Legal Briefs

Despite Movement of Negative Bill for MCA and Factoring Industries, Hope for a Solution

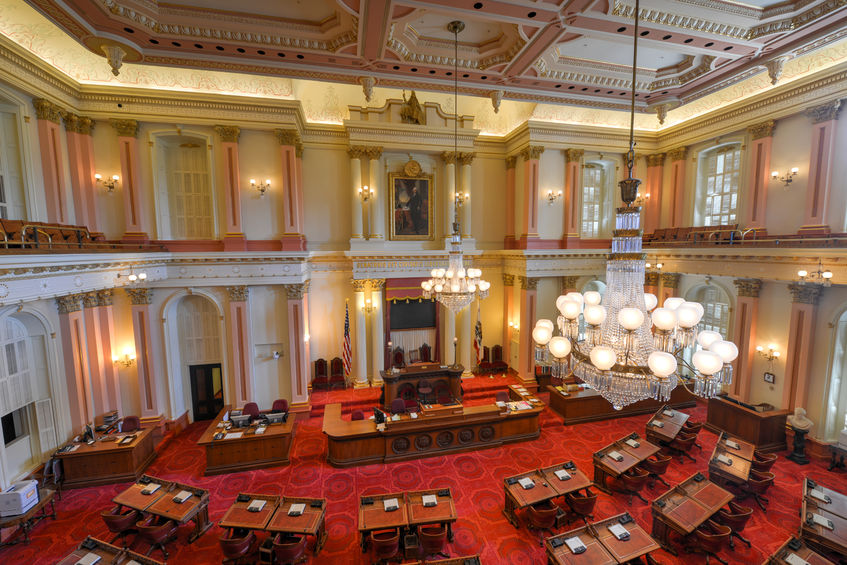

April 23, 2018 Last week, California State politicians gathered for a hearing on SB 1235, a bill that would require the disclosure of an Annual Percentage Rate (APR) for all loans and non-loans, including MCA and factoring products. This is very problematic because APR (which includes interest rate) cannot be calculated for most MCA and factoring products for one reason: time. What makes merchant cash advance and factoring unique is that the timing of payments is flexible, and therefore unknown.

Last week, California State politicians gathered for a hearing on SB 1235, a bill that would require the disclosure of an Annual Percentage Rate (APR) for all loans and non-loans, including MCA and factoring products. This is very problematic because APR (which includes interest rate) cannot be calculated for most MCA and factoring products for one reason: time. What makes merchant cash advance and factoring unique is that the timing of payments is flexible, and therefore unknown.

“It’s impossible to compute,” said veteran factoring lawyer Bob Zadek about calculating APR for most MCA and factoring products. “Interest = principal x rate x time. Since [they] cannot determine how long the advance will be outstanding – since repayment is a function of the borrower’s cash flow – the algebra doesn’t work.”

The bill, introduced by California State Senator Steve Glazer, moved out of the Senate committee on Banking and Financial Institutions and is headed to the Judiciary committee – closer to potential passage. Yet advocates of the MCA industry, one of whom testified in the assembly room in Sacramento, are hopeful.

“There were a number of state senators who clearly understood the problems with applying an APR to a commercial transaction and to a purchase and sale of receivables transaction,” said Katherine Fisher, a partner at Hudson Cook, LLP who spoke on behalf of the Commercial Finance Coalition (CFC). CFC is an alliance of financial companies that educates government regulators and elected officials on issues related to non-bank commercial finance. CFC Executive Director, Dan Gans, told deBanked that he believed the committee really understood what Fisher was trying to convey.

Another major advocacy group is the Small Business Finance Association (SBFA). They brought Joseph Looney, COO and General Counsel of RapidAdvance, to testify against SB 1235, and SBFA Chief of Staff Steve Denis sounded optimistic, saying that they have a very good relationship with State Senator Glazer’s office.

“To me, despite the fact that they moved [on] a bill that we’re opposed to through the process,” Denis said. “I think the folks that we’ve been meeting with out there – the senators – they’re all very open to our industry and open to having broader discussion about how to [best] disclose these terms and how to make sure we’re doing what’s in the best interest of small business owners. That’s a real positive, and I’m optimistic that we can get something done.”

As for concern about the bill moving forward, Denis said it’s what he expected.

“It’s just the way the process works in California,” Denis said. “If you look at committee history, they don’t really reject a lot of bills. They like to move bills forward so they can be discussed and negotiated.”

As of this story’s publication, SB 1235’s Judiciary committee hearing had not yet been scheduled.

Update 4/26/18: The hearing is scheduled for May 8, 2018 at 1:30 p.m. PST in Room 112.

Full video of the April 18th hearing below:

Champion Auto Sales Decision Brings Closure to Another Case

April 1, 2018A merchant seeking to have a judgment against them voided on the basis that the underlying Purchase and Sale of Future Receivables agreement they entered into was actually a usurious loan, has had their motion denied pursuant to the law as decided in Champion Auto Sales, LLC et al. v Pearl Beta Funding, LLC, court records show.

3148521 Canada, Inc. and Amir Soghraty, through attorney Amos Weinberg, attempted to convince the Court that their MCA agreement with Principis Capital was actually a loan. After lingering in the court system for months, the Honorable David Benjamin Cohen, issued a decision on Friday, citing the appellate court ruling.

Specifically, plaintiff argues that the underlying judgment is based upon a usurious loan. Plaintiff and defendant entered into an arrangement where defendant purchased the future receivables that may (or may not) be collected. The Appellate Division, First Department, recently decided this very issue (argued by the same attorney as plaintiff herein) and held “the evidence demonstrates that the underlying agreement leading to the judgment by confession was not a usurious transaction” (Champion Auto Sales, LLC v Pearl Beta Funding, LLC, 2018 N.Y. Slip Op. 01645 [1st Dept 2018]).

The decision can be found under Index # 655008/2017 in the New York Supreme Court

Lawyers Weigh in on Champion Auto Sales, LLC v. Pearl Beta Funding, LLC

March 22, 2018In light of the recent Champion Auto Sales, LLC et al. v Pearl Beta Funding, LLC decision, which decided that the particular MCA contract at issue “was not a usurious transaction,” deBanked spoke to a handful of lawyers, including the plaintiff’s lawyer, Amos Weinberg, to get their thoughts on the decision.

“The contract at issue in Champion Auto v. Pearl Beta Funding was really no different than the contracts reviewed over a hundred years ago by the United States Supreme Court, in Home Bond Co. v. McChesney, 239 U.S. 568 [1916], where our nation’s highest court agreed that “the transactions were really loans, with the accounts receivable transferred as collateral security,” and “[i]n so far as the contracts in question here use words fit for a contract of purchase they are mere shams and devices to cover loans of money at usurious rates of interest.” Like most patrons of funding providers, Champion Auto was a one-person company that needed immediate, overnight cash. Presiding Justice Rolando T. Acosta of the Appellate Division remarked, at the argument, that Champion was a “sophisticated” party that “knew what they were getting into.” It is therefore painfully obvious that even though the NYS Legislature criminalized and voided loans to corporations exceeding 25% interest, and even though all victims of loan sharking knew what they were getting into, the courts are loathe to be used as escape hatches for companies trying to get out of paying back loans.”

Giuliano, McDonnell & Perrone, LLP

“It’s an appellate ruling a lot of people have been waiting for. It handles the usury issue in passing, almost as if it goes without saying.”

Hudson Cook, LLP

“The court confirmed that under New York law, a properly structured MCA transaction is not a loan. But I want folks to focus on the ‘properly structured’ piece of that…The court’s decision did not indicate much. But it did say that based on the documentary evidence, which is the contract, that the transaction was not a loan. So it’s important for folks to understand that for [an MCA contract] not to be a loan, it needs to be properly described…this case really shows us how important the contract is.

This case does not mean that all MCA companies are all in the clear. What it means is that MCA companies with properly drafted contracts, and good practices and procedures, are not making loans.”

Harris Beach, PLLC

“First of all, it was a unanimous decision by the three justices in the first department. That doesn’t always happen, so that’s a good thing. I personally would have liked to have seen more discussion out of the appellate department, but the language that’s there happens to be great for the industry. The one thing that I would caution, though, is not to interpret that all merchant cash advances are outside of transactions that would be subject to usury because it really is dependent on the language of the agreement.

[The decision] is a great tool in the arsenal, but I don’t see it as the tool that is going to prevent challenges.”

Hudson Cook, LLP

“This is a very important decision because New York State has a high volume of merchant cash advance companies…so having favorable case law in New York is great for the industry.”

Mavrides, Moyal, Packman, Sadkin

“I am very pleased with the outcome. There are more cases [to be decided], but this is very beneficial. It’s a win for the industry and I hope to see other decisions go in the favor of the advance industry.”

Platzer, Swergold, Levine, Goldberg, Katz & Jaslow, LLP

“The impact of the Champion decision was direct. We represent several MCA clients and we have a number of cases where Amos Weinberg is representing the merchant. And in one of our cases where a motion to open up a default judgment is at issue, the judge’s law clerk directly emailed us and wants to conference the case based on the Champion Auto Sales decision.”

[Lafont also pointed out that even though it was a short decision, one of its two citations was to Feld v Apple Bank for Sav., which deals with overdraft protection and has interesting parallels to MCA.]

Platzer, Swergold, Levine, Goldberg, Katz & Jaslow, LLP

“Based on the email we just received from the court clerk today, this decision could expedite [future] litigation, and it could decrease certain attorney’s fees for a lot of MCA companies involved in this litigation.”

Debt Relief Scammers’ Assets To Be Auctioned Off

March 20, 2018 A crew of debt relief scammers that carried out an $80 million fraud are having some of their assets auctioned off in Pompano Beach, FL this week. Among them a Tesla, BMW i8, Range Rover and custom luxury buses.

A crew of debt relief scammers that carried out an $80 million fraud are having some of their assets auctioned off in Pompano Beach, FL this week. Among them a Tesla, BMW i8, Range Rover and custom luxury buses.

According to the FTC and the State of Florida in a lawsuit they filed against Jeremy Lee Marcus, Craig Davis Smith and Yisbet Segrea, the defendants “got people to pay hundreds or thousands of dollars a month by falsely promising they would pay, settle, or obtain dismissals of consumers’ debts and improve their credit. Over time, victims found their debts unpaid, their accounts in default, and their credit scores severely damaged – some were sued by their creditors, and some were forced into bankruptcy.”

A court ordered an injunction against the defendants last year.

In an even uglier twist to the scheme, “the defendants also called people who were already enrolled with debt relief providers claiming they were taking over the servicing of those accounts and falsely claiming they would provide the same or similar services. The defendants told these consumers to transfer their escrow money to defendants, and then debited up to $1,000 each month from the consumers’ bank accounts.”

All of the named entities subject to the court-appointed Receiver’s control can be found here.

It’s Settled, Merchant Cash Advance Not Usurious

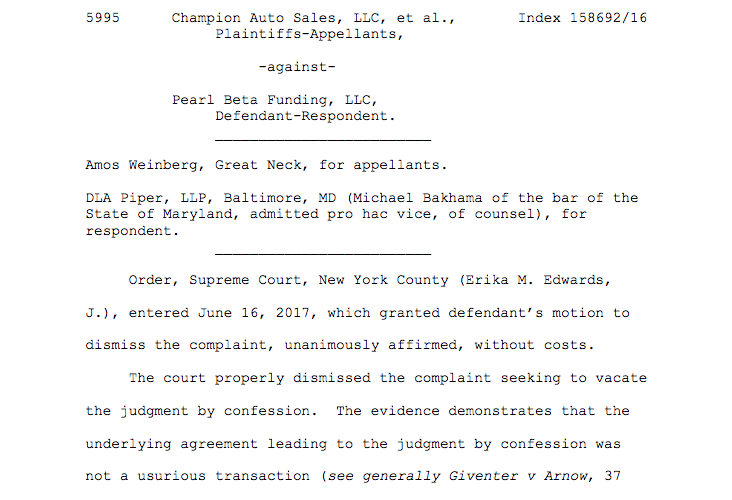

March 15, 2018 It’s not a usurious transaction. That’s how trial courts across New York State have been ruling on merchant cash advances for years, but now, thanks to Champion Auto Sales, LLC et al. v Pearl Beta Funding, LLC, the matter has been settled in a key jurisdiction.

It’s not a usurious transaction. That’s how trial courts across New York State have been ruling on merchant cash advances for years, but now, thanks to Champion Auto Sales, LLC et al. v Pearl Beta Funding, LLC, the matter has been settled in a key jurisdiction.

On Thursday, March 15th, The Appellate Division of The First Department published their unanimous decision that the underlying Purchase And Sale of Future Receivables agreement between the parties was not usurious.

In October 2016, the plaintiffs sued defendant Pearl in the New York Supreme Court alleging that the Confession of Judgment filed against them should be vacated because the underlying agreement was criminally usurious. As support, plaintiffs argued that the interest rate of the transaction was 43%, far above New York State’s legal limit of 25%.

The defendant denied it and moved to dismiss, wherein the judge concurred that the documentary evidence utterly refuted plaintiffs’ allegations.

With the case over, plaintiffs appealed the decision. Their major loss is spelled out below:

The decision is an interesting chapter in the story of Amos Weinberg, the attorney who represented the plaintiffs in this case. Prior to the appeal, he managed to file more than 100 lawsuits against merchant cash advance companies for usury. He has had very little success on the merits. Last May, deBanked reported that a judge in another lawsuit had admonished Weinberg for misleading the court over the actual wording of what a contract said.

Now he’s responsible for one of the biggest legal decisions in merchant cash advance history. And not in his favor.

The matter arose out of Index # 158692/2016 in the New York Supreme Court.

Princeton Alternative Funding Files Chapter 11

March 9, 2018Princeton Alternative Funding LLC filed for chapter 11 on Friday, court records reveal. A related entity, Princeton Alternative Income Fund, LP, also filed for Chapter 11.

Princeton Alternative Funding provides capital for businesses that make consumer loans in the non-prime market.

The Princeton Alternative Income Fund was previously reported to be a woe affecting Ranger Direct Lending after the blowup of online consumer lender Argon Credit.

AltFi reported in November that Ranger had written to Princeton to urgently seek information about Argon-related financial reporting prior to the commencement of arbitration proceedings.

The Madden Decision, Three Years Later

February 18, 2018

At first, reversing the 2015 Madden v. Midland Funding court decision, which continues to vex the country’s financial system and which is having a negative impact on the financial technology industry, seemed like a fairly reasonable expectation.

The controversial ruling by the Second Circuit Court of Appeals in New York, which also covers the states of Connecticut and Vermont, had humble roots. Saliha Madden, a New Yorker, had contracted for a credit card offered by Bank of America that charged a 27% interest rate, which was both allowable under Delaware law and in force in her home state.

But when Madden defaulted on her payments and the debt was eventually transferred to Midland Funding, one of the country’s largest purchasers of unpaid debts, she sued on behalf of herself and others. Madden’s claim under the Fair Debt Collection Practices Act was that the debt was illegal for two reasons: the 27% interest rate was in violation of New York State’s 16% civil usury rate and 25% criminal usury rate; and Midland, a debt-collection agency, did not have the same rights as a bank to override New York’s state usury laws.

In 2013, Madden lost at the district court level but, two years later, she won on appeal. Extension of the National Bank Act’s usury-rate preemption to third party debt-buyers like Midland, the Second Circuit Court ruled, would be an “overly broad” interpretation of the statute.

For the banking industry, the Madden decision – which after all involved the Bank of America — meant that they would be constrained from selling off their debt to non-bank second parties in just three states. But for the financial technology industry, says Todd Baker, a senior fellow Harvard’s Kennedy School of Government and a principal at Broadmoor Consulting, it was especially troubling.

“The ability to ‘export’ interest rates is critical to the current securitization market and to the practice that some banks have embraced as lenders of record for fintechs that want to operate in all 50 states,” Baker told deBanked in an e-mail interview.

A 2016 study by a trio of law professors at Columbia, Stanford and Fordham found other consequences of Madden. They determined that “hundreds of loans (were) issued to borrowers with FICO scores below 640 in Connecticut and New York in the first half of 2015, but no such loans after July 2015.” In another finding, they reported: “Not only did lenders make smaller loans in these states post-Madden, but they also declined to issue loans to the higher-risk borrowers most likely to borrow above usury rates.”

With only three states observing the “Madden Rule,” the general assumption in business, financial and legal circles was that the Supreme Court would likely overturn Madden and harmonize the law. Brightening prospects for a Madden reversal by the Supremes: not only were all segments of the powerful financial industry behind that effort but the Obama Administration’s Solicitor General supported the anti-Madden petitioners (but complicating matters, the SG recommended against the High Court’s hearing the case until it was fully resolved in lower courts).

Despite all the heavyweight backing, however, the High Court announced in June, 2016, that it would decline to hear Madden.

That decision was especially disheartening for members of the financial technology community. “The Supreme Court has upheld the doctrine of ‘valid when made’ for a long time,” a glum Scott Stewart, chief executive of the Innovative Lending Platform Association – a Washington, D.C.-based trade group representing small-business lenders including Kabbbage, OnDeck, and CAN Capital — told deBanked.

Even so, the setback was not regarded as fatal. Congress appeared poised to ride to the lending industry’s rescue. Indeed, there was rare bipartisan support on Capitol Hill for the Protecting Consumers’ Access to Credit Act of 2017 — better known as the “Madden fix.”

Introduced in the House by Patrick McHenry, a North Carolina Republican, and in the Senate by Mark Warner, Democrat of Virginia, the proposed legislation would add the following language to the National Bank Act. “A loan that is valid when made as to its maximum rate of interest…shall remain valid with respect to such rate regardless of whether the loan is subsequently sold, assigned, or otherwise transferred to a third party, and may be enforced by such third party notwithstanding any State law to the contrary.”

Just before Thanksgiving, the House Financial Services Committee approved the Madden fix by 42-17, with nine Democrats joining the Republican majority, including some members of the Congressional Black Caucus. Notes ILPA’s Stewart: “We were seeing broad-based support.”

But the optimism has been short-lived. The Madden fix was not included in a package of financial legislation recently approved by the Senate Banking Committee, headed by Sen. Mike Crapo, Republican of Idaho. Moreover, observes Stewart: “Senator Warner appears to have gotten cold feet.”

What happened? Last fall, a coast-to-coast alliance of 202 consumer groups and community organizations came out squarely against the McHenry-Warner bill. Denouncing the bill in a strongly worded public letter, the groups — ranging from grassroots councils like the West Virginia Citizen Action Group and the Indiana Institute for Working Families to Washington fixtures like Consumer Action and Consumer Federation of America – declared: “Reversing the Second Circuit’s decision, as this bill seeks to do, would make it easier for payday lenders, debt buyers, online lenders, fintech companies, and other companies to use ‘rent-a-bank’ arrangements to charge high rates on loans.”

The letter also charged that, if enacted, the McHenry-Warner bill “could open the floodgates to a wide range of predatory actors to make loans at 300% annual interest or higher.” And the group’s letter asserted that “the bill is a massive attack on state consumer protection laws.”

Lauren Saunders, an attorney with the National Consumer Law Center in Washington, a signatory to the letter and spokesperson for the alliance, told deBanked that “our main concern is that interest-rate caps are the No. 1 protection against predatory lending and, for the most part, they only exist at the state level.”

But in their study on Madden, the Stanford-Columbia-Fordham legal scholars report that the strength of state usury laws has largely been sapped since the 1970s. “Despite their pervasiveness,” write law professors Colleen Honigsberg, Robert J. Jackson, Jr., and Richard Squire, “usury laws have very little effect on modern American lending markets. The reason is that federal law preempts state usury limits, rendering these caps inoperable for most loans.”

While the battle over the Madden fix has all the earmarks of a classic consumers-versus-industry kerfuffle, the fintechs and their allies are making the argument that they are being unfairly lumped in with payday lenders. “Online lending, generally at interest rates below 36%, is a far cry from predatory lending at rates in the hundreds of percent that use observable rent-a-charter techniques and that result in debt-traps for borrowers,” insists Cornelius Hurley, a Boston University law professor and executive director of the Online Lending Policy Institute. Because of fintechs, he adds: “A lot of people who wouldn’t otherwise qualify in the existing system are getting credit.”

A 2016 Philadelphia Federal Reserve Bank study reports that traditional sources of funding for small businesses are gradually exiting that market. In 1997, small banks under $1 billion in assets –which are “the traditional go-to source of small business credit,” Fed researchers note — had 14 percent of their assets in small business loans. By 2016, that figure had dipped to about 11 percent.

The Joint Small Business Credit Survey Report conducted by the Federal Reserve in 2015 determined that the inability to gain access to credit “has been an important obstacle for smaller, younger, less profitable, and minority-owned businesses.” It looked at credit applications from very small businesses that depend on contractors — not employees – and discovered that only 29 percent of applicants received the full amount of their requested loan while 30 percent received only partial funding. The borrowers who “were not fully funded through the traditional channel have increasingly turned to online alternative lenders,” the Fed study reported.

The ILPA’s Stewart gives this example: A woman who owns a two-person hair-braiding shop in St. Louis and wants to borrow $20,000 to expand but has “a terrible credit score of 640 because she’s had cancer in the family,” will find the odds stacked against when seeking a loan from a traditional financial institution.

But a fintech lender like Kabbage or CAN Capital will not only make the loan, but often deliver the money in just a few days, compared with the weeks or even months of delivery time taken by a typical bank. “She’ll pay 40% APR or $2,100 (in interest) over six months,” Steward explains. “She’s saying, ‘I’ll make that bet on myself’ and add two additional chairs, which will give her $40,000-$50,000 or more in new revenues.”

In yet another analysis by the Philadelphia Fed published in 2017, researchers concluded that one prominent financial technology platform “played a role in filling the credit gap” for consumer loans. In examining data supplied by Lending Club, the researchers reported that, save for the first few years of its existence, the fintech’s “activities have been mainly in the areas in which there has been a decline in bank branches….More than 75 percent of newly originated loans in 2014 and 2015 were in the areas where bank branches declined in the local market.”

Meanwhile, there is palpable fear in the fintech world that, without a Madden fix, their business model is vulnerable. Those worries were exacerbated last year when the attorney general of Colorado cited Madden in alleging violations of Colorado’s Uniform Consumer Credit Code in separate complaints against Marlette Funding LLC and Avant of Colorado LLC. According to an analysis by Pepper Hamilton, a Philadelphia-headquartered law firm, “the respective complaints filed against Marlette and Avant allege facts that are clearly distinguishable from the facts considered by the Second Circuit in Madden.

“Yet those differences did not prevent the Colorado attorney general from citing Madden for the broad-based proposition that a non-bank that receives the assignment of a loan from a bank can never rely on federal preemption of state usury laws ‘because banks cannot validly assign such rights to non-banks.’”

Should the Federal court accept the reasoning of Madden, Pepper Hamilton’s analysis declares, such a ruling “could have severe adverse consequences for the marketplace and the online lending industry and for the banking industry generally….”

Kalamata Capital / Biz2Credit Lawsuit Settled

January 31, 2018An old dispute between Kalamata Capital and Biz2Credit came to an end today, according to court records. A stipulation of discontinuance with prejudice was filed that confirmed the parties had settled all matters between them.

Kalamata Capital had originally brought the action against Biz2Credit in December 2014.