Announcements

Has OnDeck Turned The Corner?

August 7, 2017

OnDeck’s loan origination volume declined by approximately 20% in the second quarter to $464.4 million but more importantly the company only recorded a GAAP net loss of $1.5 million. That’s down from the $11.1 million loss recorded in Q1 and in line with the company’s plan to achieve profitability in the second half of the year. OnDeck predicts that sequential originations growth will resume in Q3.

OnDeck also announced that it has expanded its collaboration with JPMorgan Chase for up to four years to provide the underlying technology supporting Chase’s online lending solution to its small business customers, according to the release. “Chase plans to continue to refine the offering, including expanding access and enhancing features throughout next year.” The image at right is from their Q2 earnings presentation demonstrating the front-end collaboration.

The company has also implemented stricter underwriting standards which includes lower loan amounts, shorter loan terms and stronger credit metrics.

Sales and marketing expenses actually increased from $14.8 million in Q1 to $15.3 million in Q2 but that was inclusive of $1.4 million in severance charges. The high cost of marketing is consistent with anecdotal reports obtained by deBanked regarding market saturation. Just recently, a small business owner told us in an interview that she has received so many mailed advertisements for working capital that she has a pile of them that’s now four inches thick.

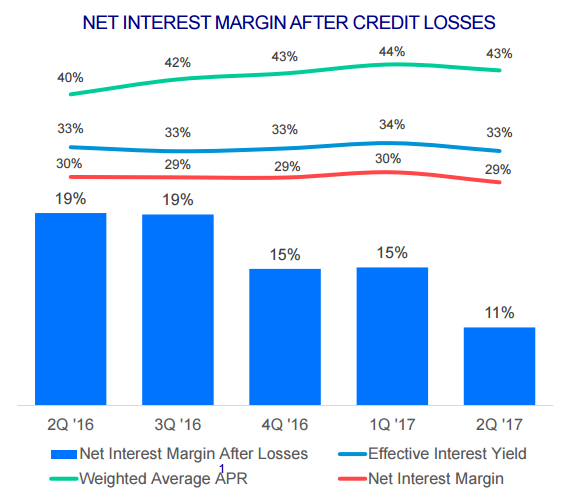

OnDeck recorded a significantly higher charge-off percentage in Q2 at 18.5% up from 14.9%, which the company partially attributed to a contracting portfolio. However, the raw dollar amount grew substantially as well. The 15+ day delinquency ration dropped from 7.8% in Q1 to 7.2% in Q2

During the Q&A session of the earnings call, CEO Noah Breslow said he believed the company was positioned well to gain some market share due to the shakeout occurring in the industry.

Breakout Capital Expands Senior Leadership Team

August 6, 2017Breakout Capital – a leading small business lender – announces the hires of Robert Fleischmann as Senior Vice President, Strategic Partnerships and Tom McCammon as Senior Vice President, Business Operations. These key additions position the small business lender for continued growth.

McLean, VA, August 7, 2017 – Breakout Capital announced today the appointments of Robert Fleischmann as Senior Vice President, Strategic Partnerships and Tom McCammon as Senior Vice President, Business Operations. Both Mr. Fleischmann and Mr. McCammon bring a wealth of knowledge and small business lending experience that can accelerate Breakout Capital’s rapid growth.

“Breakout Capital’s growing employee base shares the same passion and commitment to advancing the Company’s mission to provide transparent working capital solutions, educate small businesses, and promote industry-wide best practices. We are thrilled with the additions of Robert and Tom to the leadership team,” said Founder & CEO, Carl Fairbank.

“Breakout Capital impressed me with its outstanding commitment to educating and advocating on behalf of small businesses,” said Fleischmann. “The innovative loan products combined with the impressive team of professionals make me extremely excited about the opportunity.”

Mr. Fleischmann will lead Breakout Capital’s efforts to expand and diversify its channels through strategic partnerships. Prior to joining Breakout Capital, Mr. Fleischmann was Director of Strategic Partnerships at RapidAdvance where he worked with a diverse group of partners, including banks and commercial finance companies, to help meet the financing needs of their business clients.

Mr. McCammon joins Breakout Capital with direct industry experience as he was formerly Director of Portfolio Management and Credit Operations at OnDeck. Prior to OnDeck and his recent move to the Breakout team, Mr. McCammon was involved in two de novo banks and was a consultant to the FDIC during the financial crisis. He will be a central figure in continuing to build Breakout Capital’s stature as both a credit-and customer-centric enterprise.

“Having worked in both retail banking and fintech, I was drawn to Breakout Capital as they have successfully combined strong credit and ethics fundamentals from traditional banking while still efficiently delivering capital to small businesses,” said Mr. McCammon.

Breakout Capital has quickly established a reputation as one of the most trusted and respected lenders in the market with a focus on product innovation, transparency, responsible lending and a partnership-based approach that extends beyond providing capital. Additionally, Breakout Capital is a Principal Member of the Innovative Lending Platform Association (ILPA), the leading trade organization representing a diverse group of online lending and service companies serving small businesses.

About Breakout Capital

Breakout Capital, headquartered in McLean, VA., is a technology-enabled direct lender which has provided a wide range of working capital solutions to small businesses across the country. In addition to becoming one of the fastest growing companies in the market, Breakout Capital is a leading advocate for small business. Its CEO, Carl Fairbank, is a Board Member of the Innovative Lending Platform Association. Breakout Capital has produced a highly regarded “educational series” through its blog, Breakout Bites, that helps small businesses better understand the technology-enabled lending market and how to avoid the hidden fees and debt traps that are prevalent in the industry. With a laser focus on educating small businesses, advocating for industry-wide best practices, and providing diverse, transparent working capital solutions, Breakout Capital is changing the financial landscape for millions of small businesses in need of funding. For more information, visit http://www.breakoutfinance.com.

Bizfi Founder Stephen Sheinbaum Joins World Business Lenders

July 24, 2017

Stephen Sheinbaum has joined NJ-based World Business Lenders as a managing director. Sheinbaum founded Bizfi (Originally Merchant Cash and Capital) in 2005 and served for years as the company’s CEO. Former Lending Club exec John Donovan has been the chief executive of Bizfi since October 2016 and still holds that post.

Stephen Sheinbaum has joined NJ-based World Business Lenders as a managing director. Sheinbaum founded Bizfi (Originally Merchant Cash and Capital) in 2005 and served for years as the company’s CEO. Former Lending Club exec John Donovan has been the chief executive of Bizfi since October 2016 and still holds that post.

In a call, Sheinbaum said that World Business Lenders has a world class team and that he was proud to be joining it. He will be overseeing the company’s production from the Jersey City headquarters. The company reportedly has plans for expansion and product innovation.

Sheinbaum referred to himself as a builder and said that WBL will afford him the opportunities to execute.

Daniel Gorfine Moves On From OnDeck to CFTC

July 10, 2017Daniel Gorfine has moved on from OnDeck, according to a public announcement made by his new employer, the US Commodity Future Trading Commission (CFTC). Gorfine served as OnDeck’s VP of External Affairs and Associate General Counsel for a little over 2 and a half years.

His new job, an appointment made by Acting CFTC Chairman J. Christopher Giancarlo, will be Director of LabCFTC and Chief Innovation Officer.

According to the announcement, “Gorfine will be responsible for coordinating closely with international regulatory bodies, other US regulators, and Capitol Hill to discuss best practices around implementing digital and agile regulatory frameworks and approaches for the CFTC.”

His background in fintech is expected to help the CFTC accomplish its goal of promoting fintech innovation and fair competition.

CAN Capital Resumes Funding

July 6, 2017

CAN Capital is back in business, thanks to a capital infusion by Varadero Capital, an alternative asset manager. Terms of the capital arrangement were not disclosed.

CAN Capital stopped funding late last year and removed several top officials after the company discovered problems in how it had reported borrower delinquencies. The discovery also resulted in CAN Capital selling off assets, letting go more than half its employees and suspending funding new deals, among other things.

Now, however, the company has a new management team and its processes have been revamped and staff retrained in anticipation of a relaunch, according to Parris Sanz, who was named chief executive in February. He was the company’s chief legal officer before taking over the helm after then-CEO Dan DeMeo was put on leave of absence.

As of today (7/6), CAN Capital has resumed funding to existing customers who are eligible for renewal. Within a month, the company plans to resume providing loans and merchant cash advance to new customers. It will have two products available in all 50 states—term loans and merchant cash advances with funding amounts from $2,500 to $150,000.

To be sure, getting back into the market after so many months will be a challenge. “I think we’re absolutely going to have to work hard, no doubt about it. In many ways, given our tenure and our experience, the restart may be easier for a company like us versus others. Based on the dynamics in the market today, I see a real opportunity and I’m excited about that,” Sanz said in an interview with DeBanked.

Since its founding in 1998, CAN Capital has issued more than $6.5 billion in loans and merchant cash advances. It’s one of the oldest alternative funding companies in existence today, and, accordingly, it shook the industry’s confidence when the company’s troubles became public late last year.

Since its founding in 1998, CAN Capital has issued more than $6.5 billion in loans and merchant cash advances. It’s one of the oldest alternative funding companies in existence today, and, accordingly, it shook the industry’s confidence when the company’s troubles became public late last year.

The new management team includes Sanz, along with Ritesh Gupta, the chief operating officer, who joined CAN Capital in 2015 and was previously the firm’s chief customer operations officer. The management team also includes Tim Wieher as chief compliance officer and general counsel; he initially joined the company in 2015 as CAN Capital’s senior compliance counsel. Ray De Palma has been named chief financial officer; he came to CAN Capital in 2016 and was previously the corporate controller. The management team does not include representatives from Varadero.

Varadero is a New York-based value-driven alternative asset manager founded in 2009 that manages approximately $1.3 billion in capital. In the past five years, Varadero has allocated more than $1 billion in capital toward specialty finance platforms in various sectors including consumer and small business lending, auto loans and commercial real estate. In 2015, for instance, Varadero participated in separate ventures with both Lending Club and LiftForward.

Varadero began working with CAN Capital as part of its efforts to pay down syndicates. Varadero bought certain assets from CAN Capital last year and provided enough funding to allow CAN Capital to recapitalize. “The recapitalization enabled us to pay off the remaining amounts owed to our previous lending syndicate and provided us with access to additional capital to resume funding operations,” Sanz says. He declined to be more specific.

“We were impressed with the overall value proposition of CAN’s offerings as evidenced by the strength of its long standing relationships, the company’s core team, sound underwriting practices, technology and the strong performance of their credit extension throughout the cycle,” said Fernando Guerrero, managing partner and chief investment officer of Varadero Capital, in a prepared statement. “We’re confident the company’s focused funding practices will allow it to serve small business customers for many years to come.”

Guerrero was not immediately available for additional comment.

DLA Piper served as legal counsel for, and Jefferies was the financial advisor to, CAN Capital, while Mayer Brown was legal counsel to Varadero Capital, L.P.

Since its troubles last year, CAN Capital had been working with restructuring firm Realization Services Inc. for assistance negotiating with creditors. It also worked with investment bank Jefferies Group LLC for advice on strategic alternatives.

Sanz declined to discuss other options CAN Capital considered, noting that the Varadero deal provides the firm the opportunity it needs to jump back into the market—this time with “tip top” operations in place.

He declined to say how many employees the firm still has, other than to say it is now “appropriately staffed.” In addition to getting rid of the prior management team, CAN Capital reduced staffing in numerous parts of its business. That includes nearly 200 positions at its office in Kennesaw, Ga, according to published reports.

The company will still be called CAN Capital. “We feel that that brand has a recognition in the market, in particular with our sales partners,” Sanz says.

Yellowstone Capital Funded $47 Million in June

June 30, 2017Yellowstone Capital funded $47 million to small businesses in June, according to an announcement the company made on social media. $40 million of that was funded in-house, the post said.

Yellowstone Capital was ranked by deBanked as one of the largest small business funders of 2016. The company could see their position rise this year since two companies ranked above them are no longer funding.

Pave Stops Lending

June 29, 2017Pave, an online lender that came on the scene several years ago by marketing fair funding to millennials, is no longer lending, according to their website.

American Banker reported that the company stopped making new loans earlier this month and was exploring strategic options.

Like many several online lenders of their time, Pave touted innovative underwriting beyond just FICO scores. “We start by reviewing the individual’s credit score and history, then incorporate additional factors like use of funds, work history, current employment, education and future earning potential,” Their website says. “This gives us plenty of opportunities to recognize how financially responsible a person can be, and it’s how we can give the lowest possible rate.”

To be eligible, applicants had to either have an income, a job offer, or plans to attend a school course.

In 2015, Pave announced that a consortium of lenders led by New York-based Seer Capital had agreed to invest up to $300 million in their loans.

Former CFO of RapidAdvance Moves On to Beyond Finance, Inc.

June 27, 2017Rajesh Rao has taken the CFO position at Beyond Finance Inc., according to LinkedIn. He served as RapidAdvance’s CFO and Head of Credit Analytics and Product Strategy from October 2015 to about the end of May of this year.

Rao had come to Rapid after 13 years at Capital One where his last title was Managing Vice President.