Business Lending

Money2020 Photos

November 1, 2015Below are some of the shots we got at the 2015 Money2020 Conference in Las Vegas!

Did you go to money2020? Feel free to send us some of your photos 🙂

Blurring Small Business: A Troubling Narrative is Gaining Steam

October 30, 2015Almost 18 months ago at LendIt’s 2014 conference, Brendan Carroll, a partner and co-founder of Victory Park Capital said that in regards to business lending, “the government doesn’t have the same scrutiny on this sector as it does in the consumer space.”

This double standard is the crux of American capitalism. In business you can win or lose, be smart or foolish, risk it all or play it safe. Government regulations don’t let the average consumer be subjected to the same stakes. They are viewed to be at a natural disadvantage against businesses and thus there are laws to protect them, and perhaps rightly so.

Since entrepreneurship is a choice, businesses and the people that own businesses are held to a higher standard of acceptable risk taking. In the free market, the pursuit of profit holds the system together.

This economic worldview is part of the reason why entrepreneurial TV shows such as Shark Tank are so popular. In the Tank, contestants can just as easily walk away with a terrible deal as they can a good one. And when bad deals get made, and they do, I’ve yet to see regulators descend on the set to fine or arrest Daymond John, Kevin O’Leary, or Barbara Corcoran.

But Shark Tank features entrepreneurs on a remote stage detached from their daily environment, giving it the look and feel of a game show. If you want to see cold hard dealmaking with mom-and-pop shops on an up close and personal level, just watch CNBC’s The Profit. On the show, small business expert Marcus Lemonis does not sugarcoat what he is. “I’m not a bank. I’m not a consultant. And I’m not the fairy godmother,” he bluntly told one small business owner. It doesn’t matter if it’s a family owned store or a full fledged corporation, Lemonis is looking to make a deal and make some money. When it comes to business, he is well… all business.

Just as the CFPB hasn’t shut down Shark Tank, (which one has to wonder if they’ll be subject to Reg B of Dodd Frank’s Section 1071) none of Lemonis’ deals have been scrutinized by a Federal Reserve study, nor has the Treasury Department issued an RFI to better understand why entrepreneurs go on the show in the first place.

It’s no wonder then at LendIt 2014, Carroll also said that there wasn’t the same sort of moral hurdle when it came to institutional capital investing in business lenders as opposed to consumer lenders.

Moral was a telling word choice because the morality of certain commercial transactions have recently come under fire by groups claiming to represent small businesses. The premise of their argument is that commercial entities are no more sophisticated than consumers, that a corporation and the average joe are equal in their ability to take risks and make decisions for themselves.

Their evidence is that sometimes in business-to-business transactions, particularly in lending, one side accepts terms that would be considered far outside the norm for consumers, terms that violate a moral threshold. One has to wonder where a loan with an infinity percent interest rate ranks on this morality scale, a deal that’s actually been made and accepted several times on a TV show. Referred to as a “Kevin deal” since they are Kevin O’Leary’s favorite, the borrower is obligated to pay a perpetual royalty on top of repaying the loan itself. In simple terms, it’s a loan that can never be paid off.

In the case of Wicked Good Cupcakes, a business that appeared on Shark Tank in 2012, a mother-daughter team struck a deal that would cost them 45 cents per cupcake in perpetuity to Kevin O’Leary. Many fans criticized them for it and yet the two have said that they have no regrets.

In the case of Wicked Good Cupcakes, a business that appeared on Shark Tank in 2012, a mother-daughter team struck a deal that would cost them 45 cents per cupcake in perpetuity to Kevin O’Leary. Many fans criticized them for it and yet the two have said that they have no regrets.

The fact that Wicked Good Cupcakes decided what made sense for them and was happy about it, damages the storyline that businesses need to be saved from their own decisions. But there’s another problem, government entities themselves may be inadvertently effectuating this false narrative by inferring incorrect conclusions from their own research.

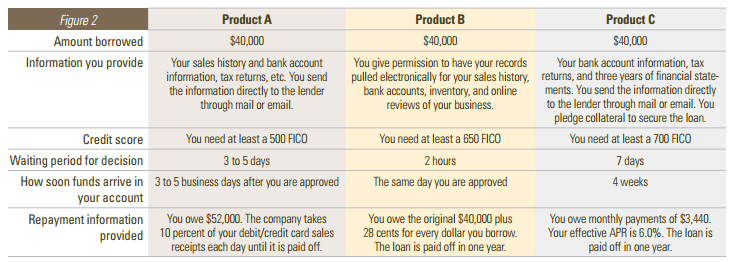

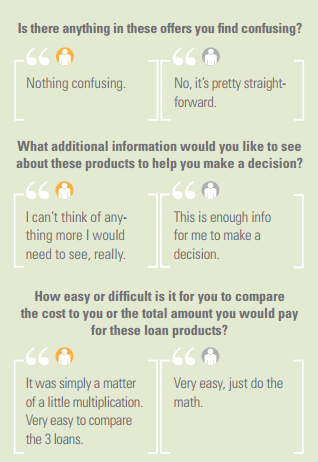

Nowhere is this more evident than in a report recently published by the Federal Reserve Bank of Cleveland that analyzed small businesses and their understanding of “alternative lending.” The report shared the results of two focus groups that had been shown terms for three hypothetical products that supposedly represented actual products in the real world.

Unsurprisingly, the report concedes “when comparing the products, participants initially reported the three were easy to compare and that they had all the information to make a borrowing decision.” But the researchers pressed on until they got an answer that fit their expectations, that small businesses are confused when it comes to money and finance.

In a hypothetical scenario where a commercial entity sold $52,000 of future receivables for $40,000 today, it stated that the “lender” would withhold 10% of each debit/credit card transaction until satisfied. Participants were then asked to guess the interest rate on this loan if they paid it back in one year. That caused a lot of folks to scratch their heads and that’s because it was a trick question.

The question itself introduced conflicting facts and lacked crucial variables to make an intelligent guess. Nevermind that respondents prior to that question said that there was “nothing confusing” about the products presented as is. The original feedback should’ve been enough. Below are some of the responses offered before they were deliberately tricked.

- “Nothing Confusing.”

- “No, it’s pretty straight-forward.”

- “I can’t think of anything more I would need to see, really.”

- “This is enough info for me to make a decision.”

The researchers concluded however that the answers to their trick question suggested there were “significant gaps in their understanding of the repayment repercussions of some online credit products and the true costs of borrowing.”

And while it might be true that they semi-admit to what they did when they wrote, “using only this information, calculating a true effective interest rate would not have been possible without making some assumptions,” the headline that spread thereafter was that small business owners are confused by alternative lenders.

And while it might be true that they semi-admit to what they did when they wrote, “using only this information, calculating a true effective interest rate would not have been possible without making some assumptions,” the headline that spread thereafter was that small business owners are confused by alternative lenders.

But even if that was the case, at what point does confusion become unfair in a purely commercial transaction? And what would be an appropriate remedy?

We’ve been down this road before where federal regulators have set mandatory disclosures in order to bring transparency to a lending environment believed to be obscure. And just recently on September 17th, 2015, the House Committee on Small Business Subcommittee on Economic Growth, Tax and Capital Access pressed community bankers on the impact of such measures dictated by Dodd-Frank.

Congressman Trent Kelly asked if all the added new pages to loan agreements make it easier for their borrowers to understand. “Do they understand what they’re signing?” he asked.

B. Doyle Mitchell Jr., the CEO of Industrial Bank that was speaking on behalf of the Independent Community Bankers of America responded that they do not. “It is not any more clear,” he answered. “In fact it is even more cumbersome for them now.”

If anything, the Federal Reserve study offered compelling evidence that small businesses are happy with the way alternative lenders are currently disclosing their terms. It is only when government researchers tricked them that they became confused. That should say it all.

One consequence of entrepreneurship is that businesses are not created equal in their ability to assess financial transactions and no amount of disclosures or intervention can save them. There must be losers in order for there to be winners.

Case in point, there are lenders out there doing deals so lopsided that they actually turn to each other and say, “I can’t believe she took that.” Such is the case of RuffleButts, a children’s fashion line that appeared on Shark Tank in 2013.

“When they wake up, they’ll realize they messed up,” said Mark Cuban in reference to the deal Lori Greiner proposed and closed. An article on BusinessInsider.com covered the episode and unabashedly concluded, “Shark Tank isn’t a charity. The investors are putting in their own money, so they have every incentive to push to get the best deal possible for themselves.”

Shark Tank has risen in popularity because it is a reflection of a culture that believes dealmaking, both good and bad, is inherent to the endeavor of entrepreneurship. When a bad deal is made, regulators don’t come on the show to urge a do-over.

But what’s dealmaking got to do with the local pizza joint seeking $20,000 that doesn’t have the time to mess around on TV shows? Unlike lenders who refer to their transactions as loans or units, merchant cash advance companies and the agents who negotiate the transactions appropriately refer to their agreements as deals. How else would one label an agreement in which a commercial entity sells future receivables for a mutually agreed upon price?

But what’s dealmaking got to do with the local pizza joint seeking $20,000 that doesn’t have the time to mess around on TV shows? Unlike lenders who refer to their transactions as loans or units, merchant cash advance companies and the agents who negotiate the transactions appropriately refer to their agreements as deals. How else would one label an agreement in which a commercial entity sells future receivables for a mutually agreed upon price?

And if the Federal Reserve study indicated anything, it’s that business owners feel there’s nothing confusing about these deals.

So it would seem that everything as Americans know it, watch it and understand it, is business as usual.

Even Brendan Ross, the president of Direct Lending Investments, was quoted by the BanklessTimes as saying, “I want to emphasize there’s absolutely nothing novel about lending money to businesses. This isn’t some phenomenon we are rediscovering. There isn’t going to be increased regulation because this isn’t new.”

Perhaps the only thing that could be considered new is that loan sizes have gotten smaller and the types of products small businesses can access has diversified. Along the way, some of these new startups have decided to offer products in line with a self-professed moral code, which is to deliberately lend money at a loss and lash out at lenders who seek profit.

There’s a term for lending startups that don’t make money. They’re called “failed startups.” By casting small businesses as being no different from unsophisticated consumers, it’s quite possible that shows like Shark Tank and The Profit would become illegal in the process. Disclosures meant to help make things more transparent could actually make things less clear and more cumbersome, just as they have in the past.

I don’t think anybody is in favor of small business failure or an environment where confusion prevails, including the guys making infinity percent interest loans like Kevin O’Leary. But if the goal is to increase transparency, it should be in a way that businesses on both sides are content with.

The Federal Reserve study showed the system is working well as is and that prescribing mandatory changes to fit some universal standard would only serve to usher in an era of confusion that everyone is trying to avoid. Lenders can always do better to serve their clients, but the free market must prevail. As Mitchell, Industrial Bank’s CEO said when he testified in front of the Small Business Committee, “the problem with Dodd-Frank is you cannot outlaw and you cannot regulate a corporation’s motivation to drive profit at all costs so while it has a lot of great intentions in over a thousand pages, it has not helped us serve our customers any better.”

Alternative Lenders Are Waiting for a Shakeout

October 28, 2015 Back in April at the LendIt conference in New York, the big consensus was that not all underwriting was created equal and therefore several players wouldn’t survive long enough to make it back to LendIt in 2016. Six months later at Money2020 and so far everyone is still standing.

Back in April at the LendIt conference in New York, the big consensus was that not all underwriting was created equal and therefore several players wouldn’t survive long enough to make it back to LendIt in 2016. Six months later at Money2020 and so far everyone is still standing.

Loan terms are getting longer, rates cheaper and the cost to acquire borrowers higher. Somebody has to be feeling the pressure but in a rather benign economic and regulatory environment, it’s clear skies.

Valuations are soaring. SoFi is valued at more than $4 billion and Kabbage at more than $1 billion.

But Robert Greifeld, the CEO of Nasdaq warned attendees about the validity of private market valuations. “A unicorn valuation in private markets could be from just two people,” he said. “whereas public markets could be 200,000 people.” At best he described a private market valuation as being just a rough indicator.

And some wonder if these valuations are based on just scale, rather than the ability to underwrite more intelligently and efficiently than a bank. OnDeck for example, had a Compound Annual Growth Rate (CAGR) in originations of 159% from 2012-2014 when the average originations CAGR for their peers is currently 56%. But OnDeck has the advantage of time. With nearly a decade of data under their belt, they’ve been able to see what works and what doesn’t.

“You have to have enough bad loans to build a good credit model,” said OnDeck CEO Noah Breslow during a Money2020 panel discussion.

For Aaron Vermut, CEO of Prosper, getting their company to the next level was about having access to institutional capital. As a marketplace, and as a company that almost died several years ago, he pointed out, institutional money was the inflection point for them to grow. The peer-to-peer model that actually depended purely on “peers” is what held their company back.

One thing several lenders seemed to agree on was the limited applicability of FICO. FICO is not the thing to use for a small business loan, said Sam Hodges, Managing Director and Co-founder of Funding Circle. His words didn’t come as a surprise since credit scores are generally the domain of consumer lending.

But doubts about FICO’s ability to predict performance didn’t just come from the commercial finance side. Prosper’s Vermut explained that consumers still think their FICO score is the most important factor in the rate they get. So even though they’ve got a system to predict repayment outside of FICO, they’re kind of forced to incorporate it because consumers are being educated to believe that’s what matters most.

The irony was not lost that as Vermut said that on a panel, he was seated next to Kenneth Lin, the CEO and founder of Credit Karma, a company that educates consumers about credit. “A credit score is one of the most important components of a consumer’s financial profile,” says Credit Karma’s website. Such language puts a tech-based lender with their own scoring model perhaps at odds with what their own prospects believe.

For instance if a potential borrower with a 750 FICO score is offered a high interest rate because the lender’s advanced and more in-depth underwriting determined them to be high risk, they’re going to walk away confused.

That of course begs the question, who needs to change? Those educating consumers about credit scores or the lenders who are moving away from them?

Before educational services shift though, it would probably make sense if the lenders can prove that their non-FICO dependent systems will work in the long run. And the sentiment among many lenders is that there are plenty of flawed models out there that will inevitably fail. That makes a shakeout not just a matter of if, but when.

Six months after LendIt, everybody is still standing. Whispers from in and around Money2020’s halls and exhibit floor revealed that the confident lenders wish the correction would happen sooner rather than later but that they are prepared to wait however long it takes.

Right now, confidence about the future on the commercial finance side came in at an 83.7 out of 100, according to the Small Business Financing Report. While there are no other points of reference to compare that to, industry captains are generally very bullish.

That could mean that for those secretly under tremendous pressure already, you could be left waiting for a shakeout for a very long time.

MCA & Small Business Lending’s Compound Annual Growth Rate (CAGR)

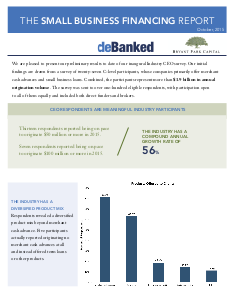

October 25, 2015 If you haven’t seen the industry’s first Small Business Financing Report prepared by Bryant Park Capital and deBanked, you can DOWNLOAD IT HERE. These are the only statistics from the survey that are being shared publicly. A more comprehensive report will be privately available about three weeks from now.

If you haven’t seen the industry’s first Small Business Financing Report prepared by Bryant Park Capital and deBanked, you can DOWNLOAD IT HERE. These are the only statistics from the survey that are being shared publicly. A more comprehensive report will be privately available about three weeks from now.

Seven of the respondents in the study were on pace to originate more than $100 million in 2015 and overall the industry was found to have a three-year Compound Annual Growth Rate (CAGR) in originations of 56%. For comparison’s sake, OnDeck had an originations CAGR of 159% from 2012 to 2014 according to their quarterly reports.

The numbers show an explosive industry and evidence as to why OnDeck may have been the first to go public. CAN Capital, by contrast has a five-year originations CAGR of 29% according to Orchard Platform. While perhaps lower than the industry average, it’s an astounding figure considering they’re a 17-year old lender.

According to Morgan Stanley analysts, a broad evaluation of “marketplace lending” originations will continue to grow at a CAGR of 47% through 20%.

There is apparently a lot more room for growth.

The Industry’s First Small Business Financing Report Revealed

October 25, 2015deBanked teamed up with Bryant Park Capital, an investment bank providing M&A and corporate finance advisory services to emerging growth and middle market public and private companies, to conduct the industry’s first comprehensive report.

Our initial findings are drawn from a survey of twenty-seven C-level participants, whose companies primarily offer merchant cash advances and small business loans. Combined, the participants represent more than $1.9 billion in annual origination volume. The survey was sent to over one-hundred eligible respondents, with participation open to all of them equally and included both direct funders and brokers.

- Thirteen respondents reported being on pace to originate $50 million or more in 2015.

- Seven respondents reported being on pace to originate $100 million or more in 2015.

Analyzing the origination volume of participants over a three-year period, the industry was determined to have a:

Compound Annual Growth Rate of 56%.

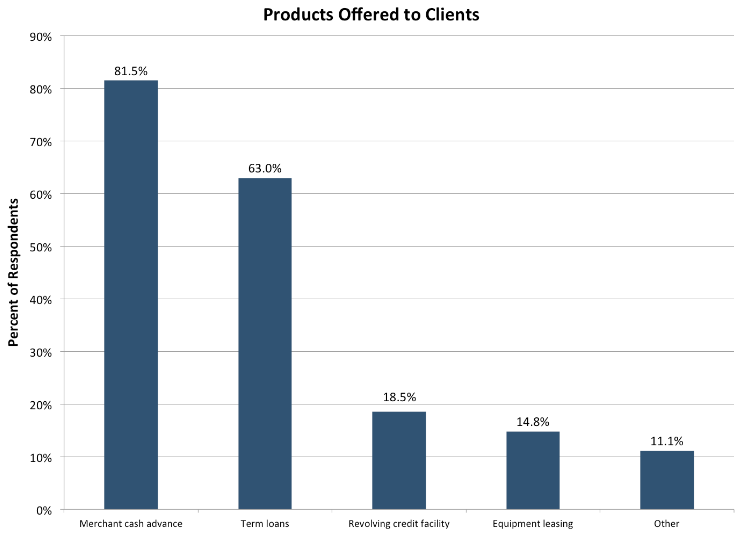

THE INDUSTRY HAS A DIVERSIFIED PRODUCT MIX

Respondents revealed a diversified product mix beyond merchant cash advance. Five participants actually reported originating no merchant cash advances at all and instead offered term loans or other products.

THE INDUSTRY CEOS HAVE A CONFIDENCE INDEX OF 83.7

Based on responses from CEO/participants asked to give their confidence level in the continued success of the small business lending/MCA industry over the next 12 months on a scale of 0–100, with 100 being the highest.

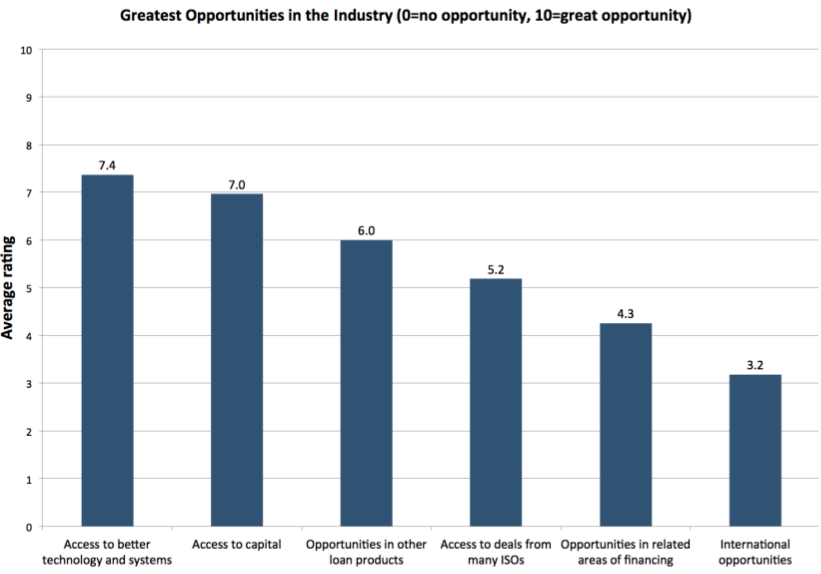

ACCESS TO BETTER TECHNOLOGY AND SYSTEMS IS THE GREATEST OPPORTUNITY IN THE INDUSTRY

Based on responses from participants asked to score the importance of opportunities on a scale of 0–10, with 10 being the highest.

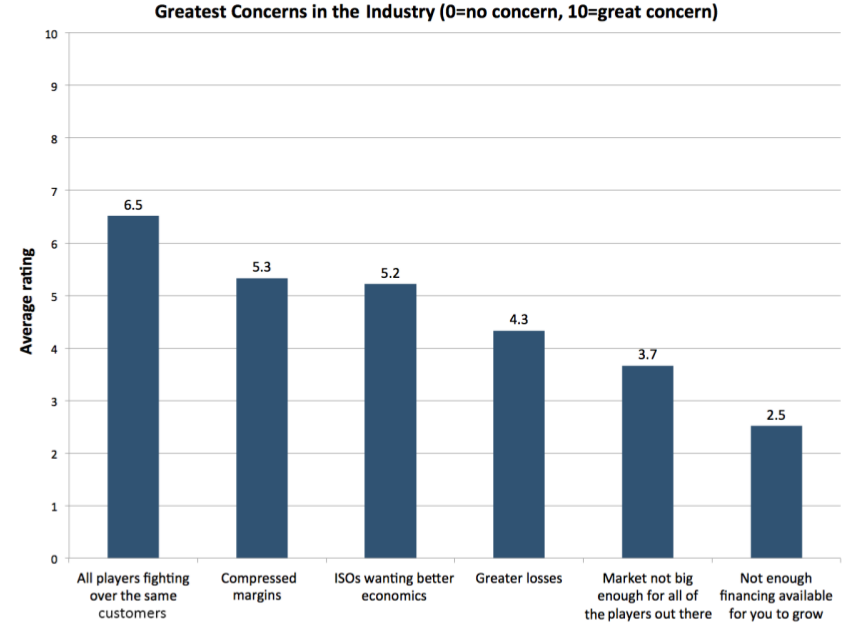

ALL PLAYERS FIGHTING OVER THE SAME CUSTOMERS IS THE GREATEST CONCERN IN THE INDUSTRY

Based on responses from participants asked to score their concerns on a scale of 0–10, with 10 being the highest.

The identities of participants and their individual responses are confidential. Participants were asked a total of 27 questions and had the ability to waive a response to any question, including the disclosure of their identity to the surveyors themselves.

Survey participants are eligible to receive the full anonymized report. Industry players who complete the full survey will automatically receive a full copy of this report. If you are not part of an operating company in the industry and you would like to obtain a copy of the report or participate in the survey, please contact Bryant Park Capital or deBanked.

DOWNLOAD THE PDF VERSION

Lenders Subject to Section 1071 of Dodd-Frank May Find Silver Lining in CFPB’s Roll Out of New HMDA Rules

October 23, 2015 Last week, the CFPB finalized its update to the reporting requirements of the Home Mortgage Disclosure Act (HMDA) regulations. Under the new rules, the CFPB expects that the number of non-depository institutions that will be required to report may increase by as much as 40 percent. This will lead to a sizable increase in the total number of records reported.

Last week, the CFPB finalized its update to the reporting requirements of the Home Mortgage Disclosure Act (HMDA) regulations. Under the new rules, the CFPB expects that the number of non-depository institutions that will be required to report may increase by as much as 40 percent. This will lead to a sizable increase in the total number of records reported.

Given the breadth of the new rules and the additional compliance efforts they will require, the CFPB has set January 1, 2018 as the effective date of the new regulations. Given that the Bureau could have chosen January 1, 2017 as the effective date, the longer lead time is welcome news for many in the mortgage industry.

The longer lead time may also be positive news for small business lenders that will be subject to the new Small Business Data Collection rule required by the Dodd-Frank act. Section 1071 of the act requires the CFPB to issue implementing regulations. The Bureau has yet to begin its work on the new rule but some small business lenders have already voiced concerns about the costs of other regulations implemented pursuant to Dodd-Frank. They argue that these costs have already begun to restrict access to small business credit.

A well-timed roll out of the new data collection rule could reduce some of these costs. Having adequate time to develop and implement regulatory compliance procedures in a cost-effective manner will lessen the financial impact to small business lenders. This in turn will allow lenders to minimize the new rule’s impact on credit availability to small businesses.

Once the Small Business Data Collection rule is finalized, small business lenders should be given a sufficient period to adjust to the new requirements, just as the CPFB has done for mortgage lenders with the new HMDA rules. HMDA was enacted in 1975 and lenders have been subject its reporting rules for decades. Yet the increased reporting requirements of the revised rules more than justify a two year lead period.

A similar lead period is just as, if not more important for the small business lenders that will be subject to the new data collection rule. The Dodd-Frank act was enacted just five years ago and requires reporting about small business lending that has never been required before. Lenders will need adequate time to develop the new systems required to meet their reporting obligations.

The CFPB’s conscientious roll out of the HMDA revisions is a rare regulatory silver lining. Let’s hope small business lenders get one too.

Meet the Source: How Jared Weitz and United Capital Source became one of the industry’s fastest growing shops

October 23, 2015Jared Weitz came from humble beginnings and nearly settled for a humble fate. But associates say an ordinary, uneventful life wouldn’t have suited him – he works too hard and figures things out too quickly.

Almost ten years ago Weitz, 33, was parking cars to earn money for community college. After finishing at St. Johns University, he almost made plumbing his career. But now he’s CEO of United Capital Source LLC, an alternative-finance brokerage with deal flow of between $9 million and $10 million a month and an annual growth rate of over 65 percent.

Business associates, former bosses and his small cadre of employees all seem to revere Weitz for his honesty and straightforwardness. They consider him a personal friend. They say he continues to grow as a businessman and as a human being while taking pleasure in helping others do the same.

Geographically, Weitz has the good fortune to know where he belongs – the city of New York is in his DNA. “Every time I fly back,” he said, “I’m so happy to land.”

His love affair with the city began in Brooklyn. He was born there and raised in a Brighton Beach apartment in the shadow of Coney Island. When he was 16, the family moved to Oceanside on Long Island.

As the second of six children, Weitz had to come up with the money for college on his own. “My older sister and I had to pay our way,” he said. “Everybody else, my dad was able to cover.” He started school at Nassau Community College, selling cell phones and parking cars at night.

But then came an abrupt change. Once Weitz saved enough money, he transferred to Tulane University in New Orleans to pursue a relationship with a woman who was finishing her studies there. He attended classes part-time, worked as the athletic director at the Jewish Community Center, tended bar in a Mexican restaurant and served summonses for a law firm.

But then came an abrupt change. Once Weitz saved enough money, he transferred to Tulane University in New Orleans to pursue a relationship with a woman who was finishing her studies there. He attended classes part-time, worked as the athletic director at the Jewish Community Center, tended bar in a Mexican restaurant and served summonses for a law firm.

The relationship with the woman fizzled, but Weitz made lasting friendships during his days down south. His old roommate in New Orleans, who now practices law in Atlanta, serves as counsel for United Capital Source.

When Weitz had been in New Orleans for two years, Hurricane Katrina struck. He evacuated to Houston, where he stayed in a Holiday Inn for two weeks before realizing he wouldn’t be able to return to southern Louisiana anytime soon. The magnitude of the devastation was just too great.

Shouldering the duffel bag of belongings he had managed to pack on his back during the evacuation, he returned to New York, enrolled in St. John’s University and began working in sales for Honda Financial Services and parking cars.

Weitz had started school expecting to become a teacher. He had grown up with younger siblings and liked leadership roles, which convinced him teaching would be a good fit.

Still, many of his college jobs had required him to sell. As a bartender, for example, he promoted drink specials. As an athletic director he convinced people to sign up for classes. “Everything that I took to naturally wound up being in the sales, marketing and finance arena,” Weitz observed.

When he was nearly finished at St. John’s, Weitz was parking a car for an acquaintance who offered him a job as a union plumber. Suddenly, he was making $27 an hour and had health benefits. “It was a big breather for me,” Weitz recalled.

He quit his three jobs and labored as a plumber from 7 a.m. to 3 p.m. School started at 3:30 p.m. for him and stretched into the evening. But when he finished his degree, working as a teacher for $35,000 to $40,000 a year no longer seemed attractive.

Besides, his plumbing work didn’t center on toilets. On typical commercial plumbing jobs he did things like install air, medical and gas lines in hospitals. He was reading blueprints and bidding for jobs. A promotion to foreman didn’t seem that far off.

At about the same time, near the end of 2006, a friend, Mike Caronna, landed a job at Bizfi, formerly known as Merchant Cash and Capital (MCC), The company, which had just started and had only a few employees, was looking for underwriters.

As fate would have it, Weitz fell into a conversation with a fellow union plumber, one who had been on the job for 30 years. The older man reminded him that his wages would never climb much higher than they were right now. The veteran plumber then showed the younger man his hands, bent from decades of holding tools. “That got me thinking,” Weitz said.

He asked his friend Caronna to arrange a job interview at MCC. He got an offer and took a 90-day leave from his plumbing job to give the world of finance a try. “After about two weeks, I knew it was for me,” he said of the alternative-finance industry. It was by then the beginning of 2007.

Weitz excelled as an underwriter, and the company CEO, Stephen Sheinbaum, picked him and four others for a sales contest. Sheinbaum gave them some leads and turned them loose. Weitz won the competition but asked his boss to help him gain experience in business development and operations before taking on a sales position.

Sheinbaum was happy to comply. “He is one of the best and the brightest in the space,” he said of Weitz.

So, at age 25, Weitz found himself building a business development department by cultivating relationships with ISOs and persuading them to send business to MCC. “It was amazing,” he said of those days. “That was a big opportunity.”

Weitz learned the mechanics of the business. He found that the right ISO can originate good deals and a bad ISO can ruin deals. He learned the politics of when to talk, when to remain silent and when to let someone vent.

Then Weitz and a good friend at MCC, Anthony Giuliano – who’s now managing partner of Sure Payment Solutions – worked out how they could improve the MCC sales effort. They pitched Sheinbaum on the idea of having a second internal sale force, and that led to the birth of Next Level Funding (NLF), a division of MCC.

Weitz and Giuliano each owned 10 percent of NLF, and MCC owned 80 percent. “I’m 26, about to be 27, and I’m like, ‘You did it, Man,’” Weitz said as he looked back.

After about four months, NLF absorbed MCC’s original sales division. Next, Giuliano and another executive, Paul Giuffrida, decided to leave MCC. Weitz felt torn. He felt an allegiance to Giuliano and respected Giuliano’s knowledge of programming – a subject that was alien to him. Yet Sheinbaum had provided Weitz a series of opportunities.

Weitz stayed at MCC but felt he deserved to become chief sales officer. When that didn’t happen, he sold his shares back to the company at a dramatically reduced price to extricate himself from a non-compete clause and set off to start United Capital Source (UCS).

With a five-figure investment, Weitz and his then partner, started UCS in January of 2011 in a 250-square-foot office in Long Beach, L.I. Weitz invested about 90 percent of the money he had saved while working at MCC.

Jon Baum left NLF with Weitz and became the first UCS employee. Within a week or two, Danielle Rivelli, left NLF to join UCS, and Weitz put the remaining 10 percent of his savings into the business to meet the expanded payroll. Today, Baum and Rivelli are UCS sales managers.

Jon Baum left NLF with Weitz and became the first UCS employee. Within a week or two, Danielle Rivelli, left NLF to join UCS, and Weitz put the remaining 10 percent of his savings into the business to meet the expanded payroll. Today, Baum and Rivelli are UCS sales managers.

The first month UCS was open, it funded $240,000 in deals. “It just felt good to be on my own and start funding deals,” Weitz said. From the beginning of UCS, he won praise from funders for bringing them the right kind of deals with merchants who were likely to repay.

“He really has the pulse of the marketplace and what a lender is looking for,” said Todd Sherer, who handles business development for Entrepreneur Growth Capital. “He doesn’t waste time giving you transactions that don’t fit in your box.”

That’s because doing things right means a lot to Weitz. “He is one of the most straightforward, honest, high-integrity people I have met in the industry,” said Steven Mandis, adjunct associate professor at the Columbia University Business School and chairman of Kalamata Capital LLC.

He’s won the OnDeck seal of approval. “OnDeck has a rigorous and extensive background check process as part of our broker certification process,” said Paul Rosen, OnDeck’s chief sales officer. “Jared Weitz and United Capital have passed our screens and process and are currently active brokers for OnDeck.”

And with time, Weitz has learned patience. He was sometimes short with funders when he started his company but has matured into a pleasant person to deal with, said Heather Francis, CEO of Elevate Funding. “I’ve seen that growth with him,” she said.

All of those good qualities soon came together to help UCS succeed. Within four months of its launch, the company rented a 1,500-square-foot office in Garden City and hired two more people. Next came a 3,200-square-foot office in Rockville Centre and three more employees.

“The company was growing and gaining traction,” Weitz recalled. “I bought out my original partner.” Since then, Vincent Pappalardo has invested in UCS and become a minority partner.

Meanwhile, the lease was expiring on Long Island, and Weitz felt the time had come to move to Manhattan. That would enable the company to draw employees from throughout the region and not just Long Island.

“We decided to bite the bullet and pay the excess money to move to the city because we believed it would be better for the business,” Weitz said. He added two people and rented a 5,500-square-foot space near Penn Station in the Garment District in September of 2014.

Within three months of making the move to Manhattan, business doubled. “Being in a faster-paced environment caused the business to go through another growth phase,” he said. After nine months in the city, UCS is now taking over a whole 8,500-square-foot floor of the same building.

Within three months of making the move to Manhattan, business doubled. “Being in a faster-paced environment caused the business to go through another growth phase,” he said. After nine months in the city, UCS is now taking over a whole 8,500-square-foot floor of the same building.

UCS remains a small shop in terms of headcount with 21 people, but the company’s funding numbers equal the output of many brokerages five times its size. Twelve of the UCS employees work in sales, with the others engaged mainly in underwriting, operations and customer service.

Less than 2 percent of UCS’s funding volume comes from broker business. “We self-generate all of our business,” Weitz said, declining to elaborate too much on his company’s marketing efforts.

“My salespeople – bar none – are the best in the industry,” he claimed. “Much like the Navy has the SEALS and the Army has the Rangers, there are groups in the industry that can do triple or quadruple what other people do because that’s just the way they are.” His people fund an average of $750,000 per month per person in new business, while his renewals reps fund well into the 7-figure range per person.

UCS salespeople achieve their results because they have detailed knowledge of the industry, Weitz said. The staff’s understanding of alternative finance doesn’t end with sales but also includes underwriting and finance, he noted. “That’s what makes you a very good and knowledgeable sales rep,” he maintained.

His salespeople don’t just tell a client what he or she wants to hear. They take the time to understand the client’s financial situation. “They know how to read a profit and loss statement, a balance sheet and tax returns,” Weitz said.

ARE THE BEST IN THE INDUSTRY”

While 90% of Weitz’s sales team has a college degree, most of the salespeople have come from outside the industry, he said, noting that one was with Sleepy’s, the mattress company. Another was selling memberships at a gym, one worked for a credit card processing company, two were barbers and one had just graduated from college.

UCS doesn’t make double-digit commissions because the company isn’t over-charging merchants, Weitz maintained. The company does not obtain excess funding that a customer can’t afford or increase the factor rate to dangerous levels, he noted.

“You’re not really helping the merchant” by providing too much capital, Weitz asserted. “You’re sucking the blood out of him before he goes away. That’s not why I’m in business.”

A clean record will also prove beneficial when federal regulation comes to the industry, he said. Integrity in the workplace can also spill over into other parts of a person’s life, Weitz believes.

As UCS grew larger and Weitz grew older, he saw his employees rent their first apartments and then buy their first homes. He learned then that he had taken on more responsibility than was apparent to him at first.

As UCS grew larger and Weitz grew older, he saw his employees rent their first apartments and then buy their first homes. He learned then that he had taken on more responsibility than was apparent to him at first.

To accommodate the employees he added a human relations department and commissioned a company handbook. He’s also started marketing, finance, operations and other departments.

He’s lost only four employees because he pays them well, respects their time and doesn’t view their youth as a liability.

Meanwhile, talking daily to merchants and hearing about their heartaches and triumphs has humbled and matured Weitz. Seeing how the merchants’ choices panned out or fell short also shaped him and helped him grow up a little, he said.

Weitz has found time in his 70-hour workweek to meet his future bride. They’re planning to wed next year, and he plans to invite his entire staff. “It wouldn’t feel right without them,” he said.

Weitz has skipped the Ferrari, Rolls Royce and mansion because he didn’t feel he needed them. But even without those status symbols, it’s clear that Weitz has avoided settling for a humble fate.

As for what comes next, UCS is said to be developing an online marketplace to take their business to the next level, though Weitz declined to provide specific details about how it will work. “We’re on pace to do more than $100 million worth of deals a year,” Weitz said. “And as far as we’ve come, I feel like this is still just the beginning.”

Did Your Deal Slip Out The Back Door?

October 22, 2015Gil Zapata found himself in the right place at the right time to catch someone red-handed at backdooring, the practice of stealing an alternative-funding deal and cheating the original ISO or broker out of the commission.

It seems that Zapata, who’s president and CEO of Miami-based Lendinero, was sitting in a client’s office about three years ago when the phone rang. The call came from an employee of a direct funder that had turned down Zapata’s deal to fund the merchant. Now, the employee was offering funding from another source without notifying Zapata. Fortunately, the merchant didn’t accept the surreptitious funding, Zapata said. “There’s a huge loyalty factor with maybe 50 percent of the clients an ISO has under their belt,” he noted.

It seems that Zapata, who’s president and CEO of Miami-based Lendinero, was sitting in a client’s office about three years ago when the phone rang. The call came from an employee of a direct funder that had turned down Zapata’s deal to fund the merchant. Now, the employee was offering funding from another source without notifying Zapata. Fortunately, the merchant didn’t accept the surreptitious funding, Zapata said. “There’s a huge loyalty factor with maybe 50 percent of the clients an ISO has under their belt,” he noted.

But many merchants sign up for backdoor deals out of ignorance, callousness or desperation, and the problem seemed to gather momentum in the first quarter of this year, according to Cheryl Tibbs, owner of Douglasville, Ga.-based One Stop Funding LLC.

When Tibbs found herself the victim of backdooring a few months ago, the merchant’s loyalty to the ISO prevailed once again. “Because of the relationship we had with the merchant, he let us know and didn’t go along with it,” she said.

Both cases fall into one of the categories of backdooring. This type usually occurs when an ISO or broker submits a deal and the funder declines it, said John Tucker, managing member of 1st Capital Loans LLC in Troy, Mich. An employee of the funder then takes the file and offers it to other funders, often those that accept higher-risk deals. The funder’s employee conveniently forgets to include the originator in the commission, Tucker said. Meanwhile, the employee’s boss might know nothing of the post-denial goings-on.

In another variety of backdooring, ISOs or brokers deceptively claim that they’re direct funders. They solicit deals in online forums, by email message or over the phone, and then they offer the deals to companies that really do function as direct funders. In many cases, the fake funders pocket the entire commission, Tibbs said.

“I’m bombarded with probably 10 emails every day of the week from a supposedly new lender that wants my business, and they’re really just a broker shop like we are,” she maintained.

To guard against both kinds of backdooring, ISOs and brokers should know their funding sources, everyone interviewed for this article suggested. “What we’ve done is tighten up on how we do submissions,” Tibbs said. “We’re very particular about which lending platforms we use.” Although her company has contracts with 60 to 70 funders, it uses only three or four regularly, she noted. “Shotgunning” deals to lots of potential funders invites backdooring, Tibbs said.

To guard against both kinds of backdooring, ISOs and brokers should know their funding sources, everyone interviewed for this article suggested. “What we’ve done is tighten up on how we do submissions,” Tibbs said. “We’re very particular about which lending platforms we use.” Although her company has contracts with 60 to 70 funders, it uses only three or four regularly, she noted. “Shotgunning” deals to lots of potential funders invites backdooring, Tibbs said.

Tibbs also scrutinizes deals to determine which funder would provide the best fit. That way, fewer deals are declined and thus fewer became candidates for backdooring by unscrupulous funder employees. “We have a system. We scrub it. We do the numbers,” she said of her company’s close attention to underwriting, which helps determine what funders would accept the deal.

Her company also keeps a watchful eye on every deal’s progress. “We know exactly where the deal is, and who’s looked at it,” she said. It also helps to insist upon having a dedicated account rep, Tibbs emphasized. That way she can form a relationship that discourages backdooring.

Perhaps the most basic safeguard comes with determining that the company claiming to fund the deal really has the capital to do it and isn’t just shopping the file to real funders. Tucker advised using Internet searches to turn up evidence that the supposed funder really isn’t another ISO or broker. Searches should reveal press releases on equity rounds that direct funders have received, for example. If open-ended Web searches don’t produce satisfying results, check state registrations, he said.

ISOs and brokers can also prevent backdooring by avoiding sub-agent status, Tucker cautioned. “I don’t know why guys would want to be a broker to a broker,” who could steal commissions, he observed. One exception to the sub-agent problem comes with agents who are just entering the business and are receiving training from a broker, Tucker said. In another exception, sub-agents may find another broker has competitive advantages that aren’t easy to duplicate – like a $20,000 monthly marketing budget to generate sales leads, he continued. Or perhaps the other broker gets low base pricing from a funder that allows for reduced factor rates without sacrificing part of the commission.

Brokers and ISOs can also protect themselves from backdooring – and just in general – by maintaining their relationships with merchants, even those who’ve been denied funding from four or five sources, Zapata said. An increase in revenue or jump in credit worthiness can qualify them a few months later, and other brokers or funders may be soliciting them in the meantime, he said.

Brokers and ISOs can also protect themselves from backdooring – and just in general – by maintaining their relationships with merchants, even those who’ve been denied funding from four or five sources, Zapata said. An increase in revenue or jump in credit worthiness can qualify them a few months later, and other brokers or funders may be soliciting them in the meantime, he said.

Then there’s the possibility of collective action against backdooring. An association or some other entity representing the industry could compile a database of companies accused of backdooring, Tibbs said. “Just as there’s a black list of merchants that have been red-flagged from getting merchant cash advances, there should be some type of database of funders that frequently backdoor deals – that way, ISOs know to stay away from them,” she maintained.

The database would also prompt owners and managers of direct-funding companies to crack down on employees who use nefarious tactics, Tibbs continued, because the heads of companies would want to stay off the list.

But finding the financial support and staffing for such a database might prove difficult, according to Tucker. He noted that the card brands, such as Visa and MasterCard, maintain a match list of merchants barred from accepting credit cards. But the card brands have vast resources and a keen interest in the list, he said.

Requiring funders to pay to register might discourage ISOs and brokers from posing as funders, Tibbs suggested. But that, too, would require an infrastructure and would demand financial investment, sources said.

Still, everyone interviewed agreed that the industry should police itself with regard to backdooring instead of inviting federal regulators to enter the fray. “The federal government will mess with pricing without understanding every merchant can’t get low factor rates because there’s too much risk on the deal,” Tucker warned.

Perhaps extending the protection period in funding applications would help guard ISOs and brokers, Zapata said. But he cautioned that making the time period too long could interfere with the free market.

Keeping backdooring in perspective also makes sense, Zapata said, noting that merchants often receive multiple funding offers because everyone in the industry is basing phone calls on the same Uniform Commercial Code filings regarding distressed merchants.