Marketplace Lending

Avant Crosses $3 Billion in Personal Loans

March 2, 2016 The naysayers of automated underwriting will have to be silenced again.

The naysayers of automated underwriting will have to be silenced again.

Chicago-based marketplace lender Avant, which uses big data and machine learning to underwrite loans announced that it has beat its online rivals as the first lender to cross $3 billion in personal loans in three years.

The four year old company has 440,000 customers and has issued 480,000 loans so far. It goes after the middle class consumers who take personal loans for an average of $8,000.

“This is a huge accomplishment and speaks to the market demand for affordable and accessible personal loans,” said CEO, Al Goldstein.

Much of its success came from the beefed up presence in the UK, a world leader in P2P lending — where the average loan size is 72 percent higher than the US on a per capita basis. The company hired key executives from MasterCard and HSBC after closing a Series E round from General Atlantic for $325 million last year. With that, it has so far raised $1.7 billion in total.

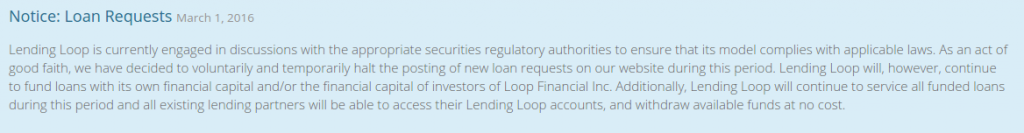

Canadian Small Business Loan Marketplace Suspends Operations After Run-in With Securities Regulators

March 2, 2016Lending Loop, which describes itself as an online marketplace for Canadians to lend money to growing local businesses, has voluntarily suspended the posting of new loan requests since it is engaged in talks with the Ontario Securities Commission.

Ontario regulators started cracking down on peer-to-peer lending last June. “If you are approaching any Ontario investors to fund peer-to-peer loans or loan portfolios, then you should be talking to the OSC about securities law requirements, including whether you need to be registered or require a prospectus,” said Debra Foubert, Director of Compliance and Registrant Regulation at the OSC, in a news release.

The directive is not unlike the system set up for such lenders in the US. Lending Club and Prosper for example, issue a prospectus and file a registration statement for every single loan with the SEC.

“Lending Loop is Canada’s first peer-to-peer lending marketplace,” the website states. “Our core focus is providing businesses with accessible capital at fair interest rates through a simple online process.”

At present, the investor signup page has been replaced with a button to subscribe to their newsletter to find out when investing opportunities might resume.

The Yield Bubble of Marketplace Lending

March 2, 2016 There was a twinkle in his eye, the sort of glimmer one gets when they’ve just learned of a hidden treasure. “It’s called marketplace lending,” I said to him, “and it allows you to invest in loans online. It can be a nice way to diversify your overall portfolio.”

There was a twinkle in his eye, the sort of glimmer one gets when they’ve just learned of a hidden treasure. “It’s called marketplace lending,” I said to him, “and it allows you to invest in loans online. It can be a nice way to diversify your overall portfolio.”

The more I described it, the more it whet his appetite. “Yes, I like it. That sounds awesome,” he said, followed by a huge toothy smile. I was the one seemingly drawing a map to the secret trove of Wall Street riches. Marketplace lending, whatever my old college friend was envisioning it to be, was going to make him a millionaire. He was sure of it. All this techie stuff was involved, big name financial institutions were backing it and Silicon Valley all-stars were driving it. It was all very exciting to him.

“I’m making about 7% on one platform and like 9% on another one, but those are the,” I was saying until he interrupted me.

“–WHAT?! THAT’S IT?”

His dreams crushed by the potential for only single digit returns, he could only laugh at himself for dreaming so big and then at me for thinking numbers like that were worth discussing at all.

I was almost sorry I brought it up.

Somewhere out there, American Greed‘s Stacy Keach is probably shaking his head. On the TV show that he famously narrates, guest law enforcement officials regularly warn people that double digit investment returns are a sure sign of a Ponzi scheme or fraud. Worse, they advise that smart scam artists advertise lower rates like 7-9% so as not to arouse suspicion. The moral of every story? Even those enticed by single digit percentage returns as high as those are partially guilty for being scammed because they too were driven by blinding greed.

And yet there are opportunities to all kinds of people these days that have never have been available before in the past. I know individual investors who regularly make over 20% a year in commercial financing and seriously believe that anything less is an outrage. There are those touting success by earning only 9% through consumer lending and writing blogs to share exactly how they did it. And then there are people who look to double or triple their money and succeed at it.

How to reconcile these new classes of investors in a near-zero interest rate environment when my local bank is paying 5 basis points annually on a savings account and up to 60 basis points annually on a high-yield investment? At times I feel like I am stepping into an alternate reality. Just recently, my bank pitched me on a structured investment that would still gross less than 1% a year. It was presented as something exclusive, exotic and high risk. That’s supposedly why the yield was so high. It was the kind of risk that required a minimum $250,000 investment, you know to see if I was serious about sitting at the big boy table of yield. And we were seriously talking about 60 basis points…

The buildup on their presentation fell so flat that I laughed at myself and then at them for thinking that it was worth discussing at all. Deja vu.

The first time I ever invested in a merchant cash advance, it was at a 1.49 factor rate. It had the potential to cycle through to completion in just two to three months. Do a few of those a year as a passive investor and you could earn triple digit percentage returns. Not a scam, not a Ponzi, totally legit. It was a seemingly real hidden treasure.

The deal went bad in the 2nd week and I took an almost complete loss on my investment. With great reward comes great risk, but I knew that already. I participated in more deals and lo and behold was able to generate double digit percentage returns even after defaults and commissions.

Double digit returns are a real thing. Peter Renton’s investment in the Direct Lending Fund is earning 13.29% according to his latest update. The Direct Lending Fund “owns a diversified pool of high-yielding, 3-36 month business notes. The notes are purchased from a number of lenders including IOUCentral.com and QuarterSpot,” according to their website. “These lenders make loans to qualified, established businesses that fit our strict filtering criteria.”

While very impressive, the fund’s returns are not too good to be true. CNBC labeled it a new flavor of fixed income when interviewing the fund’s founder. In that interview, it was said that returns are ranging from 6% to 14% and that access could soon be open to unaccredited investors as well. Lending Club, a publicly traded loan marketplace, advertises that 99.9% of its investors that buy 100+ notes on their platform have earned positive returns, a fantastically alluring statistic.

My bankers assured me no such investments could legitimately exist. Yet these yields are typical for marketplace lending investors today, and would be considered outrageously low to commercial financing’s high risk crowd. To that end, I know investors that have doubled and tripled their money over a few short years. If they could narrate their own version of American Greed it would be to say that 7% definitely is a sign of criminal intent, because it’s criminally low. “Never settle for less than double digit returns,” I imagine they would advise.

Marketplace lending has created investing anomalies. What shouldn’t be, is. It’s a bad time to be out of the loop. And it’s a bad time to put $250,000 in a non-FDIC insured investment that earns less than 1% a year. There’s always the stock market, you know, if you’re in to that kind of thing. Nobody I know ever talks about the stock market. It’s goes up, it goes down. It can be very emotional.

The new way to avoid the roller coaster is marketplace lending. These returns for the little guy are not supposed to exist and yet they do. 6%, 7%, 9%, 20%, 100%. Take your pick.

Yield is out there.

Task Force Convenes to Investigate Terrorism Financing

March 1, 2016 It’s a hearing that the country probably wishes it didn’t have to have. But after it was discovered the San Bernardino terrorists had obtained a loan from an online lending marketplace, government officials and news media wondered if something could’ve been done to prevent it.

It’s a hearing that the country probably wishes it didn’t have to have. But after it was discovered the San Bernardino terrorists had obtained a loan from an online lending marketplace, government officials and news media wondered if something could’ve been done to prevent it.

Today, members of the House Committee on Financial Services are convening the terrorism financing task force for a hearing titled, “Helping the Developing World Fight Terror Finance.”

“As terrorist financing and other illicit financial activity continues to pose risks to the international financial system, some have called for greater [anti-money laundering / combating the financing of terrorism] cooperation between, and among, national and international agencies,” reads a memo circulated in advance of the hearing.

Back in December, committee spokesman Jeff Emerson said that the task force was expected to look at whether any new regulations are needed after the San Bernardino shootings, according to the Los Angeles Times.

The Hill reported that when asked whether online lenders would get extra scrutiny, Committee Chairman Jeb Hensarling said, “Everything’s on the table.”

In the latest memo however, the words online, marketplace lending, Prosper and other related terms were not on the agenda, but that may be perhaps because the focus of this hearing is on the “developing world.”

The last time this task force was convened was a month ago on February 3rd, when they held a hearing titled, “Trading with the Enemy: Trade-Based Money Laundering is the Growth Industry in Terror Finance.” Online lending was not part of that agenda either.

It is uncertain if online lending will actually become a focus or be discussed by this task force in the future. At this point, it does not appear to be a pressing matter.

LoanDepot Adds Performance Data to Orchard Lending Index

February 29, 2016Marketplace lender loanDepot tied up with analytics firm Orchard to integrate its data into its U.S. Consumer Marketplace Lending Index which measures the overall performance of U.S. consumer marketplace loans.

The index allows investors to calculate returns based on charge-off and industry growth rates and is distributed through the Bloomberg Professional Service. In May last year, California-based loanDepot entered the marketplace lending market, moving beyond mortgages and launching its first unsecured personal loan product. Through its lending platform, it offers personal loans, purchase and refinance, and home equity loan products.

“As online lending continues to grow in size and importance, access to transparent and unbiased, benchmarked data will become more important to investors as they evaluate opportunities,” said Brian Biglin, chief risk officer at loanDepot. “We’re excited to showcase our portfolio on the Orchard platform as an attractive option to investors interested in specific loan types, borrower profiles and risk and return potential.”

Former Deutsche Bank Exec Anshu Jain Joins SoFi Board

February 29, 2016SoFi has made news again — and this time garnering some serious industry cred.

After its controversial SuperBowl ad and the proposed dating app, the student loan lender has hired former head of Deutsche Bank, Anshu Jain as a board member.

Anshu Jain, who resigned from the German bank as its co-chief exeutive officer will join SoFi as an adviser initially and help the company secure long-term capital. In December last year, the company hired Barbara Lambotte, a twelve year veteran of Moody’s Investors Service, to the capital markets team. These high-profile hires mark a significant step in bringing attention to the fast-growing online lending market.

San Francisco-based SoFi, valued at $4 billion, funded over $6 billion in loans across various products including mortgages, personal loans and student loan refinancing and this year launched the sale of a $551 million securitization offering.

Lending Club Shifts Fee Arrangement With WebBank

February 26, 2016 It’s a “belt and suspenders” precaution according to Lending Club CEO Renaud Laplanche. The Madden v Midland case has forced the company to rethink their arrangement with WebBank, the chartered bank that allows them to make loans nationwide. Under the new terms, the fee LendingClub pays to WebBank for the loans it issues will be related to how the loans perform over time.

It’s a “belt and suspenders” precaution according to Lending Club CEO Renaud Laplanche. The Madden v Midland case has forced the company to rethink their arrangement with WebBank, the chartered bank that allows them to make loans nationwide. Under the new terms, the fee LendingClub pays to WebBank for the loans it issues will be related to how the loans perform over time.

Even if the U.S. Supreme Court were to rule unfavorably in Madden, Lending Club would still have been able to operate freely under their old arrangement. The change then may be a response to several cases, including ones that have accused online lenders of using chartered bank relationships to carry out alleged abuses. According to law firm Ballard Spahr, a “federal court refused to dismiss Pennsylvania racketeering claims against companies alleged to have partnered with a state bank to market Internet loans illustrates the risks inherent in these relationships and the importance of proper structuring.”

In a brief, Ballard Spahr wrote:

In Commonwealth of Pennsylvania v. Think Finance, Inc., et al., the Pennsylvania AG, working with a well-known private plaintiffs’ firm, claimed that the companies and their individual principal had engaged in a “rent-a-bank” scheme in which a Delaware state bank “acted as the nominal lender while the non-bank entity was the de facto lender—marketing, funding and collecting the loan.”

By WebBank maintaining an interest in the outcome of the individual loans, Lending Club will reduce its potential standing as the de factor lender.

Notably, the breaking story focused on Lending Club. WebBank also has a relationship with others in the alternative finance community such as CAN Capital, Prosper, AvantCredit and PayPal. It’s uncertain if their arrangements will also be subject to change.

The Reason Behind Lendio’s 1175% Growth

February 25, 2016 Lendio, the small business loans marketplace closed 2015 with $128 million in financing for 5100 businesses. That number swiftly becomes impressive compared to the 400 businesses funded with $12.4 million the previous year.

Lendio, the small business loans marketplace closed 2015 with $128 million in financing for 5100 businesses. That number swiftly becomes impressive compared to the 400 businesses funded with $12.4 million the previous year.

Lendio CEO Brock Blake attributes this 1175 percent growth to the partnerships the company forged, the most noteworthy one with Staples where Lendio finances the small businesses that Staples often interacts with. “We had a great year with our partnership,” he said. “Staples has been a fantastic partner — they have the merchants and we have the finance.”

The Salt Lake City-based company prides itself on its partnership strategy. In 2014, the company struck a deal with UPS to offer their marketplace for free to The UPS Store business customers.

Blake is also excited about expanding the marketing channels and growing the firm’s online marketing strategy.

Lendio’s average loan size is $25,000 and their clients have typically been in business for 26 months in industries like construction, retail, restaurants and real estate.