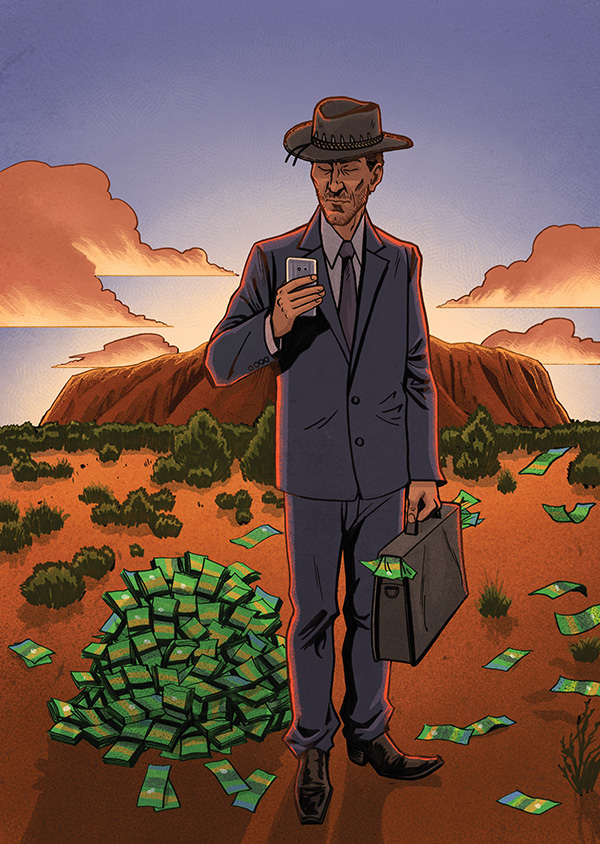

Australia Brimming with Alternative Lending Activity

OnDeck announced today that it has closed on a $75 million (AUD) asset-backed revolving credit facility with Credit Suisse for its business in Australia. This will be used to refinance OnDeck Australia’s current loan book at a significantly lower cost, as well as to fund future originations there.

OnDeck announced today that it has closed on a $75 million (AUD) asset-backed revolving credit facility with Credit Suisse for its business in Australia. This will be used to refinance OnDeck Australia’s current loan book at a significantly lower cost, as well as to fund future originations there.

This comes shortly after Lending Express CEO Eden Amirav told deBanked that the success his company had in Australia in just a little more than a year gave them the confidence to enter the U.S. market.

“After the immense success we’ve had in the Australian market, we knew that our platform was ready to take on the U.S.,” Amirav said in June.

And several large fintech companies, including OnDeck, joined forces this month to create a set of best practices, called The Code, that would regulate how fintech companies operate in Australia. The market down under has seen a fairly rapid expansion over the last several years.

Some of the major fintech companies there include Prospa, OnDeck, Capify, GetCapital, Moula and Spotcap.

Last modified: April 20, 2019