Legal Briefs

Payday Lending King Scott Tucker Convicted

October 14, 2017 One year after a federal judge awarded a record-setting $1.3 billion judgment to the FTC against Scott Tucker for damages caused by his payday lending empire, a jury in the Southern District of New York found him guilty on criminal charges that include participating in a racketeering enterprise through the collection of unlawful debt, wire fraud, money laundering, and violations of the Truth In Lending Act.

One year after a federal judge awarded a record-setting $1.3 billion judgment to the FTC against Scott Tucker for damages caused by his payday lending empire, a jury in the Southern District of New York found him guilty on criminal charges that include participating in a racketeering enterprise through the collection of unlawful debt, wire fraud, money laundering, and violations of the Truth In Lending Act.

Tucker and another defendant, who happened to be his attorney in the scheme, are set to be sentenced on January 5th. He will remain on house arrest until then. Tucker is facing more than 20 years in prison. He is 55.

Among the luxuries Tucker spent his ill-gotten gains on were his professional racing hobby. His auto racing team, Level 5 Motorsports, participated in international tournaments and won 4 championships. The feds auctioned off his race cars that included two Ferraris and a Porsche earlier this year.

According to the DOJ:

TUCKER devised a scheme to claim that his lending businesses were protected by sovereign immunity, a legal doctrine that, among other things, generally prevents states from enforcing their laws against Native American tribes. Beginning in 2003, TUCKER entered into agreements with several Native American tribes (the “Tribes”), including the Santee Sioux Tribe of Nebraska, the Miami Tribe of Oklahoma, and the Modoc Tribe of Oklahoma. The purpose of these agreements was to cause the Tribes to claim they owned and operated parts of TUCKER’s payday lending enterprise, so that when states sought to enforce laws prohibiting TUCKER’s loans, TUCKER’s lending businesses would claim to be protected by sovereign immunity.

At trial, the jury wasn’t fooled. Read the full DOJ report here.

Updates On Several Industry Court Cases

October 4, 2017Curious to know the status of industry court cases we’ve reported on? Here’s an update on several:

| Case | When filed | Where pending | Status |

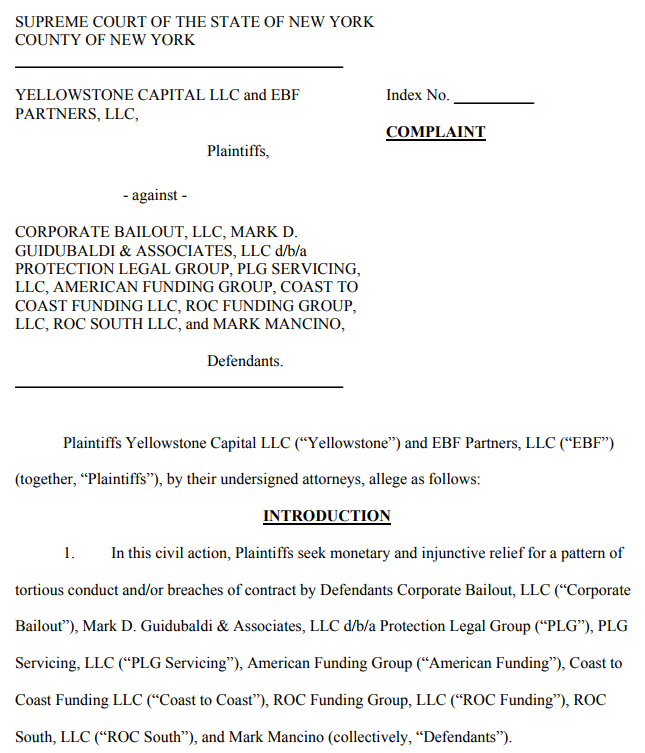

| Yellowstone Capital LLC and EBF Partners, LLC v. Corporate Bailout, LLC, Mark D. Guidubaldi & Associates, LLC dba Protection Legal Group, PLG Servicing, LLC, American Funding Group, Coast to Coast Funding, LLC, ROC Funding Group, LLC, ROC South LLC, and Mark Mancino. | 9/27/17 | New York State Supreme Court | Complaint filed. No anwswer filed yet |

| Sean Pullen, Christina Cane, Michael Cane, Michael Carrera, Matthew Taylor, and Yulia Zamaora v Social Finance, Inc. and Does 1-50 | 8/14/17 | Superior Court of California | SoFi filed an answer to the complaint on 9/15 |

| Craig Cunningham v. Mark D. Guidubaldi & Associates, LLC dba Protection Legal Group, and Corporate Bailout, LLC, Sanford J. Feder Esq, Mark D. Guidubaldi, Esq, Cashflow Care, LLC | 5/10/17 | Northern District of Texas | Motion for default judgment filed against Corporate Bailout on 9/12/17. Defendant never responded |

| Natures Market Corp v. Creditors Relief | 4/28/17 | New York State Supreme Court | Creditors Relief’s motion to dismiss and sanctions are still pending |

| Pearl Gamma Funding, LLC and Pearl Beta Funding, LLC v. Creditors Relief, LLC | 11/16/16 | New York State Supreme Court | Pearl has moved to dismiss Creditors Relief’s counterclaims |

| United States v. Sergiy Bezrukov | 10/26/16 | Western District of New York | The criminal indictment was amended on 8/3/17 to add more charges. Bezrukov is facing up to 30 years in prison |

| Ronald Bethune, on behalf of himself and all others similarly situated v. Lendingclub Corporation;WebBank, Steel Partners Holdings, L.P.; The Lending Club Members Trust; and does 1 through 10, inclusive | 4/6/16 | Southern District of New York | The judge granted the defendants motion to compel arbitration on Jan 30, 2017 |

| Kalamata Capital LLC v. Biz2Credit, Inc. and Itria Ventures, LLC | 12/8/14 | New York State Supreme Court | Kalamata plans to amend the complaint and the Court is scheduled to decide on the debate over whether certain documents should be sealed from public view |

| Federal Trade Commission v. AMG Services, Inc., et al. | 4/2/12 | District of Nevada | $1.3 billion judgment entered. Company owner Scott Tucker is also currently being tried criminally in the Southern District of New York for ill-gotten profits related to his payday lending empire. The jury is expected to decide the outcome this month |

ISOs Alleged to Be Partners in Debt Settlement “Scam” in Explosive Lawsuit

September 28, 2017 ISOs and brokers referring deals to debt settlement companies should pay attention to a lawsuit that was filed in the New York Supreme Court on Wednesday. In it, plaintiffs Yellowstone Capital and EBF Partners (“Everest Business Funding”) allege that certain ISOs are culpable partners in a scam that nefarious debt settlement companies are perpetrating on small businesses.

ISOs and brokers referring deals to debt settlement companies should pay attention to a lawsuit that was filed in the New York Supreme Court on Wednesday. In it, plaintiffs Yellowstone Capital and EBF Partners (“Everest Business Funding”) allege that certain ISOs are culpable partners in a scam that nefarious debt settlement companies are perpetrating on small businesses.

The debt settlement companies “mislead the merchants as to the services they will perform and the cost to the merchant, and they also conceal their relationships with the ISO Defendants and the fact that they or their affiliates are introducing these same merchants to merchant cash advance providers like Plaintiffs only to later induce those merchants to breach their agreements with their cash advance providers,” the complaint states.

Among the named defendants are:

- Corporate Bailout, LLC

- Mark D. Guidubaldi & Associates, LLC dba Protection Legal Group

- PLG Servicing LLC

- American Funding Group

- Coast to Coast Funding, LLC

- ROC South, LLC

- Mark Mancino

Several defendants are already best known for running an office “so sexually aggressive, morally repulsive, and unlawfully hostile that it is rivaled only by the businesses portrayed in the films ‘Boiler Room’ and ‘The Wolf of Wall Street,’” according to a salacious story that graced the back cover of the New York Post last month.

One paragraph of the complaint summarizes the allegedly collaborative scheme like this:

American Funding, Coast to Coast, […] (the “ISO Defendants”) are independent sales organizations (“ISOs”), companies that ostensibly support the merchant cash advance industry by brokering merchant agreements for companies like Plaintiffs. The ISO Defendants are anything but the proverbial “honest brokers.” As alleged below, they have partnered with companies that purport to offer debt relief services to merchants who have agreements with merchant cash advance companies like Plaintiffs. In practice, for these companies, “debt relief” is a code word for deceiving merchants to breach their existing agreements with Plaintiffs and to instead pay fees to these debt relief entities. In short, they scam merchants into believing that they can save them money when, in fact, they leave these merchants in financial shambles, while causing Plaintiffs to suffer millions of dollars in losses and future los[t] profits.

“’DEBT RELIEF’ IS A CODE WORD FOR DECEIVING MERCHANTS TO BREACH THEIR EXISTING AGREEMENTS”

Central to the plaintiffs’ claim is that they have ISO agreements with the defendants and that the defendants’ conduct is a breach of those agreements. The three causes of action alleged are tortious interference with contract, conversion, and breach of contract. Plaintiffs claim that 100 merchants with more than $3 million in outstanding balances are in breach of their contracts because of the defendants’ conduct.

The complaint was prepared and filed by attorneys at Proskauer, a 142-year old law firm founded in New York City.

Debt Relief Under Fire

The small business debt relief industry has been marred by scandal in recent years. In an unrelated criminal matter being handled in the Western District of New York, the owner of Corporate Restructure Inc. (no ties to Corporate Bailout) is currently residing in the Niagara County Jail awaiting trial on charges of conspiracy to commit mail fraud, wire fraud, bank fraud and money laundering for failing to deliver the debt relief services it charged for. In that case, United States vs. Sergiy Bezrukov, Bezrukov advertised that he could reduce a merchant’s short term debt by up to 75%. He is facing up to 30 years in prison. He was also previously a merchant cash advance ISO.

Two other MCA funding companies, Pearl Gamma Funding and Pearl Beta Funding, filed a lawsuit last November against another debt relief company that calls itself Creditors Relief. The complaint in that case also alleges tortious interference with contract and is still pending.

Meanwhile, a lawsuit filed in May by famous TCPA litigant Craig Cunningham against Corporate Bailout and Mark D Guidubaldi & Associates LLC went unanswered, according to court records. Cunningham, who alleged violations of telemarketing laws, filed for a default judgment against Corporate Bailout on September 12th.

Taking Advantage

Both Yellowstone Capital and Everest would not comment on the lawsuit they filed, citing pending litigation. Sources close to them, however, contend that both companies take matters that involve merchants being taken advantage of very seriously.

“When our own ISOs work directly in concert with companies that induce merchants to breach our contracts, that’s a problem,” said one source who did not wish to be named and was speaking generally about the recent introduction of debt relief service companies to the industry. “They’re taking advantage of businesses that can’t afford to be taken advantage of.”

An email sent by deBanked to Mark Mancino early Thursday afternoon, an individually-named defendant alleged to be affiliated with the other defendants, has not yet received a response. This story may be updated if a reply is received.

A COPY OF THE COMPLAINT CAN BE VIEWED HERE.

Alternative Finance Bar Association Event is Wednesday

September 10, 2017If you’re interested in going, the Alternative Finance Bar Association event on Wednesday is open to both funding company executives and industry attorneys. The New Regulatory Challenges Facing Small Business Lending: Navigating the New Frontier will feature Joann Needleman, Esq., Jane Luxton, Esq. & Tommy Brooks, Esq. from Clark Hill PLC in the NYC Bar Association Offices on 42 West 44th Street in New York City.

To register or for more information, contact Tiffany Diaz at Tiffany@LRohanlaw.com.

The original announcement can be accessed here.

Amos Weinberg and Creditors Relief Are Battling it Out

September 8, 2017A lawsuit filed by a small business against Creditors Relief in April has gone off the rails, according to court documents. Creditors Relief has sought to dismiss the case that attorney Amos Weinberg brought on behalf of a Deli in New York that alleged among other things, that Creditors Relief practiced law without a license and reneged on a contract to settle its debts.

While both sides were disputing the facts, Weinberg suddenly withdrew the complaint on September 1st, a move which did not actually bring the matter to a resolution. Instead, Creditors Relief has still asked the court to dismiss the case with prejudice and to sanction Amos Weinberg for the frivolous pleading in the first place. In its papers, Creditors Relief argues that the lawsuit was brought primarily to harass Creditors Relief and its owner Michael Lupolover and that the complaint asserted material factual statements that were false.

Across the docket, Weinberg attached documents that exposed Lupolover’s previous snafu with a federal regulator while Creditors Relief later filed an exhibit showing that Weinberg had been sanctioned in another lawsuit.

The case is still active with the motion to dismiss and sanction still pending in the New York Supreme Court under index number: 56406/2017 Natures Market Corp v. Creditors Relief LLC

CFPB Sanctioned By Federal Judge After Engaging in Funny Business During Discovery

August 26, 2017 When the CFPB was asked to support their claims in a brutal lawsuit they had brought against several payment processors, they balked and stonewalled. Eventually, the judge had enough.

When the CFPB was asked to support their claims in a brutal lawsuit they had brought against several payment processors, they balked and stonewalled. Eventually, the judge had enough.

On Friday, US District Judge Richard W. Story granted sanctions against the Consumer Financial Protection Bureau (CFPB) for misconduct in discovery and dismissed their case against several payment processors entirely. The CFPB had accused defendants Global Payments, Pathfinder, Frontline and EMS of providing substantial assistance to deceptive conduct carried out by debt collectors.

During discovery, the CFPB attempted to block their own representatives from being deposed in any capacity. The Court disagreed and ordered the depositions to proceed. Rather than comply, the CFPB asked for a protective order to block questioning on topics relevant to their claims. The court mostly denied it, ordering that the defendants were entitled to question the CFPB about the factual underpinnings of its allegations against them.

Apparently determined to undermine the process further, the CFPB produced a witness for a deposition who relied almost entirely on “memory aids,” which in one case was a 200+ page document that the witness merely read aloud verbatim when asked questions.

In a Court conference call conducted in April, defendants complained that the CFPB’s “memory aids” were merely lengthy prepared scripts.

And this was not really a memory aid. This was a script. The witness simply read answers. He did not sort of use it as a refresher of his memory. And frequently the witness would not answer the question asked. But you would ask the witness for the factual basis for something, especially outside Global’s knowledge, and he would read, in one instance for an hour, about things that had nothing to do with Global’s knowledge.

The tactics continued throughout, according to the defendants.

[…] I could be wrong on this Your Honor, but it’s quite possible that in the seven hours yesterday there was no human touch; everything was read. And when anything was asked that would be, well, what facts do you have to support that, it was either met with objection, work product, don’t answer; or the witness would just read lengthy narratives, often that were nonresponsive, that sometimes went as long as 45 minutes and often an hour.

Incredulous that the CFPB refused to answer questions at all costs, the judge ordered sanctions against the CFPB and dismissed the case on the basis that they had failed to produce a knowledgeable witness, made improper objections during depositions, and willfully violated the Court’s repeated instructions.

“In light of the CFPB’s pattern of conduct in this case, the Court is not optimistic that reopening the depositions would be fruitful,” the judge said.

The case is Consumer Financial Protection Bureau v. Universal Debt Solutions, LLC, et al. in the Northern District of Georgia, Atlanta Division, Action 1:115-CV-859-RWS.

SoFi Hit With Class Action Lawsuit Over Wage Issues

August 19, 2017Five SoFi employees have joined together to file a class action lawsuit against SoFi in the Superior Court of California. According to the docket, Sean Pullen, Christina Cane, Michael Carrera, Matthew Taylor and Yulia Zamaora are claiming employment improprieties with regards to how wages were paid. The suit is separate from a similar suit that was recently filed by former employee Brandon Charles over what he believed was wrongful termination.

The case number is CGC17560700 and titled Sean Pullen et al vs. Social Finance Inc, A Delaware Corporation Et Al.

‘Debt Relief’ Company is Allegedly Robo-dialing Out Of Control

July 18, 2017 A lawsuit brought by famous serial TCPA plaintiff Craig Cunningham against defendants who allegedly robo-dial with offers for small business debt relief services, has a new twist, according to recent court records. That is that the defendants allegedly continue to robo-dial Cunningham despite having been served with the suit from him. All told, Cunningham says he has received at least 105 automated calls for the defendants’ business debt relief services despite the fact that he doesn’t even own a business.

A lawsuit brought by famous serial TCPA plaintiff Craig Cunningham against defendants who allegedly robo-dial with offers for small business debt relief services, has a new twist, according to recent court records. That is that the defendants allegedly continue to robo-dial Cunningham despite having been served with the suit from him. All told, Cunningham says he has received at least 105 automated calls for the defendants’ business debt relief services despite the fact that he doesn’t even own a business.

Cunningham filed an amended complaint that also added new defendants alongside Mark D. Guidubaldi, Corporate Bailout and Protection Legal Group. They include Sanford J. Feder and Cashflow Care, LLC.

Cunningham was one of several TCPA litigants referenced in a featured story deBanked published about TCPA lawsuits last October.

Protection Legal Group, meanwhile, was cited in another brief where a small business owner sued them for allegedly not providing the debt relief services promised. According to the docket, Protection Legal Group has yet to file an answer to it.

Debt relief and debt settlement services have become a booming business as of late, but it’s a risky endeavor. Earlier this year, four individuals were arrested when they did not actually attempt to negotiate the MCAs or business loans they were paid to assist with. One of those arrested is still in prison awaiting trial. He is facing a maximum of 30 years.