Archive for 2017

Former CFO of RapidAdvance Moves On to Beyond Finance, Inc.

June 27, 2017Rajesh Rao has taken the CFO position at Beyond Finance Inc., according to LinkedIn. He served as RapidAdvance’s CFO and Head of Credit Analytics and Product Strategy from October 2015 to about the end of May of this year.

Rao had come to Rapid after 13 years at Capital One where his last title was Managing Vice President.

Square to Expand Beyond Business Loans to Consumer Loans

June 27, 2017Square is making the leap from business loans to consumer loans, according to the WSJ. The company, which already makes loans to its payment processing clients, will now begin offering loans to the customers of those clients. The WSJ reports that the loans will be available in six states including California, New York and Florida. They also used a wedding photographer and a veterinarian as examples of services that consumers may wish to finance.

Square Capital head Jacqueline Reses is quoted as saying that there are no plans to get into car loans or mortgages.

From the Board of Credit Suisse to the FinTech World – Gaël de Boissard joins the winner of last year’s Money20/20 Europe Startup Competition

June 27, 2017 New York, NY – 26 Jun, 2017 – Exactly one year after winning Money20/20 Europe Startup Competition, James (a FinTech in Credit Risk, formerly known as CrowdProcess) returns to Copenhagen after closing an oversubscribed investment round led by Ex-Credit Suisse Board Member Gaël de Boissard. This round also included ex-Deutsche Bank COO, Henry Ritchotte, and BiG Start Ventures, a VC focused on FinTech and InsurTech. As a result of this deal, Mr. de Boissard has now joined James’s Board of Directors, after having previously been at the board of Credit Suisse.

New York, NY – 26 Jun, 2017 – Exactly one year after winning Money20/20 Europe Startup Competition, James (a FinTech in Credit Risk, formerly known as CrowdProcess) returns to Copenhagen after closing an oversubscribed investment round led by Ex-Credit Suisse Board Member Gaël de Boissard. This round also included ex-Deutsche Bank COO, Henry Ritchotte, and BiG Start Ventures, a VC focused on FinTech and InsurTech. As a result of this deal, Mr. de Boissard has now joined James’s Board of Directors, after having previously been at the board of Credit Suisse.

The company that successfully pivoted into the FinTech industry in late 2015 sees its ambition of building the first Credit Risk AI, together with the superb results achieved with banks’ risk departments as the major factors behind this successful investment round. According to Mr. de Boissard, “Having worked in banking and credit for more than two decades, I was always surprised to see how little progress was being made in advancing the science, data analysis, and process automation around credit risk. When I met James I knew that was the future I’d been looking for, and I’m incredibly excited to be part of implementing the first credit risk AI.”

Providing financial institutions with solid, scientifically-backed risk management tools can help prepare them against cyclical crisis and help protect their reputation, making the global financial system safer in the long-run. Additionally, the fact that the company has a track record of helping banks achieve results such as 30% default rate reduction and 10% acceptance rate increase has been the cornerstone of its growing reputation both in the US and in Europe.

After going through a product/market fit process that involved testing the solution with over 25 financial institutions in three different continents, the company is now focused on execution and growth. In order to fulfill this, company co-founder and lead researcher Pedro Fonseca recently handed over the role of CEO to his co-founder João Menano, who built the company’s strong international commercial reach. This marks the beginning of a new stage for the company, where the focus has shifted from finding product/market fit to reaching global scale.

This investment round will allow James’s team to grow accordingly to the market needs felt mainly in the US and in Europe.

About

James is a data science company focused on the credit industry. Founded with the goal of bringing the best of data science to every risk department, James is on its way to build the first Credit Risk AI. Currently operating in three continents, the solution was tested by over 25 financial institutions, from Tier 1 banks to alternative lenders.

Winner of last year’s Money20/20 Europe Startup Competition, the 20 person startup aims to one day place the best of data science in every risk department.

Contact

Name: Francisca Beija

Email: francisca@crowdprocess.com

Phone Number: +351 968 183 576

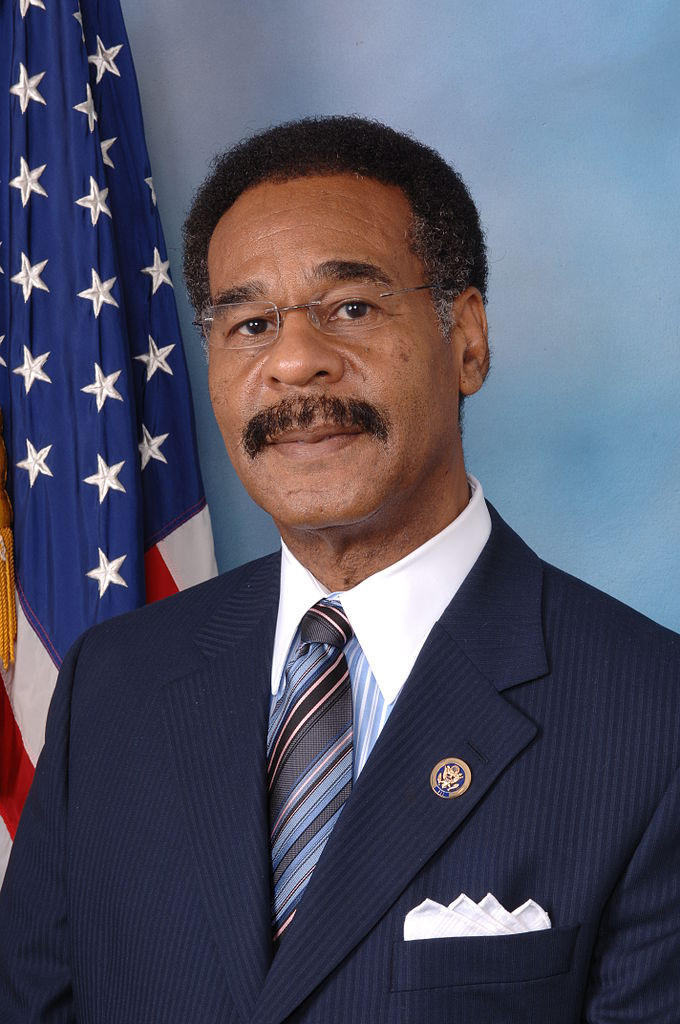

Congressman Emanuel Cleaver, II Makes Inquiry Into Merchant Cash Advances

June 26, 2017 A US Congressman from the fifth district of Missouri is conducting an inquiry into “Fintech Lending,” according to a statement posted online. Rep. Emanuel Cleaver, II published letters that his office sent out last week to five companies seeking information on how they avoid discriminatory lending practices in small business lending.

A US Congressman from the fifth district of Missouri is conducting an inquiry into “Fintech Lending,” according to a statement posted online. Rep. Emanuel Cleaver, II published letters that his office sent out last week to five companies seeking information on how they avoid discriminatory lending practices in small business lending.

An excerpt:

I have recently launched a review into FinTech small business lending. I am particularly interested in payday loans for small businesses, also known as “merchant cash advance.” The payday loan industry has often targeted communities of color with high rates and fees, and Congress needs further information that small business payday lending is operating with transparency and free of discrimination

Ironically, two of the five recipients, Prosper and LendUp, don’t even operate in the small business space, so how exactly they were selected remains a mystery.

Only two of the five companies have any connection to merchant cash advances, but the Congressman’s connection between them and payday loans is perplexing nonetheless.

The subject matter at hand, however, is similar to another fact-finding endeavor that the Consumer Financial Protection Bureau is conducting as part of its mandate under Dodd-Frank.

A response is not required but the Congressman asked the recipients to respond by August 10th.

Amazon vs. Banks

June 23, 2017Amazon made headlines most recently for its blockbuster acquisition of Whole Foods, but the online behemoth already disrupted another sector – fintech — including banks and online lenders when in 2011 it started lending to small businesses. So far Amazon Lending has extended $3 billion-plus in capital to the small business community, a cool billion of which was lent in the past year alone.

Amazon has dealt a one-two punch to the lending market, filling a gap that was left by banks following the financial crisis and leveraging the massive data that the online retailer has access to through its Amazon Marketplace platform.

Matt O’Malley, co-founder and president of Looking Glass Investments, a fixed-income alternative investment firm focused on marketplace lending, said small business lending was a very natural evolution of Amazon’s business.

“Large levels of data give you the ability to increase your predictive power. Amazon has a great deal of information on how a company is doing and an ability to assess credit risk that is very likely unmatched as it relates to businesses selling on their platform,” O’Malley said.

This is not to suggest that Amazon’s future market share in the small business lending segment is a lock.

“In the long run, this entire fintech revolution is about the movement of capital and having to do it faster. So even Amazon is going to have competition. And the reason is there are fewer barriers to entry than before. From Milwaukee to Wisconsin, there is competition for building bank products. I’d put our math up against anybody in New York City thanks to technology,” said O’Malley of Looking Glass Investments’ own lending platform.

Nonetheless a lack of transparency surrounding interest rates for Amazon loans could interfere with repeat business. “Amazon should be careful about being respectful to business owners. Assuming the business does succeed, imagine that the borrower is either going to have a positive reaction or a negative reaction to the initial loan with Amazon. It won’t be good for long-term business if they have a negative reaction. If I were Amazon, I would be cautious on rates,” O’Malley said.

Something else that could throw a wrench into Amazon’s plans as a small business lender is banks, if and when they open the spigots to loan to this segment. While small businesses businesses have already proven a willingness and even a preference for turning to alternative lenders, the tables could turn at some point.

“That’s an unsettled question we think about every day. When do banks make the decision to get in the game? And we would like that to happen sooner rather than later because it would be good for our company LendSight, Inc. But at the same time, we don’t see that tipping point in the near term,” said O’Malley.

deBanked spoke with a pair of business owners that sell on the Amazon Marketplace platform, both of which Amazon has lent to.

LonoLife Living the Life

San Diego-based food and beverage maker LonoLife, the Hawaiian translation for which is peace and prosperity, was offered a line of credit with Amazon without having to ask for it. Jesse Koltes, one of LonoLife’s co-founders, spent some time with deBanked to talk about the offer, which came over the phone.

“It was super quick, super easy, as opposed to what you get with a banking relationship even if you get a better rate,” said Koltes. “Bank loans take more time and paper work, and with Amazon there was none of that.”

LonoLife never approached a bank for a loan. And given an exclusive agreement with Amazon for its top selling bone broth, they didn’t have to. “I 100 percent agree that access to capital for businesses without a lot of revenue is problematic. We’re not a capital intensive business so there are not a lot of assets to put behind as collateral for a loan with a bank,” Koltes said.

And while he declined to disclose the size of the credit line, Koltes characterized the amount as “meaningful” adding that Amazon adjusts it higher and lower, mostly to the upside.

“They have 100 percent transparency to one of the biggest parts of our business. That is something other lenders don’t have,” he said, referring to the sale of the bone broth product. “One reason they are able to move first and with more confidence is they have confidence you can pay something off. They are literally seeing how much money you make every month.”

LonoLife’s Koltes compared the rate at which Amazon lent to them as comparable to other non-bank lenders but probably not best in class and not equivalent to an asset-backed small business loan. “But it’s not as high as you get from venture debt,” he quipped.

LonoLife has been selling on Amazon since 2016 and was offered the line of credit about a year later. “It’s a virtuous cycle. We’re growing on Amazon and they’re funding the growth,” Koltes said.

Mini Bezos

Stephan Aarstol, founder of direct-to-consumer brand Tower, is best known for pitching his Stand Up Paddle Boards, in response to which he received a $150,000 backing from billionaire investor Mark Cuban. Little did Aarstol know that this would be the excuse banks would use not to lend.

“After Shark Tank banks no longer looked at us as a startup. They told us we don’t technically qualify for an SBA loan because they’re not in the business of giving billionaire loans,” said Aarstol referring to the company’s silent partner Cuban. Before the show banks pointed to the company’s lack of a two-year financial history. Meanwhile Tower’s revenue has climbed higher every single year since the company was founded, reaching $7.5 million last year.

Amazon, which offered its first loan to Aarstol in the amount of about $35,000 at about the same time PayPal offered him a $25,000 loan for working capital. He took them both. “We needed the capital for inventory,” he said of the Paddle Boards, which can take up to three months to produce. A couple of months later in 2013 Amazon followed up with another offer for a $145,000 loan. Tower accepted that loan too.

The first time Tower got a loan of any kind from a traditional bank was September 2014, more than four years from inception for a company that was profitable from day one. That fall the banks started lining up after Tower was named the fastest growing company in San Diego by the San Diego Business Journal.

Since then Aarstol has been straddling the fence of alternative lenders and traditional banks, having borrowed more than $1 million from Amazon alone. He feels loyalty to Amazon because they were one of the first lenders to offer him a loan. That plus the ease and speed at which he can access capital.

Meanwhile Aarstol has since widened the beach lifestyle brand, almost like a mini-Bezos would, to include sunglasses, surf boards, snorkeling, bikes, skateboards and even a magazine through which Tower can do its own advertising.

“We’ve expanded the brand and every new product class we open up requires additional inventory and additional capital,” he noted.

The Future Amazon

Perhaps the greatest sign for just how massive Amazon can become as a small business lender is in their ability to capture repeat business. If it’s any indication, both Koltes and Aarstol would return.

“We’ve been really pleasantly surprised with access to capital Amazon has given us,” said Koltes. “It has helped us grow our business. We’re growing at a fast rate. Without Amazon we would have had to pick and choose what we did.”

For Aarstol, it’s a combination of both allegiance and fear that fuels his relationship with Amazon as a borrower.

“What if banks all of a sudden are no longer willing to lend to small businesses again? What’s my fallback? This is a hedge for me to keep establishing credit. I’ll keep borrowing from and paying back Amazon loans,” he said, despite the interest rates of 11 percent to 13 percent.

Recent Court Decisions Impacting Merchant Cash Advances – Still Not a Loan

June 22, 2017In the United States District Court, Southern District of New York, a judge expounded on his decision as to why the Purchase and Sale of Future Receivables contract between TVT Capital and Epazz, Inc. was not a loan.

In this case, the “receipts purchased amounts” are not payable absolutely. Payment depends upon a crucial contingency: the continued collection of receipts by Epazz from its customers. TVT [TVT Capital] is only entitled to recover 15% of Epazz’s daily receipts, and if Epazz’s sales decline or cease the receipts purchased amounts might never be paid in full. See counter- claims, Exhs. A-C at 1. The agreements specifi cally provide that “Payments made to FUNDER in respect to the full amount of the Receipts shall be conditioned upon Merchant’s sale of products and services and the payment therefore by Merchant’s customers in the manner provided in Section 1.1.” Id. at 3 § 1.9.

Defendants’ argument that the actual daily payments ensure that TVT will be paid the full receipts purchased amounts within approximately 61 to 180 business days, id. ¶¶ 33-47, is contradicted by the reconciliation provisions which provide if the daily payments are greater than 15% of Epazz’s daily receipts, TVT must credit the difference to Epazz, thus limiting Epazz’s obligation to 15% of daily receipts. No allegation is made that TVT ever denied Epazz’s request to reconcile the daily payments. TVT’s right to collect the receipts purchased amounts from Epazz is in fact contingent on Epazz’s continued collection of receipts. See Kardovich v. Pfizer, Inc., 97 F. Supp. 3d 131, 140 (E.D.N.Y. 2015), quoting Amidax Trading Grp. v. S.W.I.F.T. SCRL, 671 F.3d 140, 147 (2d Cir. 2011) (“Where a conclusory allegation in the complaint is contradicted by a document attached to the complaint, the document controls and the allegation is

not accepted as true”).None of the defendants’ arguments, Counterclaims ¶¶ 51-109, change the fact that whether the receipts purchased amounts will be paid in full, or when they will be paid, cannot be known because payment is contingent on Epazz generating suffi cient receipts from its customers; and Epazz, rather than TVT, controls whether daily payments will be reconciled.

The judge relied heavily on the reconciliation clause common to merchant cash advance agreements, whereby merchants can adjust their daily ACH amount to correlate with their actual sales activity. The case # is: 1:16-cv-05948-LLS. The full decision can be downloaded through a link contained at: http://dbnk.news/7

MISREPRESENTATIONS? WHAT MISREPRESENTATIONS?

In the New York Supreme Court, a judge addressed a business owner’s allegations that they had been misled into entering into purchase agreements when they actually wanted loans. In the decision excerpt below, Passley is Shaun Passley, one of the plaintiffs in the case.

[The plaintiffs] state that they would not have knowingly entered into merchant agreements, because what they really wanted were loans. Indeed, plaintiffs allege that “the word ‘purchase’ or ‘sale’ would have caused Passley to decline a transaction with [defendants] because a loan – the product Passley wanted to obtain – is not a purchase or sale.”

A review of the contracts in this action shows that not only do they all clearly state that they involve purchases or sales, but they all expressly state they are not loans. Even if someone were confused by the contracts, or did not understand the obligation or the process, by reading the documents, one would grasp immediately that they certainly were not straightforward loans. The very fi rst heading on the page was “Merchant Agreement,” and the second heading says “Purchase and Sale of Future Receivables.”

[…] For plaintiffs to state that they would not have entered into a purchase or sale if they had known that that is what they were doing is utterly undermined by the documents themselves. As the Second Department has held, in Karsanow v. Kuehlewein, 232 A.D.2d 458, 459, 648 NY.S.2d 465, 466 (2d Dept. 1996), “the subject provision was clearly set out in the … agreements, and where a party has the means available to him of knowing by the exercise of ordinary intelligence the truth or real quality of the subject of the representation, he must make use of those means or he will not be heard to complain that he was induced to enter into the transaction by misrepresentations.” So too here, plaintiffs had the means to understand that the agreements set forth that they were not loans. As it has long been settled that a party is bound by that which it signs, the Court finds that the ninth cause of action, for recission based on misrepresentation or mistake, and the tenth cause of action, for fraudulent inducement based on misrepresentation, must be dismissed as a matter of law. Pimpinello v. Swift & Co., 253 N.Y. 159, 162-63 (1930) (“the signer of a deed or other instrument, expressive of a jural act, is conclusively bound thereby. That his mind never gave asset to the terms expressed is not material. If the signer could read the instrument, not to have read it was gross negligence; if he could not have read it, not to procure it to be read was equally negligent; in either case the writing binds him.”).

The case # is 54755/2016 in the County of Westchester in the New York Supreme Court. The full decision can be downloaded through a link contained at: http://dbnk.news/8

Dubious Story On Strategic Funding Unfounded

June 22, 2017 A questionable story published by Allen Taylor of Lending Times pushed the boundaries of journalism earlier this week. Citing a single anonymous source, Taylor wrote that an alleged breakdown in negotiations between Strategic Funding Source (SFS) and CAN Capital (CAN) had compounded into more problems for SFS when a burst water main drenched their main office and server room at a time when they supposedly had no disaster backup plan in place.

A questionable story published by Allen Taylor of Lending Times pushed the boundaries of journalism earlier this week. Citing a single anonymous source, Taylor wrote that an alleged breakdown in negotiations between Strategic Funding Source (SFS) and CAN Capital (CAN) had compounded into more problems for SFS when a burst water main drenched their main office and server room at a time when they supposedly had no disaster backup plan in place.

“Unfortunately, in order to save money, they [SFS] did not have a disaster backup plan in place,” is the quote Lending Times ran with from their anonymous and only source.

Peculiar on its face, especially with no published response from SFS to confirm it, the story was nonetheless rebroadcast by a new blog calling itself SmallBusinessLending.io, who added their own little editorial flair to it in an email they sent out.

“Having cut a few corners to save money, the company [SFS] didn’t have a disaster backup plan in place. Owch,” the email said.

Eager to determine the accuracy of the story, I reached out to SFS personally for comment, whose executives responded with an astonished bewilderment. They invited me over to go see for myself, which I took them up on. deBanked had ranked SFS as one of the largest small business funders of 2016, and their demise (especially in a great flood of some kind) would indeed be newsworthy.

A water main was struck on the 5th floor of Tower 45 at 120 West 45th Street, only one of three buildings in Manhattan that SFS has offices in. Andy Reiser, the company’s CEO, and David Sederholt, a Senior Advisor, gave me a tour of several floors, including the 5th where the incident happened. There is some water damage on lower floors, prompting some employees and executives to reshuffle their workspaces, and necessitating the use of available office space up on the 19th floor. That much is true.

Little, if anything seemed to have been disrupted, however, least of all their servers, which Sederholt maintained is in Amazon’s cloud anyway. They have redundancy built in nonetheless for all types of disasters should something impede New York’s operations, they explained, with Virginia and Texas operations as their fallback.

Just to be sure, I visited their other Manhattan offices at 1501 Broadway and 145 West 45th street, each of which hummed with normal activity.

The company wouldn’t comment on matters regarding CAN. CAN, if you recall, suspended funding operations almost 7 months ago and rumors have surfaced from time to time on industry forums regarding a comeback, but none have been confirmed.

On June 13th, American Banker reported that CAN had laid off an estimated 55 employees in their Kennesaw, GA office.

A message left for Lending Times about their reporting on SFS had not been answered by the time this story went live.

Pearl Capital Secures $15M in Financing From Chatham Capital Management

June 21, 2017

Pearl Capital Business Funding, LLC has closed on $15 million in financing from Atlanta-based Chatham Capital Management, according to the company. Pearl is a NY-based small business funder that was acquired in 2015 by Capital Z Partners, a private equity firm.

“We understand that despite personal credit issues, many small business owners have triumphed in building successful businesses,” said Pearl CEO Solomon Lax. “Locked out of the traditional bank financing channels, those small business owners turn to Pearl Capital Business Funding to enable their dreams. By partnering with Chatham, we are able to make those dreams a reality.”

Chatham has invested in other companies such as iPayment, Vitamin Shoppe, DirectTV, QVC, Neiman Marcus, and 5-hour energy, according to their website.

Pearl also secured $20 Million from Arena Investors, LP in July of last year.