Business Lending

What IOU Financial Revealed in its Earnings Statement

April 29, 20172016 was a weird year for online lenders and IOU Financial, who lends to small businesses, fared no differently. Loan origination volume for the year was $107.5 million, down 26.5% from 2015. Revenues were up due to the company retaining more of their loans on balance sheet but losses were up as well.

Here are the most interesting statistics we found:

- 93% of their loan volume came from brokers

- 15% of merchants in their portfolio were classified as specialty trade contractors and home building renovation

- 14% of merchants in their portfolio are based in Florida (more than New York and New Jersey combined)

- Their borrowers have been in business for an average of 11.4 years

- Their average loan size is $69,695

- Their average loan term is 12 months

- They sold $60.8 million of loan receivables in 2016, down from $137.3 million in 2015

- The company has loaned $415 million to small businesses since inception

- The company had 53 full-time employees at year-end

IOU Financial is the only lender that deBanked is tracking whose stock is down year-to-date. At close on Friday, company shares were down more than 28% for the year.

Text The Merchant, Close The Deal

April 15, 2017

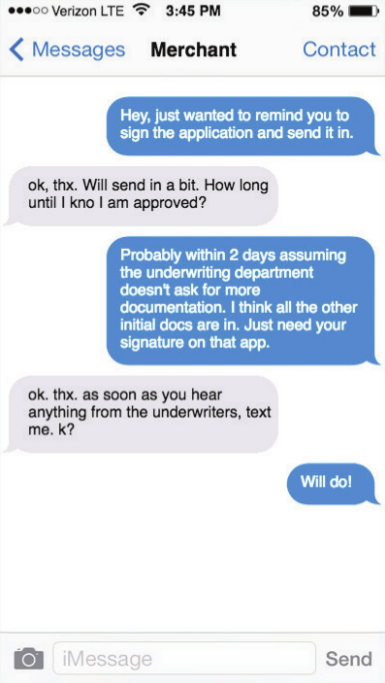

About a year ago, Cheryl Tibbs, general manager of Douglasville, Ga.-based One Stop Funding, was having trouble getting in touch with one of her clients. The merchant in question runs a lawn care service and is usually out on the job, so he isn’t quick to return phone calls or respond to email messages.

“I just got the idea to send a text,” Tibbs recalls. She typed a message expressing her regret for intruding but letting her client know that he needed to take certain steps to advance the funding process for his loan application. He texted right back.

After that initial success, the texting continued between Tibbs and the lawn care provider. He’s been a customer for us for a while, and that’s just how we communicate,” she says. “It’s easy for him to stop and shoot me a text as opposed to having a full conversation with me.”

Tibbs isn’t alone in her appreciation for text messaging as a part of the sales process. Quick responses to texts are making the medium increasingly important in the alternative small-business funding business, maintains Gil Zapata, CEO of Miami-based Lendinero. “Text messaging is more powerful than emailing nowadays,” he declares.

One reason for that shift is that texts are easy to use, according to Tibbs. “It’s a matter of convenience for the merchant,” she contends. “In this business, any way you can make it easier for the merchant to facilitate the transaction with you is the method you have to use.”

Besides the convenience, there’s the sense of urgency people feel when they receive a text, asserts Jeb Blount, a sales trainer who’s written eight sales-oriented books, including the bestselling Fanatical Prospecting. “When you send a text message you move to the top of a person’s priority list,” he says. In fact, people who are talking face-to-face often disengage from the conversation to respond to a text message, he notes. “It’s treated as something that’s urgent.”

As texting becomes more commonplace in the alternative-finance business, some industry salespeople are beginning to view the medium in the same way they regard email, telephones and fax machines. “I use them as another tool for follow-up communications,” John Tucker, managing member of 1st Capital Loans in Troy, Mich., says of text messages. “In addition to sending them an email, I’ll shoot them a text.”

As texting becomes more commonplace in the alternative-finance business, some industry salespeople are beginning to view the medium in the same way they regard email, telephones and fax machines. “I use them as another tool for follow-up communications,” John Tucker, managing member of 1st Capital Loans in Troy, Mich., says of text messages. “In addition to sending them an email, I’ll shoot them a text.”

Texting has become almost standard procedure at Florida-based Financial Advantage Group LLC, according to Scott Williams, the firm’s managing member. He prefers that sales associates make the initial contact by phone to get a sense of what the merchant is looking for in a funding deal. After gathering information and getting approval, it’s best to send the offer by email so the merchant has “all the numbers in black and white” and more details than a text message can hold, he notes. After that, text messages can deliver requests for additional documentation and provide updates on the progress of the funding process. “We can tell them, ‘Hey, everything got cleared this morning – we should be able to do the funding this afternoon,’” he says.

Texting expedites communication regarding renewals, too, Williams observes. “If a merchant is 50 percent paid back, you can check in and see if they need some additional capital right now,” he says. “It’s really good for that.”

Clients can use messaging to convey images of documents needed in the funding process, Tibbs says. “I had a merchant yesterday who sent me over her IRS tax agreement through picture message,” Tibbs says by way of example. Often, funders request color images of both sides of an applicant’s driver’s license, she notes. To fulfill such requirements, it’s generally easier to snap a photo with a phone and send it as a picture message than to scan pages of paper into a computer to create an electronic document and then send the resulting file by email. “We do a lot with picture messaging,” she observes.

But as useful as text messaging can become for contacting phone-shy clients or helping clients share an image to document a key cancelled check, companies should exercise care when using the medium for prospecting, warns Zapata. He and just about everyone else deBanked consulted emphasizes that sending unsolicited text messages can violate Federal Trade Commission regulations. “Just because our industry isn’t regulated doesn’t mean there aren’t regulations out there on the side,” he says.

Most say they learned of the regulations from third-party vendors who specialize in sending batches of text messages simultaneously. The key to sending those groups of messages legally is to get permission from the recipients in advance, notes Ted Guggenheim, CEO of TextUs, a Boulder, Colo., company specializing in multiple-texting services. “If you’re (randomly) contacting people you got off a list somewhere, that’s a pretty bad idea,” he maintains.

Most say they learned of the regulations from third-party vendors who specialize in sending batches of text messages simultaneously. The key to sending those groups of messages legally is to get permission from the recipients in advance, notes Ted Guggenheim, CEO of TextUs, a Boulder, Colo., company specializing in multiple-texting services. “If you’re (randomly) contacting people you got off a list somewhere, that’s a pretty bad idea,” he maintains.

The feds heavily regulate five-digit short-code texts but tread lightly with long-code texts – the ones sent from 10-digit phone numbers, Guggenheim says. The latter would apply in alternative finance, and if a text recipient calls back on the phone number associated with a long-code text, someone will answer, he notes.

Citing guidelines from the Cellular Telecommunications Industry Association (CTIA), Guggenheim stipulates that consumers should have the ability to opt out of additional messages after receiving the first one. Members of the industry who want to send groups of text messages can post conditions on their websites that compel users to grant permission to contact them by text if they submit their contact information, he suggests.

After ensuring everything’s legal, Tucker reports 1st Capital Loans nets a good response when he uses a vendor to blast multiple identical text messages to lists of prospective clients who have already granted permission for his company to contact them by text message. The strategy has helped bring in a reasonable number of deals because the prospects were “already in the pipeline,” he notes.

Remember, though, that cell phone numbers change more often than land line numbers, Tucker cautions. That means a call to a number that’s been reassigned could inadvertently fall into the unsolicited text message category that violates federal rules, he says. “You could be texting a 14-year-old,” instead of a small business, he warns.

When mounting a mass text campaign, marketers are wise to avoid lengthy missives, according to Tibbs. “Keep it simple,” she says. A typical message from her might read: “Looking for funding? Looking for capital? Give us a call,” she notes.

In business texts, avoid acronyms like “LOL” and write in complete sentences with proper punctuation and capitalization, Blount suggests. “Begin by typing out the message somewhere other than in the text box, read it, make sure it makes sense and then send it,” he says. Put your name with the word “from” at the top of the message so the recipient knows who sent it, he emphasizes.

Keep messages conceptual rather than marketing-oriented, Guggenheim advises. Messages should directly address the customer’s situation to avoid seeming they were sent by a robot, he says. As with any response a salesperson receives, getting back to customers quickly pays off in better results, he adds. When sending a batch of texts, vendors of the bulk service can ensure every text bears the same phone number that the sales rep uses to call the client, thus avoiding the possible confusion of using more than one number, says Guggenheim. The system he offers can trigger a pop-up on the computer screen of a specified salesperson when a text recipient responds, he says. It also keeps management informed of the volume of texts and the response rate, he says. That helps managers determine which types of text messages are working, he maintains.

Keep messages conceptual rather than marketing-oriented, Guggenheim advises. Messages should directly address the customer’s situation to avoid seeming they were sent by a robot, he says. As with any response a salesperson receives, getting back to customers quickly pays off in better results, he adds. When sending a batch of texts, vendors of the bulk service can ensure every text bears the same phone number that the sales rep uses to call the client, thus avoiding the possible confusion of using more than one number, says Guggenheim. The system he offers can trigger a pop-up on the computer screen of a specified salesperson when a text recipient responds, he says. It also keeps management informed of the volume of texts and the response rate, he says. That helps managers determine which types of text messages are working, he maintains.

Users can also rely on Guggenheim’s TextUs system to schedule messages for delivery in the future to remind clients of meetings. The system detects land-line numbers and informs the user that the phone will not receive text messages, and it integrates with customer-relationship management systems to exchange information, he says.

So used properly, texting can offer benefits for everyone involved. But some unscrupulous players still insist upon using the medium to mislead prospective clients, says Zapata. His customers have shown him texts from competitors who make initial contact or early contact by sending text messages that might look like offers but are really just marketing letters, says Zapata. That approach, which might tout the availability of $50,000, can cause problems when it turns out that the merchant qualifies for only $25,000, he explains. “Trust me, you’re not going to look like the good guy,” he says of the firms that send what he considers objectionable text messages.

Sensitivity comes into play with text messaging, according to Blount. He and other sources say a great number of people regard email as business-oriented and texts as personal. That leads them to nonchalantly delete unwanted email messages but to become angry when they receive a text they didn’t want, he says. “You can’t send text messages to customers if they don’t know you,” he counsels.

Once a relationship is established, however, text messages can nurture it, Blount maintains. Suppose two businesspeople meet at a networking event and exchange business cards, he says. He advises noting the cell number on the card and sending a LinkedIn invitation immediately after meeting the potential client. Twelve hours later he would send a text message mentioning the encounter. If the salesperson can get the potential client to respond to a text message, that prospect is granting permission to receive texts, he says.

Once a relationship is established, however, text messages can nurture it, Blount maintains. Suppose two businesspeople meet at a networking event and exchange business cards, he says. He advises noting the cell number on the card and sending a LinkedIn invitation immediately after meeting the potential client. Twelve hours later he would send a text message mentioning the encounter. If the salesperson can get the potential client to respond to a text message, that prospect is granting permission to receive texts, he says.

Blount’s example seems to suggest the line between business and personal may be blurring when it comes to texting. People often check their email messages on phones these days – instead of on a laptop or desktop computer – which also minimizes the difference between texting and emailing, says Tibbs. “Everybody does everything with their phone these days,” she notes.

Communicating through a more personal channel such as texting has advantages, too, Williams contends. That’s because some merchants consider their financing to be personal and don’t want to broadcast the details to employees, he says. To protect their privacy, merchants often provide financial institutions with their cell phone number instead of their office number or toll-free line, he notes.

Meanwhile, the world continues to become more comfortable with texting. When Williams and his sales associates began messaging clients about four years ago, they found younger customers receptive and older ones reluctant, he remembers. In the intervening years, however, the 50 plus crowd has warmed to the medium, he observes.

An advantage that accrues with text messaging – compared with email – arises from the fact that spam filters and spam folders don’t seem to have a place in the world of texting. Several sources cite that as a big advantage with using texts. “If you send someone a text message, they’re going to see it,” notes Zapata.

Asked about a downside to the proper use of text messaging in business, most sources could not name one. However, Williams has discovered one area where the mode of communication comes up short. “I would not deliver bad news over text-messaging,” he advises. “If the merchant is upset or frustrated by the news, it would be better-handled in a phone call so you could explain the reason for the negative news. A text message leaves too many things unsaid.”

The Secret to Reviving Your Alternative Lending Business

April 14, 2017 It’s no secret times are changing for Small and Medium Enterprise (SME) lending. I think we can all agree the easy return on investment has given way to rising defaults and an origination engine that sounds like it’s barely chugging along. We all know the basic math in this business. Put lots of money on the street and hope the factor rates cover the losses while managing operating expenses to achieve a rate of return acceptable to private equity investors. So, when originations stall and defaults increase, the math becomes scary.

It’s no secret times are changing for Small and Medium Enterprise (SME) lending. I think we can all agree the easy return on investment has given way to rising defaults and an origination engine that sounds like it’s barely chugging along. We all know the basic math in this business. Put lots of money on the street and hope the factor rates cover the losses while managing operating expenses to achieve a rate of return acceptable to private equity investors. So, when originations stall and defaults increase, the math becomes scary.

As the fintech business leader for DataRobot, the leader in automated machine learning, I’ve had the opportunity to meet many SME business owners at LendIt in New York, and more recently at the Innovate Finance Global Summit in London. It’s very clear interest in machine learning (a branch of artificial intelligence used by many lenders to build risk-based pricing models) is at an all-time high. We’re grateful for the support of our customers, and we take our leadership role in predictive analytics and automated machine learning very seriously. We don’t just see ourselves as a software vendor. We’re innovators that listen intently to our customers (and potential customers), and build solutions that help them achieve their goals. So, when I see this critical juncture in the SME lending industry, I feel compelled to comment.

I believe the response in the industry to the current problem of growing defaults and dwindling originations is the wrong approach. Lenders seem to be doing one of three things (and potentially all of them): lowering underwriting standards, raising factor rates, or pushing independent sales organizations (ISOs) to bring in more applications by handing out one-time commission bumps or in-kind resources such as marketing support. I believe these actions are indicative of lenders who don’t fully realize the wealth of data they have in their companies. Let’s review what I would call a “prototypical” merchant cash advance or business loan lender. First, as Sean Murray, publisher of deBanked, recently pointed out in a LinkedIn post (see, https://www.linkedin.com/feed/update/urn:li:activity:6253411111144685568/), most of the applications lenders receive are of very low quality, and in some cases are fraudulent. This will never be an industry where 50 percent of the applications will result in an offer. From the perspective of someone who talks to lenders almost every day, a company is lucky if 25 percent of its applicant pool can justify an offer. The fact is there just aren’t enough applicants in the industry to force that percentage to go much higher while still maintaining an acceptable default rate. And in terms of default rate, I’d question any lender who says their default rate is single digits. What that leaves us with is the number of applications which are approved and result in a closed deal (i.e., the “win-rate”). And this is where lenders are missing opportunities.

If lenders want to win in this industry, they need to win the right kind of deals that work for their individual business. If all lenders pursue the same strategy of pushing originations and taking on more risks, then many lenders are going to fail because a one-size fits all response to the current funding environment doesn’t work because there is no such thing as a one-size fits all portfolio. For example, if you specialize in “C” and “D” paper in the 3rd or 4th lien position, you want to win deals that look much different than lenders who want “A” paper in the 1st or 2nd lien position. Knowing how to increase your “win-rate” for YOUR type of deals is the key to success. And the key to the lender winning more of their type of deals is being able to understand their underwriting history and immediately spot deals that fit their framework, price them accordingly, and aggressively secure them before the competition. And that only happens if lenders understand their own data and have a risk-based pricing system which is lightning fast and makes the right decisions.

I’m not going to tell every lender to pursue automated machine learning. If a lender is brand-new to the market and isn’t keeping their data for analytical purposes, then deploying advanced machine learning algorithms is an inferior solution to good old-fashioned rules-based underwriting. But for everyone else, here is something you need to know. Many private equity funds are using machine learning algorithms to allocate their investments. It doesn’t take much imagination to consider those funds may start asking themselves why they are using machine learning to allocate their investments to companies not using machine learning to manage their risk exposure. The key to achieving success in a tightening market such as SME lending is to intimately understand your business. There is no more room for one-size fits all strategies. Consider what would happen if you simply doubled your “win-rate” for the deals that fit your business without looking at more applications? You would start spending a lot less time beating the originations drum and have more time to deliver superior customer service to increase your renewal rate. Automated machine learning can make that happen.

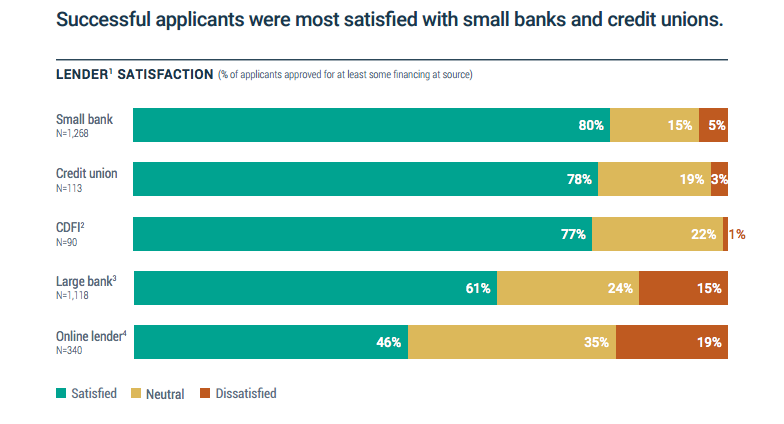

81% of Online Business Lending Borrowers Report Being Satisfied or Neutral

April 12, 2017The latest Small Business Credit Survey published by the Federal Reserve shows that 81% of small business borrowers were either satisfied or neutral about their online loan experience. Online lenders were defined as nonbank alternative and marketplace lenders, including Lending Club, OnDeck, CAN Capital, and PayPal Working Capital.

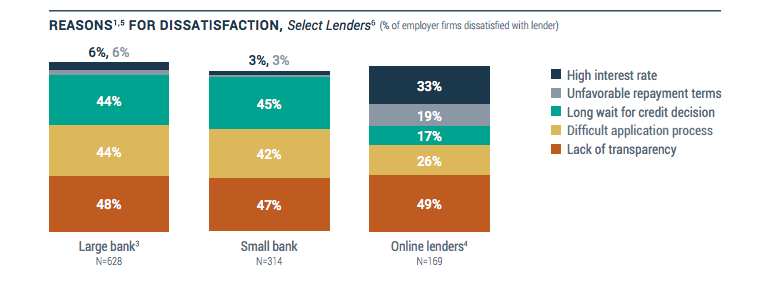

Of the 19% that were dissatisfied, nearly half cited transparency as a root cause. But that’s to be expected given that businesses dissatisfied with their loan from a large or small bank also cited transparency just as often.

While these charts indicate that there is still room for online lenders to improve, the 2016 report paints a more honest narrative than last year. Last year’s report used net satisfaction scores, which measured the difference between satisfied and dissatisfied borrowers. That methodology resulted in 15% net satisfaction for online lenders in 2015, which unless you read the fine print, easily misled even the most sophisticated of readers to conclude that only 15% of borrowers were satisfied. (Those readers included experts testifying in congressional hearings, the media, and government agencies, all of whom relied on that report to argue that online borrowers were terribly dissatisfied).

The 2016 report shows that businesses borrowing from an online lender were only slightly more likely to be dissatisfied than those that borrowed from a large bank (19% vs. 15%). And it’s the high interest rates that stand out to those dissatisfied online borrowers. 33% said that a high interest rate was the reason for their dissatisfaction. This is to be expected since non-banks inherently suffer from a higher cost of capital than banks.

Cash Advances?

Unfortunately, all of their data on “cash advances” is tainted. If they meant “merchant cash advances” or sales of future receivables, they should’ve specified such in the survey that went out to small businesses. Instead, the survey repeatedly asked about cash advances, a term most commonly associated with borrowing money through an ATM with a credit card. Those surveyed were also asked if they used personal loans, auto loans or mortgages so the multiple choice context suggests a credit card cash advance. Similarly, a cash advance could also mean a payday loan. With so many interpretations, the consequence is that it’s impossible to tell what the Federal Reserve meant or what those being surveyed thought they were being asked.

Notably, one question asked businesses if “portions of future sales” were used as collateral for a debt, but since merchant cash advances do not collateralize future sales (the future sales are actually sold, they don’t serve as collateral for a loan), it’s difficult to understand what they meant or how a respondent might interpret that.

Statistically representative?

The 2016 report also spends more time defending the Fed’s sampling methodology. Perhaps they are aware that their data is being put under the microscope.

Read the full Fed report here

Can Factors and MCA Companies Get Along?

April 7, 2017 At the factoring conference in Fort Worth, TX on Thursday, the 2 PM panel was officially called The Fintech Disruption. But it could’ve just as easily been named The MCA Disruption considering that the panelists all ran companies engaged in either unsecured business lending or MCA. The tension in the packed room was palpable. For some factors, the competitive pressure they feel with unsecured finance companies cuts deep, down to their soul. So naturally it only made sense, being that it’s Texas and all, that they lassoed a few of those unsecured guys up and put them on stage to explain theirselves.

At the factoring conference in Fort Worth, TX on Thursday, the 2 PM panel was officially called The Fintech Disruption. But it could’ve just as easily been named The MCA Disruption considering that the panelists all ran companies engaged in either unsecured business lending or MCA. The tension in the packed room was palpable. For some factors, the competitive pressure they feel with unsecured finance companies cuts deep, down to their soul. So naturally it only made sense, being that it’s Texas and all, that they lassoed a few of those unsecured guys up and put them on stage to explain theirselves.

So what’s the best way for an MCA company to make a peace offering to a room full of factors?

Sol Lax, the CEO of Pearl Capital Business Funding LLC, kicked it off by telling the audience that a small business customer might begin their quest for capital by searching the internet for a small business loan. “There’s no factoring companies that are going to pop up,” he exclaimed, suggesting that they were already losing when it came to the Internet to acquire customers and had little hope of catching up. But if you are a small factor, he conceded, you should continue generating leads through relationship building since the Internet is now so cost-prohibitive.

Dean Landis, the President of Entrepreneur Growth Capital, ran with that and asked attendees to raise their hands if they really pay attention to the cost of lead acquisition. While this was an informal survey, virtually no one raised their hand, seeming to confirm that deal flow for factors is largely acquired through relationships. Landis, who played the role of moderator and devil’s advocate, asked if MCAs and factors were really even targeting the same customers. Would you lend to someone who already has a senior lien? he asked. “These [MCA] guys figured out how to do that.”

Dan Smith, President of Fora Financial and Paul Rosen, Chief Sales Officer of OnDeck, explained that their customers often seek a fast-paced application-to-funding process, which drew a rebuke from an audience member who had a hard time believing that so many merchants truly needed that speed and simplicity. Smith and Rosen countered by saying that customers will choose whatever is best for them and that not every customer fits their boxes.

Lax advised factors to look at the bigger picture, that one big lender on their own might not seem like a threat but that a company like OnDeck could license out their scoring model to banks and banks could adapt that to make loans to companies they have otherwise been ignoring (the same ones that go to factors) and compete against the factors directly.

As the audience chipped away with questions about the soundness of these scoring models and fintech, Smith of Fora reminded everyone that they still have underwriters that are manually overseeing deals, rather than let computers do everything entirely on their own. “You can literally fintech yourself out of the business,” Smith cautioned lenders who might overzealously replace their core competency with algorithms that don’t perform as well.

But even then, do these scoring models work when merchants gets stacked on? This question was asked and it suggests that stacked merchants have a higher risk of default. Rosen of OnDeck confirmed that when he said “customers that stack on us have much higher loss rates.” Meanwhile, Smith said that when customers are doing something that affects their model, they just need to improve their model, just like they would if there was a recession or some other economic event underway. “All of our models are built on lifetime value,” he said. They want to grow and nurture their clients, he explained.

While factors fear that MCA companies could stack on their clients, there are signs that a path forward exists. An informal poll of the room indicated that not only are factors referring prospects to MCA companies but that MCA companies are returning the favor and sending prospects to them. The former was more prevalent.

Lax of Pearl, was more pointed about the future for factors. “You either need to evolve or become a phone booth,” he proclaimed. He prefaced that with a story about a child who was absolutely befuddled by an old Superman movie, as in ‘what were all these ridiculous random booths doing in the city that enabled Clark Kent to go around changing his clothes?’ The concept of a phone booth could hardly even be explained to the next generation. “Your industry is suffering a phone booth moment,” Lax said to the factors.

Is he right?

To the unsecured lenders and MCA companies who attend the factoring conference, they invariably see value in partnerships. And for the factors still hesitant to take that step, is it really the MCA model that’s causing friction? Or is it the evolution of the way that businesses interact with financial technology, i.e. fintech? And might fintech disrupt everyone in the end?

Only time will tell.

Quotes and paraphrases were derived from the panel. The summary is my own analysis of it and much of the 90-minute discussion was omitted here for brevity.

StreetShares Reports $2.8M Loss on Just $277,000 in Revenue For Last Six-Month Period

March 30, 2017 StreetShares, an online small business lender that is self-described as proudly veteran-run, published their most recent financial statements with the SEC earlier this week. For the six-month period ending December 31st, 2016, StreetShares recorded a $2.8 million loss on $277,883 in revenue. Over the same period in the prior year, they recorded a $1.35 million loss on $145,019 in revenue. To-date, the lender has issued $20 million in loans since they first began in July 2014.

StreetShares, an online small business lender that is self-described as proudly veteran-run, published their most recent financial statements with the SEC earlier this week. For the six-month period ending December 31st, 2016, StreetShares recorded a $2.8 million loss on $277,883 in revenue. Over the same period in the prior year, they recorded a $1.35 million loss on $145,019 in revenue. To-date, the lender has issued $20 million in loans since they first began in July 2014.

StreetShares has so far charged off 23 loans for a combined principal balance of $380,804. Charge-off determinations are made after 150 days of delinquency.

The company made history last year by becoming the first lender in the US to be approved by the SEC to use funds from public investors to back loans to small businesses. This was done through Regulation A+ of the Jumpstart Our Business Startups (JOBS) Act. Reg A+ investors make up $656,675 of StreetShares’ liabilities on the balance sheet.

StreetShares currently makes loans to small businesses between $2,000 to $500,000 for terms of three months to three years.

The company also spent more than 5x their revenue on payroll and payroll tax for the six-month period and more than 3x their revenue on marketing expenses.

Earlier this month, StreetShares announced a partnership with Nor-Cal FDC “to assist small business and veteran business owners in obtaining funding needed to win new opportunities.”

In the release, StreetShares CEO Mark Rockefeller said, “we’re eager to provide veteran-owned small businesses with the funding solutions they need to grow.”

Enrolling a Merchant’s “Debt” May Be Harmful… to the Merchant

March 29, 2017 How would you like to make $12,000 on a single referral?, a flyer directed at business finance brokers asks. This ad wasn’t offering a commission for brokering a loan or advance, but rather for enrolling a merchant’s debt into the company’s restructuring program. Debt restructuring, negotiation, or settlement is a booming cottage industry these days. Some of these debt restructuring companies promise ISOs that they will be completely discreet with referrals. Others offer them commission bonuses for achieving certain enrollment targets. It’s a way to monetize declined deals, they typically say.

How would you like to make $12,000 on a single referral?, a flyer directed at business finance brokers asks. This ad wasn’t offering a commission for brokering a loan or advance, but rather for enrolling a merchant’s debt into the company’s restructuring program. Debt restructuring, negotiation, or settlement is a booming cottage industry these days. Some of these debt restructuring companies promise ISOs that they will be completely discreet with referrals. Others offer them commission bonuses for achieving certain enrollment targets. It’s a way to monetize declined deals, they typically say.

For merchants, the allure of a restructuring company’s help might just be payment terms tied to their monthly budget. That’s allegedly what one NJ firm’s agreement says, in fact. “I hereby authorize [the company] to negotiate my unaffordable business debts and to enter into affordable repayment terms on my behalf based on my monthly budget,” reads a document submitted in a New York Supreme Court case involving Creditors Relief. And based on the marketing materials deBanked has reviewed from several similar companies, their definition of debt is so broad that it can even include things that aren’t debt, like merchant cash advances, for example.

Even if the restructuring company held a critical view of MCAs and believed them to be loans, treating them as such for the purpose of negotiation might actually cause harm to their customers. That’s because a well-formed MCA contract already offers payment adjustments at regular intervals to appropriately match a merchant’s sales activity. Depending on what the language says, a merchant might just have to call their funder and ask them to reduce the debits to reflect their current sales activity. And yes this goes for ACH-only deals. Even ones that could appear to have fixed payments do not actually have fixed payments. This is basically how all MCAs work by the way, so if you are a broker or funder and this all sounds foreign to you, you need to take this course ASAP.

The point is this: a merchant need not pay a fee to an outside company to restructure anything when sales drop because a free remedy already likely exists and is a key benefit to MCAs in the first place. And yes, I’m talking about MCAs with daily ACH debits. If you’re confused by this, you need to take this course ASAP.

The best advice a restructuring firm can give a merchant struggling with an MCA due to slow sales is to tell them to look for a reconciliation clause in their contract that explains how to get the payments reduced. Once the merchant finds it, have them call the funder and execute it. There’s no need to enroll anything, negotiate anything, risk breaching a contract, or pay a broker tens of thousands of dollars in commissions. The debt restructuring firm might not want merchants to simply take advantage of what they’re already entitled to however, because they stand to make no money that way. In this regard, mischaracterizing future receivable sales as loans only serves to carry out their agenda to confuse merchants about what their rights might be under those agreements.

I myself, am occasionally contacted by merchants who claim to be facing hardship and in one instance where a merchant had spoken to a negotiator, the negotiator didn’t tell him that the remedy he sought was already a natural provision of his contract. I helped him find it. He didn’t have to pay any fees which would’ve gone to pay someone a huge commission or end up in some crazy situation where he’s being sued for breach of contract. Think about this the next time you encounter a distressed merchant. Not everything is debt and that can be very much to the merchant’s benefit.

If you work for a debt restructuring, settlement, or negotiation company, you should probably take this course too. It will help you understand MCA agreements and what remedies merchants already have at their disposal.

Amazon Sure is Making a Lot of Small Business Loans

March 26, 2017 Amazon had $661 million in seller receivables at the end of 2016, according to their earnings report, nearly double from the year before. These receivables are from loans made to small businesses (primarily to purchase inventory) who are sellers on their platform.

Amazon had $661 million in seller receivables at the end of 2016, according to their earnings report, nearly double from the year before. These receivables are from loans made to small businesses (primarily to purchase inventory) who are sellers on their platform.

Apparently the lending business is going well for them too, since they claim the allowance for loan losses is so small that it’s not even material enough to report. And similar to Square Capital, Amazon incurs virtually no cost to acquire these borrowers.

One year ago, company CEO Jeff Bezos said in a letter to shareholders that “there are over 70,000 entrepreneurs with sales of more than $100,000 a year selling on Amazon.” By then the company had already lent more than $1.5 billion to small businesses across the US, UK and Japan.

“We wanted to bring the same shopping experience that you have on amazon, which is the one-click shopping experience, to the lending program,” a spokesperson says in a 2014 video about the program. “Instead of going to a bank, having interviews, audited financial statements, a 3 week process and then only a small fraction of people getting approved, our process is literally 3 fields and 3 clicks.”