PPP

Loan Fraudsters Resorting to AI Generated Faces

April 27, 2021 According to a sneak peek posted by Lendio CEO Brock Blake, fraudsters are stopping at nothing to game the government’s emergency loan system.

According to a sneak peek posted by Lendio CEO Brock Blake, fraudsters are stopping at nothing to game the government’s emergency loan system.

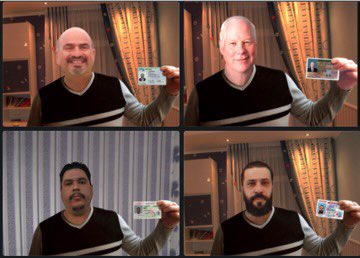

“Wanna glimpse into what lenders are experiencing with attempted fraudulent applications?” Blake wrote in a tweet. “Here are four ‘applicants’ seeking a loan.”

Four pictures showing computer-generated “business owners” all have the same sweater, but different heads. People are using AI tech to create randomized, just barely discernible pics of borrowers holding IDs beside them to beat new compliance measures.

It’s like a techno arms race between an automated scanning system that looks for fakes versus an automated fake ID and person generator that tries to make passable fakes.

After a year of PPP and EIDL success stories and fraud concerns, funders are still beating back scam artists. During a recent U.S. Senate hearing, SBA Inspector General Mike Ware said his office had secured $2.1 billion in fraudulently claimed PPP and EIDL loans.

In related news, the SBA announced the $28.6 billion Restaurant Revitalization Fund applications would open on Monday, May 3. Fraudsters start your fake restaurant owner generators.

Wanna glimpse into what lenders are experiencing with attempted fraudulent applications?

Here are 4 different “applicants” seeking a #ppploan. pic.twitter.com/kdbLmNGlvt

— Brock Blake (@BrockBlake) April 26, 2021

Move Over PPP, There’s a New Gov Grant in Town

April 23, 2021 We’ve heard rumblings of funding slowdowns because of competition from Uncle Sams’s emergency stimulus programs. But a soon-to-launch grant specifically targeting restaurants, food, and alcohol services may put PPP to shame.

We’ve heard rumblings of funding slowdowns because of competition from Uncle Sams’s emergency stimulus programs. But a soon-to-launch grant specifically targeting restaurants, food, and alcohol services may put PPP to shame.

The $1.9 trillion American Rescue plan signed last month set aside $28.6 billion toward the Restaurant Revitalization Fund. Just like PPP, the fund will dole out refundable grants up to $10 million to the most hard-hit food-related businesses.

Since PPP funds tend to run out quickly, the SBA apportioned $500 million just for merchants with less than $50,000 gross receipts in 2019. $4 billion will be set aside for the $50k- $500k bracket and $4 billion toward the $500k- $1 million bracket.

During the first 21 days of the program, the SBA will also focus efforts on disadvantaged businesses controlled by veterans, women, or those that suffer bias due to race or ethnic prejudice.

Just as in the PPP program, eligible businesses will have to devote the grant toward business expenses. That means payroll, loan financing, utilities, supplier, and equipment costs. Only companies that have survived the pandemic thus far with a physical location are eligible. The stipulations forbid a recipient to use funds to open a new venue.

Recipients will have to spend the money before the SBA end date, possibly December 2021 or later, or they will have to return the funds. The program is not live yet, but rumor has it will be opening in late April.

PPP Deadline Extended, Jobs Act Proposed

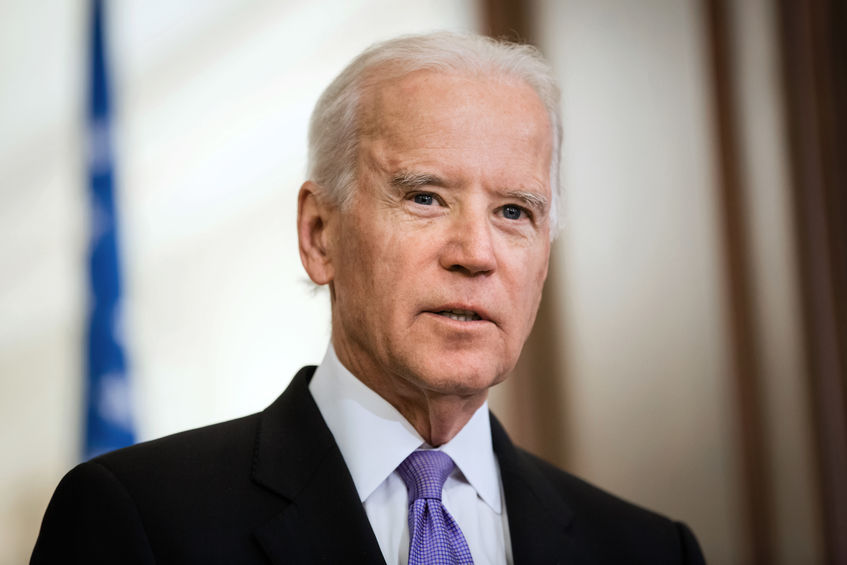

April 1, 2021 President Biden signed a law extending PPP lending until May 31st. The PPP Extension Act passed through Congress on March 25th and will allow businesses to access emergency loans past the original March 31st deadline.

President Biden signed a law extending PPP lending until May 31st. The PPP Extension Act passed through Congress on March 25th and will allow businesses to access emergency loans past the original March 31st deadline.

According to the PPP loans tracker, as of 3/21 the SBA has disbursed $718 billion of the $806 billion available, leaving $88 Billion left for funding. Businesses will be able to apply until the new deadline, and the SBA will be able to process applications until the end of June. The new filing deadline gives the SBA some breathing room to review the 234,000 applications currently in the queue.

Biden signed it a day after unavailing a $2 trillion American jobs and infrastructure plan, aimed at revitalizing roads, bridges, and protecting the environment. The money is split into a cross-section of infrastructure, subsidies, like $100 billion toward bringing broadband internet to 30 million Americans, $50 billion toward semiconductor research, and $174 billion toward electric car manufacturing.

Not every spending point is for future tech. There are lump sums for healthcare, like $400 billion for long-term elderly care, and $30 billion for pandemic preparedness.

Biden has said he plans to pay for the expenses through the Made In America corporate tax plan raising the corporate tax rate from 21% to 28% after President Trump leveled the tax from 35%.

Fintech Lenders Did Better Job Meeting Intentions of the CARES Act, Study Finds

February 18, 2021 Fintech lenders doling out PPP not only reached smaller businesses on average but played an essential role in extending PPP loans to Black-and Hispanic-owned businesses, according to a study conducted by professors at the NYU Stern School of Business.

Fintech lenders doling out PPP not only reached smaller businesses on average but played an essential role in extending PPP loans to Black-and Hispanic-owned businesses, according to a study conducted by professors at the NYU Stern School of Business.

“Fintech lenders originated much smaller loans than other lenders, suggesting they served smaller firms on average,” researchers found. “Overall, we find that, relative to other lenders, [Minority Development Institutions] nonprofits, and fintech lenders make a substantially larger share of their loans to minority borrowers, particularly Black- and Hispanic-owned businesses.”

The team of economists looked over 3.4 million PPP transactions to determine what category of lenders had the highest minority share among their loans. Ryan Metcalf, Head of Public Policy for Funding Circle, member of the Innovative Lending Platform Association (ILPA), shared the full study on LinkedIn, pointing out that six ILPA members had contributed to saving jobs.

“(Funding Circle US, BlueVine, Kabbage, Inc, OnDeck, Fundbox, Lendio) provided more than 476,000 #PPP loans totaling $16.5 billion with an average loan size of ~$30,000, median loan size of $15,000, and helped save more than 2 million jobs,” Metcalf wrote. “And that was just in 2020.”

The study found that fintech lenders did a better job meeting the intention of the CARES act. While most lenders were giving out larger loans to large firms, fintech better reached actual small businesses with smaller loans on average.

“Section 1102 of the CARES Act explicitly specified that the program should prioritize ‘small business concerns owned and controlled by socially and economically disadvantaged individuals,'” they wrote. “However, the SBA did not issue specific guidance for distributing the loans, leaving private financial institutions administering the loans to independently determine which businesses to serve first or at all.”

Instead, as has become clear, many funds went to larger firms and seemed to miss minority communities. The team compared the mean and median loan amounts for different Lenders, finding the smallest in both types were fintech loans.

Researchers put first and last names through a mathematical model to predict race because that data was not available from the majority. Then predictions were compared to the sample borrowers that self-reported race. The algorithm was 78% accurate in guessing black names, 84% in guessing Hispanic, 95% for Asian, and 99% accurate for white names.

BlueVine’s CEO on Latest Round of PPP

February 10, 2021BlueVine CEO Eyal Lifshitz took to twitter last night to update customers on the status of this PPP round. Word from around the industry has suggested that approvals have been slower and that in certain situations, additional documentation is being asked for because of the SBA’s heightened scrutiny.

Below is Lifshitz’s consolidated twitter thread.

As a third-generation entrepreneur, my decision to build BlueVine was personal—I believe in and have dedicated myself to small businesses. To the customers reaching out for Paycheck Protection Program support, know that I’ve read your messages and want to update you directly.

When the latest Paycheck Protection Program was announced, we knew we had to step up again and help small businesses. Though the cause was close to our mission, we had to refocus our business completely. If you feel this program has been slower, it has. But for good reasons.

Waiting is frustrating, especially if these funds will make or break your business. There are explanations for the longer wait times, which can actually mean GOOD news for your business. Let me break this down.

The SBA’s program changes were significant, adding Second Draws and other improvements. Every change requires an additional product build and support team training, ensuring we’re compliant and provide the most efficient and effective application process.

The program’s adjustments include serving the hardest-hit businesses (and not large well-known companies). This extra due-diligence means additional documentation and information for us to review. It also means that smaller businesses may have a greater share of the funds.

The previous PPP round was impacted by some fraudulent actors. To prevent funds from getting in the wrong hands, the SBA added more robust requirements. While this added protection is more work and slows things down, it ensures funding remains for those that need it most.

We know the process of reviewing and approving PPP loans was slow at first, but we wanted to ensure we got it right before automating. Since we started, our throughput has more than tripled. If you’re in review, be patient. We haven’t forgotten about you!

I want to emphasize that BlueVine, and me personally, are committed to serving small businesses. We’ve more than doubled our customer support team to better assist you during what I can only imagine has been a brutal year. We see you and are doing everything we can to help.

Newest Round of PPP Funding Faces Some New Technical Issues

January 26, 2021New technical issues are plaguing the latest round of PPP funding, according to Rob Nichols, the President and CEO of the American Bankers Association. On Monday, Nichols wrote to the acting heads of the SBA and Treasury addressing them.

Though thousands of businesses are awaiting forgiveness, the SBA’s online portal is not allowing a second loan to be processed unless pending first-round forgiveness applications are marked as complete. This runs contrary to the official SBA rules that state a borrower can apply if they can prove they spent their first loan correctly by the time they get a second.

“We urge SBA to fix this technical error and permit a lender to upload a borrower’s second draw PPP loan application irrespective of the status of the borrower’s First Draw Loan forgiveness application,” Nichols wrote. “More broadly, lenders are receiving a high number of incorrect error messages when the lender attempts to submit PPP loan applications through the portal.”

Part of those errors come from confusion Nichols writes, between previous guidance handed out by the SBA and current stipulations. Funders are unclear as to why a $30,000 per employee loan cap exists or why some borrowers found that the documentation they prepared to prove a 25% reduction of revenue met requirements two weeks ago but don’t meet the criteria recently, Nichols wrote.

Lendio Starts Funding Engines, PPP is On The Way

December 30, 2020 President Trump officially signed the economic relief package Sunday night. While the House, President, and Senate can’t agree on the checks individual Americans will get from Uncle Sam, $284 billion for PPP is on the way.

President Trump officially signed the economic relief package Sunday night. While the House, President, and Senate can’t agree on the checks individual Americans will get from Uncle Sam, $284 billion for PPP is on the way.

In preparation, Lendio, an online loan marketplace that facilitated $8 billion in PPP funds over the summer, has already opened the application floodgates. But when is the bill landing?

“The SBA has ten days from the time it was signed into law, January sixth, when they have to give guidance,” Lendio CEO Brock Blake said. “Then, they have some time after that they’ll open it up, my guess is that it will likely go live somewhere between the 10th to 15th.”

Firms, start your funding engines; the money is coming in about two weeks. And Blake said that with the demand for capital this high—the funds would go quick.

“My guess is that it will be two to three weeks, maybe a little longer,” Blake said. “One of the reasons it will last a little bit longer is because they reduced the loan maximum size from ten million to two million. As a result, two to three weeks or more like, you know, three or four.”

Lawmakers initiated limits to the high end this time around to halt concerns that “small business” bailout money was going to larger sized firms. That isn’t the only change for what some say could be the final round of government stimulus.

“I like what they’ve done this time around, addressing some of the key issues, first of which allowing borrowers to have a second turn on PPP loans,” Blake said. “This pandemic has lasted longer than anyone expected, and there’s a lot of restrictions on these business owners.”

The first time around, the Fed handed out forgivable funds based on two and a half months of payroll, and that went real quick, Blake said. For a firm to meet the criteria for a second loan, they have to prove they have a 25% reduction in revenue from 2019 to 2020.

Blake said he was excited that the new aid is granting industries especially hard hit, like restaurants and hotels, to get larger loans “three and a half time instead of two and a half times.” Blake’s favorite part of the new program is incentivizing lenders to serve genuine smaller businesses, where last time they were not.

“Last time, so many of the smallest small businesses were at a disadvantage because we all know lenders prioritize the largest loan sizes first,” Blake said. “They left the smallest of small business out.”

Lendio and fintech lenders focused on this underserved market of small businesses last time, Blake said. After advocating on behalf of small borrowers, Blake said there are incentives for lenders to give to the underserved and actually make money.

“Thankfully, in this new PPP program, they created a new incentive package for loans smaller than $50,000,” Blake said. “That makes these smaller loans a priority, instead of put toward the back of the list.”

Here Comes More PPP and Stimulus

December 23, 2020 Congress finally passed a new stimulus bill.

Congress finally passed a new stimulus bill.

The aid package calls for $600 payments to American adults and $284 billion for the second round of PPP, with some amended rules.

Following its passage, President Trump called the bill “a disgrace” and voiced that individuals should be receiving much more, as much as $2,000 in stimulus. He is refusing to sign it unless changes are made.

“It’s called the Covid relief bill but it has almost nothing to do with Covid,” Trump said.

And yet the passed deal was considered a watershed moment for congressional leaders. After standing in the way of a stimulus of more than $500 billion and refusing to sign a House-passed $3 trillion aid package this summer, Senate Majority Leader Mitch McConnell spoke Monday with a message: help is finally on the way.

“Moments ago, the four leaders of the senate and the house finalized an agreement,” McConnell said. “A package of nearly $900 billion, it is packed with target policies to help struggling Americans who have already waited entirely too long.”

McConnell said that around $500 billion of the package was reused money from stimulus spending allocated earlier this year, that was never used.

McConnell said that around $500 billion of the package was reused money from stimulus spending allocated earlier this year, that was never used.

The stimulus also extends unemployment benefits for another 11 weeks and adds a $300/week unemployment bonus. .

“It is a strong shot in the arm to help American families weather the storm,” Senate minority leader Chuck Schumer said. “For the 20 million people that would lose unemployment benefits the day after Christmas, help is on the way.”

This round of PPP will allow a second forgiven loan to some firms and attempt to curb larger companies’ ability to take more than $2 million. Firms will be eligible for a second share of loans if they can prove a 25% reduction in business from the same quarter in 2019 and other stipulations.

Lawmakers plan to make it easier for nonprofits and local media companies to get funding and are allocating $15 billion for performance venues hit by lockdown restrictions. The stimulus will also give billions toward school aid, protecting renters from evictions, protecting gig workers, internet broadband, funding food access.

“Our purpose has always been to crush the virus,” House majority leader Nancy Policy said. “Put money in the pockets of the American people, which we do in this legislation.”