Online Lending

Can The SBA Handle The Stimulus On Their Own?

March 27, 2020 As the market cheers the upcoming passage of a $2 Trillion stimulus bill that is intended to provide much needed support to small businesses, industry insiders are beginning to raise concerns about the SBA’s infrastructural ability to process applications in a timely manner.

As the market cheers the upcoming passage of a $2 Trillion stimulus bill that is intended to provide much needed support to small businesses, industry insiders are beginning to raise concerns about the SBA’s infrastructural ability to process applications in a timely manner.

In a webinar hosted by LendIt Fintech yesterday, Opportunity Fund CEO Luz Urrutia estimated that conservatively, it could take the SBA up to two months to even begin disbursing loans offered by the bill. Kabbage President Kathryn Petralia offered the most optimistic estimate of 10 days, while Lendio CEO Brock Blake thinks that perhaps it could take around 3 weeks.

Blake followed up the webinar by sharing a post on LinkedIn that said that small businesses were reporting that the SBA’s website was so slow, so riddled with crashes, that the SBA had to temporarily take their site offline.

Most skeptics raising alarms are not referring to the SBA’s staff as being unprepared, but rather the systems the SBA has in place.

A March 25th tweet by the SBA reported that the site was undergoing “scheduled” improvements and maintenance.

The website is currently undergoing continued scheduled improvements and maintenance. For more info on SBA #COVID19 resources, visit https://t.co/yG2N17KF63

— SBA (@SBAgov) March 25, 2020

This all while the demand for capital is surging. Blake reported in the webinar that loan applications had just recently increased by 5x at the same time that around 50% of non-bank lenders they work with have suspended lending.

Some informal surveying by deBanked of non-bank small business finance companies is finding that among many that still claim to be operating, origination volumes have dropped by more than 80% in recent weeks, mainly driven by stay-at-home and essential-business-only orders issued by state governments.

It’s a circular loop that puts further pressure on the SBA to come through, none of which is made easier by the manual application process they’re advising eager borrowers to take on. The SBA’s website asks that borrowers seeking Economic Injury Disaster Loan Assistance download an application to fill out by hand, upload that into their system and then await further instructions from an SBA officer about additional documentation they should physically mail in.

Perhaps there’s another way, according to letters sent to members of Congress by online lenders. 22 Fintech companies recently made the case that they are equipped to advance the capital provided for in the stimulus bill.

“We seek no gain from this crisis. Our only aim is to protect the millions of small businesses that we are proud to call our customers,” the letter states.

Members of the Small Business Finance Association made a similar appeal in a letter dated March 18th to SBA Administrator Jovita Carranza. “In this time of need, we want to leverage the experience and expertise we have with our companies to help provide efficient funding to those impacted in this tough economic climate. We want to serve as a resource to governments as they build up underwriting models to ensure emergency funding will be the most impactful.”

How fast things come together next will be key. The House is scheduled to vote on the Senate Bill today. If a plan to distribute the capital cannot be expedited and the crisis drags on, the consequences could be dire.

“Hundreds of thousands of businesses are going to be out of business,” Urrutia warned in the webinar.

Online Lenders Ask Congress For Capital For Help and To Help

March 20, 2020 Members of Financial Innovation Now (FIN) have called on senior members of Congress to play a role in supporting small businesses with capital support and by loan distribution. Among their suggestions are:

Members of Financial Innovation Now (FIN) have called on senior members of Congress to play a role in supporting small businesses with capital support and by loan distribution. Among their suggestions are:

- To direct Treasury to provide conditional capital to alternative lenders

- Permit these non-bank lenders to disburse loans, including via partnership with financial institutions

- Allocate a portion of funds for distribution via these lenders

FIN’s members include Amazon, Apple, Google, Intuit, PayPal, Square, and Stripe.

The organization also said:

An emergency Treasury facility will get funding to small businesses in a timely manner. FIN welcomes Congressional efforts to dramatically streamline Small Business Administration loans and include alternative lenders in this process as well.

Canadian Lenders Association Announces Creation of Covid-19 Working Group

March 20, 2020 The Canadian Lenders Association has announced its establishment of a covid-19 working group to support its members’ response against the coronavirus. The group will act as an advisory committee and resource for CLA members, while also serving as a lobbyist group to various government entities.

The Canadian Lenders Association has announced its establishment of a covid-19 working group to support its members’ response against the coronavirus. The group will act as an advisory committee and resource for CLA members, while also serving as a lobbyist group to various government entities.

“We presently are in an unprecedented period in Canadian business,” CLA President Gary Schwartz said in a statement. “In the weeks and months ahead, CLA members will have an important role to play in supporting small business and in providing much needed credit to consumers across Canada. The goal of this initiative is to engage with and advocate on behalf of all stakeholders across the innovative lending ecosystem to help mitigate the disruption that covid-19 create in Canada.”

The working group will engage Canadian policy makers on key issues relating to small business lenders and small businesses. In a call, CLA Board Member and Merchant Growth Partner CEO David Gens said that “there’s a lot that governments can do to bridge businesses through this, so that once this virus is over, life resembles, as much as possible, what it looked like pre-virus … I don’t think we have seen enough yet in terms of the government response as it relates specifically to mom and pop small businesses … And I think that those businesses, those local storefronts really do make up the fabric of communities.”

Marketplace Lending Association Members Take Steps To Help Borrowers During The Coronavirus Crisis

March 17, 2020 Members of the Marketplace Lending Association are taking steps to alleviate financial pressure facing borrowers during the recent crisis.

Members of the Marketplace Lending Association are taking steps to alleviate financial pressure facing borrowers during the recent crisis.

“This includes providing impacted borrowers with forbearance, loan extensions, and other repayment flexibility that is typically provided to borrowers impacted by natural disasters. During the time of payment forbearance, marketplace lenders are also electing not to report borrowers as ‘late on payment’ to the credit bureaus,” a letter to senior members of Congress signed by Exec Director Nathaniel Hoopes states. “Members are also waiving any late fees for borrowers in forbearance due to the COVID-19 pandemic, posting helplines on company homepages, and communicating options via company servicing portals.”

Members of the MLA include:

- Affirm

- Avant

- Funding Circle

- LendingClub

- Marlette Funding

- Prosper

- SoFi

- Upstart

- College Ave Student Loans

- Commonbond

- LendingPoint

- PeerStreet

- Yieldstreet

- Arcadia Funds, LLC

- Citadel SPV

- Colchis Capital

- Community Investment Management

- cross river

- dv01

- eOriginal

- Equifax

- experian

- Fintech Credit Innovations Inc.

- FutureFuel

- Laurel road

- LendIt

- pwc

- Scratch

- SouthEast bank

- TransUnion

- tuition.io

- VantageScore

- Victory Park Capital

- WebBank

How Kabbage Insights Seeks to Level Playing Field for Small Businesses

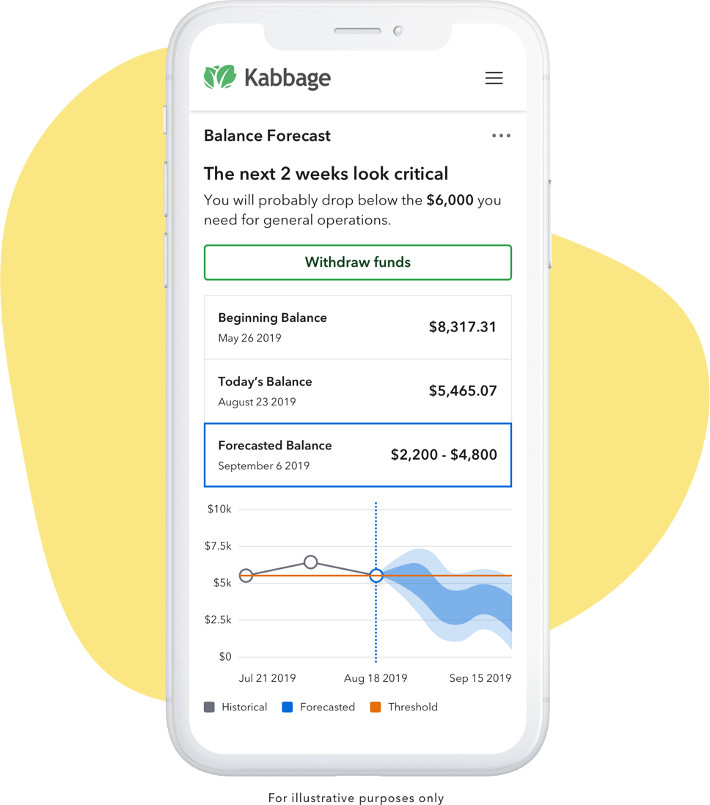

March 5, 2020 This week, Kabbage released its latest product, Kabbage Insights, to the public. Having been available privately since February 10th, the service is now free to all Kabbage customers. Released a month after Kabbage Payments, Insights adds to Kabbage’s ecosystem of products by helping small business owners identify and prepare for cash flow deficits.

This week, Kabbage released its latest product, Kabbage Insights, to the public. Having been available privately since February 10th, the service is now free to all Kabbage customers. Released a month after Kabbage Payments, Insights adds to Kabbage’s ecosystem of products by helping small business owners identify and prepare for cash flow deficits.

Acting almost like a virtual assistant, Insights links to and analyzes a business’s financial data, serving up a report of how the company has performed historically, how it’s doing currently, and what the projections for its future are looking like. While this may sound like standard business planning and budgeting, the time and resources required to provide in-depth financial analyses are usually only in possession of larger companies. Insights, according to Kabbage’s Head of Income Products, Abraham Williams, is an attempt to bridge this gap between what larger businesses have traditionally had access to and what small business owners have been unable to claim.

“Kabbage has, for a number of years now, used data science, modeling, and machine learning to come up with financial decisions on whether to give someone a loan, and we’re right a lot of the time.” Williams told deBanked over the phone. “With this, we’re able to bring this modeling to our small business customers.”

As well as providing a breakdown of a company’s financial history and future, Insights offers a threshold alert system wherein customers can set a desired low-balance amount and receive notifications when they are nearing it. And by pairing Insights with Kabbage’s Small Business Revenue Index, users will be able to compare their company against those of a similar size/location, so long as these businesses are Kabbage customers. The data used to make these comparisons will be aggregated and anonymous.

The public launch of Kabbage is part of the company’s plan to create a fintech ecosystem that completely eliminates waiting times, and is the culmination of Kabbage’s ten years of collecting and analyzing small business financial data.

Or, as Kabbage CEO Rob Frohwein said in a statement: “As a small business owner for many years, I spent many sleepless nights trying to figure out whether I’d have the cash to pay my various expenses, including payroll at the end of the month and it’s been a mission of mine to solve this ubiquitous problem for all small business owners ever since. Kabbage is pleased to launch Insights, taking on this burden for small business owners and providing them with cash flow analyses that large enterprises have at their fingertips. We will continue to level the playing field for the small business owner.”

Lendio Plans Development and Growth With $55 Million Series E

February 27, 2020 Today Lendio announced that it raised $55 million as part of its series E funding round. This included $31 million in equity led by Mercato Partners Traverse Fund and a $24 million debt facility from Signature Bank.

Today Lendio announced that it raised $55 million as part of its series E funding round. This included $31 million in equity led by Mercato Partners Traverse Fund and a $24 million debt facility from Signature Bank.

“We think that we’re just getting started, that there’s a really large opportunity in front of us and we’re excited that this round will give us the fuel that we need to continue to grow,” Lendio CEO Brock Blake told deBanked in a call. “We have a few different reasons for pulling together the round, but primarily, it’s all around investing in organic growth through partnerships and different marketing channels.”

Asked where these funding rounds may continue in an F, G, and H, Blake was unsure, saying that “every time we raise a round we do it with the expectation that it will be the last round.”

The funds in part will be used to further develop Lendio’s integrated lenders services, which are a set of tools used to identify which loan product and lender are the best match for a business owner; as well as the expansion of Sunrise, the bookkeeping platform Lendio acquired in 2019.

Luxury Asset Capital Acquires and Relaunches Borro

February 26, 2020 Luxury Asset Capital, the Denver-based lender that secures financing against goods such as Ferraris and Rolexes, has announced this month that it has acquired Borro and will be relaunching borro.com. LAC did not disclose the purchase price.

Luxury Asset Capital, the Denver-based lender that secures financing against goods such as Ferraris and Rolexes, has announced this month that it has acquired Borro and will be relaunching borro.com. LAC did not disclose the purchase price.

The news comes after LAC had been in talks to acquire Borro for years, LAC CEO Dewey Burke told deBanked. The merger will see Borro’s New York office remain open for business as many of its staff will stay on. As well as this, LAC and Borro will now be offering loans on a wider range of goods, that start at lower minimum amounts, and which will make use of more flexible terms, Burke stated.

“This was a transformational acquisition for us because obviously the competitor was out of the marketplace, but it really pushed us further to the forefront of being the preeminent lender in our niche space.”

Other news to come from announcement is that LAC is now offering to store customers’ luxury assets in its company vault, allowing the users who choose to do so to access capital immediately via a phone call. LAC will also be retiring its Lux Exchange and Pawngo brands, in favor of replacing them with Borro, because, as Burke put it, “we just thought it was a brand that was stronger than the legacy brands that we had.”

Beyond the merger, LAC plans to continue forging corporate partnerships, like that of its preexisting one with WatchBox, a trading service for preowned luxury watches. The strategy here being to link with the luxury goods ecosystem, enabling convenient pathways for customers to collateralize their asset.

LendingClub Becomes First Fintech Lender to Buy a Bank

February 19, 2020 Today LendingClub announced that it has agreed to acquire Boston-based Radius Bank for a purchase price of $185 million, made up by cash and stock. Holding more than $1.4 billion in assets, the merger will enable LendingClub to offer checking accounts and save millions in bank fees and funding costs each year.

Today LendingClub announced that it has agreed to acquire Boston-based Radius Bank for a purchase price of $185 million, made up by cash and stock. Holding more than $1.4 billion in assets, the merger will enable LendingClub to offer checking accounts and save millions in bank fees and funding costs each year.

Coming one month after LendingClub settled to pay out $1.25 million to resolve allegations that it charged rates in violation of Massachusetts state law, now, more than ever, appears to be a good time for the company to be on its way to attaining a bank and all of the FDIC-approved measures that come with it.

Described as a “no-brainer decision” by LendingClub’s CEO Scott Sanborn, the news comes after the fintech had tried unsuccessfully to get a bank charter. Becoming a popular trend among online lenders and fintechs, with Square having applied for one recently and Varo Money getting approved last week, the merger is the first time that a fintech has actually bought a bank. “Adding the capabilities of a bank charter to the LendingClub mix really changes the game both in terms of what we can do for our customers and what we can do for shareholders,” Sanborn stated.

Having been in discussions with Radius for over a year, it is believed that the purchase was made with the opinion that buying a bank would be less time-demanding than getting approved for a bank charter. The federal banking regulatory approval process is expected to take between 12 and 15 months.

In October 2019, LendingClub VP & Head of Communications Anuj Nayar spoke to deBanked about the company’s future, noting its intentions to broaden its offerings and transition from a product-centric company to a platform-centric company.

“We talk about a customer journey, moving our customers to being visitors, where they basically came to us for a personal loan and then come back to the company a couple of years later for another personal loan, to being much more about lifetime value of the customer and our relationship with the customer.” Nayar said. “The customer experience over the next year is going to change pretty dramatically as we start with bringing some of these new learning products on board but we’ve also been making clear that we’re investigating broader banking services that we’re going to be offering our customers.

Originally valued at $8.5 billion, LendingClub had one of the biggest US tech IPOs in 2014. However the share price has fallen more than 88% over the previous 5 years.