merchant loans

Should Licensing and Accreditation Come to MCA?

August 13, 2014 It’s not said often, but it has been suggested by some players in the merchant cash advance industry to introduce sales licensing requirements. Anybody can sell and broker MCAs or alternative business loans, even your mom.

It’s not said often, but it has been suggested by some players in the merchant cash advance industry to introduce sales licensing requirements. Anybody can sell and broker MCAs or alternative business loans, even your mom.

That’s been a boon for growth but a bust for maintaining any kind of uniformity or standards. That’s a bad position to be in when influential political leaders are beginning to talk about oversight and regulation, even if it’s way too early to sound the alarm.

Earlier today, former SBA head Karen Mills published, Can Lending Technology Revive America’s Small Businesses? in which she states, “there is already concern that, if left unchecked, small business lending could become the next subprime lending crisis.”

One way to dispel future regulation is through self-licensing, much like the payments industry worked to pull off three years ago. For the first time ever, merchant account sales reps could take an official exam and become a CPP, a Certified Payment Professional. This originated when I was still directly selling merchant cash advances and along with it, merchant accounts.

Merchant accounts were the focus of my compensation strategy and I seriously considered taking the first ever CPP exam in 2011 even though it cost $350. I considered it solely on the basis of whether or not it would convince more people to change their merchant accounts. I finally decided to wait and see if it was helping others before jumping in myself. The question in my mind was, would merchants care? If not, then why busy myself with being accredited?

Now that three years have gone by, the Green Sheet is attempting to answer this question: Is the CPP Dead on Arrival? Members of their forum reported that accreditation had no teeth because the Electronic Transactions Association (ETA) which created it, lacks industry oversight authority. Others said it was a flawed idea from the beginning. And just as I expected to find, there is belief that merchants do not recognize it as meaningful, don’t know about it, or they don’t care.

Now that three years have gone by, the Green Sheet is attempting to answer this question: Is the CPP Dead on Arrival? Members of their forum reported that accreditation had no teeth because the Electronic Transactions Association (ETA) which created it, lacks industry oversight authority. Others said it was a flawed idea from the beginning. And just as I expected to find, there is belief that merchants do not recognize it as meaningful, don’t know about it, or they don’t care.

The story concludes by saying there is hope since three years is too early to judge CPP adoption. Regardless of what will become of CPPs, today any person with access to a phone or the Internet can sell merchant accounts. If you don’t understand how interchange works or what it is, it doesn’t matter.

Ironically, in the very same Green Sheet issue there is a story that argues the secret to selling merchant accounts successfully is really just about having the right tone. Accreditation? What’s that? Interchange? Huh? Instead, ask the owner a few things about their business, “match your response as closely as possible to that of the merchant. Use similar words. Try to pause as the prospect paused.”

The advice touches upon an interesting aspect of sales, that your clients don’t necessarily care about how smart or knowledgeable you are about the subject matter. They’re buying YOU even if your product sucks. Compare that to say accounting where prepared financial statements need to be constructed in such a way to comply with IRS codes or law where a lawyer needs to be admitted to the Bar to practice. In those cases the clients can’t even receive the service unless the seller meets certain professional standards.

And that’s where accreditations become murky. As a business owner, you’re allowed to wildly overpay for printer ink and buy it from someone who doesn’t know anything about printers or ink. I’ve done it myself. I don’t care if they have a certificate in printing expertise or if they’re members of the National Ink Masters of America. Part of being a business owner means being automatically qualified to make transactional decisions.

The same can be applied to merchant accounts. Need to accept cards? Find a rep you like that can articulate what’s important to you. You can make a deal based on no intellectual substance or one completely dependent on it. If it’s not legally required to be a CPP, then the target audience needs a lot of convincing as to why it should be important to them.

Tom Waters and Ben Abel of Bank Associates Merchant Services are the writers behind the CPP DOA piece in Green Sheet and they admit that success in mainstreaming accreditation can and has taken up to 25 years in other industries. That of course brings me full circle to MCA and business lending. The enormity of self-licensing could take years or perhaps even decades to nail down. And even if they were instituted, would the merchants care? That’s the question I ask myself.

With virtually no outcry from merchants over best practices currently, I think the dream some have of becoming a CMCAP (Certified Merchant Cash Advance Professional) will have to be put on hold. Of course you could always be proactive and become a Certified Lender Business Banker, though I predict it would do nothing to help you in this business.

The reality is that we should expect to live with the status quo at least for now. My advice is to be honest, fair, and a good example for everyone else. Do that and we’ll never have to worry.

—-

What Would Barney Frank Say?

July 16, 2014While crowd funders navigate the JOBS Act and a possible revision to what constitutes an accredited investor, non-bank business lenders are raising eyebrows with sky high interest rates. Annual Percentage Rates (APRs) are reaching into the triple digits and critics are reaching for their megaphones to say something about it.

Unfortunately APRs don’t spell out the true dollar for dollar cost, a flaw pointed out by OnDeck Capital CEO Noah Breslow in regards to daily amortizing loans. In the June Access to Capital Small Business Panel, Breslow explained that a 60% APR loan could actually only cost 15% on a dollar for dollar basis over 6 months simply because of daily amortizing.

Still, the figures make for enticing headlines and it is to be expected that they will come under greater public scrutiny as time goes on.

In an opportunity I got to speak one-on-one with former Congressman Barney Frank in June, he offered some pretty interesting thoughts on the governance of business to business transactions.

Frank, who was the key author of the Dodd-Frank Wall Street Reform and Consumer Protection Act that was signed into law in 2010, was a longtime champion of consumer financial protections. But he sings a different tune when it’s all about business. Many people may not realize that he opposed the Durbin Amendment of the Dodd-Frank Act, the addition that placed caps and restrictions on debit card interchange fees. Federal restrictions on how much a business can charge another business? Not his thing…

Frank, who was the key author of the Dodd-Frank Wall Street Reform and Consumer Protection Act that was signed into law in 2010, was a longtime champion of consumer financial protections. But he sings a different tune when it’s all about business. Many people may not realize that he opposed the Durbin Amendment of the Dodd-Frank Act, the addition that placed caps and restrictions on debit card interchange fees. Federal restrictions on how much a business can charge another business? Not his thing…

Unsurprisingly then when I asked him if he’d be in favor of a federal cap on business loan interest rates, he sternly replied, “no.” He went on to say that he supported transparency in business loan transactions, such that the borrower should be easily able to identify the terms, but that the premise behind consumer loan protections was that consumers were less sophisticated.

Curiously, there are a few states that impose caps on commercial interest rates, making the regional landscape for high rate business lenders a little bit tricky. In a recent publication by financial law firm Hudson Cook, they spelled out federal laws that already govern business loans.

To date there has been no legislative activity related to merchant cash advance or alternative business lenders. If such discussion did arise though, it’s ironic to say that one of the most liberal congressmen of the last decade, a man who wrecked Wall Street, would stand to make an excellent champion of the alternative business lending cause.

I never thought I’d say this, but too bad the guy retired.

Access to Capital – A Dose of Reality

June 15, 2014So much for a lack of transparency… While sitting directly next to Maria Contreras-Sweet, the head of the Small Business Administration, OnDeck Capital’s CEO corrected U.S. Senator Cory Booker’s comments about the APR of their loans. High teens? Not so, said Noah Breslow who explained their average 6 month loan has an APR of 60% even while costing only 15 cents on the dollar.

Why is access to capital so expensive? Rob Frohwein, the CEO of Kabbage said that up until recently his company was borrowing funds at a net rate of more than 20% APR. In order to turn a profit, they had to lend at a rate much higher than that.

Great info about democratizing #Access2cap for #smallbiz w/ @CoryBooker @RutgersU. More info @SBAgov pic.twitter.com/qxCu2tbW4z

— Maria ContrerasSweet (@MCS4Biz) June 13, 2014

.@rohitfounder and Sen. @Corybooker at Access to Capital New Jersey #Access2cap pic.twitter.com/FRfoAH2CjU

— Biz2Credit (@biz2credit) June 13, 2014

The Access to Capital small business panel included:

Maria Contreras-Sweet – Head of the U.S. Small Business Administration

Noah Breslow – CEO, OnDeck Capital

Rohit Arora – CEO, Biz2Credit

David Nayor – CEO, BoeFly

Rob Frohwein – CEO, Kabbage

Paul Quintero – CEO, Accion East

Rohan Matthew – CEO, Intersect Fund

Jonny Price – Senior Director, Kiva Zip

Jeff Bogan – SVP, LendingClub

Steve Allocca – Global Head of Credit, PayPal

Jay Savulich – Managing Director of Programs, Rising Tide Capital

Do Opportunities Abound?

June 8, 2014 Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.

Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.

Me: You guys looking to recruit ISOs?

Them: Damn right

As far as the industry is concerned, these guys might as well have fought in ‘Nam. They’re from another generation where life was hard and men were still men. When businesses couldn’t get bank loans, these guys were splitting payments with their bare hands and reprogramming credit card machines with nothing more than a paper clip and a ball of twine. Funding a deal wasn’t a product of technology, it was one of sweat, tears, and blood. Have you ever bled for your deals?

This August I celebrate my 8th year in the industry. Next month marks the 4 year anniversary of this blog. I enjoy reading some of my posts from back then, particularly since most of them discuss the ordeals of credit card processing. A lot of what I’ve written no longer applies and some of what I’m writing these days will be outdated years from now. As I approach 600 articles and blog posts on this subject matter, I’ve had to stop and ask myself if everything has already been written. What more can possibly be said about this business? Perhaps the tale of the industry has already been told and I am on my way to retelling exaggerated stories to anyone who will listen. I don’t want to be that wrinkled up old man swaying back and forth in a rocking chair talking about how ISOs got it so easy these days.

Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

But the story’s not finished. Every passing month is filled with events that inspire a dozen new chapters, which is more than one man can keep up with. Last month at the LendIt conference, I got a glimpse of just how many opportunities still lie ahead.

Some alternative business financing companies such as Funding Circle and DealStruck are diverging away from merchant cash advance and going back to the traditional roots of term lending. Funding Circle is doing it with a 21st century twist, by making their system peer-to-peer based.

Still other firms have sprung up around LendingClub’s and Prosper’s APIs and offer their users ways to make better loan investment decisions.

And even among the players we’re all familiar with, there is innovation, growth, and new ideas. Just recently CAN Capital launched CAN Connect, a software application that can be integrated with any other company’s software. According to CAN’s release,

Through CAN Connect™, merchants will be able to receive a CAN Instant Quote™ based solely on data provided by the partner. Once the merchant elects to proceed, they are taken through a simple online application process and can obtain access to working capital without ever leaving the partner’s platform.

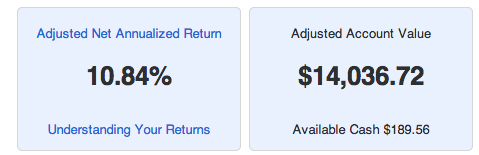

Indeed technology has even allowed me to become a lender myself,

My LendingClub portfolio, which is still very young and made up by hundreds of $25 consumer loan contributions has a current Net Annualized Return of more than 10%. Contrast that against the average U.S. savings account that pays out less than 1%.

While it’s certainly not the 54% yield that OnDeck Capital enjoys, there are levels of risk and markets set up for just about anyone interested in alternative lending.

And what might come next may not all be broker/funder related. As the industry flies in a thousand different directions, entire new industries and services are going to grow up around them. That brings me back full circle. Has everything already been written? 4 years of blogging here and this might as well be my first day.

Some things haven’t changed a bit, but the rest of it, well… we must soldier on in this strange new world.

Do you see opportunities ahead? Discuss with industry insiders on DailyFunder.

Make Your Voice Heard

May 29, 2014Have an opinion on which way the industry is headed? Or eager to read about events that you feel are most relevant? DailyFunder is running a preliminary research survey geared towards those involved in merchant cash advance and alternative business lending. It’s completely anonymous and it will be used to help steer the direction of DailyFunder, the only alternative business lending publication. That means we want to know how you think, what you think, and what you care about.

Collected responses already prove that industry insiders have a lot to say, especially in the write-in questions. So go and make sure your voice is heard. It’s anonymous and it’ll only take a minute or two.

Some of the statistical results may be published in the next issue of the magazine.

START SURVEY

Industry Leaders Tell All (Videos)

May 25, 2014A few weeks ago, I recapped my two days at the LendIt conference in San Francisco.

Peter Renton of Lend Academy, who hosted the conference, is putting up the professionally finished videos on his youtube channel. I’ve embedded the ones I think you’ll find most relevant, though I think there’s still one or two good ones that aren’t up yet.

As a side note, many of you in the merchant cash advance space have asked if LendIt was worth it. The answer is yes, but it is not a place to recruit ISOs. I actually don’t think there were any ISOs there at all. It was a good place to meet institutional investors, technology companies that cater to alternative lenders, leading industry attorneys, and the wild pack of peer-to-peer lenders. Basically, it was a way to hear and see everything outside of the bubble that can be merchant cash advance.

Next year it’s in New York City and I’ll definitely be attending again. And on that note, check out the full videos below:

The Deal

May 25, 2014When times are tough, small businesses take chances. Last year, a family run business in Cohasset, MA made a snap decision and agreed to a $75,000 loan with infinity percent interest, literally. The principal was completely repaid in just 74 days but as per the contract, they still had to make fixed interest payments for as long as the business was open.

It wasn’t necessarily a good deal. Heck, some might think it was a really bad deal, but they got the cash when they needed it. The perpetual fixed payments kicked in after the principal was repaid because the lender structured them as royalty fees. A normal merchant cash advance will take a percentage of a merchant’s sales up until a predetermined amount has been satisfied, but this deal required a percentage forever. Is Wall Street running amok yet again? Shouldn’t people be monitoring stuff like this?

As it would turn out, about 6.5 million people were witness to this transaction. More than half of those people, most of whom are hard-working American families, cheered the business owner on. That’s because this deal had nothing to do with Wall Street and did not involve a commercial loan broker.

The business is named Wicked Good Cupcakes and it’s a deal they made on Shark Tank, a hit TV show on ABC. Kevin O’Leary loaned them $75,000 and took a percentage of every sale until he was repaid just 2.5 months later. Since then he is taking a permanent royalty of 45 cents per cupcake sold.

As quoted in the Boston Business Journal

“The royalty deal has worked great for us,” said Tracey Noonan, the CEO of the company.

Many people told her immediately following the deal that she was stupid. But today, Wicked Good Cupcakes is doing better than ever.

O’Leary, whom the business owners called an “angel in disguise” has referred to the deal as one of the most phenomenal ever made on the show. Wicked Good Cupcakes is actually on pace to do $3 million in revenue in 2014.

While it’s true that part of their success is due to the appearance on the show, nowhere does it say that entrepreneurs have to agree to take a deal if offered one. That means the owners could have walked away from O’Leary’s offer and still experienced the same post-show hysteria of celebrity. But they needed the money… and there was an offer on the table. It wasn’t the best deal, but it was A deal.

And that’s the nature of business. Everything is about circumstances. You could be flush with cash or in a pinch, growing fast or playing defense. All the while opportunities and obstacles approach from every turn.

Unlike consumers who are afforded protections from making decisions that might not be in their best interest, small businesses are free to pursue whatever strategy they want. The best part about capitalism is that you’re the master of your own destiny.

Unlike consumers who are afforded protections from making decisions that might not be in their best interest, small businesses are free to pursue whatever strategy they want. The best part about capitalism is that you’re the master of your own destiny.

The terms O’Leary offered to Wicked Good Cupcakes were not unique. Just recently in the 12th episode of Season 5, he offered a $100,000 loan to Tipsy Elves that once repaid, would still require payments in perpetuity in the form of a royalty fee for every sale. That’s an equivalent APR of infinity. In the end, they turned it down and went with Robert Herjavec’s equity offer instead.

Many viewers have taken to twitter to share their doubts about the viability of the Tipsy Elves business model, which is selling ugly Christmas sweaters. That healthy dose of skepticism is something alternative lenders are no strangers to, and as such they tend to price their deals accordingly.

Even deal making that is done on TV in front of millions of witnesses can go sour. Just ask Marcus Lemonis, the star of the TV show The Profit, who recently made a deal with a business in my own backyard, A. Stein Meat Products in Brooklyn, NY. After learning the business was on the brink of insolvency, Lemonis offered them a cash lifeline in exchange for buying their Brooklyn Burger brand at a bargain price of $190,000. In any other circumstances, that deal might not have happened.

Lemonis expeditiously wired them the cash, but never got what he paid for in return. Mora and Buxbaum, the owners, claim the funds were a loan but they have never made a payment. Defaults like these happen every day, especially in alternative business lending.

Hated to do it but here's the update on stein meats and Brooklyn burger. I tried not to but was ignored for 90 days. http://t.co/4oyYOiXK68

— Marcus Lemonis (@marcuslemonis) May 16, 2014

The entrepreneur applies for a business loan, the loan gets made, and the borrower quickly defaults. The result is that the price goes up for the next guy. That’s the risk part that lenders always talk about, the odds that they’re not going to get paid back. If every business repaid their loans, the average cost of financing in alternative business lending would probably be about 6% a year, around what an A rated personal loan costs on LendingClub, instead of the high double digit or triple digit rates that exist now.

Even Kevin O’Leary isn’t taking any chances, hence he protects himself by charging infinity percent interest, and America thanks him every Friday night for blessing entrepreneurs with an opportunity. It’s not the best deal, but it’s A deal.

Small business owners are sophisticated enough to make tough decisions all on their own. That’s the reason we can put them in the public eye, in front of more than 6 million people who either cheer for their success or literally cry out for their demise. These entrepreneurs don’t go on Rainbow & Unicorn Tank, they go on Shark Tank. Sometimes the entrepreneurs walk away with a partner, sometimes they get a loan with infinity percent interest. In the end, it’s their choice, a choice that 36,000 small businesses hoped they would have in 2012. That’s how many applied to be on the show that year.

Business is business and a deal’s a deal. The ball’s always in your court…

Quotes from Kevin O’Leary

Business is war. I go out there, I want to kill the competitors. I want to make their lives miserable. I want to steal their market share. I want them to fear me and I want everyone on my team thinking we’re going to win.

Here’s how I think of my money – as soldiers – I send them out to war everyday. I want them to take prisoners and come home, so there’s more of them.

You may lose your wife, you may lose your dog, your mother may hate you. None of those things matter. What matters is that you achieve success and become free. Then you can do whatever you like.

I’m not a tough guy. I’m just delivering the truth and only the truth and if you can’t deal with it, too bad.

Nobody forces you to work at Wal-Mart. Start your own business! Sell something to Wal-Mart!

Don’t cry about money, it never cries for you.

The only reason to do business is to make money; that’s the only reason for doing business.

Money has no grey areas. You either make it or you lose it.

Working 24 hours a day isn’t enough anymore. You have to be willing to sacrifice everything to be successful, including your personal life, your family life, maybe more. If people think it’s any less, they’re wrong, and they will fail.

I have met many entrepreneurs who have the passion and even the work ethic to succeed – but who are so obsessed with an idea that they don’t see its obvious flaws. Think about that. If you can’t even acknowledge your failures, how can you cut the rope and move on?

I don’t mind rude people. I want people that I can make money with, so if their executional abilities are good, and they’re arrogant and rude, I don’t care.

Can you handle it?

The Real Impact on Small Business

May 22, 2014 It’s not easy being in the lending business. Just talking about money can make people uncomfortable. Bringing up how much money you have, don’t have, or wish you had is like bringing up politics at Thanksgiving dinner. It’s taboo in this society. It’s even rude to ask somebody how much they make a year. That’s one of two reasons why being a lender or loan broker is so difficult, you’re forced to dive head first into emotionally charged waters.

It’s not easy being in the lending business. Just talking about money can make people uncomfortable. Bringing up how much money you have, don’t have, or wish you had is like bringing up politics at Thanksgiving dinner. It’s taboo in this society. It’s even rude to ask somebody how much they make a year. That’s one of two reasons why being a lender or loan broker is so difficult, you’re forced to dive head first into emotionally charged waters.

The second reason is telling an applicant ‘no’. It feels personal even if it’s not. “It’s just business,” the bearer of bad news will say, but it never feels that way. I know that firsthand through my experience as both a broker and an underwriter. Rejection is a painful experience for an applicant no matter how professional they are.

But sometimes you get to tell an applicant ‘yes’ and that can be an emotionally moving experience as well. Looking back, the only applicants I ever heard cry were the ones that got approved. Some of those approvals were expensive but they were given an opportunity in a world where up until that point, no one was willing to give them any opportunity at all. They were the forgotten businesses of America.

PayPal’s VP of SMB Lending recently said that he feels “blessed to be serving this higher need.” Blessed was an interesting word choice. Being able to support small businesses doesn’t just make him feel happy or hopeful or satisfied, it makes him feel blessed.

What is the real impact that alternative financing companies have on small businesses? Thanks to the funding companies who took the time to find out. Today, we can see for ourselves:

Above is just a small handful of the testimonials you can find on the websites of CAN Capital, Kabbage, RapidAdvance, Fora Financial, and Merchant Cash and Capital. Real businesses, real stories, real impact.

And there you have it…