Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

For Marketplace Lending Securitizations, A Bumpy Road But Strong Investor Sentiment

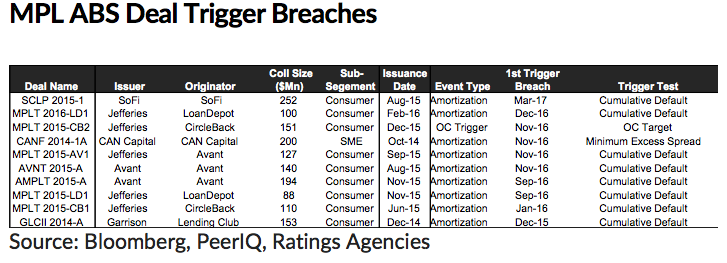

April 3, 2017A new report by published by PeerIQ contains 10 recent examples of trigger breaches in marketplace lending ABS transactions.

“Since the inception of MPL ABS market, we have observed 10% of deals breaching triggers historically,” the report says. It goes on to say that these events are typically manifestations of “unexpected credit performance, poor credit modeling, or unguarded structuring practice.”

“If an early amortization trigger is violated, excess spreads are diverted from equity investors to senior noteholders with the goal of de-risking the senior noteholders as quickly as possible.”

CAN Capital is the lone small business lender on the above list and we reported on their trigger breach back in December. Little public information has come out about the company since they stopped lending late last year.

![]() The most recent trigger breach on the list was SoFi, a company known for courting super prime borrowers.

The most recent trigger breach on the list was SoFi, a company known for courting super prime borrowers.

“Trigger breaching events do not necessarily imply credit deterioration of the collateral pool,” the PeerIQ report states. In another section of the report that addresses increased losses for non-bank lenders, it says that two of the three primary drivers of that are borrowers stacking loans and lenders shifting to riskier borrowers.

Nonetheless, Q1 was a record quarter for marketplace lending securitizations with seven deals priced for $3 billion. That’s a 100% increase over Q12016. “The industry continues to experience strong investor sentiment as evidenced by growing deal size and improved deal execution,” they say.

“We expect higher volatility from rising rates, regulatory uncertainty, and an exit from a period of unusually benign credit conditions. Platforms that can sustain low-cost stable capital access, build investor confidence via 3rd party tools, and embrace strong risk management frameworks will grow and acquire market share.”

Enrolling a Merchant’s “Debt” May Be Harmful… to the Merchant

March 29, 2017 How would you like to make $12,000 on a single referral?, a flyer directed at business finance brokers asks. This ad wasn’t offering a commission for brokering a loan or advance, but rather for enrolling a merchant’s debt into the company’s restructuring program. Debt restructuring, negotiation, or settlement is a booming cottage industry these days. Some of these debt restructuring companies promise ISOs that they will be completely discreet with referrals. Others offer them commission bonuses for achieving certain enrollment targets. It’s a way to monetize declined deals, they typically say.

How would you like to make $12,000 on a single referral?, a flyer directed at business finance brokers asks. This ad wasn’t offering a commission for brokering a loan or advance, but rather for enrolling a merchant’s debt into the company’s restructuring program. Debt restructuring, negotiation, or settlement is a booming cottage industry these days. Some of these debt restructuring companies promise ISOs that they will be completely discreet with referrals. Others offer them commission bonuses for achieving certain enrollment targets. It’s a way to monetize declined deals, they typically say.

For merchants, the allure of a restructuring company’s help might just be payment terms tied to their monthly budget. That’s allegedly what one NJ firm’s agreement says, in fact. “I hereby authorize [the company] to negotiate my unaffordable business debts and to enter into affordable repayment terms on my behalf based on my monthly budget,” reads a document submitted in a New York Supreme Court case involving Creditors Relief. And based on the marketing materials deBanked has reviewed from several similar companies, their definition of debt is so broad that it can even include things that aren’t debt, like merchant cash advances, for example.

Even if the restructuring company held a critical view of MCAs and believed them to be loans, treating them as such for the purpose of negotiation might actually cause harm to their customers. That’s because a well-formed MCA contract already offers payment adjustments at regular intervals to appropriately match a merchant’s sales activity. Depending on what the language says, a merchant might just have to call their funder and ask them to reduce the debits to reflect their current sales activity. And yes this goes for ACH-only deals. Even ones that could appear to have fixed payments do not actually have fixed payments. This is basically how all MCAs work by the way, so if you are a broker or funder and this all sounds foreign to you, you need to take this course ASAP.

The point is this: a merchant need not pay a fee to an outside company to restructure anything when sales drop because a free remedy already likely exists and is a key benefit to MCAs in the first place. And yes, I’m talking about MCAs with daily ACH debits. If you’re confused by this, you need to take this course ASAP.

The best advice a restructuring firm can give a merchant struggling with an MCA due to slow sales is to tell them to look for a reconciliation clause in their contract that explains how to get the payments reduced. Once the merchant finds it, have them call the funder and execute it. There’s no need to enroll anything, negotiate anything, risk breaching a contract, or pay a broker tens of thousands of dollars in commissions. The debt restructuring firm might not want merchants to simply take advantage of what they’re already entitled to however, because they stand to make no money that way. In this regard, mischaracterizing future receivable sales as loans only serves to carry out their agenda to confuse merchants about what their rights might be under those agreements.

I myself, am occasionally contacted by merchants who claim to be facing hardship and in one instance where a merchant had spoken to a negotiator, the negotiator didn’t tell him that the remedy he sought was already a natural provision of his contract. I helped him find it. He didn’t have to pay any fees which would’ve gone to pay someone a huge commission or end up in some crazy situation where he’s being sued for breach of contract. Think about this the next time you encounter a distressed merchant. Not everything is debt and that can be very much to the merchant’s benefit.

If you work for a debt restructuring, settlement, or negotiation company, you should probably take this course too. It will help you understand MCA agreements and what remedies merchants already have at their disposal.

Citing Unnamed Sources, Reuters Reports Kabbage Possibly Looking to Acquire OnDeck

March 23, 2017 Reuters is reporting that Kabbage is in talks to raise equity capital to potentially use for acquisitions and that OnDeck is one of several targets under consideration. As Reuters attributed the OnDeck portion to just one of their multiple unnamed sources, it’s entirely speculative at this point.

Reuters is reporting that Kabbage is in talks to raise equity capital to potentially use for acquisitions and that OnDeck is one of several targets under consideration. As Reuters attributed the OnDeck portion to just one of their multiple unnamed sources, it’s entirely speculative at this point.

From a theoretical perspective, would such a thing make sense?

Kabbage has momentum on their side right now. Their recent half billion dollar securitization that was finalized earlier this month was oversubscribed. Although they only originated about half the loan volume of OnDeck last year, Kabbage’s last private market valuation ($1 billion in Oct 2015) is nearly 3x as large as OnDeck’s current market cap.

Valuations in the industry have changed a lot over the last 18 months but there’s no doubt that Kabbage has become a unique competitor. At LendIt, company CEO Rob Frohwein revealed a bit of their secret sauce when he said that their customers borrow from them on average 20-25 times over the course of 4 years, whereas their competitors make only 2.2 loans to their customers on average.

There is a general view in this industry that acquiring a competitor adds little value other than more marketshare. Kabbage, however, may potentially believe that (1) OnDeck is too undervalued to pass up (2) That OnDeck could generate better margins using Kabbage’s strategy (3) That OnDeck’s partner relationships would add additional value (4) That the company cultures are compatible enough to make an acquisition work (5) that the combined entity would allow them to better align their political and regulatory agendas.

We mustn’t forget however that a single unnamed source is pretty weak to go off of. One possible reason that someone would want to report that OnDeck is an acquisition target is to cause a temporary spike in their stock price. (and I certainly do not have any position in the stock)

For now, it’s fun to think about such an acquisition scenario and we’ll report more, if and when we hear anything.

In This Online Lender’s Earnings Report, Profits, MCAs and Term Loans

March 22, 2017Limited details were offered when Enova, a publicly traded company, acquired The Business Backer (TBB) in June 2015. For one, the Cincinnati Business Courier had the exclusive, which one might not describe as the typical go-to source for online finance news. But TBB was not typical. Based in Blue Ash, Ohio as opposed to New York City or San Francisco, the company had originally focused on offering merchant cash advances before eventually expanding their suite of solutions to include other products.

According to Enova’s earnings report, TBB had been purchased for $26.4 million with an estimated contingent $5.7 million of that being based on future earn-out opportunities. There was a caveat though. If future operating results exceeded expectations, that contingent amount could increase over time, but not beyond where the total consideration paid for the company exceeded $71 million. As of 2016’s year-end, that contingent amount had increased by $3.3 million.

Enova’s report makes several mentions of their merchant cash advance business or as they call them, receivable purchase agreements (RPAs). For the most part, they obscure the financial metrics of this aspect by lumping it in with installment loans. These installment loans are described as “multi-payment unsecured consumer installment loan products in 17 states in the United States and in the United Kingdom and Brazil” with repayment periods of two to sixty months, so yeah, they’re pretty different.

Their RPA customers, however, “average approximately $1.5 million in annual sales and 10 years of operating history while those who obtain an open line of credit account average approximately $450 thousand in annual sales and 7 years of operating history,” the report says. These lines of credit are primarily offered through a business lending subsidiary called Headway Capital.

While companies like Lending Club and OnDeck grab all the headlines, Enova describes itself as a “leading technology and analytics company focused on providing online financial services.” And in 2016, they extended nearly $2.1 billion in credit to borrowers and had a net income of $34.6 million.

On the company’s Q4 earnings call in February, Company CEO David Fisher said, “There currently seems to be a bit of a shakeout occurring in the non-bank small business lending and financing industry. A number of our competitors have either ceased funding or completely shut down over the past several months. From the intelligence we were able to gather, this is largely due to credit issues and their portfolios. As we mentioned last quarter, we have taken a more methodical approach than some to growth for our small business products. And we’re now seeing the benefits of that approach. Recent advantages of our small business book are performing well and the unit economics continue to improve especially as acquisition costs have dropped following the shakeout I just mentioned.”

Enova’s small business financing portfolio only constituted 12% of their loan portfolio at the end of last year. And at $13.70 a share, the company’s current market cap is larger than OnDeck’s.

Are Those Shopping for an Online Loan More Risky?

March 18, 2017ID Analytics is enabling online lenders to know a thing or two they might not be able to find out on their own. For example, did a loan applicant apply for other loans on the same day? There’s a good chance ID Analytics can tell you the answer since they claim their Online Lending Network has achieved visibility into 75% of marketingplace lending activity in the US.

Their network includes business lenders but it’s the individuals behind the businesses that they monitor and data shows that 1.5% of online loan applicants applied for additional loans elsewhere within six hours of submitting their application. Conventional wisdom might suggest that a shopping borrower is an engaged and responsible borrower but ID Analytics’ early research found that this group was twice as risky as the average online loan applicant.

During a brief interview at LendIt, company VP Patrick Reemts said that their service isn’t limited to the point-of-application. Members can monitor their borrowers for up to 90 days and see if they apply for other loans or take other loans, Reemts explained. How lenders make use of that data is up to them though, he added.

Members of the Online Lending Network must report all their volume for the value of the data to be effective. They can’t selectively decide which applicants or borrowers to put in the system. ID Analytics is also not a startup, Reemts said. Having been in business for 15 years, they’re tapped into some of the nation’s largest credit card issuers so they have visibility into traditional credit sources too.

The company is a subsidiary of LifeLock, Inc.

Mel Chasen, Founder of Rewards Network and a Merchant Cash Advance Visionary, Has Died

March 15, 2017 Melvin Chasen passed away on Monday. He was 88. Chasen founded Rewards Network in 1984 as Transmedia Network, Inc. and it went on to become the world’s largest dining rewards program. As part of that, the company pioneered the use of future sales to facilitate working capital to restaurants.

Melvin Chasen passed away on Monday. He was 88. Chasen founded Rewards Network in 1984 as Transmedia Network, Inc. and it went on to become the world’s largest dining rewards program. As part of that, the company pioneered the use of future sales to facilitate working capital to restaurants.

Transmedia became iDine Rewards Network in 2002 but was later shortened to just Rewards Network in 2003. While Chasen had an incredibly accomplished career, a newspaper obituary paying tribute to his life says that Transmedia, a specialized restaurant financing company, was his biggest business success.

A 1991 New York Times article explained the business model as follows: “It gives the restaurant $10,000, a debt that is paid off by providing $20,000 worth of meals to Transmedia customers. The customers pay Transmedia $15,000, a 25 percent discount from face value. If the restaurant goes out of business before Transmedia’s customers eat enough meals, or if customers do not patronize a restaurant, Transmedia suffers the loss.”

To think that concept was not only being applied 26 years ago, but was already a big hit, undoubtedly makes Chasen a top player in merchant cash advance lore. He will be greatly missed.

A service will be held on Thursday, March 16 in North Miami Beach. Memorial donations may be made to the ALS Recovery Fund.

Stolen Deals? How One Funder Used Technology to Say ‘No More’

March 14, 2017 It’s another chapter in the saga of stolen deals, a problem that shops all over the country seem to be grappling with. For Miami-based Greenbox Capital, company CEO Jordan Fein hoped it was something that they didn’t have to worry about. But believing it was better to be safe than sorry, Greenbox launched a 90-day probe to review all controls and personnel to see if theft existed in their organization and how it was being done. They weren’t too happy with the results, which determined that there was indeed employee theft taking place.

It’s another chapter in the saga of stolen deals, a problem that shops all over the country seem to be grappling with. For Miami-based Greenbox Capital, company CEO Jordan Fein hoped it was something that they didn’t have to worry about. But believing it was better to be safe than sorry, Greenbox launched a 90-day probe to review all controls and personnel to see if theft existed in their organization and how it was being done. They weren’t too happy with the results, which determined that there was indeed employee theft taking place.

Sources across the industry have told deBanked that some employees will do things that make it easy to catch them, while others say that their tactics are constantly evolving. Disabling the USB ports isn’t enough, they say, since personal smart phones can be used to covertly steal data by simply taking pictures of a computer screen. Some say that apps like Snapchat are even making it increasingly easy for them to erase the evidence trail.

For Greenbox Capital, the probe convinced them that being a funding company meant they also needed to become a top-notch security company, especially since they are being entrusted with sensitive information. It’s their ISOs’ deals they have to protect, they say. Understanding how important that is, the company designed proprietary software to monitor the actions of all users on their system, which allows them to know who clicked on what when, and for how long. But that wasn’t enough, they insist. They also developed algorithms to detect suspicious behavior and their security team receives an alert whenever it gets triggered.

And it’s not just what someone clicked on or downloaded, they say, since their system also analyzes phone call activity, texting activity, wifi activity and the number of absences from one’s desk. The implication from that, of course, is that they must be incorporating video surveillance, which they confirmed they are.

They’re not alone. Chad Otar, CEO of Excel Capital Management, an ISO based in New York City, says that when it comes to their office, they have “eyes and ears everywhere.” Otar explains that because commission payouts can be so high, even experienced salespeople can feel tempted to risk their jobs to get their hands on good leads. Some will try to use different emails accounts on the office computer, using their private ones to transact information they’re not supposed to. To prevent that, they’re using Google Vault. “It allows us to monitor all emails going out and coming in from everyone’s account that is linked to the server,” he explains. “And if they try to access another email account, it blocks them.”

But even while threats like Snapchat exist, Otar says some employees will take a low-tech approach and hide valuable information in the trash bin and then offer or attempt to “take out the trash.”

For Greenbox, thanks to their new platform, they were actually able to catch two employees who were stealing data and actually selling deals on the black market.

A black market?

A black market?

To put such behavior in perspective, 3 years ago, the name and phone number for someone qualified and interested in working capital could fetch $200 through normal lead channels. These days, sources say it can cost several thousand dollars in marketing just to fund a single deal and that a good lead is worth more than gold.

Greenbox believes that all companies should stop and take a close look at the controls they have in place to catch internal theft. Determined to prevent what they found from ever happening again, they say they now have the tightest internal controls in the industry and advise all businesses to rethink their approach to data security. “As it stands today there is no safer place to send your deals,” company CEO Jordan Fein says.

Of note, readers should stand to realize that getting caught might not just mean embarrassment or termination. Last year, a former MCA sales rep pled guilty to attempted criminal possession of computer related material for being on the receiving end of stolen deal information and using it. Since then, other companies have privately suggested that this was not the only deal-stealing situation that has involved law enforcement and that data theft is a serious offense.

Excel Capital Management‘s Otar says that if you create a sense of pride and loyalty in your workplace, your own employees will report any bad behavior they witness to you.

For Greenbox Capital, they believe their cloud-based system and advanced algorithm is not just about funding more deals, it’s about protecting the integrity of the entire process and maintaining trust.

Stealing deals? it’s not worth the risk.

Brief: New York’s Attempt to Over-Regulate Lenders Downgraded to Doubtful

March 14, 2017 The Governor’s budget bill has encountered resistance up in Albany, sources say, specifically Part EE that aimed to amend New York’s banking law and impose sweeping licensing restrictions on all types of lending and finance. Analysts felt that the language could have vast unintended consequences beyond just online lenders, including factoring, commercial lenders and brokers, merchant cash advance and the securitization markets.

The Governor’s budget bill has encountered resistance up in Albany, sources say, specifically Part EE that aimed to amend New York’s banking law and impose sweeping licensing restrictions on all types of lending and finance. Analysts felt that the language could have vast unintended consequences beyond just online lenders, including factoring, commercial lenders and brokers, merchant cash advance and the securitization markets.

The passage of this proposal now looks doubtful. The Assembly, one of two branches of the State’s legislature, introduced their own version of the budget on March 13th and removed the language.

“The Assembly rejects the Executive proposal granting DFS regulatory authority over any online lenders doing business in New York State,” the bill says. Notably, they also rejected “the Executive proposal to authorize enforcement of Insurance, Banking, and Financial Services Law against unlicensed individual or businesses, including bringing a civil action.”

The Senate echoed same. “The Senate denies the Executive proposal to authorize the Superintendent of the Department of Financial Services to expand the regulation of small loan lenders,” their bill states.

Industry trade groups, namely the Commercial Finance Coalition (CFC), had mobilized quickly to tell their members’ stories up in Albany two weeks ago. One of the group’s concerns was that they had not been consulted in advance, nor given any time to engage in a discussion about the proposal.

“They should allow all the stakeholders to have their voices heard,” said Dan Gans, CFC’s executive director. With the proposal’s chances of making it through the final budget by the March 31st deadline waning, the group and others may finally get an opportunity to do just that at some point later in 2017. According to The CFC, they are looking for additional companies to support them in that endeavor. Anyone interested in finding out how they can help should contact Dan Gans at dgans@polariswdc.com.