Industry News

Long Island Business Loan Brokers Arrested in Bust

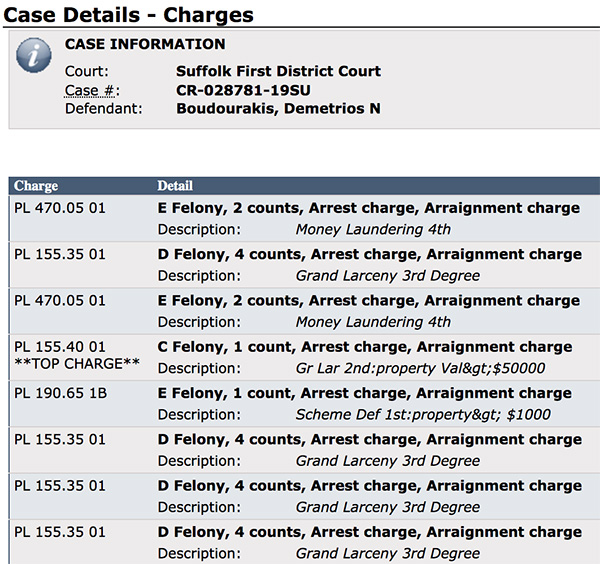

June 13, 2019 The owner of a Long Island based ISO/loan brokerage and several employees have been arrested, Newsday reports. Demetrios Boudourakis, whom deBanked has previously reported on, is charged with grand larceny, money laundering and other crimes for his role in an advance fee loan scheme. Boudourakis allegedly led a fraud ring that stole more than $2 million from small business owners nationwide. Six other defendants have also been charged with related crimes. They include Nadim Afzali of Hicksville, Tanya Balbi of Farmingdale, Christopher Looney of Bethpage, Joseph Johnson of Brentwood, Jude Brun of Elmont, and Michelle Soccodato of Hicksville.

The owner of a Long Island based ISO/loan brokerage and several employees have been arrested, Newsday reports. Demetrios Boudourakis, whom deBanked has previously reported on, is charged with grand larceny, money laundering and other crimes for his role in an advance fee loan scheme. Boudourakis allegedly led a fraud ring that stole more than $2 million from small business owners nationwide. Six other defendants have also been charged with related crimes. They include Nadim Afzali of Hicksville, Tanya Balbi of Farmingdale, Christopher Looney of Bethpage, Joseph Johnson of Brentwood, Jude Brun of Elmont, and Michelle Soccodato of Hicksville.

The investigation began last year and involved numerous agencies, including the Suffolk and Nassau police and sheriff’s departments, New York State Police, the FBI and the Drug Enforcement Administration.

The investigation began last year and involved numerous agencies, including the Suffolk and Nassau police and sheriff’s departments, New York State Police, the FBI and the Drug Enforcement Administration.

According to Newsday, “Boudourakis and his associates, through the dark web, obtained the names of people who had been denied loans. They would then call those people to tell them they had qualified for loans but would have to pay interest and fees upfront.”

According to Long Island Business News, law enforcement agents who executed search warrants at several locations recovered electronic equipment, three handguns, a sawed-off shotgun and a pill press. The investigation leading up to the bust included court-authorized eavesdropping and audits of financial records and physical and electronic surveillance.

Previously, deBanked reported that JTT Funding, Boudourakis’ company, had been accused of forging a Confession of Judgment and impersonating rival companies. Those were civil cases, not criminal cases. Court records show that those cases remain ongoing.

Among the company names the ring used in the alleged scheme were Federal Business Lenders, Federal Business Funding, JTT Funding, JTT Global Holdings, Inc. Blackrock Funders, Inc. and Blackrock, Inc. It is possible that some of those names closely resemble names of competitors and the actual companies have not been accused of any wrongdoing.

Boudourakis is a retired MMA fighter. His nickname in the ring was “The Tyrant.”

Jonathan Braun Sentenced to 10 Years

May 28, 2019

Jonathan Braun, who Bloomberg Businessweek profiled in a merchant cash advance story series, was sentenced to 10 years for drug related offenses this morning at the federal courthouse in Brooklyn. He will get credit for 17 months previously served in 2010 – 2011. He is scheduled to surrender on August 25th.

Prior to the judge’s order, Braun was given an opportunity to speak and proclaimed himself a changed man. The judge took many things into consideration including letters supporting Braun’s transformation as well as some new lawsuits and allegations that cast him in a negative light. Nevertheless, the judge explained that no new charges had been brought against Braun since he pleaded guilty 8 years ago. The 10-year sentence was the mandatory minimum.

Small Business Finance Broker Wins Entrepreneur Of The Year

May 17, 2019

Sonia Alvelo, CEO of Newington, CT-based Latin Financial LLC, has been awarded Entrepreneur of The Year by the Latinas & Power Symposium. The event, incubated in Hartford, Connecticut in 2004, is the largest of its kind in New England and has reached upwards of 8,000+ women since its inception.

Alvelo’s company markets and brokers business loans and merchant cash advances throughout the mainland United States and Puerto Rico.

Connecticut Secretary of State Denise Merrill presented the award to Alvelo, who referenced the moment on social media by writing, “I was deeply honored to present the Entrepreneur of the Year Award to Sonia Alvelo at the 16th Annual Latinas & Power symposium today. Her small business is bolstering the Newington economy and her leadership serves as an example for women across the state.”

Alvelo has been an oft-quoted source in deBanked on the state of the small business finance market in Puerto Rico, most recently in the May/June 2018 magazine edition.

“I’m here today because of the merchants and clients from Puerto Rico and the US,” she told deBanked on Thursday, adding that this is just the beginning for what she and her company will accomplish.

I was deeply honored to present the Entrepreneur of the Year Award to Sonia Alvelo at the 16th Annual Latinas & Power symposium today. Her small business is bolstering the Newington economy and her leadership serves as an example for women across the state. pic.twitter.com/POwlvx0XkA

— Denise Merrill (@SOTSMerrill) May 16, 2019

Kapitus Rolls Out Fully Automated Funding Process

April 2, 2019 New York, NY – Kapitus, a leading provider of alternative financing to small and midsize businesses, announces the roll-out of auto-checkout – a fully automated funding process for qualified deals. The new process allows for not only a faster, more streamlined experience for its partners; but it also provides more flexible financing options, by providing multiple offers at once. At the same time, the new process provides merchants with secure and quick access to funds for their business.

New York, NY – Kapitus, a leading provider of alternative financing to small and midsize businesses, announces the roll-out of auto-checkout – a fully automated funding process for qualified deals. The new process allows for not only a faster, more streamlined experience for its partners; but it also provides more flexible financing options, by providing multiple offers at once. At the same time, the new process provides merchants with secure and quick access to funds for their business.

Unlike competing models where only an “option of approval” or “conditional approval” is provided at the time of checkout, Kapitus is able to determine approval eligibility with only an application and bank statements without the need for multiple upfront stipulations to confirm bank information, ownership and identity. Utilizing proprietary machine learning models – eligible deals can be closed without any additional documentation.

“This is a true turning-point for us from a technology perspective and we’re very excited about it,” said Andrew Reiser, Chief Executive Officer at Kapitus. “With this new automated process, we’re able to provide our partners an extremely simple process with an exceptionally quick time-to-funding. At the same time, merchants are provided with a more seamless experience with enhanced security”

Major features in the roll-out include:

- True auto-check functionality with full approval at time of checkout

- Progress tracking and customizable notifications to follow merchants through the checkout process

- Intuitive user interface with precise, easy-to-understand instructions for both merchants and partners

- Simple, seamless secure checkout functionality for merchants

“This is the first of many technology advancements we will be rolling out over the next year,” adds Arun Narayan, Chief Product Officer. “We are committed to creating exceptional experiences for both our partners and merchants. Incorporating the right technology is paramount in building out the right environment and the best experience for all of our audiences.”

ABOUT Kapitus

Founded in 2006 and headquartered in NYC, Kapitus is one of the most reliable and respected names in small business financing. As both a direct lender and a marketplace built with a trusted network of lending partners, Kapitus is able to provide small businesses the financing they need, when and how it is needed. With one application business owners can save time and money, while eliminating the stress that comes with applying to different lenders. At Kapitus, we believe that business owners should be able to focus on running their business, while we take care of the financing. Learn more at https://kapitus.com

CONTACT: Bernadette Abel

Kapitus

babel@kapitus.com

646-722-1484

What Did Direct Lending Investments Invest In?

March 27, 2019 When Bloomberg News reported that Direct Lending Investments (DLI) had lost approximately 25% of its portfolio value from a deal gone bad, some were surprised to learn that it had nothing to do with its core competency of online lending. VOIP Guardian Partners I, which stuck DLI with more than $190 million in unpaid loans, was in the business of lending money to smaller telecoms against their accounts receivables, Bloomberg News reported. VOIP was then supposed to be repaid the money when larger telecom companies paid the smaller ones.

When Bloomberg News reported that Direct Lending Investments (DLI) had lost approximately 25% of its portfolio value from a deal gone bad, some were surprised to learn that it had nothing to do with its core competency of online lending. VOIP Guardian Partners I, which stuck DLI with more than $190 million in unpaid loans, was in the business of lending money to smaller telecoms against their accounts receivables, Bloomberg News reported. VOIP was then supposed to be repaid the money when larger telecom companies paid the smaller ones.

On March 11, VOIP filed for Chapter 7, and limited details behind these telecom borrowers became public.

VOIP’s largest loan default was to a Hong Kong-based company formed in 2015 named Telacme, Ltd. Records indicate that $1 billion overall had been loaned to Telacme through 30-day rolling advances but that they stopped making payments in October 2018, leaving a remaining balance to VOIP and in turn to DLI, of $101.1 million. Telacme’s official website no longer exists and only a holding page by Godaddy indicating that the page has been parked free remains. (Update 4/16/19 – The website has been restored)

The second largest default at $58 million was to a company named Najd Technologies, Ltd, headquartered in the United Arab Emirates. Like Telacme, Najd stopped paying in October 2018 and their website is also no longer accessible. Internet archives show it advertised itself as a global telecom company based in Bangkok, Thailand.

The other remaining telecom loan issues spanned companies all across Europe.

A lawsuit filed against DLI in 2017 complained that DLI falsely represented to investors that it typically made loans that ranged between $5,000 and $100,000 when in fact DLI had been financing multi-million dollar telecom deals as far back as 2014. The plaintiffs went so far as to claim that at one point up to 50% of DLI’s portfolio was invested in telecom receivables.

But the claims were removed in a subsequent amended version of the lawsuit after the judge ordered them stricken because the plaintiffs themselves were not aggrieved investors, but instead unhappy former business partners alleging violations of a non-compete.

“I don’t understand why it’s in the complaint,” the judge said. “Particularly, when [DLI] says it is impacting their ability to raise money.”

The decision was prescient as DLI would not only go on to raise more money but also lose more than $190 million of investor money in telecom deals that weren’t overtly advertised.

A March 2017 DLI investor presentation obtained by deBanked touts its focus on underserved Main Street USA businesses. There is no mention of international telecom lending, nor any plans to finance telecom businesses for hundreds of millions of dollars, let alone do so in the Middle East, Asia, and Europe.

In VOIP’s bankruptcy filing, DLI is the primary secured creditor. DLI’s chief executive recently resigned and the fund has been sued by the Securities & Exchange Commission for issues unrelated to VOIP and is being placed under receivership.

The 2017 lawsuit against DLI and VOIP can be found under Index #650973/2017 In the New York Supreme Court.

WeWork, The Home Office of Small Business Finance Startups

March 20, 2019 Kunal Bhasin, owner of brokerage 1 West Finance, funded three A paper deals for companies that all happened to work out of the same Manhattan office building on the corner of 42nd Street and Third Avenue. It’s actually not as big a coincidence as it sounds because it’s the same building where 1 West Finance operated out of, along with likely hundreds of others at a midtown WeWork, the giant co-working company that has 59 offices in New York City alone.

Kunal Bhasin, owner of brokerage 1 West Finance, funded three A paper deals for companies that all happened to work out of the same Manhattan office building on the corner of 42nd Street and Third Avenue. It’s actually not as big a coincidence as it sounds because it’s the same building where 1 West Finance operated out of, along with likely hundreds of others at a midtown WeWork, the giant co-working company that has 59 offices in New York City alone.

What is remarkable is that the co-working concept (where companies work alongside each other for the benefit of all) actually works. At least it did for Bhasin. Because Bhasin’s company was expanding and needed to find space very quickly, he was unable to find a larger office at that same WeWork office. And because location was critical, he relocated to a Regus right nearby. Regus, which preceded WeWork, also rents space to companies, but focuses less on encouraging resident companies to get to know each other.

“I already miss it a lot,” Bhasin said of his old office at WeWork.

Bhasin said he met his former WeWork colleagues, who became clients, at the communal coffee stations and lunch events organized by WeWork.

Peter Graves, founder of Two Trees Funding, a one-man ISO shop, runs his business out of the WeWork office at 110 Wall Street. He said that he has gotten referrals from colleagues at other companies in his WeWork office. And he really appreciates the ability to to expand without having to change your lease.

The office culture is one of the main reasons why another company in the small business finance space loves WeWork. “Here, we engage with other people [and] we get a fresh perspective from other people, whether it’s a graphic designer or someone who works in cryptocurrencies,” a representative who asked to remain anonymous said. They also appreciate the flexibility, acknowledging that when they started with only four people, they rented month to month. Now, they have 12 people and a lease agreement for two years.

“We could have gotten a commercial space for 5 years,” they said. “But maybe we’d need a bigger space. This allows for flexibility.”

Direct Lending Fund CEO Resigns, Investigation

March 20, 2019

Direct Lending Fund CEO Brendan Ross, has resigned, according to Bloomberg News and numerous individuals identifying themselves as investors on an industry blog. The fund not only lost nearly 25% of its portfolio in a single sour investment, but it’s reported that they may have overvalued its investments in QuarterSpot’s small business loan platform.

The fund was reputed as one of the largest funds in the online lending industry and one that “historically earned investors unlevered double digit returns” by investing in online loan marketplaces.

Were there signs of problems?

In a tell-all book published by DealStruck founder Ethan Senturia in late 2017, Senturia describes how Ross’s fund had been overly dependent on his company’s success. “I am like, literally staring over the edge. My life is over,” Senturia quotes Ross as saying in Unwound when he became aware of DealStruck’s downward spiral*. Despite this characterization, Ross’s fund continued to grow relatively unscathed.

Meanwhile, James R. (“Jim”) Hedges, IV wrote an op-ed in Mid-2017 on Lend Academy of a mystery fund he refused to identify that had a Bernie Madoff-feel to it. In the comments, users point out that the monthly returns matched the ones on Direct Lending’s investor letters.

“When I first saw these returns, I instinctively thought of Madoff,” Hedges wrote. “The narrow band of returns is, in my experience, highly unusual and inconsistent with the returns of investments being marked-to-market. To be clear, I am not saying that this fund is a fraud. I am stating that the performance they’ve reported is, in my experience, unlikely indicative of a valuation methodology that accurately reflects the month-to-month performance of the underlying assets.”

*DealStruck announced a restructuring in December 2018

Business Loan Brokers Indicted

March 16, 2019 Five business loan brokers were named in a federal indictment in Ohio for defrauding a 69-year-old business owner out of his money and cars. In addition to being asked for hundreds of thousands of dollars in upfront fees to apply for the loan, the victim signed over the title of 55 vehicles to a broker to serve as the collateral. The vehicles included a Ford Mustang, several dump trucks, several tractors, several restored classic vehicles, a Freightliner motor home, and trailers.

Five business loan brokers were named in a federal indictment in Ohio for defrauding a 69-year-old business owner out of his money and cars. In addition to being asked for hundreds of thousands of dollars in upfront fees to apply for the loan, the victim signed over the title of 55 vehicles to a broker to serve as the collateral. The vehicles included a Ford Mustang, several dump trucks, several tractors, several restored classic vehicles, a Freightliner motor home, and trailers.

In reality, there was no loan.

Text messages quoted in the indictment indicated that one of the defendants traveled from New York to Youngstown, Ohio by Greyhound Bus to begin driving the vehicles back to New York one-by-one, but their scheme faced challenges when they could not afford the gas to drive all of the cars. By the end, the victim was cooperating with the police and one of the defendants was lured back to Ohio in September to pick up a payment where he was then arrested.

deBanked discovered a message board post that appears to be published by one of the defendants months after the alleged crime. In it, she attempts to recruit other brokers to send her business with promises of high commissions, same day approvals, free leads, and a policy of no backdooring.