Industry News

Letter From the Editor – Jan/Feb 2017

March 4, 2017When deBanked first launched online in 2010, I thought it was too late, that perhaps all the exciting changes in alternative finance had already taken place and that aside from a few obsessed geeks, there wasn’t that big of an audience to write for. It certainly felt a bit out-of-style, especially since I had been working in the industry for more than four years by that point. The only publication that was dedicated to the scene at the time had already come in to the public eye and vanished. Many alternative financial companies had met the same fate, thanks to the financial crisis.

In a way, deBanked started off as a post-apocalyptic diary, an accounting of the industry’s survivors and their roles in the new world order. Primitive, my reporting may have been then, but interest quickly grew. By mid-2011, I was already forced to change web hosts to keep the website from slowing down. In my day job as a commercial finance broker, I continued to talk to small business owners all the over the country about a common theme, that banks just weren’t lending. And maybe they never would again, some predicted anyway. Or maybe the way loans were made in general would just never be the same.

Looking back among my old 2011 stories, I discovered that I had written a personalized review of Square’s payment technology and had given it high marks. Back then however, I saw Square as a payments toy. It was innovative and sexy, but unrelated to lending. Fast-forward to 2016 and Square’s capabilities have expanded. I should know, they funded my business exactly five years after my review. In this issue, I’ll walk you through what it was like to play the role of borrower, and put marketplace lending up to the ultimate test. Thanks to Square Capital, my journey has come full circle or more appropriately, full square.

This issue is the first of 2017. For alternative finance, it fortuitously feels like the beginning, not the end. If our descendants far in the future stumble upon these stories, I pray they will enjoy our accounts of the transformation, when entrepreneurs dared to look at the world in front of them and boldly decided to change it. It was the early 21st century, historians will say, when mankind dared to de-bank and change everything we knew about finance. In the here and now, you are a part of it all…

Letter From The Editor – Mar/Apr 2017

March 1, 2017Out of the many lenders and marketplaces that reported their 2016 earnings in the last month, several didn’t look so good. If algorithms and branchless-finance was supposed to make lending so much more efficient, why is it that so many online lenders are struggling to make a pro t?

As it would turn out, banks were not as doomed or as outdated as the technologists characterized them to be. Their cost of capital and brand name recognition (for most of them anyway) is proving very tough to compete with. In this issue we explore the latest trend, the drift back towards banking. That doesn’t mean that we are returning to a purely bank-dominated lending universe, however. On the contrary, it’s mainly the prime borrower market that banks are working to service better. There’s an entire segment out there for which bank financing is not the answer, at least not yet, and there’s plenty of exciting events taking place.

For small business owners, some still want a relationship with the person helping them obtain capital, they just want it in a different way. In the last few months, we spoke with several professionals who attest to having a text-based relationship with their clients, as in they communicate back and forth through their phones over text.

When I first heard about this, I assumed it had to be a one-off. “Wait, your applicants text you for updates with the underwriting process?” I asked a sales representative who seemed stunned that I would think that was odd. After a quick poll of other salespeople at a conference, the truth became clear to me. If you don’t attempt to have a text relationship with your clients, you might be at a disadvantage. In this issue, we explore why that might be.

And on that note, RU ready 4 this issue? Cuz I g2g so ttyl. Thx. ![]()

–Sean Murray

Square Capital Made More Loans, Maintained Default Percentage, Continued to Show Why They’re A Tough Competitor in Fintech Loan Market

February 22, 2017Square has continued to set itself apart in the fintech lending space. The company announced Wednesday that Square Capital had facilitated 40,000 business loans for a total of $248 million in the fourth quarter of 2016. And they did that while holding their default rate at 4%.

A look at their recent loan volume compared to their competitor OnDeck:

| 2016 | Square | OnDeck |

| Q1 | $153,000,000 | $570,000,000 |

| Q2 | $189,000,000 | $590,000,000 |

| Q3 | $208,000,000 | $613,000,000 |

| Q4 | $248,000,000 | $632,000,000 |

Square Capital’s biggest competitive advantage is that they have practically no acquisition cost for their borrowers. “We’re able to upsell and cross-sell to our base of millions of sellers with minimal incremental cost,” Square’s Q4 earnings presentation says. Their payment’s customers, which they can convert to borrowers, processed around $50 billion in transactions last year.

Square had a net loss of $171.6 million across 2016 however, the bulk of which originated in the first quarter. The net loss for Q4 was only $15 million.

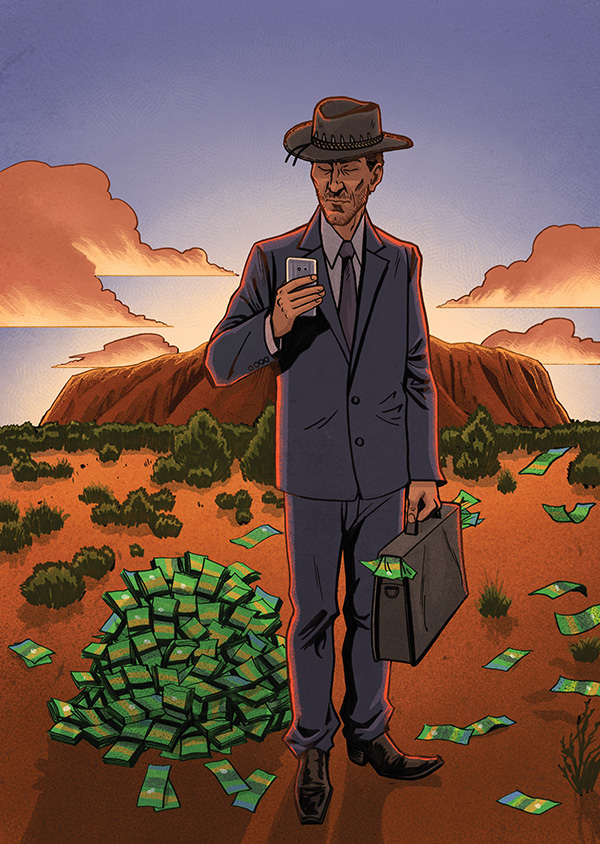

Prospa, Now Valued at $235 Million, is a Major Online Small Business Lender

February 22, 2017 Online small business lending in Australia is taking off, especially for Sydney-based Prospa, who according to the Australian Financial Review, has slightly more than half of the industry’s market share. The company just announced a $25 million (AUD) equity round led by AirTree Ventures that pegged Prospa’s value at $235 million (AUD).

Online small business lending in Australia is taking off, especially for Sydney-based Prospa, who according to the Australian Financial Review, has slightly more than half of the industry’s market share. The company just announced a $25 million (AUD) equity round led by AirTree Ventures that pegged Prospa’s value at $235 million (AUD).

Prospa is significant in that it received early support from US-based Strategic Funding, the same company that just absorbed the US operations of Capify. A 2013 press release said that Strategic would be providing the technology for the electronic servicing, underwriting and cash management of all Prospa Advance accounts in Australia in addition to jointly funding all the merchant cash advances and loans they originated. Sources say however that the arrangement is no longer in effect.

In September 2015, The Carlyle Group, one of the largest private equity firms in the world, participated in a $60 million round for the company. Prospa has now funded more than $250 million to small businesses since inception.

“The market in Australia has been very ripe for alternative finance,” Prospa co-CEO Beau Bertoli said to deBanked about 18 months ago. “We see an opportunity for the alternative finance segment to be more dominant in Australia than it is in America.”

The Australian Financial Review cites Bertoli as more recently saying that the market there could grow to at least $20 billion in the next five years.

Similar to offers in the US, Prospa lends between $5,000 to $250,000 for loans up to one year.

Layoffs, Big Losses for OnDeck in Q4

February 16, 2017 OnDeck weathered a brutal fourth quarter driven largely by an increase in provision for loan losses which increased to $55.7 million, up from $20.0 million in the comparable prior year period. $18.7 million of this can be attributed to loans with original maturities of 15 months or longer whose performance has deviated or is expected to deviate, the company said. “As a result, the Provision Rate in the fourth quarter of 2016 was 10.2% compared to 5.6% in the comparable prior year period,” the company reported. For the full year of 2016, the Provision Rate was 7.4%, compared to 5.8% in 2015. CFO Howard Katzenberg said on the earnings call that it will likely continue to hover at around the 7% level.

OnDeck weathered a brutal fourth quarter driven largely by an increase in provision for loan losses which increased to $55.7 million, up from $20.0 million in the comparable prior year period. $18.7 million of this can be attributed to loans with original maturities of 15 months or longer whose performance has deviated or is expected to deviate, the company said. “As a result, the Provision Rate in the fourth quarter of 2016 was 10.2% compared to 5.6% in the comparable prior year period,” the company reported. For the full year of 2016, the Provision Rate was 7.4%, compared to 5.8% in 2015. CFO Howard Katzenberg said on the earnings call that it will likely continue to hover at around the 7% level.

The company lost $36.5 million in Q4 and $86.5 million for the year.

To try and turn things around, OnDeck is laying off up to 11% of their staff as part of a “cost rationalization plan.”

James Hobson, their COO, recently announced his resignation and March 15th is his last official day.

On the earnings call, Katzenberg wouldn’t say how many loans in their portfolio were 15 months or longer, but did say that it’s more than a third of their book. This is notable given that this segment is the one in which performance isn’t matching their models and led to the recalibration of loss expectations.

Meanwhile CEO Noah Breslow explained that losses did not stem from their partnership with Chase since Chase held all those loans on their own balance sheet. Breslow said their role in that relationship is servicing.

No origination channel was directly responsible for the loss provision increase. One analyst surmised if perhaps third party brokers or funding advisors, as OnDeck calls them, might be responsible, but the company said that origination channel wasn’t a factor.

Despite the fact that OnDeck is now using the 5th generation of their proprietary OnDeck Score, they were unable to predict performance on loans that now make up more than a third of their portfolio, yet the company said they remain very confident in their scoring model.

“Loans sold or designated as held for sale through OnDeck Marketplace represented 15.8% of term loan originations in the fourth quarter of 2016 compared to 39.8% of term loan originations in the comparable prior year period,” the company reported.

Lending Club Reveals Q4 Figures, $146 Million Loss for the Year

February 15, 2017

The year that shook the industry ended six weeks ago but the total damage wrought is just now coming out. Lending Club lost $146 million in 2016, $32 million of which can be attributed to Q4. But it didn’t end all that badly according to CEO Scott Sanborn.

On the earnings call he said, “our attention was focused on rebalancing our funding mix, a key step to bolster our resiliency and enable a return to growth. We set a target to help our bank partners close out their rigorous diligence, so that they could return to scale. I’m pleased to say that our efforts have paid off as not only are all of our key bank investors back buying on the platform, but we’ve also welcomed multiple new bank partners over the last few months.”

And so they’re feeling quite optimistic. “It’s an exciting time for Lending Club and I look forward to beginning the next phase of our growth,” Sanborn concluded before turning the call over to new CFO Tom Casey.

Casey went on to predict that the company would lose another $69 million to $84 million in 2017, with nearly half of that expected to be generated in the first quarter of this year.

In brighter news, the company celebrated the 10th year anniversary of their first loan and surpassed more than $25 billion in loans since inception. With close to 2 million customers-to-date, that would mean that nearly 1% of the adult population in the US has had a Lending Club loan.

Less than 10% of their loan volume is comprised of education and patient finance loans, small business loans, and small business lines of credit, according to their report.

What Shakeout? Breakout Capital Secures $25 Million Credit Facility

February 8, 2017 Put a tally up on the board for small business lenders in 2017. McClean, VA-based Breakout Capital, which just announced a move into a larger office last week, has also secured a $25 million credit facility with Drift Capital Partners. Drift is an alternative asset management company.

Put a tally up on the board for small business lenders in 2017. McClean, VA-based Breakout Capital, which just announced a move into a larger office last week, has also secured a $25 million credit facility with Drift Capital Partners. Drift is an alternative asset management company.

Breakout is young by today’s industry standards, founded only two years ago by former investment banker Carl Fairbank, who is the company’s CEO. And don’t count them out just because they’re not in New York or San Francisco. Washington DC’s Virginia suburbs have become somewhat of a hotspot for fintech lenders. OnDeck, Fundation, StreetShares and QuarterSpot all have offices there, Fairbank points out. “And Capital One is right up the street,” he adds while explaining that the community has a strong talent pool that is familiar with creative lending. Breakout has already grown to about 20 employees and they’re still growing, he says.

Fairbank considers Breakout to be a more upmarket lender, whose repertoire includes serving the near-prime, mid-prime customer. CAN Capital and Dealstruck had focused on this area and both companies stopped funding new business in 2016. As I point this out, I ask if that suggests that segment is perhaps too difficult to make work.

“Candidly, that’s the part of the market that I feel the best about,” he says matter of factly. The company tries to product-fit deals based on the borrower, and will even make monthly-payment based loans. “I think the subprime side with the stacking and the debt settlement companies is a very very difficult place to play right now,” he says, adding that they have worked with subprime borrowers using their original bridge program but that they’ve kind of pulled back from doing those. As with all programs regardless, their goal is to graduate merchants into better or less costly products later on. We have helped merchants move on to get SBA loans, he maintains.

That all sounds very hands on, and part of it is, Fairbank confirms while asserting that technology does indeed do a lot of the legwork. “There’s absolutely a human element to underwriting these deals,” he says. He also agrees with much of what RapidAdvance chairman Jeremy Brown wrote in a deBanked op-ed titled, The New Normal. Both Breakout and RapidAdvance refer to themselves as technology-enabled lenders, an acknowledgement that tech is a component of the company, not the entire company itself.

“I think we will see the beginning of the demise of fully automated, no manual touch funding,” Brown wrote in his article.

Brown also predicted that the legal system will ultimately impose order on some industry practices like stacking or that a state like New York could take a public policy interest in products he believes have legal flaws. As he was writing that, Governor Cuomo’s office published a budget proposal that redefined what it means to make a loan in the state. And it leaves much to be desired, some sources contend. Two attorneys at Hudson Cook, LLP, for example, published an analysis that demonstrates how its wording is ambiguous and far-reaching.

“What they really need to do is take the time to think through the implications and basically do a full study of the market to ensure that what they’re pushing forward is going to have the desired consequences,” Breakout’s Fairbank offers on the matter.

This doesn’t mean he’s anti-regulation. The company already holds itself to high standards and customer suitability and is a founding member of the Coalition for Responsible Business Finance.

“I personally do believe that there’s bad forms of lending or cash advances in the market and I’m sure that’s what Cuomo thinks as well but at the same time, it’s getting pushed very quickly and they really really ought to step back and do the research to understand the broader implications and to understand what exactly they’re trying to accomplish,” he maintains.

His pragmatism extends to the OCC’s proposed limited fintech charter, which he finds intriguing, assuming it gets buttoned up. “I believe it’s a concept worth pursuing,” he says, explaining that regulators will need to get comfortable with unsecured lending.

In the meantime, he’s optimistic about Breakout’s prospects. “In a time when institutional appetite for alternative finance companies has dried up, we believe our ability to raise a credit facility in this market speaks volumes about what we have already accomplished, our position as a leading player in the space, and our prospects for strong, but measured, growth,” Fairbank is quoted as saying in a company announcement. The company was also invited and joined the Task Force for the PLUM Initiative, a collaboration between the U.S. Small Business Administration (SBA) and the Milken Institute to more effectively provide capital to minority-owned businesses throughout the United States. The Task Force consists of a very select group of industry leaders, who are in positions to improve access to capital in underserved markets, according to the announcement.

While other companies are making adjustments or in his opinion, continuing to make questionable underwriting decisions, Fairbank thinks his formula for success works. “I think that we do look at deals differently than most folks because I intentionally built the core of my underwriting team with folks who are not from this space so they take a more traditional approach and mix it with some of the greatest aspects of alternative finance.”

OnDeck’s COO Announces Resignation Prior to Q4 Earnings

February 3, 2017OnDeck COO James Hobson notified the company on Friday that he is resigning to “pursue another opportunity.” According to the 8-K filed with the SEC, it will become effective on March 15, 2017.

Hobson started at OnDeck in 2011 and became the COO in 2012.

The announcement comes weeks before OnDeck is expected to disclose their Q4 and full-year 2016 report. In Q3, the company had shifted to keeping more loans on their own balance sheet, while increasing their reliance on third party brokers for business. They had also reported a GAAP net loss of $16.6 million for the quarter, bringing the 2016 Q1 – Q3 total losses to $47.1 million.