Industry News

Broker Fair 2018 Pre-Show Photos

May 17, 2018Photos from the Broker Fair 2018 May 13th Pre-show party at The William Vale in the Vale Garden Residence. Photos from the conference will be published separately. We hope you had fun.

LendingPoint Secures Facility of up to $600 Million

May 17, 2018 LendingPoint announced today that it has closed on a credit facility for up to $600 million, arranged by Guggenheim Securities. The direct consumer lender secured a facility in September 2017 for $500 million, bringing its recent combined credit facility to $1.1 billion, in just nine months.

LendingPoint announced today that it has closed on a credit facility for up to $600 million, arranged by Guggenheim Securities. The direct consumer lender secured a facility in September 2017 for $500 million, bringing its recent combined credit facility to $1.1 billion, in just nine months.

LendingPoint Chief Marketing Officer Mark Lorimer told deBanked that he was thrilled about the new facility for a number of reasons.

“But what I’m most excited about is the fact that we need it,” he said.

In the first quarter of 2018, LendingPoint processed more than 850,000 applications from borrowers requesting more than $9.2 billion in loans. These numbers are up from a year ago and also up from the fourth quarter of last year.

This rapid increase in demand has mostly been for the company’s primary loan product, a consumer loan for people with credit scores between 580 and 700, which LendingPoint calls “near prime.” These loans are between $2,000 and $26,500 with terms of 24 to 48 months.

“While our competition will occasionally dip down [to our level], they tend to be more comfortable in the 680 and up type of range, and that means that many of [the near prime] customers will come to us.”

With LendingPoint’s acquisition of merchant onboarding company LoanHero in December 2017, LendingPoint started offering a point of sale product to merchants at the begin of 2018. This loan product offers between $500 and $15,000 to consumers making specific purchases and these loans (with terms from from 12 to 60 months) have also been in very high demand, according to Lorimer.

This product has only been offered for six months, but Lorimer said that he would not be surprised if it becomes the larger contributor to overall originations within the next few years. For now, though, the company’s direct consumer loan product is responsible for the lion’s share of originations.

Since company issued its first loan in 2015, LendingPoint has originated more than 50,000 loans totaling more than $500 million. Headquartered in Kennasaw, GA, outside of Atlanta, the company employs about 160 people.

World Business Lenders Secures Credit Facility

May 16, 2018 World Business Lenders announced yesterday that it obtained a $30 million credit facility from a Cayman Islands fund created by a group of Asian banks and investors.

World Business Lenders announced yesterday that it obtained a $30 million credit facility from a Cayman Islands fund created by a group of Asian banks and investors.

“The terms [of the facility] are very attractive,” said World Business Lenders CFO Tom Wills. “Single digit fixed interest rate and high advance rates.”

The new facility will be used to continue funding a loan product that is a hybrid of a business loan and a mortgage, Wills told deBanked. He said that World Business Lenders invented this product three years ago.

“Three years ago, we saw some credit weakness coming into the market and we decided to develop this real estate collateralized product,” Wills said.

World Business Lenders provides business loans that range from $5,000 to $2 million and are paid back between six and 36 months. Their average loan size is $150,000.

Wills said that the hybrid product is becoming more institutionally accepted and that they have been seeing more demand for it. Created in 2011, the company employs over 100 people at its office in Jersey City, NJ.

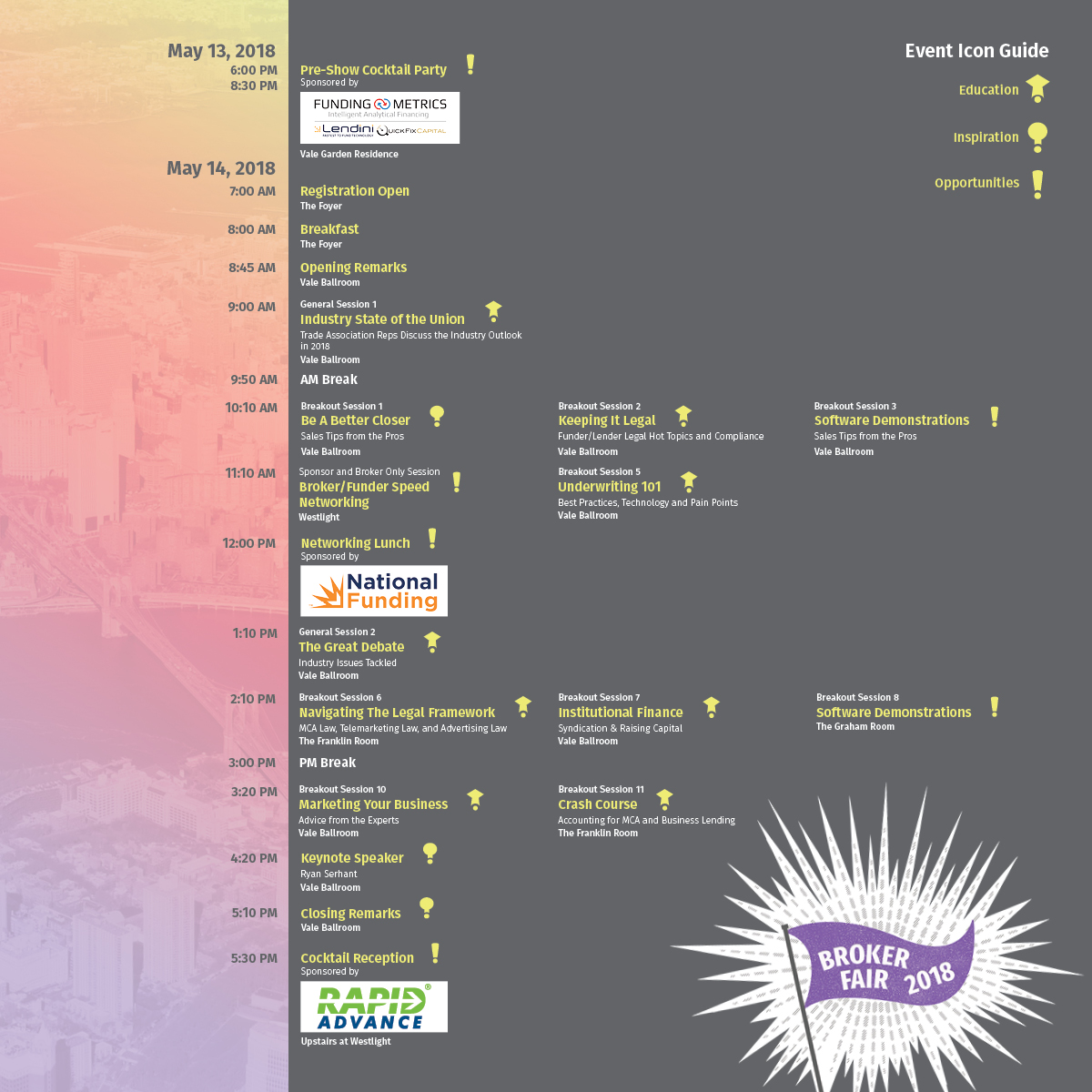

Welcome to Broker Fair

May 13, 2018Update: Thanks to everyone who attended, participated, and sponsored!

Registration on Monday starts at 7am where you will be able to pick up your badge. The continental breakfast will be available at 8am and the opening remarks begin at 8:45am.

Registration on Monday starts at 7am where you will be able to pick up your badge. The continental breakfast will be available at 8am and the opening remarks begin at 8:45am.

The lunch, sponsored by National Funding, begins at 12. There will be a kosher option available.

Later at the end of the day, the cocktail reception at Westlight, which is upstairs on the 22nd floor, will begin at 5:30pm. Westlight offers amazing outdoor views of the Manhattan skyline. That event is sponsored by RapidAdvance and all you need to enter is your Broker Fair badge.

The agenda will also be available on the backside of your badge.

Thank you also to our Gold Sponsors: National Business Capital, CFG Merchant Solutions, BFS Capital, and CanaCap

Strategic Funding Announces Securitization

May 12, 2018

Strategic Funding received preliminary ratings from Kroll Bond Rating Agency on four classes of Series 2018-notes that can be sold to investors. The notes are composed of Strategic Funding’s receivables, packaged together based on quality.

“It’s certainly exciting to be able to meet the requirements of a securitization,” said Strategic Funding CEO Andrew Reiser. “Kroll is a very responsible agency and they put you through a lot of rigor to be able to meet [their] requirements and have a rated bond.”

Reiser told deBanked that although their securitization starts at $100 million, it gives the company the ability to ramp up to $500 million.

“A securitization allows you to continue to grow without having to constantly find who’s the next source of capital,” Reiser said.

He spoke of a securitization in contrast to a warehouse line of credit, which is a short-term revolving credit facility.

“A warehouse line requires banks to bring on more banks [which] is more tedious. With a securitization, it’s a very seamless process. It makes growth easier.”

Only Kabbage and OnDeck have a securitization in the alternative lending space, Reiser said.

The notes will be secured by a pool of the company’s receivables consisting of business loans and merchant cash advances. This securitization is particularly unique as it is uncommon to securitize merchant cash advances since the timing of a cash advance receivable is uncertain. (The securitizations for Kabbage and OnDeck are not backed by merchant cash advances as those companies don’t provide this product.)

The four classes of notes, valued at $100 million, received the following ratings by Kroll:

A- notes ($65,394,000), BBB- notes ($19,131,000) BB notes ($5,777,000) and B notes ($9,698,000).

Founded in 2006, Strategic Funding is headquartered in New York, with other offices in Boca Raton, FL, Arlington, VA, and Rockwell, TX, outside of Dallas.

FinMkt Launches ISO Business

May 10, 2018

FinMkt has launched a broad ISO, working with referral partners from brokers to accountants to small business advisors. With two years of experience facilitating consumer lending, the company has just entered the small business lending market.

“We took the same engine that we used on the consumer side and we rolled it over to the small business side,” said FinMkt’s VP of Business Development who is overseeing this new division, called Bizloans.

The Bizloans brand within FinMkt started at the end of last year, but has been in stealth mode for the last three to six months, Sklar told deBanked. So far, Bizloans has facilitated $15 million in loan application requests over the last 60 days. Of this, roughly $5 million has been funded.

The new division can present small businesses with a variety of financing, from merchant cash advance to factoring and lines of credit. In the few months that FinMkt’s Bizloans has been in operation, Sklar said that real estate asset-backed loans, equipment leasing and merchant cash advance has made up the bulk of the funding products facilitated.

For MCA products, $35,000 has been the average request and $150,000 has been the average for equipment leasing. According to Sklar, some of the funding companies that Bizloans has already worked with include OnDeck, Gibraltar, SOS Capital, 6th Avenue Capital and the San Diego-based bank holding company, BofI.

For successfully funded deals, Sklar said that they will get paid a commission and then pay the broker, depending on how involved they were in the deal.

“The commission splits vary depending on the amount of legwork and the amount of sophistication [the broker has] in the industry,” Sklar said.

For deals where the broker did most all of the work and simply used Bizloans as a platform, those brokers will generally get 80% of the commission, Sklar said. If the broker only supplied the lead, then they may only get 40%. Bizloans offers training to brokers less familiar with the industry.

Founded in 2011 by CEO Luan Cox and CTO Sri Goteti, FinMkt initially operated in the crowdfunded securities space. The company of 15 people is headquartered in New York City and has an office in Hyderabad, India.

SmartBiz Adds Seacoast Bank as a Partner

May 9, 2018 SmartBiz announced yesterday that it has added Seacoast Bank as one of its partner banks, bringing the total number of its bank partners to eight. Seacoast Bank is one of Florida’s largest regional banks with approximately $5.8 billion in assets and $4.6 billion in deposits as of December 31, 2017.

SmartBiz announced yesterday that it has added Seacoast Bank as one of its partner banks, bringing the total number of its bank partners to eight. Seacoast Bank is one of Florida’s largest regional banks with approximately $5.8 billion in assets and $4.6 billion in deposits as of December 31, 2017.

“I think they’ve got a real innovation mindset as a way to deliver on customer needs,” SmartBiz CEO Evan Singer said of Seacoast.

Singer told deBanked that SmartBiz seeks to partner with banks that embrace technology and like working with fintech companies, which is why he said Seacoast is so appealing.

“We are very focused on meeting small business needs from a capital perspective,” Singer said, “[which means saying] yes to the amount that I need in a way that I can repay it at the lowest rate I can get, [and] in a fast and easy way. If a bank has a similar philosophy on meeting customer needs, putting customers first and wanting to embrace technology…then it could be a good fit.”

SmartBiz is an online marketplace for SBA loans that helps small businesses apply for loans and helps banks underwrite them. The company makes money by licensing software to both parties to ultimately connect the right small business with the most appropriate bank, given the customer’s needs and the bank’s credit parameters.

Seacoast Bank has offices in cities throughout Florida, including Fort Lauderdale, Boca Raton, West Palm Beach and Orlando.

“We see SmartBiz Loans and its unique technology platform as a great fit and the means to supply more qualified small business owners with the capital infusion they need to grow,” said Julie Kleffel, executive vice president and community banking executive at Seacoast Bank.

In February, SmartBiz announced that it had surpassed JP Morgan as the number one facilitator of SBA 7(a) loans under $350,000 for the calendar year 2017. When asked if SmartBiz is on par to maintain its record for 2018, Singer said that he thinks so, but would have to check the data. He said SmartBiz is growing and is currently looking to hire.

Founded in 2009, SmartBiz employs a little over 100 people. The company is headquartered in San Francisco and has an office in Austin. The employee ratio between San Francisco and Austin is roughly 80 and 20 percent, respectively.

World Global Financing, Inc. Declares Bankruptcy

May 9, 2018World Global Financing, Inc., a Florida-based merchant cash advance provider, filed for bankruptcy yesterday, according to Chapter 11 documents obtained from the Southern District of Florida.

Company CEO Cyril Eskenazi reported that its assets and liabilities were both between $10 and $50 million. Among the company’s creditors are ACH Capital, LLC, Capital One, Eaglewood funds, MB Financial Bank, the IRS and other tax authorities, WG Financing Inc, WG Funding Trust, Wilmington Savings Fund Society, FSB, several law firms, a mortgage company and more.