Fintech

Top Minds in Fintech Came Together in Manhattan Last Night

April 3, 2019 More than 200 people packed into a Manhattan office last night to hear panelists from top fintech companies discuss everything from Artificial Intelligence (AI) in fintech to U.S. regulations to diversity. The event, called Disruption Forum Fintech NYC, was organized remotely by a Poland-based software and technology consulting company called Netguru. This was their third event, following one in Berlin and another in London.

More than 200 people packed into a Manhattan office last night to hear panelists from top fintech companies discuss everything from Artificial Intelligence (AI) in fintech to U.S. regulations to diversity. The event, called Disruption Forum Fintech NYC, was organized remotely by a Poland-based software and technology consulting company called Netguru. This was their third event, following one in Berlin and another in London.

The event took place at the office of Work-Bench, a VC firm, and most panelists during the four panel event discussed regulations in some form or another.

“We have a conversation with customers before thinking about regulations,” said Katherine Kornas, Senior Director of Product at Betterment, an online financial advice company. “I try to free my team of constraints.”

Afterwards, they address constraints and work creatively with them, she said. But at least they know that they started off from a place of trying to solve a problem for the customer.

“Hire a really fun and creative Chief Compliance Officer,” said Melissa Cullens, Chief Design Officer at Ellevest, which provides investing advice geared towards women. “We wanted to create profiles with people’s faces and she said “No.” But then we ended up coming up with a different idea that was also really great.”

Melissa Cullens, Chief Design Officer at Ellevest, Katherine Kornas, Senior Director of Product at Betterment, Sudev Balakrishnan, Chief Product Officer at Stash

One theme was how U.S. regulations have made it difficult for fintech companies to enter the highly coveted U.S. market, particularly when compared to Europe.

“Regulators in the U.S. decided to go after the banks after the [financial crisis in 2008,]” said Arshi Singh, North America Head of Product at Currencycloud, a London-based company that improves B2B payments. “The UK went the opposite way and made it very lax for fintechs so they could compete with banks.”

In the U.S., fintechs must partner with banks to carry out many services and some banks are friendlier to fintechs than others.

Charley Ma, NYC Growth Manager at Plaid, Jody Perla, MD of Global Banking & Payment Infrastructure at Payoneer

Andrew Boyajian, Head of Banking, North America at Transferwise, which makes it cheaper to send money across country borders, said that part of his job is to find U.S. banks that are willing to work with them. He said that some of them are, but other banks still have policies against working with companies like his that deliver bank-like services.

Nicolas Kopp, U.S. CEO at N26, Dan Westgarth, North America General Manager at Revolut, Arshi Singh, North America Head of Product at Currencycloud, Andrew Boyajian, Head of Banking, North America at Transferwise

One panel focused on AI in fintech.

“All the data is useless if you’re not getting insights from it,” said Farrah Lakhani, Director of Growth and Operations for OakNorth Analytical Intelligence, which analyzes data to fund business loans. “I ask ‘How are we doing this faster with this data?’ How does this add to our value proposition? This helps me get through the wall of lingo.”

With regard to the notion of AI replacing human beings altogether, Lakhani said she thinks we all need to get that idea out of our heads.

“You do need human beings to think and reason,” she said.

Regarding the fear that robots may become as human-like as humans, AI specialist and panelist Alex Jaimes joked that he’s met some humans who he could have sworn were robots.

Farrah Lakhani, Director of Growth and Operations at OakNorth Analytical Intelligence, Alex Jaimes, SVP AI & Data Science at Dataminr

With seven offices in Poland, Netguru employs 600 people, a quarter of whom work remotely. They company was founded in 2008 and more than 90% of its business comes from the U.S., the UK and Germany.

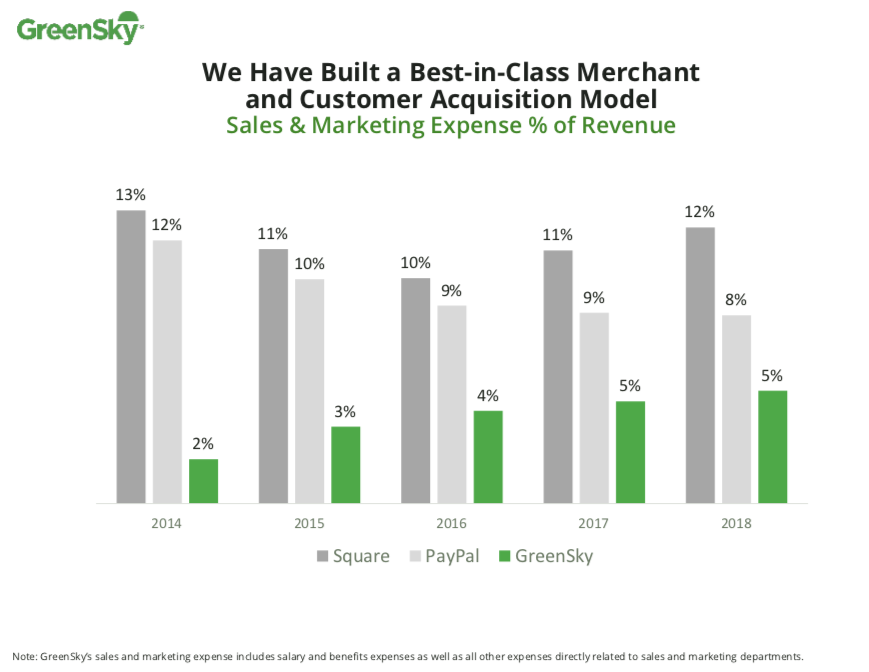

Acquisition Costs Compared for GreenSky, Square, PayPal, OnDeck, Lending Club, and Prosper

March 5, 2019 Greensky, a consumer lending company, wants investors to know how low its acquisition costs are relative to the competition. The chart above, which appeared in their year-end earnings report, showed how much lower their sales & marketing expense ratio is versus Square and PayPal.

Greensky, a consumer lending company, wants investors to know how low its acquisition costs are relative to the competition. The chart above, which appeared in their year-end earnings report, showed how much lower their sales & marketing expense ratio is versus Square and PayPal.

deBanked examined three additional fintech lending companies and ranked them as follows:

| Company Name | 2018 Sales & Marketing Ratio | 2017 |

| GreenSky | 5% | 5% |

| PayPal | 8% | 9% |

| OnDeck | 11% | 15% |

| Square | 12% | 11% |

| Lending Club | 39% | 40% |

| Prosper Marketplace | 76%* | 72% |

*indicates an estimate

The closeness between Square and OnDeck is notable in that Square markets its payment services first and then offers loans (and other products) as an add-on, while OnDeck only offers loans. Despite that, sales & marketing as a percentage of revenue are still virtually the same for each of them. Square is outspending OnDeck on marketing by more than 10:1, however, and is on pace to surpass OnDeck’s annual loan volume.

Prosper, meanwhile, is doing just as poorly as its wacky ratio looks. The company is losing tens of millions of dollars a year with no end in sight.

Square Capital On Pace to Overtake OnDeck in Small Business Lending

February 28, 2019 OnDeck’s annual loan origination volume has more than doubled since 2014, from $1.2 billion to $2.5 billion, allowing them to retain the top spot in deBanked’s small business funder rankings. But Square Capital, the small business lending division of Square, has grown by 16x since 2014. In the course of 5 years, they’ve gone from being a footnote compared to OnDeck to a fierce rival that is rapidly closing the gap in loan volume.

OnDeck’s annual loan origination volume has more than doubled since 2014, from $1.2 billion to $2.5 billion, allowing them to retain the top spot in deBanked’s small business funder rankings. But Square Capital, the small business lending division of Square, has grown by 16x since 2014. In the course of 5 years, they’ve gone from being a footnote compared to OnDeck to a fierce rival that is rapidly closing the gap in loan volume.

Square’s secret is the ability to generate loan volume at virtually no cost because the product is merely an add-on to their payments-first business. And that’s a problem for OnDeck, because Square has a lot of money to spend on marketing its payments business. More than $400 million a year to be precise. OnDeck, meanwhile, only spent $44 million last year on sales and marketing.

With OnDeck being outspent by a factor of 10, there is a likelihood that Square will overtake OnDeck in the business loan market within the next two years.

And Square’s strength is the ecosystem it’s building. On the Q4 earnings call, company CEO Jack Dorsey said, “I believe the ecosystem is extremely sticky, because it builds durable relationships. If we’re just focused on providing payments in the Register, certainly, there are so many other competitors out there. But when people come in for payments in the Register and then they use [our] payroll for their restaurant and they use Caviar and are really getting offers from Square Capital, it’s really hard to find that mix anywhere else and that builds durability.”

Small Community Banks Power Fintech Revolution

February 15, 2019 “A few years back there was a lot of disruption talk about how the fintechs were going to destroy the banks,” said Jo Ann Barefoot, co-founder of Hummingbird Regtech and a former deputy U.S. Comptroller of the Currency, which regulates national banks. “There’s much more talk in the last few years about the need for banks to partner [with fintechs].”

“A few years back there was a lot of disruption talk about how the fintechs were going to destroy the banks,” said Jo Ann Barefoot, co-founder of Hummingbird Regtech and a former deputy U.S. Comptroller of the Currency, which regulates national banks. “There’s much more talk in the last few years about the need for banks to partner [with fintechs].”

This quote was cited in a CNBC story published today and judging from the recent bank partnerships with some of the largest fintech companies – including Square, Stripe and Robinhood – this could not be more evident. The CNBC story points out that most of these fintech/bank partnerships are not with household name banks, but rather with small community banks that welcome the business. These banks, including Sutton Bank, headquartered in Attica, OH, Cross River Bank, headquartered in Fort Lee, NJ, and Celtic Bank, headquartered in Salt Lake City, UT, are handling the banking activities for these growing fintechs – activities like holding customer deposits and underwriting consumer and business loans. And significantly, making sure that everything is up to snuff with government regulations.

A number of fintechs, including Square and SoFi, have tried to take the banking component of their businesses into their own hands by applying to become an ILC bank. But they have been met with tough resistance, much of it coming from, interestingly, community banks.

“No one envisioned when they wrote the ILC charter that we would have fintech companies that finance mortgages and student loans from private equity capital and not deposits,” President and CEO of the Consumer Bankers Association told deBanked last year. “It’s a new world. Like with all rules and regulations, federal regulators should periodically review longstanding policy.”

So far, the opposition has been relatively successful but time will tell if it keeps up. Square and SoFi withdrew their ILC loan their applications, but Square eventually reapplied. At the 2018 Money 2020 conference in Las Vegas, SoFi CEO Anthony Noto said he would entertain seeking ILC bank status.

Fintech Inevitable, But Petrou Says Risks Abound

February 12, 2019 At the end of last week, two large regional banks, BB&T and SunTrust announced that they are merging. The entity will be the sixth largest U.S. bank and the largest bank merger since the 2008 financial crisis. A MarketWatch story yesterday indicated that large bank mergers are part of a somewhat recent trend, citing the mergers of Chemical Bank with TCF Bank, and Key Bank with First Niagara, both in 2016. (The number of bank acquisitions have been static in 2017 and 2018, with 252 and 253 banks, respectively, according to American Banker.)

At the end of last week, two large regional banks, BB&T and SunTrust announced that they are merging. The entity will be the sixth largest U.S. bank and the largest bank merger since the 2008 financial crisis. A MarketWatch story yesterday indicated that large bank mergers are part of a somewhat recent trend, citing the mergers of Chemical Bank with TCF Bank, and Key Bank with First Niagara, both in 2016. (The number of bank acquisitions have been static in 2017 and 2018, with 252 and 253 banks, respectively, according to American Banker.)

If large bank mergers are a trend, Managing Director of Federal Financial Analytics Karen Petrou told MarketWatch that this is in part because banks realize that they can combine resources to develop mobile banking capabilities to compete with online banks.

“If banks don’t come up with ways to innovate, they die,” Petrou told MarketWatch yesterday. “Then consumers are left to do their banking with nonbanks.”

Federal Financial Analytics, where Petrou is the managing director, is a Washington, D.C.-based consulting firm and Petrou is a highly regarded voice in the financial regulation space.

While Petrou acknowledges that online banking is the only alternative if traditional banks don’t innovate, she sees serious problems in fintech which she outlined in a paper published earlier this month, according to American Banker.

For instance, she wrote about the danger of a company like Amazon getting into banking and being able to charge individuals different amounts for the same item based on its knowledge of how much money the customer has. Or, the implementation of better banking policies for people who exercise and eat healthier. Petrou says this favors wealthier people with more time for exercise and greater access to more expensive, healthier food.

“I am all for technology,” Petrou said. “But I spent a lot of time when I was a student at MIT studying tech policy, and there is one after another example of seemingly promising technologies with terrible, unintended consequences.”

Liquid FSI to Augment Healthcare Lending Platform with Blockchain Technology

February 11, 2019Liquid FSI announced today that it has entered into an agreement with TVS Next, an IT company, to build a blockchain platform to enhance its healthcare lending capabilities.

“Our Blockchain solution solves a myriad of issues including the privacy of provider [typically medical office], biller, payer, patient and bank data,” said Liquid FSI President and CEO, Frank Capozza. “Blockchain will also support our on-demand payment offering Convert2Pay…and we believe that TVS Next has the depth of resources we need to serve the $3.6 trillion healthcare market.”

The is an improvement of Liquid FSI’s Convert2Pay offering which can provide cash in as little as 24 hours to medical offices with insurance claims.

“Instead of waiting 45 days or 60 days to get paid, [the doctor] can get paid in 24 hours because we’ve done all the analytics, and we’re scored [the medical practice] on a scale from 1 to 10,” Capozza said. “If he’s a solid performer and he’s using our platform to level out his peaks and valleys in cash flow, we see all of that in the system.”

The new use of blockchain, a decentralized system that logs information anonymously into a ledger, should give increased confidence to Liquid FSI’s medical office clients, Capozza said.

Capozza said he has excellent relationships with a number of brokers who send him clients. But as evidence of the privacy problem, he said that he will occasionally get applications from some brokers that include patient names, addresses, and social security numbers. This information isn’t stolen, but can be released by a medical practice if it needs money urgently. Capozza said he would rather see less of this and is confident that the new blockchain technology will significantly reduce any privacy lapses.

“It’s the same product, but it’s improving the privacy for everyone involved,” he said.

He also said that they are in talks with three banks that will be able fund on the Convert2Pay platform and will be comforted by the increased privacy afforded by the blockchain technology to be used by Liquid FSI. Capozza said Liquid FSI has plans to offer credit to doctors and sees itself as a VISA for the healthcare industry.

Aside from working with broker partners, Liquid FSI also works with medical billing companies to obtain clients, like pediatrician or dentist offices. Founded in 2014, the company has made some key recruitments to its overall team over the past year, including the addition of Barry Blecherman, professor of Finance and Risk Engineering at the NYU Tandon School, to its Board of Advisors.

deBanked CONNECT Miami 2019 Photos

January 28, 2019

Joust Launches Banking Platform for Entrepreneurs

January 17, 2019 Lamine Zarrad, CEO, Joust

Lamine Zarrad, CEO, JoustThis week marked the launch of the Joust iOS app, a platform for freelancers and small businesses that provides banking, payments, collections and invoice factoring solutions. The Android App is scheduled for release on February 1, 2019.

“We straddle three different domains: payments, merchant processing, and factoring, all in one app,” said Joust co-founder and CEO Lamine Zarrad. “Most freelancers have a bank account, then add a payments account using Stripe or Paypal, or both.Then you need an invoicing tool. Now you’ve accumulated three or four different tools to bill your customers. What Joust did, in partnership with [our banking partner], is we were able to consolidate all of these tools.”

Zarrad said that Joust has three categories of customers: traditional small businesses, part-time freelancers, and full-time freelancers, or “solopreneurs” – people who dedicate all of their efforts to their entrepreneurial endeavors.

Some of the most common financial problems among solopreneurs that Joust aims to fix are stabilization of cash flows, gap financing, and integration of payments and banking.

In conjunction with an online banking platform, called Cambr, Joust provides customers with a bank account as well as a merchant account, which gives them the ability to accept credit cards directly into their account, Zarrad said. Cambr was created by StoneCastle, a technology enabled financial services company managing over $15 billion on behalf of its clients. It stores cash within a network of 850 community banks in all 50 states.

Another significant pain point for freelancers is collection of unpaid receivables. Zarrad said that entrepreneurs in general lost 14% of their receivables to non-paying or extremely delayed paying clients in 2018. The Joust platform/app also includes a collections service, which is a series of five emails strategically spaced out.

“Most bills don’t get paid not because people don’t want to pay, but because it’s been de-prioritized,” Zarrad said, “and having a third party act on behalf of a freelancer is immensely more powerful.”

If there is no response after the fifth email, Joust then outsources the collections. Having a Joust bank and merchant account is completely free, with the exception of credit card processing fees, which Joust passes on to the customer. Joust anticipates making money in part by bringing business accounts to StoneCastle and primarily from its factoring capabilities. Zarrad said they make 1 to 6% on guaranteeing invoices.