Archive for 2017

Check Out The Preliminary Agenda of Broker Fair 2018

November 15, 2017The preliminary agenda of Broker Fair 2018 was published to the event’s website on Tuesday evening. While subject to revisions between now and May 14th, Broker Fair is already shaping up to be the hallmark event for the MCA and small business lending industry. Fifteen sponsors have already signed on including National Funding, RapidAdvance, and Funding Metrics as Platinum-level and CFG Merchant Solutions as Gold-level.

Broker Fair 2018 will be the largest gathering of merchant cash advance and business loan brokers in the country. Until now, there’s never been anything like it.

To register, sign up online or contact Sarah@brokerfair.org

We hope to see you in Brooklyn at The William Vale in May!

Update 4-26-18:/strong> Most recent version of the agenda below

Don’t Forget About FastFlex

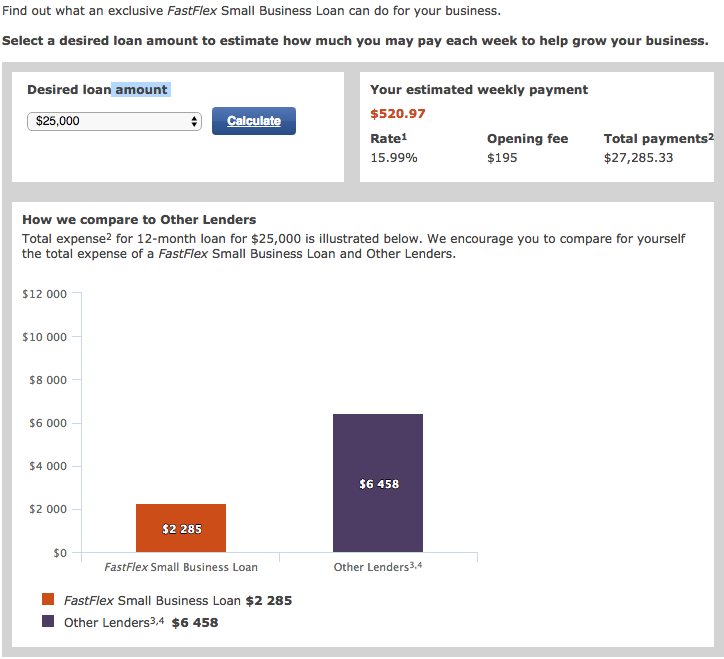

November 13, 2017 The OnDeck-Chase partnership isn’t the only game in town when it comes to fast weekly payment bank loans. Wells Fargo announced their own program, called FastFlex, in 2016 as part of a goal to lend $100 Billion to small businesses over five years.

The OnDeck-Chase partnership isn’t the only game in town when it comes to fast weekly payment bank loans. Wells Fargo announced their own program, called FastFlex, in 2016 as part of a goal to lend $100 Billion to small businesses over five years.

deBanked was shown an anonymized bank statement snippet recently of a merchant that was purportedly being debited daily by Wells Fargo. So we reached out to Wells to ask if there might be a daily payment loan product that had not yet been announced.

“[F]or Wells Fargo’s FastFlex Small Business Loan, we only offer the weekly payment option, in which required payments are made on a weekly basis automatically deducted from the customer’s business-deposit account,” they responded. “None of our Small Business loan products have daily payments.”

While the mystery remains unsolved, Wells already compares its FastFlex product to OnDeck, Kabbage, and CAN Capital on their website. Loan amounts ranging from $10,000 to $35,000 come with 1-year terms, weekly repayment, and interest rates starting at 13.99%. Their loan calculator approximates a 1.09 total cost factor on a $25,000 loan.

Their underwriting criteria comprises of cash flow history, existing credit obligations, credit experience, payment history, and relationship status with Wells Fargo. Merchants are funded the day after accepting the terms.

Users on a handful of message boards have reported that cash flow history weighs heavily in the approval.

From Ineligible to 0% APR – Los Angeles Company Monetizes Startup Leads, Combats Stacking

November 10, 2017 Merchants have no shortage of options when it comes to accessing funding in today’s climate. And while MCAs and loan products have become more pervasive, one company’s solution is to reintroduce traditional financing in a strategic manner. Seek Business Capital finds credit card offers and credit lines for the credit-worthy who may not be eligible or ideally suited for a business loan.

Merchants have no shortage of options when it comes to accessing funding in today’s climate. And while MCAs and loan products have become more pervasive, one company’s solution is to reintroduce traditional financing in a strategic manner. Seek Business Capital finds credit card offers and credit lines for the credit-worthy who may not be eligible or ideally suited for a business loan.

Roy Ferman is an Australia transplant who runs the company out of the Los Angeles headquarters, miles from the usual domicile for alternative funders of Silicon Valley, New York and Austin.

“We liked LA from a perspective of the sunshine, but we also like being away from the rest of the funding industry. It gives us the ability to put our heads down and focus on what we’re doing and not worry about what anybody else is doing,” Ferman told deBanked.

Seek Business Capital partners with MCAs and brokers on leads and recently expanded with a new hire in New York. Kunal Bhasin joined the company over the summer as vice president of business development. “We were traveling out there to meet with partners and doing redeye flights. Now someone is on the ground there training partners on how to better find opportunities to use our product,” Ferman said.

Basically, the company tells MCAs and brokers that the startup leads (those that are trying to start a business or have just started one), to send those deals to Seek Capital, instead of throwing them in the trash.

They recently adopted a fully automated underwriting product that delivers an instant decision for merchants though there’s an element of the human touch on the services side of the transaction.

“For us, the biggest driver is FICO. We take someone with a good FICO score but just started their business and we are still able to offer this person funding,” said Ferman, adding that the sweet spot is a credit score of 680 or higher. “Cash flow is always going to be a factor. For us, we’re predominantly based on FICO. Even still, FICO is one thing. That’s the body of the car. Sometimes we want to look under the hood and see what’s really going on,” said Ferman.

Economic Indicator

Seek Business Capital is industry agnostic though some of the more common sectors they work with are retail, restaurants and trucking. “What’s really interesting is we get a little bit of a sneak peek into emerging industries and local economies,” Ferman said.

For instance, when cannabis was legalized for recreational use in Colorado, they saw a spike in demand from “peripheral businesses” such as contractors that were building out the storefronts, security companies and restaurants amid a rise in tourism to the area.

A similar boom is expected in California when cannabis for recreational use becomes legal in the state in 2018 via Prop 64.

Zach Lazarus, CEO of San Diego-based A Green Alternative, a cannabis dispensary and delivery service, said: “You name it, it’s going up in California right now,” in response to Prop 64. He added there are desert towns and farm communities looking to embrace the boom, which he compares to the gold rush of 1849.

Zach Lazarus, CEO of San Diego-based A Green Alternative, a cannabis dispensary and delivery service, said: “You name it, it’s going up in California right now,” in response to Prop 64. He added there are desert towns and farm communities looking to embrace the boom, which he compares to the gold rush of 1849.

“It’s the service providers, architects, contractors, all these different niche needs are the people who are really going to benefit from the boom,” Lazarus said. Contractors especially need access to capital right away; they don’t generally get fully compensated until once the job is complete, and they need to purchase materials in the interim.

Lazarus said banks won’t loan to cannabis businesses and in his experience other lenders have been predatory in nature. He may just not have come across the right funder yet.

Anti-Stacking Tool

One of the problems that Seek Business Capital seeks to solve is that of merchants taking on too many positions. “We found two ways to provide our services. Our bread and butter and our historical performance has always been in startup funding. We’ve evolved to move more upstream with lenders and we’ve become an anti-stacking tool, if you will,” Ferman noted.

The problem with stacking is that it can put a major strain on the cash flow of the merchant and it put the first position funder at additional risk than what they originally agreed to underwrite.

“We offer 0% for the first 12 months. It’s very advantageous and we’re not crushing cash flow. We view it as an anti-stacking tool. There are few lenders and ISOs who use it, taking both our credit card position and the original term loan but protecting the merchant. The merchant gets all the money they need so they’re not interested in stacking,” said Ferman.

Seek Business Capital charges merchants a success fee of 9.9% of whatever funding they receive for them. Payment is made once the small business receives their funding and the merchant will typically choose to pay Seek Business Capital with the capital they receive from the credit extended to them.

Now they’re taking things to the next level with a data product that they plan to license to third party credit aggregators next quarter.

“We’ve seen everything from the credit profile, to income, to the approval rate, the approval score and the amount. We’ve taken all that data and analyzed $150 million worth of credit card approvals for big clients. We now have a strong indicator of which profile is going to get approved from which bank and how much,” Ferman explained.

A customer submits their details into Seek Business Capital’s decision engine, which generates an estimated approval or decline rate in real time. For instance, they might see that their approval likelihood is 25% for one card and 86% for another along with the estimated approval amount. It’s a soft credit pull so customers don’t have to worry about harming their credit. In addition to the decision engine there’s a recommendation engine that makes credit card suggestions to merchants.

Ferman said the biggest competition the company faces is a potential customer taking out a home equity line, dip into their 401(k) or borrow from friends and family.

MCA Funder Asks Court to Set Aside Default Judgment in Usury Case

November 10, 2017If it wasn’t for the Usury Law Blog, an MCA company may never have known about the default judgment entered against it in Florida for usury, according to documents filed in the case.

On Wednesday, the funding company filed a motion to set aside the default judgment and reopen the case on the basis that the in-house attorney handling the case for them left the company in September. The company had no way of receiving case notices after he left, they say, because the attorney had used a non-company email address as the email of record with the Court.

The funding company’s new attorney only became aware of the case when the Usury Law Blog published an analysis of it, they say.

The Court has initially denied their motion without prejudice on the basis that procedure requires that they certify that they have conferred, or describe a reasonable effort to confer, with the parties affected in good faith effort to resolve the dispute. Presumably, the funder can refile the motion once the defect has been cured.

Two More Senior Employees Leave SoFi

November 9, 2017According to the WSJ, SoFi’s head of banking Arkadi Kuhlmann and general manager of asset management Peter Early, are both leaving the firm. The personnel move has to do with the fact that SoFi is no longer pursuing a bank charter while also pulling back on its plans for its asset management business.

It has been a tumultuous year for SoFi. On top of its former CEO Michael Cagney resigning in a scandal, co-founder Dan Macklin, chief financial officer Nino Fanlo, and chief revenue officer Michael Tannenbaum have all also left the company.

Former MCA Co-founder Meir Hurwitz Kicks Off New Venture With Kim Kardashian West

November 9, 2017I love how @screenshopit lets you find the exact designer looks you see people wearing online, plus suggests similar items at all price points! #ScreenShop_Ambassador https://t.co/TXZ23agVoT pic.twitter.com/nA8JBDVbU5

— Kim Kardashian West (@KimKardashian) November 7, 2017

An early innovator of the merchant cash advance industry has re-emerged on the business scene in a very different new venture focused on mobile shopping.

Meir Hurwitz, co-founder of Pearl Capital, the MCA company acquired in 2015 by Capital Z Partners Management LLC for as much as an estimated $60 million, is now the chief visionary officer of ScreenShop. The New York startup markets an app designed to enable users to shop for a specific item by uploading a screenshot of the item to the app.

Working on a mobile app is a longer shot than MCA and it doesn’t always pay off, but Hurwitz said Thursday he’s enjoyed learning the business after two years off and visiting 62 countries since selling Pearl Capital.

“It’s new and exciting for me, but I don’t get paid right away,” he said. “It’s something I haven’t done before — it’s kind of exciting for me.”

The app is the first developed by New York-based Craze Ltd. and publicly launched on Nov. 7 with celebrity Kim Kardashian West cited as an advisor. Craze employs 12 technical workers in Israel and five in New York, Hurwitz said.

Hurwitz started in MCA in 2006 and then launched Pearl Capital with partner Abe Zeines in 2010.

Pearl launched with $1 million and generated an $8 million profit in 2012. The following year, the company doubled its profit and reached origination volume of $100 million, Bloomberg reported in 2015. Hurwitz’s ScreenShop profile indicates that he’s a “three-time successful entrepreneur” and cites “over $500 million in funding capital.”

In addition to a real estate business in Puerto Rico, Hurwitz said he’s managing partner of New York-based GS Capital, a convertible debt company lending to small businesses. Zeines lists himself as the CIO of GS Capital, according to his online profile.

At ScreenShop, Molly Hurwitz (Meir’s sister) is listed as the co-creator and co-founder. CEO Mark Fishman was previously a risk manager for Pearl Capital.

The startup’s app, which is free, scans screenshots taken from any app or website on a mobile phone, converting them to similar items that can be bought for various prices. It plans to generate revenue by collecting a commission at the point of sale, Forbes reported.

“The results have been — we’re No. 5 on the app store category of fashion,” Meir Hurwitz said. “We’re just getting started.”

Good Riddance F and G Notes on Lending Club

November 9, 2017 When Lending Club announced they were discontinuing F and G grade notes on their platform for investors, I wasn’t surprised. Investors in general have been reporting disappointing returns, even dipping into negative territory some months. My own portfolio there is on track to generate a loss for 2017, which seems even worse when I consider that those funds could’ve returned nearly 15% in an S&P 500 index fund or more than 600% in bitcoin. Granted, only a small portion of my investable assets were tied up in Lending Club so it’s not all bad.

When Lending Club announced they were discontinuing F and G grade notes on their platform for investors, I wasn’t surprised. Investors in general have been reporting disappointing returns, even dipping into negative territory some months. My own portfolio there is on track to generate a loss for 2017, which seems even worse when I consider that those funds could’ve returned nearly 15% in an S&P 500 index fund or more than 600% in bitcoin. Granted, only a small portion of my investable assets were tied up in Lending Club so it’s not all bad.

Out of the 3,262 notes I purchased on Lending Club, only 99 were F-grade and 53 were G-grade. They didn’t do so well in retrospect, echoing Lending Club’s findings.

27 of my G notes have already been charged off. 17 have been paid off, with the rest still outstanding. A charge-off rate over 50% is not so good on its own, but the data is worse because the interest earned on the performing ones was not enough to offset the charge-offs. Even if all of the remaining notes perform, it is no longer possible to earn a positive return on G notes. The amount I loaned exceeds the total dollars returned. The end result of a category that investors heralded as high-risk, high-return is a big fat loss.

31 of my 99 F notes have already been charged off. Only 26 remain outstanding, 4 of which are delinquent. The rest have been paid off. At this time, the amount I loaned exceeds the total dollars returned. It is still mathematically possible to break even if the remaining loans do not default, but we’ll see. Suffice to say, these were a bad investment.

I have been winding down my portfolio since May 2016. RIP F and G notes.

Lending Club is Discontinuing F and G Grade Notes

November 7, 2017 Per Lending Club’s website, the company is discontinuing issuance of F & G grade notes.

Per Lending Club’s website, the company is discontinuing issuance of F & G grade notes.

According to an announcement published by the company:

We are consistently assessing the value our product delivers to our investors, and have noticed an increase in prepayment and delinquency rate in F and G grade Notes. We feel it is in the best interest of our investors to remove F and G grade Notes while we test new capabilities and refinements to the underwriting and pricing criteria and determine how to best offer a better experience for both borrowers and investors in the F and G segment.

Peers invested in previously-issued F & G grade notes will still receive their payments until maturity.

Performance played a role in their decision.

Every quarter, we review product performance. During our third quarter 2017 forward-looking analysis, we saw increases in delinquency and prepayment rates in F and G grade loans. This update allows us the opportunity to re-assess how we can best deliver value to our investors through the platform.

More information about this change can be found here.

Lending Club also published their Q3 earnings Tuesday afternoon. The company loaned $2.44B for the quarter and hit a record $154 million in revenue. The company still eeked out a $6.7 million loss, but that’s down from $19 million over the same period last year.

Dependence on retail investors or “peers” declined again. Only 10% of loan funding was sourced from the self-managed individuals category in Q3 or $249 million of the $2.44 billion funded.

Lending Club funded 9% of their own originations in the quarter or $217 million.