Regulation

California Bill May Disadvantage Small Brokers

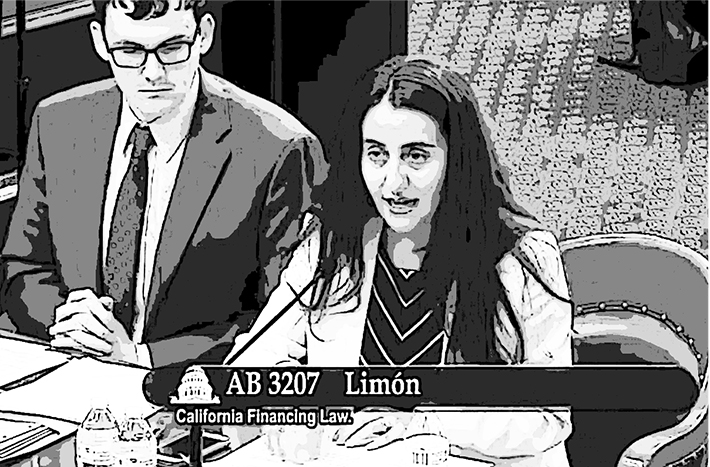

July 17, 2018A California State Assembly bill that carefully defines what a broker is, could significantly affect small, unlicensed brokers, according to Tom McCurnin, an attorney at Barton, Klugman and Oetting in Los Angeles.

Assembly bill 3207 enumerates the ways that the bill would depart from the current law. Most notably, the definition of a broker would be far more precise. The current California Licensing Law, which requires brokers to be licensed, defines a broker as “anyone who is engaged in the business of negotiating or performing any act as a broker in connection with loans made by a finance lender.”

Tom McCurnin – Barton, Klugman & Oetting LLP

Tom McCurnin – Barton, Klugman & Oetting LLP“It’s a circular definition,” McCurnin said. “It presently says that a broker is someone who is brokering transactions.”

Essentially, it defines a broker as a broker, leaving plenty of room for ambiguity.

“With respect to registering to conduct business in the state of California, we’ve got tons of brokers doing deals in California, but they’re not licenced here,” McCurnin said. “They do deals in California, but they’re located in Florida or New York or Michigan. They’re making money in the state of California. Why shouldn’t they pay their fair share of taxes?”

People can always evade the law and not get licenced. But the idea behind this bill is that by making the definition of a broker perfectly clear, it’s no longer possible for a broker to make an argument that they’re not really a broker. With the language in the bill, a broker would be in clear violation of the law if they don’t obtain a licence.

The new definition of a broker would be “anyone who, among other things, transmits confidential data about a prospective borrower to a finance lender with the expectation of compensation.” McCurnin notes that “expectation of compensation” is an important phrase, currently used to describe real estate brokers, because it states clearly that the broker intends to earn money from the consumer. The proposed definition in the bill continues to define a broker as someone who “participates in any loan negotiation between a finance lender and prospective borrower, participates in the preparation of loan documents, communicates lending decisions or inquiries to a borrower, or charges a fee to a prospective borrower for any services related to an application for a loan from a finance lender.”

This definition leaves little room for debate. So what does getting a California State broker licence entail? It requires that a broker have at least $25,000. Beyond this, McCurnin says it inquires primarily about three other things: 1) if you have a criminal record (fingerprints are required), 2) what type of loans you intend to broker (secured, unsecured, etc.), and 3) the size of the loans you intend to broker. There are different regulations for different loan sizes.

Being licensed requires being registered to conduct business in the state of California. And a registered business must pay taxes on earnings in the state. With this in mind, McCurnin said the passage of this bill could be a win for California in that it could result in more out-of-state brokers getting registered and paying taxes on their earnings in the state.

At the same time, should the bill pass, McCurnin thinks it would be a big loss for the small broker who is either unable to show $25,000 or who might have something unsavory to hide. But if the small broker working from his basement has enough capital and is willing to state what he intends to broker in California, then obtaining the license shouldn’t be a problem.

The bill passed in the state Assembly and is being reviewed in the Senate. An amendment to the bill was made on July 5. Another California bill of great significance to the alternative lending industry is SB-1235, which has passed in the state Senate and is being reviewed in the state Assembly. McCurnin said he believes that the broker bill will pass.

“California is a very liberal place,” McCurnin said. “It’s like another country.”

How to Avoid Being Sued by a Professional TCPA Plaintiff

July 13, 2018

Did you know that if you receive an unwanted solicitation call on your private cell phone or residential landline, you can win between $500 and $1,500 in damages from the offending company? The company can be charged for violating a statute of the 1991 Telephone Consumer Protection Act (TCPA), which prohibits companies from calling consumers without their express permission. You might not know about this, but others know about it all too well.

Some people use this TCPA statute as a way of making money, by purchasing multiple phone numbers in the hope they will receive unsolicited phone calls that violate the TCPA statute. And if they do, they sue. deBanked previously explored “professional plaintiffs” like this, with a focus on those who have come up against funding companies.

According to Michael O’Hare, CEO of Colorado-based Blindbid, people who manipulate the TCPA statute for profit also target lead generation companies like his. O’Hare is currently being sued by a plaintiff for several million dollars in a class action lawsuit. The claim is that Blindbid allegedly made five unsolicited calls in 2016 to the plaintiff’s plumbing company. (According to David Klein, Managing Partner at Klein Moynihan and Turco, there is a murky area in the TCPA regulation where, if a cell phone is used for both personal and business use, the phone can be considered a personal phone, protected under TCPA.) In O’Hare’s case, upon further discovery, it was determined that only one of the five alleged calls actually came from Blindbid. But O’Hare says that the number was opted in and manually dialed. Regardless, O’Hare’s plaintiff is a pro, what some might call a “professional plaintiff.”

Over the last six years, this plaintiff participated in four major class action lawsuits that have led to combined settlements of $31 million, according to O’Hare. The plaintiff has also filed 34 cases in federal court since 2016, O’Hare said.

Over the last six years, this plaintiff participated in four major class action lawsuits that have led to combined settlements of $31 million, according to O’Hare. The plaintiff has also filed 34 cases in federal court since 2016, O’Hare said.

What is noteworthy about O’Hare’s case is that it’s part of what he says is a trend towards class action lawsuits based on TCPA violations, and often brought on by professional plaintiffs. O’Hare said it’s no coincidence that his plaintiff waited for two years to sue.

“The longer a plaintiff waits, the more members he can bring into the class. And the more members in the class, the larger settlement,” O’Hare said.

As a way to transform O’Hare’s lawsuit into a class action suit, he said that his plaintiff’s attorney has made the argument that if Blindbid violated his client’s TCPA rights to privacy with the one unsolicited call, then Blindbid likely violated others as well. So in discovery, the plaintiff’s attorney wants to compel Blindbid to turn over its phone records for the past two years to prove that Blindbid had “express written consent” from the other merchants it called. In the age of the internet, “express written consent” translates to filling out an online form where the individual consents to receive a phone call.

To satisfy the attorney’s request, Blindbid would have to match every phone number that was called with a corresponding computer IP address. This should be doable, but O’Hare says that professional plaintiffs, like his, deny that they ever filled out an online lead form, or that the IP address O’Hare has on record belongs to them.

“In the past, if there was an alleged TCPA violation, most companies could settle for a few thousand dollars to $10,000 depending on the number of violations,” O’Hare said. “Now there are these are multi-million dollar settlements.”

Unlike the fines of years past, these class action lawsuits can sink your company. While O’Hare said that there is no way to completely protect one’s company from being sued, below are some of his recommendations.

Have express written consent of all the merchants you call

Online consent is valid if the text explicitly states to the user that he is giving, in effect, express written consent to be contacted by your company by phone, text and/or email.

Register your company with Federal and State Do Not Call Registries.

Respect merchants’ requests

If they do not want to be called any longer, put their numbers on your “Do Not Call” list.

Have a written “Do Not Call” policy

Have a TCPA attorney review the policy and include a copy in your company employee guide.

Find a good TCPA scrubbing service

These are services that have many of the numbers that belong to professional plaintiffs and they monitor for newly registered phone numbers. They tell you which numbers to remove from your lists. Some good scrubbing services are TCPALitigatorList.com and DNC.com.

Don’t buy lists from overseas

These lists are full of professional litigator phone numbers you are taking a huge risks.

Never autodial / robo call

Robo calls are the most dangerous type of calls you can make unless you have a full opt-in list with express written consent from each of the merchants. Robo calls and text messaging TCPA violations are the easiest TCPA cases for plaintiffs to win and the settlements are higher. Every robocall or text is fined. The use of an autodialer is one of the elements to prove a TCPA violation. If you use an auto dialer with human intervention, like EVS 7, you can argue that your autodialer calls are manual calls. Still, use caution.

Consult with a TCPA attorney

I would advise every company that does any outbound calling to consult with a TCPA attorney about best practices. An ounce of prevention is worth a pound of cure.

DFS Releases Recommendations for Online Lending

July 12, 2018

The New York State Department of Financial Services (DFS) released a report on Wednesday on the subject of online lending in the state. The report was mandated by a bill signed by New York Governor Andrew Cuomo on June 1 of last year. According to the original bill, this report was to be researched and composed by a task force of multiple parties. But in the eleventh hour, the section regarding the task force was struck. The report is to be presented to the governor, the temporary president of the senate, the speaker of the assembly, the chair of the senate standing committee on banks, and the chair of the assembly standing committee on banks.

Wednesday’s 31-page report is based on survey responses from 35 online lenders operating in the state, lending both to businesses and to individuals. One of the revelations in the report is that, from the data obtained, “New York individuals appear to account for a higher total dollar amount of loans than New York businesses.”

The report presents three primary assertions:

Equal Application of Consumer Protection Laws.

The report establishes that New York has strong consumer protection laws and regulations that apply to financial institutions. “These protections should apply equally to all consumer lending and small business lending activities,” the report reads. The report explains that there are strong protections against payday lenders and indicates that there should be strong protections across the board, even though the financial products and the consumers may vary widely.

Usury Limits Must Apply to All Lending in New York.

The report asserts that access to credit at usurious rates has long been prohibited in New York and that online lenders should not be able to bypass this by having arrangements with banks in other states, like Utah, where the usury laws are different. In New York, the civil usury rate is 16% and the criminal usury rate is 25%. But because online lenders have arrangements with out-of-state banks, they can charge interest at rates well above 25%.

Currently, if an online lender sues a merchant for not paying, the merchant cannot use usury as a defense. In the report, DFS recommends that a business should have the right to present usury as a defense.

All Online Lenders Should be Licensed and Supervised.

The report states that New York State chartered banks, credit unions and licensed non-depositories are subject to regular examinations by the DFS and, if applicable, federal regulatory agencies.

“Many online lenders remain unlicensed in New York with no direct supervisory oversight from a safety and soundness or consumer compliance perspective,” the report reads. “Direct supervision and oversight is the only way to ensure that New York’s consumers and small business owners receive the same protections irrespective of the channel of delivery [of financing.]”

Some of these issues relate to the well-known 2015 Madden v. Midland Funding court decision, in which a credit card consumer (Madden) won a case against a debt-collection agency (Midland Funding) because the court decided that Midland, as a non-bank, was not allowed to charge interest above what was allowed in the state.

House Passes Bill That Would Help More Consumers Build Credit

June 26, 2018 Yesterday, the house passed the Credit Access and Inclusion Act of 2017, a bill that would allow reporting of telecom and utility payments to credit reporting agencies. The idea behind the bill, written by Rep. Keith Ellison of Minnesota, is to give people more opportunities to report positive on-time payments that could improve their credit.

Yesterday, the house passed the Credit Access and Inclusion Act of 2017, a bill that would allow reporting of telecom and utility payments to credit reporting agencies. The idea behind the bill, written by Rep. Keith Ellison of Minnesota, is to give people more opportunities to report positive on-time payments that could improve their credit.

“By allowing more of Americans’ positive financial information to be reported to credit rating agencies, this bill will help millions more Americans access credit and everything that comes with it,” Ellison wrote in a statement. “Once this bill is signed into law, millions of Americans who previously couldn’t will now be able to access lower-cost loans, cheaper car payments, or a mortgage on their first home.”

If passed in the Senate, the law would allow a person to present to a consumer reporting agency information about payments “with respect to a dwelling, including such a lease in which the Department of Housing and Urban Development provides subsidized payments for occupancy,” according to the bill.

This bill is an amendment to the Fair Credit Reporting Act, which was originally passed in 1970.

Lawyers Weigh in on Federal Decision That CFPB is Unconstitutional

June 22, 2018In light of a federal court ruling yesterday that the structure of the Consumer Financial Protection Bureau (CFPB) is unconstitutional, deBanked spoke with some lawyers to get their perspective on what this decision could mean.

Alan Kaplinsky, Partner, Ballard Spahr

“I think it will sow more confusion related to the CFPB. I think it’s important to note that this opinion – while it is precedent that could be cited in other cases…it’s not binding on any other court anywhere in the country, including in the Southern District of New York. That being said, I anticipate that the CFPB will appeal [the decision] if for no other reason than because they have other cases. Ultimately, I would anticipate that the case will end up in the U.S. Supreme Court.”

Lucy Morris, Partner, Hudson Cook (previously a Deputy Enforcement Director at the CFPB)

“The bottom line is that it creates yet more uncertainty for the bureau, for industry and for consumers. Is this bureau legitimate or not? And if not, what does that mean for all of the many decisions and actions taken by the former [CFPB] director Cordray and the current acting director, Mulvaney.

Maybe this can add to a momentum to create a bipartisan commission to finally resolve this, and to give everyone a commission that…avoids the wide pendulum swings that have been happening. This requires a legislative fix, which is challenging of course.”

Lawrence Kaplan, Of Counsel, Paul Hastings

“Typically, in a case like this, you would have a circuit split, where now you have one circuit saying yes and one circuit saying no. And ultimately that would go up to the supreme court. But you could have the administration saying ‘We’re not going to defend this.’ [Given the administration’s unfavorable attitude toward the CFPB], it’s likely that you’re not going to see anyone vigorously defend the agency.

As for alternative lenders, [these] are state issues. And as a result, [lenders] are not off the hook…At the end of the day, everyone will still have to comply with a patchwork of state laws. You’re really taking away the federal hammer. So, [certain cases] may no longer be a federal case. Now, in some ways, be careful what you wish for, because now you have to face 50 executioners [because] a lot of the states would defer to and join with the feds.”

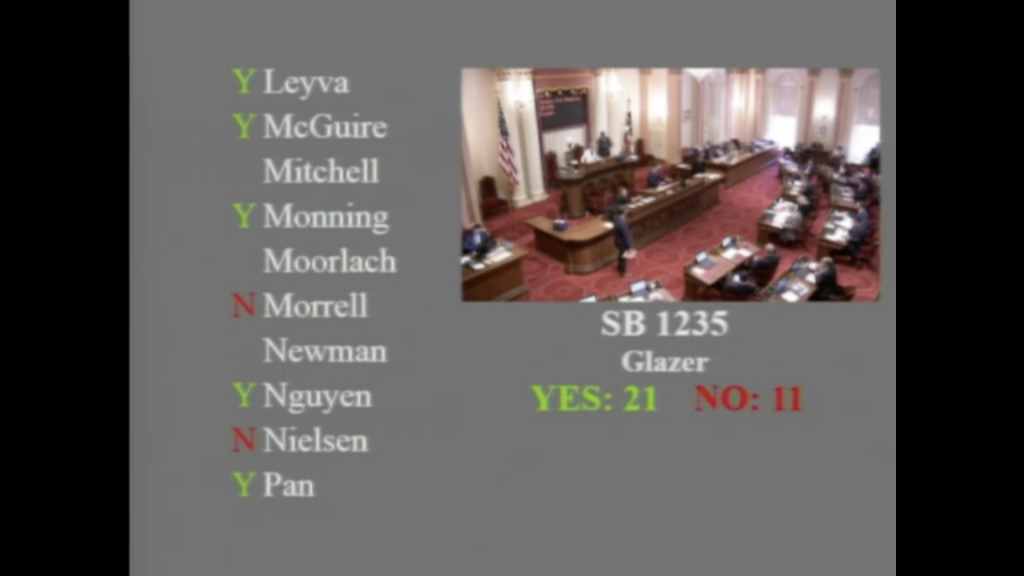

Commercial Financing Disclosures Bill Approved in the CA Senate

May 31, 2018The use of an annualized cost metric on loan and non-loan contracts alike is now one step closer to becoming the law in the State of California. On Thursday, SB 1235 was approved on the Senate floor. The bill calls for commercial finance companies to disclose an Estimated Annualized Cost of Capital. In previous hearings, the bill’s author, Sen. Steve Glazer (D), stated that it was his intention that this apply to merchant cash advances as well.

“This estimate includes all charges and fees incurred for the financing, assuming you make all payments when scheduled and adhere to the terms of the agreement. This number is based on the estimated term. If the actual term is shorter than estimated, the annualized cost of capital may be higher than shown. If the actual term is longer than estimated, the annualized cost of capital may be lower. This is not an Annual Percentage Rate (APR).”

Here is how to calculate the Estimated Annualized Cost of Capital as set forth in the bill:

Here is how to calculate the Estimated Annualized Cost of Capital as set forth in the bill:

(1) Divide the total dollar cost of financing by the total amount of funds provided.

(2) Multiply the result in paragraph (1) by 365.

(3) Divide the result from paragraphs (1) and (2) by the term or estimated term of the financing in days.

(4) Multiply the result from paragraph (3) by 100.

(5) The result from paragraph (4) shall be labeled “The Estimated Annualized Cost of Capital.”

In addition, commercial finance companies will also have to disclose the total dollar cost of the transaction and the total amount of money the merchant will receive net of all fees.

The bill must now pass through the solidly Democrat-controlled Assembly and be signed by the Governor to become the law.

New Law Benefits Small Banks

May 24, 2018 President Trump signed into law today the Economic Growth, Regulatory Relief and Consumer Protection Act, which pares down Dodd-Frank regulations for thousands of small and medium-sized American banks. Dodd-Frank refers to the 2010 Dodd-Frank Act, which instated laws to regulate the risky behaviors of banks that led to the 2008-2010 financial crisis.

President Trump signed into law today the Economic Growth, Regulatory Relief and Consumer Protection Act, which pares down Dodd-Frank regulations for thousands of small and medium-sized American banks. Dodd-Frank refers to the 2010 Dodd-Frank Act, which instated laws to regulate the risky behaviors of banks that led to the 2008-2010 financial crisis.

Among the changes this new law makes to Dodd-Frank is reducing the number of banks that are subject to strong government oversight because they are considered “systemically important.” Banks with assets of $50 billion or more had been considered “systemically important.” As of today, only banks with assets of $250 billion or more will get that moniker and be subject to the strictest government regulations.

In addition to this, small banks – generally with assets of $10 billion or less – will now be much freer to originate residential mortgages. And they will have to comply with fewer regulations in general.

“There are simplifications in [this law] that change the capital costs for smaller banks,” said Dodd-Frank expert and Senior Counsel at Morrison & Foerster, Oliver Ireland. “By lowering the cost structure of the bank, you may facilitate lending at either lower rates, or more lending.”

Ireland said that there is no way to quantify this, but acknowledged that small banks will be in a stronger position with this new law in place. As for the effect of the new law on alternative lenders, Ireland didn’t predict anything at all dramatic.

Still, he said, “There are a number of provisions in here that make the cost of being a small bank somewhat less. That may put them in a better position to compete with non-bank lenders.”

Andrew Smith Named Director, FTC’s Bureau of Consumer Protection

May 20, 2018 On Wednesday, Andrew Smith, former partner of the law firm Covington & Burling, was named the Federal Trade Commission’s Director of the Bureau of Consumer Protection.

On Wednesday, Andrew Smith, former partner of the law firm Covington & Burling, was named the Federal Trade Commission’s Director of the Bureau of Consumer Protection.

This is not Smith’s first role in government. From 1997 to 2000, Smith worked as a lawyer for the Securities and Exchange Commission. And from 2001 to 2005, he worked as a lawyer for for the Federal Trade Commission (FTC), where he will now be returning.

Since leaving the FTC, Smith served as a partner at Morrison & Foerster and most recently at Covington & Burling. Smith’s recent appointment garnered criticism from government officials who pointed out that Smith has represented egregious offenders of consumer rights. Of the five FTC commissioners, the two Democratic commissioners voted against his appointment.

But a recent New York Times article, which stressed the fact that Smith has represented violators of consumer rights, also acknowledged that he is “regarded as a hard-working and knowledgeable lawyer even by critics.”

Chairman of the FTC Joe Simons, who appointed Smith, expressed dismay over his colleagues’ rejection of Smith.

“I am disappointed that two of my new colleagues have chosen to turn Mr. Smith’s appointment into a source of unnecessary controversy,” Simon said in an FTC statement. “I am highly confident that Mr. Smith will be an effective leader of the Bureau of Consumer Protection. He is widely respected as one of our country’s best and most experienced consumer protection lawyers.”

Smith has recently represented Facebook, Uber and Equifax, all companies with cases before the FTC. Because of this, it is most likely that Smith will recuse himself from these cases. Critics of Smith’s appointment, including Democratic U.S. Senators Elizabeth Warren, Richard Blumenthal and Brian Schatz believe that this makes him unfit to be director of the bureau. But Simon strong disagrees.

“When a political appointee is recused, the Commission relies even more heavily on these seasoned career professionals to allocate resources and tee up recommendations for the Commissioners, who are the ultimate decision makers,” Simon said in an FTC statement. “When Mr. Smith is recused on a matter, I know [the bureau’s] career managers and staff will ensure that American consumers are still well protected.”