Articles by Srividya Kalyanaraman

OnDeck Appoints Former GE Exec to Board

June 6, 2016OnDeck appointed Daniel Henson to its board, the company said on Monday.

Henson spent 30 years at General Electric, holding positions at GE Capital and ran the company’s commercial lending business globally in addition to managing GE Capital’s lending and leasing business through the 2008 financial crisis.

“Dan ran one of the largest commercial lending operations in the U.S. and his deep experience in strategic growth initiatives, process excellence and risk management will be a tremendous asset for OnDeck as we continue providing small businesses in the U.S., Canada and Australia with the capital they need to succeed,” said CEO Noah Breslow.

New York-based OnDeck netted a loss of $12 million in Q1 this year and also predicted a full-year adjusted EBITDA loss of between $41 million and $49 million. Online lenders have been battling turbulent times with increased scrutiny on business practices, portfolio performance and rising delinquencies.

‘We Serve a Fragmented Market That is Ripe for Disruption,’ says Patch of Land CEO

June 3, 2016$484 million: That’s how much real estate crowdfunding platforms attracted in 2015, which was three times of that the previous year. There are an estimated 125 such portals and the new SEC rule which allows non accredited investors some leniency to invest in these projects. To demystify real estate crowdfunding, deBanked spoke to Patch of Land’s CEO Paul Deitch to unravel the concept, measure the momentum of investor interest and the regulatory environment. Here are excerpts from the interview.

What’s on the horizon for Patch of Land this year?

Now that Patch of Land’s model is proven, we will be adding complimentary products for the real estate entrepreneur and investor, accompanied by a broadening of funding strategies. For example, we recently launched the new midterm loan product that addresses the opportunity in the $4 trillion single-family rental space.

How is the investment momentum different from that in ‘08-’09?

One of the biggest changes between then and now has been the enactment of the JOBS Act, which actually came about as a result of investment conditions in ‘08-’09. Peer-to-peer lending came into existence during the 2008 Recession when consumers and small businesses could not rely on banks for their funding needs. In 2012, President Obama signed a historic bill called the JOBS Act (Jumpstart Our Business Startups Act), allowing companies to raise working capital in the form of debt and equity via a crowdfunding model. When the SEC implemented Title II of the JOBS Act in 2013 it allowed companies to publicly solicit, via Internet marketing, their equity and debt offerings; private placements could now be advertised. Marketplace lending is an evolution of peer-to-peer lending, defined by the participation of traditional financial institutions purchasing the loans being issued by P2P lenders.

Whom do you consider your competition in the industry and how do you differentiate yourself from them?

We approach the competition question from a different perspective. One would think that other online lenders or real estate crowdfunding companies are our competition but they are not. We are all working towards creating more efficiency, transparency and access to real estate and investments. The market that Patch of Land is serving is fragmented, locally delivered, and highly manual — it is ripe for disruption. Banks are exiting the space due to capital and liquidity constraints and hard money lenders are limited by a single source of capital and local footprint. Unlike these offline incumbents, Patch of Land has a national footprint, and uses proprietary software to quickly and reliably make first lien position loans, pre-fund those loans, and then crowdfund the financing from thousands of investors (both individuals and institutions) on a fractional or whole loan basis.

Who regulates P2RE? And what are the challenges there?

P2RE and the real estate crowdfunding sector is regulated by the SEC. Patch of Land operates under Title II, Regulation D, Rule 506(c) whereby we can only accept investments from accredited investors, as defined by the SEC. This is a strict regulation that requires thorough diligence and vetting of the accredited status of the investor. The biggest challenge we face is that we have many retail investors who want to invest with us and we cannot accommodate them.

How are the ripples in the capital markets affected or will affect business?

Capital markets volatility has not had an adverse effect on our business. Our capital sources are very diversified and are not dependent on large capital market players. Over 90 percent of our loan volume has been, and continues to be, funded by crowd capital. We have on-boarded multiple institutions of various sizes that buy loans on a fractional basis, in addition to the whole-loan forward flow agreements in place.

How is crowdfunding for real estate different from marketplace lending specifically?

Crowdfunding for real estate, specifically when referencing debt, is a subset of marketplace lending. Patch of Land is a ‘real estate marketplace lender’ because we focus specifically and exclusively on debt and do not offer any equity projects for funding. Equity deals are crowdfunding deals, not marketplace lending deals. Therefore, a real estate marketplace lender that transacts with individual investors can be considered a crowdfunding platform, and a crowdfunding platform that does not transact in debt is not a marketplace lender. Two other elements that differentiate crowdfunding from marketplace lending are: 1) prefunding, where the platform fully funds the loans upfront and therefore is not engaging in crowdfunding that usually involves raising capital first, before disbursing it to the sponsor/borrower; 2) marketplace lending includes institutional and individual investors who participate in loan purchases, whereas a crowdfunding model is focused exclusively on individual investors.

How is crowdfunding poised to change real estate investing?

Traditional real estate (debt or equity) can be highly time consuming. We offer an alternative to have real estate debt as part of a portfolio, bringing both new and experienced investors all the data they need to make a decision. Most would never have the time to aggregate this much data on their own, through traditional methods. Crowdfunding allows capital to flow more easily to across the nation, rather than locally, to places and projects that might have been shut out or simply left behind because they were too difficult to assess, evaluate and understand, or were the purview only of local investors and gatekeepers “in the know”. Crowdfunding puts investors in the driver’s seat, giving them the power to pick and choose investments that meet their personal risk/return needs. It allows for investment strategies that are both more “bespoke,” and yet more diversified -both in the way of product type and geographies, all through fractional investments across a technology enabled, online platform. Investors not only have broader choices of where to invest, but they can do it from their mobile phones in seconds.

As Mortgage Applications Slow Down, is it Smarter to Rent?

June 1, 2016It turns out those who rent might be smarter, after all. Applications for refinancing mortgages and new home purchases fell 4 percent from the previous week, according to Mortgage Bankers Association.

As home prices rise and the anticipation around Fed raising rates builds, it will only lead to loans getting more expensive. As such, refinance applications decreased 4 percent, seasonally adjusted, and purchase applications decreased 5 percent and applications for government loans fell 6 percent. The average loan size on refinances also dropped for three straight weeks.

“House prices have breached the peak levels of 2006, raising concerns about the long-term sustainability of current price levels,” Sean Becketti, chief economist at Freddie Mac, wrote in a report on the housing market.

This doesn’t bode well for lenders like SoFi which is trying to make a big headway into mortgage refinancing. “While we launched our mortgage business focused on larger ‘jumbo’ loans, the certainty and efficiency offered by Fannie Mae will enable us to serve more members by expanding geographically and into smaller loan amounts,” Michael Tannenbaum, VP of Mortgage at SoFi said when the lender became a Fannie Mae seller.

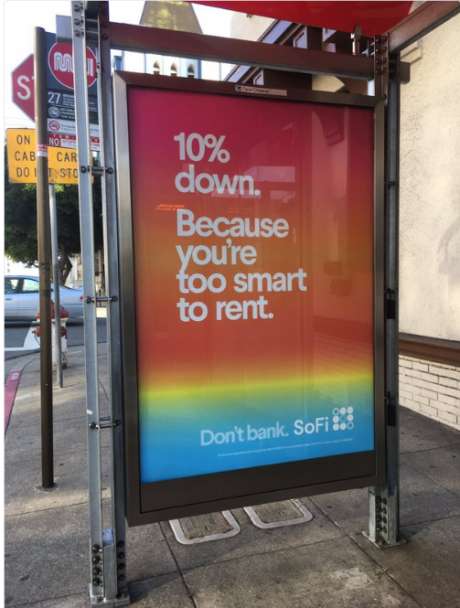

SoFi Ads: When You’re too Cheeky to be Nice

May 27, 2016 Controversial SoFi ads are back and this time they’re targeting renters.

Controversial SoFi ads are back and this time they’re targeting renters.

SoFi’s new ‘tone deaf’ ad for its mortgage loan reads, “10 percent down. Because you’re too smart to rent,” implying those who rent aren’t.

The ad, running in San Fracisco and Portland has attracted some ire among people. SoFi’s penchant for cheeky ads is known by now. Its SuperBowl ad — “great loans for great people” boldly labels some people as “not great,” implying that they are ineligible to join a rather exclusive club of people who can get great loans.

Here’s what people said on Twitter:

Tone deaf? Yes. Hard to believe, but even some smart people don't have $110k sitting around @SoFi https://t.co/O8isvxCUjS

— Jess Fleuti (@jessfca) May 25, 2016

Tone deaf ad for SoFi. Especially ill advised when 63% of those in SF rent. https://t.co/cyH63Oe8mv

— Stuart Robinson (@stuartrobinson) May 24, 2016

@SoFi Do you actually think that poor people are stupid or are you just stupid? https://t.co/On9dYo4ByY

— DrunkenGeeBee (@DrunkenGeeBee) May 18, 2016

Screw you, @SoFi. https://t.co/LgNaiPxtCH

— Jesse M. Locker (@JesseMLocker) May 18, 2016

Arrogance isn't that attractive: https://t.co/RaHgq7XdVA #badad #marketingmistake

— Bill Stewart (@billstewartmktg) May 25, 2016

Here’s Why The DOJ Wants to Keep an Eye on Online Lenders

May 26, 2016

Online lending has been getting a lot of attention, but not necessarily all good.

The U.S. Justice Department is among the latest authorities to be concerned about online lending, while it’s going through a rather choppy ride.

Assistant Attorney General at the DOJ, Leslie Caldwell voiced the regulator’s concern that the loans made online were backed by investors and are without “traditional” safeguards of deposits that banks rely on. Although alternative lending is still a small part of the lending industry, DOJ wants to keep an watchful eye to avoid another mortgage crisis-like situation.

“I’m not saying … that we’ve uncovered a massive fraud, but just that there’s a potential for things to go awry, like when underperforming loans were being sold in residential mortgage-backed securities,” Caldwell told Reuters.

And while the DOJ questions Lending Club, New York’s financial regulator is said to have sent letters to 28 online lenders seeking information on loans made in the state.

The New York Department of Financial Services first subpoenaed Lending Club on May 17th, seeking information about fees and interest on loans made to New Yorkers. Bloomberg reported that the regulator has sent letters to 28 firms including Funding Circle and Avant asking for similar disclosures. The full contents of those letters have not been made public yet, but Reuters seemed to characterize them as being perhaps more aggressive than the inquiry in California six months ago.

Most lenders, the NYDFS will likely learn, are relying on preemption granted under the National Bank Act or Federal Deposit Insurance Act. Chartered banks covered under these laws are typically the entities in question making the actual loans. The “online lenders” buy the loans from the banks and service them. But absent that structure, it is possible that New York could model future regulation on California’s system, where lenders must go through a vetting process and be licensed.

Online lenders dependent on chartered banks to enjoy preemption have slightly less reason to be worried after the US Solicitor General recently filed a response to the US Supreme Court’s request, that argued the Second Circuit’s ruling in Madden v Midland, a case that challenged preemption, was simply incorrect.

‘As Reality Kicks in, Companies Have to be Discplined,’ Says Fora Financial’s Dan Smith

May 25, 2016

Starting a financial company couldn’t have come at a more inauspicious time for two friends that have known each other since college. Jared Feldman and Dan Smith started Fora Financial in June 2008 and today their company has provided $450 million to over 9,500 small businesses. It recently launched PRISM, a proprietary scoring and decisioning framework and secured a credit facility. Founders Smith and Feldman spoke to deBanked about working with Palladium, recent industry news and did some crystal ball gazing. Below is an excerpt from the interview

What does the industry look like to you, with its myriad of players and the recently surfaced problems?

JF: There are a lot of players but I don’t know how much business they are originating. It might sound greater than it actually is. While there is no doubt that competition exists, it is still from the usual cast of characters who have been around for quite some time. However the competition is driving up acquisition costs, possibly some irrational buying from some companies which then trickles down and causes some ISOs and brokers to fail.

DS: Our competitors and we have felt things change in the market in terms of regulation and capital. The influx of capital that came in with the new players is starting to contract a little bit and the lending companies like ourselves are controlling the amount they lend. There has been a lot of artificial growth in the industry – a lot of companies trying the test and learn strategy to see how deep they can buy into the market but they struggle to maintain profits.

And what will be the aftermath of these changes we see in the next six to twelve months?

DS: The reality is starting to kick in and companies will have to be disciplined about their underwriting models and be wise about where they spend their money in order to to grow and sustain profits.

What then should be the top priority for lenders now?

JF: Two top priorities that lenders should focus on is A) To build out a compliance framework and B) securing a long-term credit facility apart from the already mentioned disciplined underwriting making risk, analytics and data capabilities strong.

You started working with private equity firm Palladium last year. Tell us more about where you are with that?

DS: We got into this great partnership and a fund of theirs gave us the capital to grow our business and it aligned with everything we had in our 100 day plan – we wanted to build our regulatory compliance framework, close on a credit facility and bring some key people onboard — all of which we have accomplished. Working with Palladium teaches us how to run a disciplined company and we have already been entertaining M&A opportunities.

What do you think of the hybrid model approach that some lenders take ?

DS: Hybrid model is a great idea in theory and there are concerns with every approach — of holding everything on balance sheet and then buyers buying the loans. There is a lot that goes into capital raising and we have done what we know well and have continued to organically grow our balance sheet. It’s not to say that we have not considered other options but for now, we are focused on getting the right cost structure.

JF: If you have the credit facility with the right cost structure, that is a cheaper cost of capital than what the marketplace is selling these loans for but we are considering options for diversifying our capital sources and we would like to add some kind of market element but that might be in the future. Maybe in the first quarter of 2017.

Prosper Might Want to Sell. But Who Wants to Buy?

May 25, 2016

Keynote Presentation by Ron Suber of Prosper at the LendIt USA 2016 conference in San Francisco, California, USA on April 11, 2016. (photo by Gabe Palacio)Has the atmosphere for the industry changed enough for Prosper to consider selling? It might be.

The beleaguered online lender is in talks with JP Morgan Chase and Financial Technology Partners to explore “strategic options,” implying a stake sale, according to Reuters.

The company is in pursuit of capital to fund its loans while trying to keep its investors happy. For that purpose, Prosper increased rates on its riskier borrowers by 0.29 percentage points this week. A move the company suggests is “appropriate and makes the risk-reward tradeoff of investing in newly originated loans at least as attractive as purchasing ABS products backed by loans through Prosper in the secondary market.” In February, Prosper raised rates by 1.4 percentage points, the same time it increased its loss estimates for investors.

This second increase, according to its new chief risk officer, Brad Pennington is a “direct result of forward looking credit market” and with the possible Fed rate hike already priced in. This move from the San Francisco-based lender follows a 28 percent cut in its taskforce, shutting down its Utah office and letting go of former risk officer and CEO Aaron Vamut foregoing a year’s salary.

The lender also lost a securitization deal with Citi in April as investors started demanding more yield from Prosper bonds. “When we don’t have alignment with our investors, when groups sell our loans into the market no matter what, if the market’s not ready, it’s not good,” Prosper’s president Ron Suber said at LendIt.

With great prosperity comes….?

Lending Club Finds Respite as Chinese Billionaire Ups Stake

May 24, 2016

Lending Club finally has a taker, well sort of.

The Wall Street Journal reported that a Singapore-based investment firm led by Chinese billionaire Chen Tianqiao has upped its stake in Lending Club to nearly 12 percent.

The investment makes Shanda Group the largest shareholder in the online lender. This comes at a time when the Chinese game company turned investment firm, is investing in an array of US companies and troubled Lending Club looks to restore confidence.

So far, Citigroup, Goldman Sachs and Jefferies have pulled support from the company, though Jefferies was hired to help them find replacement investors.

According to a Reuters report, Citigroup told regulators that it will not back the beleaguered marketplace lender after declining Jefferies’ request to “lend support in order to calm the markets.”

The acting CEO Scott Sanborn sent out an email to appease investors. “Let me assure you that we are in a strong financial position with a substantial amount of cash and securities on our balance sheet — $868 million. We plan to be around for many years to come,” according to excerpts of the letter published by CNBC.

For full coverage on Lending Club, click here.