Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Let The Games Begin

November 2, 2020 In the run-up to the 2016 election, a Capify survey recorded that small business owners felt Trump had their best interests at heart over Clinton by a 2 to 1 margin.

In the run-up to the 2016 election, a Capify survey recorded that small business owners felt Trump had their best interests at heart over Clinton by a 2 to 1 margin.

The alternative finance industry, meanwhile, was largely preparing for a Clinton administration. Then Trump won.

And a lot has changed since then.

deBanked has refrained from conducting any formal survey on the matter and takes no position on a candidate, but anecdotal conversations I’ve personally had with industry participants and a review of industry chats across social networks all lean in favor of Trump.

Those positions are drawn in part from resistance to future business shutdowns, which devastated the small business finance industry, views on taxes, and views on regulatory enforcement. All in all, it’s a business decision.

Talk about Biden has been virtually non-existent. The election is a referendum on Trump.

Once a candidate is elected, we will explore what the next 4 years could be like.

StreetShares Stops Lending Directly to Small Businesses, Records $10.7M Annual Loss

November 1, 2020 StreetShares, the online lender known for its focus on veteran-owned businesses, is no longer lending directly to small businesses, the company disclosed last week. This became effective as of October 26.

StreetShares, the online lender known for its focus on veteran-owned businesses, is no longer lending directly to small businesses, the company disclosed last week. This became effective as of October 26.

“We still offer lending products to small business customers via our LaaS clients,” the company said however.

“As of June 30, 2020, 47 banks, credit unions, and alternative lenders have contracted to use our Lending-as-a-Service (LaaS) small business financing technology.”

It defined LaaS as:

“Since the launch of LaaS, the Company has offered several LaaS packages, which include various products and services depending on the package, such as: online product presence for small business lending, web design collaboration, client-branded landing page, intelligent online loan application for small business borrowers (client-branded or StreetShares-branded), decisioning platform, loan analytics platform, and small business loan marketing services. Depending on the LaaS package, either the Company or the LaaS client will originate, underwrite, and service the small business loans. Our LaaS products and services are available in all 50 states and the District of Columbia.”

Financially, StreetShares’ June 30 fiscal year-end report revealed a massive $10.7M loss on only $4.5M in revenue. Despite the impact of covid, these figures are actually in line with (and perhaps even better than) historical performance. The company had a $12.3M loss on only $4.4M in revenue for the fiscal year prior, for example.

“Beginning in March 2020, we experienced an increase in late payments and requests from our borrowers for payment deferments. As a result, there has been an increase in predicted losses on our loan portfolio and we expect to observe an increase in our charge-off ratio in the near-term; however, we are unable to predict a long-term trend in our charge-off ratio. Beginning in March 2020, we instituted a deferment program that permitted our small business borrowers to defer loan payments as necessary due to the COVID-19 pandemic. We worked closely with our borrowers and have exited all of them from the deferment program as of this filing. We also provided, and continue to provide, certain borrowers with payment plans with reduced payments as necessary. The payment deferments or modifications made as a result of the COVID-19 pandemic consisted of short-term payment deferrals or reduced weekly payments.”

Earlier in the month of October, StreetShares announced they had secured a $10 million round of funding from Motley Fool Ventures, Ally Ventures (the strategic investment arm of Ally Financial), and individual fintech angel investors.

The OnDeck Roller Coaster of 2020

October 30, 2020 “2019 was an important year for OnDeck and we finished strong,” said OnDeck CEO Noah Breslow in the year-end earnings call that took place on February 11, 2020. “Financially, we had our second full year of profitability. And strategically, we are making significant progress positioning the company for improved performance and even greater long-term success.”

“2019 was an important year for OnDeck and we finished strong,” said OnDeck CEO Noah Breslow in the year-end earnings call that took place on February 11, 2020. “Financially, we had our second full year of profitability. And strategically, we are making significant progress positioning the company for improved performance and even greater long-term success.”

OnDeck reported net income of $28 million for 2019 and its share price closed at $4.07 the day earnings were announced, giving it a market cap of roughly $240 million. This was down significantly from its IPO value of $1.3 billion, but up from the lows it had hit in 2017 and 2019.

Over the next 30 days, however, the price fell by 50% on fears that the looming novel coronavirus could cause catastrophic disruption. The company also announced the departure of its Chief Accounting Officer.

As the industry looked on with wonder, news coming out of the company seemed strangely at odds with reality. For example, OnDeck announced a “first-ever” NASCAR sponsorship on March 10th.

“OnDeck is proud to sponsor the JR Motorsports team and driver Daniel Hemric for races during the 2020 NASCAR Xfinity Series season,” said a senior vice president of marketing at OnDeck. “So many of our small business customers are avid motorsports fans and we look forward to joining them to cheer on Daniel and the No. 8 car decked out in OnDeck colors at the Atlanta 250 and the Chicago 300.”

“OnDeck is proud to sponsor the JR Motorsports team and driver Daniel Hemric for races during the 2020 NASCAR Xfinity Series season,” said a senior vice president of marketing at OnDeck. “So many of our small business customers are avid motorsports fans and we look forward to joining them to cheer on Daniel and the No. 8 car decked out in OnDeck colors at the Atlanta 250 and the Chicago 300.”

On March 23, OnDeck closed at 70 cents. The market, it seemed, valued OnDeck at a paltry $41 million.

Publicly, OnDeck kept up the optimism. The company applied to be a PPP lender as the program was just beginning to roll out. “We are excited to be one of the fintechs delivering PPP loans as a direct lender,” Breslow said. “Our team has been working around the clock getting us ready and now we wait and hope we are approved soon!”

Publicly, OnDeck kept up the optimism. The company applied to be a PPP lender as the program was just beginning to roll out. “We are excited to be one of the fintechs delivering PPP loans as a direct lender,” Breslow said. “Our team has been working around the clock getting us ready and now we wait and hope we are approved soon!”

Simultaneously, the company suspended the funding of its “Core” loans and lines of credit to new and existing customers. The company then went on to report a Q1 net loss of $59M due to covid-related damage, wiping out all of its 2019 profits and more. It also furloughed many employees while reducing the pay for those that stayed on.

That same month, OnDeck’s management “commenced a review of potential financing options to secure additional liquidity and potentially replace [its] corporate line facility and began contacting potential sources of alternative financing, including mezzanine debt.”

The response it got was grim.

“The interest rates offered by those alternative financing sources ranged from 1-month LIBOR plus 900 basis points to 1,700 basis points (in addition to an upfront fee) and all but one required a significantly dilutive equity component,” the company later disclosed. “The one proposal that did not include an equity component was at an interest rate of 1-month LIBOR plus 1,400 basis points to 1,700 basis points.”

“The interest rates offered by those alternative financing sources ranged from 1-month LIBOR plus 900 basis points to 1,700 basis points (in addition to an upfront fee) and all but one required a significantly dilutive equity component,” the company later disclosed. “The one proposal that did not include an equity component was at an interest rate of 1-month LIBOR plus 1,400 basis points to 1,700 basis points.”

OnDeck engaged in negotiations with four potential sources of alternative financing, but two dropped out as the economic effects of the pandemic worsened. At the same time, it was speaking with Enova about something else entirely, a potential merger.

On the frontend, OnDeck was keeping the public abreast of its negotiations with creditors. The pandemic had put them in a technical breach of its terms with several of them but the company was experiencing some success with securing workouts and reprieves.

Regardless, the stock continued to trade below $1 as the world looked on to see what would become of their Q2.

On July 28th, bombshell news broke. Enova, an international lending conglomerate, announced it was acquiring OnDeck for the price of approximately $90 million.

On July 28th, bombshell news broke. Enova, an international lending conglomerate, announced it was acquiring OnDeck for the price of approximately $90 million.

“Following an extensive review of our strategic options, we believe this is the right path forward for our customers, employees, and shareholders,” Noah Breslow said on a call with Enova executives the following day.

Some shareholders had a different opinion and thought that the deal and the terms looked a little fishy, all considered. Nine different shareholder lawsuits were filed over the next two months with the intent to delay or block the acquisition.

How could this possibly be the best deal or the right path?!

That was the underlying question being posed between the lines of the various claims asserted. OnDeck ultimately settled with all the parties by releasing supplemental information to the public about its financial situation and thought process that led up to the Enova merger. All the objections appeared to fade as shareholders approved the deal by an overwhelming majority.

On October 13th, Enova announced that it had completed the acquisition of OnDeck.

But by that time, was OnDeck merely a hollowed out shell of its former self? Not quite, according to disclosures made two weeks later. Enova announced that OnDeck’s portfolio performance was already exceeding their expectations.

“On the small business side, the makeup of the demand is surprisingly similar to a year ago,” said David Fisher, CEO of Enova. “You would expect so many differences given what the economy has been through but there’s actually very very few. It’s pretty broad based. Credit quality look really really strong. If anything it’s stronger- I think it’s the stronger businesses that are trying to borrow at this point that are trying to lean into covid, not the ones that are just trying to survive so if anything on the demand there is a slight improvement on credit quality in small business.”

“On the small business side, the makeup of the demand is surprisingly similar to a year ago,” said David Fisher, CEO of Enova. “You would expect so many differences given what the economy has been through but there’s actually very very few. It’s pretty broad based. Credit quality look really really strong. If anything it’s stronger- I think it’s the stronger businesses that are trying to borrow at this point that are trying to lean into covid, not the ones that are just trying to survive so if anything on the demand there is a slight improvement on credit quality in small business.”

Fisher was also bullish going forward. “We believe now is a great time to be increasing our presence in

small business lending. The pandemic has devastated many small businesses across the country. Their

revenues are down and small business owners are digging into their savings to survive until the pandemic subsides and the economy reopens.”

Enova reported monster quarterly earnings of $94 million, a company record.

“Together Enova and OnDeck will be well positioned to further support small businesses and consumers in the wake of the pandemic,” Fisher said.

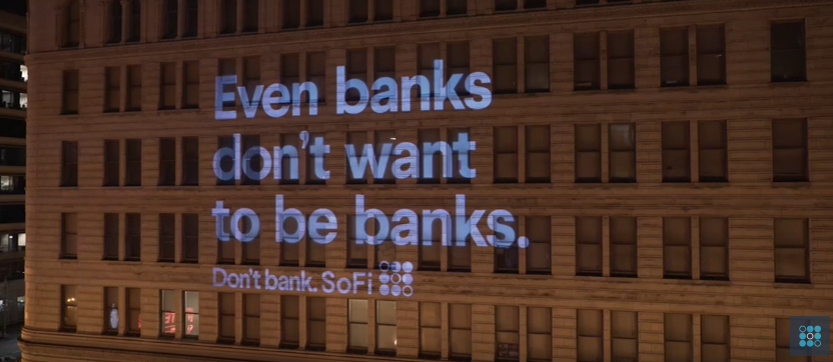

SoFi, The “Don’t Bank” Non-Bank, Has Been Approved to Become a Bank

October 29, 2020It’s a little ironic. SoFi, one of the pioneers of the bank disruptor market, is embracing everything it preached against. The company founded in 2011 as an online student lender was just granted a preliminary approval for a national bank charter by the OCC.

When the company launched, SoFi’s message to the masses was not only that they were better than a bank but that customers shouldn’t use banks in general. They took this message to the extreme:

Just, don't do it. #DontBank pic.twitter.com/lnxKJHH3QJ

— SoFi (@SoFi) February 11, 2016

Banks send you statements. Our statement is we don’t like banks. Check us out at https://t.co/B5YXtHWKL0. #DontBank pic.twitter.com/RshfsAhdYR

— SoFi (@SoFi) January 26, 2016

Happily not a bank. http://t.co/bDN6i1Fd5W #SoFiSoFun

— SoFi (@SoFi) August 25, 2015

To be fair, a lot has changed at SoFi since. Anthony Noto, a former Goldman Sachs banker, took over as CEO in February 2018. And SoFi has grown well beyond just student loans to personal loans, home loans, insurance, small business financing, credit cards, and investing.

The company has also expanded its visibility, including by securing the name rights to the Los Angeles football stadium that serves as the home to the Rams and Chargers. When the deal was announced, it all sounded something very much like what a… bank… would do.

SoFi has technically been mulling the idea of becoming a bank for a long time. They applied for a state industrial bank charter in 2017 but withdrew it amid some internal issues as well as external criticism over the choice of charter.

According to Reuters, Noto said of the latest approval news:

“SoFi is on a mission to help consumers get their money right all in one app. This preliminary conditional approval from the OCC is a testament to the mission-driven company we have built, the employees who help it grow, and the over 1.5 million members we currently serve.”

OnDeck Originated $148M in Loans in Q3, is Moving Full Speed Ahead Under Enova

October 27, 2020 OnDeck more than doubled its Q2 loan volume, according to statements made on Enova’s latest quarterly earnings call. OnDeck originated $148M in Q3 versus the $66M in originated in Q2.

OnDeck more than doubled its Q2 loan volume, according to statements made on Enova’s latest quarterly earnings call. OnDeck originated $148M in Q3 versus the $66M in originated in Q2.

For frame of reference, this is still down significantly from the $618M that the company originated in Q4 2019, well before covid became a factor.

But expect the numbers to ramp up.

“We have basically all of our marketing channels turned on across consumer and small business [lending],” said David Fisher, Enova’s CEO.

“OnDeck is probably a little bit ahead of where we are on the Enova side. We were a little bit more cautious in our re-acceleration of our lending kind of going into the 3rd quarter but we are totally comfortable with that decision. If the biggest mistake we make during all of covid is waiting an extra 60 days to re-accelerate lending, we think that’s a great position to be in. We think that extra conservatism makes sense and with the rate that we’re re-accelerating lending, it won’t hurt that much in the long run.”

And apparently demand and credit quality are looking quite normal, despite covid, according to Fisher.

“On the small business side, the makeup of the demand is surprisingly similar to a year ago. You would expect so many differences given what the economy has been through but there’s actually very very few. It’s pretty broad based. Credit quality look really really strong. If anything it’s stronger- I think it’s the stronger businesses that are trying to borrow at this point that are trying to lean into covid, not the ones that are just trying to survive so if anything on the demand there is a slight improvement on credit quality in small business.”

OnDeck’s annualized quarterly net charge-off rate for the third quarter was 23% and its 15 day+ delinquency rate decreased from 40% at June 30th to 27% at September 30th.

Enova reported monster quarterly earnings of $94M. CEO David Fisher and CFO Steve Cunningham said it was a record-breaking quarter for profitability.

Lendified Survives, Under New Management

October 23, 2020 Toronto-based Lendified has returned from the brink. The Canadian alternative small business lender has a new CEO and has resumed the origination of new loans.

Toronto-based Lendified has returned from the brink. The Canadian alternative small business lender has a new CEO and has resumed the origination of new loans.

In June, deBanked published a story that described the company’s impending doom after it was placed in default with its credit facilities, could no longer originate new loans, and had virtually no capital to continue its operations.

The company was since able to partially recapitalize and John Gillberry has come on as the new CEO. Gillberry is described as a “seasoned senior executive with nearly three decades of experience in areas of managing the finance and operations of special situations and venture capital backed enterprises.”

In an announcement, Gillberry expressed optimism for Lendified’s future. “I am excited about the opportunity that Lendified presents and it is uniquely positioned to take advantage of a very large and underserved market,” he said. “The credit underwriting foundation that we are starting from is distinct from any other in this market and we are pleased to be once again originating new loans to independent business owners.”

The company’s primary senior lenders have resumed financing new loans.

deBanked Visits Local Commercial Finance Brokerage – Horizon Funding Group

October 22, 2020deBanked reporter Johny Fernandez visited the storefront office of Horizon Funding Group, a commercial finance brokerage located in Brooklyn. The company is owned by brothers James and John Celifarco.

The FTC’s Power to “Wipe Out” is Under Siege

October 9, 2020 As the FTC contemplates how to “wipe out” entire industries, federal courts around the country have recently ruled that the regulator can’t accomplish such a goal under Section 13(b) of the FTC act. That’s the statute the FTC relied on to bring its most recent actions against merchant cash advance companies. It might not have bite.

As the FTC contemplates how to “wipe out” entire industries, federal courts around the country have recently ruled that the regulator can’t accomplish such a goal under Section 13(b) of the FTC act. That’s the statute the FTC relied on to bring its most recent actions against merchant cash advance companies. It might not have bite.

Under 13(b), the FTC is empowered to bring a lawsuit to obtain an injunction against unlawful activity that is currently occurring or is about to occur. It’s powerful, but very limited. However, for the last several decades, the FTC, with the help of federal courts, has interpreted the statute to mean that it can also force the defendants to “disgorge” with illegally obtained funds.

That’s how the FTC wiped out Scott Tucker and his payday lending empire. In a lawsuit the FTC brought against his companies under 13(b) in 2012, the Court entered a judgment of $1.3 billion against him.

Not so fast, modern legal analysis says. Tucker’s case is being brought before the Supreme Court of the United States to settle once and for all what 13(b) allows for and what it doesn’t.

The momentum does not weigh in the FTC’s favor.

On September 30, the Third Circuit ruled in FTC v AbbVie that the FTC is not entitled to seek disgorgement under 13(b). The Seventh Circuit arrived at a similar conclusion last year in FTC v Credit Bureau Center.

In an interview with NBC, FTC Commissioner Rohit Chopra said in August “We’ve started suing some [merchant cash advance companies] and I’m looking for a systemic solution that makes sure they can all be wiped out before they do more damage.”

As the FTC attempts to be more proactive in the area of small business finance, it will be important to monitor what the Supreme Court ultimately decides it can actually accomplish.