MPR Authored

Suspicious Listing on LendingClub

August 4, 2014While perusing LendingClub’s loan platform today, I came across a highly suspicious borrower. It’s member loan #23954784 who is currently a lab assistant in Albuquerque, NM. The reason for the loan request? “Other”.

This is what I suspect behind the scenes:

Six Signs Alternative Lending is Rigged

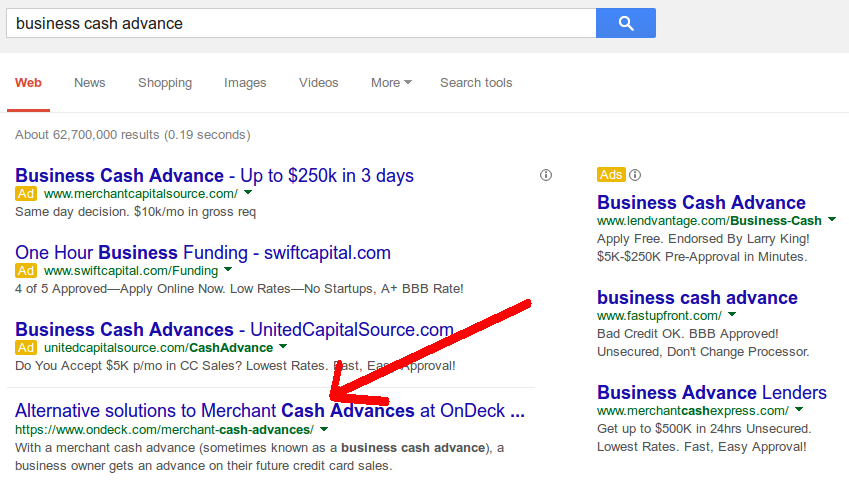

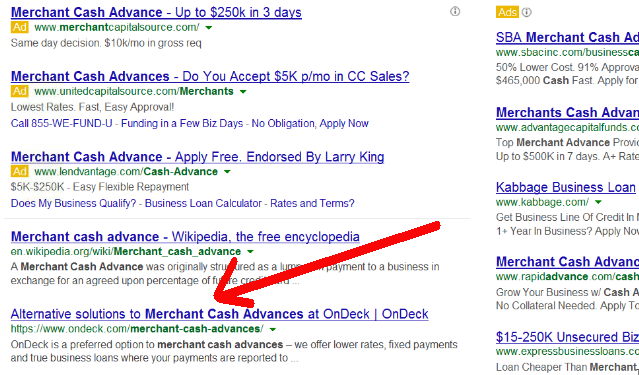

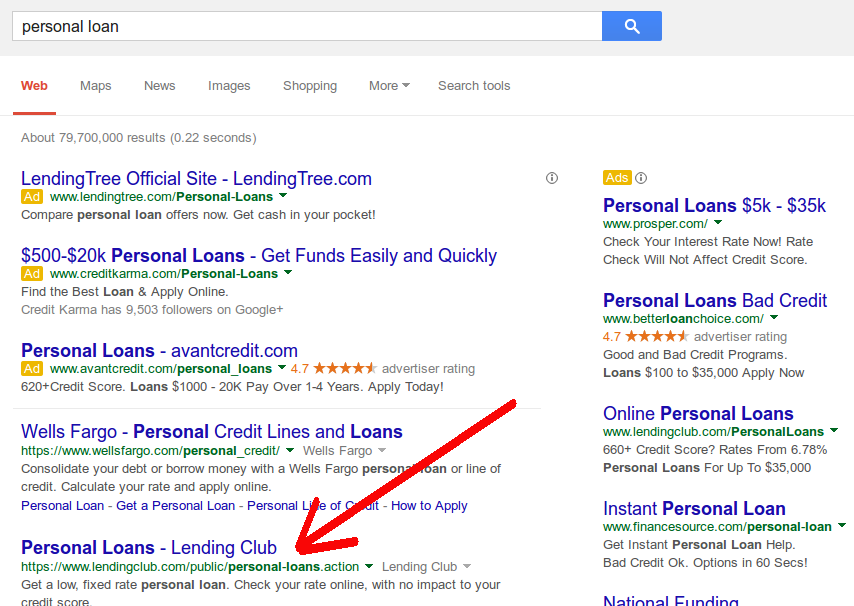

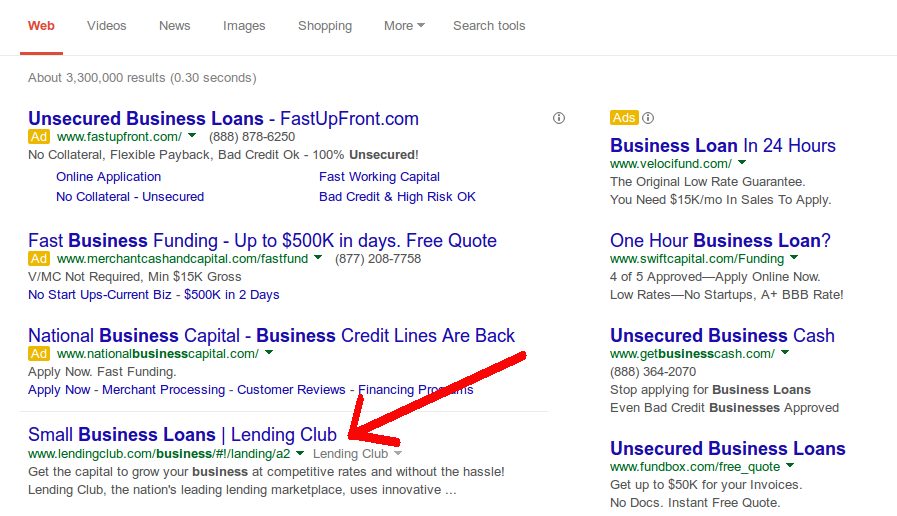

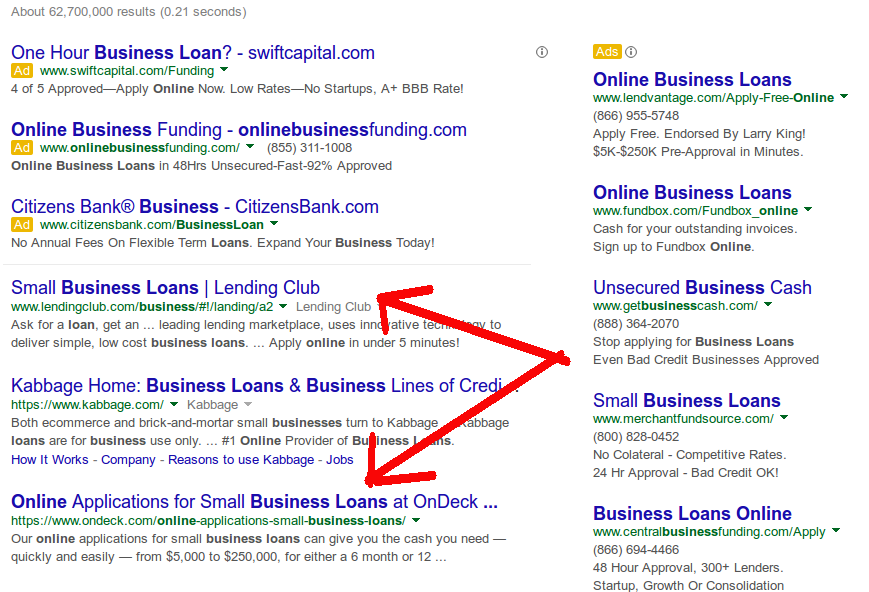

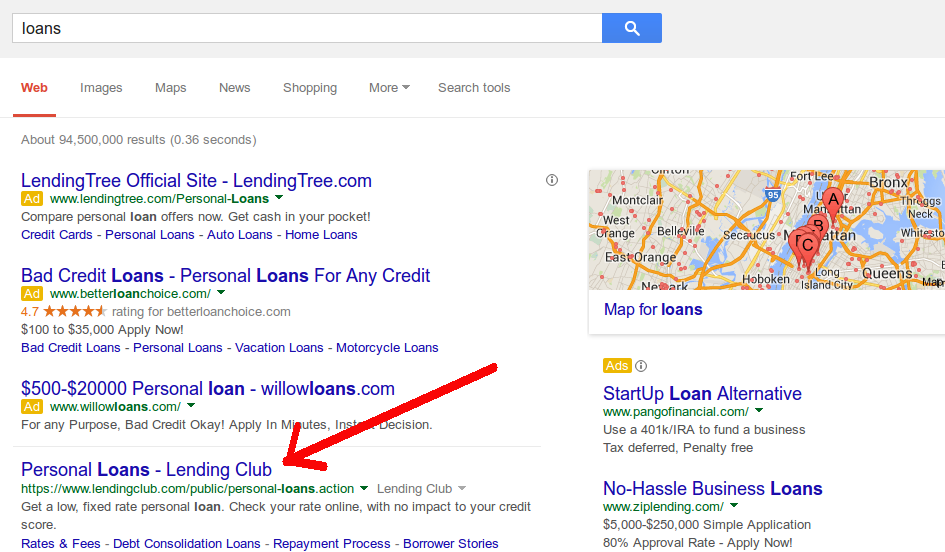

August 3, 2014There’s a lot of players at the alternative lending table but there are two that have won a string of lucky hands to put them on top. Neither were the first to draw cards, nor do either of them offer something that everybody else does not. These two lenders have something in common of course, special favor with the Internet gods. Is the game rigged?

OnDeck Capital is the most celebrated alternative business lender of our time. Their daily repayment loans and fast approval times are a hit with customers. In fact, as told in their recent securitization prospectus, OnDeck has been eroding its reliance on brokers and third parties to accommodate growth through their direct channel. Direct has been good for OnDeck, very good.

LendingClub on the other hand is the big dog in consumer lending, having funded more than $5 billion since inception. Every month they shatter the previous record for volume of loans funded and they’re expected to go public within the next year. LendingClub continues to pound their distant rival Prosper in monthly loan production. Are they just better at marketing?

Curiously I can’t help but notice they have something in common, they’re both owned by Google. Google Ventures led OnDeck Capital’s series D round and Google Ventures’ Karim Faris sits on OnDeck’s board of directors. Similarly, Google owns a minority stake in LendingClub.

While neither is outright owned or controlled, It’d be surprising if Google didn’t do something to foster the success of their investments. What could a billion dollar Internet giant possibly do to give them a little push?

Stop backlinking and SEO. The game is rigged

If you reproduce a search for the same keywords, you should know that results vary depending on what kind of device you’re using (mobile vs. desktop), what zip code you’re in, what time of the day it is, whether or not you’re logged into Gmail/Google+/Youtube, and whether you’ve searched for related topics before. I performed my searches with a fresh desktop browser on a Sunday evening in NYC with all cookies, cache, and Google account sessions wiped clean.

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.

Search engines say that if you’re popular, you’ll rank well. But there are plenty of cases where ranking well has made businesses popular.

Maybe, just maybe the game is rigged…

Yield Baby Yield

July 30, 2014 Somebody once called business loans the Cadillac of Credit products and that person is Brendan Ross, the President of Direct Lending Investments (DLI). In a newsletter he put out in September 2013, he began by saying:

Somebody once called business loans the Cadillac of Credit products and that person is Brendan Ross, the President of Direct Lending Investments (DLI). In a newsletter he put out in September 2013, he began by saying:

Business loans are the Cadillac of credit products, with the highest yields and lowest default rates. Portfolio returns of 13-17% are the norm for successful underwriters – generally private, non-bank institutions.

He goes on to share his firm’s own investment success in these asset classes, claiming to be earning approximately 1% a month. DLI currently manages $48 million, all of which is deployed in alternative lending.

In today’s newsletter Ross admitted the goal is to “maintain unlevered, double-digit, investment returns.” With savings accounts today paying only fractions of a percent, double digits sounds too good to be true. But do you need $48 million to partake in the action?

The truth is you don’t. If you’re an ISO in the merchant cash advance industry you likely have the option to syndicate on your deals and if you’re friends with the right people you can syndicate on deals you don’t even originate.

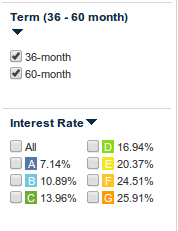

But even then for folks who don’t have tens of thousands or hundreds of thousands at their disposal to recycle into deals, you can still strive for double digit returns through peer-to-peer lenders like LendingClub or Prosper. Through investments as small as $25 a pop you can participate in 3-5 year consumer loans that pay out monthly.

I myself opened a LendingClub account early this year to understand the experience and grew comfortable enough to begin amassing a real portfolio there. You can craft a portfolio based on your yield goals but the higher paying loans have much higher levels of default.

Investing in G-rated loans with an average annual interest rate of 25% doesn’t mean you’ll get that number or that you can even comfortably expect double digit returns. But you can try… And most do.

Investing in G-rated loans with an average annual interest rate of 25% doesn’t mean you’ll get that number or that you can even comfortably expect double digit returns. But you can try… And most do.

In fact the higher yielding loans are bought up fast and furiously every time LendingClub uploads a fresh batch to the platform. They’re added at four precise times a day: 9am, 1pm, 5pm, and 9pm EST. Savvy investors call each interval feeding time and the early bird truly gets the worm. By 9:03 a.m., hundreds of newly added loans are already fully funded and off limits to late investors looking to get the good stuff.

That doesn’t mean there is nothing to invest in if you log on an hour later, but the loans with the most desirable characteristics are nowhere to be found.

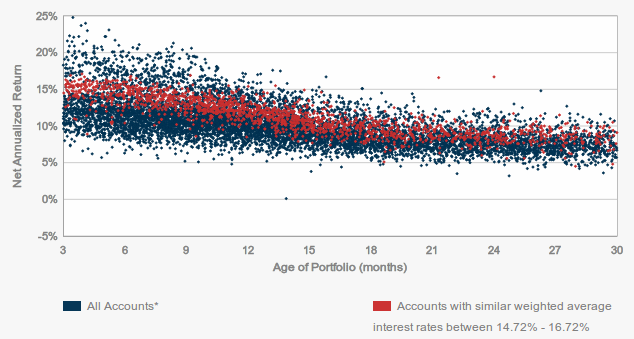

The average interest rate of my own portfolio is currently 15.72% a year before taking into account defaults. Using LendingClub’s sophisticated tools, I can compare how my portfolio is likely to play out against very similar ones on their platform (Same yield range with a minimum of 500 loans). Over the course of 30 months, it suggests that defaults will probably drop my actual yield below 10%.

I have a say in how it will actually play out. For instance if loans in Nevada and Florida are likely to default substantially more than loans in other states, then perhaps I can expect different results between a D-rated loan in Florida and one in Vermont. Using both experience as a merchant cash advance underwriter and the controversial article, The Joys of Redlining as a basis, I never make loans to consumers in Florida, Nevada, or California.

Logging into the platform between feeding times, I often notice an abundance of seemingly attractive but very available loans in those specific states.

Whether that and other aspects of my strategy allow me to prevail with consistent double digit returns is to be determined but I can’t help but contrast even a substantially worse outcome against my savings account which legitimately only pays .01% a year. Not 1% and not .1%. It actually pays .01%.

My S&P mutual funds meanwhile are up more than 6.5% this year already but stocks are far more volatile. I’d also like to add that rather than compare the performances of both and decide to choose 1 over the other, consumer lending is a great way to diversify your overall investment capital. An index fund diversifies your stock holdings but there were very few options for everyday people to invest in outside of the stock market until alternative lending came along.

I still keep some cash in the savings account, but much like Brendan Ross announced in his newsletter today, I’m going full speed ahead with buying loans. In 2014, you don’t have to have $48 million in assets to make the returns that institutional investors can. There’s yield to chase out there and anyone can grab it.

The Missing Puzzle Pieces

July 24, 2014 About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

LendingClub, like the rest of the alternative lending industry relies on ACH debits to retrieve those monthly payments. I’ve published my feelings before on single monthly debit payment systems (they’re like roulette). Out of 30 days of the month, you’re betting on the balance being available on just 1 particular day. When I noticed that 1% of my borrowers were failing right out of the gate, it validated two practices that originated in the merchant cash advance industry, daily payments and the analysis of historical cash flow.

For all the underwriting data points that LendingClub offers its investors, I don’t get to see average daily bank balance, overdraft activity, NSF data, or anything at all related to the borrower’s bank account. Ironically, many merchant cash advance companies consider that data to be the single most important piece of assessing a deal.

The problem my 1%-ers have is not a credit problem or a stable income problem, it’s a cash flow problem. You can have 750 credit and be broke. You can have a good job with a hefty salary and be broke. You and I knew this already, which is why it’s odd that LendingClub and other p2p lenders like them still rely mainly on employment data and FICO score.

What I want to know is if the borrower is broke…

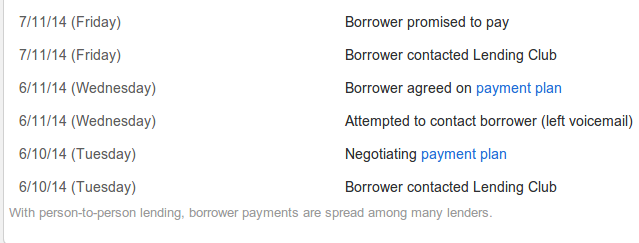

That’s something that LendingClub can’t tell me and doesn’t know. Hence a good looking borrower like the one mentioned below, missed the first payment. That led to a negotiation for a reduced monthly payment. They then failed to pay even the reduced amount.

This was a very low risk B1 note. The borrower is a nurse that has worked at their current job for 5 years. They had over 700 credit and very little revolving debt, only $5,500 (compared to some on the platform that have more than 50k!). It was a 3 year loan and it has blown up in my face.

The borrower is broke and nobody knew it.

The Missing Puzzle Pieces

The Missing Puzzle Pieces

This borrower may very well have done better with a change in how the deal was both underwritten and structured. With daily payments:

- The borrower will know exactly how much cash they can really spend on any given day. They don’t have to worry about trying to set aside for that one big day.

And

By examining their last 3 months bank transactions:

- Their payment plan will be based on more relevant data. There are 3rd party tools like yodlee that consumers could connect their bank accounts to, so at the very least LendingClub could see what’s really going on. Why business lenders consider this essential while consumer lenders completely ignore this, I don’t understand. Business lender Kabbage for example requires applicants to connect their bank accounts in the application process before they even type in their business address. It is the single most important part of their underwriting.

Picking loans on LendingClub is like trying to complete a puzzle without half the pieces. If you guessed the puzzle on the right was an ocean scene with dolphins playing because of the pretty blue border pieces, you were wrong. It’s actually a picture of a guy on a boat holding a bank statement that shows a negative $3,000 balance and 10 NSFs.

Oops…

What Would Barney Frank Say?

July 16, 2014While crowd funders navigate the JOBS Act and a possible revision to what constitutes an accredited investor, non-bank business lenders are raising eyebrows with sky high interest rates. Annual Percentage Rates (APRs) are reaching into the triple digits and critics are reaching for their megaphones to say something about it.

Unfortunately APRs don’t spell out the true dollar for dollar cost, a flaw pointed out by OnDeck Capital CEO Noah Breslow in regards to daily amortizing loans. In the June Access to Capital Small Business Panel, Breslow explained that a 60% APR loan could actually only cost 15% on a dollar for dollar basis over 6 months simply because of daily amortizing.

Still, the figures make for enticing headlines and it is to be expected that they will come under greater public scrutiny as time goes on.

In an opportunity I got to speak one-on-one with former Congressman Barney Frank in June, he offered some pretty interesting thoughts on the governance of business to business transactions.

Frank, who was the key author of the Dodd-Frank Wall Street Reform and Consumer Protection Act that was signed into law in 2010, was a longtime champion of consumer financial protections. But he sings a different tune when it’s all about business. Many people may not realize that he opposed the Durbin Amendment of the Dodd-Frank Act, the addition that placed caps and restrictions on debit card interchange fees. Federal restrictions on how much a business can charge another business? Not his thing…

Frank, who was the key author of the Dodd-Frank Wall Street Reform and Consumer Protection Act that was signed into law in 2010, was a longtime champion of consumer financial protections. But he sings a different tune when it’s all about business. Many people may not realize that he opposed the Durbin Amendment of the Dodd-Frank Act, the addition that placed caps and restrictions on debit card interchange fees. Federal restrictions on how much a business can charge another business? Not his thing…

Unsurprisingly then when I asked him if he’d be in favor of a federal cap on business loan interest rates, he sternly replied, “no.” He went on to say that he supported transparency in business loan transactions, such that the borrower should be easily able to identify the terms, but that the premise behind consumer loan protections was that consumers were less sophisticated.

Curiously, there are a few states that impose caps on commercial interest rates, making the regional landscape for high rate business lenders a little bit tricky. In a recent publication by financial law firm Hudson Cook, they spelled out federal laws that already govern business loans.

To date there has been no legislative activity related to merchant cash advance or alternative business lenders. If such discussion did arise though, it’s ironic to say that one of the most liberal congressmen of the last decade, a man who wrecked Wall Street, would stand to make an excellent champion of the alternative business lending cause.

I never thought I’d say this, but too bad the guy retired.

LendingClub Anti-Money Laundering: Too far?

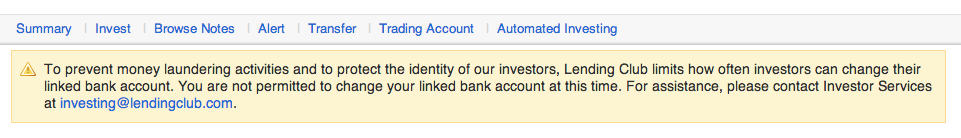

July 16, 2014 Perhaps as part of wider governmental banking pressure, p2p platform LendingClub has instituted a new controversial Anti-Money Laundering policy. The new rule is that you can only connect your investment account to 1 bank account for deposits. This isn’t a technical limitation since as of recent, you could update your bank information at any time. I regularly made deposits to LendingClub from 2 checking accounts but no longer can I do this.

Perhaps as part of wider governmental banking pressure, p2p platform LendingClub has instituted a new controversial Anti-Money Laundering policy. The new rule is that you can only connect your investment account to 1 bank account for deposits. This isn’t a technical limitation since as of recent, you could update your bank information at any time. I regularly made deposits to LendingClub from 2 checking accounts but no longer can I do this.

What’s even weirder is that if you moved from 1 bank to another, you can’t even update the new correct information. You’re cut off. In such a situation, LendingClub offers a high tech alternative, mailing in a paper check from the new account. Why this is more acceptable I do not know.

In my call to LendingClub to complain, they were adamant that all such restrictions were necessary to prevent money laundering. Recalling the discussion now, I think the investment services rep used the term money laundering more than 20 times. Realizing that they wouldn’t budge, I asked if I could update my account information just one last time so that it reflected my main checking account. The answer was ‘no’, due to possible money laundering of course.

So what do you do if you changed banks?

LendingClub said fear not, at regular specified intervals which they cannot reveal, they will allow you to update your banking information. So if you need to update your account info, all you can do is check every day to see if the ban message has gone away. Only then can you update. Better make it a bank account you plan to use for the long haul.

—-

Could the move be due to governmental pressure in the banking and lending markets? I suspect it is.

How Did Kabbage Get Their Name?

July 9, 2014I actually always wondered this myself. Kabbage??? What??? In this short 3 and a half minute video interview with COO Kathryn Petralia she reveals a little bit about how the company started.

Industry Survey Results

July 6, 2014Curious what the general consensus is on a variety of issues? DailyFunder® polled business lending industry insiders and analyzed the results. Click below to expand the graph, check out the image, or scan the text beneath it:

#1 What’s a Merchant Cash Advance?

61% consider it to be strictly a purchase of future revenue.

32% believe it’s an ambiguous term that could be used to describe a purchase transaction or a loan

How much are you earning?

62% reported making at least $100,000 per year

Almost half of the respondents in that group claimed to be making more than $200,000 per year

Stacking

62% said stacking is OK in the right circumstances

19% said stacking is not OK

16% said stacking is the bane of the industry

Who’s earning more?

57% of respondents that were in favor of stacking make at least $100,000 per year

73% of respondents that were against stacking make more than $100,000 per year.

Trade show anyone?

78% would attend an alternative business lending/merchant cash advance conference.

4% flat out said they wouldn’t.

Do you have skin in the game?

58% of respondents have invested funds in a merchant cash advance directly or through syndication

Top influencer?

A substantial portion of respondents wrote in OnDeck Capital CEO Noah Breslow as the most influential person in alternative business lending or merchant cash advance

Is government friend or foe?

49% fear future regulations could hurt their business

25% do not fear future regulations

What do insiders want to read more about?

- Regulatory issues

- Ethics, best practices

- Lead sources, lead generation, marketing strategies, sales guides

- The future, evolving products, trends

This graph appears in the July/August print issue of DailyFunder® magazine. Not subscribed? Get it free!