|

Phone: 888-398-0444 Email: jordan@flashadvance.com Learn More |

Since: August 2023 Since: August 2023 |

Stories

A True Rapid Advance For Mark Cerminaro

December 16, 2016 In the 1999 film “Any Given Sunday,” Al Pacino plays a pro football coach whose obsession with winning has torn apart his family. He’s also plagued by a meddlesome team owner, challenged by an offensive coordinator who’s after his job, and vexed by a talented but narcissistic backup quarterback. But none of that stops the coach from reaching deep inside to deliver a stirring halftime pep talk to his dispirited losing team. Assuring his players that life and football are both games of inches, he beseeches them to look into the eyes of the men around them. “You’re going to see a guy who will go that inch with you,” he declares. “Either we heal now as a team or we will die as individuals.” The players rally and explode onto the field.

In the 1999 film “Any Given Sunday,” Al Pacino plays a pro football coach whose obsession with winning has torn apart his family. He’s also plagued by a meddlesome team owner, challenged by an offensive coordinator who’s after his job, and vexed by a talented but narcissistic backup quarterback. But none of that stops the coach from reaching deep inside to deliver a stirring halftime pep talk to his dispirited losing team. Assuring his players that life and football are both games of inches, he beseeches them to look into the eyes of the men around them. “You’re going to see a guy who will go that inch with you,” he declares. “Either we heal now as a team or we will die as individuals.” The players rally and explode onto the field.

It’s a scenario the sales staff can’t get enough of at RapidAdvance, a Bethesda, Md.-based alternative small-business finance company with more than 200 employees. Mark Cerminaro has screened a clip of the scene countless times in a company conference room to fire up his crew. Salespeople emerged from those meetings eager to make that extra phone call, provide the telling detail on an application or do whatever else it would take to taste the victory of making the sale. For Cerminaro, the movie and the sales meetings embodied his penchant for winning ethically through teamwork, dogged persistence and great customer experience. That credo has helped propel him to top management at RapidAdvance and has earned him accolades from once-skeptical financial services peers.

Cerminaro’s story begins in his hometown of Highland Park, N.J., where he experienced a small-town vibe but enjoyed easy access to New York City, Philadelphia and the Jersey Shore. He graduated in a class of 85 students from the local public high school, playing varsity football, basketball and baseball. Summers, he worked construction, did landscaping, delivered flowers and umpired Little League. “It was a great place to grow up,” he says.

In high school, Cerminaro sometimes went along for the ride when his sister, who was five years older, was choosing a college. On a visit to Georgetown University in Washington, D.C., Cerminaro stood in the student center and gazed out at the campus. “I’m going to come here and play football,” he told himself.

In high school, Cerminaro sometimes went along for the ride when his sister, who was five years older, was choosing a college. On a visit to Georgetown University in Washington, D.C., Cerminaro stood in the student center and gazed out at the campus. “I’m going to come here and play football,” he told himself.

He made good on that vow when his high school football team made a reputation for itself, and Georgetown was among the schools that recruited him. Besides, it made sense to go there because he was interested in studying politics and going to law school. Growing up with a father who was chairman of the local Democratic Party, Cerminaro had his eye on eventually becoming governor of New Jersey.

Playing for the NFL on the way to the governor’s mansion seemed like a good idea, too. But Cerminaro, a quarterback, blew out his throwing arm two years into his collegiate football career. His dreams of making the pros died, but that left more time for academics. He plunged into a series of four rigorous internships, three of them in politics. He served two in the Clinton White House and one on Capitol Hill with Sen. Robert Torricelli, D-N.J. He fondly recalls talking to President Bill Clinton for five minutes before a state dinner. Then two hours later, after spending time with heads of state, the President called out, “There’s Mark, my fellow Hoya.” Cerminaro will never forget it.

In the end, however, the fourth internship won out. Although Cerminaro hadn’t studied business or finance too much, he landed an internship in the local Washington, D.C., office of Morgan Stanley. If nothing else, it would help him manage his investments some day, he reasoned. However, he soon approached the operations manager and some senior brokers and offered to take on duties they didn’t want to fulfill. He had decided to learn about operations, and taking on extra work without additional compensation was in line with his new habit of figuring out what steps would take him where he wanted to go in life.

Cerminaro earned his managerial license with Morgan Stanley and accepted a job as associate branch manager in the Washington, D.C., office, managing and training new financial advisors. He considered the position great exposure to sales, management, operations and compliance – “elements that have paid dividends in the growth of my career,” he notes.

Early in Cerminaro’s tenure at Morgan Stanley, the company sent him for training with about 300 other new employees at 2 World Trade Center in Manhattan. The date was Sept. 10, 2001. When the trainees reported to the office the next day, they were in a 64th-floor conference room when they heard an explosion and saw shreds of paper floating past the windows. They didn’t realize yet that a terrorist-controlled jetliner had hit next door at 1 World Trade Center.

Early in Cerminaro’s tenure at Morgan Stanley, the company sent him for training with about 300 other new employees at 2 World Trade Center in Manhattan. The date was Sept. 10, 2001. When the trainees reported to the office the next day, they were in a 64th-floor conference room when they heard an explosion and saw shreds of paper floating past the windows. They didn’t realize yet that a terrorist-controlled jetliner had hit next door at 1 World Trade Center.

As they evacuated down a stairwell, the trainees heard and felt the concussion of the second plane that hit their building. “I’m 22 years old and I may be about to die,” Cerminaro remembers thinking. “Make sure my family knows I love them,” he prayed. He made it out and was greeted with smoke, debris, the flashing lights of emergency vehicles and panic in the streets. He walked to a restaurant some family friends operated in Little Italy and borrowed a working phone to call his family in New Jersey and let them know he was OK.

Returning to the D.C. office of Morgan Stanley, Cerminaro got back to work. He loved the entrepreneurial spirit at the company, but as the years passed he realized he was unlikely to amass enough power in the giant firm to dictate how it would operate, grow and change. So he was interested when someone he knew at Morgan Stanley told him about RapidAdvance, then a two-year-old company with about 20 employees. “I saw the opportunity to be part of building a company – that’s what drew me to RapidAdvance,” he recalls.

In 2007, Cerminaro interviewed with Jeremy Brown, who was RapidAdvance’s CEO at the time and has since advanced to chairman. “It was apparent that Mark had a well thought-out, well-articulated plan for sales,” Brown says of his first impression. “He had a presence about him, a command that said this guy a real leader – somebody who could make a long term component of the company.”

Cerminaro joined RapidAdvance as national sales director and began building a sales structure and team based on some of the elements of Morgan Stanley’s sales model. Developing KPIs, or key performance indicators, helped him measure progress. “You had to roll up your sleeves and get involved in every aspect of things,” he said of working for a startup in a fledgling industry. The company’s outbound call center came up with sales leads, and he cut and pasted them from an Excel spread sheet and divvied them up among the five or six account executives.

Cerminaro wanted to teach that handful of salespeople to function as business advisors and help them become the single point of contact for clients. His salespeople guided small-business owners through the application process and stayed in contact with them after the sale. He emphasized doing right by customers, teammates and the company as a whole. It was a vision that inspired the team.

Cerminaro wanted to teach that handful of salespeople to function as business advisors and help them become the single point of contact for clients. His salespeople guided small-business owners through the application process and stayed in contact with them after the sale. He emphasized doing right by customers, teammates and the company as a whole. It was a vision that inspired the team.

“Mark was a great mentor and provided me a lot of guidance and tutelage over the years,” says Devin Delany, who started as an account executive at RapidAdvance and has moved up to director of sales. “His real mission was to create a sense of family and he executed on that to the fullest extent, creating a close knit team of upward of 40 folks who really care about one another.”

That sales “family” used dialogue marketing to refocus attention on prospects who had fallen out of the sales cycle. In those days they used a product-driven sales pitch based on merchant cash advances. Third-party partners included credit card processors and credit card ISOs. Brokers came onto the scene later.

Soon after Cerminaro arrived at RapidAdvance, the financial crisis struck. The company managed to navigate the troubled times and emerged with improved underwriting skills, a better understanding of leading indicators and a truer grasp of how its portfolio performs. Something else happened, too.

As traditional lines of credit dried up during the recession, small businesses that didn’t accept credit cards began to search for working capital. In response, Cerminaro, Brown and Joseph Looney, RapidAdvance’s chief operations officer and general counsel, sat down and outlined a plan to offer small-business loans as well as MCAs. “That effort really redefined who RapidAdvance was,” Cerminaro says of the new loans. “We went from a single-product company to now being more of a solutions-based company,” he maintains. “We were able to shift from selling a product to doing needs-based analysis with our clients and focusing on what was the right solution for them.”

As traditional lines of credit dried up during the recession, small businesses that didn’t accept credit cards began to search for working capital. In response, Cerminaro, Brown and Joseph Looney, RapidAdvance’s chief operations officer and general counsel, sat down and outlined a plan to offer small-business loans as well as MCAs. “That effort really redefined who RapidAdvance was,” Cerminaro says of the new loans. “We went from a single-product company to now being more of a solutions-based company,” he maintains. “We were able to shift from selling a product to doing needs-based analysis with our clients and focusing on what was the right solution for them.”

Cerminaro found it exciting to develop the loan program and oversee sales, but he was looking for more. He turned part of his attention to business development and even expanded his purview to include marketing. The company was thinking along the same lines. In 2010, RapidAdvance promoted him to senior vice president, sales and marketing. “As the company has grown we have had different needs, and we leaned on Mark and his skill set every time we made a change,” Brown says. “Every time we made a change he has stepped up and done what’s asked of him.”

Producing one of the industry’s first national television ad campaigns highlighted Cerminaro’s period as senior vice president. “We were the pioneers in being able to market through that medium,” he says. “It was absolutely scary at the same time. It was a massive investment for us and we had no idea whether it would pan out.” The sales staff were waiting in anticipation when the phones began ringing after the public saw the commercial. “The original spot we put together still tests well and drives a lot of traffic,” he notes. Viewers find a tune featured in the ad sticks in their minds and can’t help humming it – sometimes when they’d prefer they didn’t, he adds.

Then came another promotion. In 2013, just before Detroit-based Rockbridge Growth Equity LLC acquired RapidAdvance, Cerminaro was named chief revenue officer and became responsible for all revenue-generating activities and all of the company’s front end efforts. The company had grown significantly over the years, but the merger increased financial backing and thus accelerated growth, he says. For him, that meant pursuing a new type of partner company – asset-based lenders and factoring companies. It wouldn’t be easy. “The traditional lending market had a lot of misconceptions about our industry,” Cerminaro admits. “A lot of people in that business were very critical.”

But Cerminaro made the rounds of trade shows and visited conference rooms until he succeeded in winning the hearts of bankers, according to Will Tumulty, RapidAdvance’s CEO. “Mark and his team have developed partnerships in the commercial lending space,” Tumulty says. “There are a number of companies that have historically viewed working-capital funding as a competitor. We don’t see ourselves competing with those companies. Mark and his team have worked with those companies to get merchants what they need.”

As a testament to Cerminaro’s success in that quest, the Commercial Finance Association named him to its 2016 list of “40 under 40” achievers. He was the only person from alternative small-business funding to make that venerable list of prominent young lending executives. He helped spur his company on to other awards, too. The RapidAdvance Bethesda office was chosen for The Washington Post Top Workplaces 2016 list, and the RapidAdvance Detroit office made the list of 101 firms recognized as Metro Detroit’s 2016 Best and Brightest Companies to Work For.

Meanwhile, Cerminaro was successfully courting mega retailers, says Brown. When the possibility of becoming a partner with Office Depot arose, Brown felt hopeful but remained skeptical because of the long lead time required to convince so many executives in such a large corporation. “But mark was dogged,” he says. “It took him probably a year to land and close the deal and negotiate the agreement and sign the account. He went to countless meetings down in Florida. He participated in endless conference calls, but mark got the deal done. It’s a relationship we’re proud of, and he is singularly responsible for closing that deal.”

In those encounters with Office Depot execs, Cerminaro displayed savvy and professionalism, Brown says. They’re traits that will continue to pay off not only for RapidAdvance but for the entire industry, maintains RapidAdvance’s Looney. “He’s out there with lots of big banks and other potential partners,” says Looney. “He’s a good face for the industry.”

For Cerminaro, it’s satisfying to see RapidAdvance become all he dreamed it could be. But that still comes in second for him and differentiates him from the coach played by Al Pacino. Cerminaro’s the kind of guy who asked his father to be his best man and now has a wife and two sons of his own. “Your family and your loved ones are by far more important than anything else in your life,” he says.

The End Of An Era – deBanked Through The Decade

December 30, 2019

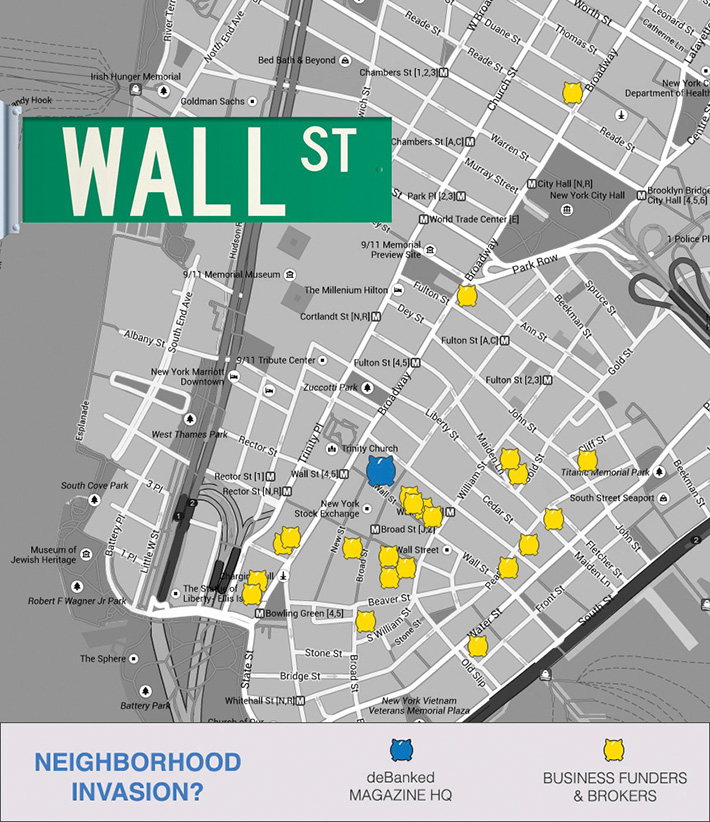

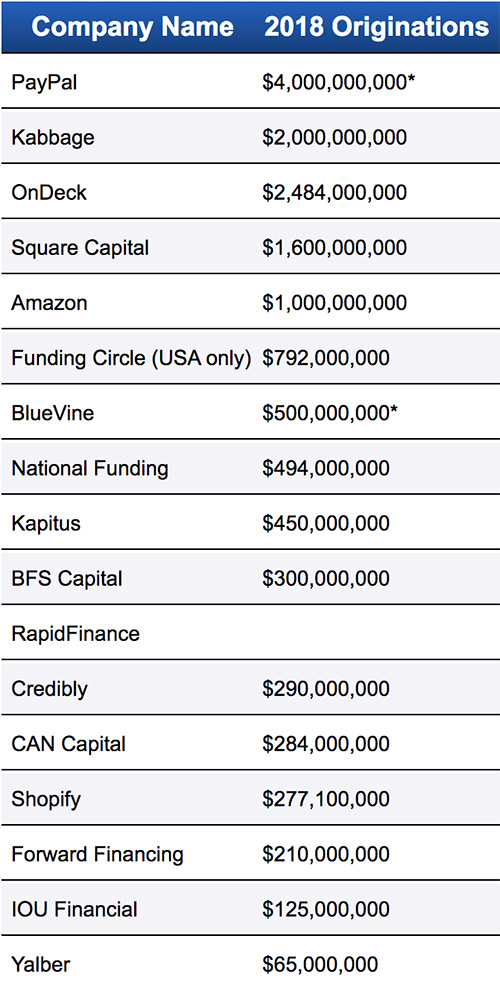

deBanked estimated that approximately $524 million worth of merchant cash advances had been funded in 2010.

In 2019, merchant cash advances and daily payment small business loan products exceed more than $20 billion a year in originations.

First Funds

Merchant Cash and Capital

Business Financial Services

AmeriMerchant

Greystone Business Resources

Strategic Funding Source

Fast Capital

Sterling Funding

iFunds

Kabbage

OnDeck

Square Capital

Amazon Lending

Funding Circle USA

Yellowstone Capital

Entrust Cash Advance

Merchants Capital Access

Merchant Resources International

American Finance Solutions

Nations Advance

Bankcard Funding

Rapid Capital Funding

Paramount Merchant Funding

2M7 Financial Solutions and the State of Alternative Funding in Canada

July 1, 2019 “What’s a cash advance?”

“What’s a cash advance?”

This is how Avi Bernstein, CEO of 2M7 Financial Solutions, recalled a typical conversation in 2008, when his company was founded in the Canadian market. According to him, customer knowledge of alternative financing methods was dismal, partly due to a handful of homogenous banks dominating the scene as well as a void of funders in the country.

Flash forward to 2019 and 2M7 is operating within a Canadian market that is much more trusting and knowledgeable of merchant cash advances, although it is not yet at the levels witnessed in the U.S.

“Low hanging fruit,” is how Bernstein describes the industry now, as small and medium-sized businesses are flocking to 2M7 and its contemporaries, which offer higher approval ratings and faster confirmation of funding than their more traditional counterparts. In fact, according to a 2018 study conducted by Smarter Loans, 24% of those Canadians surveyed stated that they sought their first loan with an alternative lender that year. As well as this, only 29% reported that they pursued funding from more established, traditional financial institutions and 85% of those that received financing confirmed their satisfaction.

Figures like these help to explain why the Canadian market has seen a rise in interest from foreign businesses in the previous five years. Greenbox Capital, First Down Funding, and Funding Circle are examples of those companies who have successfully implanted themselves within the market, a feat that Bernstein claims isn’t easy.

“It’s a different business,” he notes when comparing the market to that of the U.S. Listing the dissimilarities in market maturity levels, sales tactics, processing channels, and collection styles, as well as the currency exchange rate that’s to be considered, Bernstein says that he’s found those American funders who come to Canada unprepared never stay long enough to become a fixture of the industry.

“It’s a different business,” he notes when comparing the market to that of the U.S. Listing the dissimilarities in market maturity levels, sales tactics, processing channels, and collection styles, as well as the currency exchange rate that’s to be considered, Bernstein says that he’s found those American funders who come to Canada unprepared never stay long enough to become a fixture of the industry.

Warning against half measures, Bernstein explains that “You’ve gotta put boots on the ground” if you want to succeed in Canada. Giving the impression that unless you’re willing to learn the rules applied in the market, hire people, and house them in an office north of the American border, Bernstein is keen to highlight what’s required of foreign companies looking with interest at Canada.

But it’s a risk-reward situation. The market is opening up as more funders enter it, and with the arrival of larger companies, such as OnDeck Capital, more resources are being devoted to raising awareness of alternative financing amongst Canadians.

Meanwhile, homogenous firms like 2M7 are continuing to grow in this developing market. Receiving an average of 200-300 applications for funds per month, 2M7 is capitalizing off opportunities by proving themselves to be open to a wider range of applications. Bernstein asserts that “we try to fund everything,” and that they keep an “open mind to every opportunity” that lands on their desk. Perhaps this is a mindset not shared by more conservative of funders in the industry, but, as Bernstein says, “we’re here, we’re funding, and we’re ready to rock n’ roll.”

You can meet Avi Bernstein and 2M7 at deBanked CONNECT Toronto on July 25th.

Former MCA Co-founder Meir Hurwitz Kicks Off New Venture With Kim Kardashian West

November 9, 2017I love how @screenshopit lets you find the exact designer looks you see people wearing online, plus suggests similar items at all price points! #ScreenShop_Ambassador https://t.co/TXZ23agVoT pic.twitter.com/nA8JBDVbU5

— Kim Kardashian West (@KimKardashian) November 7, 2017

An early innovator of the merchant cash advance industry has re-emerged on the business scene in a very different new venture focused on mobile shopping.

Meir Hurwitz, co-founder of Pearl Capital, the MCA company acquired in 2015 by Capital Z Partners Management LLC for as much as an estimated $60 million, is now the chief visionary officer of ScreenShop. The New York startup markets an app designed to enable users to shop for a specific item by uploading a screenshot of the item to the app.

Working on a mobile app is a longer shot than MCA and it doesn’t always pay off, but Hurwitz said Thursday he’s enjoyed learning the business after two years off and visiting 62 countries since selling Pearl Capital.

“It’s new and exciting for me, but I don’t get paid right away,” he said. “It’s something I haven’t done before — it’s kind of exciting for me.”

The app is the first developed by New York-based Craze Ltd. and publicly launched on Nov. 7 with celebrity Kim Kardashian West cited as an advisor. Craze employs 12 technical workers in Israel and five in New York, Hurwitz said.

Hurwitz started in MCA in 2006 and then launched Pearl Capital with partner Abe Zeines in 2010.

Pearl launched with $1 million and generated an $8 million profit in 2012. The following year, the company doubled its profit and reached origination volume of $100 million, Bloomberg reported in 2015. Hurwitz’s ScreenShop profile indicates that he’s a “three-time successful entrepreneur” and cites “over $500 million in funding capital.”

In addition to a real estate business in Puerto Rico, Hurwitz said he’s managing partner of New York-based GS Capital, a convertible debt company lending to small businesses. Zeines lists himself as the CIO of GS Capital, according to his online profile.

At ScreenShop, Molly Hurwitz (Meir’s sister) is listed as the co-creator and co-founder. CEO Mark Fishman was previously a risk manager for Pearl Capital.

The startup’s app, which is free, scans screenshots taken from any app or website on a mobile phone, converting them to similar items that can be bought for various prices. It plans to generate revenue by collecting a commission at the point of sale, Forbes reported.

“The results have been — we’re No. 5 on the app store category of fashion,” Meir Hurwitz said. “We’re just getting started.”

Should I Start an ISO With Only $2,000?

January 12, 2015A long time ago in a galaxy far, far away…

It is a period of civil war. Rebel sales reps, striking from a hidden ISO, have won their first victory against the evil Galactic Funder.

During the battle, Rebel spies managed to steal secret formulas to the Funder’s ultimate weapon, the UNDERWRITING ALGORITHM, an advanced code with enough power to destroy an entire industry.

Pursued by the Funder’s sinister sales agents, our hero races home with her flash drive, custodian of the stolen formulas that can save her merchants and restore freedom to the industry…

Breaking away to start your own ISO or brokerage in this industry used to be a rite of passage. You started somewhere, learned the ropes, then went off on your own like a Jedi Master.

The stories of reps and underwriters of years past who left their jobs to start their own ISOs are a bit nostalgic. Young twenty-somethings defying authority to plant their own flags in an industry they felt offered unlimited potential. For some, going solo was a rude awakening, a healthy taste of the real world, where you needed to be able to do more than just close the leads you’re given. But for others? Well, today they are the owners or managers of companies worth millions, tens of millions, or hundreds of millions of dollars.

Empires were built not that long ago and they certainly were not in a galaxy far, far away. But today the prospects are much bleaker. The industry has matured and certain channels are saturated. Merchant cash advance and non-bank business lending are no longer part of a young unexplored universe.

So to those that have asked me whether or not it makes sense to start an ISO in 2015, I’d have to say in many cases it does not. It’s a little late in the game. Below is one of the most popular questions posed to me over the last six months:

Q: I’m thinking about starting my own ISO. I have about $2,000 to $5,000 to spend on leads. Do you think I can do it and where should I buy the best leads from?

Q: I’m thinking about starting my own ISO. I have about $2,000 to $5,000 to spend on leads. Do you think I can do it and where should I buy the best leads from?

A: There’s a few things to address here. If you are working out of your house and your rent/mortgage is already taken care of without you having to pay yourself from your new ISO, you may be able to turn a profit starting with something this small. The first problem though is that if you’re not absolutely positive where to get excellent leads, you’re going to spend a lot of money on experimenting with multiple sources. $2,000 might be the cost of an experiment with one lead provider. In other cases, it might be $5,000. Your entire budget could get wiped out in an experiment with just one source.

There may be no barriers to entry in this business, but $2,000 to $5,000 is entirely too little to give yourself a real chance to get off the ground. Direct mail takes a lot of trial and error and thousands of dollars. Google/Bing advertising takes even more trial and error and tens of thousands of dollars before you can get really meaningful results.

And if you’re going to put all your eggs in the UCC marketing basket because of budget, it’s going to be a tough climb uphill.

The companies that do actually have the best leads don’t need a $2,000 startup ISO to sell them to. A big ISO or funder is probably already paying double the price they’re worth.

So how do you stand a chance? You should realize that the odds are you won’t.

And if you need to allocate part of that 2-5k to pay for an office and get set up like a business, you might not have anything left for marketing at all. That’s a horrible place to be!

Lastly, I have seen many ISOs try to become a broker’s broker in order to acquire deals. That means trying to close ISOs to send you deals for you to forward on to a funder as a middleman where you will get a cut if the deal closes. It’s a hustle, and if you can swing this, great, but it’s not exactly a sustainable model especially if the ISO realizes they can go direct to the funder themselves. If you can’t acquire merchants on your own (and deals you stole from the last place you worked at don’t count as acquiring on your own), then you probably shouldn’t be in the ISO business at all.

If you’re going to start an ISO in 2015, I suggest having a minimum $25,000 (50k to be safe) in marketing to start off. And if you don’t know what you’re doing, well then may the force be with you.

Flash Advance is a new site sponsor!... please welcome flash advance as a new site sponsor. to learn more about them visit: https://bit.ly/2opt7v1 :cool::) (https://bit.ly/2opt7v1)... |

See Post... flash advance has been funding , will be funding . we never stopped !!!!!... |

Covid lending limits increased... flash advance increased it's covid lending limits for 2nd and 3rd position b-c paper from 50k to 65k . , , all files are underwritten upfront with minimal ... |

See Post... flash advance is open and funding . if you're not signed up this would be a great time to finish the year strong .... |

I’m in a unique position to discuss OnDeck. I started my career in this industry before they even existed. I’ve competed against them as an underwriter at a rival firm, worked with them as a referral partner when I was in sales, and covered them in my capacity as Chief Editor of an industry

I’m in a unique position to discuss OnDeck. I started my career in this industry before they even existed. I’ve competed against them as an underwriter at a rival firm, worked with them as a referral partner when I was in sales, and covered them in my capacity as Chief Editor of an industry

It’s a debate that continues even to this day and yet OnDeck has secured hundreds of millions in investments from companies like Google Ventures, Goldman Sachs, Peter Thiel, and Fortress Investment Group. Their notes got an

It’s a debate that continues even to this day and yet OnDeck has secured hundreds of millions in investments from companies like Google Ventures, Goldman Sachs, Peter Thiel, and Fortress Investment Group. Their notes got an  and take on profitability second. In their case, it’s not eyeballs or site visits, it’s loan origination volume.

and take on profitability second. In their case, it’s not eyeballs or site visits, it’s loan origination volume. Through it all, there remains the fact that OnDeck has never claimed their methodologies to be profitable, at least not yet. Red ink at IPO time might reward their detractors with a certain delicious satisfaction, but what will they say if and when they become profitable?

Through it all, there remains the fact that OnDeck has never claimed their methodologies to be profitable, at least not yet. Red ink at IPO time might reward their detractors with a certain delicious satisfaction, but what will they say if and when they become profitable?  OnDeck’s critics are in a paradoxical position because a successful IPO is good for them too. They want to believe OnDeck’s model never worked, can’t work, and have it be proven a failure. But if it goes the other way, the legitimacy of the daily funder universe will be solidified in the mainstream. What’s good for the goose is good for the gander.

OnDeck’s critics are in a paradoxical position because a successful IPO is good for them too. They want to believe OnDeck’s model never worked, can’t work, and have it be proven a failure. But if it goes the other way, the legitimacy of the daily funder universe will be solidified in the mainstream. What’s good for the goose is good for the gander.  Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist.

Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist.