Marketplace Lending

Lending Club Borrowers Are Paying Off Really Early – And There’s Something Weird About It

February 11, 2016 This week I surpassed more than 500 lifetime early note payoffs on Lending Club. Considering that loans on the platform are either for a fixed term of 36 months or 60 months, I was quite surprised to see that the average early payoff was happening just 10 months in. My portfolio is too young for even the first loans I ever bought to have reached maturity so the data isn’t entirely statistically relevant. But to put what I’ve experienced so far in perspective, out of every note I’ve ever bought on this platform up to and including today, 17% of them have already paid back early in full.

This week I surpassed more than 500 lifetime early note payoffs on Lending Club. Considering that loans on the platform are either for a fixed term of 36 months or 60 months, I was quite surprised to see that the average early payoff was happening just 10 months in. My portfolio is too young for even the first loans I ever bought to have reached maturity so the data isn’t entirely statistically relevant. But to put what I’ve experienced so far in perspective, out of every note I’ve ever bought on this platform up to and including today, 17% of them have already paid back early in full.

One borrower paid back their 3-year loan in just 8 days!

Of the 145 5-year notes I bought just 20 months ago in May 2014, 36% of them have already paid back in full. This is astounding, but apparently old news. A PeerCube analysis conducted two years ago revealed that 80.6% of all fully paid loans were pre-paid in full before reaching maturity.

At face value, these statistics could be used to boost investor confidence. The loans are so affordable that just look at how many people are paying off early! But according to Anil Gupta at PeerCube, these borrowers might not be paying these loans off at all. Lending Club might be refinancing the loans with a new loan, which cashes out the original investors early in the process. As said in his analysis:

A PeerCube user who is also a borrower on Lending Club mentioned that he has been receiving requests from Lending Club to refinance his loan. Such offers are very attractive to borrowers whose FICO score may have gone up since taking the first loan. In this case, the second loan may come with lower interest rate due to improved credit score. Moreover, there is no deterrent in the form of pre-payment penalty for borrowers to refinance the loan. Lending Club benefits from a borrower refinancing an existing loan by charging additional origination fee from the second loan, i.e. more revenue.

Lending Club’s website says that to be eligible for a second loan, borrowers have to have made 12 months of successful, on-time payments on their existing Lending Club loan. “Sometimes,” however, they “identify customers who are eligible for an additional loan before those 12 months and ask them to apply.” That’s the policy for having two active loans at once, not for refinances specifically.

Lending Club’s quarterly earnings reports make no clear mention of repeat borrowers and there’s no way for an investor to know if the debt consolidation loans they’re taking risks in are really just refinances of existing Lending Club loans. But even if they were, that wouldn’t necessarily make them a bad thing.

Would you rather invest in a borrower who has already proved 12 months of positive payment history OR somebody brand new? But then again, would you rather invest in a refinance of a loan that was originally taken to refinance a credit card?

There’s a downside to loans being paid off early. If an equal reinvestment opportunity does not exist to immediately replace the paid off loan, then the investor loses. If they are no longer reinvesting anyway, then an early payoff deprives the investor of the interest to offset future chargeoffs from the remaining loans that will go bad. And worse yet, investors are forced to pay a penalty to Lending Club for any loan that pays off early after the first 12 months in the form of a 1% fee on all outstanding principal. Seriously, investors are penalized for early payoffs for which they have no control over and are not allowed to know why or how the borrower paid off earlier.

Sounds very weird to me…

Bizfi Welcomes Record Quarter, Raises Equity

February 10, 2016![]() Bizfi, the marketplace lender for small businesses, originated a record $142 million in business financing in the last quarter of 2015.

Bizfi, the marketplace lender for small businesses, originated a record $142 million in business financing in the last quarter of 2015.

Formerly known as Merchant Cash and Capital, they have financed over 27,000 small businesses through their proprietary marketplace with over $1.4 billion since 2005. They rebranded to Bizfi in 2015 and raised $65 million from Metropolitan Equity Partners for adding products and speeding up funding.

When company founder Stephen Sheinbaum was asked by deBanked about the possibility of exploring personal loans, they said they would only do that through their partnerships with companies like OnDeck, Funding Circle and Kabbage. Sheinbaum also said that they were considering referrals and marketing tie-ups with some of these companies.

Bizfi’s lending platform provides a host of funding options like short-term financing, medical financing and lines of credit. The company plans to add more partners enriching their product offerings, among other plans. Alluding to immediate growth plans, Sheinbaum said that the firm will raise institutional equity this year along with augmenting the underwriting process to attract more customers as well as forging new partnerships.

Meet Fora Financial’s Co-founders Jared Feldman and Dan Smith

February 5, 2016Entrepreneurs Jared Feldman and Dan Smith launched their company Fora Financial in 2008. Today it has placed more than $400 million in funding through 14,000 deals. Late last year, they sold part of their company to Palladium Equity Partners LLC for an undisclosed sum, but it is rumored to be quite sizable. It’s almost by coincidence that they named their company “Fora,” which means marketplace in latin, years before “marketplace lending” would become an industry buzzword.

Palladium, which describes itself as a middlemarket investment firm, decided to make the deal partly because it was impressed by Smith and Feldman, according to Green. “Jared and Dan have a passion for supporting small businesses and built the company from the ground up with that mission,” he said. “We place great importance on the company’s management team.”

The Palladium deal marked a milestone in the development of Fora Financial, a company with roots that date back to when Smith and Feldman met while studying business management at Indiana University. After graduation, Feldman landed a job in alternative funding in New York at Merchant Cash & Capital (today named BizFi), and he recruited Smith to join him there. “That was basically our first job out of college,” Feldman said.

It struck Smith as a great place to start. “It was the easiest way for me to get to New York out of college,” he said. “I saw a lot of opportunity there.”

The pair stayed with the company a year and a half before striking out on their own to start a funding company in April 2008. “We were young and ambitious,” Feldman said. “We thought it was the right time in our lives to take that chance.”

The full 4-page featured story appears in deBanked’s January/February 2016 issue.

Subscribe FREE

to make sure you get it!

How the FDIC Defines Marketplace Lending

February 5, 2016Marketplace lending is one of this year’s hottest buzzwords but its meaning is not very intuitive. According to a recent Federal Deposit Insurance Corporation (FDIC) report, “marketplace lending is broadly defined to include any practice of pairing borrowers and lenders through the use of an online platform without a traditional bank intermediary.” This might sound similar to peer-to-peer lending and that’s because it’s the same thing, the FDIC explains. “Although the model, originally started as a ‘peer-to-peer’ concept for individuals to lend to one another, the market has evolved as more institutional investors have become interested in funding the activity. As such, the term ‘peer-to-peer lending’ has become less descriptive of the business model and current references to the activity generally use the term ‘marketplace lending.'”

Voilà, marketplace lending is what you get when peers are replaced by private equity firms, pension funds, and hedge funds. Additionally, there is a general assumption that the intermediary platform is also underwriting and grading the loans.

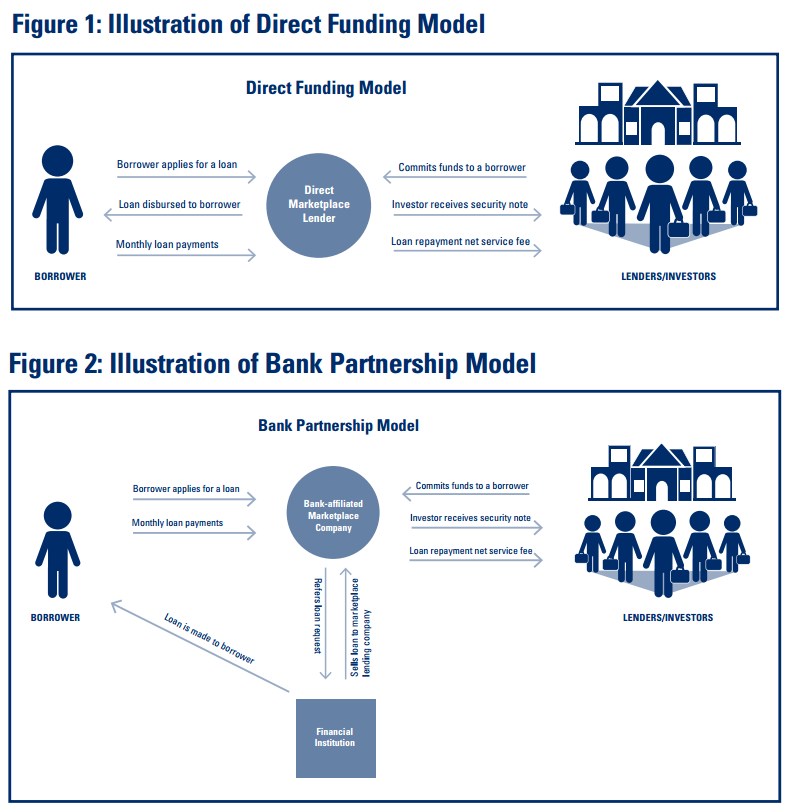

The FDIC separates marketplace lenders into two categories, the “direct funding model” and “bank partnership model,” both of which are illustrated below:

In both circumstances, investors are actually buying securities, rather than participating in the loans themselves.

The FDIC says that marketplace lending can encompass unsecured consumer loans, debt consolidation loans, auto loans, purchase financing, education financing, real estate loans, merchant cash advance, medical patient financing, and small business loans.

For even more information, read the official report.

Ponzi Scheme Threat Hangs Over Marketplace Lending

February 3, 2016 What if all the notes you bought on a peer-to-peer or marketplace lending platform were tied to loans that didn’t exist?

What if all the notes you bought on a peer-to-peer or marketplace lending platform were tied to loans that didn’t exist?

Such a scenario has not only happened but is a recurring theme over in China. The recent $7.6 billion fraud that was allegedly perpetrated by the management of Ezubao (a Chinese-based P2P lender) affected more investors than Bernie Madoff. Approximately 900,000 investors were impacted, according to CNBC.

But it gets worse, way worse. If you can believe this, the bosses of 266 other Chinese peer-to-peer lenders have fled and are in hiding. And that’s just in the last six months. Ratings agency Moody’s has said that 800 platforms have already failed or were recently facing liquidity issues.

In the case of Ezubao, there’s little doubt about what happened. Company executive Zhang Min told Xinhua news agency, “Ezubao is a Ponzi scheme.”

Lend Academy’s Peter Renton, who has witnessed the peer-to-peer lending industry in China firsthand wrote in his blog today that it’s too easy to start a platform there. “You need just US$1,000 to create a smartphone app, then obtain a very inexpensive business telephone license and you can be up and running,” he wrote.

Unsurprisingly, another Chinese peer-to-peer lender that just recently joined the New York Stock exchange, Yirendai (NYSE: YRD), was collateral damage to the Ezubao bombshell. Shares of the company dropped nearly 21% Tuesday to $4.88, down more than 50% from their IPO price.

Does the threat exist in the US?

Here at home, industry insiders are hardly worrying about China. “Could this level of fraud happen in the US?” Renton asked in his blog. “I think it is highly unlikely. There is a well-developed ecosystem in the US for both consumer and small business credit and appropriate lending licenses need to be obtained in most states before a company can begin operations.”

Renton is partially right. Most of the well-known platforms in the US are operating under watchful eyes. But there is a surging over-the-counter (OTC) marketplace that most outside investors don’t even know exists. Enter the syndication market where commercial finance brokers and investors can co-invest in loans or merchant cash advances through private marketplaces that may or may not have a website. With alluring yields of up to 100% a year or even more, it’s the perfect environment to pull off a scam if one maliciously intended to do so. [note: most are not scams at all]

The OTC market for these investments rely almost entirely on trust. There is little to no transparency into how investor funds are actually used. deBanked has received tips over the last twelve months that some companies have co-mingled investor funds with operational cash flow, with the result sometimes being a total loss of investment. Several lawsuits have been filed against these alleged fraudsters, deBanked has discovered, but none compare to the scope of damages taking place in China.

The last major Ponzi scheme to grip the commercial side of the industry for instance, involved Agape Merchant Advance (AMA), a Long Island based company that was part of a wider fraud conducted by sister company Agape World Inc. According to the 2012 complaint, “the defendants actually ran a Ponzi scheme, paying returns to Agape and AMA investors not from any profits earned on investments, but rather from existing investors’ deposits or money paid by new investors.”

The last major Ponzi scheme to grip the commercial side of the industry for instance, involved Agape Merchant Advance (AMA), a Long Island based company that was part of a wider fraud conducted by sister company Agape World Inc. According to the 2012 complaint, “the defendants actually ran a Ponzi scheme, paying returns to Agape and AMA investors not from any profits earned on investments, but rather from existing investors’ deposits or money paid by new investors.”

In a report published by the FBI that explained how it worked, they wrote, “the defendants received an e-mail from Agape’s loan underwriter informing them that the interest rate that a bridge loan borrower had agreed to pay Agape was only 16 percent for one year, at the same time the defendants had promised to pay their investors 12 percent for 60 days for this investment, or 73 percent for the year. The defendants raised approximately $32.5 million for this bridge loan, although the loan was never made.”

The fraud, carried out mainly by its chief executive Nicholas Cosmo, was captivating enough to earn it a spot on CNBC’s American Greed series.

At the time Agape was operating, such yields should’ve raised an immediate red flag for investors, at least that’s the moral the TV show tried to communicate to viewers. In the real world today, those yields could be considered too low since actual commercial bridge financing transactions can pay out up to 40% over 90 days. And therein lies the danger. When legitimate deals are transacting for incredible premiums, how do you resist considering an investment?

It’s easy to chalk up China’s peer-to-peer lending fraud woes to China being China. But the pervasiveness and ease with which such scams have been carried out should send a strong message to marketplaces in the US.

Do you trust where your money is going? Are they using it exactly how they said they will?

Next on American Greed…

JP Morgan Deal With Santander Shows Nothing To Fear From Lending Club Loans

February 2, 2016 After Santander Consumer USA Holdings Inc. [NYSE: SC] announced they were trying (almost desperately it seemed) to shed $1 billion worth of Lending Club [NYSE: LC] loans from their balance sheet, investors weren’t sure if was the loans themselves that were a problem or if there was something else going on.

After Santander Consumer USA Holdings Inc. [NYSE: SC] announced they were trying (almost desperately it seemed) to shed $1 billion worth of Lending Club [NYSE: LC] loans from their balance sheet, investors weren’t sure if was the loans themselves that were a problem or if there was something else going on.

Santander CEO Jason Kulas said back in October that, “although the personal lending portfolio is performing well, we no longer intend to hold these assets for investment.” The rationale was that they would refocus their efforts on subprime auto lending. The market didn’t take the news well and rewarded Santander by gutting the share price from $22.10 on October 28th down to $10.10 by February 1st.

In a report put out last week by Chris Donat, a company analyst at Sandler O’Neill & Partners, it was intimated that the Lending Club loans Santander was still holding may have contributed to the fourth-quarter loss of $232 million that they reported last week on its unsecured personal loan portfolio. “In light of the damage that the personal loan portfolio inflicted on Santander’s income statement in 4Q15, we will be relieved when Santander is out of this business,” Donat wrote.

But fears of possible toxic Lending Club loans subsided on Monday when the WSJ announced that JP Morgan Chase was acquiring Santander’s portfolio and at a “premium.” The average FICO score of those loans is reportedly around 700. “The sale was being closely watched by credit markets as an indicator of the health of the market for online personal loans,” the WSJ said.

Lending Club’s share price closed up 3.12% on the news, but is still stuck near its all time low.

NetSuite Stakes Claim in Alternative Lending Industry

January 28, 2016NetSuite (NYSE: N), a San Mateo, CA based software company that employs thousands of people, has been planting their flag throughout the alternative lending industry. Earlier today, they announced that Avant, an online marketplace for consumer loans, has gone live on NetSuite OneWorld to manage their “mission-critical business processes.”

In September, Avant had received a private market valuation of nearly $2 billion after completing a Series E round, with one of the investors being JPMorgan Chase.

“Our previous system just couldn’t keep pace with the rapid growth we’ve seen in our industry and our business,” Avant CEO Al Goldstein is quoted as saying in the release. So they turned to a NetSuite product.

NetSuite has a public valuation of over $5 billion and is a popular choice in the alternative lending industry for companies who require scalability. For example, NetSuite OneWorld can support 190 currencies, 20 languages, and automate the tax compliance for over 100 countries. Avant already operates in 3 countries, The US, UK and Canada. More than 24,000 companies and subsidiaries use NetSuite.

“Avant is among a growing number of financial services companies innovating in a market that’s ripe for disruption and are relying on NetSuite’s cloud platform,” NetSuite President Jim McGreever is quoted as saying in their release. “We’re excited to see Avant’s success and look forward to helping them grow.

To date, Avant has issued more than 400,000 loans worldwide.

Several business lenders and merchant cash advance companies also use NetSuite.

FICO-Free Zone

January 15, 2016 Many lenders and alternative funders over the last several years have stressed a reduced dependence on FICO scores, but SoFi might be the first lender to declare their turf a “FICO-Free Zone.”

Many lenders and alternative funders over the last several years have stressed a reduced dependence on FICO scores, but SoFi might be the first lender to declare their turf a “FICO-Free Zone.”

In a blog post, SoFi co-founder Daniel Macklin vented that his 15 years of credit history in the UK prior to moving to the US counted for nothing at all. To fix that, he felt pressured to obtain and use credit just to build his score, which he referred to as counterintuitive. For those that have been in this country all along though, his gripe was that things that should matter in a credit score for some reason don’t. “The FICO score calculation doesn’t consider things like your savings, your cash flow, your ability to pay non-credit bills like water and electric or your future earnings,” he wrote.

That’s the opposite of how other marketplace lenders are thinking.

In an online discussion I had six months ago with some members of the Lend Academy forum regarding a borrower’s ability to repay as evidenced by their bank statements, the feedback was resoundingly negative. “I have a feeling if you ask to crawl someone’s bank account, they’ll just go elsewhere,” one user said. “Seems that’d only work on subprime borrowers who have limited bargaining power,” he added.

The logic behind the defense of a continued FICO-oriented approach was steeped in competitive advantage, basically that no sane borrower would ever consider disclosing additional information about their financial situation to one lender when another would just give them a loan on FICO score alone. Ironically that translated to, anyone who wants their creditworthiness to be judged on their ability to pay probably can’t afford to pay, at least that was my takeaway from it.

But over in SoFi land, the student lender “has chosen to not use FICO scores when evaluating the financial wherewithal of applicants.” They alternatively examine your more complete financial situation and well-being, things marketplace lending investors on other platforms (at least for consumer loans) seemed to argue couldn’t and shouldn’t be done.

SoFi is no small fish. To date they have issued around $7 billion in loans.