payments

WTF, From Credit Card Processing to Funding Deals

August 6, 2024“My first name is William, my son’s name is Torre and he’s my partner, and our last name is Failla, so WTF was the name of the acronym that we came up with.”

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

“I approached my son who was a business major and a finance major out of Hofstra and I said to him, ‘you’re graduating any day now so why don’t we do some diligence, look into this business and see what you think.'”

His son, Torre, who is now the company’s CFO, signaled his approval so long as they paced themselves and mastered the most fundamental component of it first, the credit card processing side of the business. Thus 2021 kickstarted WTF Merchant Services as a shop on Long Island that focused entirely on boarding merchant accounts. They started by approaching their friends, family, and contacts and then expanded it to where they had a referral incentive program and continued to acquire more and more accounts.

The most attractive part of the business to them is the residual revenue component to it. “That’s the greatest. That’s what made us get into it because now we get paid every month. As long as you keep that customer, you get paid every month,” Failla explained.

And keeping those clients means providing great customer service, which he said they’ve placed a strong emphasis on. They’ve also gotten a firsthand look at the financial trends of the various businesses they’ve worked with, something they figured would come in handy for when they were ready to take the next step.

“We didn’t do an MCA deal until the beginning of this year,” Failla said. “We really wanted to learn the business in and out, and then we were just an ISO.”

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

“When you do the split, it’s so much easier because you take, let’s say 15 or 20% or whatever the merchant can handle at the time,” Failla said. “It’s just so much better of a direction to get paid because it doesn’t hit their bank, it doesn’t hurt them as much. When they see it coming out daily like that, it’s a little different. When it comes out of the credit cards it’s just early and it helps a lot. Mindset changes.”

The company’s traditional approach has already attracted the attention of some of their peers in the industry who like the idea of residual income but don’t have the time or the patience to worry about merchant accouts.

“We have different MCA offices that we actually do this with already,” Failla said. “We do all their credit card processing. We handle all the back-end. We handle all the front-end. All they do is give us the referral and they become what we call a referral partner, and they get paid every single month as long as we keep the account.”

Will was sure to give credit to those that have helped shorten his learning curve along the way. He has since discovered that others in the poker scene are also in the same business as he and it’s created a valuable community. WTF even has a poker table in its office as a sort of tribute to his background which he has not actually retired from. The Hendon Mob poker tracker states that Will recently placed 259th out of 10,112 players in the World Series of Poker in Las Vegas earlier this month. Meanwhile, the company name itself, a bold strategy, seems to be working out so far.

“If you look under our logo, it says our names right underneath it. William, Torre Failla, and listen there’s going to be some pushback, but the amount of pushback we’ve had is so minimal that I think it’s worth it, and we’re going to stick with it as long as we can.”

Revisiting Splits and Payment Methods in the Funding World

March 31, 2024 As most people are aware, ACH debits are only one method used in the small business finance industry to facilitate performance of a deal. Here are some other common ways:

As most people are aware, ACH debits are only one method used in the small business finance industry to facilitate performance of a deal. Here are some other common ways:

Split Funding

This method has been in use since at least 1998 and is still used by many funding companies today.

See: CC Splits Still Make Profits, Payments Knowledgeable Funders Benefit

Lockbox

A lockbox gives you the protection and visibility of a split but may require additional setup steps. This method was very common in the 2008 – 2012 era and is still available.

Variable ACH

The variable ACH system, made famous by MCC starting circa 2009, is still in use around the industry.

See: Homegrown Software Enables FundKite to Reconcile MCAs Daily Rather Than Monthly

GoDaddy Enables Any Website Domain To Accept Payments

February 22, 2024“Hey, do you have a Zelle or Venmo or Website?”

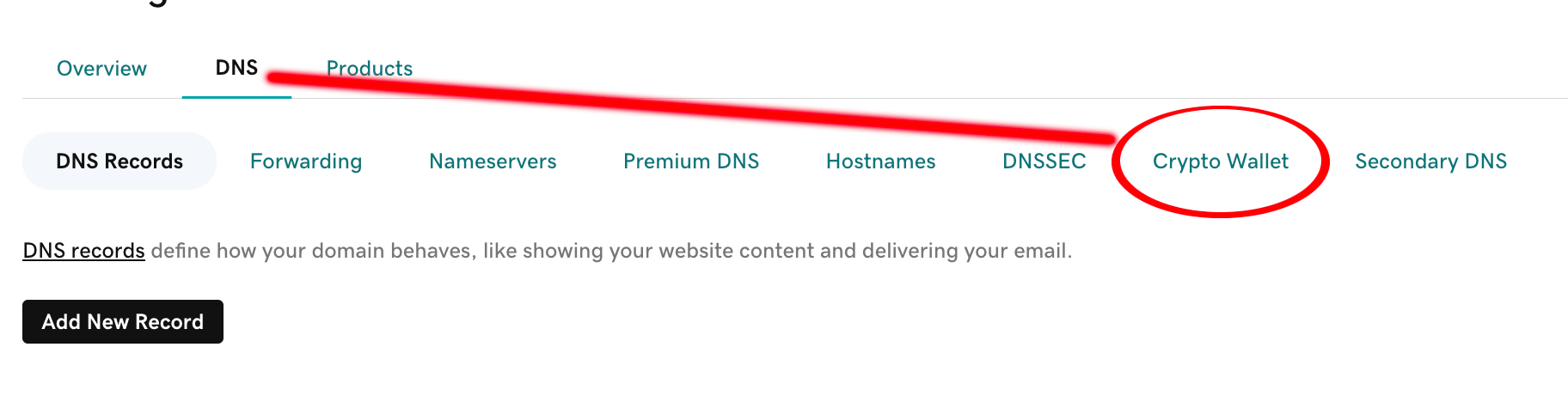

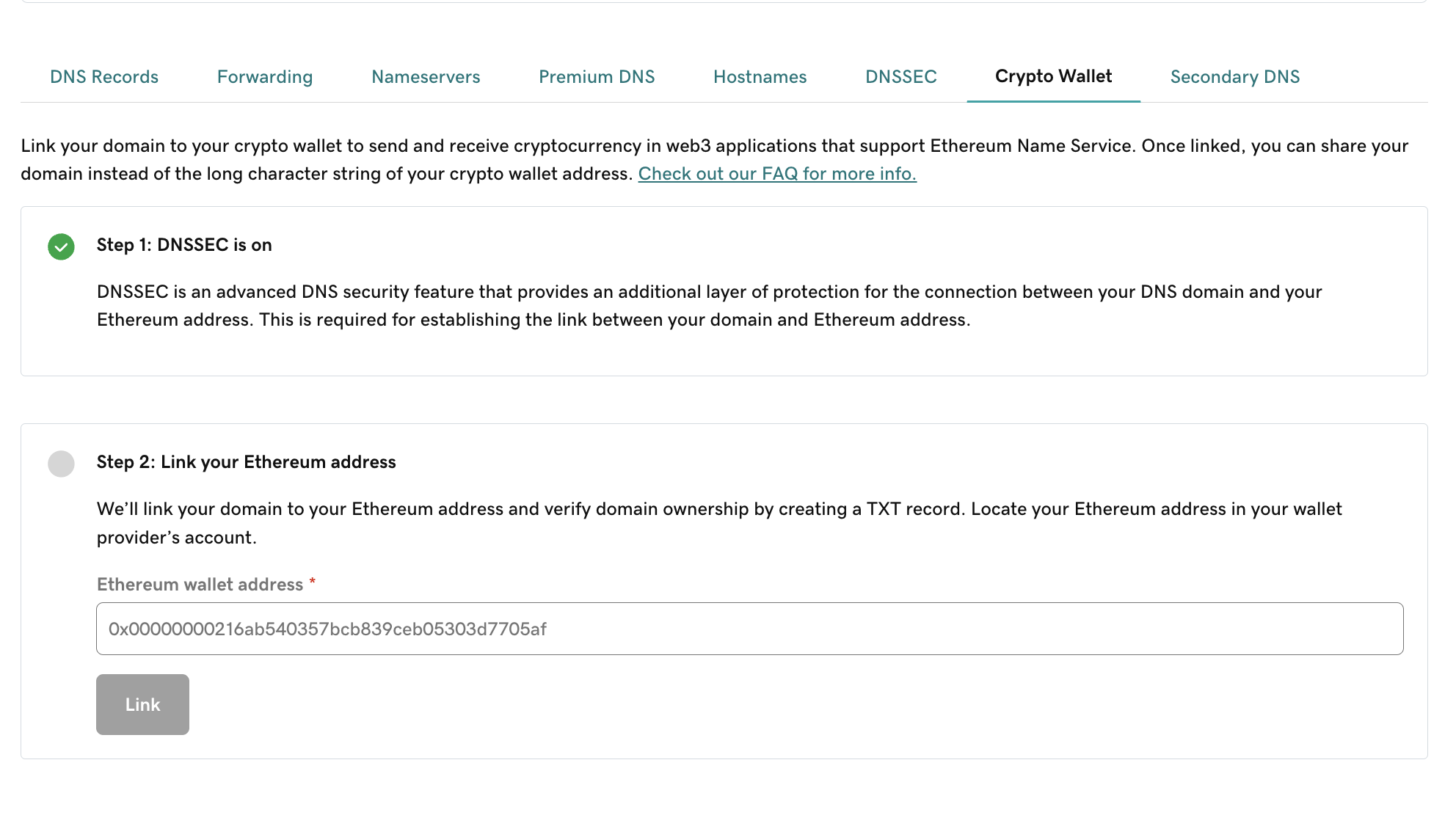

GoDaddy, the domain name registrar and popular website hosting service, has jumped into the fray to offer website owners a new easy way to receive payments. Although the new feature is called a “crypto wallet” it can accept more than just ether. That’s because one of the most popular currencies being used on the Ethereum blockchain today is USDC, a digital dollar that is fully backed by real dollars.

GoDaddy, the domain name registrar and popular website hosting service, has jumped into the fray to offer website owners a new easy way to receive payments. Although the new feature is called a “crypto wallet” it can accept more than just ether. That’s because one of the most popular currencies being used on the Ethereum blockchain today is USDC, a digital dollar that is fully backed by real dollars.

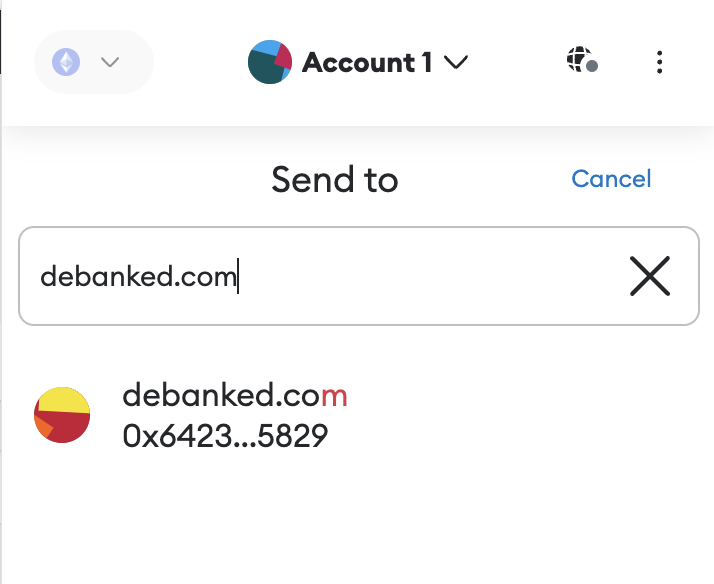

Specifically, GoDaddy is allowing any website domain owner to use their domain name as a crypto wallet address. That means instead of relying on someone’s Zelle or Venmo address, you can just send funds (ether, USDC or more) to the domain name of the website, like debanked.com for example. Again, “crypto” doesn’t necessarily mean exotic coins since the blockchain can facilitate the transfer of digital dollars as well.

To try it, just go to the DNS settings in your GoDaddy account, click the “Crypto Wallet” tab, and then just click the “turn on” button and enter in your Ethereum address in the next field. That’s it. That’s all you have to do. Now your website domain name can accept payments over the blockchain. It assumes you have an Ethereum address already, which if you don’t well then that’s an article for another day as that all happens outside of GoDaddy. In the meantime, see the below guide:

10 Commandments of ACH Processing For Brokers

May 18, 2023deBanked recently spoke with Zalman Notik, the Operations Manager of MCA Track & GoACH. Notik offered up so much advice about ACH processing that it’s been codified into a helpful list! Below are his 10 Commandments of ACH Processing.

1. Always disclose your fee. Merchants are generally okay with paying something they agreed to pay if it is disclosed.

1. Always disclose your fee. Merchants are generally okay with paying something they agreed to pay if it is disclosed.

2. Make sure that everything agreed to is in writing and plainly stated. e.g. “We’re going to debit your account for $1,000 when we get you approved for a loan.” There’s a difference between the short, long way and the long, short way. To avoid lengthy disputes, negative Google reviews, and claims of undisclosed fees, opt for the straightforward method rather than the convoluted one.

3. Remind the merchant (in writing and by phone) that you will be debiting their account on X date. As a courtesy reminder it’s probably a good idea to give that merchant a phone call saying, “Hi, John, congratulations, I got you the $100,000, we’re so excited that it worked out well and I’d like to remind you that for our agreement we’re going to debit your account tomorrow.” This can avoid a broker’s payment getting returned if in fact that merchant planned to transfer all their funds elsewhere.

4. Any change to the amount that was agreed to should come with new signed paperwork. If a broker has a piece of paper stating that they’re allowed to debit somebody’s account $10,000 and then debit them $4,000, $5,000, or $8,000, that merchant could dispute it, and they will win because they never agreed in writing to $8,000, they agreed to 10.

5. Collect a copy of the merchant’s ID and a voided check with the business name on it. Be sure that everything matches.

6. Confirm with the merchant that they own the account – Not a spouse, cousin, or friend etc. When checking state records and the business is owned by a spouse, that spouse should be signing the agreement. For example, if a couple owns Joey’s pizzeria and one of them signs the paperwork there could be a possibility that broker will receive a dispute two months later. Turns out that the other spouse is the legal signer on the bank account and now that broker is out of money. A good way to verify is through IDs or a voided check with the business name on it.

7. Communicate with your ACH provider – e.g., “The merchant said the payment will not clear etc.” No one likes surprises. Communication with the ACH provider makes them feel comfortable about working with that broker again in the future.

8. Store paperwork in a secure location so that if there is a dispute you can provide everything to the ACH processor in a timely fashion. NACHA Operating Rules & Guidelines are enforced by the government for every ACH payment. If a broker debits an account, and that merchant disputes the transaction over a period, that broker will need to provide paperwork to prove those disputes. Keep those files in a Dropbox or Google Drive account or somewhere safe and accessible.

9. Keep funds in your bank account to cover fees and returns. Having $0 in your account is a bad fit so be disciplined in keeping money in one’s account.

10. Don’t be an A*$%#%$ – if you treat your merchants well and communicate with them, you won’t find yourself fending off disputes etc. Despite what someone may sign, if the merchant feels they have been mistreated throughout the process it’s not going to stick, potentially leaving that broker with problems.

Past-Due? Your Customer May Judge How You Handle That With Them

March 28, 2023 Ask yourself this, that customer who missed a payment, do you actually want to continue working with them in the long run? If so, consider just how critical your approach to that missed payment will be. According to a survey, 40% of customers would consider switching to another service provider if a past-due situation resulted in a negative experience. The survey was conducted by Lexop who also found that Gen Z was even more sensitive to these encounters compared to other generations. A whopping 49% percent of Gen Z customers said that they would consider switching after a negative past-due experience, for example.

Ask yourself this, that customer who missed a payment, do you actually want to continue working with them in the long run? If so, consider just how critical your approach to that missed payment will be. According to a survey, 40% of customers would consider switching to another service provider if a past-due situation resulted in a negative experience. The survey was conducted by Lexop who also found that Gen Z was even more sensitive to these encounters compared to other generations. A whopping 49% percent of Gen Z customers said that they would consider switching after a negative past-due experience, for example.

But good riddance to those that can’t pay! Right? Well, maybe not. Sixty percent of consumers late on bills were late for non-financial reasons, according to the same survey. Thirty percent said they simply forgot to pay and ten percent reported that errors on the bills themselves were to blame. Eight percent said it was simply a matter of their credit card on file expiring!

Oftentimes this situation results in the payment being made. Eighty-five percent of past-due consumers are paying within 30 days of the due date, for example. But were they happy with the process to lead them there? That is the question.

Lexop is a financial technology company that helps organizations automate and scale their collections operations.

Big Short Seller’s Allegations About Block Don’t Make Block Look Too Good

March 23, 2023 Block, the parent company of Square Loans, suffered a rough day in the market (down 15%) on Thursday after an activist short seller made bombshell allegations about the way Block conducts its business. Hindenburg Research, the short seller, posted a report of alleged findings it had uncovered over a period of two years. In Block: How Inflated User Metrics and “Frictionless” Fraud Facilitation Enabled Insiders To Cash Out Over $1 Billion, the report focuses almost entirely on alleged shenanigans with Cash App. Block has often been referenced in the pages of deBanked because of its massive small business lending subsidiary, Square Loans, which last year originated $4 billion in funding to merchants. That subsidiary was not the subject of the report.

Block, the parent company of Square Loans, suffered a rough day in the market (down 15%) on Thursday after an activist short seller made bombshell allegations about the way Block conducts its business. Hindenburg Research, the short seller, posted a report of alleged findings it had uncovered over a period of two years. In Block: How Inflated User Metrics and “Frictionless” Fraud Facilitation Enabled Insiders To Cash Out Over $1 Billion, the report focuses almost entirely on alleged shenanigans with Cash App. Block has often been referenced in the pages of deBanked because of its massive small business lending subsidiary, Square Loans, which last year originated $4 billion in funding to merchants. That subsidiary was not the subject of the report.

While one can read the report on their own and form their own opinion, which the authors hope to profit from by Block’s stock going down, it should be noted that the timing of its release is a little suspicious. Block, for all the bells and whistles it has in payments and lending, is at its core these days, a crypto company. Block generated $7.1B in revenue just off of Bitcoin alone in 2022, perhaps making it an easier target given the string of recent events.

3/12/23

- Regulators shutter Signature Bank. Rumors abound that it was less about solvency and more about governmental dislike of its crypto clientele.

3/22/23

- Coinbase reveals that it received a Wells Notice from the SEC

- Tron founder Justin Sun sued by the SEC

- Several celebrities including Lindsay Lohan charged by the SEC for failing to disclose compensation they received for crypto promotions

- The President published his annual Economic Report which referenced crypto with astounding frequency

3/23/23

- Hindenburg Research releases its report about Block, causing the company stock to plummet 15% in a day. Although the focus is not on crypto, Block’s big revenue generator is Bitcoin, which generated $7.1B in revenue for the company in 2022.

Borrower Didn’t Make Their Payment? Maybe They Just Forgot

November 18, 2022 When borrowers gets squeezed, who will they pay first? According to a survey conducted by Lexop, American respondents ranked mortgage and rent payments as having the highest priority among recurring bills. Utilities (water, electricity, and gas) came second, car loans third, phone/internet bills fourth, and personal loan payments dead last. That may not be what lenders want to hear but the information could prove helpful in preparing for an economic downturn.

When borrowers gets squeezed, who will they pay first? According to a survey conducted by Lexop, American respondents ranked mortgage and rent payments as having the highest priority among recurring bills. Utilities (water, electricity, and gas) came second, car loans third, phone/internet bills fourth, and personal loan payments dead last. That may not be what lenders want to hear but the information could prove helpful in preparing for an economic downturn.

Notably, a missed payment may not even be a sign of financial stress. According to the same Lexop survey, 34% of respondents stated that the primary reason they had for being late on a bill was that they simply forgot. A majority also disclosed that they were late in paying because of other non-financial issues like invoicing errors, not having access to the bill, payment method issues, and more.

These seem like addressable issues especially since 35% of respondents wanted digital reminders via text or email. Less than 10% preferred they be reminded via phone call or snail mail.

“Empowering consumers to work with collectors toward meeting their payment goals is the best way to foster healthier business-customer relationships that will ultimately result in increased debt recovery and customer retention,” said Amir Tajkarimi, Chief Executive Officer and Co-founder of Lexop, in a published statement related to the findings. Tajkarimi was a panelist on The Need for Speed in Payment & Collection at the Canadian Lenders Summit in Toronto this week. There, he explained that his firm was hyper focused on improving the collections user experience and emphasized that a missed payment is not always the result of a borrower not having the resources to pay.

The data revealed from the study is timely since 60% of respondents also shared that they were concerned about their ability to pay bills over the next 6 months.

Apple Pay Later?

June 15, 2022 Apple is joining BNPL stalwarts Afterpay and Klarna with its own product called Apple Pay Later. Joining the Apple suite of finance products such as Apple Card, Apple Cash, and Apple Wallet, it is planned to launch in the fall of 2022 as a new feature in iOS 16. Apple will offer customers the ability to split their payments into four over a six-week period with no added interest or late fees. These payments can be deducted automatically or customers can choose to opt out and make the payments manually.

Apple is joining BNPL stalwarts Afterpay and Klarna with its own product called Apple Pay Later. Joining the Apple suite of finance products such as Apple Card, Apple Cash, and Apple Wallet, it is planned to launch in the fall of 2022 as a new feature in iOS 16. Apple will offer customers the ability to split their payments into four over a six-week period with no added interest or late fees. These payments can be deducted automatically or customers can choose to opt out and make the payments manually.

Customers will be able to link their debit cards to Apple Pay Later when making transactions but will only be able to borrow $1,000 at max. And the limit one gets depends on their Apple credit history. The new loan service will use Apple IDs to check payment history before purchases to prevent fraud and track one’s account information to determine if they’re eligible. Missing a few Apple Music payments might make an approval less likely. for example.

Buy Now Pay Later is becoming extremely popular. According to thefinancialbrand.com, BNPL is expected to skyrocket from 1.6 million users in 2018 to 59.3 million users in 2022 with the leading users being Millennials and Gen Z. Apple is entering the market with a competitive advantage since many retailers already offer Apple Pay.