Fintech

DailyPay Allows Early Paychecks, Sees Adoption Rise in Pandemic Era

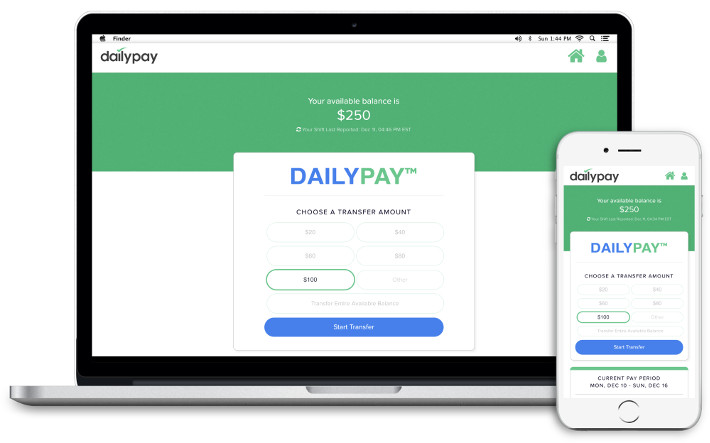

October 9, 2020 Americans are worried about paying their bills. DailyPay, a payment flexibility platform, gives businesses the ability to let workers access their paycheck early. For customers using the platform— no more waiting for payday.

Americans are worried about paying their bills. DailyPay, a payment flexibility platform, gives businesses the ability to let workers access their paycheck early. For customers using the platform— no more waiting for payday.

DailyPay has offered flexible payment since being founded in 2015. Recently, Fortune 500 companies have begun to slowly offer services like it. Last month, Square allowed a select few businesses to let employees cash out using their payment platform, but Vice President of Public Policy Matt Kopko said DailyPay stands apart, offering a payday loan-and-overdraft-killer for just $2-$3.

“We’ve created this industry that’s called the on-demand pay industry,” Kopko said, “which is essentially a technology that allows workers to get paid whenever they want without having to disrupt the employer’s payroll schedule.”

The system works as an employer-sponsored benefit; with business permission, the service collects time clock data, payroll data, and accounting data. DailyPay uses that data to estimate how much money a worker can collect after every shift, or in some cases, every hour worked Kopko said. If a worker is getting paid $2,000 a week, but after withholding gets a $1,300 direct deposit, DailyPay will be able to calculate it.

“So our technology essentially integrates all those systems, allows you to monitor your balance on a constant basis,” Kopko said. “To say: ‘Well, my work yesterday actually accumulated net of all my tax withholdings $123’ and then it’s essentially an ATM for your paycheck.”

Kopko said the product is geared toward the two out of three people in America that are only paid once or twice a month. If the first of the month comes around, but it’s a week to payday, that’s when an employee needs DailyPay- to pay rent when they have no other option.

With pandemic unemployment and state closures, the team at DailyPay has seen an increased interest in the platform. At the beginning of the shutdowns in March, DailyPay saw a 400% increase in users in just three days.

Without using a service like DailyPay, the way these consumers make payments is through overdraft on bank accounts or payday lending, Kopko said. Surveys of DailyPay customers show one in four overdraft two to four times a month. After using the service, that number went down from 25% to 5%. Kopko shared that after using DailyPay, the number of customers relying on overdraft went down 40%.

“We’ve estimated that [customer] financial savings are approximately $1,200 a year,” Kopko said. “It’s not just about a tool for convenience; it’s about putting hundreds of dollars back into people’s pockets, the most vulnerable among them.”

Overdrafts have long been used as evidence toward claims that traditional banking harbors abusive, predatory practices toward the lowest-income working families. In 2017, the CFPB found that nearly 80% of overdrafts originated from the lowest 8% of account holders. That year Americans paid $34 billion in overdraft fees, according to MarketWatch.

Kopko said the platform is not just good for consumers, but businesses as well. He said DailyPay stats show an average of 40% increase in employee retention.

“For employees, we’re seeing tons of financial benefits, and for the employers, we’re seeing financial benefits,” Kopko said. “And it’s all because essentially we created the ability to have new control over your pay.”

Square, Stripe, Intuit, Shopify, Talked SMB Lending at LendIt Fintech 2020

October 8, 2020 The LendIt Fintech digital conference last week was a sign of the times. This year, millions of average businesses and consumers have had to go virtual: they had no choice. 2020 has been a year of struggle and survival, and a time of great fintech adoption.

The LendIt Fintech digital conference last week was a sign of the times. This year, millions of average businesses and consumers have had to go virtual: they had no choice. 2020 has been a year of struggle and survival, and a time of great fintech adoption.

Some firms have been more successful than others. Going full digital, LendIt introduced virtual networking at the conference- the first day alone saw 2,171 meetings. Zoom meetings and virtual greetings took the place of handshakes and elevator pitches that would regularly accompany the convention.

On day three, LendIt hosted a panel of SMB lending leaders from Stripe, Shopify, Square, and Quickbooks Capital. Bryan Lee, Senior Director of Financial Services for Salesforce, served as moderator and he focused the discussion on “How the leading fintech brands are adapting.”

THE PIVOT

Lee began the talk by asking Eddie Serrill, Business Lead from Stripe Capital, about how the industry has pivoted.

Serrill talked about how Stripe was powering online interactions and saw an influx of traditionally offline businesses switching over to their platforms. Stripe also saw an increased demand for online purchases and payment.

“We’ve been trying to find that right balance between supporting users that have been doing incredibly well,” Serrill said. “While trying to support our users who are seeing a bit of a setback.”

Stripe introduced a lending product in September of last year and now SMBs can borrow from Stripe and pay back by diverting a percentage of their sales, much like the other panelists’ companies offer.

Jessica Jiang, Head of Capital Markets at Square Capital, talked about how her firm adjusted. Square reacted to fill the niche of their underserved customers by introducing a main street lending fund, serving industries hard hit by the pandemic, Jiang said. Small buinesess that relied on in-person action like coffee shops and retail community businesses were given preferential lending options.

Product Lead at Shopify, Richard Shaw, said that this year his firm learned to be prepared for anything. Everything that Shopify was potentially going to do or planning on implementing in the coming years suddenly became a here-and-now necessity.

“We tore up our existing plans,” Shaw said. “It was like the commerce world of 2030 turned up in 2020. You need to do ten years of work, but you need to do it today.”

Shopify, the Canadian e-commerce giant has doubled in value this year. The firm launched Shopify Capital in the US and Canada in 2016 and has originated $1.2 billion in funding to small businesses since that time.

Luke Voiles, the VP of Intuits QuickBooks Capital, talked about how his team handled pandemic conservatively.

“Five years of digital shift has happened instantaneously due to COVID,” Voiles said. “Intuit is pretty recession-resistant in the sense that you have to do taxes, you have to do your accounting, and the shift to digital helps a lot.”

Business lending was different, Voiles said, as soon as his team saw COVID coming, they battened down the hatches, slowed lending, and pivoted to facilitating PPP.

PPP

Voiles said the craziest thing he has seen in his career was what Quickbooks did to deploy PPP aid.

Within about two weeks, almost 500 people from across Intuit came together to shift all the data they carried on customers to aid applications.

“We were uniquely positioned to help solve and deploy that capital,” Voiles said. “We have a payroll business where 1.4 billion business use us, we have a tax business where we have Schedule C tax filings, and we have a lending business. We were able to pivot and put the pieces together quickly.”

QuickBooks Capital deployed $1.2 billion to 31,000 business in a process that Voiles said was 90% automated. Now customers are awaiting other rounds of government aid.

Square’s Jiang said the initial shutdown weeks in March and April saw hundreds of Square team members working on PPP facilitation through the night and weekends. As the funds dried up those first two weeks, it was clear to Jiang the program was favoring larger firms and higher loan amounts, leaving out small businesses.

“That’s typical of investment bankers, but not very typical of tech,” Jiang said. “PPP is a perfect example of how small businesses are continuing to be underserved by banks.”

THE SHAKEOUT AND THE FUTURE

2020 has been a major shock to the lending marketplace. Voiles from Quickbooks said the amount of work it took to make it through the first wave was a significant shakeout.

“You’ve seen what’s happening with Kabbage and OnDeck and other transactions with people getting sold; there is a shakeout happening in the space,” Voiles said. “The bigger players will make it through and will continue to help small businesses get access to capital that they need.”

When asked about the future roadmap of QuickBooks Capital, Voiles said it wasn’t just about automating banking. Using Intuit’s resources to build an automated system is only half of the picture- the firm believes in an expert-driven platform. After the automated process, customers will be able to talk to an expert to review the data, and “check their work.” Voiles said Quickbooks wants to offer a service that is equivalent to the replacement of a CFO.

“These small businesses that have less than ten employees, they can’t afford to hire a pro,” Voiles said. “They need automated support to show them the dashboard and picture of what their business is.”

Pointing to Stripe’s online infrastructure, Serrill exemplified what successful lenders will offer next year: a platform that combines many needs of SMBs in one place.

“I think it’s really about linking all of this data, making it super intuitive and anticipating the need for their users, so they don’t need a team of business school grads to manage their finances,” Serrill said. “So they can get back to building the core of their business, not figuring out whether they have enough cash flow tomorrow.”

Jiang said the future of small business would be written in data, contactless payments, and digital banking. She sees consolidation in the Fintech space and has a positive outlook on bank-fintech partnerships.

The FDIC granted Square a conditional approval for the issuance of an Industrial Loan Company ILC in March this year. Jiang outlined plans on launching an online SMB lending and banking service next year called Square Financial Services if the conditional charter remains in place.

For Shopify’s future, Shaw was excited to look forward to the launching of Shopify balance- a cash flow management system, and Shopify installment payments. He reiterated that the success of Shopify’s lending division was due in part because making loans was not the entire business.

“Shopify Capital is one piece of a wider ecosystem,” Shaw said. “All these things together are more powerful than individual parts.”

Software That Automatically Fights For Bank Refunds Adds “PRO Index”

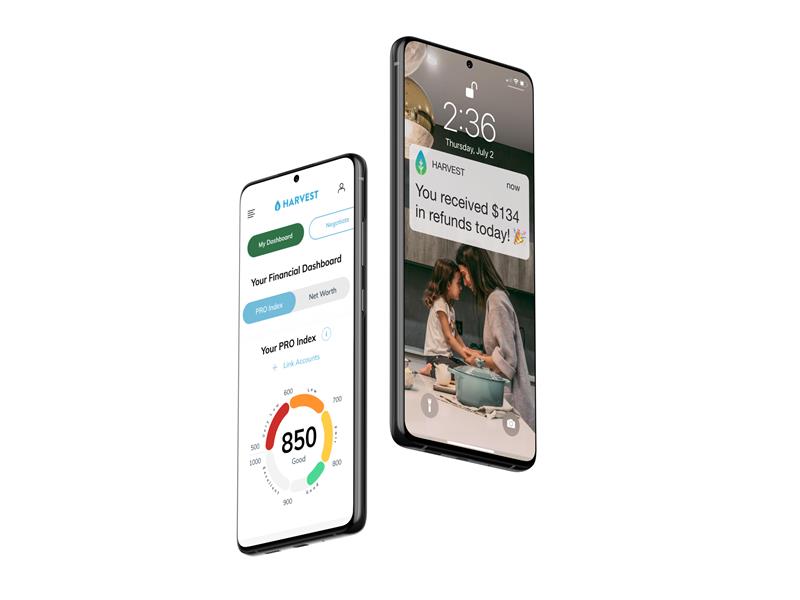

October 1, 2020 Harvest fills a unique role in the fintech world. The platform is an automatic banking advocation software that fights on behalf of users for the best deals possible.

Harvest fills a unique role in the fintech world. The platform is an automatic banking advocation software that fights on behalf of users for the best deals possible.

Connect your bank information and the Harvest AI will fight late fees and overdraft fees. Customers are only charged a portion of funds returned, and if the program does not succeed at getting money back, it doesn’t cost the user a cent.

Automatically arguing for better deals, the platform last year saved customers a collective $2 million, and manages $500 million in debt to date.

The brainchild of CEO and founder Nami Baral, Harvest released a new “PRO Index” that builds a credit profile for each customer to pair with information from FICO scores. Harvest created the index to help lenders get better information and for customers to track their financial health. Baral hopes the data will help lenders find a reason to continue credit flowing to those who have hit hard times but still can make their payments.

“In the post-COVID recessionary environment, the creditworthiness of customers continues to plummet,” Baral said. “[Harvest] saw that traditional credit scores do not provide enough of a picture about a customer’s actual worthiness and potential.”

This announcement is not just a press release, but a continuation of the founding premise of Harvest: to help the average American overcome debt and build financial health.

Baral, a Nepali native, came to America during the last financial crisis on a scholarship to study ovarian cancer at Harvard medical school. Expecting the country to be a utopic economic powerhouse, Baral instead saw lost jobs, defaulting mortgages, and debt.

“In many ways, America is one of the most wonderful places in the world,” Baral said. “But at the time it was a complete departure from what I’d hoped the US to be, because what I saw was, people were losing their jobs, losing their homes in the financial crisis.”

She decided to work toward fixing the problems she saw, pivoting to study finance. Graduating with an applied math and economics degree, Baral then trained in investment banking. She worked on an auto-advocation software for a digital advertisement startup that was eventually bought by Twitter.

She decided to work toward fixing the problems she saw, pivoting to study finance. Graduating with an applied math and economics degree, Baral then trained in investment banking. She worked on an auto-advocation software for a digital advertisement startup that was eventually bought by Twitter.

She had seen a company’s growth from IPO to merger and stayed at Twitter for four years. When she left, she began market research, talking to everyday Americans about what they needed to improve their finances.

“In those conversations with people from all over the US, Alaska, Oklahoma, San Francisco, New York everywhere,” Baral said, “I realized that the issues plaguing Americans in the last financial crisis had not gone away.”

Baral said these issues had intensified over this past decade. Incomes were volatile and stagnating, student loans had risen, and the people Baral talked too were getting more and more into debt.

“So I thought what the average American needs today is not another savings product, not yet another investment product,” Baral said. “But something that can help them reduce the debt that they have in their lives. That’s the genesis of Harvest.”

With the addition of the PRO Index, Baral is excited to offer another way Americans can maintain their financial health. She said that during the pandemic, every day could be a challenge for the average American, but the new platform can act as a barometer and compass.

“A lot can change between the time you extend a loan to the customer versus when they have to pay,” Baral said. “We call that Ability-to-pay as-a-service, and that’s where the PRO Index is used, determining: ‘is this customer still healthy? is my overall portfolio still healthy?'”

If the customer is no longer healthy, the info gathered to form the PRO Index, like transactional cash flow data, can supply lenders with information on improving their health. Baral says the platform encourages lenders to keep customers and shows borrowers how to improve their credit standing.

Prashant Fuloria Explains Why Fundbox Has Been Successful in 2020

September 28, 2020 When Prashant Fuloria joined Fundbox as Chief Operations Officer in 2016, the San Franciscan firm was a three-year-old startup with less than eighty employees. By the time Fuloria moved into the office of CEO this July, the small business credit and invoice financing company had grown exponentially, with more than $430 million in raised capital to date and triple the number of employees.

When Prashant Fuloria joined Fundbox as Chief Operations Officer in 2016, the San Franciscan firm was a three-year-old startup with less than eighty employees. By the time Fuloria moved into the office of CEO this July, the small business credit and invoice financing company had grown exponentially, with more than $430 million in raised capital to date and triple the number of employees.

At the height of the pandemic, many firms halted funding or shuttered their doors for good. Meanwhile Fundbox kept lending, and outperformed the market, Fuloria said.

“It’s become very clear to us that we have greatly outperformed the market,” Fuloria said. “In terms of delivering value to customers, and also in terms of our business performance.”

In the toughest weeks of the pandemic, he said that Fundbox’s loan delinquency rose to 8-9%, up from a “low single-digit number” pre-pandemic. In comparison, the industry standard according to Fuloria, was a delinquency rate of 30-40%, including from larger firms and more traditional lenders like big banks.

“I think we’ve performed extremely well during COVID; the numbers just validate the investment we’ve made, especially in data,” Fuloria said. “That puts us in a very good position because a number of folks have exited the market and the need, the demand has not gone away.”

The number one thing you can do to perform well in a recession is to have a strong business going into it, Fuloria explained. Fundbox attributes part of its strength to its data. Nearly a fourth of Fundbox’s capital goes toward data assets, Fuloria said.

“If you add it all up, we’ve invested a little over $100 million in our data asset,” Fuloria said. “It’s a big investment for anybody- particularly a big investment for a mid-sized company.”

Fuloria said this money goes toward collecting customer information, which is processed by in-house tech and a talented team of engineers who can turn data into valuable information for serving SMBs.

“Small businesses,” Fuloria said, “they have the complexity of enterprises but the scale of consumers.”

Coming from twenty years of tech and product managerial experience at firms like Google, Facebook, and Yahoo, Fuloria knows a thing or two about scale. He said he found his roots at Google, working when it was just a small team- by the time he left six and a half years later, Google had 35,000 employees.

When it came to joining Fundbox in 2016, Fuloria said he was attracted by the company’s mission, the talented team there, and how in just three years, the small firm had demonstrated how it could help SMBs.

“Fundbox as a company said ‘We are a financial services platform that is powering the small business economy with new credit and payment solutions,'” Fuloria said. “And that mission was very strong: it made sense to me, and it resonated with me.”

Nav CEO Talks About Platform Enhancements

September 28, 2020 “Our news is really about improving and enhancing our platform to use real-time business data to uncover and align qualifications for small business owners to the best financing options available to them,” said Nav CEO Greg Ott about a recent announcement.

“Our news is really about improving and enhancing our platform to use real-time business data to uncover and align qualifications for small business owners to the best financing options available to them,” said Nav CEO Greg Ott about a recent announcement.

Nav is a small business information service that connects borrowers to lenders across the entire finance industry, from SBA loans, major credit cards, to nonbank lenders, and more. This new enhancement streamlines the finance process for both sides of the transaction, Ott explained.

“Historically, the model is inverted disproportionately against the small business owner, in that they can’t see what they’re qualified for until after they apply,” Ott said. “By using real-time business analysis and dynamic financing profiles, Nav is the only place that can show them what they can qualify for before they apply.”

Nav is also adding a new service team that connects to small businesses through the digital platform, offering a more personalized experience; someone will be on the line to help borrowers find their way. The platform uses cash flow, revenue, credit, and behavioral data to match SMBs with loan offers.

Nav is expanding its service because Ott said this year, many businesses could not find financing at all. Nav began helping customers find lenders for PPP loans, facilitating 70k applications in all and built an online community of 18k businesses going through the process this year alone.

Ott said it became clear during the rounds of PPP and government stimulus that banks gave preferential treatment to some of their customers and left out small businesses.

“Many banking options aren’t available to the vast majority of small businesses,” Ott said. “The traditional financial system is not always available or not the best option for a small business owner. Small business owners know this in spades, It’s just now that in the growth of this fintech ecosystem that it’s becoming clear how big that addressable market is.”

As Fintech Accelerates in Canada, Smarter Loans Expands

September 22, 2020 Smarter Loans, a Canadian loan comparison site, announced they are expanding their services to new categories- including “Everyday Banking, Insurance, Investing Money Transfers, and Debt relief.”

Smarter Loans, a Canadian loan comparison site, announced they are expanding their services to new categories- including “Everyday Banking, Insurance, Investing Money Transfers, and Debt relief.”

The additions are part of the Smarter Loans’ mission to become the go-to place for Canada’s online financial options. Founders Vlad Sherbatov and Rafael Rositsan founded the company to bring together information on the top financial companies all in one place. They started with information on personal and business financing but have expanded to auto loans, mortgages, equipment financing, and information on all kinds of financial products.

“We wanted to bring additional financial services and products that people can now access online,” Vlad Sherbatov, the president said. “And to do that, we partnered with some of the leading companies that offer these financial services.”

The addition is the latest resource for their 40,000 monthly user base, who access a database of top banks, credit unions, and innovative fintech leaders. Rafael Rositsan, the CEO, said as a trusted industry voice, the firm is adding this new info to update consumers on new opportunities firms provide.

“There’s a rise of companies that are now offering innovative products online,” Rositsan said. “Canadians might not be aware of some of the services that are out there.”

Sherbatov said that Canadians have been gravitating toward conducting business on the go at an accelerated rate this year. The firm listened to the customer base and learned they’re not going online for just financing.

“Entrepreneurs are running their businesses online,” Sherbatov said. “People that used to just shop for household items online are now looking for ways to handle investments and everyday financial errands because the old way of doing things is not available.”

He said that many areas of the financial space have evolved. Customers can obtain life insurance, get a line of credit, and a bank account funded in less than 24 hours, all from the comfort of their home.

“This move is to both bring more services relevant to our existing user base that use Smarter Loans,” Sherbatov said. “But also for all Canadians that are looking for these types of products. We want Smarter Loans to be the go-to place for them to learn about [these offerings], and to learn about the companies behind these products.”

Stavvy Co-Founder Kosta Ligris on Navigating Real Estate Loans in a Contact-less world

September 18, 2020 How does real estate loan signing work in a contactless world? One company offers a solution.

How does real estate loan signing work in a contactless world? One company offers a solution.

Stavvy, a platform that empowers businesses and lenders to close real estate loans digitally, has seen a dramatic change in their business landscape since the launch of their E-signing platform in March.

“Over the course of literally a couple of weeks, [states] realized that they had to empower people to be able to do business as usual, despite what was going on,” Co-Founder Kosta Ligris said. “We were able to put all the necessary tools in one platform to empower these title companies, law firms, notaries to have identity solutions when we went live in March.”

Right when the platform came live, contactless signing became a necessity. Kosta Ligris, a co-founder of Stavvy, said his team worked hard to include emergency digital notarization options in states that had not allowed it yet before. The market went from about 20 states with legalized digital signing to 48 that had legalized or created a temporary law.

Stavvy also reached out to engineers and employees who were losing their jobs during the first wave and picked up new hires while many firms were downsizing.

“The pandemic is a once in a lifecycle opportunity,” Kosta said. “I hope that we don’t see anything that resembles COVID again. But this opportunity has given us the chance to get in front of people that we otherwise would not have been able to hire.”

Unlike competitors, Stavvy does not get involved in signing or notarizing themselves, but instead offer a digital platform for both lenders, signers, and state compliance checking. The platform is somewhat like the Uber app Ligris said- they don’t bring a car to you, but they give you a digital way to connect to people who can pick you up.

In many states, especially in New York and New Jersey, complete digital signing is still not allowed. Instead, Stavvy encrypts film of the “wet signing” -ink pen on a document- and sends the encrypted data and other identification guarantees in a live “Zoom-like experience” to the county registry.

Ligris said Stavvy is very passionate about empowering both lenders and signers. As an MIT entrepreneurship resident who looks at student companies and ideas every year, he knows about barriers to entry. He said one such barrier to digitalized innovation is a simple fear of change.

Ligris said Stavvy is very passionate about empowering both lenders and signers. As an MIT entrepreneurship resident who looks at student companies and ideas every year, he knows about barriers to entry. He said one such barrier to digitalized innovation is a simple fear of change.

“Change in and of itself is always frustrating and scary, but it doesn’t necessarily mean that it’s bad,” Ligris said. “In so many industries where people regard technology, they look at it as this is the next thing that’s going to take my job away from me.”

That’s the concept Stavvy is fighting- that digital innovation is not automating away livelihood, but further connecting people. Ligris said that the one thing technology could not replace: broker buyer relationships.

“When it comes down to making one of the largest financial decisions of their life, they want a trusted professional,” Ligris said. “If we’re going to provide the technology, we want to empower the stakeholders that know best to be more efficient and better at what they do.”

Upstart Welcomes Policy Head Nat Hoopes

September 15, 2020 Upstart, an AI lending platform, welcomed longtime industry advocate Nat Hoopes to the team this week, to lead as Head of Government Policy and Regulatory affairs. Hoopes previously served as the Marketplace Lending Association executive director (MLA), where he grew the trade group and advocated on behalf of its members.

Upstart, an AI lending platform, welcomed longtime industry advocate Nat Hoopes to the team this week, to lead as Head of Government Policy and Regulatory affairs. Hoopes previously served as the Marketplace Lending Association executive director (MLA), where he grew the trade group and advocated on behalf of its members.

“My hope is to bring the energy that I did in growing the organization [MLA] and also just in tackling a lot of different workstreams to Upstart,” Hoopes said. “But also, deepen their ties with the DC policy community.”

Hoopes is excited to join the Upstart team and advocate for the company to state and federal legislators. Hoopes intends to address the development of two main issues as he enters his new office: facilitating better credit reporting with the help of AI, and using better credit to bring financing options to disenfranchised minority communities.

Upstart uses non-traditional data like a college education, job history, and residency to evaluate borrowers for personal loans. The company recently introduced an AI-powered Credit Decision API to deliver instant credit decisions. Upstart added auto loans to the platform in June, so the new API works with personal, student, and auto loans.

Hoopes said he and Upstart shared a similar motivation: to provide credit to people and improve financial futures, especially to people unfairly blocked from receiving credit.

“I think because of the structural inequality that we have in our society, a lot of minority groups get really left behind and stuck in a low credit score environment,” Hoopes said. “By using more data, and using it in new ways with artificial intelligence we can really level the playing field.”

Hoopes said that he has already seen Federal regulators in the FDIC and the OCC, and the CFPB working on using AI learning in credit underwriting. He said the Fed is planning out how to help banks adopt more of these models to approve more people.

“I think that’s a key initiative,” Hoopes said. “A key area where I’ll be working for Upstart: Engaging with regulators on how to help banks get more comfortable in serving more customers,”

While advocating for banks to use the credit capabilities of partners like Upstart, Hoopes said he would be devoted to ensuring decisions are made with equality and inclusion in mind. Hoopes will stay on as a member of the MLA board, and working in concert with his responsibilities advocating at Upstart.

“At MLA, I helped develop the diversity and inclusion strategies for our part of the fintech industry,” Hoopes said. “I’ll remain active on those issues at Upstart both collectively with other members of the industry as a member of the MLA.”

Hoopes referred to the Diversity and Inclusion strategy released by MLA last month. Board members signed off on the paper, written with the help of the National Urban Leauge. League president and CEO Marc Morial and Representative Gregory Meeks (D-NY) to create a vision of an inclusive fintech industry.

Hoopes addressed what he said was the failure of the American credit scoring system. For instance, according to Upstart’s study in 2019, 80% of Americans have never defaulted, yet only half have a prime credit score. It’s a problem he says disproportionately affects minority borrowers.

According to a Federal Reserve study, more than three times as many Black consumers (53%) and nearly two times as many Hispanic consumers (30%) as White consumers (16%) are in the lowest percentiles of credit scores.

Hoopes said Upstart does not collect racial data from applicants but cites a CFPB test that found Upstart’s platform increased access to credit across race and ethnicity by 23-29% while decreasing annual interest rates by 15%-17%.