Small Business

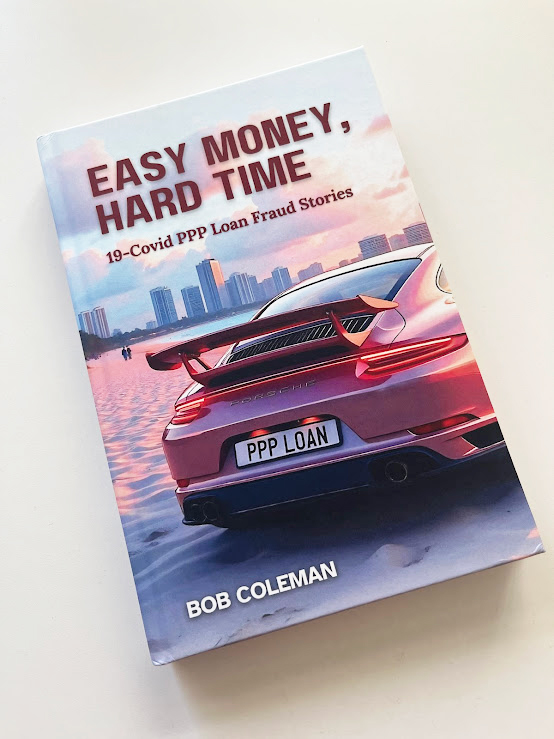

Coleman Report’s Bob Coleman is Out With a New Book: “Easy Money, Hard Time”

July 18, 2025 Bob Coleman, founder of Coleman Report, the leading provider of information to small business bankers to help them make less risky small business loans, recently authored a book. Titled Easy Money, Hard Time: 19-Covid PPP Loan Fraud Stories, the book dives into “the most shocking cases of PPP loan fraud, exposing the audacity, greed, and recklessness of those who saw an economic disaster as a chance to cash in.”

Bob Coleman, founder of Coleman Report, the leading provider of information to small business bankers to help them make less risky small business loans, recently authored a book. Titled Easy Money, Hard Time: 19-Covid PPP Loan Fraud Stories, the book dives into “the most shocking cases of PPP loan fraud, exposing the audacity, greed, and recklessness of those who saw an economic disaster as a chance to cash in.”

Coleman has also previously authored PPP Saves Millions of Main Street Jobs During Covid (2022) and Money, Money Everywhere But Not a Drop for Main Street (2011).

Coleman’s premium content trade newsletter began in 1993 and it provides critical analytical information for today’s small business lending professional. They are the largest producer of training courses and webinars for small business bankers.

Bob Coleman will be moderating a panel on SBA lending at the B2B Finance Expo in Las Vegas this October.

Seventy Five Percent of Small Businesses Expect to Do Better in the Coming Year

January 17, 2025 2025 is looking up. That’s one takeaway from the recent State of Small Business Report produced by IOU Financial. More than 75% of small business owners that responded to a survey said that they expected to do better in the coming year, with 42% expecting to do much better. Meanwhile, more than three-fourths of those surveyed plan to invest in their business within the next six months.

2025 is looking up. That’s one takeaway from the recent State of Small Business Report produced by IOU Financial. More than 75% of small business owners that responded to a survey said that they expected to do better in the coming year, with 42% expecting to do much better. Meanwhile, more than three-fourths of those surveyed plan to invest in their business within the next six months.

Still, cost of goods and interest rates ranked among the highest concerns. Eighty two percent said that they are very or somewhat concerned about cost of goods and seventy seven percent said the same about interest rates.

To read the full report, click here.

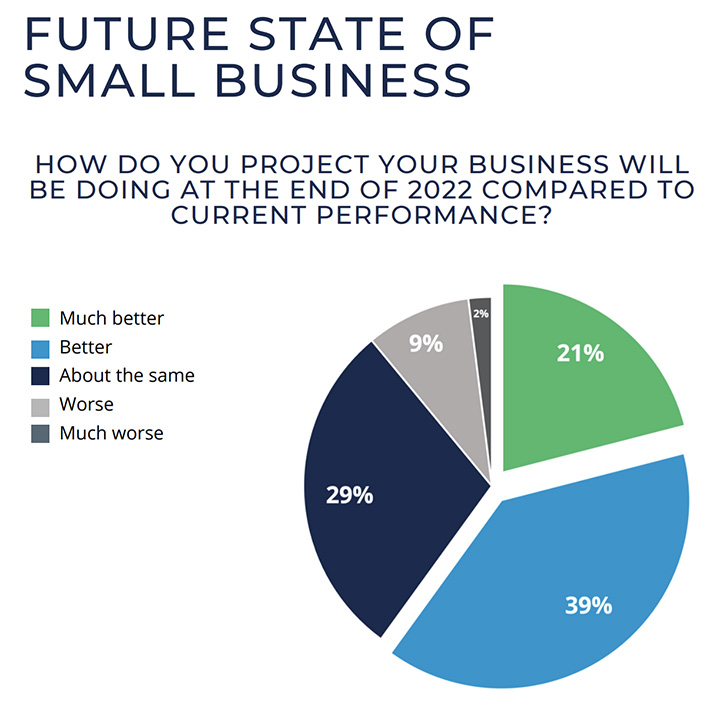

Inflation? So What – SMBs Are Bullish On the Rest of 2022

August 17, 2022Eighty-nine percent of respondents projected that their small business will be doing the same, better, or much better by the end of the year, according to a recent survey conducted by IOU Financial. The majority of those polled actually selected better (39%) or much better (21%). Twenty-nine percent said they expected to be about the same.

The sentiment is significant given that 84% said that they were somewhat concerned or very concerned about rising inflation and 85% said that they were somewhat concerned or very concerned about a possible recession.

This data is in line with responses found from other surveys like the recent NFIB study that determined that inflation was the single most important problem that business owners were facing. But even that study revealed a sense of persistent optimism, similar to the IOU survey, when respondents said that financing and interest rates ranked the lowest on their selected list of problems.

All of which means that the biggest challenge small businesses are facing right now is not viewed as a mortally perilous one. Indeed, 74% of respondents to the IOU survey said that they plan to invest in their business in the next six months.

All of which means that the biggest challenge small businesses are facing right now is not viewed as a mortally perilous one. Indeed, 74% of respondents to the IOU survey said that they plan to invest in their business in the next six months.

“They plan to fund expansion, make equipment or inventory purchases as well as put money into staffing and marketing,” the IOU report states. Only 5% flat out said that they do not plan to invest in their business in the next 6 months. The rest said that they might invest.

The optimism that is there is cautious, however. Seventy-five percent of respondents said that the covid pandemic is not fully over and 32% said that they would rate the current state of their business as somewhat negatively or very negatively.

The damage from the last two years lingers on but business owners are looking at what’s ahead of them and signaling that it’s onward and upward regardless.

The full IOU Small Business Survey can be downloaded here.

Could More Free Money Be Coming to Restaurants?

April 11, 2022 The House passed a $55 billion bill on Thursday to provide assistance to restaurants that were not successful in receiving help from the federal Restaurant Revitalization Fund (RRF) last year. In a 223-203 House vote the measure was approved by lawmakers and was backed by only a few Republicans.

The House passed a $55 billion bill on Thursday to provide assistance to restaurants that were not successful in receiving help from the federal Restaurant Revitalization Fund (RRF) last year. In a 223-203 House vote the measure was approved by lawmakers and was backed by only a few Republicans.

Over $40 billion in COVID-19 assistance was approved, replenishing the fund. An additional $13 billion would be provided for other businesses that remain struggling to recover.

The Restaurant Revitalization Fund was established under the American Rescue Plan, and signed into law by President Joe Biden on March 11, 2021 which issued $28.6 billion in direct relief funds. However, three weeks after launching, the funds ran out leaving only a third to receive relief funding out of 300,000 applicants.

Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

If the bill passes the Senate, the 177,000 restaurants that were approved for RRF grants but did not receive funding before the portal closed are already in line as stated by legislators.

To overcome the 60-vote threshold to end a potential prolonged debate and pass the measure, it is undetermined whether Democrats in the evenly split Senate will be able to win over at least 10 Republicans.

Despite protocols of the pandemic being lifted, restaurants are still facing the negative effects with less staff and fewer customers. According to the National Restaurant Association, 9 in 10 restaurants have fewer than 50 employees and restaurant industry sales in 2021 are down by $65 billion from 2019’s pre-pandemic levels.

The main sponsor of the bill, Rep. Earl Blumenauer, D-Ore., and Rep. Dean Phillips, cited a survey from the Independent Restaurant Coalition and stated that over 80 percent of restaurants that didn’t receive grants have reported that they are on the verge of permanent closure.

Kabbage Survey Shows American SMBs Recovering Post-Pandemic

March 30, 2022

Kabbage from American Express issued the fifth Small Business Recovery Report, an online survey that tracks recovery trends and potential growth of small businesses in the US. Respondents represented industries across retail, marketing, healthcare, financial services, technology, food and beverage, construction, automotive, manufacturing, media, professional services, education, agriculture and more.

After polling 563 small business leaders that included 255 of the “smallest small businesses,” the latest report showcases how many small businesses are doing well in a changing market, as they look beyond challenges over the past two years while simultaneously overcoming the new problems of inflation and supply chain issues.

“Small businesses are preparing for a new type of market. One that’s not driven by the direct impact of COVID-19 – but rather, one determined by the economic aftermath of the pandemic,” said Kathryn Petralia, co-founder of Kabbage. “Economic indicators like inflation will require adjustments, but the new data illustrates how small businesses are making changes and adapting.”

According to the study, small businesses are becoming less concerned about COVID-19’s impact on their operations. The report’s responses showed over 90% of businesses did not have to “stop, slow, limit or shut down” their companies due to the Omicron outbreaks during the holiday season of 2021, while 70% surveyed said they weren’t affected by the variant in any way.

Along with pandemic-induced wounds beginning to heal for small business, respondents to the survey reported their average monthly revenues increased 77% in the past six months, from $47,900 in July 2021 to $84,935 in February 2022. Along with those increases, merchants reported average monthly profits have increased an average of 39% in the same period as well. The study does hint that these growth percentages are heavily weighted toward larger small businesses.

Kabbage says that the smallest small businesses, those with 20 or less employees, reported a 13% increase in average monthly revenues and a 12% increase in average monthly profits from July 2021 to February of this year.

The report touched on hiring rates for smaller merchants, as an initial void of lost workers has been filled. Despite a widespread notion of the job market being wide open, the study found that three quarters of the smallest small businesses said they are not hiring.

The study also found that inflation is increasing prices by an average of 21% across industries. Largely due to increased costs from their vendors and skyrocketing cost of raw materials, smaller merchants are beginning to push these costs on customers.

65% of businesses in the survey said they plan to keep prices high for the next six months, while almost 20% said they plan to raise prices further. Combating increasing costs of their own is an issue in and of itself, and over half (53%) expect their business to be impacted by supply chain issues for up to a year.

NJEDA Approves Grants to Support Micro Business Lenders

February 16, 2022 Last week, the New Jersey Economic Development Authority (NJEDA) endorsed the construction of the Main Street Lenders Grant.

Last week, the New Jersey Economic Development Authority (NJEDA) endorsed the construction of the Main Street Lenders Grant.

Eligible micro business lenders will be offered up to $1 million that can be used to create new lending products or as supplemental funding for existing products. The Main Street Lenders Grant is the third product the NJEDA plans to launch under the Main Street Recovery Program. The $100 million small business support program was created under the Economic Recovery Act of 2020 (ERA) and was signed by Gov. Phil Murphy in January of 2020.

The technical assistance grant will support those who qualify with the costs associated with providing technical assistance to micro businesses, aiding these businesses to qualify for loans. The maximum grant one can receive is 50 percent of their lending grant amount (not to exceed $500,000).

The second product under the Main Street Recovery Program is the Small Business Improvement Grant, with applications now open as of Thursday. This product will reimburse eligible small businesses and nonprofits for up to 50 percent of eligible project costs associated with building improvements or purchases.

“Small businesses are the backbone of New Jersey,” stated Governor Phil Murphy. “This program will allow small businesses and nonprofits throughout our state to make the investments necessary for their success and for improvements to their spaces.”

EIDL Applicants Still Waiting for Funds as Deadline Approaches

December 16, 2021 There is a major pileup of applicants waiting to hear back from the SBA regarding EIDL applications, according to Iron Capital Equities, a fintech firm who owns websites that help businesses through the EIDL application process. According to a press release by the company, many applicants who have not yet received funding seem to believe they’ve been ghosted by the SBA.

There is a major pileup of applicants waiting to hear back from the SBA regarding EIDL applications, according to Iron Capital Equities, a fintech firm who owns websites that help businesses through the EIDL application process. According to a press release by the company, many applicants who have not yet received funding seem to believe they’ve been ghosted by the SBA.

The EIDL deadline to file an application is December 31.

“90% (9 out of 10) of our 400 client applicants are still in limbo, with no update regarding the status of the funds,” states co-founder Matthew Elling. “The short-term economic outlook from small businesses is dim, so these funds are highly sought after.”

Elling insisted that he is in constant contact with his customers, and says his company is doing everything they can to service these clients who are playing the waiting game.

“Even though we are a financial technology company, we still ‘talk’ with our customers,” Elling continued. “We understand their struggles in a post COVID economic environment, we have provided them with advice on the SBA assistance like EIDL and the two PPP rounds for payroll and business expense assistance during and after the government-imposed lockdowns.”

EIDL loans were a beacon of hope for many businesses struggling to survive in the pandemic. This type of government funding isn’t a grant, and needs to be paid back by the merchant at a term of 30 years at 3.75% annual interest.

Was That Loan Forgiven? The Tax Man Cometh

March 10, 2021 With tax season upon us, the events of 2020 will soon be reviewed and evaluated by everyone’s best friend, the IRS. Lenders that offered debt forgiveness might have done a favor to distressed borrowers in 2020, but a consequence of that courtesy is that the borrowers’ forgiven debt might be taxable.

With tax season upon us, the events of 2020 will soon be reviewed and evaluated by everyone’s best friend, the IRS. Lenders that offered debt forgiveness might have done a favor to distressed borrowers in 2020, but a consequence of that courtesy is that the borrowers’ forgiven debt might be taxable.

This is as good a time as ever to review a report prepared by Grassi Advisors & Accountants whether you are a lender that forgave debt or a borrower that had debt forgiven.

“This issue was noticed early last year,” said deBanked President Sean Murray, “but at the time everyone was so focused on PPP forgiveness, the EIDL program, and government stimulus, that I think the potential consequences of lenders forgiving non-PPP debt for their borrowers were lost in the shuffle. Imagine you’re a borrower that had $100,000 of non-PPP debt forgiven last year and you’re only now about to learn that the IRS may classify that as income. Or worse yet, you don’t even realize it and are told that later on during an audit.”

In May 2020, deBanked labelled this as a hidden tax time bomb that was set to detonate in 2021. And now here we are.