Archive for 2019

California DBO Making Progress On Finalizing Rules Required By The New Disclosure Law

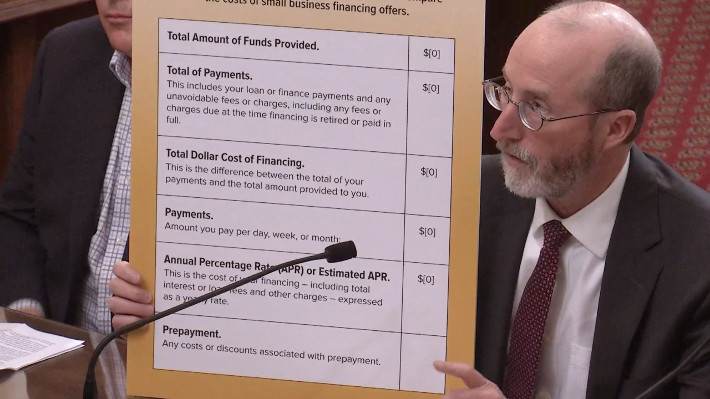

July 29, 2019 Last October, California Governor Jerry Brown signed a new commercial finance disclosure bill into law. The bill, SB 1235, was a major source of debate in 2018 because of its tricky language to pressure factors and merchant cash advance providers into stating an Annual Percentage Rate on contracts with California businesses. The final version of the bill, however, delegated the final disclosure format requirements to the State’s primary financial regulator, the Department of Business Oversight (DBO).

Last October, California Governor Jerry Brown signed a new commercial finance disclosure bill into law. The bill, SB 1235, was a major source of debate in 2018 because of its tricky language to pressure factors and merchant cash advance providers into stating an Annual Percentage Rate on contracts with California businesses. The final version of the bill, however, delegated the final disclosure format requirements to the State’s primary financial regulator, the Department of Business Oversight (DBO).

The DBO then issued a public invitation to comment on how that format should work. They got 34 responses. Among them were Affirm, ApplePie Capital, Electronic Transactions Association, Commercial Finance Coalition, Fora Financial, Equipment Leasing and Finance Association, Innovative Lending Platform Association, International Factoring Association, Kapitus, OnDeck, PayPal, Rapid Finance, Small Business Finance Association, and Square Capital.

On Friday, the DBO published a draft of its rules along with a public invitation to comment further. The 32-page draft can be downloaded here. The opportunity to comment on this version of the rules ends on Sept 9th.

You can review the comments that companies submitted previously here.

Chase Ends Partnership With OnDeck, OnDeck Stock Tanks On Bucket of Mixed News

July 29, 2019 The market didn’t take too kindly to OnDeck’s Q2 earnings announcement on Monday. The stock price set a new all time intraday low of $3.01, down 24% from Friday’s close.

The market didn’t take too kindly to OnDeck’s Q2 earnings announcement on Monday. The stock price set a new all time intraday low of $3.01, down 24% from Friday’s close.

First, JPM Chase ended their partnership with OnDeck, the company said, bringing a 3-year relationship to a close. “We can’t speak for Chase and their change in priorities,” OnDeck CEO Noah Breslow said during the Q&A with analysts. “I don’t think it was specific to us.”

It was subsequently revealed that the relationship was never a significant moneymaker for their business to begin with. “On a standalone basis, it was a positive contributor,” the company said, but that it was “not a contributor to the bottom line profit.”

Breslow called the Chase deal a one-off that had some costs involved with it, but that they were optimistic about other deals with banks through their subsidiary ODX. “We do believe the drivers of this are not some fundamental readout on the ODX model,” he explained. “Again, we had a product that performs very well from an underwriting perspective. Customers loved it. We can’t speculate on why Chase made this particular decision. We just know it was specific to them.”

OnDeck also announced plans to pursue a bank charter and believed that the timing was right. Although they were “far along in [their] thinking,” they had not actually applied for a charter and they left the door open to possibly acquiring a chartered bank to achieve that goal. “I think the next logical milestone would be to look for some kind of either application for such a charter, but we’re not prepared to talk about a timeframe over which that would occur,” the company said.

Originations shrank to $592M, down from $636M in the previous quarter. “We do expect a return to sequential originations growth in the third quarter,” Breslow said.

The company also plans to buy back up to $50 million worth of stock to boost the share price.

PayPal Begins Offering Business Loans in Canada

July 28, 2019 PayPal has extended its popular working capital business loan program to Canada, according to company CEO Dan Schulman.

PayPal has extended its popular working capital business loan program to Canada, according to company CEO Dan Schulman.

“This quarter, we began offering our PayPal business loan product to PayPal merchants in Canada, allowing them to access financing to build and sustain their businesses,” he said during the Q2 conference call. “This follows the expansion of our business financing solutions to Germany in Q4 2018 and in Mexico earlier this year in partnership with Mexican lending platform Konfio.”

deBanked ranked PayPal as the leading alternative small business finance company by originations in 2018. They are followed by OnDeck, Kabbage, Square, and Amazon.

Early Bird Ticket Pricing To deBanked CONNECT San Diego Ends Soon!

July 26, 2019deBanked CONNECT Toronto was a hit and photos and coverage of the event will be available soon. But in the meantime there’s only SIX DAYS LEFT of early bird pricing to deBanked CONNECT San Diego! This event is taking place at the Hard Rock Hotel in October 24th. Brokers get in with a discounted price.

deBanked CONNECT Toronto Kicks Off Today

July 25, 2019Welcome to The Omni King Edward Hotel |

|

|

Don’t be late! Registration and networking starts at 1:30pm at The Omni King Edward Hotel in Toronto.

Schedule of events:

Be sure to introduce yourselves to each of our sponsors and listen to our great speakers. |

||||||

|

|

||||||

|

|

OnDeck Taps Bank Veteran to Lead ODX Sales and Strategy

July 23, 2019 NEW YORK – OnDeck® (NYSE: ONDK), the leader in online lending for small business, today announced the appointment of Lonnie Hayes as the Head of Sales and Strategy for ODX, a wholly owned subsidiary of OnDeck that assists banks with streamlining and digitizing small business credit origination.

NEW YORK – OnDeck® (NYSE: ONDK), the leader in online lending for small business, today announced the appointment of Lonnie Hayes as the Head of Sales and Strategy for ODX, a wholly owned subsidiary of OnDeck that assists banks with streamlining and digitizing small business credit origination.

Mr. Hayes brings more than thirty years of experience to his new role. He most recently served as Executive Vice President of Small Business for BBVA USA, where he established the organization’s U.S. strategy to serve businesses with less than $10 million in annual revenues. At BBVA USA, Mr. Hayes oversaw product development, digital and sales operations, as well as leading the bank’s nationally recognized Small Business Administration (SBA) lending unit.

“Lonnie’s proven track record building and managing high-growth sales organizations and programs will be crucial as we continue to address the market from banks seeking enhanced digital lending capabilities,” said Brian Geary, President, ODX. “Lonnie will be a tremendous asset to our team as we engage financial institutions to help them accelerate their ability to serve small businesses.”

“I am excited to join ODX, the pioneer in digitizing and speeding the online lending experience for banks,” said Lonnie Hayes, Head of Sales and Strategy, ODX. “I hope to bring a banker’s perspective to our partnership efforts and look forward to collaborating with bank colleagues old and new, to strengthen the economics of small business lending while dramatically improving the customer experience for borrowers.”

ODX operates as a subsidiary of OnDeck and offers a combination of software, analytic insights, and professional services to help banks reinvent their small business lending process. At the core of the ODX solution is a modular, scalable, and reliable SaaS platform that allows banks to either create a fully end-to-end digital experience for their customers or to select certain components for specific product functions. An ODX-powered bank platform experience can enable a small business customer to apply for financing from their bank online, receive immediate decisions, and obtain funding in as fast as 24 hours.

About OnDeck

OnDeck (NYSE: ONDK) is the proven leader in transparent and responsible online lending to small business. Founded in 2006, the company pioneered the use of data analytics and digital technology to make real-time lending decisions and deliver capital rapidly to small businesses online. Today, OnDeck offers a wide range of term loans and lines of credit customized for the needs of small business owners. The company also offers bank clients a comprehensive technology and services platform that facilitates online lending to small business customers through ODX, a wholly-owned subsidiary. OnDeck has provided over $11 billion in loans to customers in 700 different industries across the United States, Canada and Australia. The company has an A+ rating with the Better Business Bureau and is rated 5 stars by Trustpilot. For more information, visit www.ondeck.com.

Media Contact:

Jim Larkin

OnDeck

jlarkin@ondeck.com

P: 203-526-7457

Investor Contact:

Stephen Klimas

OnDeck

sklimas@ondeck.com

P: (646) 668-3582

OnDeck, the OnDeck logo, OnDeck Score and OnDeck Marketplace are trademarks of On Deck Capital, Inc.

Become: The Who, What, and Why of a Rebrand

July 23, 2019Last week Lending Express rebranded to Become. Founded in 2016, the company, which educates businesses looking for loans on how to appear more attractive to funders, was spearheaded by CEO Eden Amirav in Australia originally, with an eventual expansion to the US. Three years in, the company has over 50 lending partners across its two markets, a record of having facilitated over $150 million in funding, and more than 150,000 members on their platforms. As indicators of progress go, these are far from undesirable. So, when things were going so well, what led Amirav to decide to rebrand?

In short, the company had evolved into something different from what it was in 2016, and its name, logo, and stylized website fonts had to reflect that. Thus, Lending Express became Become.

Gone are many of the aesthetic features of Lending Express, replaced with fresher counterparts, but beyond the brand, much of the company has remained. Amirav, the ex-pro gamer who was national champion of Israel in Warcraft 3 when he was a teenager, is still around; their AI-powered funding odds calculator, LendingScore, continues to be used; and their offices in both the US and Israel remain open.

Gone are many of the aesthetic features of Lending Express, replaced with fresher counterparts, but beyond the brand, much of the company has remained. Amirav, the ex-pro gamer who was national champion of Israel in Warcraft 3 when he was a teenager, is still around; their AI-powered funding odds calculator, LendingScore, continues to be used; and their offices in both the US and Israel remain open.

Rather than being hoarded remnants of times past, what Become has brought with it from Lending Express were deemed necessary by Amirav when discussing what was required to execute the rebrand. Explaining that before planning for the future of the rebrand even begun, Lending Express worked for months to comprehensively take stock of itself, and Amirav noted that all hands were needed and the entire company pitched in. Whether it was ensuring that URL links which once directed people to Lending Express now went to Become, or the drafting up of the new name, much of the work that went into the business’s metamorphosis came from within the company. Of course, Become specializes is helping small businesses get approved for loans, so not everything could be done by themselves, which is where a marketing firm came in to aid them with the crafting of the company’s new image.

As to the motives of the rebrand, the brief explanation given above doesn’t cut it. A blog post on Become’s website explains the origins of both names. With Lending Express having a ‘do-what-it-say-on-the-tin’ aspect to it, Become is much more abstract in how it reflects the company. Noting that Become originates from both within the company and without, Amirav explains the name owes itself to Lending Express’s development into a “no human-touch, all-tech based” company, following LendingScore’s creation; as well as the business’s ability to help its customers achieve their goals, enabling them to become what they wish.

Rebranding comes at a massive financial cost, with no guarantee of an immediate large payout upon launch, but as Amirav asserted, the switch to Become was necessary in his long-term plan for the company, as the “stress [of the rebrand] is offset by the goal of where they want to go.” “We’re well equipped with people, resources, and vision,” Amirav went on to say, and as well as this, he believes in the importance of a strong brand, regardless of industry, claiming that it “becomes a power to work with.”

And with their new logo and four-tone color palette sure to catch eyes, perhaps Amirav’s gamble will pay off. For now, he’s content with his rebrand going public, the continued business of Become, and the “shareholders [being] happy.”