Brendan Garrett was a Reporter at deBanked. Articles by Brendan Garrett

Hudson Cook Partner Appointed to CFPB Taskforce on Federal Consumer Financial Law

January 14, 2020Jean Noonan, a Partner at Hudson Cook, LLP, has been announced as one of the new members of the Consumer Financial Protection Bureau Taskforce on Federal Consumer Financial Law.

Seeking to produce research and legal analysis of US consumer financial laws, over the next year the taskforce will focus on “harmonizing, modernizing, and updating the federal consumer financial laws – and their impending regulations – and identifying gaps in knowledge that should be addressed through research, ways to improve consumer understanding of markets and products, and potential conflicts or inconsistencies in existing regulations and guidance,” according to a CFPB statement.

Noonan has served as General Counsel at the Farm Credit Administration and Former Associate Director of the bureau of Consumer Protection Credit Practice at the Federal Trade Commission. The Hudson Cook Partner has also focused her legal practice on fair lending, private and consumer protection matters, as well as consumer financial services.

“It is a true honor to participate in this historic undertaking by the Bureau,” Noonan said in a Hudson Cook statement. “I look forward to collaborating with the other members of the Taskforce who share my deep interest and experience in the field to help the Bureau to enhance and fortify our consumer financial laws and regulations.”

Visa Acquires Plaid in $5.3 Billion Deal

January 14, 2020 Yesterday it was announced that Visa and Plaid, the financial services company that helps business connect with customers’ bank accounts, have penned a deal that would see Visa purchase the San Francisco-based startup for $5.3 billion. The purchase price is roughly double Plaid’s previous valuation of $2.7 billion after its 2018 Series C investment of $250 million. Pending regulatory confirmation, the acquisition is expected to be completed in 3-6 months.

Yesterday it was announced that Visa and Plaid, the financial services company that helps business connect with customers’ bank accounts, have penned a deal that would see Visa purchase the San Francisco-based startup for $5.3 billion. The purchase price is roughly double Plaid’s previous valuation of $2.7 billion after its 2018 Series C investment of $250 million. Pending regulatory confirmation, the acquisition is expected to be completed in 3-6 months.

Founded in 2013 by Zach Perret and William Hockey, Plaid’s API enables companies to easily link with customers bank accounts and connects to a host of apps, such as Venmo, Robinhood, Coinbase, TransferWise, and Acorns. The company claims to have connected to one quarter of Americans with bank accounts and has expanded to both the UK and Canada.

Not being Visa’s first interaction with Plaid, the startup had previously received investment from its new owner, along with other recognizable names like Mastercard, Goldman Sachs, Citi, and American Express.

“This fits well, strategically,” commented Al Kelly, Visa’s CEO, in a call with investors on Monday. “We’re excited about new business and the ability for this to accelerate our revenue growth over time.”

Speaking to CNBC, Perret told CNBC that “We feel fortunate to have been there for the early days of fintech, and to have helped develop that ecosystem … This represents an important milestone, and the ability to work with Visa to make our products much bigger and better – both domestically and internationally.”

Whether such developments mean added features, further expansion to new territories, or something else entirely remains unclear. However, much like Google’s acquisition of Fitbit late last year, this merger witnesses the passing on of a treasure trove of data, with the curtain being pulled on the financial details of millions of transactions between startups and consumers; leaving Visa better positioned to understand and pre-empt what exactly is happening in industries where unpredictable disruption is valued above all else.

Amazon Says Browser Extension No Longer Secure, Just After PayPal Acquired It

January 13, 2020Last week Politico reporter Ryan Hutchins noted on Twitter that Amazon has been alerting its website users who had installed Honey that the browser extension is no longer safe. The extension, which searches the web for sales coupons for items in your checkout basket and automatically applies them, was recently acquired by PayPal for $4 billion. The deal was agreed upon in November and completed last week. According to Hutchins, such warnings have been viewed by Amazon customers since just before Christmas.

Amazon is telling shoppers that the browser extension Honey — it gives you coupon codes and other ways to save — is malware.

Paypal bought Honey in November for $4 billion. That’s one extensive piece of Malware. pic.twitter.com/Di6I8RAX2X

— Ryan Hutchins (@ryanhutchins) December 20, 2019

Having been compatible for years without any security warnings from Amazon, critics have now raised the question over whether this was intentionally done to level competition between the two tech giants. Honey makes a profit by charging retailers a percentage of the sales made with the coupons that it finds, and with this now under PayPal’s umbrella, Amazon may no longer be comfortable taking that hit. Especially when its own Amazon Assistant offers a similar experience.

Having been compatible for years without any security warnings from Amazon, critics have now raised the question over whether this was intentionally done to level competition between the two tech giants. Honey makes a profit by charging retailers a percentage of the sales made with the coupons that it finds, and with this now under PayPal’s umbrella, Amazon may no longer be comfortable taking that hit. Especially when its own Amazon Assistant offers a similar experience.

Speaking to The Verge, an Amazon spokesperson said that “Our goal is to warn customers about browser extensions that collect personal shopping data without their knowledge or consent.” A charge against Honey that did not seem to stick for Hutchins, who continued on Twitter with, “That’s how all browser extensions work – including Amazon’s own extension.”

During the summer, a security vulnerability was found in the browser extension only to be quickly patched. Following the coverage of this latest security warning, a Honey spokesperson stated to Wired that “We only use data in ways that directly benefit Honey members – helping people save money and time – and in ways they would expect … Our commitment is clearly spelled out in our privacy and security policy.”

Pacific Equity And Loan Acquires Emerald Capital Funding

January 12, 2020 This week Pacific Equity & Loan, a hard money lender based in Washington state, acquired Emerald Capital Funding. Done to “provide more resources and investment opportunity to real estate investors in the Washington market,” according to a statement from PEL, the merger will see all of ECF’s staff move over to PEL.

This week Pacific Equity & Loan, a hard money lender based in Washington state, acquired Emerald Capital Funding. Done to “provide more resources and investment opportunity to real estate investors in the Washington market,” according to a statement from PEL, the merger will see all of ECF’s staff move over to PEL.

“The move comes amid a rapidly evolving mortgage industry in specifically the private money and hard money lending sector,” ECF’s President and Founder Christopher Robinson commented. “We need to stay ahead of the curve and assure that our customer receive the best value, the best technology, and continue to work with a trusted local lender.”

Speaking to deBanked, Sang Yoon, PEL’s Director of Business Development and Co-founder said that he was excited to move forward, noting that it’s a “two heads are better than one situation. By merging or acquiring a company, we are better able to service our customers.”

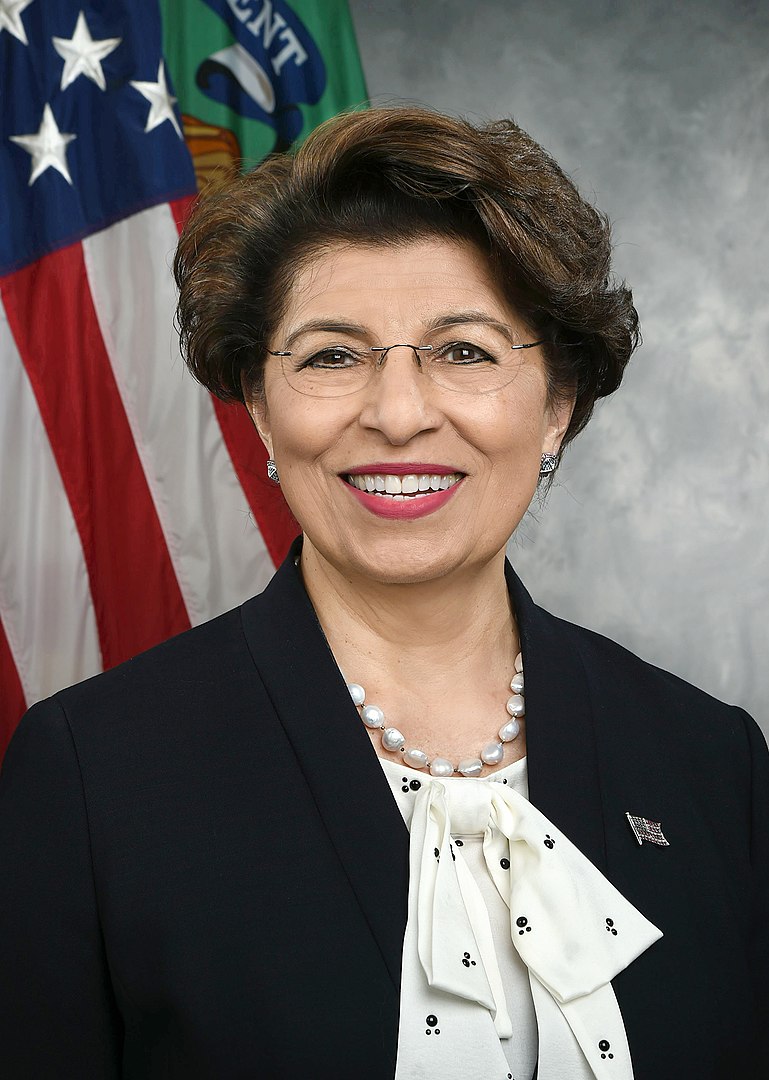

New Small Business Administration Chief Confirmed

January 9, 2020The newest Administrator of the SBA was announced on Tuesday. Jovita Carranza was appointed after President Trump had tweeted the previous Thursday about her nomination.

I am pleased to announce that Jovita Carranza will be nominated as the new @SBAgov Administrator. She will be replacing Linda McMahon, who has done an outstanding job. Jovita was a great Treasurer of the United States – and I look forward to her joining my Cabinet!

— Donald J. Trump (@realDonaldTrump) April 5, 2019

Replacing Linda McMahon, of WWE corporate fame who left the position in early 2019 to work at pro-Trump super PAC America First Action, Carranza will be the SBA’s first permanent leader in just under a year. The Administration had been led by Chris Pilkerton as the Acting Administrator in the interim.

Nominated by bipartisan vote of 88-5 in the Senate, Carranza appears to draw support from both sides of the political spectrum. Among those who voted against Carranza were former Democratic presidential nominee hopefuls Kamala Harris and Kirsten Gillibrand. Speaking on the appointment, Democrat and Ranking Member of the Senate Committee on Small Business and Entrepreneurship Ben Cardin said that he was “optimistic that Treasurer Carranza can be the leader and advocate that the Small Business Administration and American small businesses need right now.”

Nominated by bipartisan vote of 88-5 in the Senate, Carranza appears to draw support from both sides of the political spectrum. Among those who voted against Carranza were former Democratic presidential nominee hopefuls Kamala Harris and Kirsten Gillibrand. Speaking on the appointment, Democrat and Ranking Member of the Senate Committee on Small Business and Entrepreneurship Ben Cardin said that he was “optimistic that Treasurer Carranza can be the leader and advocate that the Small Business Administration and American small businesses need right now.”

Discussing her confirmation, a moment of political unity in an increasingly divided period for Washington, Heidi Chung of Yahoo! Finance noted the duality that Carranza brings to the office: “Long been known as someone for the people, she want to definitely help women as well as people of color, so I think, broadly speaking, even though she is a Trump favorite, I think a lot of people are looking forward to what she’s going to bring to the table when she really takes this job on.”

Having served as United States Treasurer from 2017 to 2019, Carranza was responsible for the operations of the US Mint, had dealings with the Federal Reserve, acted as an advisor to Secretary of the Treasury Stephen Mnuchin, and is likely to appear inside your wallet as a signature on dollar bills. Carranza also served as Deputy Administrator in the SBA during George W. Bush’s presidency.

Prior to her time in Washington however, Carranza worked at UPS for over twenty years. Starting off as a part-time truck loader, Carranza worked her way up through the package delivery service to become President of the company’s Latin American and Caribbean operations and subsequently Vice President of Air Operations from their Louisville, Kentucky facility.

Having worked at UPS while being a young mother and attending college, Carranza said on those years that “I thought if I could make it out of this situation – having an opportunity to acquire leadership and managerial skills; receiving on-the-job training – I would be able to finance higher education for myself; secure better caretakers and schools for my daughter – this is the American dream – what I strived to achieve not looking back!”

Carranza was born in Chicago to Mexican immigrant parents. Her father working as a factory foreman and her mother as a housewife. According to Carranza, her mother read a newspaper every day in order to teach herself English.

Seen as a long-time ally to Mnuchin, Carranza is credited by the Secretary as being instrumental in Republicans’ 2017 tax bill, and has said in a statement that she will “continue to promote pro-growth economic policies, eliminate job-killing regulations, and fight for the small businesses that are the lifeblood of the American economy.”

When asked at her Senate confirmation hearing in December what she would do in office, Carranza said that she would “put particular emphasis on opening more doors for women and for entrepreneurs in underserved communities, including military families and veterans,” and that she “will be a tireless advocate in the Cabinet for small businesses.”

Created in 1953, Carranza will be the SBA’s 44th Administrator, working with a budget of $820 million for 2020.

Report Finds Canadian Alternative Lending Market Making Gains

January 8, 2020 A study released by Smarter Loans this week indicates that the Canadian alternative finance industry has grown since last year’s iteration of the report. Titled ‘The State of Alternative Lending in Canada 2019,’ the report highlights how the market has developed in regard to the age and gender of its customers, the level of trust in online lenders compared to financial institutions, as well as the levels of satisfaction felt by Canadians dealing with alternative funders.

A study released by Smarter Loans this week indicates that the Canadian alternative finance industry has grown since last year’s iteration of the report. Titled ‘The State of Alternative Lending in Canada 2019,’ the report highlights how the market has developed in regard to the age and gender of its customers, the level of trust in online lenders compared to financial institutions, as well as the levels of satisfaction felt by Canadians dealing with alternative funders.

The first of these, regarding aspects of the customers’ identities, demonstrates that generational gaps are as wide as they’ve ever been amongst customers. Each age bracket questioned by the study showed differing priorities when seeking a loan. Generation Z, fitting in between those aged 18-24, paid attention to funders’ track records and reputation when looking for funding; whereas millennials (25-34) sought speedier applications and approvals. Generation X (45-54) however appeared more money-minded, with the priority being placed on terms and interest rates; and Baby Boomers (55-64) demonstrated a desire for having someone to talk to, putting customer service at the top of their list.

Vlad Sherbatov, Smarter Loans’ President and Co-founder, told deBanked that these differences can be summed up as the values each generation has developed through experience. Explaining that Gen Z is “all about the personal brand,” Sherbatov said, “People that are younger now really associate with the company they work for, they ask, ‘Am I aligned with or would I be embarrassed supporting this brand?’” While the Millennials’ response indicates a greater desire for results, “as the age progress the intent increases.” Gen X is “more educated and experienced people,” who appear to place the greatest importance on money; and Baby Boomers, the least digitally fluent group, just want the online applications to go smoothly and to have ready access to assistance.

As well as age, gender appeared to divide customers, with women more likely to spend more time researching loan providers than men; and more men saying that they were interested in approaching a traditional financial institution for a loan in the future, with half of them being of this opinion compared to just 39% of women. As well as this, it was found that women are more likely to find the application easier, but are less likely to be approved than men.

Regarding trust and transparency, roughly 70% of Canadians believe alternative finance to be a safe way of getting a loan. With 80% of customers feeling that they are informed enough of the industry’s practices and 69% saying that they believe online loan providers are transparent about their fees, interest rates, terms, and conditions.

According to Sherbatov, “this is a trend that’s been moving in a positive direction” over the years. With the 2018 version of this study emphasizing the need to build trust with Canadians to reduce that 30% which is holding out on, Sherbatov maintains the need to do more. “The more transparency from lenders, the more trustworthy it’ll be, the further the industry will advance.”

Customers appear to be mostly satisfied with the service they received from alternative lenders in 2019, with the average rating taken from the 2,415 respondents being 3.4 out of 5. This being a 0.2 bump up from last year’s score. Interestingly, one of the sectors reporting the highest levels of satisfaction were those customers who received payday loans, noting that they appreciated the speed with which they were approved.

Altogether, the report paints a picture of the Canadian scene as a market still in flux, where growth is happening, albeit slight, and both the customers and the lenders still have much to learn from each other.

The Scoop Behind The Primary Capital / Infinity Capital Funding Acquisition

January 6, 2020 This morning, Primary Capital announced that it had acquired the merchant cash advance division of Infinity Capital Funding. Infinity, which has been operating from California since 2006, began as an MCA company before expanding to offer small business loans as well. The acquisition will see Infinity’s thirteen years of data, technology, and merchant portfolios pass onto Primary.

This morning, Primary Capital announced that it had acquired the merchant cash advance division of Infinity Capital Funding. Infinity, which has been operating from California since 2006, began as an MCA company before expanding to offer small business loans as well. The acquisition will see Infinity’s thirteen years of data, technology, and merchant portfolios pass onto Primary.

Speaking on the acquisition, Primary Capital Managing Member David Korchak said that “anything that you can acquire with that much time behind it and that much experience behind it is excellent, and for us with what we’re trying to do it’s tremendous. It’s a big, massive help for us.”

As well as the intangible assets that will be conferred to Primary, Isaiah Kenigsberg will be joining their team. Having served as Infinity’s Financial Controller, Kenigsberg is now CFO at Primary.

The decision to acquire Infinity’s book came after Primary noticed that it was winding down its MCA operations, Korchak told deBanked. Seeing the value in obtaining such a trove of data proved too enticing to pass the Managing Member said, and Primary has been digging into the information obtained for the last three months.

For Korchak, something that has stood out from this analysis is the patterns that have emerged in the portfolio. “The thing that’s remarkable for these companies that have been around as long as them, is everyone seems to have clients that have taken 30 advances from them. They have clients that started back in ’07, ’08, that are still active merchants which is remarkable.

“The only difficulty is trying to analyze and say, ‘Why is this merchant after 30 different cash advances over a 12-year period still taking cash?’ And that’s really our model. And our goal for this year is to try and help subprime borrowers get out from having to take toxic debt like cash advances for their business. Ultimately, the data that we’re acquiring from ICF and this acquisition is going to help us study a lot of the transitions that MCA merchants have made since the beginning and see which ones have actually been able to get out of it.”

Asked whether there are any more acquisitions in the pipeline, Korchak responded, “Absolutely, we’re heavily data and service-driven for this year specifically, and we have a lot more to come.”

Robocalls Targeted by Trump, Cuomo, Michigan Attorney General

January 2, 2020 In what turned out to be a tough week for illegal robocalls, both the President and New York’s Governor have been behind bills set to combat the invasive form of marketing.

In what turned out to be a tough week for illegal robocalls, both the President and New York’s Governor have been behind bills set to combat the invasive form of marketing.

On Tuesday, President Trump signed the TRACED (Telephone Robocall Abuse Criminal Enforcement & Deterrence) Act, bringing into effect legislation first introduced to in November 2018. Aiming to crack down on the number of robocalls received by Americans, TRACED increases the fine faced by robocallers, setting it now in the range of $1,500 to $10,000 if caught. As well as this, the bill pushes for the rollout of call-authentication technology by telecommunication companies to identify ‘spoofed’ numbers and block them accordingly.

Such technology was authorized for use by an FCC vote last June. However while it has since been employed by the likes of T-Mobile and AT&T, the authorization did not guarantee all Americans access to the service, as in some cases it has been offered as a premium feature of more expensive phone plans.

Another detail of TRACED is that it extends the FCC’s period of time to collect fines from illegal robocallers from one year to four, a development that is seen optimistically as a path to increasing the number of charges made. According to the FCC, between 2015 and March of 2018, $208.4 million in fines was collected from illegal robocallers.

Historically, the onus has been on the individual to shield themselves from robocalls, with companies such as Hiya and YouMail offering apps to block them. But with this legislation, moves are being made to compel service providers to better protect their customers, and Governor Cuomo’s bill seeks to take this one step further.

Announced on January 1st, one day after Trump’s signing, Cuomo’s robocall bill is part of his 2020 agenda, titled State of the State. Sharing similarities with TRACED, one of the primary differences between the two bills is that Cuomo’s would require telecommunications companies to block robocalls, pinning them with a fine upon failing to do this.

And making it a hat-trick for anti-robocall legal action this week is Michigan’s Attorney General, Dana Nessel, who set up a Robocall Crackdown Team dedicated to charging those partaking in the criminal activity. “The message we want to send loud and clear is if you are engaged in this kind of illegal activity, we are going to come after you,” said Nessel at a press conference. “And we are going to prosecute you to the fullest extent of the law.”