Archive for 2019

Liquid FSI Partners With Stackfolio

May 28, 2019

Liquid FSI announced today that it has entered into a joint venture with Stackfolio, an online loan marketplace, which allows small banks, hedge funds and credit unions to buy and sell loans. Liquid FSI funds mostly doctor’s offices, as a factor, and it also builds financial technology products to make it easier to fund healthcare providers.

Through this new partnership with Stackfolio, all of Liquid FSI’s applicants will now automatically be posted to Stackfolio’s marketplace. Since Liquid FSI is a funder, why send deals to the competition?

“Just like there’s a college for everyone, there’s a loan [or type of funding] for everyone,” said CEO of Liquid FSI Frank Capozza.

And for deals that come from Liquid FSI but are funded elsewhere on the Stackfolio marketplace, Liquid FSI will get an origination fee and a transaction fee.

Capozza said that their proprietary technology gives banks a far clearer picture of the finances of medical offices, which can be risky to fund because insurance companies often pay a fraction of what doctors bill.

“Now they don’t have to turn business away,” Capozza said of banks that have declined medical offices because of imprecise data which he says Liquid FSI provides.

From Stackfolio’s CEO, Pavleen Thukral, “We are excited for this new partnership with Liquid FSI. It not only aligns our view of the loan trading and origination markets moving online, but more critically for our clients, it helps fill a loan growth gap with commercial and industrial customer opportunities in the healthcare industry.”

In conjunction with this new partnership, Capozza said that he is in final talks with a 55-person, California-based brokerage that will help increase medical office applications to Stackfolio, via Liquid FSI.

“We’re the acquisition engine,” Capozza said.

He said that this brokerage, to be announced at the end of the week, will have its people on the phone and on the ground (i.e., pitching doctors in their offices). Brokers will get a percentage of the origination and residuals on monthly factoring transactions.

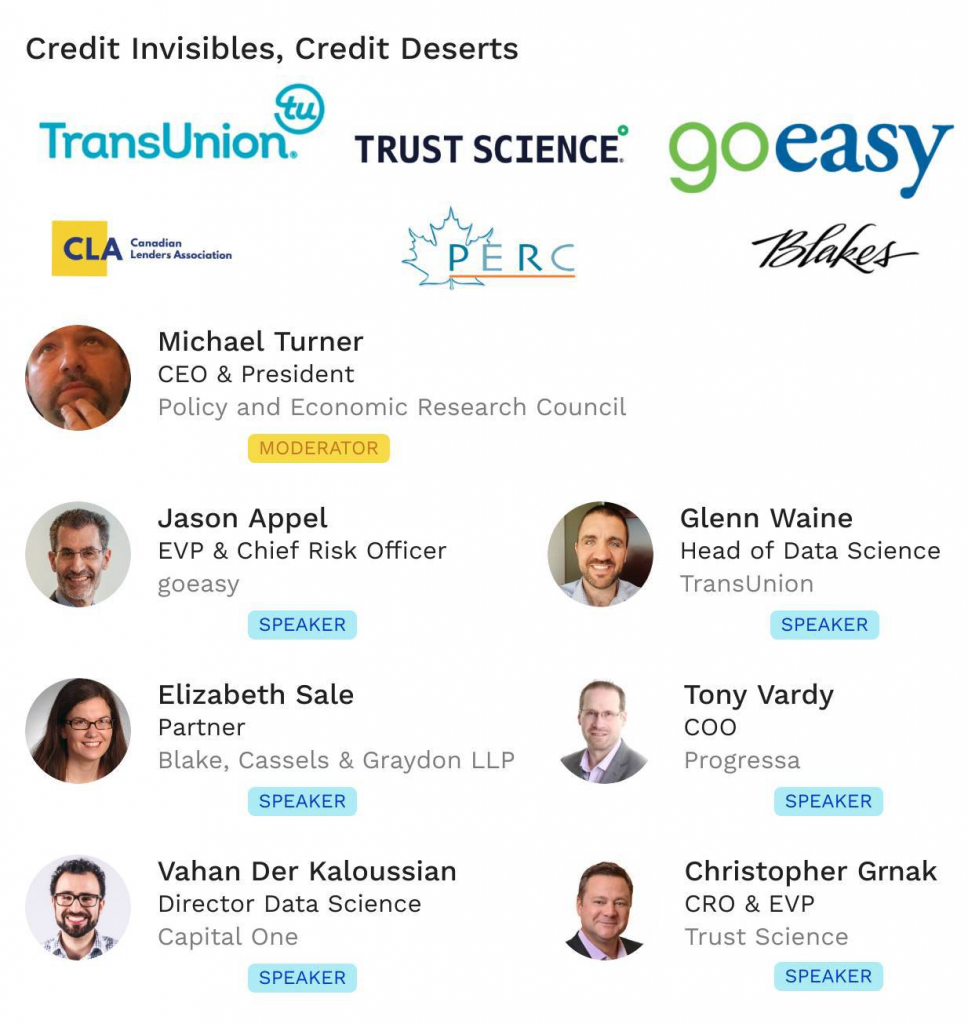

Canadian Alternative Finance Event Calendar

May 28, 2019Here’s what’s on the agenda this Summer for the Canadian alternative finance industry:

June 5th

Credit Invisibles Summit – Presented by the Canadian Lenders Association

July 25th

deBanked CONNECT Toronto – Presented by deBanked

Jonathan Braun Sentenced to 10 Years

May 28, 2019

Jonathan Braun, who Bloomberg Businessweek profiled in a merchant cash advance story series, was sentenced to 10 years for drug related offenses this morning at the federal courthouse in Brooklyn. He will get credit for 17 months previously served in 2010 – 2011. He is scheduled to surrender on August 25th.

Prior to the judge’s order, Braun was given an opportunity to speak and proclaimed himself a changed man. The judge took many things into consideration including letters supporting Braun’s transformation as well as some new lawsuits and allegations that cast him in a negative light. Nevertheless, the judge explained that no new charges had been brought against Braun since he pleaded guilty 8 years ago. The 10-year sentence was the mandatory minimum.

Does The Borrower Even Exist? Image Algorithms, Site Inspectors Spot The Fakers

May 24, 2019 Their product research lab was the real deal. That’s what a business seeking capital hoped to convince a lender of when they snapped a photo of a $450,000 microscope and sent it over to underwriting along with two dozen other photos of their warehouse.

Their product research lab was the real deal. That’s what a business seeking capital hoped to convince a lender of when they snapped a photo of a $450,000 microscope and sent it over to underwriting along with two dozen other photos of their warehouse.

Most of the pictures were genuine, but the microscope was not. Truepic, a virtual site inspection and photo verification company that the lender had relied on, algorithmically determined that the microscope was actually a photo of a photo, one that had been grabbed off the web.

If they had just emailed these photos directly to the lender, the loan would’ve been issued, but this image analyzing technology changed everything.

Truepic founder and COO Craig Stack said that they were able to identify the false ones because of software they have that can detect when a photo is being taken of a two-dimensional image. Truepic didn’t just obtain the photos, they were taken in real time using their mobile photo-taking app. In addition to detecting only two dimensions, Truepic also found the real photos online through a reverse-image search to show where the photos came from.

Photo verification isn’t brand new. Nationwide Management Services has been providing these very same services to their customers since 2015, according to its CEO John Marsh. Marsh started his company in 2005 and originally provided traditional on-site inspections with certified field agents taking pictures.

“You can’t tell the difference,” Marsh said of photos taken by a field agent, compared to those taken virtually by the owner of the store or office. In the virtual one, the merchant receives a text and clicks on a link that essentially turns the merchant’s phone into a live video feed for the lender.

Commonly, the lender wants to see, among other things, the company’s signage, credit card machine and merchant’s driver’s license. Using GPS technology, Nationwide Management Services can tell exactly where the merchant is, so they can’t be taking photos – in real time – of a different store.

Marsh still offers on-site inspection for clients, but mostly as discreet, unannounced visits to check up on a merchant that is having a hard time making payments. Sometimes a field agent will find that a direct competitor moved in across the street or the neighborhood is declining and there are a number of vacant stores, Marsh said.

Marsh still offers on-site inspection for clients, but mostly as discreet, unannounced visits to check up on a merchant that is having a hard time making payments. Sometimes a field agent will find that a direct competitor moved in across the street or the neighborhood is declining and there are a number of vacant stores, Marsh said.

Marsh’s virtual video verification product is instantaneous, allowing the lender to see the merchant’s space – and face – in real time, virtually eliminating misrepresentation of the merchant’s store. Stack said that Truepic also has a video verification product that they will be releasing in less than three weeks.

Marsh said that would-be merchant fraudsters get scared as soon as they hear about a real time virtual inspection.

“When we reach out to them for the virtual inspection, they go dark,” Marsh said.

Most of the deception Marsh has encountered is of merchants giving a P.O. Box address as the address of their “physical store.”

Gayle Juhl, President and CEO of Metro Inspections, said that one of her field agents found a merchant with a far more unusual distortion of its company address. The field agent went to the address of the merchant only to find a 1970s bright blue Volvo station wagon with a sign on it, parked in front of the address listed, which belonged to a completely different store.

The man seeking funding, who came out of the car-turned-store, was apparently confrontational, according to the field agent’s report.

Juhl said that she will coordinate a virtual inspection upon request, but that her company primarily does onsite inspections.

“You can’t replace a handshake and an eye-to-eye to see what’s really going on,” Juhl said.

This may be true, but Marsh said that it can take 24 to 48 hours to collect photos for his onsite inspections whereas it can take as little as four minutes with his virtual video or virtual photo services. (This depends on how many images the lender is looking to capture.) Granted, Juhl said that Metro Inspections’ on-site inspections can be collected and delivered on the same day it was requested, given that the request comes early enough in the day.

Stack, who has only been servicing the online lending industry for about five months, says that he has gotten financial services clients who are very excited about the speed of virtual inspections and the fact that they are far less invasive for the merchant. Rather than have a stranger come in to take pictures – raising questions among employees and customers – the business owner can discreetly photograph their space at their convenience. Stack’s company has never offered onsite inspections and says he never will.

“Our camera doesn’t lie,” he said.

Lawyers: Earn CLE Credits While Learning About Alternative Finance

May 23, 2019| June 13 Sessions | June 14 Sessions |

| Case Law Updates | Regulatory Download: The Complete Picture |

| TCPA: Defining ATDS, Exploring the TCPA and How Emails are Covered | Legislation, Business and Lobbying: How does it work and Does it work at all? |

| Bankruptcy Updates | Future Invoice Factoring and Traditional Factoring: Can’t We All Just Get Along? |

| Securities: A Lesson from Bitcoin and Recent Industry Case Law | Clean Contracts: Merchant Agreements, Inter-Creditor Agreements and ISO Agreements: What you MUST know to keep up with the times |

| Inside the UCC with Bob Zadek | |

| Collections in a Post Bloomberg World | |

| Ethics: Conflicts of Interest | |

| *Evening Social event at Lucky Strike in Manhattan Food, drinks and bowling! 7:00pm – 9:00pm* | *Rooftop Cocktail Reception, Castell Rooftop Lounge 3:00pm – 5:00pm* |

Admission Price List:

Admission for Members: $75

2-Day Ticket Includes:

- Day One: breakfast and lunch during the full day of panels. Evening at Lucky Strike with food and drinks.

- Day Two : Three panel discussions, lunch and cocktail hour immediately to follow.

Non-Member Attorneys $250.00 for the 2 day ticket

Non-Member Attorneys $150.00 for a 1 day ticket

(may only attend one of the two days.)

Corporate Guests (Day Two only) $150.00

Featuring the Following Speakers:

- Christopher Murray, Esq.

- Patrick Siegfried, Esq.

- William Molinski, Esq.

- Natalie Nahabet, Esq.

- David Fuad, Esq.

- Kate Fisher, Esq.

- Jamie Polon, Esq.

- Thomas Telesca, Esq.

- Richard J. Zack, Esq.

- Robert Zadek, Esq.

- Richard Simon, Esq.

- Anthony Giuliano, Esq.

- Mark Dabertin, Esq.

- Gregory Nowak, Esq.

Email Lindsey Rohan: lindsey@lrohanlaw.com

BFS Capital Joins ILPA

May 23, 2019

The Innovation Lending Platform Association (ILPA), a group of online small business financing and service companies, announced today the addition of BFS Capital. ILPA is known for creating the Straightforward Metrics Around Rate and Total Cost (SMART) Box.

“We believe that transparency matters,” Ruddock told deBanked.

“BFS Capital is committed to being both a responsible and an innovative lender,” Ruddock said. “Our membership in the ILPA allows us to work with industry leaders who are dedicated to advancing standards and best practices in the critical small business lending marketplace… [and] we believe that clarity and transparency is critical in helping [small businesses] make educated and informed financial decisions.”

As a new member of ILPA, BFS will join current members including OnDeck, Kabbage, BlueVine and 6th Avenue Capital.

“We applaud Mulligan Funding and BFS Capital for committing to adopt fair and transparent disclosure best practices to ensure small businesses are well informed when seeking funding,” said ILPA CEO Scott Stewart. (ILPA announced that Mulligan Funding has joined the association as well).

BFS is also a member of the Small Business Finance Association (SBFA) and Ruddock told deBanked that BFS will remain a member of that trade association as well.

Separately, BFS announced today that it has named Fred Kauber as the company’s new Chief Technology Officer and Chief Product Officer. Kauber was previously with fintech marketplace platform CAIS Group and he served in senior roles at First Data, Dun & Bradstreet and IBM.

“I’m confident that Fred is the right person to advance both our vision and our capabilities [at BFS,]” Ruddock said.

Canada’s Alternative Financing Market Is Taking Off

May 20, 2019

Canadians have been slow out of the gate when it comes to mass adoption of alternative financing, but times are changing, presenting opportunities and challenges for those who focus on this growing market.

Historically, the Canadian credit market has traditionally been dominated by a few main banks; consumers or businesses that weren’t approved for funding through them didn’t have a multitude of options. The door, however, is starting to unlock, as awareness increases about financing alternatives and speed and convenience become more important, especially to younger Canadians.

Indeed, the Canada alternative finance market experienced considerable growth in 2017—the latest period for which data is available. Market volume reached $867.6 million, up 159 percent from $334.5 million in 2016, according to a report by the Cambridge Centre for Alternative Finance and the Ivey Business School at Western University. Balance sheet business lending makes up the largest proportion of Canadian alternative finance, accounting for 57 percent of the market; overall, this model grew 378 percent to $494 million in 2017, according to the report.

Industry participants say the growth trajectory in Canada is continuing. It’s being driven by a number of factors, including tightening credit standards by banks, growing market demand for quick and easy funding and broader awareness of alternative financing products.

To meet this growing demand, new alternative financing companies are coming to the market all the time, says Vlad Sherbatov, president and co-founder of Smarter Loans, which works with about three dozen of Canada’s top financing companies. He predicts that over time more players will enter the market—from within Canada and also from the U.S.—and that product types will continue to grow as demand and understanding of the benefits of alternative finance become more well-known. Notably, 42 percent of firms that reported volumes in Canada were primarily headquartered in the U.S., according to the Cambridge report.

To meet this growing demand, new alternative financing companies are coming to the market all the time, says Vlad Sherbatov, president and co-founder of Smarter Loans, which works with about three dozen of Canada’s top financing companies. He predicts that over time more players will enter the market—from within Canada and also from the U.S.—and that product types will continue to grow as demand and understanding of the benefits of alternative finance become more well-known. Notably, 42 percent of firms that reported volumes in Canada were primarily headquartered in the U.S., according to the Cambridge report.

To be sure, the Canadian market is much smaller than the U.S. and alternative finance isn’t ever expected to overtake it in size or scope. That’s because while the country is huge from a geographic standpoint, it’s not as densely populated as the U.S., and businesses are clustered primarily in a few key regions.

To put things in perspective, Canada has an estimated population of around 37 million compared with the U.S.’s roughly 327 million. On the business front, Canada is similar to California in terms of the size and scope of its small business market, estimates Paul Pitcher, managing partner at SharpShooter, a Toronto-based funder, who also operates First Down Funding in Annapolis, Md.

Nonetheless, alternative lenders and funders in Canada are becoming more of a force to be reckoned with by a number of measures. Indeed, a majority of Canadians now look to online lenders as a viable alternative to traditional financial institutions, according to the 2018 State of Alternative Lending in Canada, a study conducted by online comparison service Smarter Loans.

Of the 1,160 Canadians surveyed about the loan products they have recently received, only 29 percent sought funding from a traditional financial institution, such as a bank, the study found. At the same time, interest in alternative loans has been on an upward trajectory since 2013. Twenty-four percent of respondents indicated they sought their first loan with an alternative lender in 2018. Overall, nearly 54 percent of respondents submitted their first application with a non-traditional lender within the past three years, according to the report.

Like in the U.S., there’s a mix of alternative financing companies in Canada. A number of companies offer factoring and invoicing and payday loans. But there’s a growing number focused on consumer and business lending as well as merchant cash advance.

Some major players in the Canadian alternative lending or funding landscape include Fairstone Financial (formerly CitiFinancial Canada), an established non-bank lender that recently began offering online personal loans in select provinces; Lendified, an online small business lender; Thinking Capital, an online small business lender and funder; easyfinancial, the business arm of alternative financial company goeasy Ltd. that focuses on lending to non-prime consumers; OnDeck, which offers small business financing loans and lines of credit; and Progressa, which provides consolidation loans to consumers.

By comparison, the merchant cash advance space has fewer players; it is primarily dominated by Thinking Capital and less than a dozen smaller companies, although momentum in the space is increasing, industry participants say.

“The U.S. got there 10 years ago, we’re still catching up,” says Avi Bernstein, chief executive and co-founder of 2M7 Financial Solutions, a Toronto-based merchant cash advance company.

OPPORTUNITIES ABOUND

In terms of opportunities, Canada has a population that is very used to dealing with major banks and who are actively looking for alternative solutions that are faster and more convenient, says Sherbatov of Smarter Loans. This is especially true for the younger population, which is more tech-savvy and prefers to deal with finances on the go, he says.

Because the alternative financing landscape is not as developed in Canada, new and innovative products can really make a significant impact and capture market share. “We think this is one of the key reasons why there’s been such an influx of international companies, from the U.S. and U.K. for example, that are looking to enter the Canadian market,” he says.

Just recently, for example, Funding Circle announced it would establish operations in Canada during the second half of 2019. “Canada’s stable, growing economy coupled with good access to credit data and progressive regulatory environment made it the obvious choice,” said Tom Eilon, managing director of Funding Circle Canada, in a March press release announcing the expansion. “The most important factor [in coming to Canada] though was the clear need for additional funding options among Canadian SMEs,” he said.

OnDeck, meanwhile, recently solidified its existing business in Canada through the purchase of Evolocity Financial Group, a Montreal-based small business funder. The combined firm represents a significantly expanded Canadian footprint for both companies. OnDeck began doing business in Canada in 2014 and has originated more than CAD$200 million in online small business loans there since entering the market. For its part, Evolocity has provided over CAD$240 million of financing to Canadian small businesses since 2010.

“There is an enormous need among underserved Canadian small businesses to access capital quickly and easily online, supported by trusted and knowledgeable customer service experts,” Noah Breslow, OnDeck’s chairman and chief executive, said in a December 2018 press release announcing the firms’ nuptials.

There are also a number of home grown Canadian companies that are benefiting from the growth in the alternative financing market.

2M7 Financial Solutions, which focuses on merchant cash advances, is one of these companies. It was founded in 2008 to meet the growing credit needs within the small and medium-sized business market at a time when businesses were having trouble in this regard.

But only in the past few years has MCA in Canada really started picking up to the point where Bernstein, the chief executive, says the company now receives applications from about 200 to 300 companies a month, which represents more than 50 percent growth from last year.

“We’re seeing more quality businesses, more quality merchants applying and the average funding size has gone up as well,” he says.

NAVIGATING THROUGH CHALLENGES

Despite heightened growth possibilities, there are also significant headwinds facing companies that are seeking to crack the Canadian alternative financing market. For various reasons, some companies have even chosen to pull back or out of Canada and focus their efforts elsewhere. Avant, for example, which offers personal loans in the U.S., is no longer accepting new loan applications in Canada at this time, according to its website. Capify also recently exited the Canadian business it entered in 2007, even as it continues to bulk up in the U.K. and Australia.

One of the challenges alternative lenders face in Canada is distrust of change. Since Canadians are so used to dealing with only a few major financial institutions to handle all their finances, they are skeptical to change this behavior, especially when the customer experience shifts from physical branches to online apps and mobile devices, says Sherbatov of Smarter Loans. He notes that adoption of fintech products in Canada has lagged in recent years, partially because there has been a lack of awareness and trust in new financial products available.

One way Smarter Loans has been working to strengthen this trust is by launching a “Smarter Loans Quality Badge,” which acts as a certification for alternative financing companies on its platform. It is issued to select companies that meet specified quality standards, including transparency in fees, responsible lending practices, customer support and more, he says.

The Canadian Lenders Association, whose members include lenders and merchant cash advance companies, has also been working to promote the growing industry and foster safe and ethical lending practices. For example, it recently began rolling out the SMART Box pricing disclosure model and comparison tool that was introduced to small businesses in the U.S. in 2016.

The Canadian Lenders Association, whose members include lenders and merchant cash advance companies, has also been working to promote the growing industry and foster safe and ethical lending practices. For example, it recently began rolling out the SMART Box pricing disclosure model and comparison tool that was introduced to small businesses in the U.S. in 2016.

Another challenge that impacts alternative lenders in the consumer space is having restricted access to alternative data sources. Because of especially strict consumer privacy laws, access is “substantially more limited” than it is in any other geography,” says Jason Mullins, president and chief executive of goeasy, a lending company based in Mississauga, Ontario, that provides consumer leasing, unsecured and secured personal loans and merchant point-of-sale financing.

From a lending perspective, goeasy focuses on the non-prime consumer—generally those with credit scores of under 700. Mullins says the market consists of roughly 7 million Canadians, about a quarter of the population of Canadians with credit scores. The non-prime consumer market is huge and has tremendous potential, he says, but it’s not for the faint of heart.

Another issue facing alternative lenders is the relative difficulty of raising loan capital from institutional lenders, says Ali Pourdad, co-founder and chief executive of Progressa, which recently reached the $100 million milestone in funded loans for underserved Canadian consumers. “The onus is on the alternative lenders to ensure they have good lending practices and are underwriting responsibly,” he says.

What’s more, household debt to income ratios in Canada are getting progressively worse, with Canadians taking on too much debt relative to what they can afford, Pourdad says. As the situation has been deteriorating over time, there is inherently more risk to originators as well as the capital that backs them. “Originators, now more than ever, have to be cautious about their lending practices and ensure their underwriting is sound and that they are being responsible,” he says.

On the small business side of alternative lending, getting the message out to would-be customers can be a challenge in Canada. In U.S. there are thousands of ISOs reaching out to businesses, whereas in Canada, most funders have a direct sales force, with a much smaller portion of their revenue coming from referral partners, says Adam Benaroch, president of CanaCap, a small business funder based in Montreal.

He predicts this will change over time as the business matures and more funders enter the space, giving ISOs the ability to offer a broader array of financing products at competitive rates. “I think we’re going to see pricing go down and more opportunities develop, and as this happens, the business is going to grow, which is exactly what has happened in the U.S,” he says.

Generally speaking, Canadian businesses are still somewhat skeptical of merchant cash advance and require considerable hand-holding to become comfortable with the idea.

“You can’t wait for them to come to you, you have to go to them and explain what the products are,” says Pitcher of SharpShooter, the MCA funding company.

While Pitcher predicts more companies will continue to enter the Canadian alternative financing market, he doesn’t think it will be completely overrun by new entrants—the market simply isn’t big enough, he says. “It’s not for everyone,” he says.

The Road Back to Residual Commissions

May 17, 2019

“We’re still getting resids from a company 14 years later.” That’s what Phil Dushey said about a factoring client he has at Global Financial Services, a New York-based financial brokerage firm he founded.

He was speaking at deBanked’s “Broker Fair” to a room filled mostly with MCA brokers. Years ago, in the early stages of the merchant cash advance industry, brokers would earn residual payments from credit card processing companies when the merchants were converted from one merchant account to another to make the advance possible. Brokers also got residuals from MCA funders that would pay them over time as the merchant paid back.

Now that MCA companies rarely ever rely on credit processors and since they started to offer brokers their entire commission upfront, the concept of residual payments for MCA brokers became history. But for MCA brokers interested in broadening their product offering, residuals can resurface as a revenue stream if they embrace factoring.

Dushey later conceded that residuals from a factoring client lasting 14 years is highly unusual. What is common, though, is to get residuals that last four to five years, he said.

Ed DeAngelis, founder of Amerifi, a brokerage of 12 in Pennsylvania, said that brokers’ residual payments can be anywhere from 8% to 15% of what the factor collects from the merchant. He presented what he said was a realistic example of a merchant factoring a $100,000 invoice. The factor might typically take a 2% factoring fee, or $2,000. And the broker might take 10% of that amount, or $200, for every month that the invoice is outstanding.

“It’s a steady drip that makes a puddle,” DeAngelis said.

Of course, for a larger invoice, like for $500,000, the broker would get $1,000 a month, as long as the client keeps factoring. But DeAngelis said that most factoring companies have a one year agreement and that most clients stay with their factoring company for two to three years. And some, like Dushey’s client, stay for as many as 15 years. Since DeAngelis opened his brokerage two years ago, he said that all of his factoring clients are still in their agreements.

Eyal Lifshitz, CEO of BlueVine, one of the larger factoring companies, said that MCA brokering definitely pays more upfront, whereas factoring is more about building a book of business.

“There are factoring brokers that make quite a lot, but I would say they probably focus on larger deals,” Lifshitz said.

Lifshitz wouldn’t disclose the average size of a BlueVine factoring deal, but his estimation was that the industry average was $250,000 to $500,000.

“What we’re trying to build is a 20 to 30 year sustainable business,” DeAngelis said. “…So we’re trying to build those small residuals because five years from now, who knows? With regulations [in] cash advance, it may not be around. We’re already diversifying our portfolio with all these other traditional products so we’re not cash advance dependent.”

Not all brokers of factoring deals make residuals, according to Frank Capozza, founder of LiquidFSI, which provides factoring services to doctors offices. He said that he works with select brokers and they generally don’t get residual payments from his company. Instead, he pays them an origination fee.

Still, it seems more common for brokers of factoring deals to receive residuals. But it might not be for everyone.

For MCA brokers interested in also offering factoring, Lifshitz said: “They need to understand the product and what merchant could fit the criteria. It is more complex to understand than MCAs in my opinion.”