Marketplace Lending

Should Marketplaces Have Skin In The Game?

July 10, 2016 These answers were offered by the following execs to the question over whether or not lending marketplaces should have skin in the game, during a panel at LendIt in April.

These answers were offered by the following execs to the question over whether or not lending marketplaces should have skin in the game, during a panel at LendIt in April.

Gilles Gade, Cross River Bank YES

Jeffrey Meiler, Marlette Funding NO

David Johnson, First Associates IT DEPENDS

Sid Jajodia, Lending Club YES (but it depends on what skin means)

THEIR EXPLANATIONS:

Gilles Gade said it’s not only for the platforms but for the banks sponsoring the platforms to put loans on their balance sheet as well to qualify and perfect the status as true lender.

Jeffrey Meiler said that it shouldn’t be a requirement but something you want to do because it’s a superior value proposition.

David Johnson said that if we’re talking about retail investors then skin in the game is very appropriate. If we’re talking about institutional investors, then I don’t think it’s necessary.

Sid Jajodia said it depends on what “skin” means. From his perspective, if you don’t deliver a value proposition to one side of the market, which is the investors, you don’t have a market so there’s inherent skin in the game by being a marketplace.

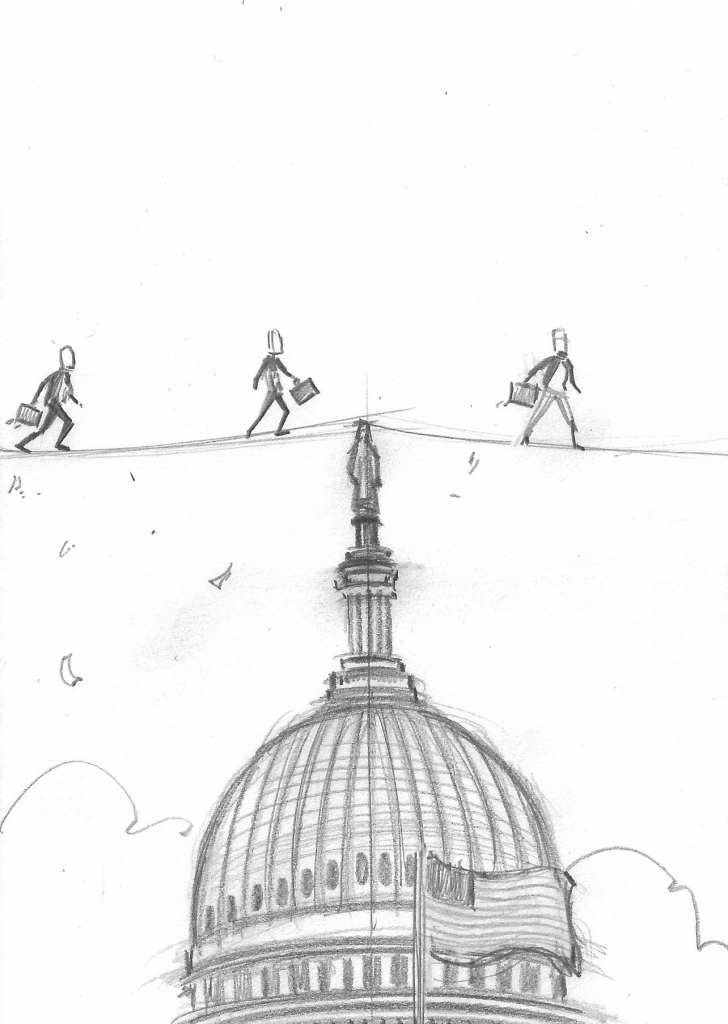

Marketplace Lending Hearing To Be Held By House Subcommittee

July 7, 2016 On July 12th, the Subcommittee on Financial Institutions and Consumer Credit is scheduled to hold a hearing to examine the opportunities and challenges specifically in online marketplace lending. Among the witnesses offering testimony will be Parris Sanz, Chief Legal Officer of CAN Capital and Sachin Adarkar, General Counsel of Prosper Funding. Rob Nichols, the CEO of the American Bankers Association and Bimal Patel, a partner of O’Melveny & Myer will join them.

On July 12th, the Subcommittee on Financial Institutions and Consumer Credit is scheduled to hold a hearing to examine the opportunities and challenges specifically in online marketplace lending. Among the witnesses offering testimony will be Parris Sanz, Chief Legal Officer of CAN Capital and Sachin Adarkar, General Counsel of Prosper Funding. Rob Nichols, the CEO of the American Bankers Association and Bimal Patel, a partner of O’Melveny & Myer will join them.

The hearing will be held at 2PM in room 2128 of the Rayburn House Office Building and also streamed online.

A memorandum circulated by the House Financial Services Committee said that the “hearing will give Committee members the opportunity to assess the development of the FinTech market, including how online lenders and banks interact. Further, the hearing will evaluate the current regulatory structure and recent policy developments.”

Russian Startup Blackmoon Wants to Play Middleman in Marketplace Lending

July 6, 2016Russian startup Blackmoon, that screens other company’s loans before selling them to investors, has launched in the US, drawn to the lure of its $1 trillion addressable market. Blackmoon aims to reach a billion dollar in loans by the end of 2017 and is targeting business, consumer, student and car loans.

The company provides ‘marketplace lending as a service’ working as a middleman between debt investors, lenders as well as banks. Its platform brokers deals between balance sheet lenders and investors. The company was founded in Moscow City last year by investor and entrepreneur Oleg Seydak. Seydak was a partner at venture capital fund Flint Capital and managing director of private equity firm FINAM Global.

Cofounder Ilya Perekospky in an interview with Venturebeat said that the US market is ripe with opportunity for companies like Blackmoon. “We believe that existing marketplace lenders have only scratched the surface with respect to the volume of loans being originated in the U.S. today,” he said. “The size of the marketplace lending market is measured in billions of dollars, whereas balance-sheet lender loan origination volume is nearly a trillion U.S. dollars or more.”

Avant Will Slash More Jobs as Loan Volumes Shrink

July 1, 2016Avant is preparing for a second round of layoffs in two months.

The beleaguered online lending industry has another victim and it’s Chicago-based personal loan lender Avant, again. The company said that it expects loan volume to fall by 50 percent and consecutively lay off some employees, without disclosing details.

This is a second wave of downsizing for the four year old lender. In May, the company slashed 60 jobs after its loan volume shrunk by 27 percent in the first quarter of this year. Avant also paused its auto loan refinancing program that it announced in March.

Bloomberg reported Avant spokeswoman Carolyn Blackman Gasbarra as saying, “As the lending industry faces continued uncertainty in the capital markets and volatility of the online lending category, we are moderating loan volume to focus on the immediate profitability of our core personal loan products…As such we have made the difficult decision to launch a voluntary severance offering to our employees.”

Avant is led by Al Goldstein who made a fortune in small dollar loans through his online subprime lending company Enova International that he started in 2004 and sold it two years later for $250 million. Avant has funded over $3 billion in personal unsecured loans so far.

Are These The Loans? (That Lending Club Messed Around With in 2009)

June 29, 2016

NSR Invest’s Zach Richheimer thinks he may have found some of the loans that the former Lending Club CEO made to himself and his family members as part of an alleged scheme to inflate the company’s quarterly volume seven years ago.

Granted, this was many years before they went public and the CEO has since resigned anyway, but they’re still worth a look nonetheless.

You can check them out HERE.

In his blog post, Richheimer makes the point that Lending Club’s transparent platform is valuable because of the opportunity afforded to the average investor to examine things like this. While true, the data points used to identify likeness, the credit profile, same borrower location, issue date within days of each other – all for amounts exceeding $20,000 are still speculative. For one, nobody even noticed these similarities for seven years.

On the plus side, Lending Club has been subject to a thorough internal review as of late after the recent scandal and this is the worst case of platform abuse that was found, and it was very long ago back when they were a struggling startup.

In a press release on Tuesday, Lending Club announced changes to their internal process, presumably to avoid something like this from happening ever again.

Over the last seven weeks, Lending Club initiated a comprehensive review of its controls, compliance and governance and has taken actions that included implementing KPMG best practice recommendations; increasing testing of data changes; increasing compliance and oversight resources; aligning business and control functions into a better risk management structure; and retraining employees on code of conduct and ethics and reinforcing the importance of a high compliance culture.

Scott Sanborn, the company’s temporary CEO, was upgraded to permanent CEO.

Lending Club: Road to Investor Confidence is Paved in Negative Returns

June 28, 2016It’s been an eventful Tuesday for Lending Club. The company held its previously adjourned annual meeting where it upgraded Scott Sanborn’s status to permanent CEO, appointed temporary executive chairman Hans Morris as Chairman of the board and slashed 179 jobs.

The new management has tasked itself with restoring investor confidence that’s necessary after Sanborn said that its Broad Based Consumer Credit fund will see its first negative return after five years of performing well. It is the largest inhouse portfolio for the company with regular returns of 0.5 percent. Subsequently, the board has established new policies prohibiting investments in ecosystem partners that invest in lending club loans and also imposed restrictions on investors requesting redemptions worth $442 million in its consumer credit fund.

An internal review also discovered that Renaud Laplanche and three members of his family borrowed $722,800 in 2009, which was not reported as a personal investment.

Lending Club hired an independent firm to assess the valuation of its marketplace assets and found assets held by six private funds to be inconsistent with GAAP standards.

Loan originations fell by a third in Q2 2016 compared to the previous quarter but in a necessary attempt to appease investors, the company has committed to spend $9 million in the current quarter on investor incentives and another $20 million on employee retention, due diligence and advisory relationships. Earlier this month it purchased $19 million of its own loans until it rebuilds its funding base.

It resolves to be back on track and resume revenue and EBITDA growth by the first half of 2017. As if these troubles weren’t enough, it also faces mounting pressure rising from Britain’s exit from the European Union and the market volatility that followed. This could cause hedge funds and loan buyers to retreat at a time when the beleaguered lender is trying to score funding deals with hedge funds.

Sam Hodges, CEO of London-based Funding Circle definitely feels the burn. “We have to hunker down and recalibrate our growth plan and credit models to account for how the U.K. economy will be more stressed in the near term,” he told WSJ.

Click here for the Lending Club timeline.

OnDeck’s New Marketing Channel: Accountants

June 27, 2016What if accountants replaced loan brokers?

OnDeck has been on it. The New York-based online lending company unveiled a new medium of reaching potential borrowers. Through its ‘Accountant Advisor Program,’ launched in March this year, the lender wants to reach small businesses through accountants, bookkeepers and CPAs.

OnDeck is rolling out the program in Kentucky, Florida and Alabama and recruiting accountants in these states to refer their clients to OnDeck. What do they get in exchange? They can either choose to get a revenue share of 5 percent of the total loan volume, or have OnDeck give the small business a 2 percent discount on the loan cost for loans of up to $500,000 with terms of 3 to 36 months and lines of credit ranging from $6,000 to $100,000.

“We’ve put this program together, realizing that the accountant community is the most trusted advisor to small business,” said Frank Orofino, director of the OnDeck Accountant Advisor Program was quoted as saying.

The company isn’t shaken by the troubled environs of online lending. Earlier this month, (June 16th), the company expanded its operation in Denver buying a bigger office space and hiring staff along side forging new partnerships.

“I think it’s a smart idea to partner with CPAs,” said Justin Benton who runs Lenders Marketing, a lead generation site for loans. “These are people who are helping with taxes and investments. They are going straight to the horse’s mouth,”

Will this new channel yield results?

Madden v Midland Won’t Be Heard By The US Supreme Court

June 27, 2016

The US Supreme Court has decided not to hear the case of Saliha Madden v Midland Funding.

This was to be expected after US Solicitor General Donald Verrilli filed a devastating brief last month on behalf of the United States government that argued the US Court of Appeals for the Second Circuit was incorrect in its ruling. There is “no circuit split on the question presented,” he wrote, and “the parties did not present key aspects of the preemption analysis” to the lower courts.

Vincent Basulto, a partner at Richards Kibbe & Orbe LLP in New York, said “While it is not expected that other circuits will adopt the reasoning of the Second Circuit, in part due to the arguments made by the Solicitor General, the appellate decision stands as good law in NY. The case will return to the district court for further consideration of other issues and there is reason to believe that the outcome there may be favorable for the financial services industry due to a choice of law issue which remains to be decided.”

US Solicitor General Verrilli resigned three days before the Supreme Court’s decision, but his brief on the case will likely be cited for years to come.

“For the foreseeable future,” Basulto added, “parties can be expected to structure their arrangements in an attempt to distinguish the Madden decision from their transaction, though it is not clear how best to do that.”