Archive for 2017

ISO Alleged to Have Forged a Confession of Judgment

November 6, 2017 Underwriters, keep your eyes on the notary stamps.

Underwriters, keep your eyes on the notary stamps.

A lawsuit filed in the New York Supreme Court last week by a merchant cash advance company against an ISO and several co-defendants, alleges that an ISO was partially responsible for damages when a merchant defaulted.

And they make a compelling argument. In this case where a Confession of Judgment (COJ) was required to approve the deal, the merchant, who defaulted within 30 days of being funded, claims to have never signed one, despite the ISO having delivered a signed one to the funder.

Well then who signed it?

Upon inspection, the notary stamp on the COJ belonged to a notary in Nassau County, NY, where the contract logically would’ve been notarized. But the merchant is based in Florida and claims to have been in Florida at the time the COJ was allegedly signed.

So who would’ve been in Nassau County that day?

According to the funder, it was the ISO, since the ISO is based on Long Island and the ISO is the one that delivered the signed COJ to them.

These are just the allegations at this point, of course, since the defendants have not even yet had a chance to respond.

The complaint, however, adds another twist, that after the ISO got the deal funded, they then referred it to a debt settlement company, who assisted the merchant in defaulting.

As you might imagine, the debt settlement company is a named co-defendant.

The case is filed under Index Number: 656692/2017 in the New York Supreme Court. You can view the entire complaint here.

CFC on the Front Lines of the MCA Regulation Battle

November 6, 2017

As the US Senate attempts to reach a bipartisan agreement on relaxing some of the rules in the Dodd Frank legislation of 2010 that would treat banks more favorably, the MCA industry is having to fend off legislation and regulation of its own at the state and federal levels that could position funders in a similarly crippling position.

MCA regulation has been thrust into the spotlight for a number of reasons, not the least of which has been the Consumer Financial Production Bureau (CFPB). The CFPB is moving forward with the Dodd-Frank Section 1071 rulemaking process for data collection regarding small business lending, a sector of the market for which they do not have jurisdiction, sources say.

Front and center in the policy discussions has been the Commercial Finance Coalition (CFC), a merchant cash advance trade association that is coming up on its two-year anniversary in December. While federal policymakers appear to be listening, state legislatures have been a more difficult nut to crack.

The CFC’s Influence

In its short two-year history, the CFC has been one of the most vocal if not the most influential trade organization lobbying on behalf of the MCA industry, having attended 70 congressional meetings and having led advocacy efforts for the industry in the halls of Albany, Sacramento, Illinois and Washington, D.C.

Dan Gans, executive director of the CFC, has been the voice of the MCA industry on Capitol Hill and has been invited to testify in key congressional hearings. “For whatever reason, the CFC has really become the voice and has taken an active part in the so far successful advocacy efforts to educate and mitigate potential harm to our members’ ability to deploy capital to small businesses that need access,” Gans told deBanked.

Most recently the CFC participated in a fly-in, one of two such events this year, to Washington, D.C. in which the association’s counsel Katherine Fisher of Hudson Cook, LLP testified.

In her testimony Fisher said: “The MCA and commercial lending spaces are sufficiently regulated by existing federal and state laws and regulations. Both MCA companies and commercial lenders must comply with laws and regulations affecting nearly every aspect of their transactions, from marketing and underwriting through servicing and collection.”

She went on to explain: “Even if they comply with every applicable law and regulation, small business financers must also be wary of the Federal Trade Commission’s powerful authority to prevent unfair or deceptive acts or practices.”

Fisher told deBanked she received a “positive” response to her testimony from funders but has not heard anything from lawmakers.

Gans said Fisher did a fantastic job in articulating the needs and status of the industry.

“She presented a very good case as to why the industry is currently adequately regulated. We don’t feel there is a need for federal regulation. In some cases, less regulation would allow our members to deploy more capital and help more small businesses,” Gans said.

The sweet spot for MCAs, Gans explained, are transactions under $100,000 and probably in the $24,000 – $40,000 range. He said the industry does a fantastic job of being able to deploy financial resources to small businesses in a timely manner that neither banks nor SBA lenders can match. He’s not suggesting MCA is for everybody but for some businesses it’s an essential product that can help. There have been many success stories.

“Competition is all over the place. But that’s great for the merchant. The more options that merchants have, the more we can enforce best practices and more competitive rates. And the more we can keep the government from impeding people from getting into this space, the better off small businesses are going to be,” said Gans.

Setting the Record Straight

The CFC was formed with the mindset that the organization, which is currently comprised of CEOs of small- and medium-sized funders, would take a proactive rather than a reactive approach to industry regulation. In its two-year history the CFC has tasked itself not only with educating policymakers on the role of MCA funders for small businesses but also with undoing the misinformation and misconception surrounding the anatomy of an MCA.

“Unfortunately, because MCA uses the term cash advance in its product name, uninformed people will often confuse MCA as some form of payday lending. And so that has been one of our biggest challenges, educating members of congress and committees that there is absolutely no correlation between MCA products and what their views of consumer payday loans is,” said Gans, adding that the CFC has had to communicate that MCA is a version of factoring has been around for more than 1,000 years.

A common thread that the CFC has been able to weave with lawmakers has been the diverse geographical representation of both the trade group and the House and Senate.

“Most venture capital is deployed in a few spots – New York, California and Texas – and it’s a cliff to get to those three states. So, one nice thing that I take pride in is my members are looking all around the country regardless of the geographic location. That helps us with policymakers, most of whom are not from the New York City metropolitan area or Silicon Valley. It’s nice being able to look at them in the eye and tell them we care just as much about your district as you do,” he said.

The Road Ahead

The CFC has an ambitious long-term agenda, one that includes raising their profile in the industry and participating in events.

“I think one of the ambitions we have is to have an organization where funders and brokers can be at the same table and work though some of the issues impacting the industry and try to make sure people are doing things in the right and best way.”

The trade group is planning to partner up with deBanked for Broker Fair 2018 and they’re looking to bolster membership.

“The industry has had a lot of free riders that are benefiting from our advocacy efforts but not supporting it. So, from my perspective, if you’re in this industry, particularly in the MCA space, we’d like to expand membership. If we grow our membership, we can do more things, engage more states and expand our lobbying team,” said Gans. “The more members we have, the more we can do to advance the ball and protect the interests of the industry.”

The CFC will need all the help it can muster given the fight ahead to fend off regulation particularly in Washington, Albany and Sacramento. “I think we could see some harmful regulations and potentially legislation over time. Some of those bad ideas that emanate in states have a tendency to percolate into Washington. If at some point there is a less business-friendly administration in the future, we could see all those ideas get some traction at the federal level,” Gans warned.

Catching Up With LendingPoint

November 6, 2017 At Money2020, we sat down with Chief Executive Officer Tom Burnside and Chief Strategy Officer Juan Tavares, both of LendingPoint, an online consumer lender we examined in the July/August magazine issue. Not mentioned in that story is Tavares’ background at Avanzame Latin America, a merchant cash advance company based in the Dominican Republic. Burnside, however, originally started on the consumer side at First Data, before working for 13 years at CAN Capital, until he left and launched LendingPoint.

At Money2020, we sat down with Chief Executive Officer Tom Burnside and Chief Strategy Officer Juan Tavares, both of LendingPoint, an online consumer lender we examined in the July/August magazine issue. Not mentioned in that story is Tavares’ background at Avanzame Latin America, a merchant cash advance company based in the Dominican Republic. Burnside, however, originally started on the consumer side at First Data, before working for 13 years at CAN Capital, until he left and launched LendingPoint.

The lender focuses on near prime consumers and has even trademarked the word “NEARPRIME.” Their algorithm, which processes data from dozens of APIs in 5 seconds, handles the heavy lifting, the secret sauce of which they could not disclose. “You could use 3,000 attributes but maybe actually 57 attributes could become your core,” Tavares says. Their “credit-first” mentality has allowed the company to build a healthy performing portfolio. And “credit-first” doesn’t necessarily mean FICO scores, Burnside says, it’s about “predictives” to price accordingly for the risk you take. “How you run [the variables] together, that’s the magic,” they say together.

An interesting initiative that they’re now just ramping up, Tavares says, is partnerships with hospitals that allow patients to determine their deductible expenses and obtain credit on the spot to pay for it. Fitting into their “point of need” strategy, Tavares say “We’re at the intersection between credit and payments.”

Burnside says that LendingPoint was on par to finish with $28 million in funded loans for the month of October. “Demand is not the problem,” Tavares interjects. “We’re tempering growth to make sure that we grow wisely.”

And the market to expand that growth is big despite the numerous tech companies competing in the lending space. Burnside reports the company receiving $2.5 billion worth of loan applications in September alone. 60% of their applications come in through mobile devices. Peak application hours are lunch time and late at night, sometimes as late as 1 or 2 in the morning, they say. The entire loan application process can be done on mobile without them ever having to talk to anyone. Tavares qualifies that by saying that doesn’t mean that they take shortcuts.

As to whether an IPO could be in the works, Burnside deflects and says, “we’re busy building something special right now. We’ll see what happens.”

“What I will tell you is, is that investor confidence is up,” Tavares says.

FundKite Event at the Jets/Bills Game Had a Big Turnout

November 3, 2017About 100 people attended the FundKite event at the Jets/Bills Thursday night game in The Meadowlands including several dozen ISOs. In addition to premium seating and sideline access through the 50 Club, a select group got to stand on the field during the national anthem. Below is a handful of snaps I took at the game:

6th Avenue Capital Secures $60 Million Commitment For Merchant Cash Advance Funding

November 2, 2017Highly Experienced Executive Team Offers Flexible Financing Options to Small Businesses

New York City – November 2, 2017 – 6th Avenue Capital, LLC (“6th Avenue Capital”), a leading provider of small business financing solutions, announced today its securement of a $60 million commitment from a large institutional investor. The investor made their commitment based on 6th Avenue Capital’s industry-leading underwriting, compliance standards and processes. 6th Avenue Capital will draw from this commitment to offer merchant cash advances to small businesses through its nationwide network of Independent Sales Organizations (“ISOs”) and other strategic partnerships, such as banks and small business associations.

6th Avenue Capital launched formal operations in 2016 to help finance small businesses that are often ineligible for funding due to traditional underwriting criteria. 6th Avenue Capital evaluates each application for funding individually and keeps the merchant’s short and long-term needs in mind including, most importantly, what they can afford. 6th Avenue Capital also understands that small businesses may need funding quickly. The company’s data-driven underwriting processes, expertise and technology can give the merchant secure and equitable approvals of qualified requests and funding within hours.

Leading the team, CEO Christine Chang oversees all strategic aspects of 6th Avenue Capital. She also serves as COO to sister company Nexlend Capital Management, LLC. She brings more than 20 years experience in institutional asset management, including alternative lending. Previously, Chang served as Chief Compliance Officer at Alternative Investment Management, LLC, COO at New York Private Bank & Trust and Vice President at Credit Suisse. She serves on the board of Blueprint Capital Advisors, LLC and Bottomless Closet, a not-for-profit empowering economic self-sufficiency in disadvantaged NYC women.

“Our mission at 6th Avenue Capital is to help small businesses grow, and we continue to expand our existing network of ISO and strategic partners to ensure these businesses have access to capital in hours,” said Chang. “Our leadership team of financial industry experts has extensive experience navigating multiple economic cycles. We know how to serve merchants and how to deliver quickly while meeting the highest operational standards for our investors.”

COO Darren Schulman joined the team in March 2017. Schulman is a 20-year veteran of the alternative finance and banking industries. He is responsible for oversight of 6th Avenue Capital’s origination, underwriting, operations and collections, as well as strategic initiatives. Schulman served previously as COO at Capify (formerly AmeriMerchant), a global small business financing company, and President and CFO at MRS Associates, a Business Process Outsourcing (BPO) company specializing in collections. In addition, Schulman was an Executive Vice President at MTB Bank.

“We form strong relationships with the merchant and consider it essential for our underwriters to speak to every merchant, on every deal, regardless of its size,” said Schulman. “We also make our underwriters available for discussions with ISOs whenever necessary. We are proud to offer competitive volume-based commissions, buyback rates and white label solutions.”

About 6th Avenue Capital, LLC

6th Avenue Capital is changing the small business financing landscape by offering a data-driven underwriting process and fast access to capital. The company employs a unique blend of industry experts and is committed to the highest operating standards, high touch merchant service, including a policy of direct merchant access to underwriters. 6th Avenue Capital is a sister company of Nexlend Capital Management, LLC, a fintech investment management firm founded in 2014 and focused on marketplace lending (consumer loans). For more information, visit www.6thavenuecapital.com.

# # #

Fundera Passes $500M in Loans Funded to 8,500+ Small Businesses

November 1, 2017(New York, NY–Nov 1, 2017) – Fundera, the trusted advisor and online marketplace for small business financing, today announced that it has surpassed the $500 million mark in loans funded to over 8,500 small businesses on its platform.

Fundera’s platform allows small business owners to apply to a curated network of 25-30 lenders in the industry with one easy common application. Small business owners come to Fundera for all of their financing needs, from credit cards to SBA loans and everything in between.

“It’s about more than just saving time and money for the small business owner,” said Jared Hecht, CEO and cofounder of Fundera. “At Fundera we’re truly able to become a partner in these businesses’ financial decisions. Our goal is to use our resources and technology to educate small business owners on their credit eligibility, improve their creditworthiness over time, and help them graduate into better and better financing products.”

Fundera replaces small business loan brokers with software and algorithms, making the process faster and easier to navigate. The average loan size on Fundera’s platform is about $60,000, and although no single industry accounts for more than 10% of Fundera’s customer base, the most popular industries include ecommerce and retail.

Since launching in 2014, Fundera has raised over $20M in equity financing.

LendUp May Have a Leg-up

November 1, 2017

deBanked recently sat down with LendUp CEO Sasha Orloff and COO Vijesh Iyer at an auspicious time. The company, an online lender that provides consumers with alternatives to payday loans and credit cards, is uniquely positioned in the wake of the CFPB’s 1600+ page Payday loan rule that was issued in early October.

And that’s not exactly an accident. Orloff says the company was founded (5 years ago) with the expectation that the CFPB would issue an eventual rule. “At the time, we had no idea what it was going to be but I could imagine that if they were going to write a federal rule that it would completely change the industry,” he said.

Orloff’s journey, as he tells it, began by reading Banker to the Poor, which inspired him to move to rural Honduras nearly 15 years ago to help the Grameen Foundation, a non-profit that focuses on providing loans and education to the poorest of communities. He was only 21 at the time. After a three-year tour, he moved on to roles at The World Bank, Citi, and finally starting in 2012, LendUp.

When LendUp was being envisioned, he explains, the smart phone was making it possible for consumers to access financial services outside of what was in their neighborhood and bank technology was the last thing that was going to become modernized.

“The CFPB rule was going to make it harder for banks to work with underserved consumers,” he says. “So we said let’s start a financial services company that focuses exclusively on the people that have the least amount of options and let’s start reinventing [these] products one at a time.”

And with that, they consulted academics, educators, government officials, and people from the industry. “How do you give somebody credit in an emergency fashion that can change it from a trap into an opportunity? And so we did that and it turned out the rule looked really similar to what we did,” he explains.

“I think there’s a lot of things they got right [about the CFPB rule],” he says in regards to how to eliminate debt traps. LendUp, for example, doesn’t allow customers to roll over their loans, they have to pay off their loans in full before they can consider borrowing again. Rollovers were a big sticking point for the CFPB when they published their rule last month. Their official announcement on the matter had stated that “many borrowers end up repeatedly rolling over or refinancing their [payday] loans, each time racking up expensive new charges. More than four out of five payday loans are re-borrowed within a month, usually right when the loan is due or shortly thereafter. And nearly one-in-four initial payday loans are re-borrowed nine times or more, with the borrower paying far more in fees than they received in credit.”

One piece of the payday alternative puzzle is in the underwriting. COO Vijesh Iyer, an alumni of both Capital One and PayPal, says “we basically use a variety of data sources, both the traditional bureaus and as what we call the non-traditional bureaus.” For the credit card product, LendUp will pull credit from a traditional bureau. “For the small dollar loan product we use non-traditional CRAs,” he says. Their team of data scientists tries to extract the most significant signals out of all of the data sources they have at their disposal. “That’s really valuable when you’re dealing with a subprime customer where the reason why someone could be underserved or subprime is very different. We all have different life stories and we’re really trying to figure out the differences which we get from multiple signals, multiple data sources.”

“The easiest person to convince that we’re a better product is an existing payday user,” Orloff says. “because it’s slightly cheaper at the beginning, it gets much cheaper over time. It has a lot more flexibility. It gives people for the first time the opportunity to report to the credit bureaus. It teaches you better financial behavior. You can do it on a mobile phone. You can get alerts and reminders…”

Meanwhile, payday borrowers always have to pay the same amount, Orloff contends. The loan terms don’t improve, he says. One notable advantage a LendUp borrower might experience is that when they first run into trouble with making a LendUp loan payment, they can get a few extra days leeway at no extra charge, which usually comes as a welcome surprise.

Granted, a LendUp loan’s APR can still look pretty steep. A calculator on their website offers an example of one that is 458.86% APR. Orloff says a part of understanding that is understanding what a consumer’s options are and what the costs to process the applications are. A 220% APR might only equate to something like $30 total in fees depending on what the loan terms are, he explains. Their borrowers don’t get paid in APR though he says, they get paid in dollars. “They care about what’s the total cost of credit in terms of dollars.”

“Our customers pay more than that on overdraft fees,” Iyer adds. “Every time they have a slight overdraft, even if it’s for a dollar, even if it’s 10 cents. Even if it’s two dollars. No one ever tries to evaluate what the APR for that is. But that is their fee and this is also a fee.”

But more than anything else, it’s about whether the borrower’s and lender’s interests are aligned, Iyers contends. Right now, LendUp believes they’re doing the right thing at the right time.

—

This interview was conducted at Money2020 in Las Vegas

StreetShares Reports $6.2M Loss For Fiscal Year 2017

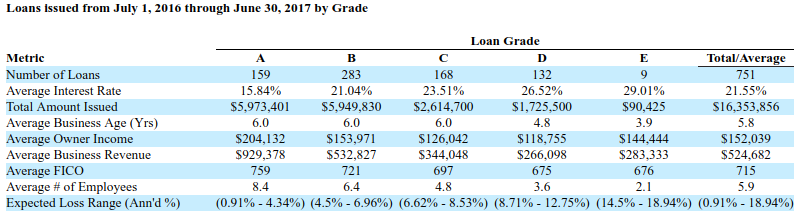

October 31, 2017StreetShares, the veteran-run small business lender, continued to post sizable losses, according to their June 30th fiscal year-end financial statements. The company had a $6,193,154 loss on only $2,168,067 in revenue. While StreetShares has generated significant buzz for their particular focus on military-owned small businesses, the lender only made 751 loans in the 12-month period and there is no requirement that the businesses they lend to actually be military-owned.

The company spent more on payroll and payroll taxes alone ($3,258,960) than they earned in revenue. They had 32 full-time employees and 1 part-time employee as of June 30th.

“As an early stage, venture-funded company that is not yet profitable, we rely heavily on capital investments to fund our operations,” the company wrote in their annual report. “Based on our current financial situation, it is likely we will require additional capital within the next twelve months beyond our currently anticipated amounts to fund the operations of the Company.”

The chart plotting their loan performances by grade below is from their annual report:

Their loan amounts typically range from $2,000 to $150,000 and require weekly payments for anywhere from 3 months to 3 years.

Even though the company spent nearly triple on marketing in this fiscal year ($1,727,478) versus the previous year ($579,331), revenue only doubled.

StreetShares plans to raise additional capital towards the end of this year through a Series B Round.