merchant loans

Lending Club Threatens The Status Quo

March 20, 2014 In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a stir in the merchant cash advance world for a few weeks, but the hype died down. The general consensus was that there would be little to no overlap between the applicants each target.

In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a stir in the merchant cash advance world for a few weeks, but the hype died down. The general consensus was that there would be little to no overlap between the applicants each target.

To this day, I continue to doubt that the overlap will be anything less than substantial. Nik Milanovic of Funding Circle would probably disagree with me. The main argument has been that Lending Club will only target small business owners with good credit, which assumes that businesses with anything less are the only users of merchant cash advances. Not to give anyone’s figures away, but I have seen data to suggest that a large segment of merchant cash advance users have FICO scores in excess of 660. Somewhere along the line we convinced ourselves that merchant cash advances were for businesses with really bad credit. That was never the purpose it was intended for, though it’s true that many applicants have low scores.

Historically, merchant cash advances were for businesses that posed a cash flow risk to banks. Split-processing eliminated that risk by withholding a percentage of card sales automatically through the payment company processing the business’s transactions. Funders today that rely on bank debits for repayment don’t have that safeguard, but they make up for the risk they take by doing something banks don’t do, require payments to be made daily instead of monthly. This allows businesses to manage their cash flow throughout the month and enables the funder to compound their earnings daily. It’s a phenomenon I wrote about in the March/April issue of DailyFunder (Razzle Dazzle Debits & Splits: Daily is the Secret Sauce)

According to the Wall Street Journal, Lending Club will require a minimum of 2 years in business and participation will initially only be open to institutional investors.

Lending Club’s website states that they will recoup funds on a monthly basis via ACH and that interest rates range from 5.9% APR to 29.9% APR + an origination fee. Terms range from 1 to 5 years and there are no early payment penalties.

TechCrunch openly pegs CAN Capital and OnDeck Capital as chief rivals for Lending Club in the space. CAN has enjoyed frontrunner status in the industry since 1998 and while they have been tested in the last 2 years, they haven’t come up against something like this.

In the same Wall Street Journal story, Lending Club’s CEO, Renaud Laplanche lays out who his competitors are with his quote, “The rates provide an alternative to short-term lenders and cash-advance companies that sometimes charge more than the equivalent of 50% annually.”

But will the impact be felt right away? In Laplanche’s interview with Fortune, he claims that it’s very likely they’ll focus on the 750+ FICO segment first, where institutional investors will be comfortable. But make no mistake about it, that will change quick, especially with a probable IPO in the next 8 months.

Is Lending Club really all that big? To draw a comparison, RapidAdvance got a $100 million enterprise valuation when they got bought out by Rockbridge Growth Equity about 6 months ago. Lending Club on the other hand was valued at around $2.3 billion at that time. It took OnDeck Capital 7 years to fund $1 Billion in loans. Lending Club is funding a billion dollars in loans every 3 and a half months. Granted, they’ve all been consumer loans, but let’s not kid ourselves about their capabilities.

Lending Club is funding more consumer loans than the entire merchant cash advance industry is doing combined. Thanks to the peer-to-peer model, they have infinity capital at their disposal. We can pretend that no one with good credit ever applied for a merchant cash advance or we can acknowledge the 3 billion pound gorilla in the room.

Lending Club and other peer-to-peer lenders that follow them will disrupt the alternative business lending status quo.

—

Previous articles on this subject:

Will Peer-to-Peer Lending Burn the Alternative Lending Market?

Lending Club Business Loans are Here

Peer-to-Peer Lending will Meet MCA Financing

Are Loan Underwriting Algorithms Limited?

March 15, 2014As news of OnDeck Capital’s $1 billion milestone spread yesterday,

Crossing the $1B mark in small business loans from OnDeck to #smallbiz around the country! Great way to end the week! pic.twitter.com/U3KUNxjyez

— Noah Breslow (@noahbreslow) March 14, 2014

I couldn’t help but reflect on a major detail revealed about their operation a week prior in American Banker. OnDeck’s underwriting system is not as fully automated as they would have us believe. For the last few years its been said that their success is related to their advanced underwriting algorithm which analyzes thousands of factors. We were reminded of such recently in a Bloomberg interview:

Such capabilities have been received with both awe and skepticism. Do factors like social media activity really make a difference in how loans perform? OnDeck’s CEO, Noah Breslow has openly acknowledged that many of their algorithm’s innovative factors carry little to no weight. Things like credit history, cash flow, and profitability still have a major impact in approval.

American Banker revealed that 30% of all loan decisions at OnDeck are human made. That’s a shockingly high percentage for a company that has 56 employees with backgrounds in math, statistics, computer science, and engineering. Furthermore, as human involvement is reserved for the larger deals, 30% of all loan decisions could easily be 50% of all actual dollars loaned. That would seem to prove that computer automated underwriting is a far greater challenge than anyone could have been led to believe.

With 7 years in business and a tech savvy board of directors that would make most billionaires blush, one has to wonder why so much human involvement is still necessary.

More than a year ago, UK payday lender Wonga almost acquired OnDeck but the deal fell apart in the late stages. Wonga’s CEO is a strong believer that human involvement in underwriting leads to poor decisions not better ones. As was quoted in The Guardian,

Asking for a loan from a financial institution had traditionally involved making a strong first impression – putting on a suit to see the bank manager – then rigorous questioning, checking your documents and references, before the institution made an evaluation of your trustworthiness. In a way, it was exactly the same as an interview, but instead of a job being at stake it was cash.

Damelin found this system old-fashioned and flawed. “The idea of doing peer-to-peer lending is insane,” he says. “We are quite poor at judging other people and ourselves – you get to know that in your life, both with personal relationships and in business. You realise that we’re not as good as we think we are at that stuff, and that goes for almost everybody. I certainly thought I was much better at it.”

That begs the question if that mentality can be applied to (1) lending in the US as opposed to the UK and (2) to businesses as opposed to consumers.

Fast growing merchant cash advance provider Yellowstone Capital hasn’t fully subscribed to the theory that automation is better. In an ISO&Agent interview, Managing Partner Isaac Stern said, “A computer-generated algorithm is no substitute for human analysis when brokering big loans. There are companies making decisions about merchants without ever speaking to them. You cut out a lot of important information.”

Peter Renton, the founder of both Lend Academy and the LendIt Conference shared with me that, “it is very true that [business lending] requires an entirely different skill set when it comes to measuring risk.”

I think a lot of this explains why peer-to-peer lenders like Lending Club were able to get very big very quickly. Pre-packaged factors like FICO score can still largely predict consumer loan performance. That helped them scale because FICO is widely understood and believed to be reliable. Future business performance on the other hand is a mystery. The stock market is a great example of that unknown. Expectations of future performance change every nano-second.

I think a lot of this explains why peer-to-peer lenders like Lending Club were able to get very big very quickly. Pre-packaged factors like FICO score can still largely predict consumer loan performance. That helped them scale because FICO is widely understood and believed to be reliable. Future business performance on the other hand is a mystery. The stock market is a great example of that unknown. Expectations of future performance change every nano-second.

All one thousand variables examined by a computer could confidently signal a lender to approve a loan to a restaurant. But 30 days later when a brand new competing restaurant opens up across the street, all that analysis goes out the window. Loan performance may be nothing like you possibly expected.

Is it any surprise that OnDeck isn’t fully automated? In my opinion, no. But when 30% of all loan approvals are human based, that should be a strong indication that computers can’t go all the way.

Wonga’s Damelin might have it backwards. Humans might be better judges of people than any algorithm could aspire to be. An algorithm creates scalability though. OnDeck would not have broken the $1 billion mark without one. It could just be about allowing a computer to do as much of the human work as possible without delivering significantly worse loan performance results. If you can at least get close to the performance that your best and brightest human underwriters could produce, that may be considered success.

Is There Cause for Alarm?

March 8, 2014

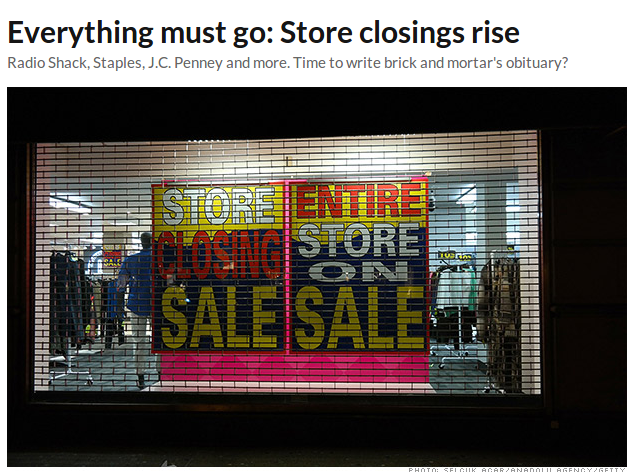

Brick and mortar chain stores died this week, after a long illness. Born along Main Street, raised in shopping malls across post-World War II America, the traditional store enjoyed decades of good health, wealth and steady growth. But in recent years its fortunes have declined. Survived by Amazon.com and online outfits too numerous to list.

– CNN 3/7/14

Just a day after Jeremy Brown’s new CEO Corner post appeared on DailyFunder with an overt bubble warning, CNN’s Chris Isidore alluded that the era of brick & mortar retail may be drawing to a close. In Isidore’s brief sensational article, he fingers an overabundance of retail space, a weak economy, and the Internet as the culprits behind Main Street‘s decline.

In the broad alternative business lending industry, the sentiment is quite the opposite. Small business demand for working capital is surging and no one is predicting anything less than stellar growth for the foreseeable future. But is the growth real?

Jeremy Brown is the CEO of Bethesda, MD-based RapidAdvance and he explains the growth may not be what it appears to be on the surface. Some cash providers are overpaying commissions, stretching out terms longer than what their risk tolerance supports, and are growing by funding businesses that have already been funded by someone else (a practice known as stacking).

If the industry collectively booked 50,000 deals in 2013 and increased that to 100,000 deals in 2014, you’d have 100% growth, or at least it would appear that way on the surface. What if the additional 50,000 deals funded this year were not new clients but rather additional advances and loans made to existing clients? It’s a lot easier to give all of your clients money twice instead of acquiring new ones.

This all begs the question, is demand for non-bank financing really growing by leaps and bounds? Or does it just appear that way because those that have already utilized it are demanding more of it?

Brown left his readers with this conclusion, “There will be a rebalancing at some point. And it will not be pretty.”

Chime in with your thoughts about this on DailyFunder.

—–

When Will the Bubble Burst? by Jeremy Brown will also appear in the next print issue of DailyFunder. If you haven’t subscribed to the magazine already, you can do so HERE.

What’s the Reason Behind the Rise of Non-bank Financing?

March 6, 2014OnDeck Capital CEO Noah Breslow is no stranger to CNBC. Just as word hit the press that his company had raised another $77 million, he made a television appearance to discuss their success.

So why are small businesses owners turning to alternatives?

Many businesses that use alternatives such as OnDeck qualify for traditional bank financing and use the alternatives anyway. Now that’s something to think about…

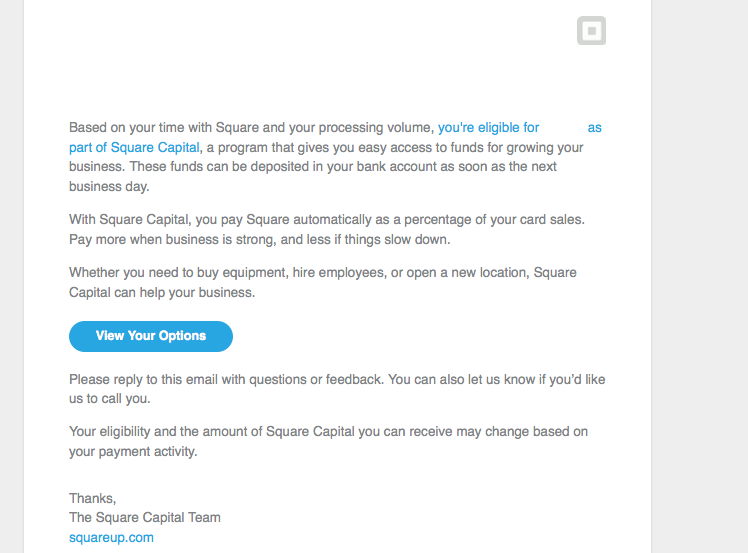

Hello Square Capital

March 1, 2014We’ve seen copies of this notice posted on a few websites now:

Square, the well-known micro-merchant processor with celebrity CEO Jack Dorsey is debuting a merchant cash advance program. Truthfully, I’m not surprised in the slightest. Come on in Square, the water’s fine!

What is still interesting to this day is the realization that so many small business owners have never even heard of the concept. You can check out comments by people on the mr. money mustache forum regarding Square Capital here.

Sell my future credit card sales? What the HECK?!

It’s a 16 year old industry now my friends. One of these days it’d be nice if people just knew this product existed. That seems to be the hardest part…

The Growing Divide

February 28, 2014 It wasn’t too long ago that everyone in this industry knew everyone else. If not personally, then at least through their credit inquiries or UCC names. You crossed paths and acknowledged each other. It was a small world then. Today, not so much.

It wasn’t too long ago that everyone in this industry knew everyone else. If not personally, then at least through their credit inquiries or UCC names. You crossed paths and acknowledged each other. It was a small world then. Today, not so much.

As the barriers to entry have remained low, the simplicity of ACH repayment has drawn in people by the thousands to become brokers, syndicates, and funders. Anyone can be any one of those three or all three at the same time. There’s still the originals out there, the guys who go to the trade shows and visit offices regularly to stay in touch. But then there’s another crowd, the newcomers that don’t file UCCs, attend shows, or interact much with everyone else. They’re funding a half million, a million, or even $5 million a month and no one really knows they exist except for their own clients. The merchant cash advance industry which was once a shadowy market in its own right now has its own shadowy sector within it.

At the Factoring 2014 conference in April, the President of Fora Financial is poised to debate the Business Development manager of Credit Cash on the subject of whether or not merchant cash advance transactions are true sales. The truth is that I have seen so many variations of funding contracts out on the street that the merits of that debate may be flawed. No one knows what a merchant cash advance is anymore. It’s a point I argued in You Can’t Ask How Big it Is Without Defining What it is in January’s issue of DailyFunder.

The industry is made up of people that deal in daily payments. How these deals are structured vary widely. Indeed there is a growing divide.

Emotions are running high in 2014 and some grievances are practically coming to blows. Stacking is as polarizing a debate as Obamacare. There are folks that believe there is no precedence for dealing with stacking, but stacking is as old as MCA.

Many years ago it was cut and dry. If one company purchased the future revenues of a small business, it was contractually impossible for a second company to buy that same block of future revenues. “How could someone else buy what has already been sold?” so the argument went…

In 2007-2008, stacking was a merchant problem, whereby small business owners would devise ways to get double or triple funded in a very short amount of time so that each company didn’t know about the other until long after the money had been wired. Much of the arguments in favor of stacking back then came from the merchants themselves who felt that MCA contracts bordered on being unlawfully restrictive because it prevented them from obtaining virtually any outside financing unless the MCA was satisfied in full. Without the capital to satisfy their entire outstanding MCA balance, they were locked into renewing with the same company indefinitely with little leverage to negotiate future terms, so the argument went…

Today, it’s the funding companies that bear the brunt of criticism from their peers for stacking, mainly because they do it willingly and are not being deceived by merchants. It is perceived as a funder problem.

In March of 2008 (a full 6 years ago), the Electronic Transactions Association (ETA) established the following guidelines on the issue in their MCA white paper:

In order to effectively manage risk and prevent a merchant from becoming over-extended, merchants should not knowingly be allowed to “stack” advances (obtaining an additional advance when an outstanding balance on a previous advance exists). In the event additional advances are sought, the original advance should be paid off directly to the previous Merchant Cash Advance Company [MCAC] by the new MCAC (to ensure that the merchant does not retain funds due to the previous MCAC) with a portion of the proceeds given on the current advance.

The ETA calls for many common sense standards such as fair retrieval rates, sound underwriting, and legal collections practices. The advice is timeless and I suggest everyone read it. The industry might be growing apart but many of the fundamentals are the same.

Still, with the new crowd of near-anonymous funders, it is impossible to know what everyone’s intentions are. Given the low barriers to entry, there’s also the question as to whether or not the newcomers are legally prepared to book such deals. The industry is fraught with risks and always has been.

I just hope that as the divide grows, we are all united by a common goal, acting in the best interest of small businesses.

Lending Club Business Loans are Here

January 19, 2014 As mentioned in a thread on DailyFunder, I have personally seen evidence that Lending Club is already doing business loans. The loan was issued this month in the amount of $35,000 and disbursed to a business, not an individual.

As mentioned in a thread on DailyFunder, I have personally seen evidence that Lending Club is already doing business loans. The loan was issued this month in the amount of $35,000 and disbursed to a business, not an individual.

I have been very outspoken about my belief that peer-to-peer lenders will compete directly against merchant cash advance companies and their short term lending counterparts. I am now absolutely positive that will be the case as the first merchant I saw to receive a Lending Club business loan was a former user of merchant cash advances.

One has to ask themselves if Lending Club will be targeting UCCs, particularly those of their new closest competitors in the space, OnDeck Capital and NewLogic. I was not able to determine the terms of the Lending Club loan but it is still my expectation that it will be a 3-5 year deal with automated monthly payments. Compare that against the industry’s dominant short term lenders that do 1 year deals with automated daily payments.

You can argue that there will be very little overlap in the merchants these companies target but I have seen overlap right out of the gate.

I expect we’ll all see a lot more of this.

Will Peer-to-Peer Lending Burn the Alternative Business Lending Market?

January 12, 2014For months I’ve been saying that peer-to-peer lenders will be companies to look out for, the latest being on December 29th. Lending Club fully intends to make the leap from consumer lending to business lending which may possibly pit them against the world of merchant cash advance.

In this video, a Bloomberg reporter asks OnDeck Capital’s CEO if his company will get burned by peer-to-peer lending.

If you watched the whole thing, you might also hear the insinuation that OnDeck’s product is similar to factoring since Breslow explains his loan program much like a merchant cash advance account rep would. “You simply pay x cents on the dollar”

I think there is room for both Lending Club and OnDeck. It’s the little funders of the world that will eventually feel a squeeze.