Archive for 2021

Senators Marco Rubio, Sherrod Brown Renew Campaign to Ban COJs Nationwide

April 15, 2021 The Small Business Lending Fairness Act is back. Senators Marco Rubio and Sherrod Brown reintroduced a bill this week that failed to advance the two previous times it was introduced.

The Small Business Lending Fairness Act is back. Senators Marco Rubio and Sherrod Brown reintroduced a bill this week that failed to advance the two previous times it was introduced.

One of cornerstone objectives is to outlaw confessions of judgment from being used in business loan transactions nationwide.

“With this bill, we are taking another step toward protecting America’s small businesses—the foundation of our economy—by preserving the right of a business to be heard in a court of law before a potential credit default,” Rubio said. “I remain committed to protecting our small businesses from predatory, out-of-state lenders, and I urge my colleagues to join me in this effort.”

“When we let financial predators harm hardworking Americans through scams like confessions of judgment, we undermine the dignity of work,” Brown said. “This bipartisan bill would protect consumers and small business owners from predatory lenders that use legal tricks to strip away their hard earned money.”

This is not the first swipe at COJs. In 2019, New York passed a law that made it illegal to file a confession of judgment against a non-New York debtor in the New York state court system. However, this does not prevent a party from using another state’s COJ and filing the COJ in that respective state.

The federal bill was previously introduced in 2018 and 2019 and failed to advance both times. The text of the bill can be found here.

Governor Phil Murphy on Fintech in New Jersey

April 14, 2021 In a joint webinar between Choose New Jersey, FinTech Ireland, the New Jersey City University School of Business, and others, NJ Governor Phil Murphy kicked off the event by saying that his state’s object is nothing short of being the state of innovation, where new ventures can take shape, companies can expand, and people can raise a family.

In a joint webinar between Choose New Jersey, FinTech Ireland, the New Jersey City University School of Business, and others, NJ Governor Phil Murphy kicked off the event by saying that his state’s object is nothing short of being the state of innovation, where new ventures can take shape, companies can expand, and people can raise a family.

Murphy’s participation in Irish fintech collaboration was steeped in his commitment to international relations and business.

“The fintech business in particular is a big part of our economy,” Murphy said. “We’ve got proximity to New York City’s financial markets and as a result we’ve become sort of the perfect home for fintech companies. We have 145 fintech companies headquartered in New Jersey.”

The island of Ireland, by comparison, is home to nearly 250 indigenous fintech companies, according to the latest Fintech Ireland map. Recently, Irish fintech companies ranked the United States and Canada as their #1 priority region for expansion.

New Jersey is hoping to benefit from transatlantic opportunities this might present.

“There’s no better place in America than to plant your flag here in New Jersey,” Murphy said. “To those who are considering [it], it’ll be the best decision you ever make.”

The Governor also revealed that his family is descended from Donoughmore, County Cork and that he hopes to make a state trip to the republic soon.

Gregory J. Nowak, Partner at Troutman Pepper, Has Passed Away

April 13, 2021 Gregory J. Nowak, a partner at Troutman Pepper, passed away suddenly on April 11th at the age of 61.

Gregory J. Nowak, a partner at Troutman Pepper, passed away suddenly on April 11th at the age of 61.

The firm’s website introduced Nowak as a veteran attorney that was “sought after for advice on complex securities law matters, particularly on issues arising out of the Investment Company Act of 1940; the Investment Advisers Act of 1940; federal and state securities laws and regulations; broker dealer, FINRA, CFTC and NFA regulatory matters; and corporate and M&A transactions.”

That perfectly sums up the context in which I first encountered Nowak in 2017 when he spoke at a small event put on by the Alternative Finance Bar Association where I was the only non-lawyer in the entire audience. One might expect a presentation on the finer minutiae of securities law of which he gave, to be a mundane, easily forgotten experience for a financial journalist such as myself, but his energetic delivery and fluid command of the subject matter translated complex securities questions into a folksy debate wherein one could feel confident in resolving the Howey Test over the dinner table just as easily as they could in the courtroom.

In fact, I approached him afterwards to thank him on his presentation and even followed up later over email, asking if I might have the honor to list him as a recommended securities attorney on the deBanked website. That was four years ago and as fate would have it, he remained the only recommended attorney that deBanked formally listed under the securities category, despite my coming to know very many accomplished and competent attorneys in the same field of law.

Nowak was one of the earliest public voices in the world of merchant cash advance participations and syndication where the securities question was a consideration some weren’t even sure applied as the industry created new products and investing structures at a furious pace.

He spoke at deBanked’s first major conference in 2018 on the subject of “Syndication and Raising Capital,” and he continued to generate recognition of the need for securities legal support in the burgeoning industry.

He was a co-author of an article published with a colleague at Pepper Hamilton LLP (now Troutman Pepper) that he had given permission to be reprinted on deBanked in December 2018, titled MCA Participations and Securities Law: Recognizing and Managing a Looming Threat. It was read by more than 1,500 people on the deBanked website that first day alone.

Nowak was highly sought out on merchant cash advance issues. “Most judges want to see consistency of treatment and that includes your vocabulary,” Nowak said in an interview with deBanked in April 2019. “The word ‘loan’ should be banned from their email and Word files.”

Although our relationship was one of professional acquaintances, I often told those seeking advice about MCA syndication that they should “probably call Greg Nowak about that.”

In “Does Your Merchant Cash Advance Company Pass The Scrutiny Test?“, Nowak explained that funders that decide for business purposes to solicit money from investors, have to be careful not to run afoul of SEC rules. He said that he recommended funders treat these fundraising efforts as if they are issuing securities and follow the rules accordingly. Otherwise they risk being the subject of an enforcement action where the SEC alleges they are raising money using unregulated securities.

“You need to be very careful here because these rules are unforgiving. You can’t ignore them,” Nowak said.

California’s Business Loan & MCA Disclosure Law Is Nearing Finality

April 13, 2021 Nearly three years after California became the first state to pass a business loan and merchant cash advance disclosure law (SB 1235), the actual disclosure rules themselves are finally nearing completion. The public has until April 26th to submit any comments on the amended portions of the proposed rules.

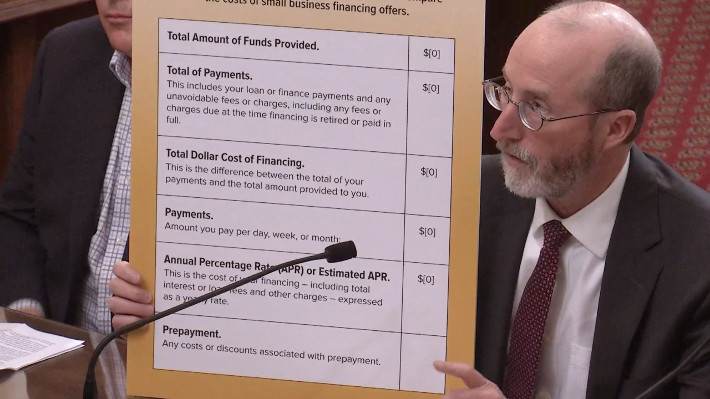

Nearly three years after California became the first state to pass a business loan and merchant cash advance disclosure law (SB 1235), the actual disclosure rules themselves are finally nearing completion. The public has until April 26th to submit any comments on the amended portions of the proposed rules.

The 52-page document is the result of years of negotiations between various parties that all have a stake in its implementation. Among the finer details are the characteristics of the fonts permitted in the disclosures, what column a certain disclosure can be placed in, and the aspect ratio of the columns themselves.

But that’s the easy part. Here’s the hard part, according to a brief published in Manatt’s newsletter yesterday.

“The modified regulations continue to require use of the annual percentage rate (APR) metric, rather than annualized cost of capital (ACC), to disclose the total cost of financing as an annualized rate. This appears to be a final decision, which will make it difficult if not impossible for many commercial finance companies to comply given the significant challenges of calculating APR on products with substantial variance in the amounts and timing of payments or remittances.”

Manatt highlights other issues, including that all the necessary disclosures be provided “whenever a payment amount, rate, or price is quoted based on information provided by the proposed recipient of financing…”

This requirement, the firm says, is not even required under Federal Regulation Z for consumer loans.

“Many companies will not be able to comply with this requirement absent radical changes to their California application and underwriting procedures, as it is common today for companies to have preliminary discussions with applicants about potentially available financing terms before full underwriting has been completed.”

Manatt’s newsletter on the issue can be found here.

Any interested person may submit written comments regarding SB 1235’s modifications by written communication addressed as follows:

Commissioner of Financial Protection and Innovation

Attn: Sandra Sandoval, Regulations Coordinator

300 South Spring Street, 15th Floor

Los Angeles, CA 90013

Written comments may also be sent by electronic mail to regulations@dfpi.ca.gov with a copy to jesse.mattson@dfpi.ca.gov and charles.carriere@dfpi.ca.gov.

The last day to submit comments is April 26, 2021

North Mill Restructures Working Capital Solution and Expands Customer Benefits

April 12, 2021NORWALK, CT – North Mill Equipment Finance LLC (“North Mill”), a leading independent commercial equipment lessor providing small-ticket financing through its network of referral agents, announced today that it has restructured its working capital solution to make it more competitive with other, less cost-effective options on the market.

The financing arrangement, called “Cash Out,” allows a customer to borrow the equity of paid-up business equipment and channel the proceeds back into the company. Although similar in concept to a sale leaseback, Cash Out is structured as a loan. It delivers a well-deserved reprieve for borrowers looking for a less expensive alternative to finance day-to-day operating expenses.

“There are many ways a company can obtain working capital,” explained Paul Cheslock, VP of Customer Relations, North Mill. “Some of the more common include a merchant cash advance (MCA), a revolving line of credit and accounts receivable factoring. And while they all fill the same need, they are not created equal. Cash Out in particular offers a long list of customer benefits including better rates, monthly vs. weekly payments, and terms up to 60 months. It’s a powerful tool for our referral agent partners looking to grow their customer base.”

According to Cheslock, the product’s loan-to-value ratio was restructured to enable customers to borrow a larger percentage of equity from an unencumbered asset. One of the most significant advantages of Cash Out is that it includes an early pay-off feature. Customers can pay off the loan without premium or penalty after 18 consecutive, on-time payments — a benefit that other products simply do not offer.

“The product is simple and straightforward. There are no fees tied to accounts receivable, invoices, or credit card sales,” said Cheslock. “What’s more, the equipment that’s used for the loan stays put on site, so business operations remain uninterrupted. And if that were not enough, the borrower retains title.”

For more on Cash Out and other financial solutions from North Mill, register for the company’s upcoming webinar “Meet North Mill and Its Financial Solutions” on Tuesday, April 27, 2021 at 3:00 pm EST.

About North Mill Equipment Finance

Headquartered in Norwalk, Connecticut, North Mill Equipment Finance originates and services small-ticket equipment leases and loans, ranging from $15,000 to $300,000 in value. A broker-centric private lender, the company handles A – C credit qualities and finances transactions for numerous asset categories including, but not limited to, construction, transportation, vocational, healthcare, manufacturing, printing, franchise opportunities and material handling equipment. North Mill is majority owned by an affiliate of Wafra Capital Partners, Inc. (WCP). For more information, visit NMEF.com.

###

CONTACT: Don Cosenza, SVP, Chief Marketing Officer

PHONE: (203) 354-1710

EMAIL: dcosenza@nmef.com

Selling Finance Door-to-Door During Covid

April 9, 2021 This week, lockdown returned to Ontario, Canada, due to the third wave of Covid cases. On April 3rd, the Premier issued a stay-at-home order, putting 14 million Canadians back behind closed doors. Based in Ontario, Canadian Financial is a one-stop alternative and traditional funding shop that still champions door-to-door sales and the lockdown has sidelined them for the third time.

This week, lockdown returned to Ontario, Canada, due to the third wave of Covid cases. On April 3rd, the Premier issued a stay-at-home order, putting 14 million Canadians back behind closed doors. Based in Ontario, Canadian Financial is a one-stop alternative and traditional funding shop that still champions door-to-door sales and the lockdown has sidelined them for the third time.

“We just went back into lockdown. The whole province, everything just shut down,” CEO Patrick Labreche said. “We were getting 20 to 30 new cases a day, and then it jumped to like 200 a day.”

Meanwhile, 110 miles down south at deBanked, de Blasio announced NYC public beaches would be opening up by Memorial Day. Because of the wide range of government shutdowns this past year, Labreche said it is hard to admit to some that his business is booming.

“I was having a conversation with a guy who does payment processing, he makes residuals on his customers, and so his book of business was not making any money right now; he’s hurting,” Labreche said. “So it’s kind of hard to tell a guy like that that we’re flourishing, and maybe you should come work with us.”

Labreche said that the processor was actually going to work with Canadian Financial. Success this past year came from leveraging the interpersonal skills that make an excellent door-to-door salesperson thrive, Labreche said.

“I started in the door-to-door and b2b at 19 years old, completely broke. I dropped out of school, and I started knocking on doors, and you know, that business model has changed my entire life,” Labreche said. “When you get into door-to-door sales, you understand how to sell yourself first. You get a sense of how to communicate with people, how to understand their needs, their pain points: How to leverage the service or product that you have.”

“I started in the door-to-door and b2b at 19 years old, completely broke. I dropped out of school, and I started knocking on doors, and you know, that business model has changed my entire life,” Labreche said. “When you get into door-to-door sales, you understand how to sell yourself first. You get a sense of how to communicate with people, how to understand their needs, their pain points: How to leverage the service or product that you have.”

With a team of salespeople connected through weekly department meetings and messaging groups to keep the energy up, the deals kept rolling in throughout covid. Labreche said his firm is set apart from a good portion of Canadian alt finance: they offer a smorgasbord of financial products directly to the borrower instead of using lead generators.

While most fintechs think all business owners want a one-button final product, Labreche attests to the opposite- his firm sends out salespeople to make sure businesses know they have a rep to rely on.

“I have nothing bad to say about aggregators; that’s their business model, not ours,” Labreche said. “Our business model is going into a business that didn’t even know that the solution was available. When you’re looking online, you’re looking for a solution that you already know is available.”

Labreche favors traditional finance. His firm offers MCAs and other alternative forms of funding but said those are mostly band-aid solutions and he regularly sees MCA deals taking advantage of merchants. For example, Labreche said he walked into an ESCO gas station last month, and through talking to the owner, discovered an opportunity. The owner had taken an MCA from a big Canadian firm but was confused about the cost of capital- he thought he was paying 17%, but Labreche read a recent statement and discovered the rate was really 50%.

“Right there and then he was like, ‘oh my God, that’s crazy I didn’t know,’ he was misled, and it’s like that across the board. So I ended up getting him a quarter-million dollars at four and a half percent on a term loan,” Labreche said. “Nobody’s ever walked into his business or called him, offering him traditional money. We feel like there’s a huge underserved, undereducated market.”

This week, walk-ins have become less of a possibility, with a lockdown banning all non-essential travel. Still, business development manager Julian Hulan looked forward to when things would open back up. He had masked up and gone out on sales calls throughout the year when the government wasn’t in shutdown mode. Recently he traveled to 20 car dealerships to offer financing in a two-day period and said he found merchants excited to see him in person instead of over email.

“They were like ‘oh, I can actually sit down and talk to this guy?’ and that’s when they eat it up,” Hulan said. “They know because they’ve already made that connection face to face, they can call me directly. We don’t do this whole 1-800 Number. You’re going to call me directly and if I don’t answer, you leave me a voicemail, I call you back, it’s that personal relationship between me and that client.”

IOU Financial Funded $12.1M in March

April 8, 2021 IOU Financial originated $12.1M in funding to small businesses last month, the company revealed. It was IOU’s biggest loan volume month since the beginning of the pandemic.

IOU Financial originated $12.1M in funding to small businesses last month, the company revealed. It was IOU’s biggest loan volume month since the beginning of the pandemic.

The figure was included in an announcement regarding the company’s intention to repurchase up to $2M of Convertible Debentures.

“The move to repurchase corporate debt comes after a year of strategic initiatives as part of IOU’s Pandemic Resilience Plan that focused on reducing corporate expenses while reaffirming commitments from its diverse portfolio of funding sources and capitalizing on new opportunities to continue to support small businesses in 2020,” IOU said.

“IOU’s response to the COVID-19 pandemic in 2020 (‘Pandemic Resilience Plan’) put the Company in a position of strength to consolidate its stake in developing the opportunities ahead,” said Phil Marleau, CEO. “We are proud to be able to stand with our network of brokers and small business owners as we prepare for the economic recovery with great optimism.”

Before the pandemic, IOU originated $154M in funding for all of 2019.

Coinbase Generated $800M Profit in a Single Quarter

April 7, 2021 The emerging powerhouse in the fintech industry isn’t a lending or payments company, it’s a cryptocurrency exchange. One can express as much skepticism as they want about Coinbase, but the company, which goes public on the Nasdaq next week, generated nearly $800 million in profit in Q1 of 2021 alone.

The emerging powerhouse in the fintech industry isn’t a lending or payments company, it’s a cryptocurrency exchange. One can express as much skepticism as they want about Coinbase, but the company, which goes public on the Nasdaq next week, generated nearly $800 million in profit in Q1 of 2021 alone.

Coinbase has 56 million verified users and holds $223 billion in assets, equal to about 11.3% of the entire crypto market.

The company says it is “building the cryptoeconomy, a more fair, accessible, efficient, and transparent financial system enabled by crypto.”

The company launched in 2012. Its last private market valuation was at about $90 billion.