Archive for 2019

Up Next On The New York Legislative Agenda: Funder, Lender, and Broker Licensing

September 10, 2019 New York State Senator James Sanders Jr. has introduced S6688, a commercial financing licensing bill that would require persons or entities engaging in the business of making or soliciting commercial financing products in New York state to obtain a license from the New York Department of Financial Services. The bill covers small business lenders, merchant cash advance companies, factors, and leasing companies for transactions under $500,000.

New York State Senator James Sanders Jr. has introduced S6688, a commercial financing licensing bill that would require persons or entities engaging in the business of making or soliciting commercial financing products in New York state to obtain a license from the New York Department of Financial Services. The bill covers small business lenders, merchant cash advance companies, factors, and leasing companies for transactions under $500,000.

The bill likely won’t see any activity until the New York legislative session resumes in 2020, at which point it could be amended or killed.

As currently drafted, applicants for a license would be subject to a criminal background search and be required to submit their fingerprints for a review by agencies such as the FBI. In addition to paying an application fee, applicants would be required to maintain liquid assets of $50,000.

Sanders, the bill’s sponsor, is the Chairman of the banking committee. You can read the full text of the bill here.

TBF Financial Buys $60 Million in Commercial Debt from Major Online Lender

September 10, 2019 DEERFIELD, IL, Sept. 10, 2019 ─ TBF Financial purchased nearly $60 million in non-performing loans from a major online small business lender in recent transactions, CEO Brett Boehm announced today.

DEERFIELD, IL, Sept. 10, 2019 ─ TBF Financial purchased nearly $60 million in non-performing loans from a major online small business lender in recent transactions, CEO Brett Boehm announced today.

TBF bought the pools of post-charge-off loans as the highest bidder in transactions arranged through multiple brokers. In most cases, the company purchases directly from alternative lenders, equipment leasing companies and banks.

“We are seeing growing interest from online lenders who want to sell off commercial debt this year. It’s a smart strategy in any economic cycle because it provides lenders and lessors with immediate cash and a way to accelerate recoveries while protecting their customer relationships. Concerns about an economic slowdown are another reason for growing interest in commercial debt sales, as companies prepare to handle a rise in delinquencies and defaults,” Boehm said.

In the most recent deal, the $60 million in transactions included non-performing loans that had not previously been handled by collection agencies as well as post-agency accounts.

TBF Financial is the leading purchaser of non-performing equipment leases, commercial bank loans and online small business loans in the U.S. The company buys commercial accounts up to 4 years old from the date of last payment. This includes equipment leases, loans and lines of credit that have personal guarantees, no personal guarantees, are secured, unsecured, pre-agency, post-agency, pre-litigation and reduced to judgment.

Just as fintechs launched a new industry, TBF created its own industry. When the company started in 1998, there were no businesses buying lease charge-offs on a consistent basis. The principals of TBF believed that they could buy charged-off equipment leases at an attractive price that would also provide TBF with a margin of profit. The equipment finance industry embraced the new services. Since then, TBF has broadened the commercial paper it buys to include commercial bank loans and lines of credit.

The company remains at the forefront of commercial debt buying for the finance industry. For more information, visit tbfgroup.com or contact Boehm at bboehm@tbfgroup.com, 847-267-0660 or via LinkedIn.

Media Contact:

Carla Young Harrington

Susan Carol Creative for TBF Financial

540.479.7835

carla@scapr.com

Stripe Ventures Into Merchant Cash Advance Financing

September 6, 2019 Stripe, a payments firm lauded as the world’s most valuable private fintech company (at $22.5B), has officially launched a merchant cash advance product.

Stripe, a payments firm lauded as the world’s most valuable private fintech company (at $22.5B), has officially launched a merchant cash advance product.

Dozens of news outlets have announced that the company is providing loans, but that’s not all, deBanked has learned. Both loans and merchant cash advances are available.

The company’s FAQ page originally explained the “Capital” product as a merchant cash advance but it’s since been updated to reflect that they offer access to both merchant cash advances and loans. An official Stripe spokesperson also clarified that an offer could be an MCA or a loan. The updated FAQ says that funding terms would be available in the customer dashboard, in the funding contract, and that which one a customer qualifies for depends on the specifics of their business.

Stripe merchant account customers can find out if they’re eligible for funding in their dashboard. If they’re not, they can still send Stripe a note through the dashboard to signal that they’re interested, say how much they’re looking for, and select what they plan to do with the funds. Stripe says they will not review your credit report and that all offers are based solely on Stripe transaction history.

The new product will not disrupt the separate integration with Funding Circle, according to a statement provided to Digital Transactions. Stripe customers can still apply to Funding Circle by connecting their Stripe account. Funding Circle offers term loans that range from six months to five years.

Stripe’s MCA product is currently only available in the US, but the company’s founders, Patrick and John Collison, brothers, hail from an unlikely place, rural Ireland. The company handles tens of billions of dollars in payments a year across 34 countries.

Like other recent entrants into the small business funding space, Stripe’s advantage is its ability to tap into its existing customer base. Other payments companies such as PayPal and Square, for example, were among the top four largest originators (for which public data is available) of alternative small business funding in 2018.

Note: This article has been updated to reflect the changes made on Stripe’s website as well as an additional clarification from the company.

Lending Valley Originates Over 100 Micro Deals in Debut

September 6, 2019 Brooklyn, NY – Lending Valley has originated 100 fundings to small businesses since the company’s debut in early June. The company was founded by small business finance veteran Chad Otar, the former CEO and co-founder of Excel Capital Management. Lending Valley focuses on micro funding deals of $1,500 to $10,000 with a variety of available payment structures. Otar is a Forbes Finance Council Member.

Brooklyn, NY – Lending Valley has originated 100 fundings to small businesses since the company’s debut in early June. The company was founded by small business finance veteran Chad Otar, the former CEO and co-founder of Excel Capital Management. Lending Valley focuses on micro funding deals of $1,500 to $10,000 with a variety of available payment structures. Otar is a Forbes Finance Council Member.

“We saw that the micro advances market needed another player and our goal is to help merchants’ businesses, not hurt them, and make it as easy as possible for them to obtain the capital and to be able to get them to the next step in their business venture,” Otar said. “Lending Valley is backed by years of industry knowledge and a diverse team that can provide the best support possible.”

About Lending Valley

Lending Valley was founded in New York City by Chad Otar. Otar is a member of the Forbes Finance Council. To learn more about Lending Valley, visit https://www.lendingvalley.com or call 866-888-3051.

A Side-By-Side Look At Small Business Funding Securitization Pools

September 6, 2019Several small business funding companies have closed majored securitization deals since 2018 with Kroll Bond Rating Agency rating the transactions. For the most recent transaction with National Funding, Kroll compared each securitized pool side-by-side in a chart. An abbreviated version of it is below:

| NFAS 2019-1 (National Funding) | RFS 2018-1 (Rapid Finance) | CRDBL 2018-1 (Credibly) | SFS 2018-1 (Kapitus) | |

| Weighted Avg Original Expected Time (months) | 9.9 | 11.7 | 11.5 | 7.8 |

| Weighted Avg RTR Ratio | 1.36x | 1.27x | 1.32 | 1.35 |

| Weighted Avg Credit Score | 664 | 665 | 679 | 649 |

| Weight Avg Time in Biz (years) | 9.6 | 14.6 | 12.3 | 12.5 |

| Percentage of MCA | 0.0% | 14.1% | 45.8% | 60% |

| Percentage of Loan | 100% | 85.9% | 54.2% | 40% |

PNC Bank Launches Fintech Startup numo

September 3, 2019 Last week, PNC Bank announced its latest venture, numo, which aims to function as an internal startup, developing apps and other services to expand PNC’s operations.

Last week, PNC Bank announced its latest venture, numo, which aims to function as an internal startup, developing apps and other services to expand PNC’s operations.

The first such app is indi, a bank account for gig workers that is exclusive to mobile phones. Offering customers tax calculators, tax savings goals, and dynamics adjustments that react to how much they’ve saved, PNC is joining the list of financial institutions which are doubling down on banking apps. The numo accounts are FDIC-insured, are held at PNC, and include a Visa prepaid debit card.

Speaking on the benefits of indi, numo CEO David Passavant said, “How do you estimate your tax liability when you don’t have an employer doing it for you? We built a system with intelligence to estimate what you should set aside for taxes.”

Beyond indi, numo has two other projects in the pipeline. One of these is unknown as of yet, but the next to be launched will be a service for companies that run portfolios of retail properties.

Not the only announcement to come from PNC last week, the bank also revealed its partnership with the RippleNet blockchain network. Joining together to offer swift cross-border payments for PNC’s commercial clients, the news comes almost a year after the bank stated that it planned to partner with RippleNet in September 2018.

“The speed of doing business continues to accelerate,” explained PNC Treasury Management Executive Vice President and Head of Product Chris Ward in 2018. “And the efficiencies of RTP [real-time payments] allow our clients to not only keep pace, but stay ahead.”

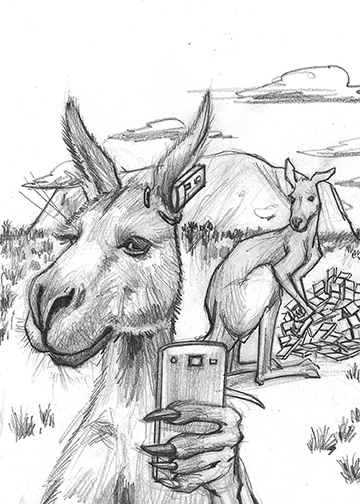

Snapshot On Australia: Growth In The Making

August 30, 2019

The Australian alternative lending market continues to gain momentum, bolstered in part by increased awareness, heightened competition and growing dissatisfaction with the status quo.

Indeed, there’s been significant growth in the few years since deBanked first wrote about the nascent alternative lending business down under. Notably, Australia’s alternative funding volume surpassed $1.14 billion in 2017, up 88 percent from $609.59 million in 2016, according to the latest data available from KPMG research. It’s the largest country in terms of total alternative finance market volume in the Asia Pacific region, excluding China, according to KPMG.

To be sure, the Australian market is still relatively small—at least compared with the U.S. Digging deeper, the largest share of market volume in 2017—the latest data available—came from balance sheet business lending, accounting for more than $574 million, according to KPMG. P2P marketplace consumer lending had the second largest market volume at $256 million. Invoice trading was the next largest segment of the Australian alternative finance market, accounting for $142.65 million, according to the KPMG report.

Its small size notwithstanding, what makes the Australian market particularly interesting is the potential promise it holds for the companies already established there and the opportunities it may offer to new entrants that find ways to successfully compete in the market.

Certainly alternative lending opportunities in Australia are growing, as awareness increases and the desire by consumers and businesses for favorable rates and faster service intensifies. The Australian alternative lending market is similar to Canada in that a small number of large banks dominate the market both in terms of consumer lending and small business lending. But, like in Canada, alternative lenders are gaining ground amid a changing customer mindset that values speed, favorable rates and a digital experience.

Equifax estimates that alternative finance volume in Australia is now growing at about 10 percent to 15 percent per year; that compares to a decline of approximately 20 percent for some major traditional lenders in terms of credit growth, says Moses Samaha, executive general manager for Equifax in Sydney. This presents an opportunity for alternative lenders to serve parts of the market the banks don’t want and those that are more attuned to a digital experience.

Even so, challenges persist. For instance, digital disruptors are still working on gaining brand awareness, and the market is only so big to be able to accommodate a certain number of alternative players. Time will time whether there will be consolidation among alternative lenders and more bank partnerships, which haven’t been so successful to date. “It doesn’t feel like they are as active as they were announced to be,” Samaha says.

At present, the Australian market consists of a few dozen alternative lenders pitted against four major banks. RateSetter, SocietyOne and Wisr are among the largest alternative players in the consumer lending space. On the small business side, Capify, GetCapital, Moula, OnDeck, Prospa and Spotcap are some of the leading companies. PayPal Working Capital also has a growing presence in the Australian small business lending market.

New lenders continue to eye the Australian market for entry, but it’s not an easy market to crack, according to industry participants. The market consists of mostly home-grown players and that’s not expected to change drastically. (Capify, OnDeck and Berlin-based Spotcap are notable exceptions. Another U.S. major player, Kabbage, previously provided its technology to Australia’s Kikka Capital, but that agreement is no longer in force.)

There can be a steep learning curve when it comes to outsiders doing business in Australia. What’s more, there’s no longer the first-to-market advantage that existed a decade or so ago. It’s also a relatively limited market in terms of size, which can be off-putting. Australia has a population of around 25 million, making it less populated than the state of California, with an estimated 39.9 million residents.

Still, for alternative players that are able to successfully navigate the challenges the Australian market presents, there’s ample opportunity to grab market share away from traditional players—similar to the pattern that’s emerged elsewhere around the globe.

Take consumer lending, for example. The unsecured consumer lending market in Australia sits at about $70 billion, with the large banks occupying maybe a 90 percent share of that, says Mathew Lu, chief operating officer of Wisr (previously known as DirectMoney Limited). Compared with other markets such as U.K. and the U.S., who went through a similar journey around a decade ago, “Australia is probably three or four years into that same journey of growth. It’s shifting and changing,” he says.

Alternative lenders have made strides in undercutting the large banks by offering generally lower rates and typically faster loan times. Unfavorable press related to bank lending practices has also benefited alternative lenders. Lu refers to these conditions as “a perfect storm” for growth.

Wisr, for instance, saw loan origination volume spike 409 percent in fiscal year 2018. The company secured $75 million in loan funding agreements last year and boasts more than 80,000 customers, according to a company presentation.

Marketplace lender, SocietyOne, which in March reached $600 million in loan originations, is another example of an alternative lender that has benefited from the momentum. The company— celebrating its 7th anniversary this summer—is hoping to reach $1 billion in loans by 2020, according to its website.

RateSetter—another major player in this space—has also experienced significant growth since launching in Australia in 2014, and is now funding over $20 million in loans each month, according to its website. In April, the company soared past $500 million in loans funded and in May it saw a record number of new investors register. The company has more than 15,000 registered investors by its own account.

One question for the future is whether the consumer alternative lending space in Australia will ultimately be too crowded amid a spate of new entrants. Wisr’s Lu says “there’s a big question mark” regarding how many alternative lenders the market can sustain. “Will there be a level of consolidation or amalgamation? These are questions ahead of us,” he says.

One question for the future is whether the consumer alternative lending space in Australia will ultimately be too crowded amid a spate of new entrants. Wisr’s Lu says “there’s a big question mark” regarding how many alternative lenders the market can sustain. “Will there be a level of consolidation or amalgamation? These are questions ahead of us,” he says.

For its part, alternative lending to small businesses is also a growing force within Australia. As a testament to the development of this market, in June 2018, a group of Australia’s leading online small business lenders released a Code of Lending Practice, a voluntary code designed to promote fair terms and customer protections. Currently, the Code only covers unsecured loans to small businesses. Signatories include Capify, GetCapital, Moula, OnDeck, Prospa and Spotcap.

Capify—an early entrant to Australia—has been pursuing businesses there since 2008. The company, which integrated its U.S. business in 2017 to Strategic Funding Source (now called Kapitus) is now operating only in Australia and the U.K. In Australia, it has executed more than 7,500 business financing transactions for Australian businesses and has more than 50 staff members in its Australian offices.

The company recently closed a deal with Goldman Sachs for a $95 million line of credit for growth in Australia and the U.K., which includes building out its broker program to increase distribution and technology investment.

David Goldin, the company’s chief executive, says Capify is hoping to grow its Australian business between 25 percent and 30 percent in 2019. The company is looking at M&A activity as well as organic growth.

Since Capify has been in the market, he has seen a number of new entrants—some more successful than others. One concern Goldin has is the lack of experience by some of these competitors. Many aren’t pricing the risk properly and not underwriting prudently to be able to weather a downturn, he says. They are so new, he questions whether they have the expertise to be able to survive a downturn given what he characterizes as pricing and underwriting missteps.

“You can’t go out 24 months on a 1.25 factor rate – that’s crazy,” he says, referring to some contracts he’s seen. “I’ve seen this movie in the U.S. before and it doesn’t end well.”

Meanwhile, competition has driven down prices and made moving quickly on potential leads more of a necessity. When leads come in today, if you’re not on the phone in 30 minutes, you could lose it to a competitor, he says.

Meanwhile, competition has driven down prices and made moving quickly on potential leads more of a necessity. When leads come in today, if you’re not on the phone in 30 minutes, you could lose it to a competitor, he says.

While the small business market is an enticing one for alternative lenders, raising awareness of their offerings continues to be a challenge.

“The small business market is fragmented and raising awareness is expensive,” says Beau Bertoli, co-founder and co-chief executive of Prospa, another prominent small business lender in Australia. “There hasn’t been much innovation in small business banking, but many Australians still don’t think of switching from banks and traditional lenders,” he says.

That said, more small businesses are turning to alternative lenders and these companies say they expect growth to increase over time. Recent research commissioned by OnDeck found that 22 percent of small and medium-sized businesses would consider an online lender, up from 11 percent in the past. This could be buoyed further by the introduction of Open Banking in Australia, which was set to be introduced in Australia in 2019, but this was pushed back to early 2020.

“We look forward to the introduction of Open Banking in Australia as it should allow lenders to use incremental data points to improve risk modeling, and increase competition in the SME lending space, ultimately providing SMEs with improved access to cashflow solutions to grow and run their businesses,” says Cameron Poolman, chief executive of OnDeck in Australia.

Bertoli of Prospa, which recently listed on the Australian Stock Exchange, says the Australian alternative lending market will also benefit from strong support from industry and government to increase competition and improve consumer and small business outcomes. The government recently established a $2 billion Australian Business Securitisation Fund, which is a huge win for small business, he says, that will ultimately make the finance available to small business owners more affordable by lowering the wholesale cost of funds for alternative lenders. “We expect this will boost credibility and consideration of alternative lenders among small business owners,” he says.

Declining property values is another factor helping alternative lending. “In November 2018 we saw the largest annual fall in property prices in Australia since the global financial crisis in 2009,” says Simon Keast, managing director of Spotcap Australia and New Zealand.

“As property prices decline, business owners find it more difficult to use their home as loan security and as such, turn to alternative lenders such as Spotcap that can provide them with unsecured loans for their business,” he says. What’s more, the SME Growth Index in March showed for the first time that business owners are almost as likely to turn to an alternative lender as they are to their main bank to fund growth, says.

“As property prices decline, business owners find it more difficult to use their home as loan security and as such, turn to alternative lenders such as Spotcap that can provide them with unsecured loans for their business,” he says. What’s more, the SME Growth Index in March showed for the first time that business owners are almost as likely to turn to an alternative lender as they are to their main bank to fund growth, says.

Overall, the market opportunity for alternative lending to small businesses is compelling, says Bertoli of Prospa. “We estimate the potential market for small business lending in Australia is more than $20 billion per annum and we’ve penetrated only about 2 percent of the market so far. There are 2.3 million small businesses in Australia, and they’re crying out for capital,” he says.

Keast of Spotcap says he expects to see more banks and non-financial enterprises looking to leverage the technology fintech lenders have built to provide swift and digital lending products to small businesses. He offers the example of a partnership Spotcap, a German-based company, has with an Austrian Bank to provide same-day finance to SMEs in Austria as an example of the types of partnerships the company could also seek in Australia. “We have already partnered with an Austrian Bank that is leveraging our lending platform to provide same-day finance to SMEs in Austria, and there is plenty of interest for similar partnerships on the ground here,” he says.

OnDeck, meanwhile, expects to see a shake-out within the alternative finance sector, which will result in a smaller number of bigger players, with the ability to scale and serve multiple customers with a variety of products, according to Poolman, the company’s chief executive.

For his part, Goldin of Capify is bullish on the Australian small business market, but he cautions others that it’s not a gold rush type of place where everyone who comes in can make money.

“The state of California has more opportunity than the entire continent of Australia,” he says.