Related Headlines

| 08/13/2024 | Debt settlement lawyer scams clients |

| 07/29/2024 | Debt settlement attorney sanctioned |

| 05/07/2024 | MCA debt settlement co sued |

| 02/01/2021 | Debt settlement scammer to be released |

| 07/25/2019 | Debt settlement scammer sentenced to prison |

Related Videos

Beware of Debt Settlement | Beware the Debt Settlement People |

Stories

Debt Settlement Attorney Sanctioned by Court

July 29, 2024A self-proclaimed merchant cash advance debt settlement attorney was sanctioned in the New York Supreme Court for frivolous conduct attributed to making an overtly false and/or misleading statement of fact.

The attorney is Dominick R. Dale, who is defending a merchant in an action brought by a revenue based financing company in Index No: EF000224-2024. According to court documents, Dale sought to move a case filed by plaintiff in Orange County, NY (which the contract specified as the forum) to either Kings County or New York County on the basis that defendant was not a resident of the State of New York, had no connection to the state, and that the forum selection clause in the agreement was invalid.

The irony is that the defendant did actually reside in Orange County, NY.

In the order granting plaintiff’s cross-motion for sanctions, the judge ruled that the defense attorney’s motion to transfer venue was “solely based on the distance between defense counsel’s office and the courthouse” because the 71 mile distance was apparently too far for him to want to travel.

The case is still ongoing.

Dale, who is listed under the name Law Office of Dominick Dale, Esq. in the action, also goes by the name “Merchant Cash Advances Law Firm” with an advertised focus on debt settlement.

An MCA Debt Settlement Owner Arrested by FBI

May 8, 2024 One of the alleged masterminds behind MCA Cure LLC, LDMS Group, LLC, and Evergreen Settlement Group LLC, was arrested by the FBI six weeks ago after inducing merchants to divert payments away from their MCA providers and then failing to negotiate with the funders.

One of the alleged masterminds behind MCA Cure LLC, LDMS Group, LLC, and Evergreen Settlement Group LLC, was arrested by the FBI six weeks ago after inducing merchants to divert payments away from their MCA providers and then failing to negotiate with the funders.

The accused is Mark Csantaveri, who is named along with two unnamed co-conspirators from New Jersey. Both co-conspirator names were made easily discoverable by details disclosed by the FBI however. The debt settlement websites made claims that they had a “proven proprietary debt restructuring system” that could lower their payments by 80%. As part of the enrollment process, merchants were directed to send funds to an escrow account, for which the co-conspirators would then transfer to their own personal accounts.

According to the complaint, they would then claim to be negotiating with the funders and give updates about waiting to hear from attorneys and settlements. The charges are for Wire Fraud, Conspiracy to Commit Wire Fraud, and Money Laundering.

Csantaveri was immediately remanded to jail, was represented by a public defender and was only recently released on a $200,000 unsecured bond.

“Csantaveri and his conspirators misappropriated the victims’ money for their personal use, including over $1 million in gambling expenses,” the DOJ said. “Csantaveri’s scheme ultimately defrauded more than 50 victims of more than $3.4 million dollars.”

Conspiracy to commit wire fraud is punishable by a maximum of 20 years in prison and a fine of $250,000 or twice the gross gain or loss involved in the offense, whichever is greatest.

“MCA Debt Settlement” Company Sued

May 7, 2024A firm that offers to “restructure corporate debt primarily MCA or Merchant Cash Advance debt” was sued last month by a small business owner for fraudulent inducement, consumer fraud, unjust enrichment, breach of fiduciary duties, and for a declaratory judgment. Corporate defendants include MCA Resolve LLC and Coastal Debt Resolve (ABSM LLC) in addition to several individuals.

The alleged scheme, as laid out by plaintiff, asks business owners to pay huge fees to the debt settlement firm all while being forced to default on their business financing agreements on the hope that they might eventually get a proposal to settle for far less than the amount agreed. In this case, plaintiff explained that the result was that they actually ended up owing more because of how much defendants were charging. The case was filed in the Superior Court of Arizona and can be viewed here.

Notably, MCA Resolve LLC is currently being sued by two unrelated MCA funding companies in the New York Supreme Court.

Stop the Debt Settlement People, Funders Come Up With Merchant-Friendly Alternative

April 3, 2024 Are debt settlement “advisors” interfering with your contracts and putting your merchants in a bad spot? The industry is now taking the reins on a solution. It’s called GreenLedger, a platform for funders to work together on resolving a merchant’s situation with no debt settlement middlemen encouraging an intentional default, taking fees, and making false promises.

Are debt settlement “advisors” interfering with your contracts and putting your merchants in a bad spot? The industry is now taking the reins on a solution. It’s called GreenLedger, a platform for funders to work together on resolving a merchant’s situation with no debt settlement middlemen encouraging an intentional default, taking fees, and making false promises.

Founded by Elevate Funding CEO Heather Francis, who aims to eventually make it a non-profit, merchants would go to this industry-collaborative platform, indicate who they have open contracts with, and the platform would notify the funders directly.

“From there, the primary points of contact at each funder can get together to come up with a more specific and comprehensive payment plan that works with the merchant’s needs,” said Francis. “GreenLedger’s mission is to work directly with our small business clients to stabilize their revenue-based financing arrangements and avoid breaching their agreements, eliminating the need for potentially predatory middlemen.”

The platform has already been generating interest.

“As an attorney deeply committed to the financial empowerment of small and medium-sized businesses, I am thrilled to endorse Elevate Funding’s creation of GreenLedger,” said industry attorney Patrick Siegfried. “This initiative represents a pivotal step in our ongoing battle against the increasing prevalence of unscrupulous entities in the commercial finance debt settlement industry. Far too often, these bad actors employ deceptive sales tactics and bind clients with unfair contracts, leading not to the promised debt relief but to further financial strain for small businesses. GreenLedger, with its dedication to transparency and integrity, stands as a true avenue for business owners seeking legitimate and effective financial solutions. Its mission to root out malpractices and safeguard the interests of small businesses is not just commendable but essential in today’s challenging economic landscape.”

To learn how you can participate and cut the debt settlement people out of the picture, attend this webinar on April 16th.

Funders Planning Mounted Response to Debt Settlement Schemers

December 30, 2021 Debt settlement companies are still using their tricky tactics, according to Efraim Kandinov of Fundfi Merchant Funding. He says a large group of funders are currently strategizing a mounted response to activity he believes is illicit.

Debt settlement companies are still using their tricky tactics, according to Efraim Kandinov of Fundfi Merchant Funding. He says a large group of funders are currently strategizing a mounted response to activity he believes is illicit.

Fundfi’s lawyers have already begun to send out Cease and Desists to the companies that have been telling his clients to breach their contracts and stop paying. He says it has become such an issue, that merchants in other parts of the country have begun ignoring his calls because of his New York area code, which they now associate with this kind of scam.

“[The merchant] said,‘I’m having all these New York numbers specifically, call me and plead with me ‘why are you doing this to yourself? Stop paying. Don’t pay these guys, pay me a fee and I’ll take care of it.’”

”This merchant was smart enough to say, ‘hey, this sounds like a scam’ and gave me the rundown.”

According to Kandinov, his company is one of the many that merchants are being told not to pay, while there are other funders who the debt settlers instruct to keep paying.

“They’re specifically targeting certain funders,” said Kandinov. “Whether they’ve been sued before by other ones, or have agreements, I have no idea. However I’m starting to realize, they’re specially targeting certain companies.”

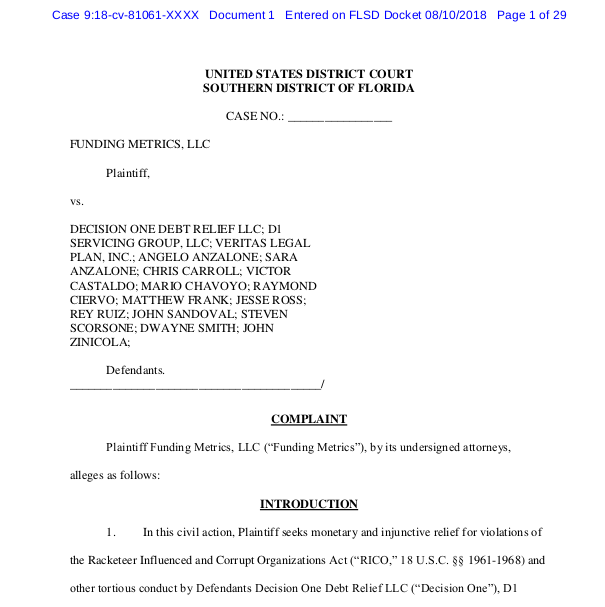

War on Debt Settlement Continues: 16 Defendants Sued in RICO Case

September 6, 2018

Fourteen individuals and two companies (including Decision One Debt Relief) were sued by Funding Metrics in Federal court last month for allegedly “conducting a nationwide illegal debt restructuring scheme through numerous acts of mail and wire fraud.”

The suit, which stems from the defendants’ interference with Funding Metrics’ merchant cash advance customers, makes six claims, among them financial damages resulting from state and federal crimes. Per the complaint:

“Defendant Decision One (along with its affiliate/alter ego D1 Servicing) fraudulently presents itself as being able to renegotiate and restructure merchant agreements with Plaintiff and other funding companies. It has established a deceptive business practice of making misleading and often outright false representations to merchants under contract with Plaintiff promising that, with its help, these merchants will save money on those contracts by defaulting on them. Decision One tells merchants that they can safely stop paying cash advance funding companies like Plaintiff; that it will go to work for them promptly; that it can reduce their debt by 60-80% or more; and that they will be provided with a Veritas insurance plan to cover legal expenses arising from their defaults, once cash advance companies exercise their rights under agreements with their merchants, as they inevitably will. Based on these misrepresentations, the merchants default on their contracts with their funders – that is, at Decision One’s direction, they stop paying their funders and instead pay Decision One – although Decision One does not even expect to achieve results for the merchants. The result is a fraud on the merchants and tortious interference with the contracts Plaintiff have with them.”

The suit is just the latest bomb dropped on the exploding debt settlement industry. deBanked began covering the controversy surrounding debt settlement in late 2016 after the owner and employees of an upstate New York debt settlement company were arrested for charging merchants to restructure their merchant cash advances and then not actually performing any services. The owner, Sergiy Bezrukov, was charged with money laundering, bank fraud, mail fraud, wire fraud and conspiracy to defraud. Bezrukov has been locked away in jail for almost two years awaiting trial. He is facing a maximum of 30 years. Two of his employees pled guilty, Vanessa Cardona to bank fraud and Dustin Walker to conspiracy to commit bank fraud.

Since then, nearly a dozen major lawsuits have been filed by merchant cash advance companies against other debt settlement companies that are alleged to be carrying out similar schemes. One of those sued companies, NJ-based Corporate Bailout LLC, was featured on the cover of the New York Post last summer for being “the craziest office in America.” Corporate Bailout was sued by both Yellowstone Capital and Everest Business Funding which later resulted in a very public settlement agreement that forced Corporate Bailout to fork over $500,000 to the two MCA companies.

Decision One Debt Relief, sued now by Funding Metrics, was also originally a co-defendant alongside MCA Helpline in a lawsuit filed by Everest Business Funding earlier this year. In February, after determining the two were not related, Everest dropped the claims against Decision One only. The suit against MCA Helpline is still pending.

Around that same time, a representative for Decision One revealed to deBanked that the company was on track to be doing more than $100 million a year in business.

Bezrukov, by contrast, who currently resides in a Niagara County New York jail, is accused of having only obtained $1.2 million throughout his entire debt settlement venture’s existence. Although Decision One is not being charged criminally, the private civil suit alleges damages caused by a violation of criminal statutes including RICO.

The Funding Metrics suit against Decision One was filed in the Southern District of Florida under ID# 9:18-cv-81061.

Collector Says “No” to Debt Settlement Companies That Want His Data

June 19, 2018

Debt settlement companies often find their leads by scouring through UCC filings, or publicly available forms that a creditor files to give notice that it may have rights to the property of a debtor. In the case of a small business, perhaps the refrigerators in a restaurant.

“[Looking through UCC filings] is a way of getting access to businesses that obviously owe somebody some money for their business,” said Shawn Smith, founder and CEO of Dedicated Commercial Recovery, a commercial collections company in Roseville, Minnesota.

But Smith told deBanked about another approach that debt settlement companies have taken to obtain leads of struggling businesses. He said they come to him.

“Who has a ton of accounts of struggling business owners?” Smith said. “Debt collection agencies that are working on behalf of funding sources. So [we] have like a list of all lists.”

Smith said that he gets approached by debt settlement companies looking for the contact information of struggling companies.

He always says “no.”

“They’re coming to me and saying ‘Hey, you know, for any merchant you send us that’s struggling, if we start working with them to help settle their debts, we will give you a large portion of the fee we make on settling that debt,’” Smith said. “And we of course would never do that.”

Dedicated works in two areas of collections: merchant cash advance and equipment leasing. In both cases, its goal is to recoup money for its clients, either merchant cash advance companies or equipment leasing companies.

Unlike this arrangement, a debt settlement company is not hired by a funding company. Instead, according to Smith, the debt settlement company searches for a struggling company, instructs the merchant to stop paying the funder and then approaches the funder with a settlement deal for often a fraction of what the funder is entitled to under the agreed upon deal. Smith said that settlement companies almost always propose to the funder: 20 percent of the value of the deal over five years.

Smith said he does work with debt settlement companies if they approach him representing a small business that can’t pay its bills, as long as what’s offered is within the range of what the funding company client would accept. Otherwise it’s a no-go. While Smith doesn’t share the names of struggling small businesses in exchange for kickbacks in the event of repayment, he’s convinced that this happens as he continues to be approached.

Founded by Smith in 2015, Dedicated has a staff of 18.

Settling Up: Debt Settlement Companies Paid Yellowstone Capital and Everest Business Funding a Half Million Dollars to End Lawsuit

June 12, 2018 A group of debt settlement companies and ISOs have entered into a settlement they’re unlikely to forget. A lawsuit that accused Corporate Bailout, Protection Legal Group, Mark Mancino, Michael Hamill and others of tortious interference with merchant cash advance contracts has led to a settlement in which the defendants agreed to pay Yellowstone Capital and Everest Business Funding $500,000. They also agreed not to offer any services to Yellowstone or Everest merchants in the future, deBanked has learned.

A group of debt settlement companies and ISOs have entered into a settlement they’re unlikely to forget. A lawsuit that accused Corporate Bailout, Protection Legal Group, Mark Mancino, Michael Hamill and others of tortious interference with merchant cash advance contracts has led to a settlement in which the defendants agreed to pay Yellowstone Capital and Everest Business Funding $500,000. They also agreed not to offer any services to Yellowstone or Everest merchants in the future, deBanked has learned.

The original complaint alleged that ISOs had partnered with companies that purport to offer debt relief services to merchants with MCAs. In practice, the complaint said, debt relief was a code word for deceiving merchants to breach their existing agreements so that they could pay fees instead to the debt relief companies.

When asked to comment, Yellowstone Capital CEO Isaac Stern said that there were companies that offer this kind of service the right way but that was not the case here. “The way they’re going about it is really wrong,” he said.

Of note is that the bound parties were not just debt settlement companies but also ISOs and a law firm (Mark D. Guidubaldi & Associates, LLC dba Protection Legal Group).

Additional companies not named in the original complaint but nonetheless bound to the settlement are Mainstream Marketing Group and Corporate Client Services LLC. Websites for both companies say that they offer small business debt relief services.

Coast to Coast Funding LLC, who the defendants represented they had no control of, did not participate in the deal.

The settled matter is not the first of its kind. Everest and Yellowstone have been hammering debt settlement companies with lawsuits this year, according to court records examined by deBanked. In January, Everest sued MCA Helpline and Todd Fisch for tortious interference, and just last month Yellowstone filed a Petition to recover funds that were allegedly fraudulently transferred by Settle My Cash Advance.

In the latter case with Settle My Cash Advance, the defendants are alleged to have actively coached a merchant to hide his money in new bank accounts and hide the paper trail rather than pay the money owed to Yellowstone.

Speaking about no case in particular, Stern said “Imagine getting a commission on a deal [where you help a small business get funding] and then sending it to a debt settlement company. If there are ISOs that are doing that, we’re going to come after you hard.”

need a home for my leads... good evening. my background is underwriting. however, i have landed into lead generation and have been selling my leads to a guy who needs them for pe... |

Slate Recovery- stop paying fees and losing money!... if you are an existing funder or a new funder, you know things have changed in the industry over the last few years. the question is, has your recover... |

Looking for New ISOs, up to 12 POINTS offered... offering 30 years of sales experience and the expediency to get your deals funded we are signed with over 60 direct lenders, 20 lenders in reserve ... |

Looking for New ISO's : Highest Payout Delivered... 08-12-2018, 12:49 pm we are an organization backed by 30 years of sales industry experience and the expediency to get deals funded we are now partner... |

See Post... debt settlement companies (thats a joke). anyone else getting flooded by these guys?, , yup, and alot if you look up linkedin were mca guys... |

debt mod companies... debt settlement companies (thats a joke). anyone else getting flooded by these guys?... |

See Post... debt settlement if you read the post. its a good thing that we never see metromedia funding solutions anywhere on the thousands of applications that we process. you would be ... |