business cash advance

Is Alternative Lending a Game of Thrones?

April 8, 2014 It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…

This blog has been many things over the years, all of it relative to who the reader was. It has encouraged and deterred, informed and confused, made people laugh or stoked their anger. The merchant cash advance industry it spoke of had been small. Annual funding volume was a billion or two or three, a blip of a blip on nobody’s radar. There was a sense of unity, a shared objective amongst competitors. They were guided by one dictum, “grow, but don’t rock the boat.”

But opportunity enticed everyone, the good, the bad, and the unexpected, and it brought a relatively peaceful chapter to an end. Winter is coming, Eddard Stark would likely say of the uncertainty that hangs in the air. Merchant cash advance has become a spoke in the alternative lending wheel that is spinning forward uncontrollably. Non-bank financing has become a worldwide phenomenon virtually overnight, setting the stage for the lords of funding to play a game of thrones. Investors with bottomless pockets are emptying them, government agencies are assessing the landscape or crafting responses, and journalists stand ready to shape public opinion.

This is a transformational moment in human history, perhaps bigger than what Facebook did for social media. Individuals are taking control of the monetary supply. Strangers pay each other in bitcoins, neighbors are bypassing banks for loans and lending to each other instead, and businesses are rising and falling with the funding they get from other private businesses. Winter is coming for traditional banking. The realm calls for a new king.

Wonga’s epic rise is being countered by both regulatory and religious resistance, and the man who dared the world to lend algorithmically has admitted defeat. Peer-to-peer lenders have encountered massive regulatory setbacks on their road to stardom and merchant cash advance companies are currently engaged in a civil war over best practices. Winter is coming indeed.

The Kings

Lending Club

Lending Club

In what is perhaps their first step towards an IPO this year, Lending Club is reducing transparency over its loan volume. Up until April 3rd, anyone could see how many loans they issued on a daily basis. Now this information will only be available quarterly. Peter Renton in his Lend Academy blog shared his belief that the move was entirely tied to the impending IPO. “Without this daily loan volume information their stock price will be less volatile and they will be able to “manage the message” with Wall Street every quarter,” Renton wrote.

OnDeck Capital

OnDeck Capital is also in contention for an IPO this year. A year ago a company executive hinted that becoming a public company would not be on the agenda for consideration until 2015, yet I am hearing rumors that they may make a late 2014 go at it. Such rumors hold weight in light of reports that they are cleaning up their ISO channel. Insiders on DailyFunder are saying that resellers with abnormally high default rates are in jeopardy of being cut off.

OnDeck Capital is unique in that outsiders chastise them for their rates being too high while insiders argue their rates are too low to be profitable. It’s a classic example of how tough the court of public opinion can be on a lender even if they are not getting rich off their loans.

Kabbage

Kabbage came and conquered the entire online space before anyone had a chance to blink. PayPal, ebay, Amazon, Etsy, Yahoo, Square, they claimed those territories for themselves and then launched an attack into the brick and mortar space. Kabbage’s secret value is their patents. They are a serious player on a serious path.

CAN Capital

CAN Capital’s greatest weakness is their lifespan. They’ve managed to stay on top after 16 years in the business but that makes them old enough to be Kabbage’s grandfather by today’s tech standards. As a pre-dot com era business, it’s impossible to argue against their sustainability. If anyone has alternative lending figured out for both the good times and the bad, it’s CAN Capital.

The Lords

The Government

Peer-to-peer lending has already been under strong scrutiny from the Federal Government. Lending Club and Prosper are regulated by the Securities and Exchange Commission these days, but they may never be free of oversight. Just two months ago, the Federal Reserve published a report on trends in peer-to-peer business lending. They hinted at further regulation.

Peer-to-peer lending has already been under strong scrutiny from the Federal Government. Lending Club and Prosper are regulated by the Securities and Exchange Commission these days, but they may never be free of oversight. Just two months ago, the Federal Reserve published a report on trends in peer-to-peer business lending. They hinted at further regulation.

As small business owners are increasingly turning to this alternative source of money to fund their businesses, policy makers may wish to keep a close eye on both levels and terms of such lending. Because such loans require less paperwork than traditional loans, they may be considered relatively attractive. However, given the relatively higher rate paid on such loans, it may be in the best interest of the business owner to pursue more formal options. More research is required to understand the long-term impact of such loans on the longevity of the firm and more education to potential borrowers is likely in order.

– a 2014 Federal Reserve study

The Merchants

Once upon a time nobody talked about alternative lending online except for the companies offering it. Merchants didn’t talk about it with each other or there were too few businesses to give rise to centralized discussions. Today, merchants communicate and compare notes:

Merchants discuss PayPal’s working Capital program: http://community.ebay.com/t5/PayPal/PayPal-Working-Capital-Loan-DONT-SIGN-UP/td-p/17630207

Merchants discuss Square’s merchant cash advance program: http://www.mrmoneymustache.com/forum/welcome-to-the-forum/square-to-offer-small-business-loans-at-exorbitant-interest-rates/

Merchants discuss Kabbage: http://community.ebay.com/t5/Part-time-eBay-Sellers/Kabbage-quot-loans-quot/td-p/3002329

OnDeck Capital’s 30+ Yelp Reviews: http://www.yelp.com/not_recommended_reviews/FOndxpkaBRP6LVIlOv6Dfw

Potential Lending Club borrowers make their cases: http://www.lendacademy.com/forum/index.php?board=3.0

The Machines

Are computers better predictors of performance than humans? Some people think so. This debate will play a pivotal role in the future of alternative lending.

The Media

Public opinion will be at their mercy.

The Vulnerabilities

Commissions

Commissions

The bigger alternative lending gets, the juicier the stories become. Just last week, Patrick Clark of BusinessWeek dove head first into the reseller model, revealing insider commissions, the truth about buy rates, and the alleged antiquated practice of enlisting a broker to secure funding. On trial was a documented 17% commission, an example I believed to be an extreme case. For a long time commissions ranged between 5% and 10% on average. But there are some big names paying up to 12 points and others boasting of 14. All were topped by the mass solicitation I received a few days ago that promised a 20% commission. These kind of figures if they continue will become an easy target for journalists looking to portray the industry in a negative light.

Stacking

There is a raging civil war within the merchant cash advance community specifically over stacking. This is the instance that a merchant sells their future revenues to two or more parties at the same time, leading to multiple daily deductions from their sales. This debate is bound to spill out into the mainstream if it cannot be resolved on its own.

Technology

Some funding companies intend to license their automated underwriting technology to banks, potentially handing the keys of alternative lending’s greatest asset (speed) to traditional bankers. It is unlikely that banks would engage in some of the high risk deals that alternative lenders target but they could recapture the top credit tier borrowers that have been flocking away from them.

Also at stake here is the sustainability of algorithmic underwriting. There are critics that believe computers appear to make great decisions during good economic periods but suffer during downturns. Do the technology based funding companies have enough data to weather a future economic storm?

So many things are happening at once, that it’s impossible to know what fate awaits the realm. Will there be a new king or will alternative lending fall apart like a house of cards?

For those of us climbing to the top of the food chain, there can be no mercy. There is but one rule: hunt or be hunted.

-Frank Underwood

May the best man win.

Join Me at Transact 14

April 1, 2014 I’ll be at the ETA’s Transact 14 Conference in Las Vegas next week (Apr 8 – 10) wearing my journalist hat for DailyFunder. DailyFunder is currently the only publication dedicated to merchant cash advance and alternative lending and is a media sponsor of this year’s event. All attendees will be able to pick up a free copy of the latest issue of the magazine at designated distributions bins.

I’ll be at the ETA’s Transact 14 Conference in Las Vegas next week (Apr 8 – 10) wearing my journalist hat for DailyFunder. DailyFunder is currently the only publication dedicated to merchant cash advance and alternative lending and is a media sponsor of this year’s event. All attendees will be able to pick up a free copy of the latest issue of the magazine at designated distributions bins.

If you’re on the fence about going, allow me to convince you. The Annual ETA hosted conference is more than a social event or meet and greet. It’s a chance to ink deals, forge partnerships, and learn about opportunities that you’ll never hear about from the comfort of your office. Of course you’ll only get out of it what you put into it. The Who’s Who of payments and financing will be all in one place. Are you one of them?

CNBC will be broadcasting the event live. It’s been reported that this year’s show has enlisted a record amount of exhibitors.

Going to be our biggest show in history! MT @MWarehouse: Who's going to #ETATRANSACT next week in #Vegas? pic.twitter.com/5zFiUm8qbY

— Jason Oxman (@joxman) April 1, 2014

I’ll be taking photos and jotting down notes for both the live blog and post show recap for the May/June issue of the magazine. So if you’ve got something cool to show off, email me at sean@merchantprocessingresource.com or sean@dailyfunder.com and I’ll be happy to come pay you a visit.

pre-registration for the event closes in less than 5 hours but you’ll be to get tickets on site.

And of course if you’re planning to bring your wolf pack to Vegas, you might want to read DailyFunder’s helpful tips on how to keep your wolf pack in check. 😉

Hope to see you there.

Errol Damelin’s Legacy

April 1, 2014 Wonga’s been a point of interest ever since they tried to buy OnDeck Capital and set up shop in the United States. Far from your average run-of-the-mill UK-based payday lender, they rode the technology wave to international fame. Founder Errol Damelin doesn’t believe in human risk analysis as I’ve cited several times before. He lives by the law of data and algorithms are his muse.

Wonga’s been a point of interest ever since they tried to buy OnDeck Capital and set up shop in the United States. Far from your average run-of-the-mill UK-based payday lender, they rode the technology wave to international fame. Founder Errol Damelin doesn’t believe in human risk analysis as I’ve cited several times before. He lives by the law of data and algorithms are his muse.

But It hasn’t been all rainbows and unicorns to get to the top. The archbishop of Canterbury told Damelin that he wanted him competed out of existence. Wonga became a religious issue and then a parental one when parents protested that children were being solicited with payday loan offers. And there was the little problem of the algorithm not delivering flattering results. More than a year ago I wrote of my shock when I learned that their bad debt had risen to 41% of their revenues, an astoundingly poor figure for a system that was being heralded as superior to human risk analysis.

Wonga’s been accused of preying on women and ruining lives. They’ve had their sponsorships protested on religious grounds and Damelin himself has even faced criticism for his own religion from the dark bowels of the Internet.

It’s been said that it was never really about lending for Damelin, who often times categorized Wonga as a technology company (something we’ve heard before in the U.S.).

It’s been said that it was never really about lending for Damelin, who often times categorized Wonga as a technology company (something we’ve heard before in the U.S.).

Despite all the outside criticism, it’s been reported that Wonga’s customers are nearly twice as satisfied with them as they are with their banks and even more so than customers of Apple and Google. Wonga seems to make everyone upset but the borrowers, but it hasn’t been any consolation.

The UK’s Financial Conduct Authority’s intent to regulate them has been the last straw for Damelin. Weary of never ending battle, he is resigning from his post. Though it’s said he will continue to play a role, it’s clear that the mojo is gone. Wonga will be regulated, restrained, and will perhaps endure or be dismantled.

Damelin’s legacy is a 15 minute loan approval that is based off of 8,000 data points. He never proved that algorithms could assess risks better than humans, but he has inspired alternative lenders around the world to pursue ultra lean lending models built for massive scalability.

Great technology exists. Damelin dared us all to use it…

Yellowstone Capital Matures With New Executive Team

March 30, 2014 In an email newsletter that went out this morning, NYC-based Yellowstone Capital announced changes and additions to their executive team.

In an email newsletter that went out this morning, NYC-based Yellowstone Capital announced changes and additions to their executive team.

- Managing Partner Isaac Stern who has long been the public face of the firm is now the Chief Executive Officer.

- Marwan Salem is now the Chief Financial Officer.

- Josh Karp has been named the Chief Operating Officer.

Stern’s partner David Glass will keep his stake in the firm and continue to play an operational role.

The newsletter states, “Gangbuster growth hardly describes what Yellowstone Capital has experienced in the last 12 months. Deal flow has simply been huge.”

Yellowstone Capital was dubbed by DailyFunder to be one of the three most talked about funding companies of 2013. In perhaps recognition of the adage, if it ain’t broke, don’t fix it, the newsletter states, “Yellowstone Capital will continue to pursue less-drastic changes in its capital structure that preserve the winning formula.”

Merchant Cash Advance Syndication: Crowdfunding?

March 28, 2014 You might not have known this, but one of the most lucrative opportunities in merchant cash advance is the ability to participate in deals. It’s a phenomenon Paul A. Rianda, Esq addressed in DailyFunder’s March/April issue with his piece, So You Want to Participate?

You might not have known this, but one of the most lucrative opportunities in merchant cash advance is the ability to participate in deals. It’s a phenomenon Paul A. Rianda, Esq addressed in DailyFunder’s March/April issue with his piece, So You Want to Participate?

Syndication is industry jargon of course. You probably know the concept by its sexier pop culture name, crowdfunding. For all the shadowy rumors and misinformation that circulates out there about merchant cash advance companies, they’re similar to the trendy financial tech companies that have become darlings of the mainstream media.

Did you know that many merchant cash advances are crowdfunded? To date, no online marketplace has been able to gain traction in the public domain aside from perhaps FundersCloud, so crowdfunding in this industry happens almost entirely behind the scenes. There is so much crowdfunding taking place that it’s becoming something of a novelty for one party to bear 100% of the risk in a merchant cash advance transaction. Big broker shops chip in their own funds as do underwriters, account reps, specialty finance firms, hedge funds, lenders, and even friends and family members of the aforementioned.

Merchant cash advance companies find themselves playing the role of servicer quite often, which is coincidentally the model that Lending Club is built on. A $25,000 advance to an auto repair shop could be collectively funded by 10 parties, but serviced by only 1. Each participant is referred to as a syndicate. This is not quite the same system as peer-to-peer lending because syndicates are not random strangers. Syndication is typically only open to businesses, and most often ones that are familiar with the transaction such as the company brokering the deal itself.

In the immediate aftermath of the ’08-’09 financial crisis, some merchant cash advance companies became very mistrusting of brokers and deal pipelines were going nowhere. Underwriters had a list of solid rebuttals for deals they weren’t comfortable with. “If you want us to approve this deal so bad, why don’t you fund it yourself!,” underwriters would say. Such language was intended to put a broker’s objections over a declined deal to bed. But with all the money being spent to originate these deals, it wasn’t long until brokers stumbled upon a solution to put anxious merchant cash advance companies at ease. “Fund it myself? I’d love to, but I just can’t put up ALL of the cash.”

And so some brokers started off by reinvesting their commissions into the deals they made happen. That earned them a nice return, which in turn got reinvested into additional deals. Fast forward a few years later and deals are being parceled out by the truckload to brokers, underwriters, investors, lenders, and friends. There’s a lot of money to be made in commissions but anybody who’s anybody in this business has a syndication portfolio. The appetite for it is heavy. Wealthy individuals and investors spend their days cold calling merchant cash advance companies, brokers, and even me, trying to get their money into these deals. They know the ROI is high and they want in.

That’s the interesting twist about crowdfunding in the merchant cash advance industry. You can’t get in on it unless you know somebody. There are no online exchanges for anonymous investors to sign up and pay in. It requires back door meetings, contracts, and typically advice from sound legal counsel. A certain level of business acumen and financial prowess are needed to be considered. These transactions are fraught with risk.

That’s the interesting twist about crowdfunding in the merchant cash advance industry. You can’t get in on it unless you know somebody. There are no online exchanges for anonymous investors to sign up and pay in. It requires back door meetings, contracts, and typically advice from sound legal counsel. A certain level of business acumen and financial prowess are needed to be considered. These transactions are fraught with risk.

In Lending Club’s peer-to-peer model, investors can participate in a “note” with an investment as small as $25. This is a world apart from merchant cash advance where it is commonplace to contribute a minimum of $500 per deal but can range up to well over $100,000.

Lending Club defines diversification as the possession of more than 100 notes. At $25 a pop, an investor would only need to spend $2,500. With merchant cash advance, 100 deals could be $50,000 or $10,000,000. By that measure, syndication is crowdfunding at the grownup’s table, a table that doesn’t care about sexy labels to appease silicon valley, only yield.

Strange merchant cash advance jargon keeps the industry shrouded in mystery. Did you know that split-funding and split-processing are terms often used interchangeably? Or that they have a different meaning than splitting? Or that the split refers to something else entirely?

Do you know what a holdback is or a withhold? How about a stack, a 2nd, a grasshopper, an ISO, an ACH deal, a junk, a reup, a batch, a residual, a purchase price, a factor rate, or a UCC lead?

Paul Rianda did a great job detailing the risks of syndication, but there is one thing he left unsaid, and that’s if you’re going to participate in merchant cash advances, you better be able to keep up with the conversation.

At face value, syndication is nothing more than crowdfunding. But if your reup blows up because some random UCC hunting ISO stacked an ACH on top of your split while junking him hard and upping the factor with a shorter turn, you just might curse the hopper that ignored your holdback and did a 2nd. And on that note, perhaps it’s better that the industry refrain from adopting mainstream terminology. We wouldn’t want everybody to think this business is easy. Because it’s not.

One factor to consider is the actual product being crowdfunded. In equity crowfunding, participants pool funds together to buy shares of a business. In crowdlending, participants pool funds together to make a loan. But in merchant cash advance syndication, participants pool capital to purchase future revenues of a business. An assessment is made to predict the pace of future income and a discounted price is paid to the business owner upfront. That purchase price is commonly known as the advance amount.

Syndication has more in common with equity crowdfunding than crowdlending. If you buy future revenues and the business fails, then your purchase becomes worthless. There is typically no recourse against the business owner personally unless they purposely interfere with the revenue stream and breach the agreement. Sound a bit complicated? It is, but crowdfunding in this space is prevalent nonetheless. To get in on it, you need to know someone, and to do it intelligently, you better know what the risks are.

If you want to sit at the grownup’s table and syndicate, consult with an attorney first. There’s a reason this industry hasn’t adopted sexy labels. It isn’t like anything else.

The Best Free Lead Source

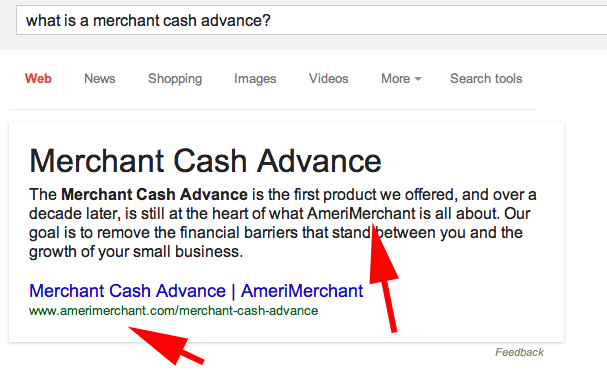

March 25, 2014In what is likely a Knowledge Graph hiccup, Google is giving New York-based AmeriMerchant a wonderfully free source of advertising. Merchant Cash Advance is a product in a multi-billion dollar a year industry. What is a merchant cash advance, you ask? Why it’s something that only AmeriMerchant invented and offers apparently.

What’s perhaps more ironic is that AmeriMerchant is famous for overturning another company’s patented claim to merchant cash advances. In the mid-2000s, AmeriMerchant led a charge against the alleged merchant cash advance inventor AdvanceMe. In a landmark case that overturned AdvanceMe’s patent and put AmeriMerchant’s CEO on the front page of the New York Times, merchant cash advance became the property of no single company. Today, merchant cash advances are offered directly or indirectly by more than a thousand companies nationwide.

I wonder how much AmeriMerchant is banking off this…

Fund it and Ask Questions Later

March 25, 2014 Ever since OnDeck Capital stopped doing verbal landlord references, the underwriting landscape of alternative lending has changed dramatically. Kabbage will supposedly fund applicants in just 7 minutes. Everybody’s under the gun to streamline their process, fund deals faster, and produce record breaking numbers month after month.

Ever since OnDeck Capital stopped doing verbal landlord references, the underwriting landscape of alternative lending has changed dramatically. Kabbage will supposedly fund applicants in just 7 minutes. Everybody’s under the gun to streamline their process, fund deals faster, and produce record breaking numbers month after month.

And why shouldn’t they? Investors are practically foaming at the mouth to get in on any and all kinds of alternative lending. Even Lending Club has thrown in the towel by no longer allowing investors to ask applicants questions. Prior to March 19th, applicants on Lending Club’s platform had the option to answer standardized questions about themselves and their purpose for seeking out a loan. This was set up to help investors feel more informed and comfortable. Once the loan was posted, prospective investors could ask the applicant additional questions of their own to help them decide if it was a deal they wanted to participate in. For example, “what are the interest rates on the credit cards you claim you want to consolidate?” That’s a fair question to ask someone seeking a debt consolidation loan.

Lending Club did away with the Q&A in the name of privacy but conceded in their blog that people are funding deals so fast that no one cares what applicants have to say.

We know that in the past some investors enjoyed reading these descriptions and answers, but as the platform has grown, fewer and fewer investors are using this approach to inform their decisions. Fewer than 3% of investors currently ask questions and only 13% of posted loans have answers provided by borrowers. Furthermore, loans are currently funding in as little as a few hours – well before borrower answers and descriptions can be reviewed and posted.

Loans are being fully funded by institutional investors and mom & pop investors before the applicant can even finish filling out the questionnaire.

The demand to invest outpaces the amount of loans that Lending Club can originate. In a call I had with Lending Club today as a potential investor, I was told that businesses were not even allowed to invest on their platform at this time because they’ll take up all the loans and leave nothing for the average mom & pop investors, the ones which have made their peer-to-peer fame possible.

The demand to invest outpaces the amount of loans that Lending Club can originate. In a call I had with Lending Club today as a potential investor, I was told that businesses were not even allowed to invest on their platform at this time because they’ll take up all the loans and leave nothing for the average mom & pop investors, the ones which have made their peer-to-peer fame possible.

In the Lend Academy blog forum, mom & pop investors debated the usefulness of the Q&A system. Some argued that responses from applicants allowed them to weed out folks with poor spelling and grammar. Others believed that a poorly worded response was better than someone who didn’t respond at all because it showed that they actually cared about the loan they were applying for.

There were folks that analyzed the applicants language on a scientific level, with one going so far as to cite this study: Peer-to-Peer Lending The Relationship Between Language Features, Trustworthiness, and Persuasion Success.

I am reminded of my underwriting days conducting merchant interviews prior to a final decision. There were applicants that looked good on paper that came across as completely clueless about their business over the phone. Like beyond clueless. And then there were applicants that looked ugly on paper that really impressed me with their command of business subject matter. What shocked me were the former and it’s a testament to how tricky business lending is. Those phone calls impacted my final decision all the time.

But in today’s world where funders are dealing in kilos of cash instead of nickels and dimes, there’s a growing impatience over non-automated things like interacting with the applicant. Fund the deal and ask questions later!

The vast majority of merchant cash advance companies still conduct applicant phone interviews and there’s a part of me that hopes that never changes. As investors grow restless for new pools of loans or advances to participate in, I fear there will be more underwriting sacrifices to satisfy that demand.

The vast majority of merchant cash advance companies still conduct applicant phone interviews and there’s a part of me that hopes that never changes. As investors grow restless for new pools of loans or advances to participate in, I fear there will be more underwriting sacrifices to satisfy that demand.

It was only a year ago that I laughed at my friend in commercial banking when he told me a small business loan application begins with lunch and a few rounds of golf. “It’s about relationships,” he said. That couldn’t be less true in peer-to-peer lending where the goal is to know as little as possible about where the money is going. I see that mentality creeping into merchant cash advance as well. Sure, there are folks that point to thousands of data points aggregated through online sources but it only takes a 5 minute phone call to determine that an applicant is completely full of crap.

Maybe Jeremy Brown of RapidAdvance was on to something. When Will the Bubble Burst?

Join the discussion about this on DailyFunder.

Kabbage Has Leverage With Patents

March 23, 2014 If you’re planning on introducing new technology to the merchant cash advance or alternative business lending space, you might want to start filing a patent, or else end up violating someone elses.

If you’re planning on introducing new technology to the merchant cash advance or alternative business lending space, you might want to start filing a patent, or else end up violating someone elses.

I’ve brought up Kabbage and patents before, but another one of theirs caught my attention. In their invention named, Method and Apparatus to Evaluate and Provide Funds in Online Environments, they claim the right to an automated application, scoring, approval, and funding model for online businesses.

Will their claim interfere with what the rest of the industry is already doing or has set their sights on?

Kabbage CEO Rob Frohwein is no amateur to the intellectual property game. With more than 30 patents to his name, Intellectual Asset Magazine once referred to him as one of the world’s top intellectual property strategists. That makes Kabbage a rather dangerous foe in the booming world of alternative lending.

The above referenced patent is summarized as:

(a) receiving mandatory information about a user and storing the mandatory information in an electronic computer database; (b) allowing a user to choose whether to enter optional information about the user, and upon receiving the optional information, storing the optional personal information in the electronic computer database; (c) computing a score using the mandatory information and optional information if provided; and (d) determining whether to approve a transfer of funds using the score, and upon approval initiating an electronic transfer of funds from a cash server to an account associated with the user, (e) wherein upon the user entering the optional information the user receives an incentive.

If you read through the entire description of the patent and scan through the photos, you’ll notice they included an option for applicants to submit additional data that could reward them with a higher approval. Such data includes sharing all their LinkedIn and Facebook friends with Kabbage, which Kabbage says it will use to systematically evaluate, determine the ones that are business owners, and solicit them.

Additionally, it outlines how such optional data could be used in their assessment of the applicant:

TABLE III

site metric significance

FACEBOOK user has more friends favorable

FACEBOOK user has less friends unfavorable

FACEBOOK fan page existsf or user favorable

FACEBOOK no fan page for user unfavorable

FACEBOOK more people like user’s fan page favorable

FACEBOOK less people like user’s fan page unfavorable

FACEBOOK more people comment on user’s fan page favorable

FACEBOOK less people comment on user’s fan page unfavorable

FACEBOOK new articles posted more frequently on user’s favorable fan page

FACEBOOK new articles posted less frequently on user’s unfavorable fan page

TWITTER user has more followers favorable

TWITTER user has less followers unfavorable

TWITTER user’s followers have more followers favorable

TWITTER user’s followers have less followers unfavorable

LINKEDIN user’s company has more employees favorable

LINKEDIN user’s company has less employees unfavorable

LINKEDIN user’s profile has more views favorable

LINKEDIN user’s profile has less views unfavorable

In their filing they also submitted what they believe to be the definition of a merchant cash advance.

A merchant account advance is an advance by an advancing party that uses a seller’s merchant account in order to receive payments by the seller for the amount advanced. For example, a seller uses their merchant account to receive payments by credit card (e.g., VISA, MASTERCARD). Once payments are processed the amounts go directly into the seller’s merchant account. When a merchant account advance (or “merchant cash advance”) is made, when a payment is processed, instead of it going directly into the seller’s account the payment may go directly into an account of the advancing party. There are alternative ways to implement merchant cash advance, including a simple advance against future receivables, but when these receivables are received they still go into the existing payment account.

That last line totally acknowledges the ACH payment phenomenon. Hopefully they didn’t file for a patent on that too. Then there might really be trouble.

Whether or not your inventions or technology is patentable or conflicts with a Kabbage held patent would best be determined by consulting with an attorney. Let this be a reminder or notice though that the battle taking place in alternative lending is happening on many levels. As the industry matures, patents could become an Ace in the hole.