Cannabis

Forget the Metaverse, I Bought Real Land

February 20, 2024 In 1958, developers purchased 82,000 acres of barren land that was situated a hundred miles north of Los Angeles with a plan to build a sprawling metropolis for 400,000 future residents. As it instantly became the third largest city in California by land area, they chose an appropriately symbolic name, California City. It was a flop from the start. Although powerful marketing led to the sale of 50,000 lots by the early 1970s, the city only had a population of 1,300 people by 1969. That was bad enough that the Federal Trade Commission intervened in 1972 and forced a settlement that allowed thousands of landowners to get refunds. California City held on, however, and it’s now home to nearly 15,000 residents. It even has its own airport. But still, what it has become is still remarkably short of the original vision.

In 1958, developers purchased 82,000 acres of barren land that was situated a hundred miles north of Los Angeles with a plan to build a sprawling metropolis for 400,000 future residents. As it instantly became the third largest city in California by land area, they chose an appropriately symbolic name, California City. It was a flop from the start. Although powerful marketing led to the sale of 50,000 lots by the early 1970s, the city only had a population of 1,300 people by 1969. That was bad enough that the Federal Trade Commission intervened in 1972 and forced a settlement that allowed thousands of landowners to get refunds. California City held on, however, and it’s now home to nearly 15,000 residents. It even has its own airport. But still, what it has become is still remarkably short of the original vision.

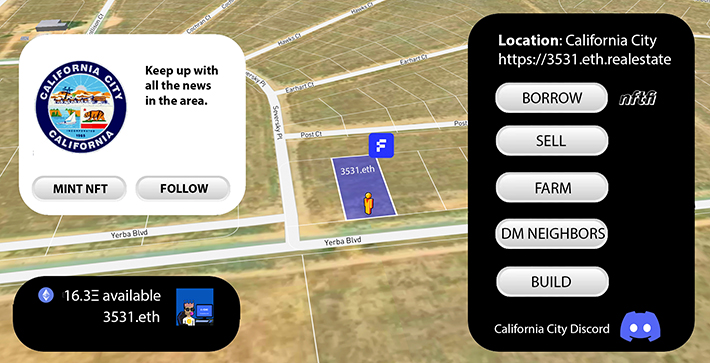

All of this history was something I breezed through right before I impulsively clicked a button on my screen asking me to confirm my purchase for a lot there. One click. That’s apparently all it took to become the newest member of a potential future neighborhood in California City, one that might not ever come to fruition. But how I found it in the first place is the real story. It appears that in the modern era this sleepy desert outpost has become a bit of an experimental laboratory for something relatively new in the real estate world, converting properties into NFTs.

Here’s how it’s done. A landowner places their property into an individual trust and ownership of that trust is governed by whomever owns the corresponding NFT on Ethereum. In effect, the owner of the trust would be defined by their ugly hex address, like this one for example: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829. It’s actually quite basic and it’s all made possible by a “proptech” company called Fabrica.

Here’s how it’s done. A landowner places their property into an individual trust and ownership of that trust is governed by whomever owns the corresponding NFT on Ethereum. In effect, the owner of the trust would be defined by their ugly hex address, like this one for example: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829. It’s actually quite basic and it’s all made possible by a “proptech” company called Fabrica.

Founded in 2018 and backed by investors like Mark Cuban and Zain Jaffer, properties tokenized by Fabrica “can be traded instantly, used as collateral and are compatible with all NFT platforms,” the company states. “The product automates sales transactions, facilitating title transfer, payments and regulatory compliance.” Fabrica facilitates the on-ramping of your land into an NFT and even provides its own marketplace for buyers and sellers. That’s where I got mine. Interested parties can read up on a property’s on-chain history and even check the title. There’s also a cool little Google Earth-like animation that flies the user to their specific plot of land. The experience feels a lot like buying a plot of virtual land in a video game or the metaverse except this land is real. That means that sleek little NFT in your digital wallet comes with real responsibilities like property taxes, which Fabrica works to keep the owner informed about. It also means any and all liabilities of property ownership. The upside is that you can go and visit it in real life and even develop it. You can’t do that in a video game.

Although I’ve counted six properties in California City that are immediately identifiable as NFTs, it’s hardly the only place in the United States where this is being done. Properties available for sale as NFTs as of this writing include locations across Colorado, Arizona, New Mexico, San Bernardino-CA, and even Orange, New York. Some are very remote and speculative, while others are a part of normal civilization and priced accordingly. Buyer beware of course given the serious nature of these assets.

Perhaps one of the biggest obstacles to understanding how this is all possible is the widespread misconception of what NFTs are. Most of the American population lives under the mistaken impression that NFTs are cartoon art pictures like Bored Apes or CryptoPunks that were all the rage in 2021 and to some extent are still popular in niche circles, but almost anything can be tokenized. More recently, for example, domain names are being converted into NFTs to facilitate faster sales and quicker payouts. The same is true now here with land. Not only can land ownership change hands in the blink of an eye by transferring the NFT but one can also easily tap into the value by pledging it on a peer-to-peer NFT loan marketplace like NFTfi. Fabrica officially announced a partnership with NFTfi this past December, for example. The possibilities are endless

For the perpetual skeptics of all things blockchain that are convinced real business will only ever be done in the real world, a visualization of an NFT on a crypto wallet app might not be all that convincing, especially if the icon for it is situated right next to one of those expensive monkey pictures that kids wouldn’t shut up about years ago. The proof then is in the adventure. With a drive of less than two hours from Downtown Los Angeles, there’s a little plot of land on a quiet street known as Yerba Boulevard. It’s covered in weeds and reddish soil. Empty plains make up most of the backdrop but the suburbs are very slowly creeping their way there. In fact, I’ve since learned who my neighbor is across the street. It’s a 26,000 square foot cannabis facility that was just built in 2022. I bet the owners would be into NFTs (😂). Since that facility is up for sale, numerous 3D surrounding views exist of my plot. Turns out I can even walk to the airport. It’s not much but it’s home to me and all I could afford for the purpose of this story and learning what it was all about. Maybe those 400,000 planned residents will eventually want my land and it’ll make me a millionaire. Ah the allure of California City.

The Sale of Recreational Cannabis Comes to New Jersey

April 20, 2022 It’s happening, on Thursday New Jersey will officially begin selling marijuana to adults. The results of the 2020 general election are finally making moves as New Jersey residents voted to legalize marijuana about 16 months ago. On Monday, the New Jersey Cannabis Regulatory Commission passed the approval to seven medical-marijuana companies to start selling their products for recreational purposes.

It’s happening, on Thursday New Jersey will officially begin selling marijuana to adults. The results of the 2020 general election are finally making moves as New Jersey residents voted to legalize marijuana about 16 months ago. On Monday, the New Jersey Cannabis Regulatory Commission passed the approval to seven medical-marijuana companies to start selling their products for recreational purposes.

Thirteen individual dispensaries will be open throughout the state, with many located only a half-hour from New York City. It is not yet determined which dispensaries will be open for business on April 21. New Jersey will become the second state on the East Coast to fully authorize the sale of cannabis to the full adult audience.

An official cannabis market is yet to exist in New York City despite cannabis cafes, THC infused fine-dining experiences and random marijuana trucks lurking along the streets. Last year, New York State legalized the recreational use of cannabis but licenses have not yet been awarded to any businesses.

For adults 21 and older it is legal to possess up to three ounces of cannabis and up to 24 grams of concentrated cannabis for personal use. It may be consumed in a private home or at a state-licensed on-site consumption site, which is coming soon. Where smoking tobacco is allowed, smoking and vaping cannabis is permitted. No one may smoke cannabis in outdoor dining areas at restaurants or in motor vehicles (even if they are parked), doing so can result in a civil summons and fine. Selling any amount of marijuana without a license or driving while under the influence or impaired is prohibited.

Cannabis Boom Exposes Difficulties in Lending

September 15, 2021 The legalization of cannabis across the U.S. has exposed an interesting opportunity for banks and small business lenders. With tons of capital, insane amounts of cash flow, and an industry outlook that couldn’t be better, banks and lenders should be swarming in droves to get their hands on a piece of the legal marijuana action. Seemingly a match made in heaven, lenders and cannabis cultivators are running into some serious trouble when it comes to how the cash crop operators manage their businesses’ finances.

The legalization of cannabis across the U.S. has exposed an interesting opportunity for banks and small business lenders. With tons of capital, insane amounts of cash flow, and an industry outlook that couldn’t be better, banks and lenders should be swarming in droves to get their hands on a piece of the legal marijuana action. Seemingly a match made in heaven, lenders and cannabis cultivators are running into some serious trouble when it comes to how the cash crop operators manage their businesses’ finances.

“We had too much cash to keep in one place,” said Charles Ball, the owner of Ball Family Farms, a wholesale grow operation based in Los Angeles. By stashing cash in different safe-houses around LA, Ball had to operate his completely legitimate and legal business like an illegal operation. “Traditional banking wasn’t an option for us,” Ball said.

“We used to drive the cash around,” said Ball. For recent renovations of lighting fixtures, Ball had to pay $125,000 in cash to the company who did the service for him. Ball also paid taxes in cash, a process in which he had to walk into a Los Angeles government building with $40,000 cash on his person. At the time, there was no bank that was willing to hold the cash for him — even for tax purposes.

Prior to going fully cash, Ball did do business with some big banks, but he realized quickly that they weren’t interested in servicing his cash upon learning what his business was doing.

“They closed my account for wearing a shirt with my business name on it, they put two and two together,” said Ball, when referencing the closing of two accounts with Bank of America and Chase after representatives of the banks saw him wearing his company shirt to make deposits. One of the biggest difficulties of running a cannabis distributor isn’t the growing or the distribution of the product, it’s what to do with the money, according to Ball.

“They closed my account for wearing a shirt with my business name on it, they put two and two together,” said Ball, when referencing the closing of two accounts with Bank of America and Chase after representatives of the banks saw him wearing his company shirt to make deposits. One of the biggest difficulties of running a cannabis distributor isn’t the growing or the distribution of the product, it’s what to do with the money, according to Ball.

“We had no way of banking,” he said, up until February of this year, when he was able to secure his first type of deposit account with a local bank in the Los Angeles area that was fully aware of what his business was doing. “I have to pay more fees, and I don’t get the same type of customer service, everything is different,” Ball said.

With service fees on his deposit account between $2,000-$3,000 per month, the security of doing business with a bank must be worth the price. When pursuing a loan with that bank to expand his operation however, the lending process was halted at the last second after federal regulators told the bank they wouldn’t allow the deal to go through.

“We were denied on the approval date [of the loan],” said Ball. According to him, the bank told him the FDIC stepped in and killed the deal. Once again, Ball Family Farms was forced to explore other options outside of banking, such as exploring renovation options through landlords or simply waiting until the cash is on hand to make the move. “The banking system in this industry is very flawed,” said Ball.

“We’ve never taken private investor money,” Ball said when asked about whether he had explored any other avenues of receiving a loan. “We took [the start] slowly and it works, we are a ground up operation.”

This problem is not unique to Ball Family Farms. Legal cannabis cash flow has been a major issue since legalization first took place in the states. It seems like local governments want the tax revenue, but the bank’s regulators want to make it difficult for lenders to get their hit off the cash pipe until the federal government changes the law on their end.

The opportunity for funding in the industry isn’t going unnoticed however, as cannabis-exclusive funders and brokers are beginning to pop up across the U.S.

Judy Rinkus, for example, CEO of Seed to Sale Funding, is a Michigan based broker who works exclusively with cannabis businesses.

“[The industry’s] biggest problem is simply finding a lender who isn’t prohibited from lending to cannabis-related concerns,” said Rinkus. According to her, one of the biggest issues is the infancy of the industry, as many cannabis wholesalers and retailers just haven’t been around long enough to be reliable borrowers.

“[The industry’s] biggest problem is simply finding a lender who isn’t prohibited from lending to cannabis-related concerns,” said Rinkus. According to her, one of the biggest issues is the infancy of the industry, as many cannabis wholesalers and retailers just haven’t been around long enough to be reliable borrowers.

“Most businesses have been established for 3 years or less, they haven’t kept good financial records, and accept a lot of cash payments, and they lack sufficient collateral,” Rinkus said.

Rinkus stressed the importance that real estate plays in giving cannabis businesses borrowing power. “Having real estate to pledge as collateral is key,” she said. “There are ways to get other types of loans, but they are often enormously expensive and are limited to no more than 10% of an entity’s historic revenues.”

Rinkus’ outlook on the industry remains positive, and she remains a supporter despite the difficulties associated with cannabis lending. “Businesses in this space are the true American entrepreneurs,” said Rinkus. “In many areas of the country, they are creating jobs and wealth for folks that would otherwise not have the same chances.”

The outlook on the industry is bright. More states are pushing for legalization, social taboo of marijuana is relatively nil, and the potential of an untapped industry in the eyes of both government and banking are becoming too good to pass up. As the industry begins to cultivate its presence, look for the money surrounding cannabis to creep its way into fintech sooner than later.

420: SAFE Banking Cannabis Finance Bill Passes House

April 20, 2021 De-banked cannabis firms are a step closer to being danked.

De-banked cannabis firms are a step closer to being danked.

The house of Representatives voted to pass the SAFE Banking Act in a partisan vote 321-101. The bill protects legitimate cannabis businesses from federal sanctions and regulations that bar banks from funding cannabis firms.

The law will pass to the Senate, where it failed to get support last year (and the year before) when it was lumped into a trillion-dollar stimulus plan that the GOP blocked over the summer.

But now, as a standalone bill, supports believe it has a chance to succeed, enabling cannabis firms to delve into institutional coffers and directing federal regulators to create guidelines to supervise weed banking.

“We are grateful to the bill sponsors who have been working with us for the last eight years to make this sensible legislation become law,” said Aaron Smith, CEO of the National Cannabis Industry Association. “The SAFE Banking Act is vital for improving public safety and transparency and will improve the lives of the more than 300,000 people who work in the state-legal cannabis industry.”

Time may be running out for alternative finance to fund cannabis firms before more traditional finance gets in. Advocates believe the bill should go through the Senate Banking Committee and pass before the end of the year.

The American Bankers Association has lobbied aggressively for the bill.

“Banks find themselves in a difficult situation due to the conflict between state and federal law, with local communities encouraging them to bank cannabis businesses and federal law prohibiting it,” the group wrote in a letter to lawmakers on Monday. “Congress must act to resolve this conflict.”

NY Legalizes Pot, Immediately

March 31, 2021 New York City is going to be blazing this weekend.

New York City is going to be blazing this weekend.

Apparently, the Northeast has had nothing to do but sit inside and smoke weed or eat edibles for more than a year, and the laws finally caught up.

New York lawmakers passed the Marijuana Regulation and Taxation Act in the state Senate on Tuesday. Twelve hours later Governor Cuomo signed the bill, ensuring adults over 21 will be able to toke freely in N.Y.

Effective immediately, adults can carry three ounces of cannabis, store five pounds of the stuff at home, and grow up to six plants per person for personal use. The law creates the Office of Cannabis Management to oversee the markets, setting a sales tax of 13%- 9% state 4% county and municipal on the kush. There will also be a tax on THC content and layers of sales taxes that could bring the total above 20%.

Just like in the N.J. legalization- cops can’t stop a car because it smells like skunk. The new regulatory office will be set up over the next six months. Expungement of past convictions will be made easier: two years after the law goes into effect on Wednesday.

In the bill, specific language aims 40% of the new industry’s tax proceeds toward minority communities disproportionately affected by the state’s drug laws.

“By directing new tax revenues to communities like the ones I represent; easing the pathway to enter this business for new and small companies, and ensuring qualified applicants of color have prioritized access, this bill paves the way for a brighter future” 20th district, Brooklyn State Senator Zellnor Myrie said in a statement. “New York’s marijuana legalization framework can be an equitable, responsible, and growth-oriented model for the rest of the country.”

Now, two-thirds of the Northeast’s 56 million residents live in states that have legalized recreational cannabis.

Governor Cuomo, recently under calls to resign for allegations of sexual assault and harassment, said in a statement that it is a historic day for New York. According to the statement, the legislation could create up to 60,000 jobs and generate $350 million in annual tax revenue for the state. Based on the markets’ size in states that have already legalized pot, the N.Y. weed industry could be a $4 billion cash cow.

Some lawmakers were unhappy with the passage of the bill. State Senator George Borrello voted no and said in a statement that the state’s one-party rule was more concerned with appeasing special interests than creating responsible policies. He and other naysayers cited concerns about driving under the influence of marijuana.

“While I am personally opposed to legalization if New York is determined to head down this path,” Borrello said. “I believe we have a responsibility to craft a law that mitigates the risks to New Yorkers to the greatest extent possible, with no loopholes or gray areas. Regrettably, this bill doesn’t meet that standard.”

SAFE Banking for Cannabis Businesses Do-Over

March 18, 2021 A bi-partisan group of congress members plans to reintroduced the Secure and Fair Enforcement (SAFE) Banking Act to the House floor, legislation that would protect financial institutions from sanctions for working with marijuana companies.

A bi-partisan group of congress members plans to reintroduced the Secure and Fair Enforcement (SAFE) Banking Act to the House floor, legislation that would protect financial institutions from sanctions for working with marijuana companies.

Representatives Ed Perlmutter (D-CO), Steve Stivers (R-OH), Nydia Velazquez (D-NY), and Warren Davidson (R-OH) joined together supporting the bill, aiming to better align federal and state laws.

“Thousands of employees and businesses across this country have been forced to deal in piles of cash for far too long,” said Rep. Perlmutter. “The SAFE Banking Act is an important first step to treating cannabis businesses like legal, legitimate businesses and beginning to reform our federal cannabis laws.”

Though legal in a growing number of states and available for recreational use for over a third of Americans, weed is still a class one drug under federal law. Based on that label, federal regulations have kept firms from providing capital, banking, and other financial products to weed companies: it’s hard to scale a business when it’s cash-only.

Representatives hope to give safe harbor to firms to transact with the weed industry if they follow state regulations. The bill first went through the house in September 2019 and passing with flying colors in a 321-103 vote. Then the pandemic hit and muddled up the Senate vote, but after pro cannabis language landed in two stimulus bills, supporters are even more confident this time around.

“At a time when small businesses need all the support they can get, and after cannabis businesses specifically have been providing essential services and generating significant tax revenues for states and the federal government with little to no financial relief, it is more imperative than ever to get the SAFE Banking Act passed into law,” Aaron Smith, the CEO of the National Cannabis Industry Association said. “These businesses are contributing billions of dollars to the national economy every year and need to be treated like any other legal, regulated industry.”

Pot Legalized In Garden State

February 23, 2021 On one of the ugliest days of sleet and rain in recent memory, it was bright for some: NJ Gov Phil Murphy signed three legal weed bills into existence Monday Morning.

On one of the ugliest days of sleet and rain in recent memory, it was bright for some: NJ Gov Phil Murphy signed three legal weed bills into existence Monday Morning.

After weeks of debate over taxes and penalties for those under 21, legal marijuana passed twenty minutes before the deadline to set legalization rules- Murphy’s movement to legalize pot in the Garden State nearly ran out of time.

But shortly after the Senate came to an agreement, Murphy put pen to paper. Recreational users can possess up to six ounces of marijuana without legal consequence. Users under 21 will be in civil trouble if caught, using a three-strike, no-fine warning system.

The new law also decriminalizes underage alcohol use and halts the police’s ability to stop kids if they smell like pot- they can only give out warnings. Past Marijuana convictions and charges have been made easier to expunge, with comments from the ACLU that this is just the beginning of fair and legal drug culture in the Garden State.

Rec users will have to wait until Murphy sets up the Cannabis Regulatory Commission, and for NJ’s 13 medical marijuana dispensaries to ramp up production and open their doors. The current grower market in NJ can just meet the demands of the state’s 100,000 medical consumers according to NJ.com, and as the only state to legalize in the entire DC-NYC metro area, there will be at least a slight uptick in demand.

Experts still think that new stores could open in late 2021. Until then, Murphy can at least finally say he met his goal to legalize pot in his first 100 days- three years later.

“Starting immediately, those who had been subject to an arrest for petty marijuana possession, an arrest that may have kept them from a job or the opportunity to further their education,” Murphy said. “Will be able to get relief and move forward.”

New Jersey Legalizes Recreational Marijuana

November 4, 2020One chill result from the 2020 election was the legalization of recreational marijuana in New Jersey for adult use. In a 2-1 victory, Option One on New Jersey ballots passed, paving the way for a regulated environment for recreational use, possession, and cultivation in the Garden State.

4:20 PM.

Time to legalize it. pic.twitter.com/157WC7qgof

— Governor Phil Murphy (@GovMurphy) October 28, 2020

Before the vote, Gov. Murphy showed support

We did it, New Jersey!

Public Question #1 to legalize adult-use marijuana passed overwhelmingly tonight, a huge step forward for racial and social justice and our economy. Thank you to @NJCAN2020 and all the advocates for standing on the right side of history.

— Phil Murphy (@PhilMurphyNJ) November 4, 2020

The amendment was billed as not only a chance to increase tax revenue but as civil rights reform. Advocates argued that prohibition laws disproportionately harmed minority communities.

The change was initially put before the legislature in 2017 but failed to pass by 2019. A bipartisan supermajority put the choice up to the public referendum. Appearing in Willingboro on Tuesday, long time advocate of legalization, Gov. Phil Murphy, spoke on voting day in last-minute support.

“I got to supporting it first and foremost due to social justice,” Murphy said. “We inherited when I became governor the largest white, nonwhite gap of persons incarcerated in America, and the biggest contributor to that was low-end drug offenses.”

New Jersey was one of four states with legalization on the ballot, and all succeeded, bringing adult use to Arizona, Montana, and South Dakota as well. After Tuesday, more than 111 million Americans- a third of the country live in a state where recreational marijuana is legal.

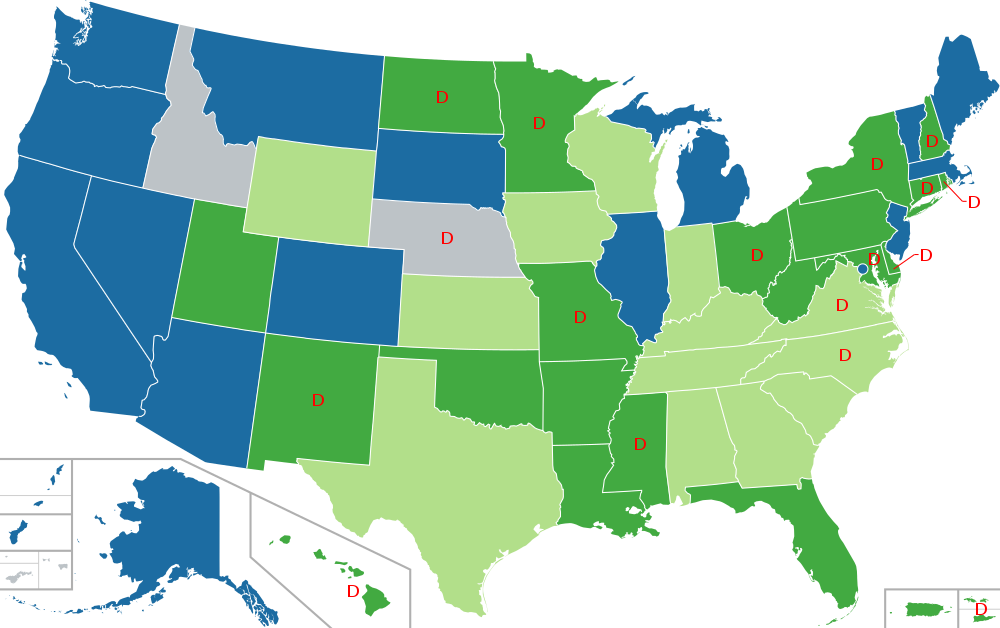

Image SourceKEY

Blue = Legal

Dark Green = Legal for medical use

Light Green = Legal for medical use – limited THC content

Grey = Prohibited for any use

D = Decriminalized

Cannabis legalization advocates, like Doctors For Cannabis Regulation (DFCR), saw the day as a significant victory for industry and social progress. Dr. David Nathan founded DFCR in 2015, where he serves as president of the board. Dr. Nathan stood up and spoke out against the prohibition of marijuana 11 years ago and said he was one of the first accredited mainstream physicians to do so.

“I’m not a medical cannabis physician, I’m a psychiatrist who sees how much damage cannabis prohibition does compared to the drug itself,” Dr. Nathan said. “I’ve really been given the platform to speak up, but at the same time, it was hard to get colleagues to speak up on an issue.”

After working for NJ United for Marijuana Reform, Dr. Nathan founded DFCR to create an organization to facilitate physicians who wanted to get involved at a national level. The success of Tuesday’s vote demonstrates how far legal cannabis advocation has come, from a resounding no to a majority yes.

“A lot of doctors who understood cannabis prohibition as a tragedy and a mistake were concerned about what their peers would think about them if they spoke out,” Dr. Nathan said. “Now we’ve got a group of highly respected physicians organized and advocating strongly, not just for legalization but much more importantly for effective regulation.”

Dr. Nathan sees the NJ amendment as a significant chance for improvement in public health. Despite legalization, it is unclear how the new law will go into effect. Per the amendment, the state will create a regulatory framework and tax the sale of marijuana at 6.625%, but implementation is up for debate.

Legislators still have to agree on how a new Cannabis Regulatory Commission will function. The state will also have to choose how decriminalization, possession limits, growing limits work, and forgiveness of past marijuana crimes.

All of which will be figured out and are necessary to the fair implementation of the passage of the amendment, Dr. Nathan said.

But those changes may come fast. NJ, like many states, is hurting during the COVID recession. Last month New Jersey officials approved a budget that is set to borrow $4.5 billion from the Federal Reserve to plug pandemic-sized holes in state spending.

Basing estimates on Colorado’s experience after legalizing cannabis in 2014, the state legislature predicts NJ could see tax revenues of up to $126 million a year from recreational sales.

“According to the Colorado Department of Revenue, retail cannabis sales, excluding medical cannabis, totaled $1.2 billion in calendar year 2018,” The report said. “Assuming New Jersey experiences similar per capita sales of recreational cannabis as Colorado, total retail cannabis sales for New Jersey could reach $1.9 billion, yielding sales tax revenues of up to $125.6 million annually at the current 6.625 percent sales tax rate.”

With such high revenues, some suspect New Jersey to lead the way for other northeastern states; income will spur jealous neighboring Pennsylvania and New York to legalization in competition.

“If this gives both Pennsylvania and New York a push, that would be great,” Dr. Nathan said. “I do think it’s going to have an impact, now that there will be a state right in the middle of the Mid Atlantic that is going to have regulated sales.”

But even with tristate legalization, the cannabis industry faces a problem with funding.

Most firms in cannabis supply chains- from growers to dispensaries- are small businesses that suffer from a lack of access to bank funding. Because marijuana is an illegal Section 1 drug like Heroin on a federal level, banks and venture capitalists have their hands tied when it comes to credit. But with Tuesday’s victories for legalization, federal regulation is closure to changing.

“I think that each state that adopts, sends a stronger message to the federal government,” Dr. Nathan said. “The voters in those states are giving resounding victories to the notion that cannabis should be de-scheduled not rescheduled, and then regulated.”

deBanked has been following the SAFE Banking Act since it passed in the House last year, a piece of legislation that hopes to address cannabis banking problems by allowing legal pot firms to open banking deposit accounts.

The law was bundled into the HEROES act with the rest of business aid projects, stuck between the GOP-controlled Senate and the blue House since the summer. Depending on the Senate’s layout when ballots are fully counted, financial institutions that have left pot companies de-banked may be-danked.