressman Stauber questioned SBA Administrator Guzman on how the Biden administration is helping both the middle class and small businesses with inflation.

Guzman discussed how the President is taking action on energy costs, “he has made available a million barrels a day, to try to control some of the gas costs which we know are affecting our small businesses…”

Stauber responded, “…the strategic petroleum reserve really should be held for national emergencies not failed policies…” He further mentioned his concerns as he believes the administration is not acting quick enough as inflationary costs are rising for small businesses.